Wireless Medical Devices Market By Product Type (Wearable Devices, Implantable Devices, Handheld & Portable Devices, Stationary Devices and Others), By Type (Diagnostic & Monitoring and Therapeutic), By Technology (Bluetooth, Wi-Fi, Near Field Communication (NFC), Zigbee, RFID (Radio Frequency Identification), Ultra-wideband (UWB) and Others), By Application (Cardiology, Neurology, Respiratory, Diabetes Management, Point of Care and others), By End-User (Hospitals & Clinics, Home Healthcare, Ambulatory Surgical Centers, Diagnostic Centers, Long-Term Care & Assisted Living Facilities and Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141096

- Number of Pages: 218

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

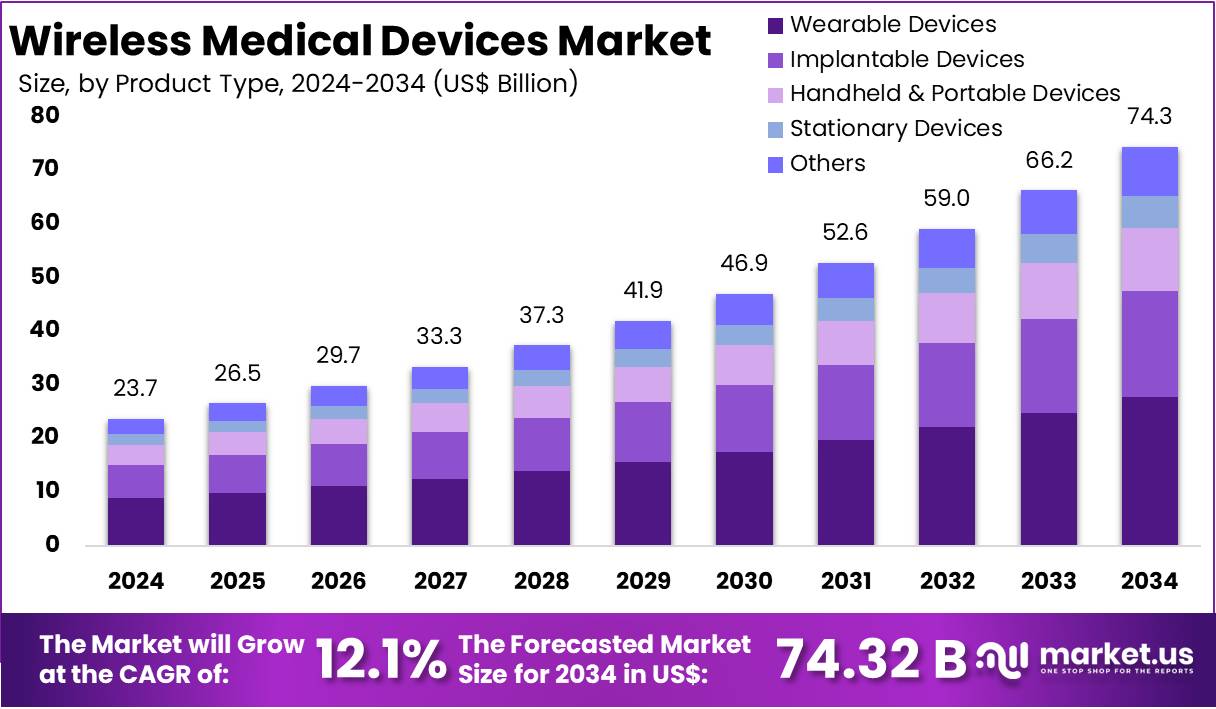

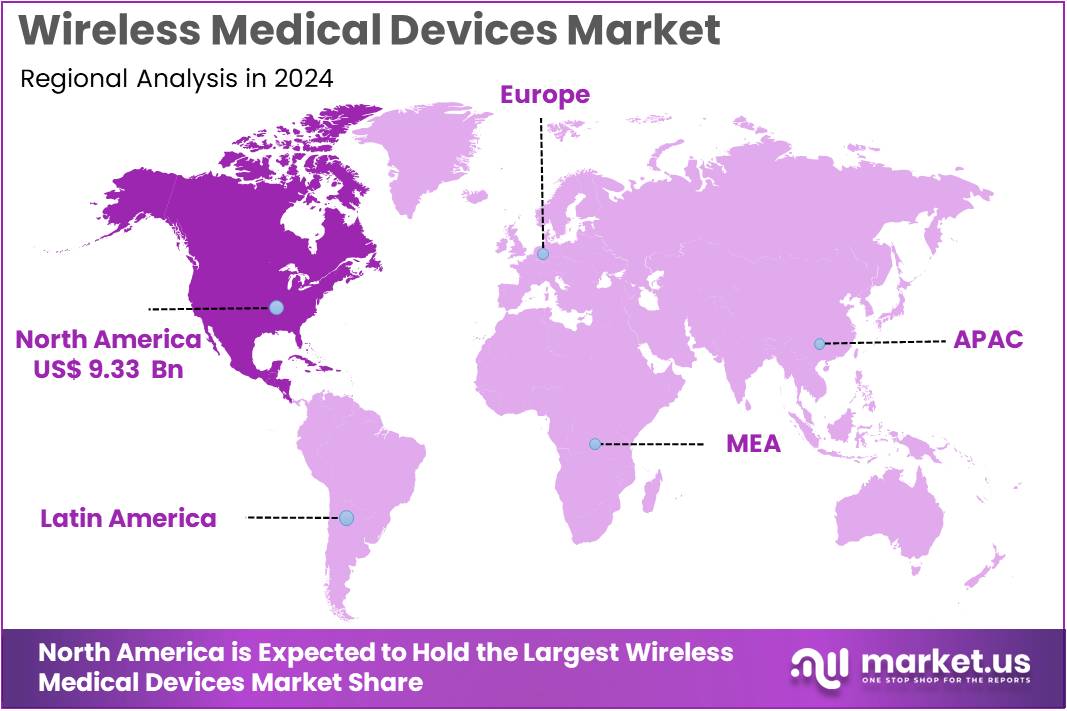

The Wireless Medical Devices Market size is expected to be worth around US$ 74.3 billion by 2034 from US$ 23.7 billion in 2024, growing at a CAGR of 12.1% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.7% share and holds US$ 9.33 Billion market value for the year.

The Wireless Medical Devices Market is growing rapidly due to advancements in telemedicine, remote patient monitoring, and wearable health technology. These devices utilize Bluetooth, Wi-Fi, RFID, and IoT to enable real-time health data transmission. This technology enhances patient outcomes and reduces hospital visits. The market includes various products such as wearable devices, implantable devices, and portable monitoring systems. The increasing prevalence of chronic diseases, an aging population, and the shift toward home healthcare solutions are key drivers. These factors contribute to the rising adoption of wireless medical devices globally.

