Global Alkoxylates Market Size, Share Analysis Report By Grade (Natural Ethoxylates, Synthetic Ethoxylates), By Type (Fatty Acid Ethoxylates, Alkyl Phenol Ethoxylates, Glycerin Alkoxylates, Sorbitan Ester Alkoxylates, Others), By Application (Wetting Agents, Cleaning Agents, Detergents, Stabilizers, Surfactants, Others), By End-Use Industry (Personal Care, Agrochemicals, Paints and Coatings, Pharmaceuticals, Oil and Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163405

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

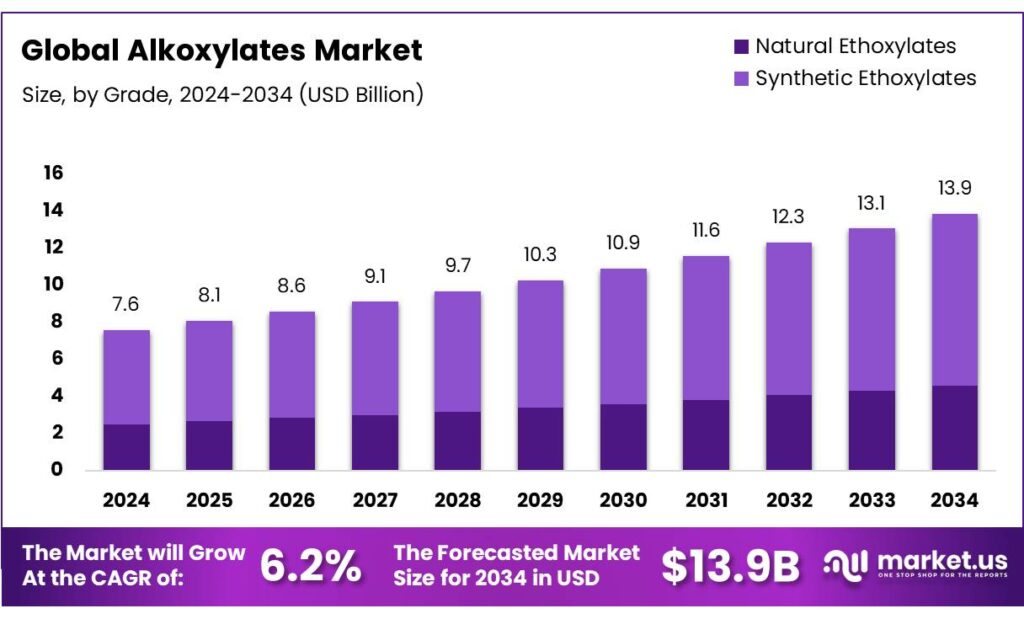

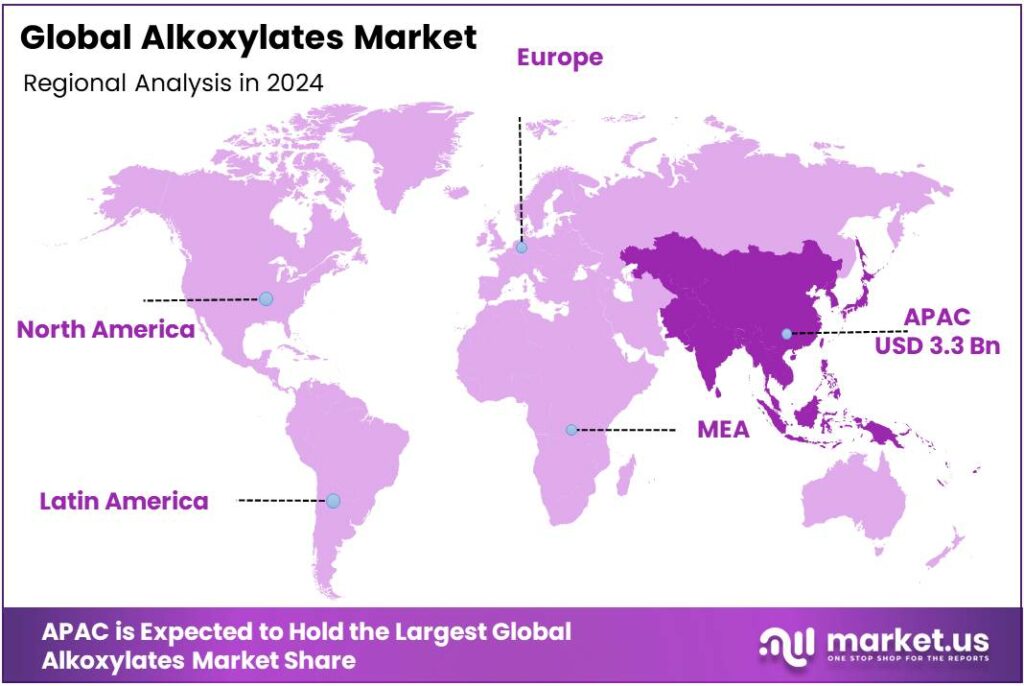

The Global Alkoxylates Market size is expected to be worth around USD 13.9 Billion by 2034, from USD 7.6 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 46.8% share, holding USD 307 Million in revenue.

Alkoxylates are a broad class of non-ionic surfactants made by adding ethylene oxide (EO) and/or propylene oxide (PO) to fatty alcohols, fatty acids, or amines. They underpin detergency, wetting, and emulsification in home & personal care, institutional cleaning, agrochemicals, oilfield chemicals, metalworking fluids, and paints & coatings.

Demand for these products is tightly linked to petrochemical feedstocks and the wider energy system, because EO/PO originate from ethylene and propylene value chains. The International Energy Agency projects petrochemicals to account for over one-third of global oil-demand growth by 2030 and nearly half by 2050, indicating a structural tailwind for downstream intermediates like alkoxylates.

