Global Zika Virus Testing Market By Test (Molecular Test and Serological Test), By End-user (Hospitals & Clinics, Diagnostic Laboratory, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170097

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

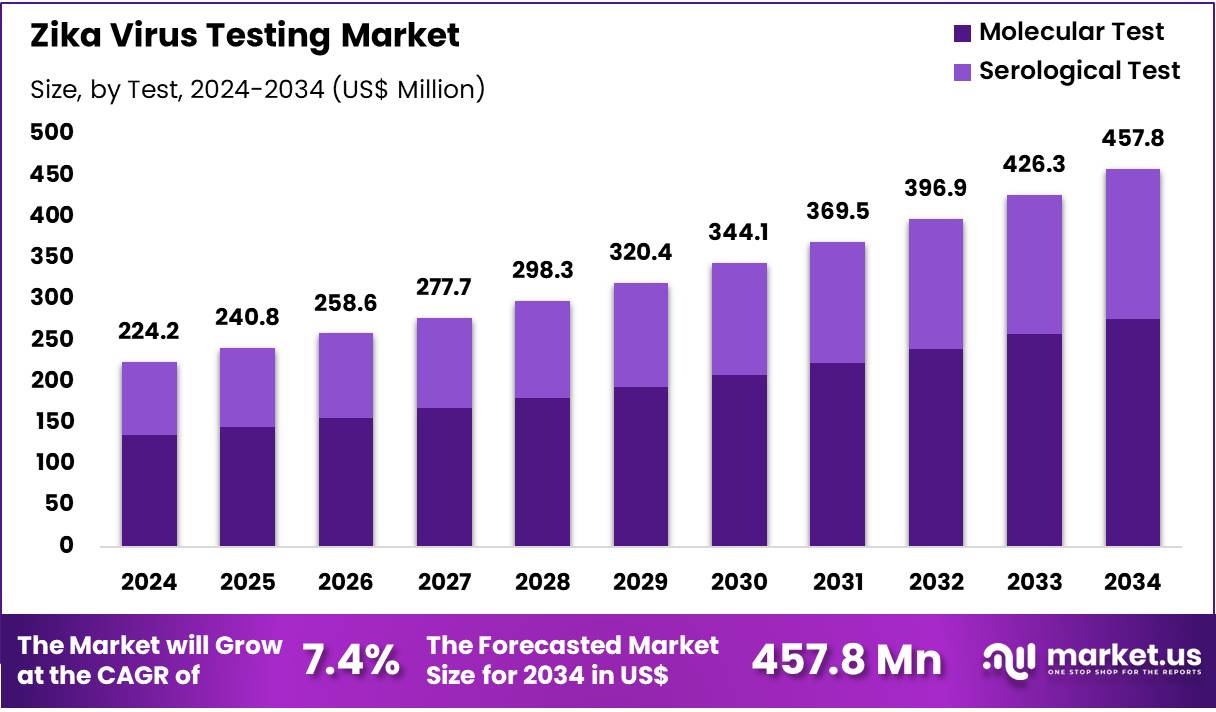

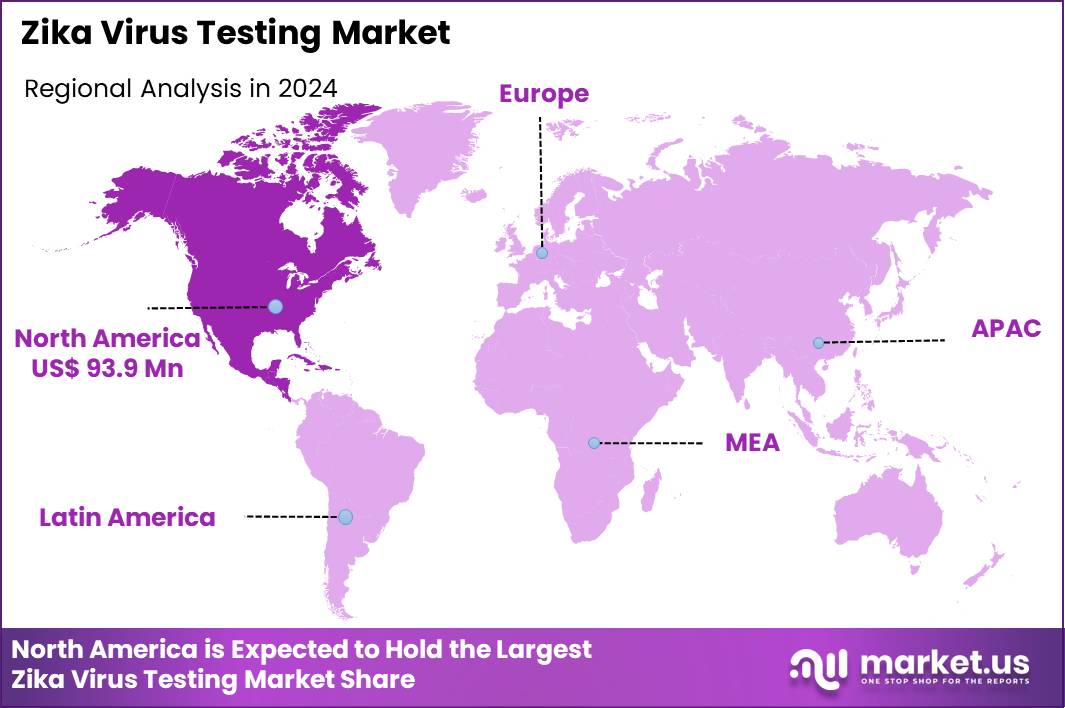

Global Zika Virus Testing Market size is expected to be worth around US$ 457.8 Million by 2034 from US$ 224.2 Million in 2024, growing at a CAGR of 7.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.9% share with a revenue of US$ 93.9 Billion.

Increasing global travel and vector-borne disease surveillance propel the Zika Virus Testing market, as public health authorities mandate rapid diagnostics to detect asymptomatic carriers and prevent transmission chains. Diagnostic firms develop nucleic acid amplification tests and enzyme-linked immunosorbent assays that identify viral RNA and IgM antibodies with high specificity from serum or urine samples.

These tests apply in prenatal screening for pregnant women to assess fetal microcephaly risks, outbreak response in endemic zones for contact tracing, travel medicine clinics for pre-departure clearance, and research cohorts evaluating vaccine-induced immunity. Multiplex advancements create opportunities for integrated arbovirus panels that streamline laboratory workflows and reduce costs.

In July 2024, diagnostic companies expanded their portfolios by launching multiplex nucleic acid amplification tests capable of detecting and distinguishing Zika, Dengue, and Chikungunya viruses from a single sample, enabling swift triage during co-circulating viral threats. This innovation enhances outbreak management efficiency and positions the market for broader clinical integration.

Growing emphasis on point-of-care solutions accelerates the Zika Virus Testing market, as frontline providers deploy portable lateral flow assays to deliver results in under 30 minutes without centralized infrastructure. Biotechnology innovators refine antigen-capture devices that minimize cross-reactivity with flaviviruses, ensuring reliable field deployment.

Applications encompass emergency department evaluations for febrile travelers suspecting acute infection, maternal health programs monitoring seroconversion in high-risk pregnancies, vector control initiatives validating exposure in mosquito-heavy communities, and occupational health screenings for aid workers in affected areas. User-friendly formats open avenues for community-based testing and real-time data reporting to surveillance networks. Pharmaceutical developers increasingly incorporate these assays into phase III trials for novel antivirals, validating efficacy endpoints with on-site confirmation. This accessibility trend drives market expansion through empowered decentralized diagnostics.

Rising adoption of genomic sequencing for variant tracking invigorates the Zika Virus Testing market, as epidemiologists leverage next-generation platforms to monitor viral evolution and inform public health responses. Technology providers offer benchtop sequencers with Zika-specific primers that achieve whole-genome coverage from low-viral-load specimens.

