Global Anti-aging Supplements Market By Ingredient (Collagen & Collagen Peptides, Vitamins, Minerals, Coenzyme Q10, Hyaluronic Acid, Omega-3 Fatty Acids, Amino Acids & Proteins, Resveratrol, Curcumin and Others), By Application (Skin, Hair & Nail Health, Joint & Bone Strength, Immune Health & Anti-inflammation, Cognitive & Brain Support and Others), By Form (Tablets & Capsules, Powder, Liquid, Softgels and Others), By Age-group (30–45 Years, 45–60 Years and 60+ Years), By Ingredient Source (Plant-based, Marine-based, Animal-based and Synthetic), By Distribution Channel (Pharmacies/Drugstores, Supermarkets & Hypermarkets, Specialty Stores, Online/Ecommerce Stores and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171502

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Ingredient Analysis

- Application Analysis

- Form Analysis

- Age-group Analysis

- Ingredient Source Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

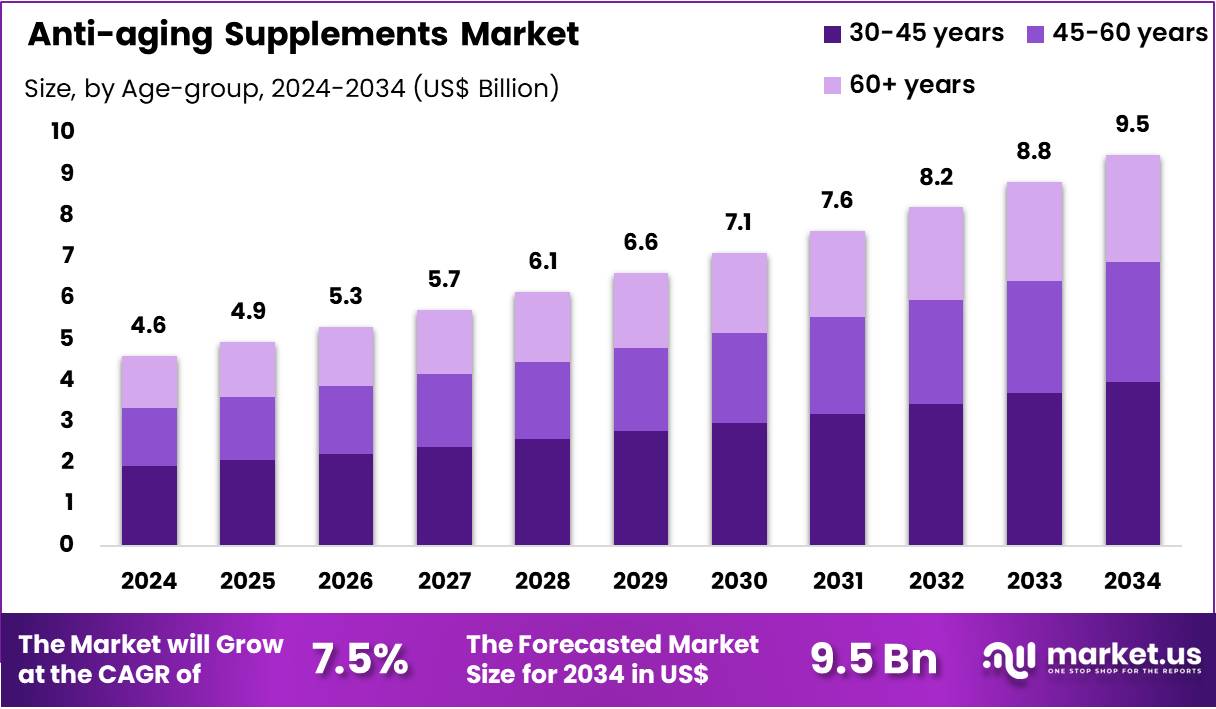

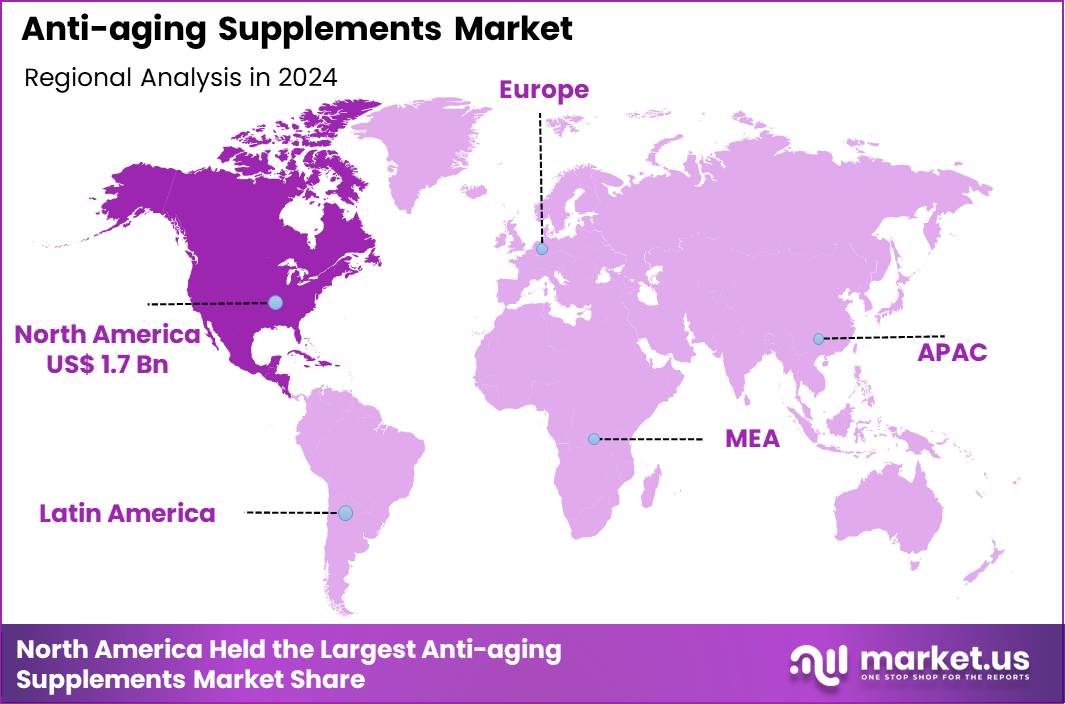

The Global Anti-aging Supplements Market size is expected to be worth around US$ 9.5 Billion by 2034 from US$ 4.6 Billion in 2024, growing at a CAGR of 7.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.2% share with a revenue of US$ 1.7 Billion.

Increasing consumer focus on preventive wellness propels the Anti-aging Supplements market, as individuals proactively incorporate nutrient-based formulations to support cellular repair and mitigate age-associated decline. Manufacturers formulate supplements with antioxidants, NAD+ precursors, and collagen peptides that neutralize free radicals and bolster mitochondrial function.

These products apply in skin rejuvenation through enhanced dermal hydration and elasticity, cognitive maintenance via neuroprotective compounds for memory retention, joint mobility preservation with glucosamine and chondroitin combinations, and cardiovascular support by reducing oxidative stress on endothelial cells. Retail channel expansions create opportunities for seamless integration of longevity-focused items into everyday health regimens.

