Global Wedding Services Market By Type (Local, Destination), By Booking (Offline, Online), By Service (Catering Services, Decoration Services, Videography & Photography Services, Wedding Planning Services, Transport Services, Other Services), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135992

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

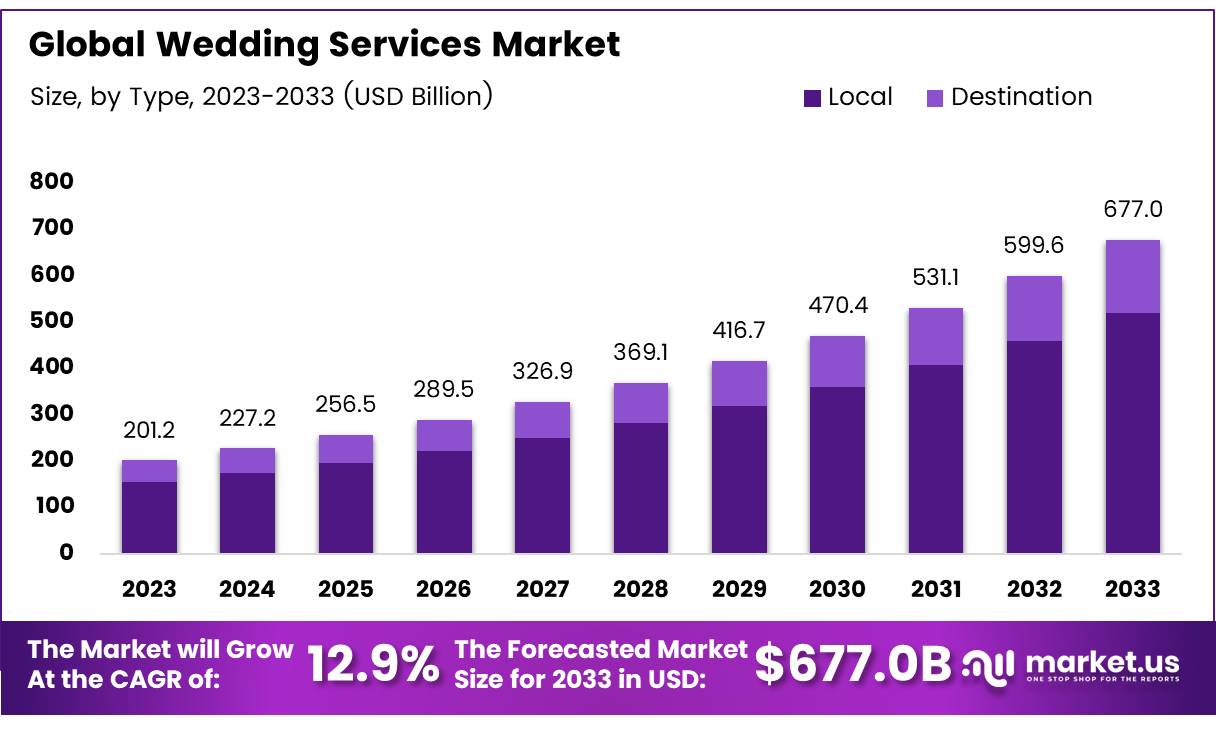

The Global Wedding Services Market size is expected to be worth around USD 677.0 Billion by 2033, from USD 201.2 Billion in 2023, growing at a CAGR of 12.9% during the forecast period from 2024 to 2033.

Wedding services encompass a broad spectrum of offerings that cater to the various needs and desires of couples on their special day. This sector includes, but is not limited to, venue selection, catering, photography, videography, event planning, attire, and entertainment.

Each component plays a crucial role in orchestrating a wedding event, ensuring that the occasion is memorable and seamlessly executed. The market for wedding services is a dynamic entity, shaped by cultural norms, personal preferences, and economic factors, reflecting the diverse demands of consumers across different regions.

