Global Animal Digital Health Market Analysis By Type (Software Solutions, Hardware Solutions, Services), By Application (Livestock Health Management, Companion Animal Health, Aquatic Animal Health, Veterinary Services), By End-User (Farmers & Livestock Owners, Veterinary Clinics, Pet Owners, Aquaculture Industry) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150196

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

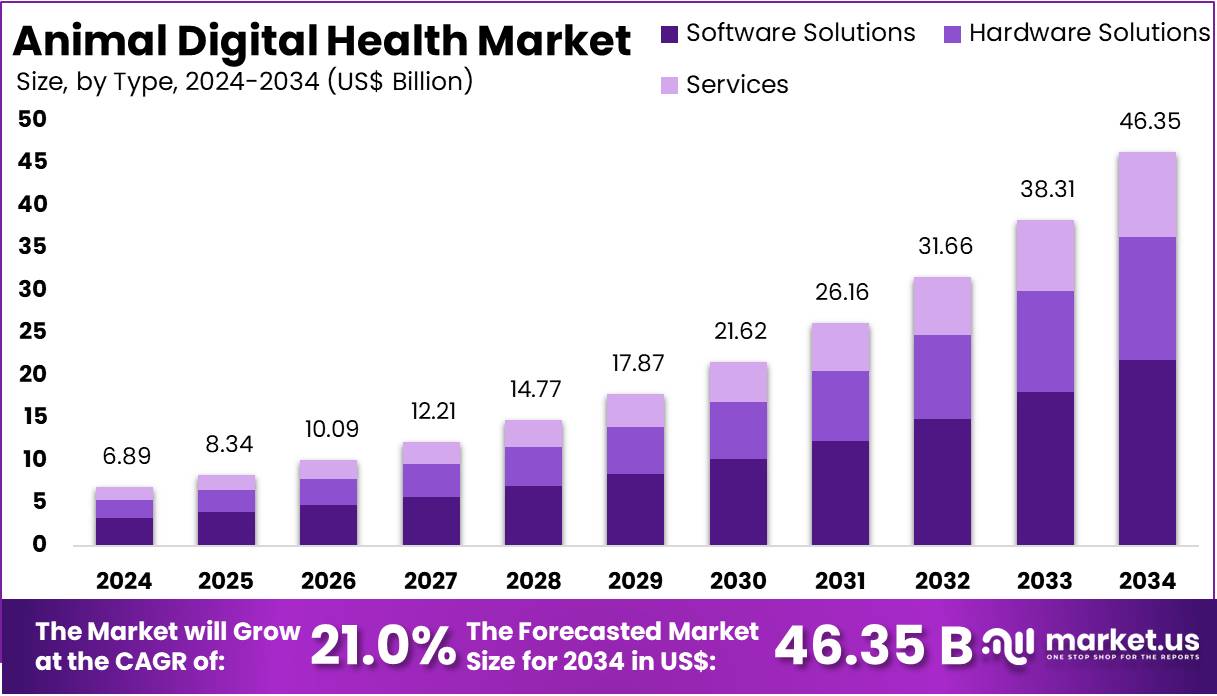

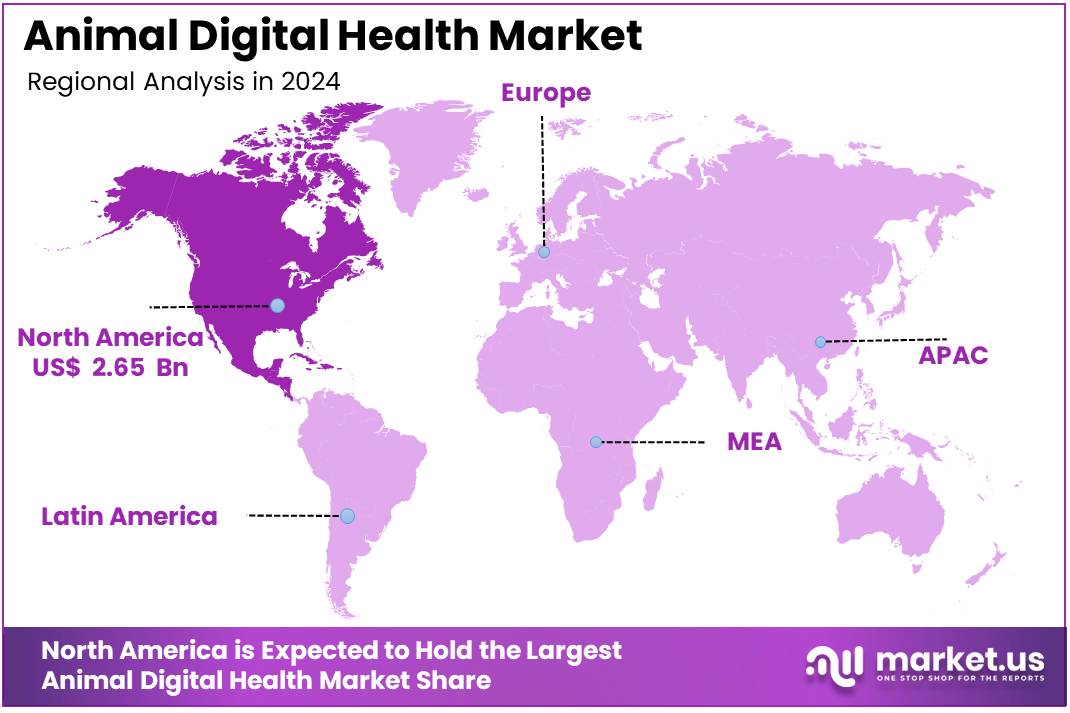

The Global Animal Digital Health Market size is expected to be worth around US$ 46.35 Billion by 2034, from US$ 6.89 Billion in 2024, growing at a CAGR of 21% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 41.2% share and holds US$ 2.64 Billion market value for the year.

Animal Digital Health refers to the application of digital technologies in veterinary care to enhance the monitoring, diagnosis, treatment, and welfare of animals. This growing sector includes tools like sensors, AI, and digital surveillance systems that improve outcomes for both livestock and companion animals. According to the World Organisation for Animal Health (WOAH), platforms like the World Animal Health Information System (WAHIS) enable quick data sharing and disease tracking, promoting faster responses to outbreaks and improved global animal health management.

Digital transformation in this sector is supported by various innovations. For instance, the use of wearable sensors, smart collars, and ear tags in the U.S. dairy sector allows for continuous health monitoring. These tools help detect diseases like H5N1 early. Machine learning models have also been implemented to predict conditions like digital dermatitis, with studies showing 79% detection accuracy on the day of clinical signs and 64% two days prior. Such technologies allow timely interventions and proactive animal health strategies.