In January 2024, Watsons Singapore rolled out Tru Niagen Immune, targeting immune resilience and age-related vitality, demonstrating how pharmacy chains accelerate market penetration by placing anti-aging supplements within mainstream immunity categories and attracting broader consumer segments. This strategic placement fosters habitual adoption and elevates supplements from niche to essential wellness staples.

Growing scientific validation of bioavailability enhancements accelerates the Anti-aging Supplements market, as formulators employ liposomal delivery and micronized particles to maximize absorption of key actives like resveratrol and curcumin. Biotechnology companies launch sustained-release capsules that maintain steady plasma levels for prolonged efficacy.

Applications encompass metabolic optimization through AMPK activators for insulin sensitivity improvement, hormonal balance restoration with adaptogens for adrenal fatigue alleviation, immune modulation via beta-glucans for infection resistance, and telomere protection with folate and B-vitamin complexes to slow cellular senescence.

Advanced encapsulation technologies open avenues for combination products that address synergistic pathways without digestive interference. Clinical research increasingly demonstrates measurable improvements in biomarkers of aging, encouraging physician endorsements. This evidence-based progression drives consumer confidence and expands therapeutic applications beyond cosmetic benefits.

Rising preference for personalized supplementation invigorates the Anti-aging Supplements market, as consumers utilize genetic and biomarker testing to tailor regimens for individual epigenetic profiles and deficiency patterns. Suppliers offer customizable blends that adjust dosages of CoQ10, astaxanthin, and pterostilbene based on lifestyle and health data inputs.