The wedding services market represents the commercial activities related to the provision of services and products for wedding events. This market is vast and varied, encompassing both local and global service providers. It operates within an ecosystem that includes small independent vendors, large-scale companies, and freelance professionals, all contributing to the planning and execution of wedding ceremonies and receptions.

The wedding services market is experiencing substantial growth, driven by increasing expenditures on weddings and the rising demand for customized and unique wedding experiences.

According to Zola, the average cost of a wedding in 2024 has surged to over $30,000, indicating robust consumer spending and an expanding market size. This financial uptrend presents lucrative opportunities for vendors across all segments of wedding services.

Furthermore, the fact that over 90% of couples are now financially contributing to their weddings underscores a significant shift towards more extravagant and personalized weddings, which in turn drives demand for diverse and specialized service offerings.

Governments have also played a pivotal role in shaping the market dynamics through regulations and investments that ensure consumer protection and promote industry standards. For instance, regulations concerning contractual agreements with service providers help safeguard consumer interests and maintain market integrity, fostering a trustworthy environment for transactions.

Regulations in the wedding services market are crucial for ensuring quality and fairness, which are vital for consumer satisfaction and industry reputation. Standards for service provision, coupled with fair contractual practices, contribute to a stable and reliable market environment, encouraging more couples to invest confidently in professional wedding services.

The demographic data from Career Explorer reveals a gender disparity in the profession, with 97% of wedding planners being female. This statistic might influence market strategies, particularly in marketing and product offerings, to better address the needs and preferences of this dominant group within the profession.

Additionally, the substantial number of weddings annually, as highlighted by Social Tables, indicates a consistently high demand for wedding services, which sustains a vast network of vendors and service providers. The data from Nunify, showing that 92% of couples hire vendors specifically for wedding dresses and 91% for venues, further illustrates the critical importance of these segments within the broader market.

Key Takeaways

- The global wedding services market is projected to grow from USD 201.2 billion in 2023 to USD 677.0 billion by 2033, at a CAGR of 12.9%.

- Local weddings dominated the market in 2023, capturing 76.7% of the market, favored for their convenience and ease of logistical arrangements.