Integration of IoT and AI has significantly improved livestock traceability and surveillance systems. For example, Australia’s National Livestock Identification System (NLIS) mandates RFID tagging, enhancing food safety and market access. The USDA’s APHIS mandates EID tags for cattle and bison to improve disease traceability. In the EU, the TRACES system tracks animal product movements across borders. According to the WOAH, only 57% of member countries maintained traceability data in electronic form as of 2015, highlighting a gap in digital adoption.

A notable growth factor is the global emphasis on the One Health approach, which recognizes the connection between human, animal, and environmental health. According to WHO, about 60% of emerging infectious diseases are zoonotic. The FAO’s EMPRES-i+ and EMA-i+ platforms help monitor and respond to such threats. For instance, during the 2022 lumpy skin disease outbreak in India, over 2 million cattle were affected, and more than 97,000 died, resulting in a loss of 500,000–600,000 liters of milk per day in Rajasthan alone.

Public-private collaborations and digital data interoperability are also accelerating innovation. Efforts are being made to improve data quality and sharing between agencies. According to the FAO, predictive analytics and digital surveillance systems are being used to track disease emergence in near real-time. Additionally, tools such as accelerometer collars for calves and rumen boluses help detect early signs of distress, improving animal welfare. These integrated digital health tools are critical for early disease detection, compliance with food safety standards, and sustainable livestock management.

Key Takeaways

- The global animal digital health market is projected to reach approximately US$ 46.35 billion by 2034, expanding from US$ 6.89 billion in 2024.

- This market is expected to grow at a robust compound annual growth rate (CAGR) of 21% between the years 2025 and 2034.

