US Digital Health Market By Product Type (Software, Hardware, Services), By Technology (Tele-healthcare, mHealth, Digital Health Systems, Healthcare Analytics), By Application (Obesity, Cancer, Respiratory Diseases, Fitness, Mental Health Management, Diabetes, Blood Pressure & ECG Monitoring, Cardiovascular Diseases, Menstrual Health, Others), By End-user (Providers, Payers, Patients, Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 147963

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

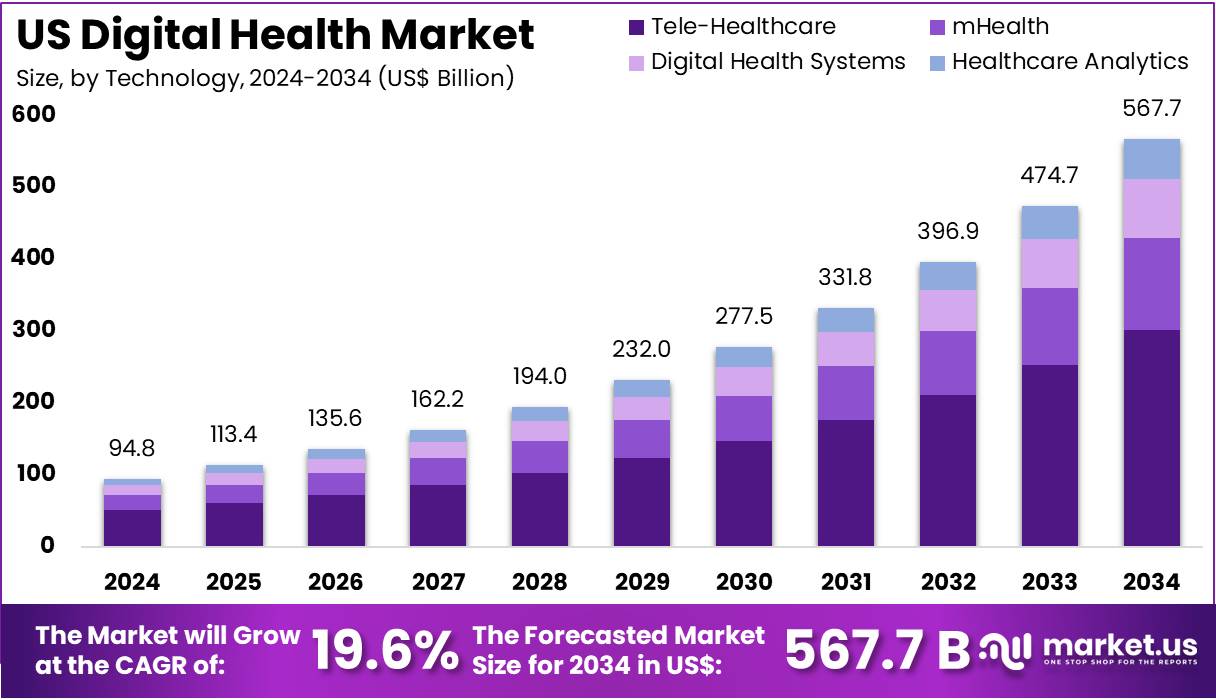

The US Digital Health Market Size is expected to be worth around US$ 567.7 billion by 2034 from US$ 94.8 billion in 2024, growing at a CAGR of 19.6% during the forecast period 2025 to 2034.

Increasing adoption of digital technologies in healthcare is driving the growth of the US digital health market. Digital health solutions, such as telemedicine, wearable devices, and mobile health applications, are transforming the way healthcare services are delivered. These innovations provide real-time monitoring, personalized care, and more efficient treatment management. The rising demand for remote patient monitoring, especially during and after the COVID-19 pandemic, has accelerated the use of digital health tools.

Additionally, the increasing prevalence of chronic diseases, such as diabetes and heart conditions, is fueling the need for continuous health management, which digital health solutions are well-suited to address. In December 2023, Google, Inc. launched MedLM, a generative AI tool designed to enhance digital healthcare by offering more accurate and efficient medical solutions.