These tailored approaches serve in muscle preservation through creatine and branched-chain amino acid support for sarcopenia prevention, vision maintenance with lutein and zeaxanthin for macular health, bone density reinforcement via vitamin K2 and magnesium synergy, and detoxification enhancement with milk thistle for liver resilience.

Data-driven customization creates opportunities for subscription models that evolve formulations over time. Digital health platforms actively incorporate supplement recommendations into holistic longevity plans, bridging diagnostics with daily intake. This individualized strategy transforms anti-aging supplements into precision tools for optimized healthspan extension.

Key Takeaways

- In 2024, the market generated a revenue of US$ 4.6 Billion, with a CAGR of 7.5%, and is expected to reach US$ 9.5 Billion by the year 2034.

- The ingredient segment is divided into collagen & collagen peptides, vitamins, minerals, coenzyme Q10, hyaluronic acid, omega-3 fatty acids, amino acids & proteins, resveratrol, curcumin and others, with collagen & collagen peptides taking the lead in 2024 with a market share of 32.1%.

- Considering application, the market is divided into skin, hair & nail health, joint & bone strength, immune health & anti-inflammation, cognitive & brain support and others. Among these, skin, hair & nail health held a significant share of 35.7%.

- Furthermore, concerning the form segment, the market is segregated into tablets & capsules, powder, liquid, softgels and others. The tablets & capsules sector stands out as the dominant player, holding the largest revenue share of 48.3% in the market.

- The age-group segment is segregated into 30–45 years, 45–60 years and 60+ years, with the 30-45 years segment leading the market, holding a revenue share of 42.0%.

- Considering ingredient source, the market is divided into plant-based, marine-based, animal-based and synthetic. Among these, animal-based held a significant share of 34.2%.

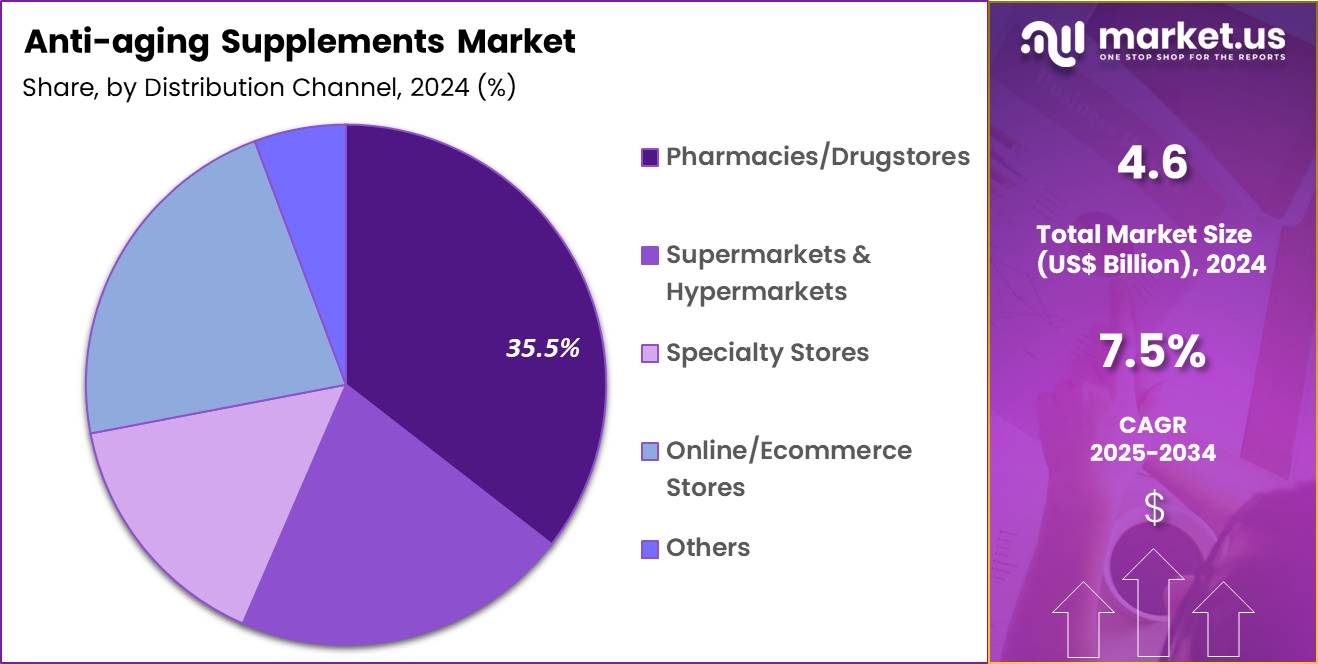

- The distribution channel segment is segregated into pharmacies/drugstores, supermarkets & hypermarkets, specialty stores, online/ecommerce stores and others, with the pharmacies/drugstores segment leading the market, holding a revenue share of 35.5%.