- In 2024, software solutions led the type segment, accounting for over 47.2% of the total animal digital health market share.

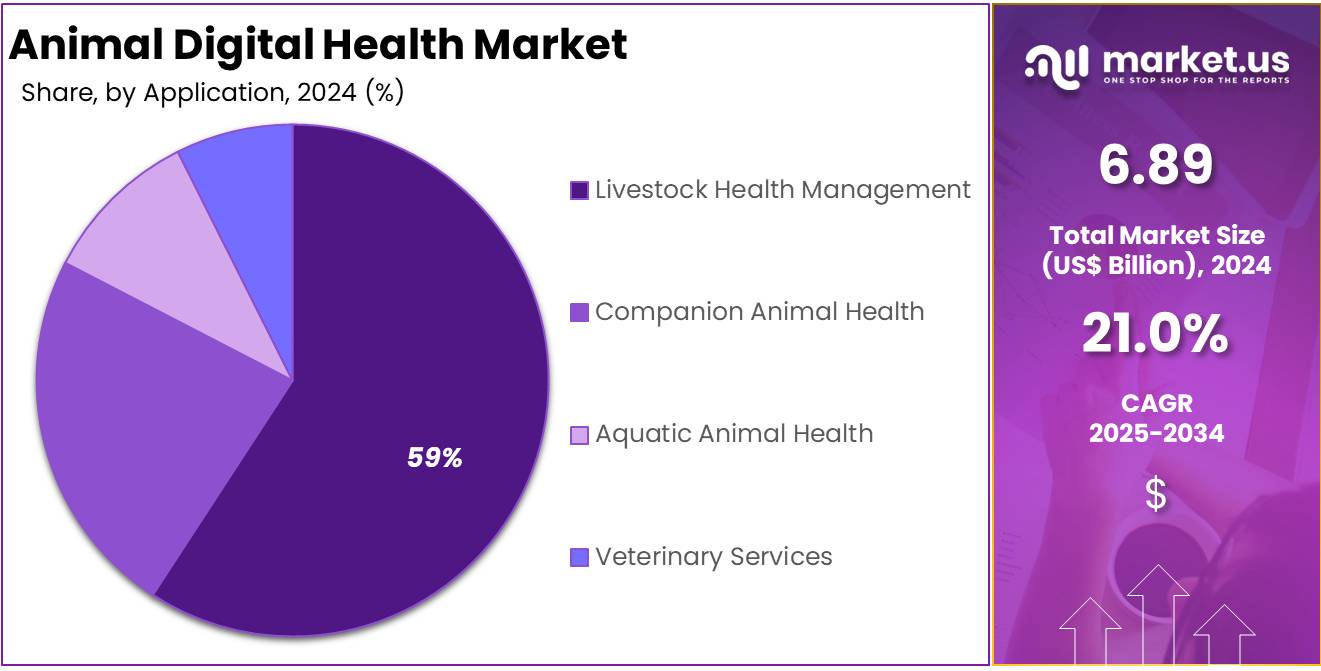

- Livestock health management emerged as the leading application area in 2024, contributing to more than 59.2% of the market share.

- Farmers and livestock owners dominated the end-user category in 2024, securing over 52.0% of the total animal digital health market.

- North America maintained regional leadership in 2024, representing more than 41.2% market share with an estimated valuation of US$ 2.64 billion.

Type Analysis

In 2024, the Software Solutions section held a dominant market position in the Type segment of the Animal Digital Health Market, and captured more than a 47.2% share. This segment led due to the growing use of digital veterinary platforms. These tools help track medical records, vaccination schedules, and treatment history. Many clinics and farms prefer software-based solutions for easy data access and remote monitoring. Cloud integration and AI features have also increased the value of such platforms in veterinary care.

The Hardware Solutions segment followed closely behind in market contribution. It includes tools like wearable devices, smart tags, and health monitoring sensors. These are used to collect real-time data on animal health and behavior. Livestock and pet owners rely on such tools for better control and early warning signs. The ability to detect illness before symptoms worsen supports animal safety. This segment benefits from rising demand for automated, real-time tracking systems across farms and households.