These tools support phylogenetic analysis in congenital Zika syndrome investigations, resistance surveillance for emerging mutations in non-structural proteins, environmental reservoir mapping in primate populations, and post-vaccination studies assessing strain-specific neutralization. Advanced analytics create opportunities for AI-enhanced mutation prediction and personalized risk modeling. Collaborative consortia actively standardize sequencing protocols to facilitate global data sharing and accelerate therapeutic development. This genomic focus establishes comprehensive testing as a cornerstone of proactive Zika containment strategies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 224.2 Million, with a CAGR of 7.4%, and is expected to reach US$ 457.8 Million by the year 2034.

- The test segment is divided into molecular test and serological test, with molecular test taking the lead in 2023 with a market share of 60.4%.

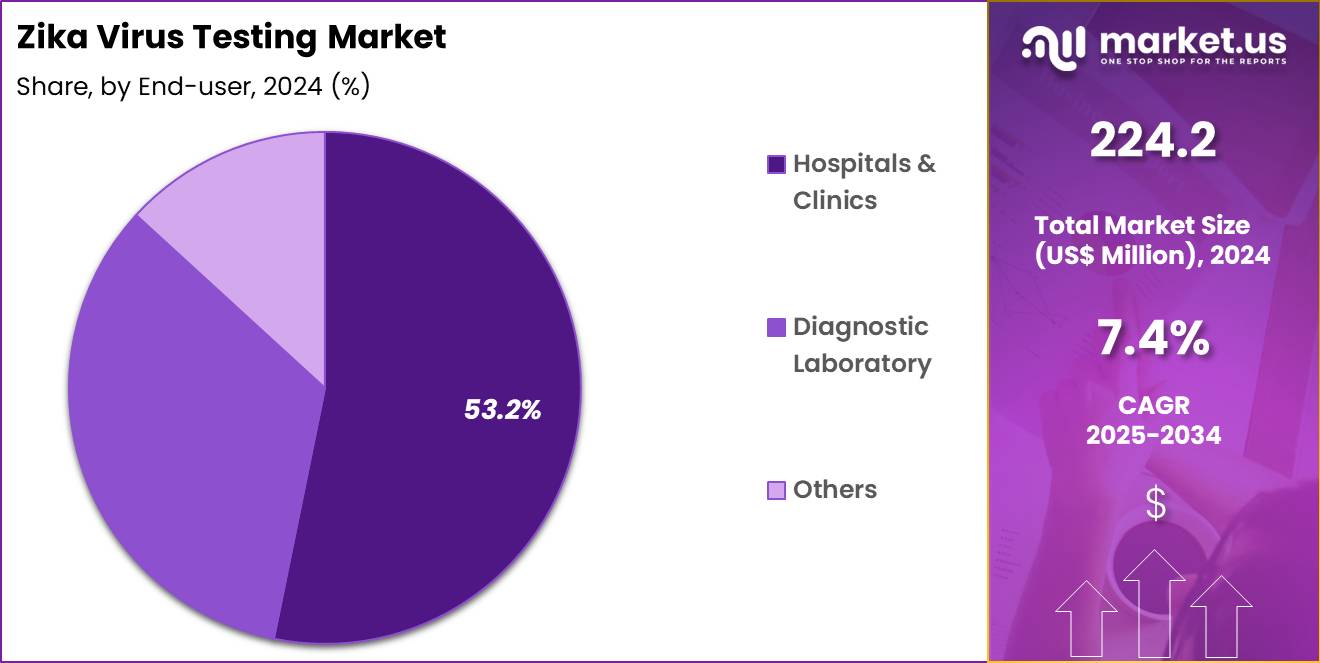

- Considering end-user, the market is divided into hospitals & clinics, diagnostic laboratory, and others. Among these, hospitals & clinics held a significant share of 53.2%.

- North America led the market by securing a market share of 41.9% in 2024.

Test Analysis

Molecular test, holding 60.4%, is expected to dominate due to its high sensitivity and ability to detect the Zika virus during the early stages of infection, even before the body develops detectable antibodies. The demand for molecular tests, especially PCR-based diagnostics, is driven by the need for accurate and timely diagnosis, particularly for pregnant women at risk of transmitting the virus to their babies.

