Global AI In Cybersecurity Market By Offering (Hardware, Software (On-premise, Cloud), Services (Professional Services, Managed Services)), By Type (Network Security, Endpoint Security, Application Security, Cloud Security), By Technology (Machine Learning (ML), Natural Language Processing (NLP), Context-aware Computing, Computer Vision), By Application (Identity And Access Management, Risk And Compliance Management, Data Loss Prevention, Unified Threat Management, Fraud Detection/Anti-Fraud, Threat Intelligence, Others), By Industry Vertical (BFSI, Retail, Government & Defense, Manufacturing, Healthcare, Automotive & Transportation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2024

- Report ID: 118112

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

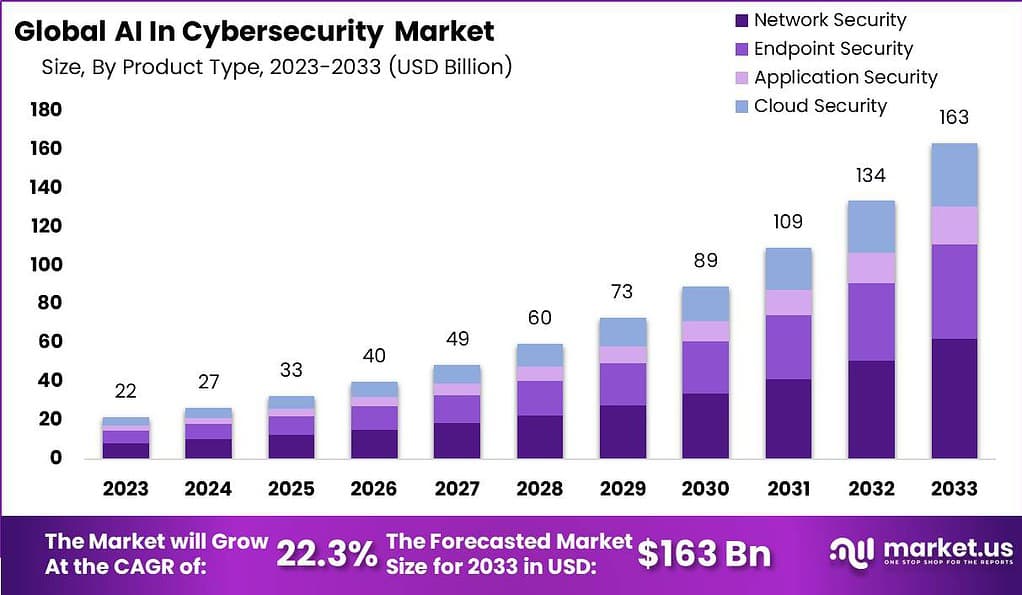

The Global AI In Cybersecurity Market size is expected to be worth around USD 163.0 Billion by 2033, from USD 22 Billion in 2023, growing at a CAGR of 22.3% during the forecast period from 2024 to 2033.

AI in cybersecurity refers to the application of artificial intelligence technologies in detecting, preventing, and mitigating cyber threats and attacks. It involves using machine learning, natural language processing, and other AI techniques to analyze vast amounts of data, identify patterns, and detect anomalies that may indicate potential security breaches or malicious activities.

The AI in cybersecurity market is rapidly growing as organizations recognize the need for advanced solutions to combat the increasing complexity and sophistication of cyber threats. AI technologies can enhance traditional cybersecurity measures by providing real-time threat detection, automated incident response, and predictive analytics to proactively identify and address potential vulnerabilities.

AI in cybersecurity encompasses a range of applications, including malware detection, network intrusion detection, user behavior analytics, and threat intelligence. By leveraging AI algorithms, cybersecurity systems can continuously learn from new data and adapt to evolving threats, improving their accuracy and effectiveness in detecting and mitigating security incidents.