The market is divided into three key product categories. Wearable devices include smartwatches, ECG monitors, and biosensors. Implantable devices consist of pacemakers, neurostimulators, and glucose monitors. Portable monitoring systems feature glucometers, infusion pumps, and remote cardiac monitors. These technologies provide continuous health tracking, helping patients manage chronic conditions effectively. The growing demand for personalized healthcare and remote monitoring solutions is driving market expansion. Increased smartphone penetration and improved wireless connectivity further boost the adoption of wireless medical devices.

Strategic collaborations and partnerships play a crucial role in market growth. Companies are investing in wireless sensing technologies and AI-driven health monitoring systems. In December 2024, Nokia announced a research collaboration with Fraunhofer Heinrich Hertz Institute (HHI) and Charité – Universitätsmedizin Berlin. This partnership explores the potential of wireless sensing technologies in medical applications. The research focuses on sub-terahertz (sub-THz) frequencies, ranging from 90 GHz to 300 GHz, to enhance non-invasive medical monitoring and diagnostics.

Sub-THz frequencies offer high precision for wireless sensing, functioning like radar but with higher accuracy. Nokia Bell Labs, Fraunhofer HHI, and Charité aim to develop sensing networks using sub-THz frequencies. These networks will enable ultra-high-resolution spatial scans in hospital environments. This will allow for continuous monitoring of patients’ vital signs without physical contact. Such advancements will revolutionize patient care, enhance diagnostic capabilities, and improve hospital efficiency. The increasing adoption of non-invasive monitoring solutions is expected to shape the future of wireless medical technology.

