Global Wireless Connectivity Chipset Market Size, Share, Industry Analysis Report By Type (Wi-Fi Standalone, Bluetooth Standalone, WIFI and Bluetooth Combo, Low-power Wireless IC),By End-user Application (Consumer, Enterprise, Mobile Handsets, Automotive, Industrial, Other End-user Applications), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov 2025

- Report ID: 165844

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

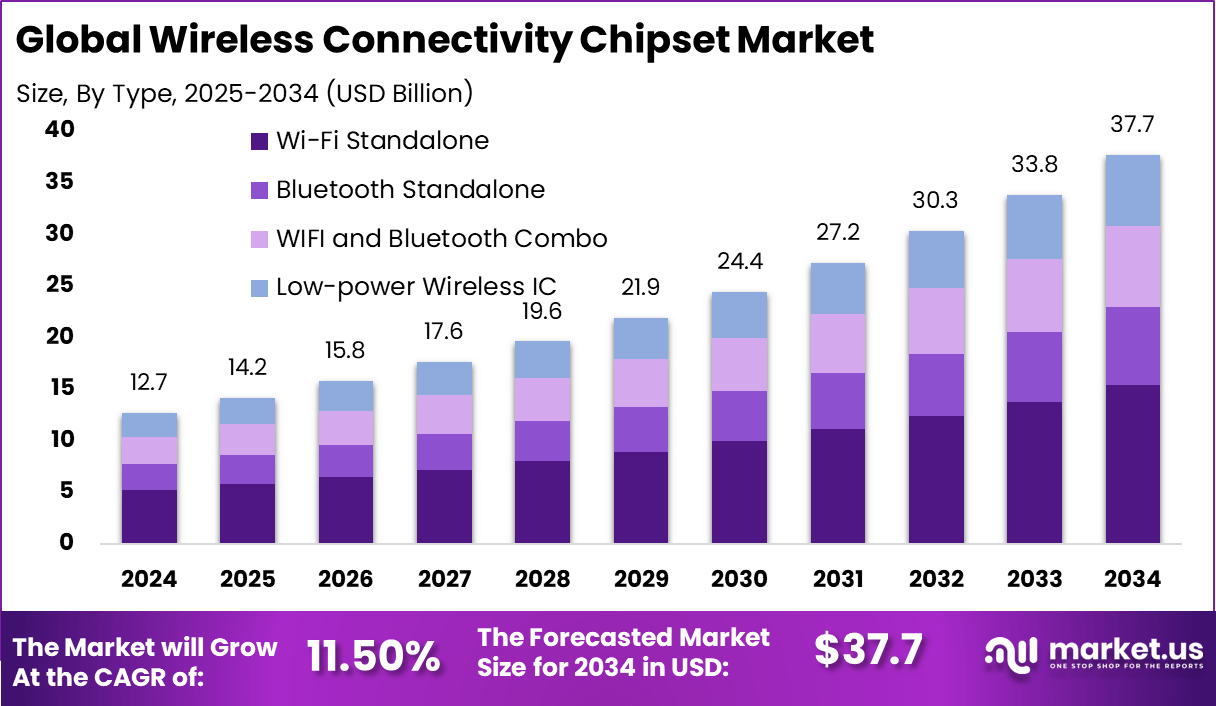

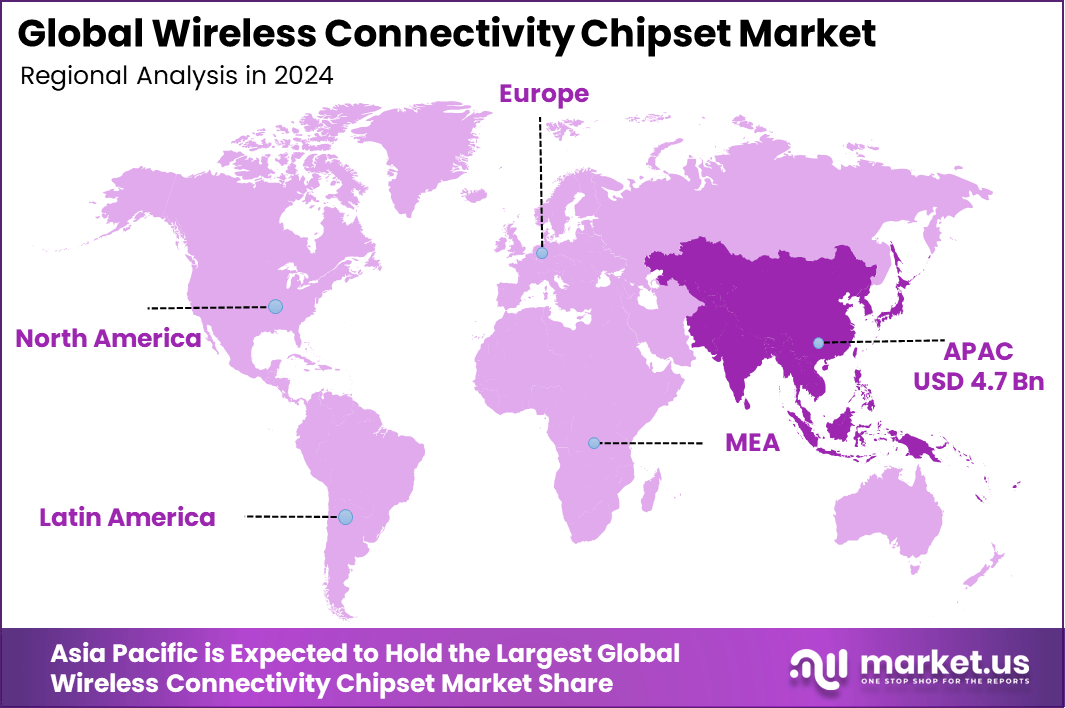

The Global Wireless Connectivity Chipset Market generated USD 12.7 Billion in 2024 and is predicted to register growth to about USD 37.7 Billion by 2034, recording a CAGR of 11.50% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 37.4% share, holding USD 4.7498 Billion revenue.

The wireless connectivity chipset market has expanded steadily as more devices require seamless communication across personal, industrial and commercial environments. Chipsets enabling Wi Fi, Bluetooth, low power wireless standards and multi protocol operation have become essential in modern electronics. Growth reflects rising demand for always connected devices and increasing integration of wireless modules into consumer goods, vehicles, industrial systems and smart infrastructure.

The growth of the market can be attributed to rapid adoption of smart home devices, wearables, mobile accessories and connected appliances. Industrial automation relies heavily on wireless chipsets to support machine to machine communication and remote monitoring. Continued expansion of cloud connected services increases the need for reliable wireless interfaces. Advancements in chipset design that reduce power consumption and support higher data rates are further accelerating adoption.

Key Takeaways

- The global wireless connectivity chipset market reached USD 12.7 billion in 2024 and is projected to increase to USD 37.7 billion by 2034, supported by an 11.50% CAGR during the forecast period.

- Wi-Fi Standalone dominated the type segment with a 40.8% share, reflecting strong demand from consumer electronics, networking devices and smart home systems.