The market for AI in cybersecurity is driven by factors such as the growing frequency and severity of cyberattacks, the increasing adoption of cloud computing and IoT technologies, and the need for scalable and intelligent security solutions. Both established cybersecurity vendors and emerging startups are investing in AI capabilities to develop innovative products and services that address the evolving threat landscape.

According to a report by Security Intelligence, the average total cost of a data breach in 2022 rose to ~$4.35 million, representing a modest increase of 2.6% compared to the previous year’s average of ~$4.24 million. This upward trend highlights the growing financial impact that cyberattacks can have on organizations worldwide.

In line with the increasing threat landscape, the World Economic Forum’s “Global Cybersecurity Outlook 2023” report revealed that an impressive 84% of surveyed organizations are leveraging AI-based tools to bolster their cybersecurity capabilities. These organizations recognize the potential of artificial intelligence in fortifying their defenses and mitigating risks associated with cyber threats.

Moreover, the European Union Agency for Cybersecurity (ENISA) observed a noteworthy surge in the adoption of AI-based security solutions, with a remarkable 30% increase over the past year. This surge can be attributed to organizations’ proactive efforts to bolster their cyber resilience and protect sensitive data from sophisticated attacks.

Key Takeaways

- The AI in cybersecurity market is estimated to reach a significant milestone, with a projected worth of approximately USD 163 billion by 2033. This growth trajectory reflects a robust Compound Annual Growth Rate (CAGR) of 22.3% over the forecast period, highlighting the increasing importance of AI technologies in addressing cyber threats.

- In 2023, the Services segment within the AI in cybersecurity market held a dominant position, capturing more than a 35% share.

- The Network Security segment within the AI in cybersecurity market held a dominant market position, capturing more than a 38% share in 2023.

- In 2023, the Machine Learning (ML) segment held a dominant market position within the AI in cybersecurity market, capturing more than a 47% share.

- In 2023, the Fraud Detection/Anti-Fraud segment held a dominant position within the AI in cybersecurity market, capturing more than a 20% share.

- In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position within the AI in cybersecurity market, capturing more than a 28% share.

- In 2023, North America held a dominant market position in the AI in cybersecurity market, capturing more than a 36% share.

- 55% of companies globally are planning to utilize AI to enhance corporate cybersecurity in 2024.

- 21% of IT decision makers believe AI can assist in creating security rules.

- 19% of respondents anticipate that attack simulation and compliance violation will be the most likely cybersecurity use cases for AI in 2024.

- 63% of security professionals believe AI has the potential to enhance security measures, particularly in threat detection and response capabilities.

- Only 12% of security professionals believe AI will completely replace their role.

- 30% of security professionals expect AI to enhance their skill set, while 28% believe it will provide general support to their role.

- 24% of security professionals anticipate that AI will replace large portions of their responsibilities, freeing them up for other tasks.

- C-suite executives demonstrate a significantly higher (52%) self-reported familiarity with AI technologies compared to their staff (11%).

- Over 55% of organizations are planning to implement generative AI solutions in 2024, indicating a revolutionary year for AI adoption in the security sector (Key Findings from the State of AI and Security Survey Report)

Offering Analysis

In 2023, the Services segment within the AI in cybersecurity market held a dominant position, capturing more than a 35% share. This prominence is primarily attributed to the escalating demand for specialized expertise and continuous monitoring in the cybersecurity domain. Organizations, ranging from small enterprises to large corporations, increasingly recognize the critical need for professional and managed services to safeguard their digital assets against sophisticated cyber threats.

Professional services, including consulting, support, and maintenance, alongside managed services that offer outsourced monitoring and management of security systems and devices, have become pivotal. This shift towards services is driven by the complex nature of cyber threats, which require not just reactive measures but proactive management and strategic planning to mitigate potential risks effectively.

The leading position of the Services segment can also be understood through its role in facilitating the deployment of AI technologies in cybersecurity. With the integration of AI, cybersecurity services have evolved to offer more predictive and preventive solutions, leveraging data analytics and machine learning to anticipate and neutralize threats before they manifest. This evolution has necessitated a higher level of expertise and technological sophistication, further propelling the demand for professional and managed cybersecurity services.

