U.S. Rigid Thermoform Plastic Packaging Market Size, Share, Growth Analysis By Material (Polyethylene Terephthalate, Polystyrene, Polypropylene, Polyethylene, Polyvinyl Chloride, Others), By Product (Containers, Blister Pack, Clamshells, Trays & Lids, Others), By Application (Electronics, Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Homecare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142773

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

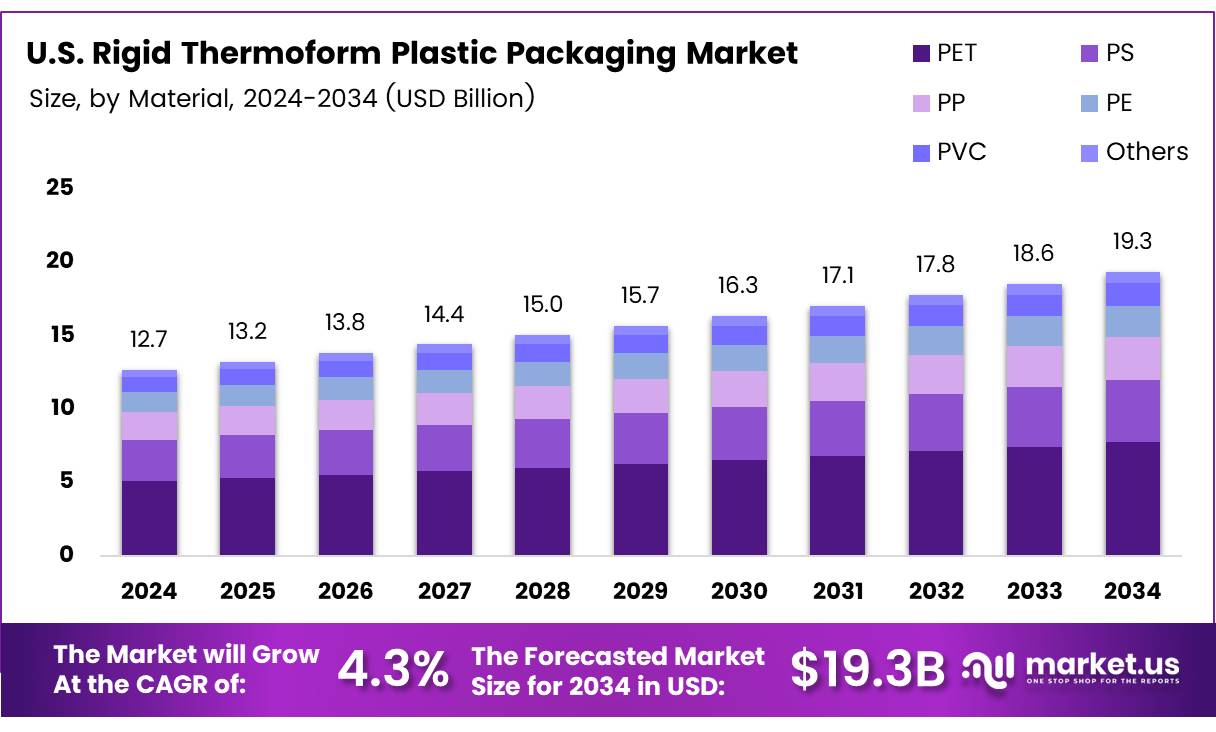

The U.S. Rigid Thermoform Plastic Packaging Market size is expected to be worth around USD 19.3 Billion by 2034, from USD 12.7 Billion in 2024, growing at a CAGR of 4.3% during the forecast period from 2025 to 2034.

The U.S. Rigid Thermoform Plastic Packaging market represents a significant segment within the packaging industry, characterized by its use of thermoforming processes to create sturdy and versatile packaging solutions. This market primarily caters to industries requiring reliable packaging for food, pharmaceuticals, and consumer goods.

Thermoform packaging is favored for its cost-effectiveness and functional designs, which include clamshells, trays, and blister packs. These products are typically made from polymers such as PET (polyethylene terephthalate), which offers clarity, strength, and recyclability, making it a popular choice among manufacturers and consumers alike.

The U.S. Rigid Thermoform Plastic Packaging market is poised for growth driven by consumer preferences and technological advancements. According to a recent Ipsos survey, a staggering 72% of American consumers admit that the design of a product’s packaging significantly impacts their purchasing choices.

This statistic underscores the importance of innovative packaging designs in consumer decision-making processes, highlighting an opportunity for market players to differentiate their products through aesthetically appealing and functional packaging solutions.

The growth of the U.S. Rigid Thermoform Plastic Packaging market is underpinned by several factors including technological innovations, increasing environmental awareness, and evolving regulatory landscapes.

The shift towards sustainable practices is particularly notable, with PET/polyester comprising 30% of all plastic packaging and textiles sold annually in the United States, according to Systemiq. This trend towards PET usage not only reflects a commitment to sustainability but also opens up new opportunities for recycling and reusing materials, thereby reducing the environmental footprint of the packaging industry.