Policy and regulation are steering product mix toward safer, more sustainable alkoxylates. The EU’s restriction on nonylphenol ethoxylates (NPEs) at ≥0.01% w/w in washable textiles took effect 3 February 2021, accelerating substitution to alcohol ethoxylates and other alternatives in apparel supply chains. In the United States, EPA has pursued a Significant New Use Rule framework for 15 NP/NPE substances, signalling heightened scrutiny around legacy APEO surfactants and encouraging reformulation.

Multiple demand and policy drivers support growth. Hygiene awareness remains elevated, while industrial sectors continue to adopt tailored ethoxylate/propoxylate structures for performance and compliance. From an energy-materials lens, the IEA expects petrochemicals to require an additional 56 billion m³ of natural gas by 2030, strengthening the link between energy markets and oxides-based intermediates. Meanwhile, government funding is catalyzing bio-based routes.

The U.S. Department of Energy’s Bioenergy Technologies Office announced $12 million in FY 2024 to advance biorefineries for biofuels and biochemicals, which can include bio-based surfactant precursors. Earlier, industry advanced $170 million bio-EO capacity at Croda’s Atlas Point to enable 100% renewable non-ionic surfactants, demonstrating technical viability at commercial scale.

Key Takeaways

- Alkoxylates Market size is expected to be worth around USD 13.9 Billion by 2034, from USD 7.6 Billion in 2024, growing at a CAGR of 6.2%.

- Synthetic Ethoxylates held a dominant market position, capturing more than a 67.4% share of the global alkoxylates market.

- Fatty Acid Ethoxylates held a dominant market position, capturing more than a 32.7% share of the global alkoxylates market.

- Detergents held a dominant market position, capturing more than a 34.8% share of the global alkoxylates market.