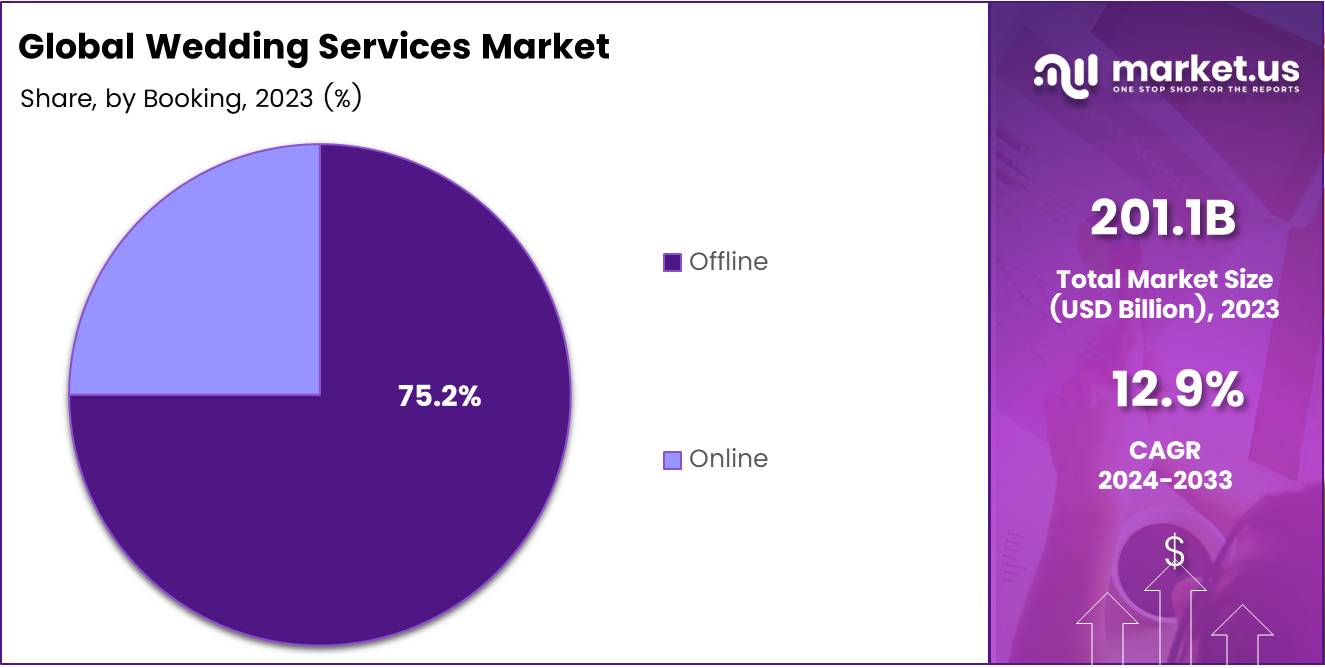

- Offline bookings continue to hold a major share (75.2%) in the booking analysis due to the personalized touch they offer in wedding planning.

- Catering services led the service segment in 2023 with a 28.2% share, driven by the demand for diverse and customized culinary options.

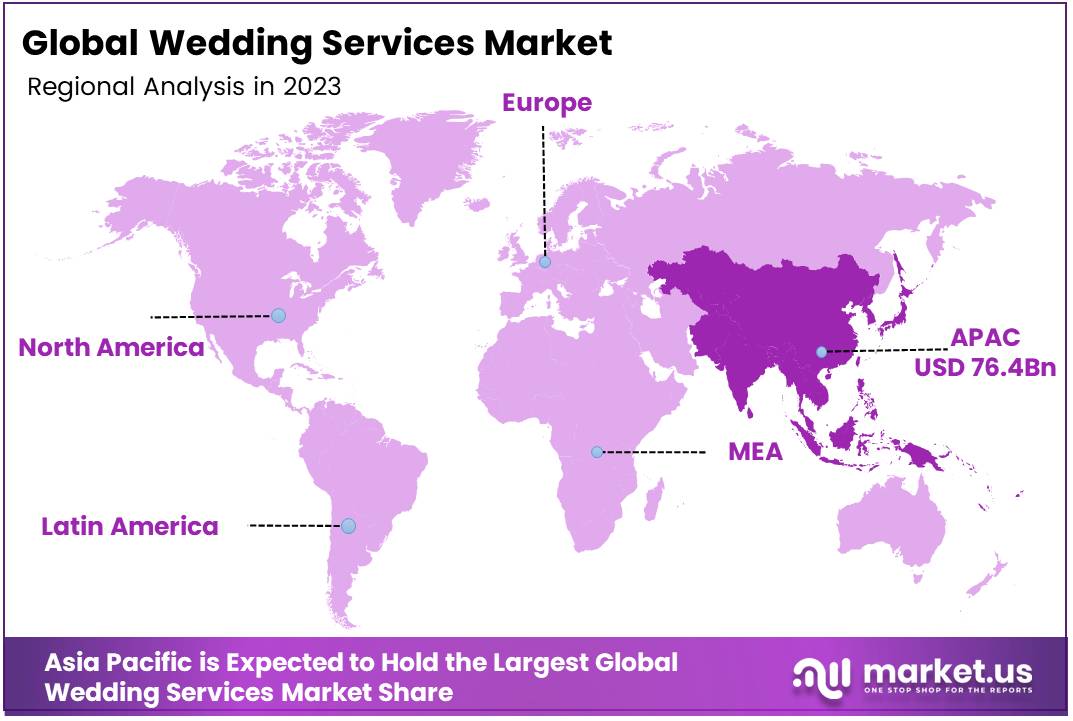

- Asia Pacific dominates the market with a 38.1% share, fueled by large-scale weddings and rising expenditures in India and China.