Governments and public health agencies recommend molecular testing as the gold standard for Zika virus detection in areas with outbreaks. Increased awareness of the risks associated with Zika virus, especially its links to birth defects, strengthens the demand for early testing. Technological advances in PCR and next-generation sequencing improve the efficiency and accessibility of molecular testing, making it more widely available. These factors keep molecular testing anticipated to remain the dominant test type in the Zika virus testing market.

End-User Analysis

Hospitals & clinics, holding 53.2%, are expected to remain the dominant end-user segment as they play a central role in diagnosing Zika virus infections, particularly in emergency and routine healthcare settings. Hospitals are primary locations for the identification and treatment of Zika virus cases, particularly in endemic regions. Increasing travel-related cases and public health monitoring programs boost hospital testing demand, as hospitals serve as the first point of care for individuals showing symptoms of Zika infection.

Hospital-based laboratories are equipped with advanced molecular testing platforms, enabling them to provide rapid and accurate diagnostic results. In addition, the presence of specialized healthcare teams in hospitals ensures comprehensive care for pregnant women and other high-risk populations. The ongoing need for surveillance and diagnosis in hospital settings further drives the growth of Zika virus testing. These factors keep hospitals & clinics projected to remain the leading end-user segment in the market.

Key Market Segments

By Test

- Molecular Test

- Serological Test

By End-user

- Hospitals & Clinics

- Diagnostic Laboratory

- Others

Drivers

The Ongoing Circulation of Zika Virus in Endemic Regions Is Driving the Market

The ongoing circulation of Zika virus in endemic regions has solidified its position as a core driver for the Zika virus testing market, compelling sustained investment in surveillance and diagnostic infrastructure to safeguard vulnerable populations. Despite the decline from peak epidemic levels, persistent low-level transmission in areas with competent Aedes vectors necessitates vigilant monitoring, particularly among pregnant individuals to avert congenital anomalies.

This continuity prompts national health agencies to maintain stockpiles of molecular and serological assays, ensuring readiness for potential resurgence. In the Region of the Americas, 40,528 Zika cases were reported across 15 countries and territories during epidemiological weeks 1 through 52 of 2022, as documented by the Pan American Health Organization. Such data reinforces the imperative for robust testing protocols in primary care and travel medicine clinics.

Manufacturers are compelled to innovate in sample stability and throughput to accommodate sporadic surges without disrupting supply chains. International collaborations, including those facilitated by the World Health Organization, further amplify demand by standardizing reporting requirements across borders. The economic rationale is compelling, as early detection curtails downstream costs associated with microcephaly management and neurological sequelae.

As climate patterns potentially expand vector habitats, testing volumes are projected to align with enhanced risk assessments in affected locales. This driver thus anchors the market’s resilience, embedding Zika diagnostics within broader arboviral preparedness frameworks.

Restraints

Diagnostic Cross-Reactivity with Other Flaviviruses Is Restraining the Market

Diagnostic cross-reactivity with other flaviviruses remains a formidable restraint on the Zika virus testing market, undermining assay specificity and eroding clinician confidence in standalone results. Serological tests, particularly IgM-based platforms, frequently yield false positives due to shared epitopes with dengue and West Nile viruses, complicating interpretation in co-endemic zones. This limitation escalates the need for confirmatory nucleic acid amplification testing, inflating operational expenses and turnaround times for laboratories.

In regions with overlapping epidemics, up to 32% of serological Zika results exhibit cross-reactivity with dengue, contributing to 27% misclassification rates among suspected cases. Resource-constrained facilities, prevalent in Latin America and Southeast Asia, struggle with the dual burden of validation protocols, diverting funds from assay procurement. Regulatory hurdles intensify this issue, as approvals demand rigorous differentiation studies that delay market entry for novel formats.

Patient outcomes suffer from diagnostic ambiguity, fostering hesitancy in presumptive treatment and surveillance reporting. Supply-side pressures compound the challenge, with reagent formulations requiring continual refinement to mitigate interference. Consequently, adoption skews toward high-income settings equipped for multiplex confirmation, perpetuating inequities in access. Resolving this restraint demands targeted investments in epitope-specific reagents to restore diagnostic fidelity.

