Global Used EV Market Size, Share, Growth Analysis By Battery Capacity (20-40 kWh, 40-60 kWh, 60-80 kWh, 80-100 kWh, Less than 20 kWh, Over 100 kWh), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two and Three Wheelers), By Range (Less than 100 Miles, 100-200 Miles, 200-300 Miles, Over 300 Miles), By Age (1-3 years, 4-6 years, 7-9 years, 10 years and above), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154871

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

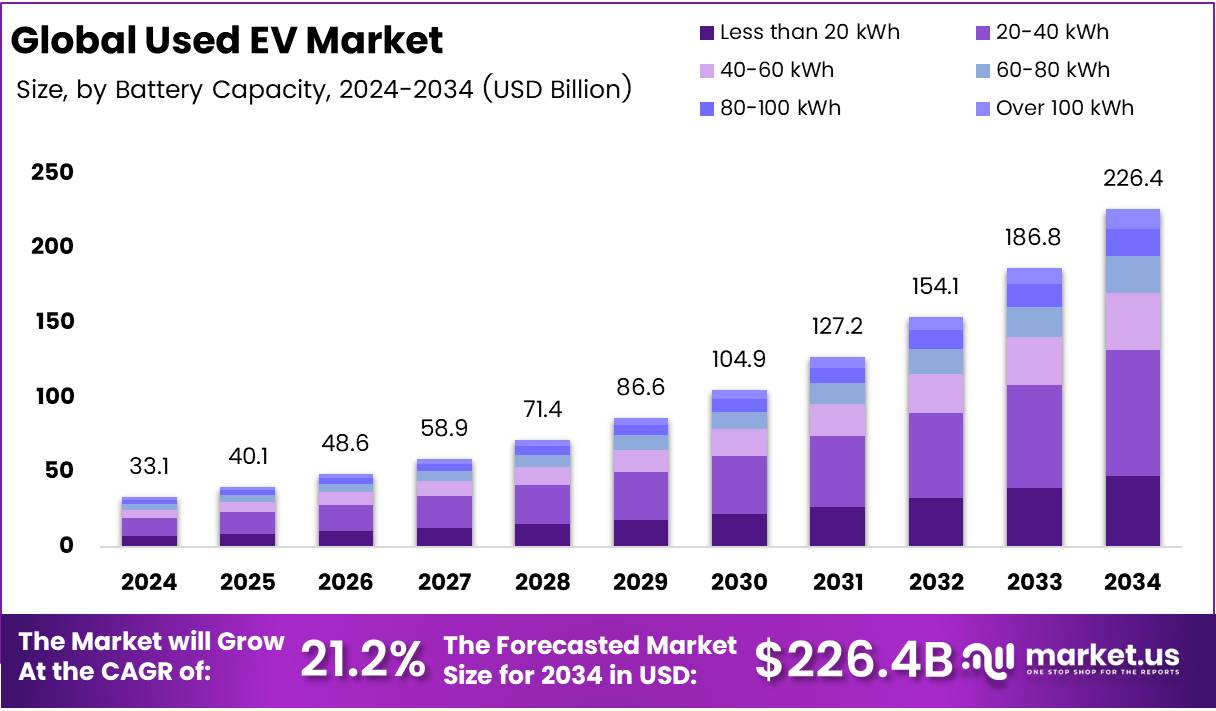

The Global Used EV Market size is expected to be worth around USD 226.4 Billion by 2034, from USD 33.1 Billion in 2024, growing at a CAGR of 21.2% during the forecast period from 2025 to 2034.

The used electric vehicle (EV) market is evolving rapidly, driven by increasing environmental awareness and the growing adoption of electric vehicles worldwide. The market for second-hand EVs is becoming more attractive as consumers seek affordable alternatives to new models while still benefiting from the environmental and economic advantages of electric mobility.

With advancements in EV technology and infrastructure, the demand for used EVs is projected to rise. Increasing fuel prices and environmental regulations are pushing more consumers towards EVs. This shift not only creates opportunities for manufacturers but also paves the way for the growth of the used EV market, as it offers a cost-effective entry point for those looking to adopt cleaner transportation.