Government investment and regulations play a crucial role in shaping the market dynamics. Recent regulatory measures aimed at reducing plastic waste have prompted companies to innovate towards more sustainable packaging solutions.

These regulations not only ensure environmental compliance but also encourage investment in new materials and technologies that meet governmental standards while appealing to eco-conscious consumers.

Key Takeaways

- The U.S. Rigid Thermoform Plastic Packaging Market is expected to reach USD 19.3 Billion by 2034, growing at a CAGR of 4.3%.

- Polyethylene Terephthalate (PET) dominated the material segment with a 41.6% share in 2024 due to its clarity, strength, and recyclability.

- Containers held a 32.6% share in the product segment, driven by adoption in food, beverage, and pharmaceuticals.

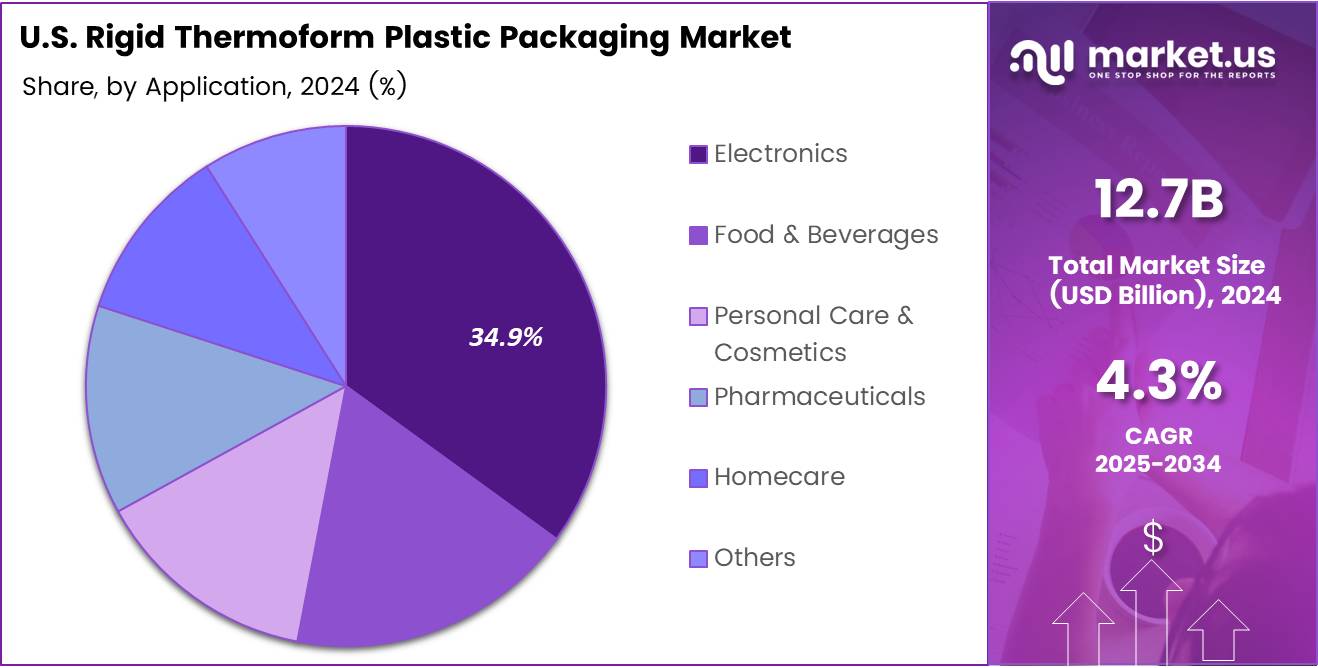

- The electronics industry led the application segment with a 34.9% share, fueled by demand for lightweight and protective packaging.

Material Analysis

Polyethylene Terephthalate (PET) Leads U.S. Rigid Thermoform Plastic Packaging Market with 41.6% Share in 2024

In 2024, Polyethylene Terephthalate (PET) maintained a dominant position in the By Material Analysis segment of the U.S. Rigid Thermoform Plastic Packaging Market, commanding a 41.6% share. This dominance can be attributed to PET’s widespread use due to its excellent clarity, strength, and recyclability, which makes it a preferred choice for packaging in industries like food and beverages, personal care, and consumer goods.

Following PET, Polystyrene (PS) holds a significant share due to its affordability and versatility, making it ideal for applications like containers and trays. Polypropylene (PP) comes next, benefiting from its high resistance to heat and chemicals, which is crucial for packaging applications that require durability.

Polyethylene (PE) and Polyvinyl Chloride (PVC) also contribute to the market, with PE being used extensively in flexible and rigid packaging, while PVC is favored for its rigidity and resistance to moisture.

Despite the rising demand for sustainable packaging materials, PET’s ability to offer a balance of performance, cost-effectiveness, and environmental benefits through recycling initiatives cements its leading role in the U.S. rigid thermoform plastic packaging market.