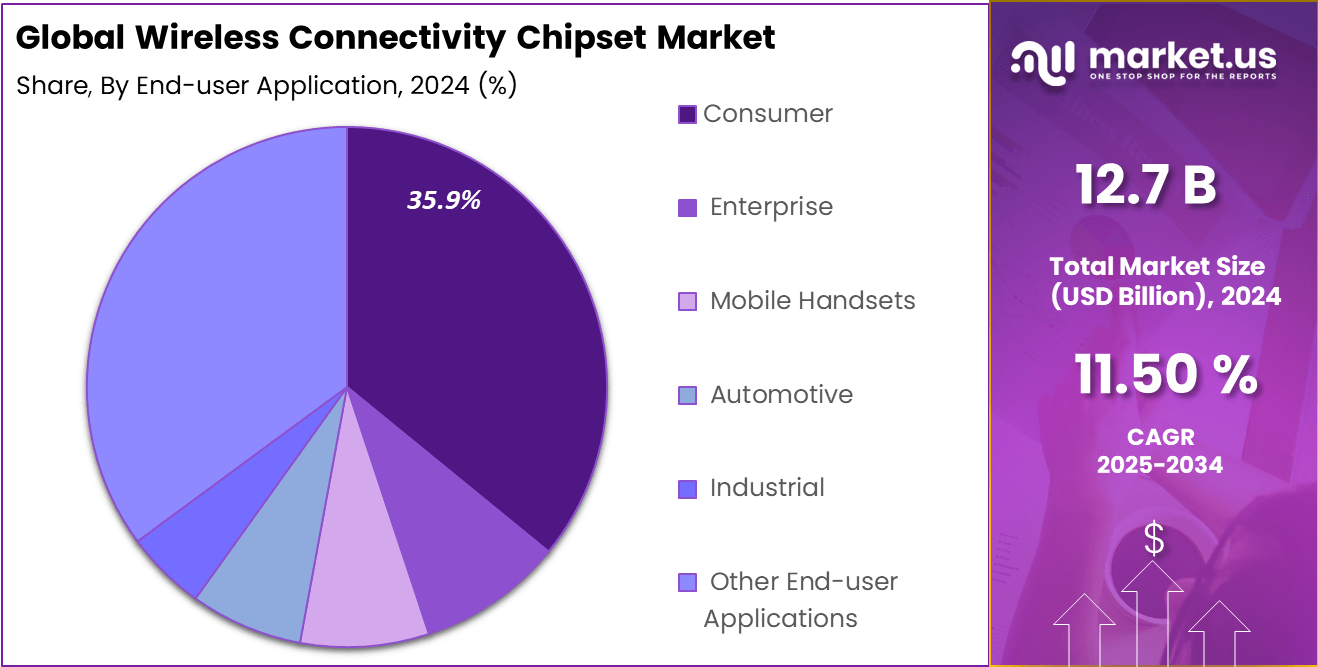

- The Consumer end-user application segment accounted for 35.9%, driven by rising adoption of smart appliances, wearable devices and personal electronics.

- Asia Pacific led the global market with a 37.4% share, generating about USD 4.7498 billion in 2024 due to large-scale production and rapid digital adoption.