Wireless Medical Devices Market, Global Analysis, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 15.32 17.00 18.86 21.13 23.67 12.1% Key Takeaways

- In 2024, the market for Wireless Medical Devices generated a revenue of US$ 23.7 billion, with a CAGR of 12.1%, and is expected to reach US$ 74.3 billion by the year 2034.

- The product type segment is divided into wearable devices, implantable devices, handheld & portable devices, stationary devices, and others, with wearable devices taking the lead in 2024 with a market share of 37.4%.

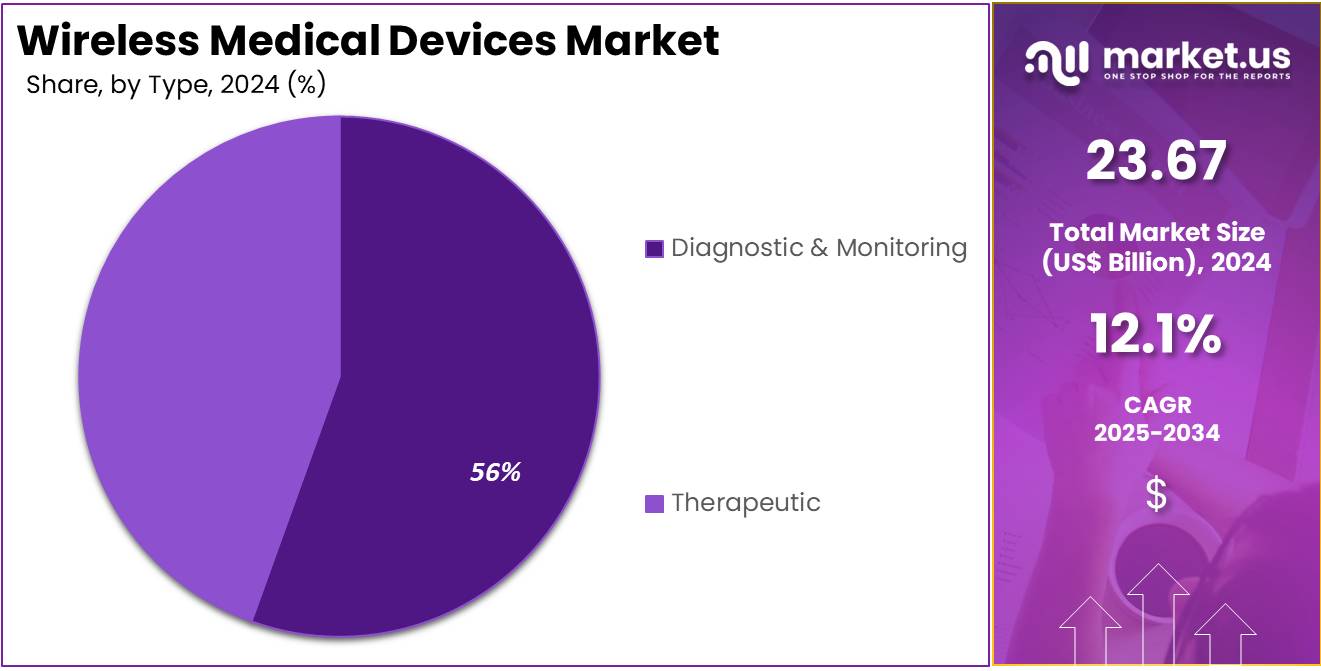

- Considering Type, the market is divided into Diagnostic & Monitoring, and Therapeutic. Among these, Diagnostic & Monitoring held a significant share of 55.5%.

- Furthermore, concerning the Technology, the market is segregated into Bluetooth, Wi-Fi, Near Field Communication (NFC), Zigbee, RFID (Radio Frequency Identification), Ultra-wideband (UWB), and Others. The Bluetooth segment stand out as the dominant segment, holding the largest revenue share of 29.7% in the Wireless Medical Devices market.