The Services segment also played a vital role in the market. It covers telemedicine, mobile health services, and remote diagnostic support. These offerings are useful in areas with limited veterinary access. Pet owners increasingly depend on online consultations and health updates. The demand for virtual check-ups rose after the pandemic. Growing awareness of preventive care has supported the service-based model. Service providers are expanding reach through digital platforms, helping improve animal wellness and reduce emergency interventions.

Application Analysis

In 2024, the Livestock Health Management section held a dominant market position in the application segment of the Animal Digital Health Market and captured more than a 59.2% share. This leadership was supported by the increasing adoption of smart farming solutions. Tools such as wearable sensors and automated feeding systems helped track animal health in real time. Many livestock producers turned to digital health tools to improve productivity and reduce losses. Government programs promoting sustainable agriculture also boosted this segment’s growth.

The Companion Animal Health segment ranked second in terms of market share. Its growth was driven by rising pet ownership and increased attention to pet well-being. Many pet owners started using digital health apps and wearables to monitor their pets at home. These tools supported early disease detection and routine health checks. Telehealth platforms for veterinary consultations also became popular. They offered quick access to expert care without requiring in-person visits, especially in urban households.

Aquatic Animal Health and Veterinary Services remained smaller but steadily growing segments. Fish farmers adopted digital solutions like water quality monitoring and automated feeding to enhance yield. The focus on sustainable aquaculture practices supported this trend. Veterinary Services also saw gains due to teleconsultation platforms and mobile clinics. These services helped veterinarians deliver care to remote or underserved areas. Real-time diagnostics and data-driven treatment plans further improved animal care efficiency. This segment is expected to grow as digital tools become more accessible.

End-User Analysis

In 2024, the Farmers & Livestock Owners section held a dominant market position in the end-user segment of the animal digital health market, and captured more than a 52.0% share. This leadership can be attributed to the increasing use of digital technologies in commercial farming. Tools such as GPS tracking, automated feeding systems, and disease monitoring platforms are widely adopted. These solutions help improve livestock health, reduce operational costs, and enhance productivity. As global demand for meat and dairy grows, digital integration in livestock farming is becoming essential.

Veterinary Clinics emerged as the second-largest end-user group in 2024. The adoption of telemedicine, electronic medical records, and AI-powered diagnostic tools has become more common in veterinary practices. These technologies assist in early disease identification, efficient treatment planning, and better clinical outcomes. Clinics are also using connected devices to monitor animals remotely. This digital shift is improving workflow efficiency and enabling more precise care delivery, especially in urban and semi-urban regions.

Pet Owners and the Aquaculture Industry are witnessing steady growth in the digital health space. Pet owners are increasingly turning to wearable health trackers and mobile apps to monitor pet wellness. This trend is supported by rising awareness of preventive pet healthcare. In aquaculture, smart sensors and automated monitoring systems are helping manage feeding, water quality, and fish health. These technologies are playing a key role in ensuring sustainable farming practices and minimizing disease-related losses in aquatic environments.

Key Market Segments

By Type

- Software Solutions

- Hardware Solutions

- Services

By Application

- Livestock Health Management

- Companion Animal Health

- Aquatic Animal Health

- Veterinary Services

By End-User

- Farmers & Livestock Owners

- Veterinary Clinics

- Pet Owners

- Aquaculture Industry

Drivers

Rising Demand for Digital Disease Surveillance in Livestock Management

The growing burden of zoonotic diseases and livestock epidemics is increasing the demand for effective disease surveillance systems. Animal digital health technologies, such as sensors, wearables, and connected diagnostics, are being widely adopted to enable early detection of infections. These tools help in reducing the risk of outbreaks by allowing continuous monitoring of livestock health. The integration of digital health solutions supports timely interventions, reduces mortality, and improves productivity in both small and large-scale farming operations.

According to the Food and Agriculture Organization (FAO), animal diseases result in annual losses of up to $300 billion globally. A significant 20% of global animal production is lost due to disease. This economic impact is driving farm operators and governments to implement digital monitoring tools. For instance, real-time data collection and cloud-based analytics help detect health anomalies early. This minimizes the spread of infections and reduces treatment costs by enabling preventive care strategies through digital technologies.