Government investments and regulations are further fueling the growth of the used EV market. Several countries are implementing policies to promote EV adoption, such as offering tax incentives, rebates, and grants. Additionally, regulations aimed at reducing carbon emissions are accelerating the transition to electric mobility, which has a direct impact on the availability and demand for used electric vehicles.

The growing importance of battery certification is an important trend to consider. According to Aviloo, over 70% of potential buyers of used EVs believe that a battery certificate plays a crucial role in their purchasing decision. This highlights the significance of trust and transparency in the used EV market, as consumers seek assurance about the health and longevity of the vehicle’s battery.

Moreover, consumer attitudes toward used EVs are shifting. According to a survey, 77% of individuals considering an EV are now looking at used models, a significant increase from 62% in 2021. This growing acceptance is reflective of the expanding confidence in the quality and reliability of used EVs. As a result, the used EV market is becoming a more attractive option for cost-conscious buyers.

The used EV market presents substantial growth opportunities. Rising interest, coupled with supportive government policies, is shaping a dynamic market landscape. Manufacturers and dealers will need to adapt to changing consumer expectations and offer value-driven solutions, such as reliable battery checks and certification programs, to maximize their presence in this growing market.

Key Takeaways

- The Global Used EV Market is projected to reach USD 226.4 Billion by 2034, growing at a CAGR of 21.2% from 2025 to 2034.

- In 2024, the 20-40 kWh battery capacity segment led the market with 37.2% share.

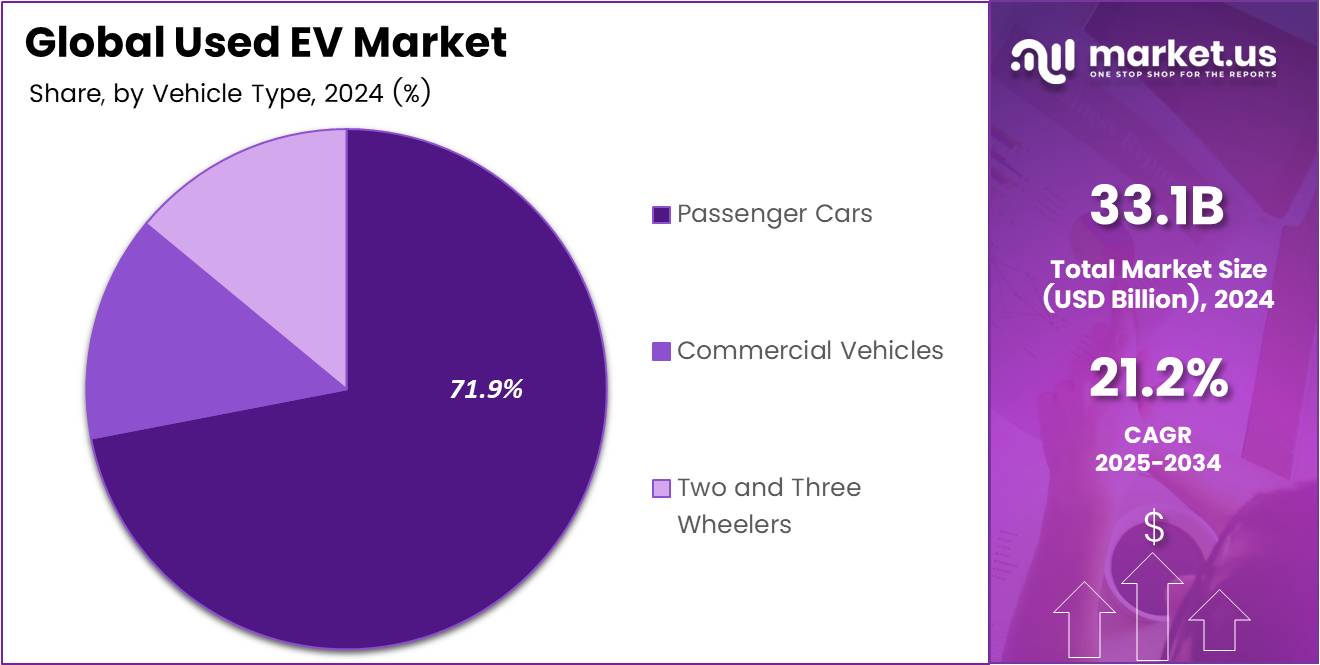

- Passenger Cars dominated the used EV market in 2024, holding a 71.9% market share.