- Based on Application, the market is bifurcated into Cardiology, Neurology, Respiratory, Diabetes Management, Point of Care, and Others. Point of Care holds the largest market share with 32.2%.

- By End-User, the market is classified into Hospitals & Clinics, Home Healthcare, Ambulatory Surgical Centers, Diagnostic Centers, Long-Term Care & Assisted Living Facilities, and Others. Hospitals & Clinics held a major share of 31.7%.

- North America led the market by securing a market share of 38.7% in 2023.

Product Type Analysis

The Wireless Medical Devices Market is segmented by product type into wearable devices, implantable devices, handheld & portable devices, stationary devices, and others. Among these, wearable devices dominated the market with 37.4% of market share in 2024, driven by their widespread adoption for continuous health monitoring and fitness tracking.

These devices, such as smartwatches, fitness bands, and wireless ECG monitors, offer convenience, real-time data access, and non-invasive monitoring, making them popular among consumers and healthcare providers. Implantable devices, like wireless pacemakers and neurostimulators, are gaining traction for chronic disease management but face challenges related to cost and regulatory approvals.Handheld and portable devices, including wireless glucose meters and ultrasound systems, are favored for their mobility and ease of use. Stationary devices, such as wireless imaging systems, cater to clinical settings but are less dominant due to their limited portability.

In November 2024, Henkel and Linxens announced a collaboration to advance the integration of cutting-edge technologies in medical wearables using printed electronics. As part of this partnership, the companies have developed a proof of concept incorporating self-regulating heating elements into wearable medical devices, significantly improving patient comfort. With plans to introduce this innovative concept to the healthcare market, the partners will showcase live demonstrations at the upcoming MEDICA trade show in Düsseldorf, Germany, from November 11, 2024 to November 14, 2024.

Wireless Medical Devices Market, Product Type Analysis, 2020-2024 (US$ Billion)

Product Type 2020 2021 2022 2023 2024 Wearable Devices 5.73 6.36 7.05 7.90 8.85 Implantable Devices 4.06 4.51 5.00 5.60 6.27 Handheld & Portable Devices 2.42 2.69 2.98 3.34 3.74 Stationary Devices 1.23 1.36 1.51 1.69 1.89 Others 1.88 2.09 2.32 2.60 2.91 Type Analysis

Diagnostic & Monitoring dominated the market covering 55.5% of market share, driven by its scalability, cost-effectiveness, and ability to facilitate real-time data access and remote monitoring. Cloud-based solutions enable healthcare providers to store, analyze, and share vast amounts of patient data securely, enhancing collaboration and decision-making. They are particularly beneficial for telemedicine and remote patient monitoring applications, which are increasingly in demand.

On-premise solutions, while offering greater control over data and compliance with strict regulatory requirements, are less dominant due to higher upfront costs, limited scalability, and maintenance challenges. As healthcare systems prioritize flexibility and interoperability, the cloud-based segment is expected to maintain its leading position, supported by advancements in cloud security and the growing adoption of IoT and AI in healthcare.

Wireless Medical Devices Market, Type Analysis, 2020-2024 (US$ Billion)

Type 2020 2021 2022 2023 2024 Diagnostic & Monitoring 8.51 9.44 10.47 11.73 13.14 Therapeutic 6.82 7.57 8.39 9.40 10.53 Technology Analysis

Bluetooth technology led the market with 29.7% of market share, owing to its widespread adoption in wearable devices, such as fitness trackers, smartwatches, and wireless glucose monitors. Bluetooth’s low power consumption, ease of use, and compatibility with smartphones and other devices make it a preferred choice for consumer and medical applications. Wi-Fi is also significant, particularly for high-data transmission applications like remote patient monitoring and telemedicine, but it is less dominant due to higher power consumption.

NFC and RFID are commonly used for short-range communication and asset tracking in healthcare settings, while Zigbee and UWB are niche technologies with specialized applications. Bluetooth’s versatility and cost-effectiveness solidify its leading position in the wireless medical devices market. In July 2020, Abbott announced that the U.S. Food and Drug Administration (FDA) had approved its next-generation Gallant implantable cardioverter defibrillator (ICD) and cardiac resynchronization therapy defibrillator (CRT-D) devices. These advanced devices offer enhanced benefits for patients with heart rhythm disorders, featuring a patient-preferred design that maintains battery longevity and ensures MRI compatibility.