- North America led the market by securing a market share of 37.2% in 2024.

Ingredient Analysis

Collagen and collagen peptides, holding 32.1%, are expected to dominate because consumers increasingly associate collagen intake with visible improvements in skin firmness, wrinkle reduction, and connective tissue strength. Scientific research highlighting collagen’s role in maintaining dermal structure strengthens consumer confidence in daily supplementation. Rising awareness of age-related collagen depletion encourages early and preventive intake across adult populations.

Beauty and wellness brands actively promote collagen as a foundational anti-aging ingredient, expanding consumer education and trial rates. Hydrolyzed collagen formats improve absorption and bioavailability, enhancing perceived results. Influencer marketing and dermatologist-backed messaging further increase adoption.

Expanding functional blends combining collagen with vitamins and hyaluronic acid increase usage frequency. Greater product availability across retail and pharmacy channels supports sustained demand. Lifestyle-driven wellness routines integrate collagen into daily nutrition habits. These factors keep collagen and collagen peptides anticipated to remain the leading ingredient segment.

Application Analysis

Skin, hair and nail health, holding 35.7%, is projected to dominate because visible appearance improvements represent the most immediate motivation for anti-aging supplement consumption. Consumers prioritize benefits that enhance complexion, reduce hair thinning, and improve nail strength as part of self-care routines. Environmental stress, pollution, and lifestyle imbalance accelerate visible aging signs, increasing reliance on nutritional support.

The beauty-from-within concept resonates strongly with both younger and middle-aged consumers. Product formulations increasingly target multi-benefit beauty outcomes, improving perceived value. Dermatology-backed claims reinforce trust and repeat purchasing behavior. Social media exposure amplifies awareness of aesthetic-focused supplementation. Preventive beauty care trends encourage earlier adoption. These dynamics keep skin, hair and nail health expected to remain the dominant application segment.

Form Analysis

Tablets and capsules, holding 48.3%, are expected to dominate due to their convenience, portability, and ease of dose standardization. Consumers prefer formats that integrate seamlessly into daily routines without preparation requirements. Capsules allow manufacturers to combine multiple active ingredients efficiently, supporting comprehensive anti-aging formulations.

Pharmacies and healthcare professionals commonly recommend capsule formats for controlled intake and quality assurance. Shelf stability and longer product life improve supply chain efficiency. Taste neutrality improves consumer compliance compared with liquid alternatives. Advances in capsule technology enhance digestion comfort and absorption. Subscription-based supplement models often favor capsule delivery. These factors keep tablets and capsules anticipated to remain the leading form segment.

Age-group Analysis

The 30–45 years age group, holding 42.0%, is projected to dominate because individuals in this range actively seek preventive strategies to delay early aging signs. Rising health awareness encourages proactive supplementation before visible deterioration occurs. Career-driven lifestyles and social engagement increase focus on appearance and vitality.

Higher disposable income supports regular spending on premium wellness products. Social media and digital health content influence early adoption of anti-aging routines. Collagen loss awareness strengthens early intervention behavior. This age group embraces supplements as part of fitness and skincare regimens. Long-term wellness planning supports consistent consumption patterns. These drivers keep the 30–45 years segment expected to lead demand.

Ingredient Source Analysis

Animal-based ingredients, holding 34.2%, are expected to dominate because collagen and protein extracts from animal sources demonstrate strong bioavailability and established clinical acceptance. Long-standing usage history builds trust among both consumers and healthcare professionals. Manufacturers favor animal-based sources due to scalable supply chains and consistent quality.

Clinical studies frequently reference animal-derived collagen, reinforcing professional endorsement. Cost efficiency compared with alternative sources improves pricing competitiveness. Established extraction technologies ensure stable formulation performance. Despite rising plant-based trends, animal-based ingredients remain deeply embedded in mainstream supplements. These factors keep animal-based sources anticipated to remain dominant.