- The Less than 100 Miles range segment held the largest share in 2024, with 45.5% share.

- The 1-3 years segment led the market in 2024, accounting for 46.7% of the share.

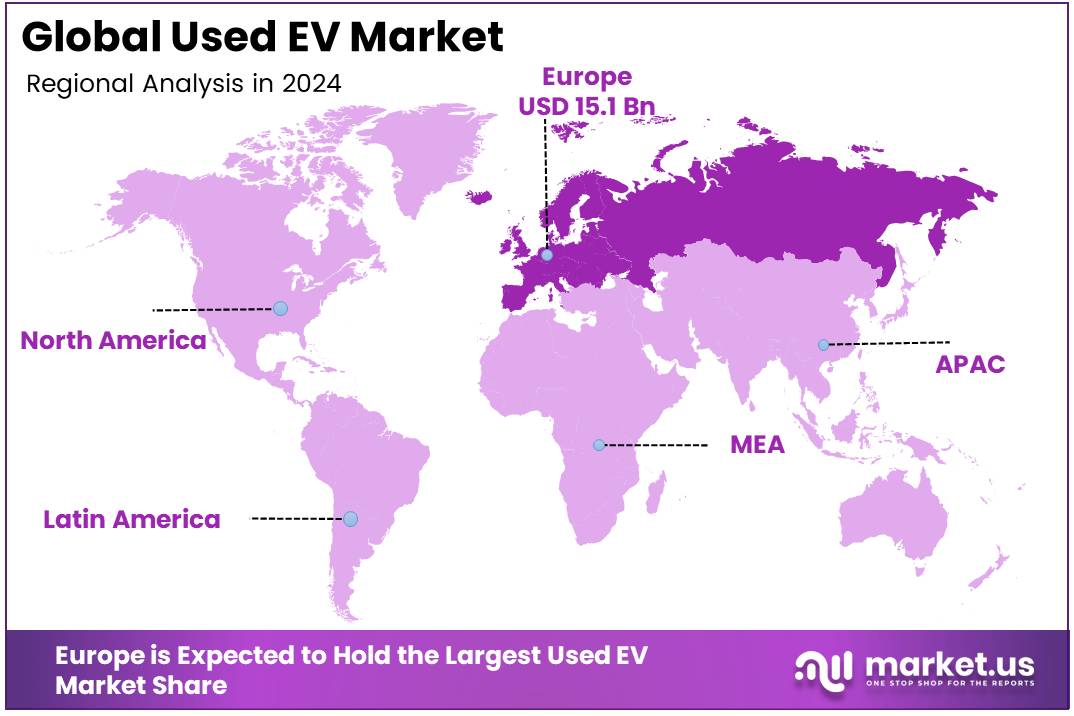

- Europe leads the global EV market with 45.7% market share, valued at USD 15.1 Billion in 2024.

Battery Capacity Analysis

20-40 kWh leads with 37.2% due to its optimal balance of cost and performance for urban commuters

In 2024, the 20-40 kWh battery capacity segment led the used EV market with a significant market share of 37.2%. This capacity range is popular due to its balance between cost and performance, making it an ideal choice for urban commuters and those seeking efficient vehicles for short to medium-range travel.

The 40-60 kWh segment followed closely, holding a notable share of the market. This range offers enhanced driving range, appealing to consumers looking for vehicles that can handle longer distances.