Wireless Medical Devices Market, Technology Analysis, 2020-2024 (US$ Billion)

By Technology 2020 2021 2022 2023 2024 Bluetooth 4.55 5.05 5.60 6.28 7.03 Wi-Fi 3.69 4.10 4.55 5.09 5.70 Near Field Communication (NFC) 2.79 3.09 3.43 3.85 4.31 Zigbee 1.07 1.19 1.32 1.48 1.66 RFID (Radio Frequency Identification) 1.09 1.21 1.34 1.50 1.68 Ultra-wideband (UWB) 0.90 1.00 1.11 1.25 1.40 Others 1.23 1.36 1.51 1.69 1.89 Application Analysis

The Wireless Medical Devices Market is segmented by application into cardiology, neurology, respiratory, diabetes management, home healthcare, and others. Among these, Point of Care dominated the market with 32.2% of market share, driven by the increasing demand for remote patient monitoring and the growing preference for at-home care, especially among aging populations and patients with chronic conditions. Wireless devices, such as wearable ECG monitors, glucose meters, and pulse oximeters, enable continuous health tracking and reduce the need for frequent hospital visits.

Cardiology applications, including wireless pacemakers and heart rate monitors, are also significant due to the rising prevalence of cardiovascular diseases. Neurology and respiratory applications are gaining traction with devices like wireless neurostimulators and smart inhalers. Diabetes management remains a key segment, with wireless insulin pumps and glucose monitors improving patient outcomes. However, the home healthcare segment leads due to its convenience, cost-effectiveness, and alignment with the shift toward decentralized healthcare.

Wireless Medical Devices Market, Application Analysis, 2020-2024 (US$ Billion)

Product Type 2020 2021 2022 2023 2024 Cardiology 2.38 2.64 2.92 3.27 3.67 Neurology 1.85 2.06 2.28 2.56 2.86 Respiratory 1.67 1.85 2.06 2.30 2.58 Diabetes Management 2.65 2.94 3.26 3.66 4.09 Point of Care 4.93 5.47 6.07 6.80 7.62 Others 1.84 2.04 2.26 2.54 2.84 End-User Analysis

Hospitals & clinics shares a significant market share of 31.7% as they are the primary adopters of advanced wireless medical technologies for patient monitoring, diagnostics, and treatment. These facilities rely on wireless devices such as wearable monitors, wireless imaging systems, and connected infusion pumps to enhance patient care and operational efficiency.

However, the home healthcare segment is rapidly growing, driven by the increasing preference for remote patient monitoring and the rising prevalence of chronic diseases. Ambulatory surgical centers and diagnostic centers also utilize wireless devices for efficient workflows and accurate diagnostics. Long-term care facilities are adopting wireless technologies to improve elderly care. Despite the growth in other segments, hospitals & clinics remain the largest end-user due to their extensive infrastructure and high patient volume.

Wireless Medical Devices Market, End User Analysis, 2020-2024 (US$ Billion)

Product Type 2020 2021 2022 2023 2024 Hospitals & Clinics 4.86 5.39 5.98 6.70 7.50 Home Healthcare 3.89 4.32 4.79 5.37 6.01 Ambulatory Surgical Centers 2.19 2.43 2.70 3.02 3.38 Diagnostic Centers 2.13 2.36 2.62 2.94 3.29 Long-Term Care & Assisted Living Facilities 0.61 0.68 0.75 0.85 0.95 Others 1.64 1.82 2.02 2.26 2.53 Key Market Segments

By Product Type

- Wearable Devices

- Implantable Devices

- Handheld & Portable Devices

- Stationary Devices

- Others

By Type

- Diagnostic & Monitoring

- Therapeutic

By Technology

- Bluetooth

- Wi-Fi

- Near Field Communication (NFC)

- Zigbee

- RFID (Radio Frequency Identification)

- Ultra-wideband (UWB)