Additionally, the growing inclination towards cloud-based solutions has bolstered the Managed Services sub-segment, as businesses seek scalable, flexible, and cost-effective cybersecurity measures. The reliance on these services is underscored by the increased need for continuous, advanced threat detection and response capabilities that AI-enhanced services can provide, thereby underscoring the segment’s leadership in the market.

Type Analysis

In 2023, the Network Security segment within the AI in cybersecurity market held a dominant market position, capturing more than a 38% share. This significant market share can be attributed to the escalating complexity and volume of network attacks, coupled with the expanding digital footprint of modern businesses. As organizations increasingly rely on intricate network infrastructures for their operations, the demand for robust network security solutions has surged.

These solutions, enhanced by AI, offer unparalleled capabilities in detecting, analyzing, and neutralizing potential threats in real-time, thus ensuring the integrity and availability of network resources. The incorporation of AI technologies into network security not only enhances threat detection but also improves the efficiency of security operations, making it a critical investment for businesses aiming to safeguard their digital environments.

The prominence of the Network Security segment is further bolstered by the continuous evolution of cyber threats targeting network vulnerabilities. AI-driven network security solutions are equipped to adapt and respond to these evolving threats more effectively than traditional security measures. They leverage machine learning algorithms to learn from historical data, enabling them to predict and prevent future attacks with a higher degree of accuracy.

This adaptability is crucial in an era where threat vectors are constantly changing, requiring defenses that are as dynamic and proactive as the threats themselves. Moreover, the shift towards remote work and the increased reliance on cloud services have amplified the need for advanced network security, as businesses must now protect data that flows across a more dispersed and heterogeneous network landscape.

Technology Analysis

In 2023, the Machine Learning (ML) segment held a dominant market position within the AI in cybersecurity market, capturing more than a 47% share. This prominence can be attributed to ML’s unparalleled efficiency in detecting and responding to cybersecurity threats with minimal human intervention.

Machine learning algorithms excel in pattern recognition, enabling them to identify malicious activities and anomalies in data that might elude traditional cybersecurity measures. The adoption of ML technologies has been further driven by their ability to learn and adapt over time, enhancing their predictive capabilities and thereby fortifying defense mechanisms against increasingly sophisticated cyberattacks.

The leading position of the ML segment is underscored by its critical role in automating threat detection processes, which significantly reduces response times to potential security breaches. The application of ML in cybersecurity not only improves the accuracy of threat detection but also facilitates a proactive security stance through the anticipation of future threats based on historical data.

Furthermore, the integration of ML technologies has enabled the development of more robust security solutions that can effectively counteract a wide range of cyber threats, from malware and phishing to more complex ransomware attacks. The efficiency and adaptability of ML algorithms have thus established machine learning as the cornerstone of modern cybersecurity strategies, reflecting its substantial market share.

Application Analysis

In 2023, the Fraud Detection/Anti-Fraud segment held a dominant position within the AI in cybersecurity market, capturing more than a 20% share. This notable market share can be attributed to the increasing sophistication of cyber threats and financial fraud, which have necessitated the adoption of advanced solutions for detection and prevention.

As businesses across various sectors continue to digitalize their operations, the volume of online transactions has surged, thereby elevating the risk of fraudulent activities. The deployment of AI-driven tools in fraud detection and anti-fraud measures has become imperative for organizations aiming to safeguard their digital assets and maintain consumer trust.

The leading status of the Fraud Detection/Anti-Fraud segment is further reinforced by its ability to offer real-time threat detection and response. AI technologies, including machine learning and behavioral analytics, enable the identification of irregular patterns and potential fraudulent activities with high accuracy and speed. These technologies learn continuously from data patterns, enhancing their efficacy over time and reducing false positives.