Foot-and-mouth disease (FMD) alone results in production losses and vaccination expenses amounting to $21 billion every year in endemic regions. This highlights the importance of digital health platforms that provide disease alerts, predictive analytics, and animal movement tracking. These systems can reduce the burden of diseases by improving traceability and allowing quick containment. The result is improved biosecurity and resilience in livestock systems through digital means.

Zoonotic diseases, which account for 60% of all human infectious diseases, also underline the importance of animal digital health. The early detection of such diseases in animals helps prevent their transmission to humans. This not only safeguards public health but also reduces healthcare costs and avoids trade disruptions. Digital animal health solutions therefore play a crucial role in managing risks at the animal-human interface and supporting global food security and health safety.

Restraints

Connectivity and Technological Barriers in Developing Economies

The adoption of animal digital health technologies in low-income and developing regions is significantly restricted due to limited infrastructure. Poor internet access remains one of the main challenges, especially in rural areas where livestock farming is dominant. For example, in rural India, nearly 70% of the population lacks sufficient internet connectivity. In Sub-Saharan Africa, only 27% of women have internet access. These connectivity gaps hinder the use of digital platforms that support real-time animal health monitoring and remote veterinary consultations.

Another major barrier is the shortage of qualified veterinary professionals in low- and middle-income countries. Community-based animal health workers (CAHWs) have been introduced to address this gap by delivering basic animal care, vaccinations, and disease surveillance. However, their limited training and restricted access to digital tools reduce their effectiveness. The lack of robust veterinary infrastructure further complicates efforts to scale digital animal health solutions, especially in remote or underserved communities.

Technological literacy also remains a critical concern. In low-income regions, many farmers, particularly women, face difficulties using digital platforms due to limited exposure and prevailing social barriers. Women make up at least 43% of the agricultural labor force in LMICs but continue to experience unequal access to mobile devices and internet services. Despite some progress, the mobile gender gap persists at 8%, restricting women’s participation in digital health initiatives for livestock management.

The cost and complexity of sensor-based animal health technologies also limit adoption in resource-poor settings. These tools are often seen as unaffordable and impractical. Financial constraints in managing livestock diseases make it hard for farmers to invest in advanced systems. Nonetheless, efforts by organizations such as GALVmed and the growing role of artificial intelligence are creating new pathways to bridge these gaps. Long-term solutions must focus on enhancing digital infrastructure, boosting digital literacy, and making technologies accessible to all stakeholders in the animal health ecosystem.

Opportunities

Advancing Companion Animal Care Through AI and Telemedicine Integration

The growing use of telemedicine and artificial intelligence (AI) in veterinary care offers a major opportunity in the animal digital health market. Urban pet owners increasingly seek convenient healthcare options, driving demand for digital veterinary services. Platforms offering virtual consultations are now more accepted, especially after emergency use during COVID-19. The U.S. FDA and AVMA continue to support telemedicine within established veterinary-client-patient relationships (VCPRs). This shift allows faster access to veterinary expertise and enhances care continuity through remote follow-ups and triage support.

Telehealth applications in veterinary care are diverse and structured. Teleadvice and teletriage offer general guidance and emergency assessment without needing a VCPR. In contrast, teleconsulting and telemonitoring require an existing VCPR to manage specific patient cases. This segmentation enables flexible use while maintaining care standards. The ability to monitor patient health remotely, paired with digital tools, improves animal outcomes. These services support veterinarians by offering timely information and reducing unnecessary clinic visits.

AI integration is transforming companion animal diagnostics and treatment personalization. According to Digitail and AAHA, around 30% of veterinarians aware of AI use it for tasks such as diagnostic imaging and medical record management. Advanced tools like RenalTech predict diseases early, while other AI applications support treatment planning for illnesses like canine lymphoma. Wearables powered by AI also track vital health data, helping detect problems before clinical signs appear. These innovations promote proactive care and improve animal health outcomes.

Despite its potential, AI adoption must consider ethical and regulatory concerns. Data privacy, algorithm transparency, and clinical validation remain important. Regulatory authorities must ensure AI tools meet safety standards. The animal digital health market stands to benefit significantly if AI platforms are developed in collaboration with veterinarians and regulatory bodies. Overall, the integration of AI and telemedicine can improve diagnosis, increase access to veterinary care, and enable personalized treatment, thereby driving sustained growth in the digital veterinary services market.