This innovation is expected to drive the US digital health market by enabling faster diagnoses, personalized treatment plans, and improving overall healthcare delivery through AI-powered technologies. As healthcare systems continue to embrace digital transformation, there will be greater opportunities for innovation in patient care, data analytics, and operational efficiencies.

Key Takeaways

- In 2024, the market for US digital health generated a revenue of US$ 94.8 billion, with a CAGR of 19.6%, and is expected to reach US$ 567.7 billion by the year 2034.

- The product type segment is divided into software, hardware, and services, with services taking the lead in 2024 with a market share of 45.7%.

- Considering technology, the market is divided into tele-healthcare, mhealth, digital health systems, healthcare analytics. Among these, tele-healthcare held a significant share of 58.4%.

- Furthermore, concerning the application segment, the market is segregated into obesity, cancer, respiratory diseases, fitness, mental health management, diabetes, blood pressure & ECG monitoring, cardiovascular diseases, menstrual health, and others. The diabetes sector stands out as the dominant player, holding the largest revenue share of 46.9% in the US digital health market.

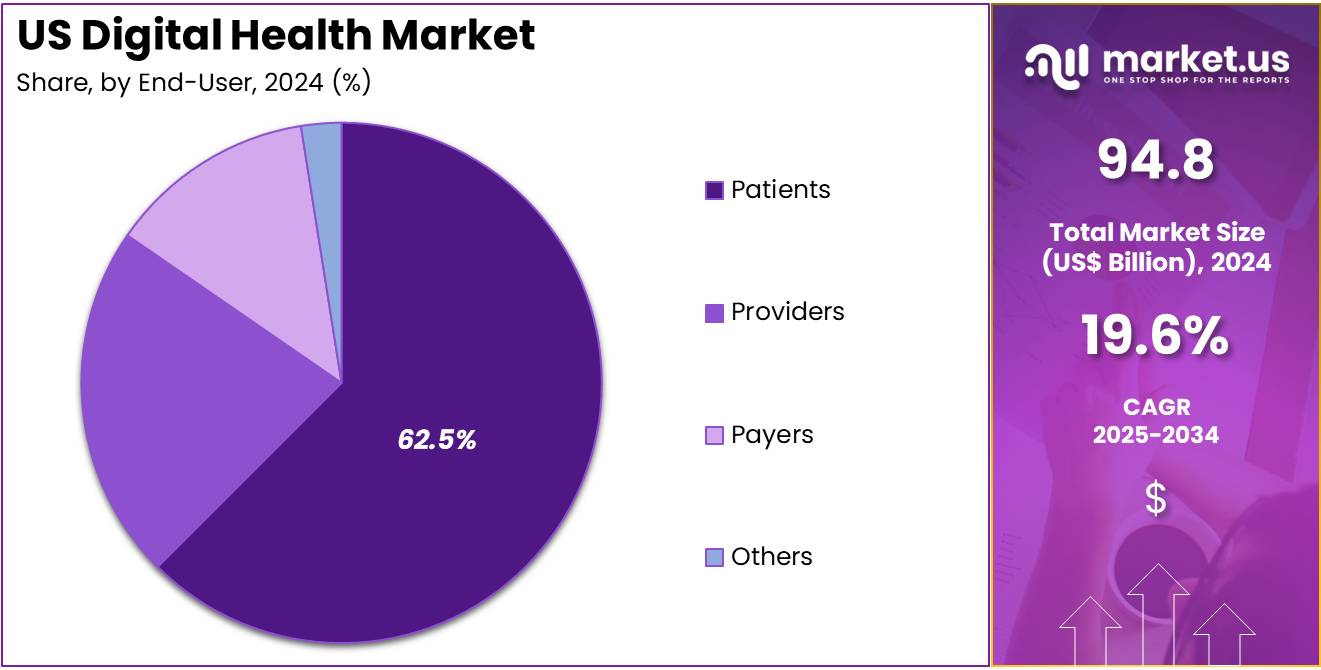

- The end-user segment is segregated into providers, payers, patients, and others, with the patients segment leading the market, holding a revenue share of 62.5%.