The 60-80 kWh battery capacity also captured a strong market segment, often preferred by consumers looking for more advanced EVs that can provide extended range and advanced features.

On the other hand, the 80-100 kWh segment held a smaller market share. Vehicles in this range are typically high-performance models, which can be more expensive and appeal to a niche consumer base.

The segments for less than 20 kWh and over 100 kWh held the smallest shares, catering to highly specific market needs such as compact city cars and high-performance luxury EVs.

Vehicle Type Analysis

Passenger Cars dominate with 71.9% due to their widespread use and practicality for daily commuting

In 2024, Passenger Cars dominated the used EV market with a market share of 71.9%. This segment’s strong performance can be attributed to the increasing consumer demand for affordable and practical electric vehicles. Passenger cars are widely used for daily commuting and urban driving, making them the primary choice in the market.

Commercial Vehicles followed with a significantly smaller share. These vehicles serve the commercial sector, including delivery and logistics, with a growing adoption of electric models for cost-saving and sustainability goals.

Two and Three Wheelers also played a key role in the market, though their share was smaller. These vehicles are gaining traction in certain regions due to their affordability, ease of use, and efficiency, especially in densely populated areas.

Range Analysis

Less than 100 Miles holds 45.5% due to its appeal for short-range urban travel and affordability

In 2024, the Less than 100 Miles range segment held the largest share of the used EV market, with a 45.5% share. This is largely due to the widespread popularity of EVs designed for short-range trips, particularly in urban environments where daily travel distances are generally lower.

The 100-200 Miles range also represented a significant portion of the market, appealing to consumers who require a balance between efficiency and the ability to take longer trips without compromising on cost.

The 200-300 Miles range attracted a growing base of consumers seeking increased range for longer journeys, though its share was smaller compared to the more budget-friendly options.

Finally, the Over 300 Miles segment, which includes high-performance EVs and luxury models, held the smallest share of the market. Despite its limited adoption, this segment is growing as high-end manufacturers expand their electric offerings.

Age Analysis

1-3 years holds 46.7% due to the preference for nearly-new vehicles with up-to-date technology and lower depreciation

In 2024, the 1-3 years segment led the used EV market with a dominant share of 46.7%. This segment’s popularity is driven by the appeal of nearly-new vehicles that offer the latest technologies, efficient battery life, and still maintain a relatively low depreciation rate.

The 4-6 years category also held a significant share, with buyers often attracted to the affordability of slightly older EVs while still benefiting from good performance and reliability.

The 7-9 years segment accounted for a smaller portion of the market. Vehicles in this range are often viewed as more budget-friendly, though they may come with a higher risk of battery degradation and require more maintenance.

Finally, the 10 years and above segment represented the smallest share. These older vehicles typically offer the lowest upfront costs but may face challenges with battery life and technology obsolescence, limiting their market appeal.

Key Market Segments

By Battery Capacity

- 20-40 kWh

- 40-60 kWh

- 60-80 kWh

- 80-100 kWh

- Less than 20 kWh

- Over 100 kWh

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two and Three Wheelers

By Range

- Less than 100 Miles

- 100-200 Miles

- 200-300 Miles

- Over 300 Miles

By Age

- 1-3 years

- 4-6 years

- 7-9 years

- 10 years and above

Drivers

Government Incentives and Tax Benefits for EV Buyers Driving Market Growth

Government incentives and tax benefits play a crucial role in boosting the adoption of used electric vehicles (EVs). Many countries worldwide offer substantial rebates, tax credits, and financial subsidies to encourage consumers to switch to electric cars. These incentives make both new and used EVs more affordable, creating a favorable environment for the second-hand EV market.

For example, tax credits on the purchase of used EVs reduce the upfront cost, making them a more attractive option for buyers looking to save money while reducing their carbon footprint. Additionally, some governments offer financial assistance based on income levels, helping lower-income groups access affordable, sustainable transportation options.

Moreover, with governments implementing stricter emissions regulations and pushing for the reduction of greenhouse gases, more people are turning to EVs as a greener alternative to traditional vehicles. These policies create a ripple effect in the used EV market, as more people consider electric vehicles an economically viable and eco-friendly choice.