Moreover, the financial implications of fraud for businesses are substantial, not only in terms of monetary loss but also regarding reputational damage. Consequently, investment in AI for fraud detection and anti-fraud measures is seen as a strategic necessity, driving the segment’s growth and its prominence within the AI in cybersecurity market.

Industry Vertical Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position within the AI in cybersecurity market, capturing more than a 28% share. This considerable market share is primarily due to the inherently high risk of cyber threats and fraud in the financial sector.

Financial institutions are pivotal in the management and movement of large sums of money and sensitive personal data, making them prime targets for cybercriminals. The necessity for advanced security measures has led to the adoption of AI technologies, which provide enhanced capabilities in detecting and preventing cyber threats in real-time.

The leadership of the BFSI segment in the AI in cybersecurity market is also a reflection of the digital transformation within the sector. As online banking and mobile financial services expand, so does the attack surface for potential cyber threats.

AI-driven cybersecurity solutions offer the BFSI sector the ability to preemptively identify vulnerabilities, monitor for suspicious activities across a multitude of channels, and respond to threats with minimal human intervention. These capabilities are essential in a landscape where cyber threats are not only growing in number but also in sophistication.

Furthermore, regulatory pressures and the need for compliance with data protection and privacy laws have spurred the BFSI sector to invest heavily in cybersecurity measures, including AI. The implementation of AI in cybersecurity allows for continuous learning and adaptation to new threats, significantly reducing the risk of data breaches and financial fraud.

Key Market Segments

By Offering

- Hardware

- Software

- On-premise

- Cloud

- Services

- Professional Services

- Managed Services

By Type

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

By Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Context-aware Computing

- Computer Vision

By Application

- Identity And Access Management

- Risk And Compliance Management

- Data Loss Prevention

- Unified Threat Management

- Fraud Detection/Anti-Fraud

- Threat Intelligence

- Others

By Industry Vertical

- BFSI

- Retail

- Government & Defense

- Manufacturing

- Healthcare

- Automotive & Transportation

- Others

Driver

Enhanced Threat Detection and Response

The use of AI in cybersecurity significantly improves threat detection and response times. AI algorithms are adept at analyzing vast amounts of data swiftly, identifying patterns, and detecting anomalies that could indicate a cybersecurity threat. This capability allows for the early detection of potential threats, reducing the window of opportunity for attackers.

Additionally, AI enhances the response to these threats by automating processes that were traditionally manual, making the mitigation of cyber attacks more efficient. This improvement in threat detection and response is a key driver for the adoption of AI in cybersecurity, as organizations seek to bolster their defenses against increasingly sophisticated cyber attacks.

Restraint

High Implementation Costs

One of the main restraints in the adoption of AI in cybersecurity is the high cost associated with implementing AI technologies. Developing or acquiring AI-powered cybersecurity solutions often requires significant investment in both technology and expertise. Small and medium-sized enterprises (SMEs) in particular may find these costs prohibitive, limiting their ability to leverage AI in their cybersecurity efforts.

Moreover, the ongoing costs of maintaining and updating AI systems, along with the need for skilled personnel to manage these advanced tools, add to the financial burden. This financial barrier can restrain the growth of the AI in cybersecurity market, especially among smaller organizations with limited budgets.

Opportunity

Growing Cyber Threat Landscape

The expanding digital footprint of businesses and the increasing sophistication of cyber threats present a significant opportunity for the AI in cybersecurity market. As cyber attackers employ more advanced techniques, traditional cybersecurity measures struggle to keep pace. AI’s ability to learn and adapt to new threats makes it an invaluable tool in this ever-evolving battle.

Moreover, the increasing adoption of IoT devices, cloud services, and remote work models expands the attack surface, necessitating more advanced security measures. This growing threat landscape offers a substantial opportunity for the development and deployment of AI-based cybersecurity solutions, catering to the urgent need for enhanced security in a digital age.