Product Type Analysis

The services segment led in 2024, claiming a market share of 45.7% as healthcare providers increasingly adopt digital technologies. With the growing complexity of healthcare needs, there is a rising demand for services that support digital health solutions, such as integration, training, and maintenance. The expansion of telemedicine platforms and the increasing use of digital health tools for monitoring, diagnostics, and treatment management will likely drive growth in this segment.

Service providers are expected to offer critical expertise, particularly in managing the integration of digital solutions into existing healthcare systems. Additionally, the need for robust cybersecurity services to protect patient data will further enhance the demand for services in the digital health market.

Technology Analysis

The tele-healthcare held a significant share of 58.4% due to the increasing demand for remote healthcare solutions. As consumers and healthcare providers embrace the convenience and flexibility of virtual consultations, tele-healthcare technology is expected to expand significantly. Telemedicine enables patients to access healthcare from home, reducing costs and increasing accessibility, particularly in rural areas.

Furthermore, the COVID-19 pandemic has accelerated the adoption of tele-healthcare services, and ongoing improvements in video conferencing, data security, and remote monitoring devices are expected to drive continued growth in this segment.

Application Analysis

The diabetes segment had a tremendous growth rate, with a revenue share of 46.9% as the prevalence of diabetes continues to rise. With increasing awareness about the importance of diabetes management and the growing use of mobile health apps, wearable devices, and continuous glucose monitoring systems, this segment is expected to experience substantial growth.

Digital health solutions, such as apps for tracking blood sugar levels, fitness, and nutrition, are anticipated to empower patients to manage their condition more effectively. The ability to integrate real-time data for personalized care and prevention will likely accelerate the adoption of digital tools for diabetes management in the US.

End-User Analysis

The patients segment grew at a substantial rate, generating a revenue portion of 62.5% as more patients turn to digital health tools to manage their healthcare needs. With increasing awareness of personal health management through wearables, health apps, and telemedicine, patients are anticipated to drive the demand for digital health solutions.

As consumers become more proactive in managing their health, there will be an increasing need for platforms that allow patients to monitor and track their conditions, communicate with healthcare providers, and receive personalized recommendations. This shift toward patient-centered care is expected to boost the growth of digital health tools in the US.

Key Market Segments

By Product Type

- Software

- Hardware

- Services

By Technology

- Tele-healthcare

- Tele-care

- Remote Medication Management

- Activity Monitoring

- Tele-health

- Video Consultation

- LTC Monitoring

- Tele-care

- mHealth

- Wearables & Connected Medical Devices

- Vital Sign Monitoring Devices

- Spirometers

- Pulse Oximeters

- Heart Rate Monitors

- Electrocardiographs

- Blood Pressure Monitors

- Activity Monitors

- Others

- Sleep Monitoring Devices

- Wrist Actigraphs

- Sleep trackers.

- Polysomnographs

- Others

- Vital Sign Monitoring Devices

- Electrocardiographs Fetal & Obstetric Devices

- Neuromonitoring Devices

- Electroencephalographs

- Electromyographs

- Others

- mHealth Apps

- Medical Apps

- Women’s Health

- Chronic Disease Management Apps

- Remote Monitoring Apps

- Personal Health Record Apps

- Medication Management Apps

- Diagnostic Apps

- Others

- Fitness Apps

- Lifestyle & Stress

- Exercise & Fitness

- Diet & Nutrition

- Medical Apps

- Services

- Monitoring Services

- Diagnosis Services

- Wearables & Connected Medical Devices

- Digital Health Systems

- EHR

- E-prescribing Systems

- Healthcare Analytics

By Application

- Obesity

- Cancer

- Respiratory Diseases

- Fitness

- Mental Health Management

- Diabetes

- Blood Pressure & ECG Monitoring

- Cardiovascular Diseases

- Menstrual Health

- Others

By End-user

- Providers

- Payers

- Patients

- Others

Drivers

Increasing Geriatric Population is Driving the Market

The escalating number of older adults in the US is a significant catalyst for the digital health market. As per the US Census Bureau, in 2024, over 56 million Americans were aged 65 and older, and this demographic is projected to grow substantially in the coming years. This aging population typically experiences a higher prevalence of chronic diseases and requires more frequent and comprehensive healthcare services.