Restraints

Limited Availability of Charging Stations in Remote Areas Restraining Market Growth

Despite the increasing popularity of electric vehicles, the limited availability of charging stations, particularly in remote areas, remains a significant challenge for the used EV market. Urban centers have seen rapid expansion in charging infrastructure, making it convenient for city dwellers to own and operate electric vehicles. However, for individuals living in less populated or rural regions, the lack of charging stations makes owning an EV more complicated and less practical.

For many potential buyers, the inability to find reliable charging options in their area creates hesitation about purchasing a used EV. The fear of running out of battery power with no nearby charging stations deters customers from making the switch. This concern is particularly prevalent in areas where long-distance driving is common, as a lack of accessible charging stations restricts the overall convenience of using an EV.

In addition, the infrastructure needed to support a widespread EV market in rural and remote areas requires significant investment and time. While governments are working on expanding charging networks, it may take several years for comprehensive coverage to reach all parts of the country.

Until this issue is addressed, the used EV market will continue to face restraints in regions where access to charging infrastructure remains limited. Addressing these infrastructure gaps is crucial to realizing the full potential of the used EV market.

Growth Factors

Increasing Adoption of EVs in Commercial Fleets and Public Transport Creating Opportunities

The growing adoption of electric vehicles in commercial fleets and public transport is opening up significant opportunities for the used EV market. Many businesses and public transportation systems are shifting towards electric fleets in order to cut costs, reduce carbon emissions, and meet government regulations for sustainability. As more commercial and public transport fleets integrate electric vehicles into their operations, there is a steady increase in the number of used EVs entering the resale market.

For businesses, adopting EVs in commercial fleets allows for lower maintenance and fuel costs over time, while also improving their sustainability image. This creates a large pool of used electric vehicles when these businesses upgrade or rotate their fleets.

Similarly, public transportation authorities are increasingly incorporating electric buses and other EVs to meet their sustainability goals, which results in the availability of used electric vehicles for consumers. This shift towards EV adoption in public transport not only provides a sustainable alternative for commuters but also contributes to the growth of the used EV market.

With more used EVs available from these commercial and public transport sources, consumers gain greater access to affordable electric vehicles, driving demand in the second-hand market. Moreover, these vehicles are often well-maintained, making them a reliable and cost-effective option for buyers. The trend of commercial and public sector adoption of electric vehicles is therefore accelerating the growth of the used EV market, providing fresh opportunities for both buyers and sellers alike.

Emerging Trends

Integration of Advanced Driver-Assistance Systems (ADAS) in EVs as a Trending Factor

A key trend driving the used EV market is the increasing integration of advanced driver-assistance systems (ADAS) in electric vehicles. These technologies, which include features like automatic emergency braking, lane-keeping assistance, adaptive cruise control, and collision warning systems, are now becoming more common in newer EV models. As these features become standard, used EVs equipped with ADAS technologies are becoming increasingly popular among buyers in the second-hand market.

The demand for used EVs with ADAS features is rising due to the enhanced safety, convenience, and driving experience these technologies offer. Consumers are drawn to the added security of ADAS systems, which make driving safer and more comfortable, especially for long-distance travel or in urban environments with heavy traffic. Furthermore, the integration of ADAS in used EVs appeals to tech-savvy buyers who seek modern vehicle features at a more affordable price compared to new models.

Regional Analysis

Europe Dominates the EV Market with a Market Share of 45.7%, Valued at USD 15.1 Billion

Europe is the leading region in the global EV market, holding a significant share of 45.7%, valued at USD 15.1 Billion. The region has experienced rapid adoption due to strong government incentives, stricter emission regulations, and an increasing shift toward sustainable transportation. Key markets like Germany, France, and the UK continue to drive growth, with a robust charging infrastructure supporting this transition.