Type Analysis

Local Weddings Dominate Market Share with 76.7% in 2023

In 2023, the wedding services market witnessed Local weddings holding a dominant position in the By Type Analysis segment, securing a substantial 76.7% market share. This prominence can be attributed to the preferences of couples seeking the comfort and convenience of familiar surroundings, coupled with the ease of logistical arrangements.

Moreover, the trend towards Local weddings is reinforced by the availability of a wide range of venues and services that cater to various budgets and styles, making it an accessible choice for a majority.

On the other hand, Destination weddings accounted for the remaining market share. Although less prevalent, this segment captures the interest of couples looking for unique and memorable experiences. These weddings typically occur in exotic or significant locations away from the couple’s local area, often doubling as a vacation spot for guests.

The allure of Destination weddings lies in their ability to offer a picturesque backdrop and an exclusive setting, which, despite higher costs and complex planning requirements, continues to attract a niche market.

This segmentation highlights the substantial variance in consumer preferences within the wedding services market, emphasizing the strong inclination towards localized celebrations while still acknowledging the unique appeal of destination events.

Booking Analysis

Offline Channels Dominate Wedding Services Booking with 75.2% Market Share

In 2023, Offline held a dominant market position in the By Booking Analysis segment of the Wedding Services Market, with a 75.2% share. The persistence of offline bookings is primarily attributed to the personal touch that is often desired in wedding planning.

Couples tend to prefer direct interactions when selecting venues, catering, and other services, which allows for a more tailored and trustworthy experience. This method ensures clarity in communication and immediate resolution of concerns, which is less straightforward through online platforms.

On the other hand, the Online segment, although smaller, is gradually gaining traction. This increase is driven by the digitalization of services and the rising convenience of accessing wedding-related services through websites and apps.

The growth of this segment is supported by the younger demographic, who favor the efficiency and breadth of options available online. The integration of virtual tours, customer reviews, and online negotiations are enhancing the appeal of online bookings. The market is witnessing a shift as service providers enhance their digital platforms to capture this growing segment, aiming to offer a blend of convenience and reliability.

Service Analysis

Catering Services Lead in Wedding Services Market with 28.2% Share

In 2023, Catering Services held a dominant market position in the By Service Analysis segment of the Wedding Services Market, commanding a 28.2% share. This sector has demonstrated robust growth, fueled by increasing demand for diverse culinary offerings and bespoke menu options tailored to various cultural and personal preferences.

Following closely, Decoration Services contributed significantly to the market’s dynamics, enhancing event aesthetics and creating memorable experiences through innovative and themed designs.

Videography & Photography Services also played a critical role, capturing the essence of matrimonial celebrations. This segment has capitalized on technological advancements in digital media, offering high-quality, creative documentation of wedding events, which has become indispensable for modern weddings.

Wedding Planning Services have streamlined the coordination of these complex events, offering comprehensive solutions that ensure a seamless execution of each component, from venue selection to vendor management.

Transport Services facilitated logistical ease, providing reliable and timely transportation solutions for guests and bridal parties, which is essential for the smooth progression of wedding festivities.

Lastly, Other Services, encompassing various niche offerings like bespoke invitations and specialized entertainment, have contributed to the market’s diversification, catering to unique and personalized wedding experiences. Collectively, these segments illustrate a vibrant and evolving industry, adept at fulfilling the multifaceted needs of wedding ceremonies.

Key Market Segments

By Type

- Local

- Destination

By Booking

- Offline

- Online

By Service

- Catering Services

- Decoration Services

- Videography & Photography Services

- Wedding Planning Services

- Transport Services

- Other Services

Drivers

Growing Popularity of Destination Weddings Boosts Wedding Services Market

The wedding services market is experiencing significant growth, driven primarily by the increasing trend of destination weddings. Couples are now seeking exotic and unique locations for their nuptials, which boosts demand for local and specialized wedding services tailored to these distinct locales.