- Others

By Application

- Cardiology

- Neurology

- Respiratory

- Diabetes Management

- Point of Care

- Others

By End-User

- Hospitals & Clinics

- Home Healthcare

- Ambulatory Surgical Centers

- Diagnostic Centers

- Long-Term Care & Assisted Living Facilities

- Others

Drivers

Increasing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases is a major factor driving the wireless medical devices market. Conditions like diabetes, cardiovascular disorders, and respiratory illnesses require continuous monitoring for effective management. Wireless medical devices enable real-time data collection and transmission, helping patients track health metrics remotely. For example, wireless glucose and cardiac monitors reduce hospital visits by providing timely interventions. The growing aging population, which is more prone to chronic conditions, further increases the demand for such devices. Their convenience and accuracy make them indispensable in modern healthcare.

According to the CDC, about 129 million people in the U.S. live with at least one chronic disease. These include heart disease, cancer, diabetes, obesity, and hypertension. Among the top 10 causes of death, five are preventable or linked to chronic diseases. The prevalence of these conditions has steadily increased over the past two decades. A growing number of Americans manage multiple chronic conditions. Around 42% have at least two, while 12% live with five or more diseases.

Chronic diseases place a significant burden on the U.S. healthcare system. They account for nearly 90% of the nation’s $4.1 trillion annual healthcare expenditure. This figure includes costs related to mental health care. Managing these conditions requires innovative solutions like wireless medical devices. These technologies help reduce hospital admissions and healthcare costs. They also improve patient outcomes by enabling continuous health monitoring. The increasing adoption of wireless healthcare solutions highlights their role in addressing chronic disease management challenges.

Restraints

Data Security and Privacy Concerns

A major restraint for the wireless medical devices market is the risk of data breaches and privacy issues. These devices transmit sensitive patient data over networks, making them vulnerable to cyberattacks. Unauthorized access to health information can lead to identity theft, misuse of data, or even life-threatening situations if device functionality is compromised.

Regulatory compliance, such as HIPAA in the U.S., adds complexity to ensuring data security. Manufacturers must invest heavily in encryption and cybersecurity measures, which can increase costs and slow down innovation. These concerns often deter healthcare providers and patients from fully adopting wireless medical technologies.

Opportunities

Integration with AI and IoT

The integration of wireless medical devices with artificial intelligence (AI) and the Internet of Things (IoT) is creating significant growth opportunities in healthcare. AI can analyze vast amounts of real-time data collected by these devices, providing predictive insights for early diagnosis and personalized treatment plans. IoT connectivity ensures seamless communication between devices, healthcare providers, and patients, enabling a unified ecosystem for remote patient monitoring. This enhances care coordination, reduces hospital visits, and improves patient outcomes. The growing adoption of AI and IoT in wireless medical devices is driving innovation and market expansion.

Smart medical devices, such as wearable ECG monitors and smart inhalers, can transmit real-time data to healthcare professionals, improving patient management. Remote monitoring allows doctors to detect abnormalities early and adjust treatment plans accordingly. The ability to collect and analyze continuous health data reduces emergency hospitalizations and enhances chronic disease management. The convergence of AI, IoT, and wireless technology is boosting demand for innovative healthcare solutions. This trend is expected to accelerate as healthcare providers seek advanced digital tools.

In February 2024, KORE, a global IoT solutions leader, partnered with Medical Guardian, a top provider of personal emergency response systems (PERS), to launch a medical alert device with eSIM technology. This device enhances connectivity by allowing electronic switching between service carriers, ensuring continuous coverage. It addresses cell signal challenges, improving healthcare accessibility and emergency response efficiency. This collaboration demonstrates the potential of AI and IoT-driven wireless medical devices to revolutionize patient safety, making healthcare services more reliable and widely accessible.

Impact of Macroeconomic / Geopolitical Factors

Global supply chain disruptions, exacerbated by trade tensions (e.g., U.S.-China relations), semiconductor shortages, and geopolitical conflicts (Russia-Ukraine war, Middle East instability), impact the production and distribution of wireless medical devices. Rising raw material costs and transportation delays affect profitability and product availability. Economic downturns and high inflation reduce healthcare spending, particularly in developing economies, slowing the adoption of wireless medical devices. Conversely, government investments in digital health and remote monitoring (especially post-COVID-19) sustain market growth.