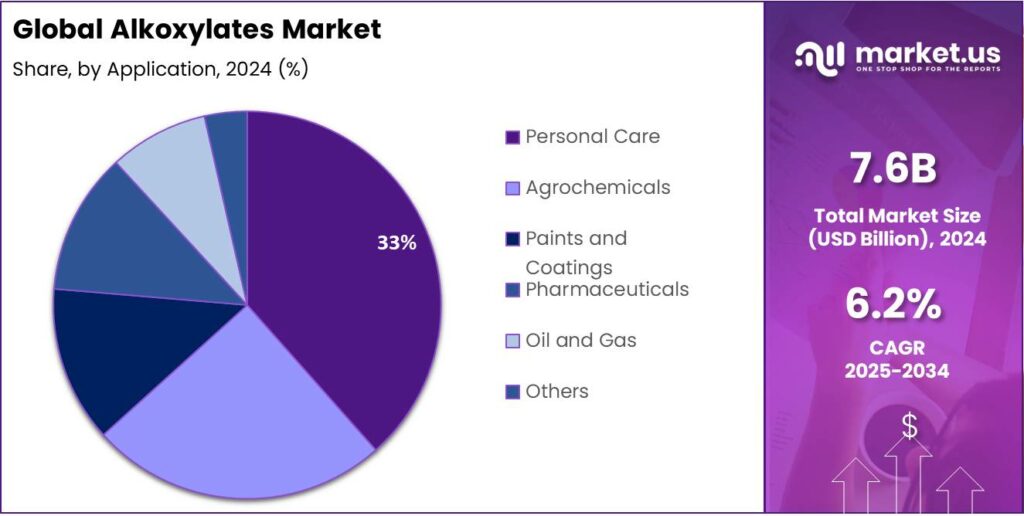

- Personal Care segment held a dominant market position, capturing more than a 32.5% share of the global alkoxylates market.

- Asia-Pacific emerged as the dominant region in the global alkoxylates market, holding a substantial 43.80% share valued at USD 3.3 billion.

By Grade Analysis

Synthetic Ethoxylates dominate with 67.4% share due to their versatility and widespread industrial use.

In 2024, Synthetic Ethoxylates held a dominant market position, capturing more than a 67.4% share of the global alkoxylates market. This strong presence is primarily attributed to their broad applicability across detergents, personal care, agrochemicals, and industrial cleaning sectors, where they serve as effective surfactants and emulsifiers. Their chemical stability, cost-effectiveness, and compatibility with a wide range of formulations make them a preferred choice among manufacturers seeking consistent performance and reliable supply.

The growing demand for industrial and household cleaning agents in 2024 further supported the segment’s expansion, especially in emerging economies undergoing rapid urbanization and lifestyle modernization. By 2025, the demand for synthetic ethoxylates is projected to remain strong, driven by technological advancements in surfactant synthesis, improved biodegradability profiles, and the continued shift toward high-performance cleaning formulations. The dominance of synthetic ethoxylates highlights their critical role in balancing efficiency, cost, and functionality across multiple end-use industries.

By Type Analysis

Fatty Acid Ethoxylates dominate with 32.7% share due to their biodegradability and broad industrial demand.

In 2024, Fatty Acid Ethoxylates held a dominant market position, capturing more than a 32.7% share of the global alkoxylates market. This segment’s leadership is driven by its excellent emulsifying and dispersing properties, making it highly suitable for detergents, textiles, personal care, and agrochemical formulations. Derived from natural fatty acids, these ethoxylates are valued for their biodegradability and low toxicity, aligning well with the growing industry focus on eco-friendly and sustainable chemical ingredients.

The year 2024 witnessed strong consumption across household and industrial cleaning applications, supported by increasing awareness of environmental safety and product efficiency. Additionally, their compatibility with both ionic and non-ionic systems made them a preferred choice for versatile formulations. Moving into 2025, the market for fatty acid ethoxylates is expected to expand steadily as manufacturers invest in green chemistry innovations and bio-based surfactant production. The segment’s strong environmental profile and functional versatility will continue to reinforce its dominance in the alkoxylates market.

By Application Analysis

Detergents dominate with 34.8% share due to their extensive use in household and industrial cleaning applications.

In 2024, Detergents held a dominant market position, capturing more than a 34.8% share of the global alkoxylates market. The strong demand for detergents was primarily supported by the rising consumption of cleaning and personal care products across both residential and commercial sectors. Alkoxylates play a vital role in detergents as effective surfactants, providing superior wetting, emulsifying, and foaming properties that enhance cleaning performance.

The growth in urban population, coupled with increasing hygiene awareness and the expansion of laundry and dishwashing product categories, further fueled market demand in 2024. Additionally, industries such as textiles, healthcare, and food processing contributed to higher consumption of industrial-grade detergents. Entering 2025, the demand for biodegradable and low-foaming alkoxylates is expected to rise as sustainability regulations tighten, reinforcing the detergent segment’s leading role in the global alkoxylates market.

By End-Use Analysis

Personal Care dominates with 32.5% share driven by rising demand for mild and efficient surfactants in cosmetic formulations.