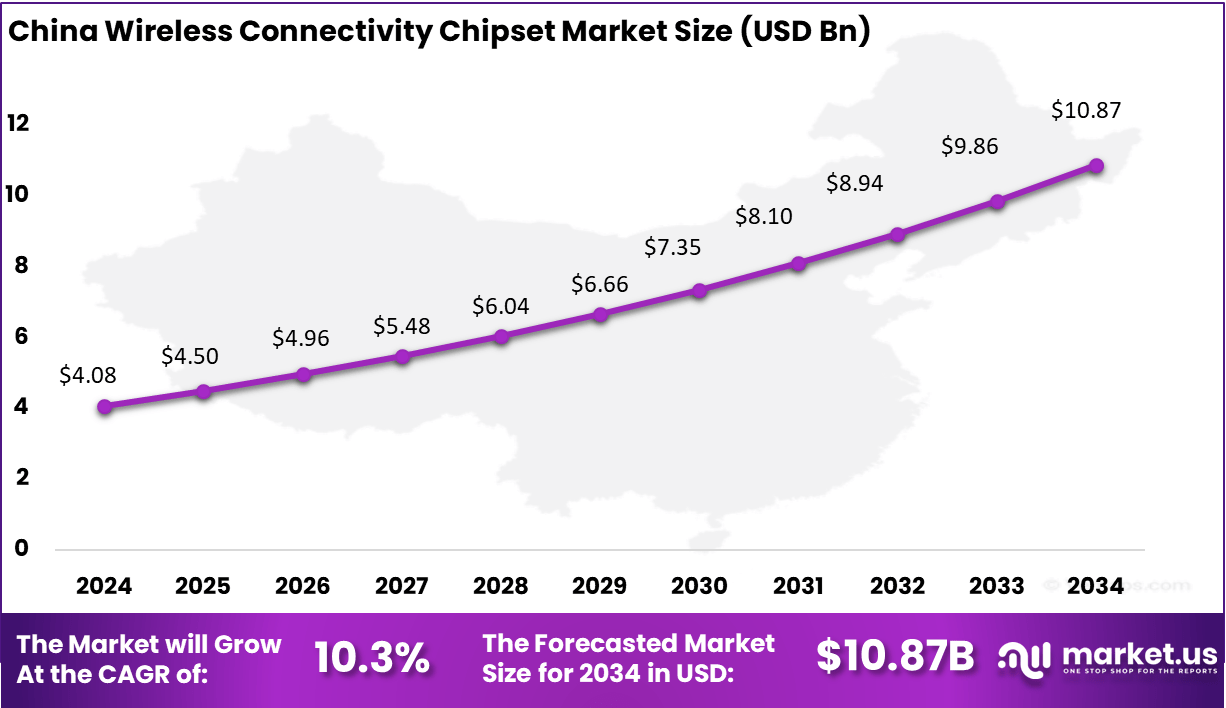

- China remained the largest contributor within Asia Pacific, recording USD 4.08 billion in 2024 and growing steadily at a 10.3% CAGR supported by strong demand from smartphones, IoT devices and connected automotive applications.

Adoption and Usage Statistics

Technology Market Share / Usage Metric Adoption Drivers Wi-Fi Accounts for 32% of all IoT connections; Wi-Fi 6 chipsets held over 73% of the Wi-Fi 6/6E/7 market share in 2023. Smart home devices, enterprise upgrades (Wi-Fi 6/7), data-heavy services (video streaming, cloud), and low-power IoT applications. Bluetooth (BLE) Accounts for 24% of connected IoT devices globally. The market is expected to reach $8.88 billion in 2025. Battery-powered devices (wearables, sensors), asset tracking (RTLS), electronic shelf labels (Bluetooth 5.4), and medical systems. Cellular (5G, LTE-M, NB-IoT) Makes up 22% of global IoT connections. The 5G chipset market is projected to reach $81.03 billion by 2028. High reliability and low-latency use cases (FWA, video telematics, automotive, industrial gateways) and replacement of older 2G/3G networks. China Market Size

China stands as the central growth engine within the global wireless connectivity chipset market, contributing about USD 4.08 Billion in 2024 and expanding at a CAGR of 10.3 %. The country benefits from large-scale electronics manufacturing, rapid adoption of smart devices and strong government support for digitalization.

China’s leadership in smartphones, wearables and smart home devices ensures continuous demand for Wi-Fi, Bluetooth and low-power wireless ICs. The rapid rollout of connected infrastructure, combined with high consumer adoption of smart appliances, strengthens China’s position as the largest single-country market in this sector.

Asia Pacific holds the dominant position in the global wireless connectivity chipset market, representing 37.4 % of worldwide revenue in 2024 and generating about USD 4.7 billion. The region’s leadership is supported by strong electronics production hubs, widespread smartphone penetration and aggressive expansion of wireless broadband infrastructure.

Over the forecast period, Asia Pacific is expected to retain its leading share as demand rises across automotive, industrial and enterprise applications. Continued investments in semiconductor manufacturing, government-led digitalization programs and growing adoption of IoT ecosystems will help the region scale rapidly. Chipset suppliers focusing on high integration, lower power consumption and cost-optimized designs are best positioned to capture long-term opportunities in Asia Pacific’s expanding connectivity landscape.

By Type

In 2024, Wi-Fi standalone chipsets make up 40.8% of the wireless connectivity chipset market. These chipsets are designed specifically for high-bandwidth Wi-Fi connectivity and are widely used in networking equipment, consumer electronics, and smart home devices. Their dedicated performance makes them ideal for applications that require reliable, fast wireless connections without the need for integrated Bluetooth or other wireless protocols.