Stricter data privacy laws (GDPR, HIPAA) and evolving medical device regulations (FDA, CE approvals) impact market entry and innovation. Protectionist policies and localization mandates force companies to restructure manufacturing strategies. Countries prioritizing healthcare digitization (U.S., China, Germany, India) continue driving market expansion, while political instability in some regions limits investment in medical technologies.

Trends

Adoption of 5G Technology

The adoption of 5G technology is a key trend shaping the wireless medical devices market. 5G offers ultra-low latency, high-speed connectivity, and the ability to support a massive number of connected devices, making it ideal for real-time healthcare applications. For instance, remote surgeries and telemedicine consultations can benefit from 5G’s reliability and speed.

Additionally, 5G enables faster data transmission from wearable devices, improving the accuracy and responsiveness of remote monitoring systems. As 5G networks expand globally, they will unlock new possibilities for wireless medical devices, enhancing their functionality and adoption in both developed and emerging markets.

In February 2024, Ericsson and Far EasTone have introduced “5G Smart Ambulances,” a life-saving service powered by network slicing within Far EasTone’s 5G Standalone network. This mission-critical innovation enhances real-time connectivity between ambulance personnel and remote medical experts, enabling faster and more precise treatment. With a focus on high-throughput and low-latency capabilities, the technology aims to improve the quality and efficiency of emergency medical services.

Regional Analysis

North America is leading the Wireless Medical Devices Market

The region benefits from a strong presence of key market players, such as Medtronic, Philips, and GE Healthcare, who are continuously developing cutting-edge wireless medical devices. The increasing prevalence of chronic diseases, such as diabetes and cardiovascular disorders, coupled with a growing aging population, fuels demand for wireless monitoring and diagnostic devices.

Additionally, favorable government policies, such as the FDA’s support for digital health solutions, and the widespread adoption of IoT and AI in healthcare further propel market growth. The U.S. dominates the region, accounting for the majority of revenue, while Canada is also witnessing steady growth due to rising healthcare expenditure and technological advancements. North America’s focus on improving patient outcomes and reducing healthcare costs ensures its leadership in the wireless medical devices market.

Companies in the region are up for innovations and constant strategic initiatives which is strengthening the market growth for wireless medical devices. For instance, in May 2023, DeviceLab (Tustin, CA) and Nouslogic Telehealth, Inc. (Irvine, CA) have formed a strategic partnership to develop and market next-generation wireless medical devices and remote patient monitoring systems. This collaboration unites two industry leaders in engineering excellence, aiming to advance innovative healthcare solutions through cutting-edge technology.

The Europe region is second largest market

Europe is also a significant market driven by advanced healthcare systems, strong government support, and increasing adoption of digital health technologies. Countries like Germany, the UK, and France lead the region, with significant investments in telemedicine and remote patient monitoring. The growing prevalence of chronic diseases and an aging population further boost demand for wireless medical devices.

Additionally, the European Union’s supportive regulatory framework, such as the Medical Device Regulation (MDR), ensures high standards of safety and efficacy, fostering innovation. However, market growth is slightly tempered by budget constraints in some countries and fragmented healthcare systems. Despite this, Europe remains a key player in the global wireless medical devices market.

In October 2024, Olympus Europa SE & Co. KG (Olympus), a global MedTech company, announced that its group company, Odin Medical Ltd. (Odin Vision), has received CE marking approval under the Medical Device Regulation (MDR) in Europe for its innovative cloud-AI endoscopy medical devices—CADDIE, CADU, and SMARTIBD. This approval marks a significant milestone in advancing AI-powered endoscopic solutions for enhanced medical diagnostics and treatment.