In 2024, the Personal Care segment held a dominant market position, capturing more than a 32.5% share of the global alkoxylates market. The strong demand stemmed from the growing consumption of shampoos, body washes, lotions, and skincare products, where alkoxylates are used as emulsifiers, solubilizers, and surfactants to enhance texture, stability, and foaming properties. Increasing consumer awareness about hygiene and grooming, coupled with the trend toward mild and eco-friendly ingredients, supported this segment’s expansion.

By 2025, the personal care industry is expected to sustain steady growth, driven by rising disposable incomes and the increasing adoption of premium and natural cosmetic products. The ongoing shift toward biodegradable alkoxylates to meet environmental standards will further strengthen their application in personal care formulations, ensuring this segment maintains its leadership position in the global alkoxylates market.

Key Market Segments

By Grade

- Natural Ethoxylates

- Synthetic Ethoxylates

By Type

- Fatty Acid Ethoxylates

- Alkyl Phenol Ethoxylates

- Glycerin Alkoxylates

- Sorbitan Ester Alkoxylates

- Others

By Application

- Wetting Agents

- Cleaning Agents

- Detergents

- Stabilizers

- Surfactants

- Others

By End-Use Industry

- Personal Care

- Agrochemicals

- Paints and Coatings

- Pharmaceuticals

- Oil and Gas

- Others

Emerging Trends

Low-impurity, food-grade alkoxylates for faster, cleaner CIP

A clear trend is taking hold: food and beverage plants are asking for APEO-free, ultra-low-impurity alkoxylates that clean faster, rinse easier, and support validated clean-in-place (CIP) programs. The human reason is simple. Unsafe food sickens an estimated 600 million people and causes 420,000 deaths each year, a burden regulators and brands are determined to cut. When plants can remove fats, proteins, and biofilms at lower temperatures and in shorter cycles, they reduce risk while saving time and utilities—so the surfactants that enable that performance gain share.

- Waste-reduction targets are accelerating the shift. The UN Environment Programme’s 2024 Food Waste Index estimates 1.05 billion tonnes of food were wasted in 2022, equal to 19% of food available to consumers. That sits on top of 13.2% post-harvest-to-retail losses tracked by FAO. Plants are under pressure to keep lines running cleaner, longer, with fewer discard batches; surfactants that deliver reliable soil lift and low residue help avoid rework and downtime.

Binding EU food-waste reduction targets for 2030—10% in processing/manufacturing and 30% per-capita across retail and consumption—are prompting plants to quantify how better cleaning chemistry reduces waste and unplanned holds. In this context, suppliers that can pair alkoxylates with validated CIP protocols and measurable cycle-time or temperature reductions are finding a warmer reception from procurement and quality teams.

Water and energy intensity keep the pressure on performance. Dairy guidance shows typical plants can use ~1–3 L of water per liter of milk processed before site-specific optimizations. Technical guidance from FAO/WHO on safe water use and reuse in dairy processing encourages validated cleaning and rinse strategies. Alkoxylates that wet rapidly, control foam, and rinse clean at cooler setpoints make these water-reuse and energy-saving goals attainable—turning formulation choices into hard savings and better hygiene.

Drivers

Enhanced Hygiene Demands in the Food And Agriculture Sector Driving Alkoxylate Use

One of the major driving factors for increased demand for alkoxylates is the growing emphasis on hygiene and sanitation throughout the food-chain, from raw-material handling to consumer delivery. According to the World Health Organization (WHO), around 600 million people—almost one in ten globally—fall ill each year from contaminated food, and approximately 420,000 deaths result from such illnesses.

These figures reflect how significant food-safety risks have become, not just from microbial pathogens but also from chemical or surface-borne contamination in processing and handling facilities. In this context, companies that produce cleaning, sanitising and surfactant chemistries—such as alkoxylates—find heightened demand for formulations that offer effective removal of residues, biofilms and emulsified fats on equipment surfaces, tanks, pipelines and packaging lines.

From a practical standpoint, the food-and-beverage industry is under increasing regulatory and buyer pressure to implement “good hygiene practices” and Hazard Analysis & Critical Control Point (HACCP) systems. For example, the Food and Agriculture Organization of the United Nations (FAO)/WHO Codex “Food Hygiene – Basic Texts” outlines that cleaning, maintenance and personal hygiene must be controlled as part of the general principles of food hygiene. The necessity of those hygiene controls naturally extends to the chemical cleaning agents used in food-contact surfaces, which drives demand for high-performance non-ionic surfactants such as alkoxylates.