Digital health solutions, such as remote patient monitoring devices and telehealth platforms, offer convenient and cost-effective ways to manage these conditions and access care from the comfort of their homes. For instance, the Centers for Disease Control and Prevention (CDC) reported in 2023 that approximately 80% of adults aged 65 and older have at least one chronic condition. This increasing need for efficient chronic disease management and remote care is fueling the demand for digital health technologies and services across the US.

Restraints

Data Breach and Security Concerns are Restraining the Market

The growing use of digital platforms and interconnected devices in healthcare offers many advantages. However, it also raises major concerns about data security and patient privacy. These concerns have become a key restraint on market growth. The Health Insurance Portability and Accountability Act (HIPAA) requires strict protection of patient information. But the connected nature of digital systems creates many entry points for cyber threats. As more systems integrate, the risk of data exposure rises. This challenge impacts trust and slows down digital health adoption.

In 2023, the U.S. Department of Health and Human Services (HHS) reported a surge in major data breaches. These incidents exposed the health information of millions of people. The breaches caused financial losses and damaged the reputation of affected healthcare providers. They also weakened patient trust in digital health technologies. Without strong cybersecurity and regulatory compliance, digital adoption remains limited. Addressing these issues is crucial for the future growth of the U.S. digital health market.

Opportunities

Integration of Artificial Intelligence (AI) is Creating Growth Opportunities

The incorporation of AI into various aspects of healthcare presents substantial growth opportunities for the US digital health market. AI algorithms can analyze vast amounts of patient data to improve diagnostics, personalize treatments, and enhance operational efficiency. For example, the Food and Drug Administration (FDA) has been increasingly approving AI-powered medical devices and software, indicating a growing acceptance of this technology in healthcare.

As of early 2025, the FDA had authorized over 800 AI/ML-enabled medical devices across various specialties, according to agency records. This trend signifies the potential of AI to revolutionize healthcare delivery by enabling more precise and timely interventions, reducing healthcare costs, and improving patient outcomes. The ongoing advancements in AI and machine learning are expected to unlock new applications and drive significant innovation within the digital health landscape.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert considerable influence on the US digital health market. Economic downturns can lead to reduced healthcare spending and investment, potentially slowing the adoption of new digital health technologies. Inflation elevates operational costs for digital health companies and can strain consumers’ ability to afford certain digital health services or devices. Fluctuations in interest rates affect the availability of capital for startups and established players alike, impacting research and development initiatives and market expansion.

Conversely, a strong economy often fosters greater investment in innovation and increases consumer spending on healthcare solutions, thereby accelerating the growth of the digital health market. Government policies, such as those related to healthcare reform, reimbursement models, and technology adoption incentives, also play a crucial role in shaping the market’s trajectory. Despite potential headwinds from economic instability, the fundamental drivers of digital health adoption, including the need for cost-effective care and improved patient outcomes, suggest continued long-term growth.

The current US tariff policies are creating a complex landscape for the digital health market. Increased tariffs on imported medical devices and components elevate the costs for both manufacturers and healthcare providers. This rise in expenses may translate to higher prices for digital health solutions, potentially hindering their widespread adoption, especially among price-sensitive consumers and healthcare systems with tight budgets.

For companies that rely on supply chains, tariffs necessitate a re-evaluation of sourcing strategies, possibly leading to shifts in manufacturing locations or increased investment in domestic production to mitigate tariff burdens. While domestic manufacturers of digital health technologies might gain a competitive edge due to tariffs on imports, retaliatory tariffs from other nations could negatively impact the export of US-made digital health products, limiting their market reach.

The uncertainty surrounding the duration and scope of tariff policies can also deter investment and innovation within the sector as businesses navigate unpredictable cost structures and market access conditions. Despite these challenges, the underlying demand for efficient and accessible healthcare solutions may incentivize domestic innovation and the development of cost-effective alternatives within the US digital health market.