Trends

Increasing Adoption of IoT and Wearable Devices in Animal Health Monitoring

The integration of IoT and wearable technologies is becoming a key trend in the animal digital health sector. These devices are increasingly used to track livestock and companion animals in real time. By capturing physiological data such as temperature, heart rate, and movement patterns, farmers and veterinarians can identify early signs of illness. This shift toward continuous digital monitoring supports proactive interventions, reducing the risk of disease outbreaks and improving overall herd and pet health outcomes.

Wearable monitoring devices also support behavioral analysis in animals, allowing for better understanding of stress, estrus cycles, and feeding patterns. When connected through IoT networks, these systems provide alerts and performance analytics remotely. Such digital insights help optimize breeding, nutrition, and treatment schedules. Governments such as the USDA and European Commission are promoting these tools through funding and regulatory support, encouraging adoption across commercial farming operations and veterinary care facilities.

These developments reflect a broader digital transformation in veterinary science. Precision livestock farming and smart health tracking for pets are helping bridge gaps in access to veterinary services, particularly in rural areas. With data-driven care models becoming more mainstream, animal health management is shifting from reactive to predictive. This trend is expected to continue as technological infrastructure expands and stakeholder awareness increases globally.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 41.2% share and holds US$ 2.64 billion market value for the year. The region’s leadership is supported by advanced veterinary infrastructure and widespread adoption of digital health tools. A strong presence of wearable animal health devices and improved connectivity further boosted digital transformation. The U.S. and Canada have well-developed animal care systems, driving the early uptake of such technologies across livestock and companion animal health.

Government initiatives have significantly contributed to market growth in North America. Policies promoting disease surveillance and smart livestock farming have raised awareness of digital tools. Public and private investments in AI-enabled platforms and veterinary telehealth have made services more accessible, especially in rural regions. As a result, both farmers and pet owners benefit from quicker diagnostics and remote consultations. These efforts have helped position the region ahead in the global animal health technology space.

Veterinary hospitals and clinics across the region are equipped with modern technologies. Institutions like Banfield Pet Hospital and VCA Animal Hospitals use digital systems such as electronic health records and telemedicine platforms. This infrastructure enhances the efficiency and quality of animal care. High digital literacy and awareness among pet owners and livestock farmers support this transformation. Increased expenditure on animal health further reflects the region’s commitment to improving well-being and disease prevention in animals.

Another major factor behind the region’s growth is its strong regulatory environment. North America maintains stringent standards for animal health technologies. These rules ensure the safety and effectiveness of new digital tools. At the same time, they promote innovation by encouraging companies to meet quality benchmarks. North America is also home to several global leaders in animal health, who continue to invest in product development. Their presence accelerates technological advancement in this domain.

Compared to other regions, North America stands out in terms of maturity and innovation. Europe ranks second in the global market, driven by high awareness of animal welfare. However, its growth is moderated by inconsistent regulations across member countries. In contrast, the Asia-Pacific region shows the fastest expansion, mainly due to increasing livestock and pet adoption. Despite this growth, infrastructure challenges still limit its full potential. Overall, North America’s integrated ecosystem keeps it at the forefront of animal digital health adoption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Animal Digital Health market is undergoing rapid transformation, led by a growing demand for smart veterinary care and real-time monitoring. Zoetis continues to dominate the market with its strong focus on precision livestock farming and advanced diagnostics. The company is leveraging sensor-based technologies and data analytics to improve animal health tracking. Strategic partnerships and acquisitions support Zoetis in delivering integrated digital platforms. These platforms serve both livestock and companion animals, strengthening the company’s global position and driving innovation across its digital veterinary portfolio.

Merck Animal Health, under its Allflex Livestock Intelligence unit, has built a solid digital footprint. The company offers solutions like animal identification, traceability, and monitoring tools. Smart ear tags and biosensors help optimize herd health and management. Merck’s focus on IoT-based tools and AI-powered analytics enables predictive veterinary care. These innovations enhance farm productivity and strengthen its presence in the precision livestock space. Its digital investments are shaping future-ready animal health infrastructure.