Challenge

AI-Generated Attacks

While AI significantly enhances cybersecurity defenses, it also presents a new challenge: AI-generated cyber attacks. Cyber attackers are beginning to use AI technologies to develop more sophisticated attack methods, including malware that can adapt to evade detection and automated systems that can carry out phishing attacks at a massive scale.

These AI-generated threats can outpace traditional security measures, requiring constant innovation and adaptation from cybersecurity defenses. This arms race between cybersecurity professionals and attackers represents a significant challenge, as the industry must continuously evolve to counter AI-powered threats.

Emerging Trends

- AI and Machine Learning Integration: There’s a growing trend towards integrating AI and machine learning technologies to predict and prevent cyber-attacks before they occur. These systems are becoming increasingly adept at analyzing patterns and predicting potential security breaches.

- Automated Security Systems: Automation in cybersecurity, powered by AI, is on the rise. These systems can automatically detect, analyze, and respond to threats without human intervention, increasing the speed and efficiency of cybersecurity responses.

- Behavioral Analytics: The use of AI to monitor and analyze user behavior for unusual patterns is becoming more common. This helps in identifying potential insider threats and compromised accounts more effectively.

- Enhanced Threat Detection: AI is improving threat detection capabilities, especially in identifying zero-day vulnerabilities and sophisticated phishing attacks by analyzing data trends and patterns that would be difficult for humans to spot.

- AI in Cybersecurity Hygiene: AI technologies are being used to improve cybersecurity hygiene by automatically updating security protocols and ensuring compliance with data protection regulations. This reduces the risk of vulnerabilities due to outdated systems or human error.

Growth Factors

- Increasing Cyber Threats: The continuous rise in cyber threats, including advanced persistent threats (APTs) and ransomware attacks, is a major driver for the adoption of AI in cybersecurity solutions.

- Digital Transformation: As businesses undergo digital transformation, the expansion of digital assets necessitates advanced cybersecurity measures. AI-driven solutions are pivotal in protecting these growing digital environments.

- Regulatory Compliance: The tightening of data protection regulations globally compels organizations to adopt sophisticated cybersecurity measures. AI-driven systems can help in ensuring compliance with these regulations more effectively.

- The Surge in IoT Devices: The proliferation of IoT devices has expanded the attack surface for cyber threats, driving demand for AI-powered security solutions that can scale and adapt to protect a vast array of devices.

- Shortage of Skilled Cybersecurity Professionals: The global shortage of skilled cybersecurity personnel has led organizations to rely on AI and automation to fill the gap, ensuring continuous threat detection and response without the need for constant human oversight.

Regional Analysis

In 2023, North America held a dominant market position in the AI in cybersecurity market, capturing more than a 36% share. This substantial market share can be attributed to several pivotal factors, including the robust presence of leading AI technology and cybersecurity firms within the region. North America, particularly the United States, is home to a dense concentration of technological innovators and pioneers, which has propelled the adoption of advanced AI solutions for cybersecurity.

The demand for AI In Cybersecurity in North America was valued at USD 4.8 billion in 2023 and is anticipated to grow significantly in the forecast period. The region’s market leadership is further bolstered by significant investments in R&D activities, aimed at enhancing AI capabilities and cybersecurity measures. Additionally, the high prevalence of cyber threats in North American enterprises and government institutions has necessitated the rapid deployment of sophisticated AI-driven cybersecurity solutions.

The prevalence of stringent regulatory frameworks governing data protection and cybersecurity in North America also plays a critical role in the region’s market dominance. Regulations such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) compliance requirements for companies operating in Europe but with data centers in North America have led to an increased demand for AI-driven cybersecurity solutions.

These solutions are not only aimed at thwarting cyber threats but also ensuring compliance with evolving legal requirements. Furthermore, the collaborative efforts between the public and private sectors in the region to combat cyber threats have fostered an environment conducive to the growth of the AI in cybersecurity market. Initiatives aimed at sharing cyber threat intelligence and best practices in AI deployment have significantly contributed to the advancement of cybersecurity measures in the region.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the domain of cybersecurity, the integration of artificial intelligence (AI) has become a pivotal aspect for advancing security measures and enhancing defense mechanisms against an ever-evolving array of cyber threats. The AI in cybersecurity market is characterized by the presence of key players who are at the forefront of innovation, developing sophisticated AI solutions to preempt, detect, and neutralize cyber attacks with unprecedented efficiency.