Additionally, the pervasive influence of social media platforms such as Instagram and Pinterest is shaping wedding trends, compelling couples to invest in highly aesthetic and thematic services to ensure their special day is both picturesque and memorable.

Furthermore, a rise in disposable income has enabled more couples to allocate substantial budgets towards creating lavish weddings, thereby expanding the market for upscale wedding services.

Culturally, weddings hold profound significance across various societies, maintaining a steady demand for comprehensive wedding planning and execution services. These factors collectively contribute to the robust growth of the wedding services market, highlighting its resilience and adaptability to changing consumer preferences.

Restraints

Economic Challenges Impacting the Wedding Services Market

In the context of the wedding services market, economic downturns represent a significant restraint. Financial instability, often triggered by broader economic recessions, leads to tighter budgets and reduced spending on weddings.

Consequently, couples may opt for smaller, less extravagant ceremonies, directly impacting the demand for extensive wedding services. This trend is compounded by shifting social attitudes towards nuptials.

There is a growing preference for more intimate gatherings or alternatives such as elopement, which bypass many traditional wedding norms and services. These changes not only reflect evolving cultural values but also indicate a significant transformation in the wedding industry’s potential market size and service demand.

These factors together create a challenging environment for service providers, as they must adapt to both decreased budgets and a shift in consumer preferences towards simplicity and intimacy in matrimonial celebrations.

Growth Factors

Diverse Wedding Services Unlock New Market Opportunities

The wedding services market is poised for growth through the introduction of inclusive wedding packages that cater to a variety of cultural, religious, and personal preferences. This strategy not only addresses the increasing demand for personalized wedding experiences but also enhances the accessibility of services to a broader demographic.

Additionally, the expansion of virtual wedding services offers a solution for couples wishing to connect with distant guests, thereby integrating technological advancements into traditional ceremonies.

Strategic partnerships with social media influencers can further augment market visibility and attract a contemporary clientele looking for trendy and memorable wedding experiences.

Moreover, exploring new geographical markets, particularly in regions within Asia and Africa where the demand for organized wedding services is escalating, represents a significant growth opportunity. By tapping into these areas, businesses can capitalize on emerging markets that are currently underserved, thereby gaining a competitive edge in the global wedding services industry.

Emerging Trends

Thematic and Niche Weddings Gain Popularity

The wedding services market is witnessing a notable shift toward thematic and niche weddings, reflecting a growing desire among couples to personalize their special day. This trend is characterized by increased interest in themed weddings, such as vintage, rustic, or pop culture-inspired celebrations, which offer unique and memorable experiences.

Additionally, the market is experiencing a rise in micro weddings, which involve smaller guest lists but higher spending per guest, emphasizing quality over quantity. The adoption of comprehensive event management software is also on the rise, streamlining the planning process and enhancing the efficiency of organizing bespoke weddings.

Furthermore, the influence of celebrity weddings continues to shape consumer expectations, setting aspirational benchmarks in both scale and style.

These factors collectively contribute to the evolving dynamics of the wedding services market, where personalization and efficiency play pivotal roles in meeting the diverse preferences of modern couples.

Regional Analysis

Asia Pacific Leads Global Wedding Services Market with Dominant 38.1% Share, Valued at USD 76.4 Billion

Asia Pacific stands as the dominating region, commanding a substantial 38.1% market share and valued at USD 76.4 billion. This market dominance is driven by the sheer volume of nuptial ceremonies, deeply rooted in the cultural and traditional values of countries like India and China, where large-scale weddings are common. Additionally, the increasing affluence in these countries is amplifying expenditure on wedding services.

Regional Mentions:

The global wedding services market exhibits significant regional diversification, reflecting cultural, economic, and social variations across different geographies.