Distribution Channel Analysis

Pharmacies and drugstores, holding 35.5%, are projected to dominate because consumers associate these outlets with safety, authenticity, and professional guidance. Pharmacist recommendations strongly influence purchasing decisions, particularly among first-time users. Pharmacies offer curated product selections aligned with health and beauty needs.

Aging populations prefer physical retail environments for reassurance and consultation. Regulatory oversight strengthens confidence in pharmacy-sold supplements. Brand visibility improves through in-store placement and promotions. Strong distribution networks ensure consistent product availability. These dynamics keep pharmacies and drugstores expected to remain the leading distribution channel.

Key Market Segments

By Ingredient

- Collagen & Collagen Peptides

- Vitamins

- Minerals

- Coenzyme Q10

- Hyaluronic Acid

- Omega-3 Fatty Acids

- Amino Acids & Proteins

- Resveratrol

- Curcumin

- Others

By Application

- Skin, Hair & Nail Health

- Joint & Bone Strength

- Immune Health & Anti-inflammation

- Cognitive & Brain Support

- Others

By Form

- Tablets & Capsules

- Powder

- Liquid

- Softgels

- Others

By Age-group

- 30-45 years

- 45-60 years

- 60+ years

By Ingredient Source

- Plant-based

- Marine-based

- Animal-based

- Synthetic

By Distribution Channel

- Pharmacies/Drugstores

- Supermarkets & Hypermarkets

- Specialty Stores

- Online/Ecommerce Stores

- Others

Drivers

Aging global population is driving the market

The progressive aging of the world’s population has created a substantial demand for anti-aging supplements aimed at supporting vitality and mitigating age-related decline. This demographic transition prompts individuals to seek proactive measures for maintaining physical and cognitive function through nutritional interventions. Healthcare authorities recognize the implications of extended lifespans, encouraging research into supplements that address cellular health and longevity pathways.

According to the World Health Organization, global life expectancy at birth reached 73.3 years in 2024, reflecting gains in health outcomes that extend the period of active aging. This extension amplifies interest in compounds like antioxidants and NAD+ precursors to sustain metabolic efficiency. Public policy frameworks increasingly incorporate healthy aging strategies, indirectly bolstering consumer adoption of supportive supplements.

Economic models project rising healthcare expenditures tied to age-associated conditions, positioning supplements as cost-effective preventive options. Educational resources from international bodies highlight nutritional roles in resilience, influencing purchasing behaviors across generations. As societal norms evolve toward wellness-oriented lifestyles, supplement formulations gain traction for their accessibility. In essence, this driver establishes a foundational impetus for market expansion in preventive health solutions.

Restraints

Regulatory uncertainty surrounding key ingredients is restraining the market

Ongoing debates regarding the classification of certain anti-aging compounds under dietary supplement regulations have introduced caution among manufacturers and consumers alike. The U.S. Food and Drug Administration’s scrutiny of nicotinamide mononucleotide (NMN) exemplifies challenges in maintaining ingredient availability, as exclusion from supplement definitions disrupts supply chains. This ambiguity stems from investigations into prior drug development pathways, prompting enforcement actions against marketed products.

Variability in enforcement timelines delays resolution, affecting product reformulations and inventory management. Stakeholder petitions for reclassification underscore the tension between innovation and compliance requirements. International discrepancies in approval processes further complicate global distribution strategies.

Consumer confidence wanes amid reports of potential market withdrawals, tempering enthusiasm for emerging formulations. Research investments face redirection toward substantiated alternatives, slowing pipeline advancements. Legal proceedings tied to regulatory petitions extend uncertainty periods, impacting strategic planning. Collectively, this restraint necessitates clearer guidelines to foster stable growth trajectories.

Opportunities

Rising interest in NAD+ precursor compounds is creating growth opportunities

The expanding body of research on nicotinamide adenine dinucleotide (NAD+) restoration has spotlighted precursor supplements as promising avenues for cellular rejuvenation and metabolic support. These compounds facilitate energy production and DNA repair mechanisms, appealing to consumers pursuing evidence-based longevity strategies.

Clinical explorations into precursors like NMN and nicotinamide riboside reveal potential in addressing age-related declines, broadening therapeutic horizons. Integration with established antioxidants enhances synergistic effects, enabling multifaceted product development. Accessibility through over-the-counter channels democratizes adoption, particularly among health-conscious demographics.

