Global Veterinary Microchips Market By Animal Type (Dogs, Cats, Horses, and Others), By Scanner Type (134.2 KHz, 125 KHz, and 128 KHz), By Distribution Channel (Veterinary Hospitals/Clinics and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138550

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

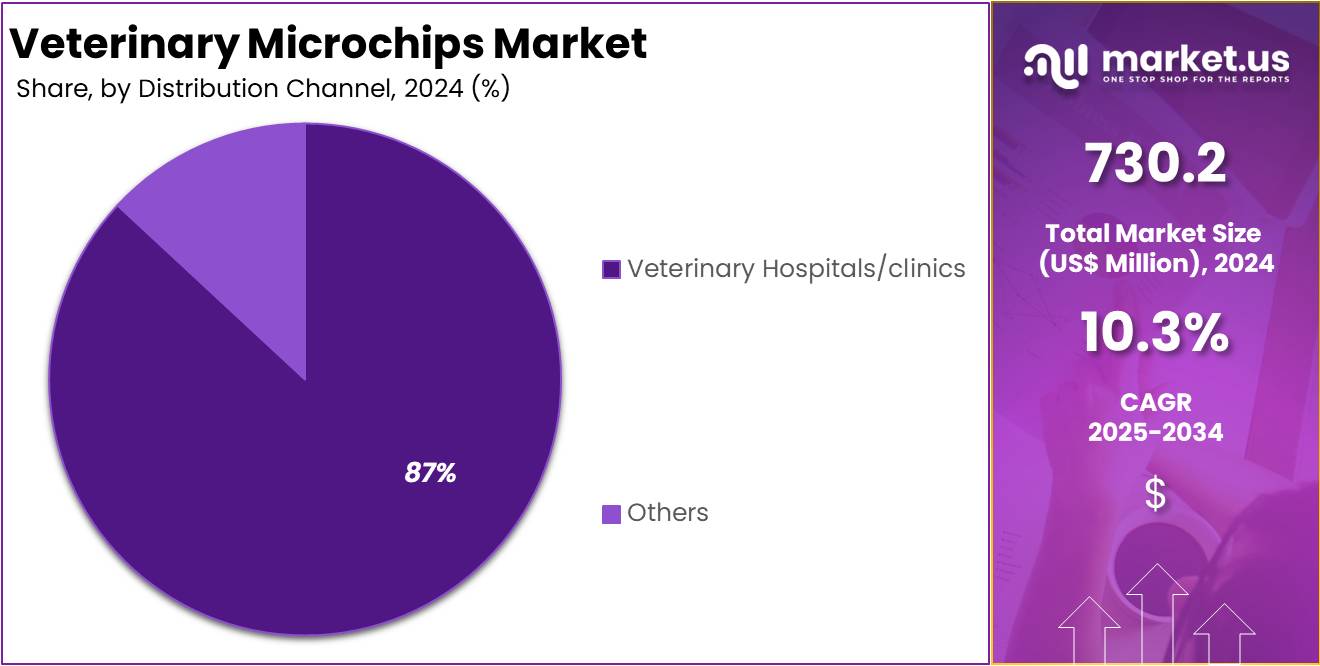

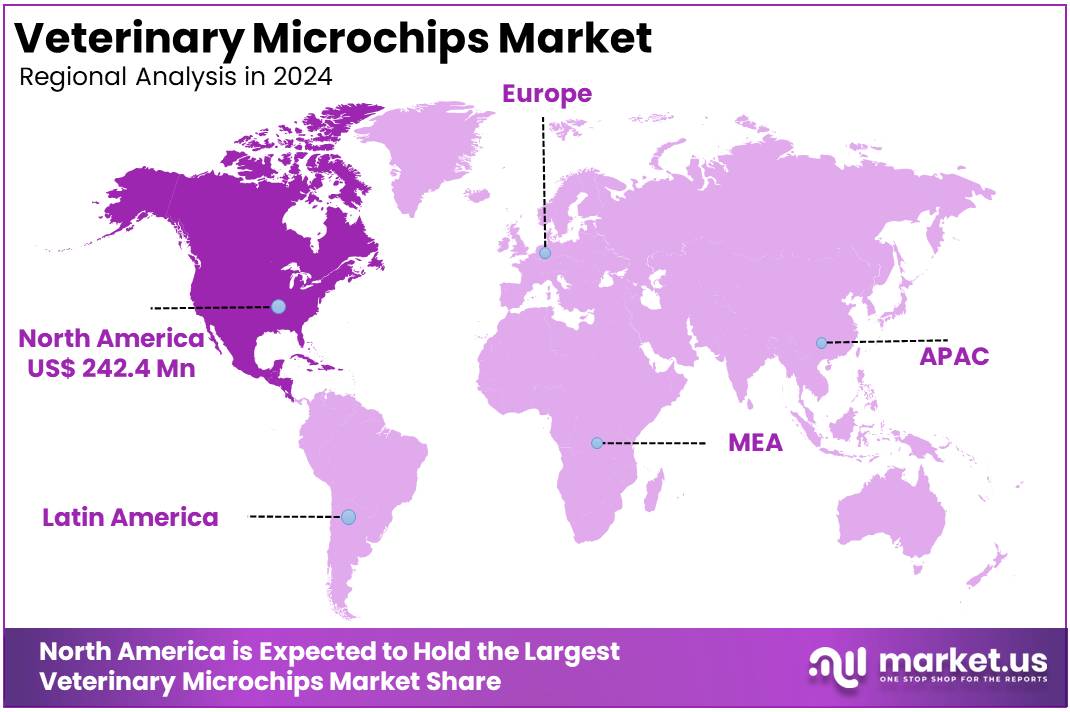

The Global Veterinary Microchips Market size is expected to be worth around US$ 1946.2 Million by 2034, from US$ 730.2 Million in 2024, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 32.2% share and holds US$ 242.4 Million market value for the year.

The veterinary microchips market is driven by several factors, including the growing emphasis on pet safety, rising adoption of pets, and increased awareness about animal identification. Technological advancements in microchip design and functionality, such as the development of smaller, more efficient chips with global positioning system (GPS) capabilities, have also contributed to market growth. Governments and animal welfare organizations advocating for pet identification further boost the demand for microchips, ensuring pets are traceable in case of loss.

Additionally, the increasing prevalence of veterinary services and pet insurance has made microchipping a standard practice during routine check-ups. However, the market faces challenges such as the high cost of microchipping procedures and the lack of regulations in certain regions. Despite these obstacles, the veterinary microchips market is poised for growth due to the rising trend of pet humanization and the expanding focus on pet health and safety.

Key Takeaways

- The global non-invasive aesthetic treatments market was valued at USD 730.2 million in 2024 and is anticipated to register substantial growth of USD 1946.2 million by 2034, with 10.3% CAGR.