North America EV Market Trends

North America is witnessing substantial growth in the EV market, driven primarily by the U.S. market, which has seen increased investment in EV infrastructure and technology. The region is expanding rapidly, bolstered by federal and state incentives aimed at reducing emissions and promoting clean energy solutions. This growth is complemented by rising consumer demand for environmentally friendly vehicles.

Asia Pacific EV Market Insights

The Asia Pacific region is experiencing a rapid shift towards electric vehicles, with countries like China leading the charge in EV adoption. The region benefits from advanced manufacturing capabilities and significant government support for green transportation initiatives. Japan, South Korea, and India are also notable contributors to the expansion of the EV market in the region.

Middle East and Africa EV Market Growth

The EV market in the Middle East and Africa is still in the early stages of development but is showing promising growth. Governments in countries like the UAE and Saudi Arabia are increasingly focused on reducing their carbon footprints, with investments in electric vehicle infrastructure and adoption incentives. While the market share remains smaller compared to other regions, its potential for future growth is significant.

Latin America EV Market Trends

The Latin American EV market is gradually expanding as countries like Brazil and Mexico begin to implement sustainable policies and incentives for electric vehicles. While the market is still developing, increasing awareness of environmental issues and the need for energy diversification are paving the way for further EV adoption in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Used EV Company Insights

In 2024, the global used electric vehicle (EV) market is witnessing significant growth, with key players emerging to capitalize on the demand for second-hand electric vehicles.

CarMax, a dominant player in the used car industry, continues to expand its EV offerings, focusing on improving customer experience with reliable used electric vehicles and an online platform for easy access. The company’s established reputation and nationwide presence allow it to capture a large portion of the market share.

Toyota Tsusho, a subsidiary of Toyota, has strengthened its position in the global used EV market by leveraging its extensive network and strong industry expertise. It has been particularly effective in sourcing used EVs from various regions, focusing on ensuring quality while maintaining competitive pricing, which appeals to a wide range of consumers looking for sustainable transportation options.

Vroom, known for its online used car sales platform, has seen a sharp rise in demand for used EVs. Vroom has been enhancing its digital infrastructure to streamline the purchasing process, making it convenient for customers to browse, purchase, and have vehicles delivered, while also offering transparency in pricing and vehicle history.

Carsome has made significant strides in the used EV space by offering a seamless digital buying experience across Southeast Asia. Its innovative approach to sourcing and certifying used EVs has gained traction, positioning the company as a key player for consumers seeking trustworthy and accessible used electric vehicles in the region.

Top Key Players in the Market

- CarMax

- Toyota Tsusho

- Vroom

- Carsome

- Manheim

- Autowini

- OLX Group

- Kavak

- Copart

- Carvana

Recent Developments

- In June 2024, Berlin-based Cardino secures €4 million in seed funding to enhance its business model focused on accelerating the sales of used electric vehicles (EVs). The company aims to leverage this investment to streamline its operations and grow its market share in the rapidly expanding EV sector.

- In July 2025, the International Motor Dealers Association (IMDA) advocates for a £1,000 government grant incentive to support the used electric vehicle market. This initiative seeks to stimulate consumer demand and drive the adoption of sustainable transportation by making used EVs more affordable.

Report Scope

Report Features Description Market Value (2024) USD 33.1 Billion Forecast Revenue (2034) USD 226.4 Billion CAGR (2025-2034) 21.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Battery Capacity (20-40 kWh, 40-60 kWh, 60-80 kWh, 80-100 kWh, Less than 20 kWh, Over 100 kWh), By Vehicle Type (Passenger Cars, Commercial Vehicles, Two and Three Wheelers), By Range (Less than 100 Miles, 100-200 Miles, 200-300 Miles, Over 300 Miles), By Age (1-3 years, 4-6 years, 7-9 years, 10 years and above) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape CarMax, Toyota Tsusho, Vroom, Carsome, Manheim, Autowini, OLX Group, Kavak, Copart, Carvana Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CarMax

- Toyota Tsusho

- Vroom

- Carsome

- Manheim

- Autowini

- OLX Group

- Kavak

- Copart

- Carvana