Collaborative studies validate bioavailability improvements, informing dosage optimizations for efficacy. Emerging markets exhibit heightened receptivity to science-backed interventions, unlocking regional expansions. Personalized nutrition trends align with precursor profiling, supporting tailored regimens via biomarker assessments.

Sustainability in sourcing promotes eco-friendly derivations, resonating with ethical consumer preferences. Overall, this opportunity landscape invigorates innovation, positioning NAD+ precursors at the forefront of regenerative supplementation.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic dynamics bolster the anti-aging supplements market as surging healthcare investments and an expanding aging population worldwide encourage consumers to seek collagen, resveratrol, and antioxidant formulations for vitality and longevity. Executives at top firms strategically broaden product lines with science-backed blends, leveraging wellness trends and preventive health initiatives to penetrate diverse demographics in mature and emerging economies.

Lingering inflation and economic uncertainties, however, inflate raw ingredient costs like botanicals and vitamins, compelling manufacturers to adjust pricing strategies and erode profit margins in competitive segments. Geopolitical frictions, notably U.S.-China trade disputes and regional supply embargoes, routinely sever access to key herbal extracts and synthetic precursors, generating production halts and sourcing dilemmas for globally integrated operations.

Current U.S. tariffs, featuring a general 10 percent levy on all imports plus escalated duties up to 25 percent on Chinese-origin supplements, amplify procurement expenses for American distributors and challenge affordability amid de minimis exemption removals. These tariffs also incite reciprocal barriers from trading partners that curtail U.S. exports of premium formulations and disrupt multinational supply alliances.

Still, the imposed measures galvanize commitments to North American cultivation hubs and diversified sourcing models, nurturing fortified infrastructures that promise heightened innovation and steadfast market progression in the foreseeable future.

Latest Trends

Increased launches of combined NMN and resveratrol formulations is a recent trend

In 2024 and 2025, manufacturers have increasingly introduced supplements combining nicotinamide mononucleotide (NMN) with resveratrol to leverage complementary mechanisms in NAD+ elevation and sirtuin activation. This pairing targets enhanced cellular repair and antioxidant defense, reflecting consumer demand for multifaceted longevity support. Formulations emphasize bioavailable trans-resveratrol alongside high-purity NMN for optimized absorption and sustained effects.

Clinical inspirations from preclinical models underscore potential synergies in mitochondrial function and inflammation modulation. Market entries feature capsule formats with added bioavailability enhancers like piperine. Regulatory navigations around NMN status have spurred resilient product iterations compliant with evolving guidelines.

Consumer education campaigns highlight evidence from human trials on energy and resilience markers. Distribution expansions via e-commerce platforms accelerate reach to global audiences. Quality assurances through third-party testing build trust amid ingredient scrutiny. This trend exemplifies a convergence toward integrated, research-aligned solutions in the evolving anti-aging supplement sector.

Regional Analysis

North America is leading the Anti-aging Supplements Market

North America accounted for 37.2% of the overall market in 2024, and the region recorded solid growth as consumers increasingly prioritized longevity, cellular health, and preventive wellness. Strong adoption of supplements targeting collagen support, oxidative stress reduction, and metabolic health reflected a shift toward proactive aging management. Retail pharmacies and e-commerce platforms expanded availability of clinically positioned formulations, improving access and consumer trust.

Healthcare practitioners increasingly recommended nutraceuticals as adjuncts to lifestyle interventions, reinforcing uptake. The U.S. Census Bureau reported that adults aged 65 and older reached 58.9 million in 2022, underscoring a large demographic actively seeking age-supportive nutrition. Rising disposable income and health literacy further accelerated demand. Product innovation focused on bioavailability and clean-label claims strengthened brand differentiation. These combined factors supported notable market expansion across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness strong growth during the forecast period as rapid population aging and urban lifestyles increase focus on healthy longevity. Consumers across Japan, China, South Korea, and Australia show growing interest in supplements that support skin health, joint mobility, and cognitive performance.

Traditional wellness practices increasingly integrate with modern nutraceutical formats, broadening appeal. Digital commerce platforms accelerate discovery and adoption among younger demographics focused on preventive care. The United Nations reported that Asia’s population aged 65 and above exceeded 414 million in 2023, highlighting a substantial and expanding target base.