- In 2024, the dogs segment took the lead in the global market, securing 28% of the total revenue share.

- The 134.2 KHz segment took the lead in the global market, securing 46% of the total revenue share.

- Veterinary hospitals/clinics segment took the lead in the global market, securing 87% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 33.2% of the total revenue.

Animal Type Analysis

Based on animal type the market is fragmented into dogs, cats, horses, and others. Amongst these, dogs segment dominated the global veterinary microchips market capturing a significant market share of 28% in 2024. The dogs segment dominates the global veterinary microchips market due to their widespread adoption as pets and their higher likelihood of being lost or straying compared to other animals.

As dogs are frequently taken outdoors and are more likely to encounter situations where they may become separated from their owners, the need for effective identification solutions has led to widespread microchipping in dogs. Additionally, the growing focus on pet safety, responsible pet ownership, and increasing regulatory requirements for pet identification in many regions have further fuelled the demand for microchips in dogs. Additionally, the growing veterinary healthcare costs and the increasing focus on pet health are expected to further drive market expansion.

- The United States is projected to have the highest number of pet dogs in 2024, with 90 million, according to the World Population Review.

Scanner Type Analysis

The market is fragmented by scanner type into 134.2 KHz, 125 KHz, and 128 KHz. The 134.2 KHz dominated the global veterinary microchips market capturing a significant market share of 46% in 2024. The 134.2 KHz frequency has dominated the global veterinary microchips market due to its global standardization for animal identification.