Wireless Medical Devices Market, Regional Analysis, 2020-2024 (US$ Billion)

Region 2020 2021 2022 2023 2024 North America 6.16 6.83 7.58 8.41 9.33 Europe 4.31 4.79 5.31 5.92 6.61 Asia Pacific 3.34 3.71 4.11 4.70 5.38 Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Medtronic plc, Koninklijke Philips N.V., GE Healthcare, Abbott, Boston Scientific Corporation, Siemens Healthineers, Omron Healthcare, Inc., Dexcom, Inc., Fitbit Health Solutions, Samsung Electronics Co. Ltd., Digi International Inc., Baxter, Biotronik SE & Co. KG, and Other Prominent Players.

Medtronic is a global leader in medical technology, offering a wide range of wireless medical devices, including implantable cardiac monitors, insulin pumps, and remote patient monitoring systems. The company focuses on integrating wireless connectivity with its devices to enable real-time data sharing and improved patient outcomes.

For example, its CareLink™ network allows remote monitoring of cardiac devices, enhancing patient care and reducing hospital visits. Medtronic’s strong R&D investments and strategic partnerships position it as a key innovator in the wireless medical devices market. Philips is a prominent player in the healthcare technology sector, specializing in wireless solutions for diagnostics, monitoring, and home healthcare. Its portfolio includes wearable biosensors, wireless ultrasound systems, and telehealth platforms like Philips eICU.

Top Key Players in the Wireless Medical Devices Market

- Medtronic plc

- Koninklijke Philips N.V.

- GE Healthcare

- Abbott

- Boston Scientific Corporation

- Siemens Healthineers

- Omron Healthcare, Inc.

- Dexcom, Inc.

- Fitbit Health Solutions

- Samsung Electronics Co. Ltd.

- Digi International Inc.

- Baxter

- Biotronik SE & Co. KG

- Other Prominent Players

Recent Developments

- In July 2023: Abbott’s AVEIR dual chamber (DR) leadless pacemaker system received FDA approval, making it the world’s first dual chamber leadless pacing system. Since over 80% of pacemaker patients need pacing in both the right atrium and right ventricle, this approval significantly expands access to leadless pacing technology, benefiting millions across the U.S.

- In August 2023: GE HealthCare secured 510(k) clearance for Portrait Mobile, a device designed for continuous vital sign monitoring while allowing patient mobility within hospital wards. The system, integrating wireless sensors with a smartphone-style monitor, enables real-time tracking without restricting movement, offering an innovative approach to patient care.

- In October 2020: Stryker introduced ProCuity, the first fully wireless hospital bed, designed to improve patient safety and workflow efficiency. With seamless integration into nurse call systems without cables, it helps reduce in-hospital falls, optimize nursing workflows, and lower hospital costs, marking a major advancement in healthcare settings.

Report Scope

Report Features Description Market Value (2024) US$ 23.7 billion Forecast Revenue (2034) US$ 74.3 billion CAGR (2025-2034) 12.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Respiratory Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Wearable Devices, Implantable Devices, Handheld & Portable Devices, Stationary Devices and Others), By Type (Diagnostic & Monitoring and Therapeutic), By Technology (Bluetooth, Wi-Fi, Near Field Communication (NFC), Zigbee, RFID (Radio Frequency Identification), Ultra-wideband (UWB) and Others), By Application (Cardiology, Neurology, Respiratory, Diabetes Management, Point of Care and others), By End-User (Hospitals & Clinics, Home Healthcare, Ambulatory Surgical Centers, Diagnostic Centers, Long-Term Care & Assisted Living Facilities and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medtronic plc, Koninklijke Philips N.V., GE Healthcare, Abbott, Boston Scientific Corporation, Siemens Healthineers, Omron Healthcare, Inc., Dexcom, Inc., Fitbit Health Solutions, Samsung Electronics Co. Ltd., Digi International Inc., Baxter, Biotronik SE & Co. KG, and Other Prominent Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wireless Medical Devices MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Wireless Medical Devices MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Medtronic plc

- Koninklijke Philips N.V.

- GE Healthcare

- Abbott

- Boston Scientific Corporation

- Siemens Healthineers

- Omron Healthcare, Inc.

- Dexcom, Inc.

- Fitbit Health Solutions

- Samsung Electronics Co. Ltd.

- Digi International Inc.

- Baxter

- Biotronik SE & Co. KG

- Other Prominent Players