On the policy side, governments are issuing more stringent food-safety hygiene standards and inspection regimes. This creates an indirect tailwind for chemical suppliers who can offer solutions certified for food-contact use or compatible with organic/eco-labels. It also means companies are willing to accept higher-cost cleaning chemistries if they reduce risk of recalls, contamination events or regulatory enforcement costs. In other words, cleaning and sanitisation become risk-mitigation investments, not just cost centres.

Restraints

Regulatory And Compliance Burden Limits Alkoxylate Uptake

A significant restraining factor for alkoxylates arises from the increasing regulatory and compliance demands around surfactants and food-contact materials, which impose both cost and formulation constraints on chemical suppliers. For example, within the European Union, all materials and articles intended to contact food must comply with Regulation (EC) No 1935/2004 and be manufactured under good-manufacturing-practice rules laid out in Commission Regulation (EC) No 2023/2006.

Under Regulation (EC) No 552/2009 amending the REACH rules, textile articles that can reasonably be expected to be washed must not contain NPEs at or above 0.01% w/w (100 ppm) as from 3 February 2021. While these restrictions explicitly reference textiles, the downstream effect is that surfactant producers—especially those employing alkoxylation technologies—must certify low or zero NPE content, invest in alternative chemistries and validate performance. As noted by the U.S. United States Environmental Protection Agency (EPA), annual consumption of NPE surfactants in the U.S. and Canada was estimated between 300 million and 400 million lb/year in 2007.

In addition, materials used in the food-processing chain (e.g., packaging, tank linings, coatings) are under continual revision: the EU’s plastics food-contact regulation, Regulation (EU) No 10/2011 (amended as of 11 July 2023 under Commission Regulation (EU) 2023/1442), imposes migration limits and restricts certain substances used in manufacture. For alkoxylates used in cleaning or contact processes, this means the raw material, by-product profile, and formulation must satisfy many moving rules, heightening testing, labeling and audit costs.

Even though chemical engineers and surfactant formulators are keen to build performance and sustainability into their products, the burden of proving regulatory compliance shifts resources from innovation toward documentation and testing. This slows time-to-market for novel alkoxylate grades, especially in fast-moving applications like food-processor CIP (clean-in-place) systems, where downtime is costly and certification lead-times long. Suppliers may hesitate to invest in ultra-fine-tuned alkoxylates if the route to approval for food-contact or food-adjacent use remains opaque or protracted.

Opportunity

Cutting Food Loss And Waste Through Better Cleaning and CI

A powerful growth opportunity for alkoxylates sits inside the global push to cut food loss and waste across processing plants, kitchens, and retail. The scale of the problem is stark: the UN Environment Programme estimates 1.05 billion tonnes of food were wasted in 2022 across households, food service, and retail—equal to 19% of food available to consumers. The Food and Agriculture Organization adds that a further 13.2% is lost between post-harvest and retail, underscoring how much is lost before food even reaches consumers.

- Hygiene is the human reason behind this opportunity. The World Health Organization estimates 600 million people fall ill from unsafe food each year and 420,000 die, with a US$110 billion annual burden in low- and middle-income countries alone. Processors respond to that risk with stronger sanitation and more frequent clean-in-place (CIP) cycles. Alkoxylates that lift fats, proteins, and biofilms at lower temperatures and shorter cycles can reduce downtime while protecting public health. As facilities scale up, the payback compounds.

In Europe, the Green Deal’s Farm-to-Fork agenda drives safer, more sustainable food systems; lawmakers have backed targets to cut food waste by 10% in manufacturing/processing and 30% per capita across retail, restaurants, food services, and households by 2030, a direction that pressures plants to improve sanitation effectiveness and efficiency.

Water and energy are the practical edge. CIP and open-plant cleaning consume substantial utilities, and industry studies show dairy processing typically uses ~1–3 L of water per liter of milk processed, before site-specific reuse and optimization. FAO and WHO have also issued technical guidance on safe water use and reuse in dairy processing, encouraging validated cleaning regimes and risk controls—an environment that favors surfactants with predictable performance and low impurities.