This frequency is recognized internationally by organizations such as the International Organization for Standardization (ISO), making it universally compatible with animal identification systems across different countries. The widespread adoption of 134.2 KHz microchips ensures that pets can be easily tracked and identified, regardless of their location, fostering global connectivity in pet recovery.

Distribution Channel Analysis

The market is fragmented by distribution channel into veterinary hospitals/clinics and others. Veterinary hospitals/clinics dominated the global veterinary microchips market capturing a significant market share of 87% in 2024. Veterinary hospitals and clinics have dominated the global veterinary microchips market due to their central role in providing essential healthcare services to pets. These facilities are often the primary locations where pets are microchipped during routine check-ups, vaccinations, or other medical procedures. The trust pet owners place in veterinary professionals to ensure their pets’ safety and well-being drives the demand for microchips in these settings.

Additionally, veterinary clinics offer a comprehensive range of services, making them the go-to place for pet identification and health management. As awareness about the importance of microchipping for lost pet recovery and identification grows, veterinary hospitals and clinics continue to serve as key distribution points for these technologies.

Key Segments Analysis

By Animal Type

- Dogs

- Cats

- Horses

- Others

By Scanner Type

- 2 KHz

- 125 KHz

- 128 KHz

By Distribution Channel

- Veterinary Hospitals/Clinics

- Others

Drivers

Growing Animal Ownership

The growing trend of animal ownership is a significant driver of the veterinary microchips market, as more pet owners seek effective ways to ensure the safety and identification of their animals. The rise in pet ownership, particularly in the United States, has led to an increased demand for microchipping services.

This surge in pet numbers underscores the need for reliable pet identification systems, especially as pets are more likely to get lost or separated from their owners. As pet owners become more aware of the benefits of microchipping for lost pet recovery and identification, veterinary microchips have become a standard solution, driving market growth and enhancing overall pet safety across the globe.

- For example, according to the American Veterinary Medical Association (AVMA), there are an estimated 92 million dogs in the U.S. as of 2023, reflecting a 39% rise in dog ownership over the past decade.

Restraints

High Cost Associated with Microchipping Procedures

A key restraining factor for the global veterinary microchips market is the high cost associated with microchipping procedures and the potential lack of affordability for some pet owners. While microchipping offers significant benefits in terms of pet identification and recovery, the cost of implantation, which often includes a one-time fee for the procedure and additional costs for registration, can be prohibitive for certain individuals.

This can especially be a challenge in regions with lower income levels or where veterinary services are less accessible. Furthermore, some pet owners may be reluctant to pay for microchipping due to misconceptions about its necessity or concerns about the procedure’s safety and invasiveness. As a result, the high cost and perceived barriers to adoption could limit the widespread implementation of microchipping, particularly in developing markets, and hinder the overall growth of the veterinary microchips market.

Opportunities

Increasing Integration of Advanced Technologies

The increasing integration of advanced technologies, such as GPS and biometric sensors, into microchips. As pet owners seek more sophisticated ways to monitor and track their pets’ health and movements, the demand for microchips with added functionalities is expected to rise. For instance, GPS-enabled microchips can help track lost pets in real-time, while biometric sensors could monitor vital signs and health parameters.

These innovations present an opportunity for microchip manufacturers to diversify their offerings and cater to a growing market of tech-savvy pet owners who prioritize not only identification but also real-time monitoring and safety. Additionally, the growing trend of smart homes and connected devices offers a potential for microchips to integrate seamlessly with other pet care technologies. By leveraging these advancements, companies can capture new customer segments and tap into the expanding market for high-tech pet care solutions.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors can significantly impact the global veterinary microchips market. Economic downturns or recessions may reduce consumer spending, leading to fewer pet ownerships or lower demand for non-essential pet services, such as microchipping.

In regions experiencing economic strain, pet owners may also delay or forgo microchipping due to the associated costs, limiting market growth. Additionally, geopolitical instability, such as trade disruptions or regulatory changes in certain countries, could affect the availability of veterinary microchips or the cost of raw materials needed for their production.