Opportunities

Advancements in Multiplex Arbovirus Assay Platforms Are Creating Growth Opportunities

Advancements in multiplex arbovirus assay platforms are unlocking substantial growth opportunities in the Zika virus testing market by enabling concurrent detection of Zika alongside dengue and chikungunya, thereby streamlining workflows in high-burden environments. These integrated systems reduce sample requirements and processing costs, appealing to laboratories facing volume constraints during seasonal outbreaks.

Regulatory endorsements facilitate rapid deployment, with validations confirming analytical concordance exceeding 95% across targets in clinical matrices. Opportunities proliferate through public-private partnerships, where developers collaborate with agencies like the Pan American Health Organization to tailor panels for regional epidemiology. In 2022, the launch of the PathoDetect Extended Monsoon Fever Panel by Mylab exemplified this trend, incorporating Zika RT-PCR within a broader monsoon-related pathogen array for enhanced syndromic surveillance.

Such innovations extend to point-of-care adaptations, bridging gaps in remote diagnostics for maternal health programs. Cost efficiencies, including up to 40% reductions in per-test expenditures, attract adoption in ambulatory networks. Emerging markets in Asia and Africa present untapped avenues, as multiplex formats align with integrated vector-borne disease strategies. Digital integration for result dissemination further amplifies utility, supporting real-time epidemiological mapping. Collectively, these platforms position the market for expansive, synergistic evolution.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors drive the Zika Virus Testing market by boosting healthcare spending and increasing demand for diagnostics, particularly in tropical regions where Zika cases surge among pregnant women and travelers. Companies leverage these trends, investing in advanced molecular tests like RT-PCR, which offer 31% higher sensitivity than serological methods, enhancing early detection.

However, inflation and economic slowdowns strain public health budgets, prompting laboratories to delay equipment upgrades and reduce testing capacity. Geopolitical tensions, including trade disputes and regional instability, disrupt supply chains for diagnostic reagents, causing delays and cost spikes.

Current US tariffs, notably the 2025 hikes on Chinese goods by 34% and 10-20% on other nations, inflate prices for imported testing kits, impacting labs dependent on foreign supplies and raising costs for end-users. These tariffs also risk shortages in low-income regions, where 42% of labs lack molecular testing infrastructure. Despite these challenges, firms innovate by developing cost-effective, AI-assisted diagnostics and multiplex kits, which detect Zika alongside dengue, driving efficiency.

Latest Trends

The FDA Classification of Zika Virus Serological Reagents in 2025 Is a Recent Trend

The FDA classification of Zika virus serological reagents as Class II devices on May 29, 2025, heralds a transformative recent trend toward formalized regulatory oversight, enhancing credibility and accelerating commercialization of antibody-based diagnostics. Codified under 21 CFR 866.3935, this designation applies to in vitro assays detecting Zika antigens or antibodies in symptomatic or at-risk individuals, imposing special controls for performance validation.

The move addresses prior Emergency Use Authorization limitations, enabling full 510(k) pathways that assure safety and effectiveness through predicate comparisons. This classification responds to evolving epidemiology, where serological tools complement molecular methods for post-acute phase evaluations. Early impacts include streamlined submissions for enhanced IgG/IgM kits, with intra-assay precision benchmarks below 5% to minimize variability.

Integration with electronic lab reporting systems gains momentum, fostering interoperability in national surveillance networks. Developers report heightened investor interest, as Class II status mitigates perceived risks in pipeline advancement. The trend aligns with global harmonization efforts, influencing parallel classifications in Europe and Latin America. Post-classification monitoring emphasizes post-market studies to track real-world sensitivity in diverse populations. In essence, this 2025 development solidifies serological reagents as reliable pillars in comprehensive Zika diagnostic armamentaria.

Regional Analysis

North America is leading the Zika Virus Testing Market

North America accounted for 41.9% of the overall market in 2024, and the region saw significant growth as healthcare systems remained vigilant against potential outbreaks of the Zika virus, particularly after previous epidemics in the Americas. Public health initiatives and increased funding for mosquito-borne disease surveillance systems pushed demand for accurate and rapid Zika virus diagnostic tests.