Boehringer Ingelheim is advancing connected health solutions for both pets and farm animals. Cloud-based platforms and disease surveillance tools are central to its strategy. The company supports remote diagnostics and encourages treatment adherence through digital therapeutics. Its focus remains on preventive, data-driven care to improve health outcomes. Meanwhile, Elanco Animal Health is investing in telemedicine, herd health analytics, and global collaborations. These efforts are building a strong digital infrastructure that supports veterinary decisions and enhances pet wellness.

IDEXX Laboratories plays a key role in companion animal diagnostics. The company’s VetConnect PLUS integrates lab data with clinical decision-making tools. Their focus on AI, cloud platforms, and diagnostic imaging enables accurate, timely care. Other players such as Covetrus, Vetoquinol, and Dechra Pharmaceuticals are entering the space with wearable devices and digital adherence tools. New tech-driven entrants are shaping the future of veterinary care through innovations in disease prediction and blockchain traceability. Market competition is expected to intensify through digital integration and strategic expansion.

Market Key Players

- Zoetis

- Merck Animal Health

- Boehringer Ingelheim Animal Health

- Elanco Animal Health

- IDEXX Laboratories

- Virbac

- Ceva Santé Animale

- Bayer Animal Health

- GEA Group

- Afimilk

- Tractive

- Petriage

- VetCT

- Others

Recent Developments

- In January 2025: IDEXX Laboratories introduced IDEXX Cancer Dx™, an innovative blood test designed for the early detection of lymphoma in dogs. This test can be seamlessly integrated into routine wellness screenings or diagnostic panels for sick pets, providing veterinarians with actionable results within 2–3 days. Priced as low as $15, the test offers an affordable solution for early cancer detection. The initial launch focuses on lymphoma, with plans to expand the panel over the next three years to cover the majority of canine cancer cases, thereby transforming cancer detection and supporting earlier intervention.

- In July 2024: Merck Animal Health finalized the acquisition of Elanco Animal Health’s aqua business for $1.3 billion. This strategic move expanded Merck’s portfolio in aquaculture, incorporating innovative products such as CLYNAV®, a DNA-based vaccine for Atlantic salmon, and IMVIXA®, an anti-parasitic treatment for sea lice. The acquisition also included manufacturing facilities in Canada and Vietnam, along with a research facility in Chile, enhancing Merck’s capabilities in fish health, welfare, and sustainability within the aquaculture industry.

- In March 2024: Boehringer Ingelheim was selected by the French government to supply 34.2 million doses of avian influenza vaccines as part of a large-scale vaccination campaign targeting ducks, which are highly susceptible to the disease. This initiative aimed to curb the spread of bird flu, which had significantly impacted France’s poultry industry. The vaccination campaign, initiated in October 2023, led to a notable reduction in bird flu cases, allowing for the easing of restrictions on poultry farming in the country.

- In January 2024: Zoetis enhanced its Vetscan Imagyst® diagnostic platform by introducing an AI-driven urine sediment analysis feature. This addition enables veterinarians to perform accurate, in-clinic analysis of fresh urine samples, facilitating prompt and informed treatment decisions for pets. The integration of deep learning artificial intelligence ensures consistent and rapid results, thereby streamlining veterinary workflows and improving patient care.

Report Scope

Report Features Description Market Value (2024) US$ 6.89 Billion Forecast Revenue (2034) US$ 46.35 Billion CAGR (2025-2034) 21% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Software Solutions, Hardware Solutions, Services), By Application (Livestock Health Management, Companion Animal Health, Aquatic Animal Health, Veterinary Services), By End-User (Farmers & Livestock Owners, Veterinary Clinics, Pet Owners, Aquaculture Industry) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Zoetis, Merck Animal Health, Boehringer Ingelheim Animal Health, Elanco Animal Health, IDEXX Laboratories, Virbac, Ceva Santé Animale, Bayer Animal Health, GEA Group, Afimilk, Tractive, Petriage, VetCT, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Animal Digital Health MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Animal Digital Health MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zoetis

- Merck Animal Health

- Boehringer Ingelheim Animal Health

- Elanco Animal Health

- IDEXX Laboratories

- Virbac

- Ceva Santé Animale

- Bayer Animal Health

- GEA Group

- Afimilk

- Tractive

- Petriage

- VetCT

- Others