- In plain terms, cutting loss and waste is now a board-level priority with numbers to match—1.05 billion tonnes wasted by consumers and 13.2% lost before retail. Alkoxylates that make cleaning more reliable, quicker, and less resource-intensive meet that moment, turning hygiene and sustainability pressure into long-run demand.

Regional Insights

Asia-Pacific Leads with Expanding Industrial and Consumer Demand

In 2024, Asia-Pacific emerged as the dominant region in the global alkoxylates market, holding a substantial 43.80% share valued at USD 3.3 billion. The region’s leadership stems from its strong industrial base, expanding population, and rapidly growing demand for cleaning and agrochemical formulations. Countries such as China, India, Japan, and South Korea anchor large-scale production and consumption, particularly in home and personal care, textiles, and food-processing industries. China remains the key growth engine, with national statistics showing the chemical sector contributing over 4.3% to its GDP in 2023, underscoring the depth of industrial integration.

Asia-Pacific’s surge is also tied to urbanization and hygiene awareness. According to the United Nations, more than 2.3 billion people in Asia-Pacific now live in urban areas, a figure expected to rise by 50% by 2035, driving use of detergents and cleaning agents that depend heavily on alkoxylates. The agricultural sector further boosts demand, as India and China together account for over 30% of global fertilizer consumption (FAO, 2024), supporting large-scale use of alkoxylate-based wetting agents and emulsifiers in crop-protection formulations. Government support is also evident: under China’s 14th Five-Year Plan, the country pledged to increase output of green and biodegradable surfactants by 20% by 2025, a move encouraging bio-based alkoxylate production.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Croda International Plc: Croda has a strong specialty-chemicals heritage and has recently expanded its alkoxylation footprint, including a Singapore facility investment of around SGD 22 million (USD 16.4 million) to increase pastille-format alkoxylate capacity by 4,600 MT. The company also offers 100% bio-based alkoxylates under its ECO range, targeting sustainable surfactant demand.

IMCD Group: IMCD is a global specialty-chemicals distributor and formulator, acting as a bridge between raw chemical producers and end-use markets including home care, agrochemicals and industrial applications. While not a producer of alkoxylates itself, IMCD supports the market by distributing and formulating surfactant chemistries, enabling broader penetration and tailored solutions.

Indorama Ventures Public Company Limited: Through its Indovinya unit, Indorama supplies alkoxylates and other surfactant derivatives, such as demulsifiers and oilfield additives. The company reported around US$15.6 billion revenue in 2023 and is considering a spin-off of the surfactant business, signalling a strategic focus on this area.

Top Key Players Outlook

- Croda International Plc

- IMCD Group

- Lamberti S.p.A.

- Dow

- Indorama Ventures Public Company Limited

- PCC Group

- Schärer and Schläpfer AG

- Solvay

- Stepan Company

- Clariant AG

Recent Industry Developments

In 2024 Croda delivered £1,628.1 million in group sales and an adjusted profit before tax of £260.0 million, illustrating a modest contraction overall but resilience in key segments.

In 2024, IMCD generated revenues of EUR 4,747.7 million (≈ USD 5.0 billion) and reported operating EBITA of EUR 531 million, reflecting a 5 % increase on a constant-currency basis for the year.

Report Scope

Report Features Description Market Value (2024) USD 7.6 Bn Forecast Revenue (2034) USD 13.9 Bn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Natural Ethoxylates, Synthetic Ethoxylates), By Type (Fatty Acid Ethoxylates, Alkyl Phenol Ethoxylates, Glycerin Alkoxylates, Sorbitan Ester Alkoxylates, Others), By Application (Wetting Agents, Cleaning Agents, Detergents, Stabilizers, Surfactants, Others), By End-Use Industry (Personal Care, Agrochemicals, Paints and Coatings, Pharmaceuticals, Oil and Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Croda International Plc, IMCD Group, Lamberti S.p.A., Dow, Indorama Ventures Public Company Limited, PCC Group, Schärer and Schläpfer AG, Solvay, Stepan Company, Clariant AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Croda International Plc

- IMCD Group

- Lamberti S.p.A.

- Dow

- Indorama Ventures Public Company Limited

- PCC Group

- Schärer and Schläpfer AG

- Solvay

- Stepan Company

- Clariant AG