Laboratories expanded their molecular testing capabilities to detect Zika virus in both symptomatic and asymptomatic individuals, particularly among pregnant women due to the known risk of congenital Zika syndrome. The Centers for Disease Control and Prevention (CDC) reported that 5,168 Zika virus cases were confirmed in the U.S. in 2022, highlighting ongoing concerns over the virus in both local and travel-associated cases (CDC – “Zika Virus in the U.S. 2022”).

Diagnostic providers introduced more affordable and portable testing solutions, helping to increase access across both urban and rural areas. These combined factors helped propel the Zika virus testing market in North America throughout 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience growth in the Zika virus testing market during the forecast period as the region continues to manage the risk of outbreaks, particularly in tropical and subtropical countries where the Aedes mosquito, the primary vector for Zika, is prevalent. Healthcare systems in countries like India, Indonesia, and the Philippines increase surveillance efforts for Zika infections, pushing demand for affordable and accurate diagnostic tests.

The World Health Organization (WHO) reported that 72% of global Zika cases were reported in Asia and the Pacific in 2023 (WHO – “Zika Virus Surveillance and Control in Asia-Pacific 2023”), emphasizing the critical need for reliable diagnostic tools in these high-risk areas. Public health authorities strengthen education campaigns regarding the risks of Zika in pregnant women and the importance of early detection. Governments also invest in expanding testing infrastructure, particularly in rural areas. These efforts will continue to fuel the market’s growth in Asia Pacific over the forecast period.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key firms drive growth in the Zika‑virus diagnostics space by accelerating development of multiplex molecular and serological assays that detect Zika alongside related arboviruses, thereby offering broader diagnostic value in regions with overlapping outbreaks. They expand outreach by forging partnerships with public‑health agencies, travel‑medicine providers, and blood‑screening services strategies that extend volume demand beyond symptomatic patients to surveillance, prenatal screening, and travel screening segments.

They invest in point‑of‑care and rapid‑test formats that deliver faster results and require minimal lab infrastructure, helping expand access in resource‑limited settings and urgent‑care scenarios. They strengthen their geographic footprint by establishing distribution networks and local regulatory approvals in endemic and high‑risk regions across Americas, Asia‑Pacific and Latin America.

They reinforce trust through assay validation studies and compliance with international diagnostic guidelines, which encourages adoption by hospitals, clinics and reference labs. One key company, Abbott Laboratories, offers molecular and serology‑based Zika testing solutions, leverages its global diagnostics business and established lab network, and uses its regulatory experience and supply‑chain strength to deliver reliable, scalable testing services for Zika and other infectious diseases.

Top Key Players

- Thermo Fisher Scientific, Inc.

- Roche Diagnostics

- Qiagen N.V.

- bioMérieux SA

- Danaher Corporation

- Abbott Laboratories

- DiaSorin S.p.A.

- Hologic, Inc.

Recent Developments

- In September 2024, the Pan American Health Organization (PAHO) reported a 14% increase in confirmed Zika cases compared to the previous year, solidifying the virus’s status as endemic in tropical areas. This surge has led hospitals to increase their procurement of rapid diagnostic cartridges to manage growing demand for testing.

- In October 2024, the World Bank’s Pandemic Fund allocated US$16 million to Caribbean countries to enhance integrated surveillance networks for arboviral diseases. This funding ensures the procurement of essential diagnostic reagents and testing infrastructure, providing a significant boost to the market for related medical diagnostics.

Report Scope

Report Features Description Market Value (2024) US$ 224.2 Million Forecast Revenue (2034) US$ 457.8 Million CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test (Molecular Test and Serological Test), By End-user (Hospitals & Clinics, Diagnostic Laboratory, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Roche Diagnostics, Qiagen N.V., bioMérieux SA, Danaher Corporation, Abbott Laboratories, DiaSorin S.p.A., Hologic, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific, Inc.

- Roche Diagnostics

- Qiagen N.V.

- bioMérieux SA

- Danaher Corporation

- Abbott Laboratories

- DiaSorin S.p.A.

- Hologic, Inc.