The demand for Wi-Fi standalone chipsets is driven by the growing number of connected devices and the need for seamless indoor connectivity. As more homes and businesses adopt smart technologies, the need for robust, high-speed Wi-Fi solutions continues to rise. This segment is especially important for routers, access points, and devices that prioritize strong wireless performance over multi-functionality.

By End-user Application

In 2024, Consumer applications account for 35.9% of the wireless connectivity chipset market. This segment includes smartphones, tablets, smart TVs, wearables, and smart home devices. The popularity of these products is a major factor behind the growth of wireless chipsets, as consumers increasingly rely on connected devices for communication, entertainment, and daily tasks.

The consumer segment is also influenced by the rapid adoption of 5G and advanced Wi-Fi standards. Modern devices require chipsets that support high-speed internet, low latency, and efficient power usage. As technology evolves, wireless chipsets are becoming more integrated and energy-efficient, meeting the demands of today’s tech-savvy users.

Key Market Segments

- By Type

- Wi-Fi Standalone

- Bluetooth Standalone

- WIFI and Bluetooth Combo

- Low-power Wireless IC

- By End-user Application

- Consumer

- Enterprise

- Mobile Handsets

- Automotive

- Industrial

- Other End-user Applications

Driver Analysis

Key drivers include the proliferation of smart devices, rising data consumption and the expansion of wireless infrastructure globally. The need for seamless and high-performance wireless connectivity across consumer electronics, smart homes, industrial IoT and automotive systems has boosted demand for advanced chipsets.

Moreover, the emergence of Wi-Fi 6/6E/7 standards, greater integration of wireless modules and the convergence of Wi-Fi, Bluetooth and low-power protocols are reinforcing chipset adoption across multiple end-use verticals.

The demand for wireless connectivity chipsets is growing strongly due to the rapid rise of Internet of Things (IoT) devices and smart consumer electronics. Products like smartphones, wearables, smart home gadgets, and industrial sensors require reliable, low-power wireless chipsets to connect seamlessly.

Restraint Analysis

Growth is constrained by rising component and manufacturing costs, significant investment required for developing next-generation chipsets and the pressure of ensuring backward compatibility and regulatory compliance across regions.

In addition, saturation in mature markets such as consumer smartphones may limit incremental growth, while anticipation of new standards (for example Wi-Fi 7/8) may lead to delayed purchasing decisions by some buyers, thereby affecting short-term demand.

Security concerns and strict regulatory requirements limit the wireless connectivity chipset market’s growth. Because these chipsets are used in critical sectors like healthcare, finance, and industrial automation, risks such as hacking, unauthorized data access, and cyberattacks are major worries.

Opportunity Analysis

Opportunities lie in the ongoing transition toward integrated connectivity systems that support multiple radio protocols, low-power consumption and edge intelligence. The automotive sector, connected vehicles and vehicle-to-everything (V2X) communications present a new growth frontier for wireless connectivity chipsets.

Equally, industrial IoT, smart manufacturing and advanced sensor networks will demand robust wireless solutions, enabling chipset vendors to move beyond commodity applications to higher margin segments. Emerging markets in Asia Pacific and Latin America also open untapped demand for cost-effective wireless connectivity solutions.

A key opportunity lies in integrating multiple wireless communication standards into single chipsets, such as combining Wi-Fi and Bluetooth functions. These combo chipsets provide cost savings, reduced power consumption, and space efficiency, making them ideal for smartphones, wearables, and smart automotive applications.

Challenges

Major challenges include the pace of technology change, fragmentation of wireless standards and the need for rapid time-to-market in a competitive environment. Chipset suppliers must balance innovation, cost control and ecosystem compatibility. Furthermore, supply chain disruptions, geopolitical trade issues and regulatory uncertainties in spectrum allocation may impact deployment schedules and pricing.

Ensuring interoperability across devices and protocols remains a technical and business hurdle for the industry as a whole.A pressing challenge for wireless connectivity chipsets is interference caused by the overcrowding of unlicensed frequency bands like 2.4 GHz and 5 GHz, heavily used by Wi-Fi and Bluetooth devices.