Government-led healthy aging initiatives reinforce awareness and acceptance. Local manufacturers expand functional ingredient portfolios to meet regional preferences. These dynamics position the region for sustained and accelerating growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the anti-aging supplements sector drive growth by formulating science-backed blends targeting cellular health, metabolic function, and oxidative stress, aligning products with preventive wellness trends among aging consumers. They scale demand through premium positioning, clinical substantiation, and clean-label sourcing that builds credibility with healthcare professionals and informed buyers.

Commercial teams expand reach via direct-to-consumer channels, personalized nutrition platforms, and subscription models that increase lifetime customer value. Innovation leaders invest in novel ingredients such as NAD+ precursors, collagen peptides, and adaptogens while refining bioavailability through advanced delivery systems.

Market expansion strategies also include geographic diversification into Asia Pacific and Europe, supported by regulatory alignment and localized marketing. Nestlé Health Science exemplifies this approach through its global nutrition portfolio, strong R&D capabilities, and focus on healthy longevity solutions that integrate supplements, medical nutrition, and consumer wellness under a science-led growth strategy.

Top Key Players

- Collagen Lifesciences

- GELITA AG

- Nutrova

- Daiken Biomedical Co., Ltd.

- The Nature’s Bounty Company

- Now Foods

- GNC Holdings Inc.

- Amway

- Nature’s Bounty

- Herbalife Nutrition

- Swisse

- Blackmores

- BioTechUSA

- Vitabiotics

- Shaklee Corporation

- Decode Age

- Nu Skin Enterprises

- Cureveda

Recent Developments

- In January 2024, Healthy Extracts Inc. introduced its LONGEVITY Anti-Aging formulation, positioning the product around cellular health, joint support, and cardiovascular wellness. By combining antioxidant-rich compounds such as trans-resveratrol with broader wellness claims, the launch reflects rising consumer demand for science-backed supplements that address aging at the cellular level, thereby expanding the premium segment of the anti-aging supplements market.

- In February 2024, a legacy wellness brand announced the upcoming launch of its NJHealth NMN 20000mg supplement, developed to enhance NAD⁺ levels associated with metabolic and cellular aging processes. The use of patented delivery technology highlights the industry’s shift toward clinically positioned NAD⁺ boosters, driving market growth through innovation, differentiation, and increased consumer awareness of longevity-focused supplementation.

- In December 2023, Reversal launched a new NMN-based anti-aging supplement that emphasized third-party purity and efficacy validation. This focus on transparency and quality assurance strengthens consumer trust in NMN products, supporting sustained demand growth and reinforcing the credibility of the anti-aging supplements market amid increasing regulatory and consumer scrutiny.

Report Scope

Report Features Description Market Value (2024) US$ 4.6 Billion Forecast Revenue (2034) US$ 9.5 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Ingredient (Collagen & Collagen Peptides, Vitamins, Minerals, Coenzyme Q10, Hyaluronic Acid, Omega-3 Fatty Acids, Amino Acids & Proteins, Resveratrol, Curcumin and Others), By Application (Skin, Hair & Nail Health, Joint & Bone Strength, Immune Health & Anti-inflammation, Cognitive & Brain Support and Others), By Form (Tablets & Capsules, Powder, Liquid, Softgels and Others), By Age-group (30–45 Years, 45–60 Years and 60+ Years), By Ingredient Source (Plant-based, Marine-based, Animal-based and Synthetic), By Distribution Channel (Pharmacies/Drugstores, Supermarkets & Hypermarkets, Specialty Stores, Online/Ecommerce Stores and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Collagen Lifesciences, GELITA AG, Nutrova, Daiken Biomedical Co., Ltd., The Nature’s Bounty Company, Now Foods, GNC Holdings Inc., Amway, Nature’s Bounty, Herbalife Nutrition, Swisse, Blackmores, BioTechUSA, Vitabiotics, Shaklee Corporation, Decode Age, Nu Skin Enterprises, Cureveda Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Anti-aging Supplements MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Anti-aging Supplements MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Collagen Lifesciences

- GELITA AG

- Nutrova

- Daiken Biomedical Co., Ltd.

- The Nature’s Bounty Company

- Now Foods

- GNC Holdings Inc.

- Amway

- Nature’s Bounty

- Herbalife Nutrition

- Swisse

- Blackmores

- BioTechUSA

- Vitabiotics

- Shaklee Corporation

- Decode Age

- Nu Skin Enterprises

- Cureveda