Latest Trends

Increased Adoption of Telehealth Services is a Recent Trend

A prominent recent trend in the US digital health market is the accelerated adoption and integration of telehealth services. Telehealth, encompassing virtual consultations, remote monitoring, and digital therapeutics, has gained significant traction due to its convenience, accessibility, and cost-effectiveness. The COVID-19 pandemic further catalyzed this trend by necessitating remote care options and prompting regulatory changes that expanded telehealth coverage and reimbursement.

Data from the Centers for Medicare & Medicaid Services (CMS) indicates a substantial increase in Medicare beneficiaries utilizing telehealth services between 2022 and 2024. This growing acceptance by both patients and providers, coupled with technological advancements in video conferencing and remote monitoring, suggests that telehealth is becoming an increasingly integral component of the healthcare delivery system in the US. This shift towards virtual care models is reshaping how healthcare is accessed and provided, driving further innovation and investment in the digital health sector.

Key Players Analysis

Key players in the U.S. digital health market drive growth through strategic investments in technology, partnerships, and service diversification. They focus on expanding telehealth services, integrating artificial intelligence for personalized care, and enhancing patient engagement through mobile platforms. Collaborations with healthcare providers, insurers, and technology companies facilitate the development of comprehensive digital health solutions. Additionally, targeting underserved populations and addressing healthcare disparities present significant growth opportunities.

Teladoc Health, headquartered in Purchase, New York, is a leading provider of virtual healthcare services. The company offers a range of services, including telemedicine, mental health support, and chronic condition management, accessible through its digital platform. In 2023, Teladoc Health reported revenues of approximately US$ 2.4 billion, with a significant portion attributed to its BetterHelp mental health services. The company serves millions of members across the United States and continues to expand its offerings through strategic partnerships and technological innovations.

Top Key Players in the US Digital Health Market

- Teladoc Health

- Epic Systems Corporation

- IBM

- Google, Inc

- Dexcom

- AT&T

- Allscripts

- Airstrip Technologies

Recent Developments

- In April 2025, Teladoc Health launched an advanced Cardiometabolic Health Program focused on enhancing population health by addressing the prevention and management of conditions like diabetes, hypertension, and obesity.

- In March 2023, IBM collaborated with Cleveland Clinic to deploy a quantum computer onsite, marking a significant milestone in biomedical research. This partnership aims to accelerate the discovery of new treatments and therapies, pushing the boundaries of computational power and driving forward the US digital health market with groundbreaking quantum technologies.

Report Scope

Report Features Description Market Value (2024) US$ 94.8 billion Forecast Revenue (2034) US$ 567.7 billion CAGR (2025-2034) 19.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Software, Hardware, and Services), By Technology (Tele-healthcare (Tele-care, Remote Medication Management, Activity Monitoring, Tele-health, Video Consultation, and LTC Monitoring), mHealth (Wearables & Connected Medical Devices, Vital Sign Monitoring Devices, Spirometers, Pulse Oximeters, Heart Rate Monitors, Electrocardiographs, Blood Pressure Monitors, Activity Monitors, Others, Sleep Monitoring Devices, Wrist Actigraphs, Sleep Trackers, Polysomnographs, Others, Electrocardiographs Fetal & Obstetric Devices, Neuromonitoring Devices, Electroencephalographs, Electromyographs, Others, mHealth Apps (Medical Apps, Women’s Health, Chronic Disease Management Apps, Remote Monitoring Apps, Personal Health Record Apps, Medication Management Apps, Diagnostic Apps, Others), Fitness Apps (Lifestyle & Stress, Exercise & Fitness, Diet & Nutrition, Services (Monitoring Services, Diagnosis Services)), Digital Health Systems (EHR, E-prescribing Systems), Healthcare Analytics), By Application (Obesity, Cancer, Respiratory Diseases, Fitness, Mental Health Management, Diabetes, Blood Pressure & ECG Monitoring, Cardiovascular Diseases, Menstrual Health, and Others), By End-user (Providers, Payers, Patients, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Teladoc Health, Epic Systems Corporation, IBM, Google, Inc, Dexcom, AT&T, Allscripts, and Airstrip Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Teladoc Health

- Epic Systems Corporation

- IBM

- Google, Inc

- Dexcom

- AT&T

- Allscripts

- Airstrip Technologies