Key Players Analysis

Broadcom, Qualcomm, and MediaTek lead the wireless connectivity chipset market with strong portfolios in Wi-Fi, Bluetooth, and integrated combo solutions. Their strategies focus on improving energy efficiency, boosting data throughput, and supporting new wireless standards. These companies continue to strengthen their competitive edge by investing in advanced RF design and multi-band architectures.

Intel, Texas Instruments, STMicroelectronics, NXP Semiconductors, ON Semiconductor, Infineon Technologies, and Microchip Technology add significant depth to the market. Their developments target industrial automation, automotive connectivity, and IoT deployments. These suppliers emphasize reliability, enhanced security, and wide protocol support.

Qorvo, Skyworks Solutions, Hisilicon Technologies, Tsinghua Unigroup (Unisoc), and other major players strengthen the RF ecosystem with advanced front-end modules and cellular communication solutions. Their expertise in power amplifiers, filters, and 5G-ready components enhances device performance and signal quality. These companies support high-volume production for smartphones and IoT hardware.

Top Key Players in the Market

- Broadcom Inc.

- Qualcomm Incorporated

- Mediatek Inc.

- Intel Corporation

- Texas Instruments Incorporated

- STMicroelectronics NV

- NXP Semiconductors NV

- On Semiconductor Corporation

- Infineon Technologies AG

- Microchip Technology Inc.

- Qorvo Inc.

- Skyworks Solutions Inc.

- Hisilicon Technologies Co. Ltd

- Tsinghua Unigroup Co. Ltd (unisoc (Shanghai) Technologies Co. Ltd.

- Other Major Players

Recent Developments

- January 2025, Qualcomm Incorporated and MediaTek Inc. collaborating on advanced Wi-Fi 6E and Bluetooth 6 chipsets that bring improved speed and reliability to smart home and IoT devices. Broadcom Inc. also launched new multi-band Wi-Fi chipsets supporting seamless connectivity across home and enterprise networks.

- August 2025, Intel Corporation’s debut of new low-power wireless chipsets tailored for automotive and industrial IoT applications, enhancing energy efficiency and network resilience. Meanwhile, companies like Texas Instruments, STMicroelectronics, and NXP Semiconductors focused on expanding product portfolios with integrated 5G and Wi-Fi 7 solutions to cater to growing demand for higher bandwidth and lower latency in wireless networks.

Report Scope

Report Features Description Market Value (2024) USD 12.7 Bn Forecast Revenue (2034) USD 37.7 Bn CAGR(2025-2034) 11.50% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Wi-Fi Standalone, Bluetooth Standalone, WIFI and Bluetooth Combo, Low-power Wireless IC),By End-user Application (Consumer, Enterprise, Mobile Handsets, Automotive, Industrial, Other End-user Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Broadcom Inc., Qualcomm Incorporated, Mediatek Inc., Intel Corporation, Texas Instruments Incorporated, STMicroelectronics NV, NXP Semiconductors NV, On Semiconductor Corporation, Infineon Technologies AG, Microchip Technology Inc., Qorvo Inc., Skyworks Solutions Inc., Hisilicon Technologies Co. Ltd, Tsinghua Unigroup Co. Ltd (Unisoc (Shanghai) Technologies Co. Ltd), Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wireless Connectivity Chipset MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Wireless Connectivity Chipset MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Broadcom Inc.

- Qualcomm Incorporated

- Mediatek Inc.

- Intel Corporation

- Texas Instruments Incorporated

- STMicroelectronics NV

- NXP Semiconductors NV

- On Semiconductor Corporation

- Infineon Technologies AG

- Microchip Technology Inc.

- Qorvo Inc.

- Skyworks Solutions Inc.

- Hisilicon Technologies Co. Ltd

- Tsinghua Unigroup Co. Ltd (unisoc (Shanghai) Technologies Co. Ltd.

- Other Major Players