Top Market Leaders

- NVIDIA Corporation

- Intel Corporation

- Xilinx Inc.

- Micron Technology Inc.

- Amazon Web Services, Inc.

- IBM Corporation

- Microsoft Corporation

- FireEye, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- McAfee LLC

- Other key players

Recent Developments

- In August 2022, Microsoft introduced a new service called Microsoft Defender Experts for Hunting. This service is all about actively looking for and stopping cyber threats before they cause harm. Thanks to this effort, along with other security measures, Microsoft’s Security team was able to block a huge number of dangers in 2021 alone.

- In August 2022, BluVector, a Comcast company specializing in network security, introduced a new tool called Automated Threat Hunting (ATH). This is a cloud service that uses the latest AI to change how we look for cybersecurity threats, allowing teams to be more proactive rather than just reacting to attacks. This tool gives cybersecurity teams the ability to actively search for threats, improving their ability to protect their networks.

Report Scope

Report Features Description Market Value (2023) USD 22 Bn Forecast Revenue (2033) USD 163 Bn CAGR (2024-2033) 22.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware, Software (On-premise, Cloud), Services (Professional Services, Managed Services)), By Type (Network Security, Endpoint Security, Application Security, Cloud Security), By Technology (Machine Learning (ML), Natural Language Processing (NLP), Context-aware Computing, Computer Vision), By Application (Identity And Access Management, Risk And Compliance Management, Data Loss Prevention, Unified Threat Management, Fraud Detection/Anti-Fraud, Threat Intelligence, Others), By Industry Vertical (BFSI, Retail, Government & Defense, Manufacturing, Healthcare, Automotive & Transportation, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape NVIDIA Corporation, Intel Corporation, Xilinx Inc., Micron Technology Inc., Amazon Web Services Inc., IBM Corporation, Microsoft Corporation, FireEye, Inc., Palo Alto Networks Inc., Fortinet, Inc., Check Point Software Technologies Ltd., McAfee LLC, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is AI in Cybersecurity?AI in cybersecurity refers to the utilization of artificial intelligence techniques such as machine learning, natural language processing, and behavioral analytics to enhance the security posture of systems, networks, and data against cyber threats.

How big is AI In Cybersecurity Market?The Global AI In Cybersecurity Market size is expected to be worth around USD 163.0 Billion by 2033, from USD 22 Billion in 2023, growing at a CAGR of 22.3% during the forecast period from 2024 to 2033.

Which technology segment accounted for the largest artificial intelligence in cybersecurity market share?In 2023, the Machine Learning (ML) segment held a dominant market position within the AI in cybersecurity market, capturing more than a 47% share.

Who are the prominent players operating in the artificial intelligence (AI) in cybersecurity market?The major players operating in the artificial intelligence (AI) in cybersecurity market are NVIDIA Corporation, Intel Corporation, Xilinx Inc., Micron Technology Inc., Amazon Web Services Inc., IBM Corporation, Microsoft Corporation, FireEye, Inc., Palo Alto Networks Inc., Fortinet, Inc., Check Point Software Technologies Ltd., McAfee LLC, Other key players

Which region will lead the global artificial intelligence (AI) in cybersecurity market?In 2023, North America held a dominant market position in the AI in cybersecurity market, capturing more than a 36% share.

AI In Cybersecurity MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample

AI In Cybersecurity MarketPublished date: April 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- NVIDIA Corporation

- Intel Corporation

- Xilinx Inc.

- Micron Technology Inc.

- Amazon Web Services, Inc.

- IBM Corporation

- Microsoft Corporation

- FireEye, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- McAfee LLC

- Other key players