Latest Trends

The global veterinary microchips market is witnessing several key trends that are shaping its growth. One notable trend is the integration of advanced technologies, such as GPS and RFID, into microchips. GPS-enabled microchips are gaining popularity as they allow pet owners to track their pets in real-time, reducing the risk of loss and enhancing pet safety.

Another trend is the increasing focus on pet health and wellness, with microchips now incorporating biometric sensors to monitor vital signs, providing added value beyond identification. Additionally, regulatory changes and animal welfare initiatives in various regions are pushing for mandatory microchipping, further boosting demand. The rise in pet ownership, especially in emerging markets, and the increasing humanization of pets are also contributing to market growth.

Regional Analysis

North America holds a significant position in the global veterinary microchips market, driven by a combination of factors including high pet ownership rates and a strong focus on pet health and safety. Additionally, increasing per capita income and rising veterinary treatment costs have led pet owners to invest more in advanced technologies like microchips for ensuring the safety and health of their pets.

The presence of established organizations such as the North American Pet Health Insurance Association (NAPHIA) also supports market expansion by promoting pet health insurance, further fuelling the adoption of microchipping as a standard practice. These factors, combined with strong consumer awareness, continue to propel North America’s leadership in the veterinary microchips market.

- In 2023, 66% of American families, or 86.9 million homes, owned a pet, according to the American Pet Products Association’s National Pet Owners Surveys, reflecting a growing demand for pet-related services such as microchipping.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the global veterinary microchips market is characterized by the presence of several key players offering a wide range of microchipping solutions. Prominent companies dominate the market, focusing on developing innovative and reliable microchip technologies that ensure accurate pet identification and enhanced safety features.

These companies invest heavily in research and development to introduce advanced microchips, such as those with GPS tracking capabilities or integrated health monitoring features. Additionally, many companies are expanding their global presence through strategic partnerships, collaborations, and acquisitions to capture a larger share of the growing market.

Merck & Co., Inc. is a global healthcare company known for its contributions to human and animal health. With a strong focus on research and development, Merck offers a wide range of pharmaceutical products, including vaccines, biologics, and animal health solutions. Its animal health division provides innovative treatments and preventive solutions for various animal species, including pets.

In addition, Peeva Inc. is a company specializing in pet health technologies, including innovative microchip solutions for pet identification and tracking. Their products are designed to enhance pet safety, offering reliable and efficient identification systems that help reunite lost pets with their owners.

Top Key Players in the Veterinary Microchips Market

- Merck & Co. Inc.

- Peeva Inc.

- Virbac

- ID Tech (Eruditus Executive Education)

- Dipole RFID

- Trovan Ltd.

- Wuxi Fofia Technology Co. Ltd

- Avid Identification Systems Inc.

- Datamars

- Pethealth Inc.

Recent Developments

- In May 2023, Kippy S.r.l., a renowned provider of GPS trackers and activity monitoring systems for dogs, was acquired by Datamars. This acquisition effectively broadens Datamars’ offerings to pet owners globally.

- In March 2019, a significant advancement in digital dentistry was unveiled as Dentsply Sirona and Carbon® introduced the Lucitone Digital Print Veterinary Microchips workflow and material system. This new system enhances the precision and speed of creating complex designs for veterinary microchips, positioning 3D printing as a highly beneficial technology for dental professionals and their patients.

Report Scope

Report Features Description Market Value (2024) US$ 730.2 million Forecast Revenue (2034) US$ 1946.2 million CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Animal Type (Dogs, Cats, Horses, and Others), By Scanner Type (134.2 KHz, 125 KHz, and 128 KHz), By Distribution Channel (Veterinary Hospitals/Clinics and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Merck & Co., Inc., Peeva Inc., Virbac, ID Tech (Eruditus Executive Education), Dipole RFID, Trovan Ltd., Wuxi Fofia Technology Co., Ltd, Avid Identification Systems, Inc., Datamars, and Pethealth Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Microchips MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Microchips MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Merck & Co. Inc.

- Peeva Inc.

- Virbac

- ID Tech (Eruditus Executive Education)

- Dipole RFID

- Trovan Ltd.

- Wuxi Fofia Technology Co. Ltd

- Avid Identification Systems Inc.

- Datamars

- Pethealth Inc.