In North America, the market is characterized by a high demand for customized and luxury wedding services, which has propelled market growth. Technological integrations, such as virtual reality tours of venues and digital wedding planning tools, are increasingly popular.

Europe follows a similar pattern, with an emphasis on historic and iconic venues, driving the market for destination weddings. The market in this region benefits from the rich cultural heritage and scenic landscapes, attracting couples from around the world.

The Middle East & Africa region is witnessing gradual growth, with luxury weddings serving as a status symbol among the affluent classes. The market here is boosted by lavish spending on venues, elaborate decor, and high-end photography.

Latin America shows a trend towards incorporating local customs and traditions, with a growing preference for eco-friendly weddings that leverage the region’s natural beauty and biodiversity.

This diverse landscape highlights the evolving preferences and spending behaviors across different regions, with the Asia Pacific leading in both market share and growth potential, primarily due to cultural significance and economic developments driving the market forward.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Wedding Services Market, BAQAA Glamour Weddings and Events stands out for its distinctive blend of luxury and cultural depth, primarily targeting high-end clients seeking bespoke services. With a pronounced focus on Middle Eastern and South Asian weddings, BAQAA’s expertise in opulent, thematic events positions it uniquely within the competitive landscape.

The company’s ability to merge traditional elements with modern aesthetics has resonated well with a diverse clientele, ensuring its prominence in regions with a rich cultural heritage.

Another notable player, Nordic Adventure Weddings, capitalizes on the growing trend of destination weddings, offering unique experiences in Denmark’s picturesque landscapes. This niche positioning allows the company to attract couples from around the world, looking for intimate, nature-centric ceremonies. This is particularly appealing to those who prioritize sustainability and minimalism, aligning with broader consumer trends towards eco-consciousness in event planning.

On the more traditional yet innovative end of the spectrum, Colin Cowie has made significant waves through his attention to detail and a keen eye for luxury, making him a favorite among celebrities and high-profile clients. His approach to wedding design not only sets trends but also elevates wedding experiences, combining personalization with unexpected elements to create memorable events.

Each of these key players BAQAA Glamour Weddings and Events, Nordic Adventure Weddings, and Colin Cowie—demonstrates a strong understanding of their target market segments, adopting strategies that emphasize specialization, customization, and experiential luxury. Their respective successes underscore the importance of niche focus and adaptability in the evolving global wedding services market.

Top Key Players in the Market

- BAQAA Glamour Weddings and Events

- Augusta Cole Events

- A Charming Fête

- David Stark

- Nordic Adventure Weddings

- JZ Events

- Colin Cowie

- Fallon Carter

- Lindsay Landman

- Eventures Asia

Recent Developments

- In July 2024, the wedding services startup Meragi successfully raised $9.1 million in a Series A funding round led by Accel, with the aim of enhancing and expanding their innovative wedding planning solutions.

- In June 2024, Meragi secured an $8 million investment in a financing round also led by Accel, focusing on broadening its market reach and strengthening its position in the wedding services marketplace.

- In September 2024, The Knot Worldwide, a prominent player in the wedding industry, completed the acquisition of an online elopement platform, further diversifying its offerings and expanding its digital services.

Report Scope

Report Features Description Market Value (2023) USD 201.2 Billion Forecast Revenue (2033) USD 677.0 Billion CAGR (2024-2033) 12.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Local, Destination), By Booking (Offline, Online), By Service (Catering Services, Decoration Services, Videography & Photography Services, Wedding Planning Services, Transport Services, Other Services) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BAQAA Glamour Weddings and Events, Augusta Cole Events, A Charming Fête, David Stark, Nordic Adventure Weddings, JZ Events, Colin Cowie, Fallon Carter, Lindsay Landman, Eventures Asia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BAQAA Glamour Weddings and Events

- Augusta Cole Events

- A Charming Fête

- David Stark

- Nordic Adventure Weddings

- JZ Events

- Colin Cowie

- Fallon Carter

- Lindsay Landman

- Eventures Asia