Product Analysis

Containers Lead U.S. Rigid Thermoform Plastic Packaging Market with 32.6% Share in 2024

In 2024, containers held a dominant position in the By Product Analysis segment of the U.S. rigid thermoform plastic packaging market, commanding a substantial 32.6% share. This market segment’s growth is primarily attributed to the widespread adoption of containers in various industries such as food and beverage, pharmaceuticals, and consumer goods. Containers offer superior protection, easy handling, and cost-effective solutions, making them a preferred choice for packaging.

Blister packs, while significant, hold a smaller share in the market compared to containers. Blister packs are commonly used for smaller consumer goods and pharmaceuticals, but their market growth is constrained by competition from other packaging solutions.

Clamshells, another prominent packaging product, are valued for their transparency and durability, and they are particularly popular in retail packaging for food and small electronics. Trays and lids are also gaining traction, especially in the food industry, due to their ability to provide secure, stackable, and efficient packaging options.

Overall, containers maintain a strong market position due to their versatility and broad usage across multiple sectors, outpacing other packaging types in both demand and market share. The Others category accounts for a smaller portion of the market, as it includes niche packaging solutions with less widespread adoption.

Application Analysis

Electronics Lead U.S. Rigid Thermoform Plastic Packaging Market with 34.9% Share in 2024

In 2024, Electronics held a dominant position in the By Application Analysis segment of the U.S. Rigid Thermoform Plastic Packaging Market, commanding a 34.9% share. This significant market share is attributed to the growing demand for lightweight, durable, and protective packaging solutions in the electronics industry. With the increasing production of consumer electronics, including smartphones, laptops, and wearables, rigid thermoform plastic packaging offers optimal protection for these sensitive products during shipping and storage.

The Food & Beverages sector followed closely, driven by the rising preference for convenient and cost-effective packaging solutions. With a growing focus on sustainability, the market is seeing an increasing shift toward recyclable thermoform plastics.

Personal Care & Cosmetics and Pharmaceuticals sectors also contribute significantly, leveraging rigid plastic packaging for its ability to safeguard delicate formulations and enhance shelf appeal. Homecare products, while smaller in share, are expected to grow steadily due to the increasing demand for packaged home cleaning and maintenance products.

The Others category captures niche applications, though its overall contribution remains relatively modest compared to the key sectors highlighted above. As the demand for efficient, safe, and sustainable packaging rises across industries, these segments are likely to experience continued growth.

Key Market Segments

By Material

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Others

By Product

- Containers

- Blister Pack

- Clamshells

- Trays & Lids

- Others

By Application

- Electronics

- Food & Beverages

- Personal Care & Cosmetics

- Pharmaceuticals

- Homecare

- Others

Drivers

Increasing Demand for Durable and Lightweight Food Packaging Fuels Market Growth

The U.S. rigid thermoform plastic packaging market is experiencing significant growth, driven by several factors. One of the key drivers is the increasing demand from the food and beverage industry, where durable and lightweight packaging solutions are essential to extend the shelf life of products.

Innovations in packaging technology have also played a vital role, with improved barrier properties and recyclability making thermoform plastics more attractive to manufacturers and environmentally conscious consumers. Additionally, the cost-effectiveness of thermoform plastic packaging compared to other alternatives is appealing to manufacturers aiming to reduce production expenses. This affordable option helps businesses stay competitive while providing reliable packaging solutions.

Another important factor is the growing consumer preference for convenient and aesthetically pleasing packaging. Thermoform plastics are not only functional but also offer visual appeal, which makes them popular among consumers looking for packaging that is easy to use and visually appealing.

Restraints

Environmental Concerns Over Plastic Waste Hinder Market Growth

The U.S. rigid thermoform plastic packaging market faces several challenges, with environmental concerns being a key restraint. Plastic waste is a growing problem, and the environmental impact of disposable plastic packaging has led to increasing pressure from both consumers and regulators.

As people become more aware of the negative effects of plastic pollution, businesses and governments are pushing for eco-friendly alternatives. This has prompted many companies to seek sustainable packaging options, limiting the demand for traditional plastic packaging.

Additionally, there is strong competition from flexible packaging, which is often considered more environmentally friendly and cost-effective. Flexible packaging uses less material, is lighter, and is easier to recycle compared to rigid plastic packaging. This shift toward more sustainable options further restricts the growth of the rigid thermoform plastic packaging market.

As environmental concerns continue to shape consumer preferences and regulations, the market for rigid plastic packaging is likely to face increasing challenges.

Growth Factors

Expansion in Emerging Markets Opens New Doors for U.S. Rigid Thermoform Plastic Packaging

The U.S. rigid thermoform plastic packaging market is set to benefit from the expansion of emerging economies, where rising incomes and increasing consumer demand present substantial growth opportunities.

As these markets continue to grow, the need for packaging solutions to meet the demands of expanding industries—such as food, beverages, consumer goods, and healthcare—will rise. Companies can capitalize on this by entering new geographic regions with tailored products designed to suit local consumer preferences.

Additionally, the ongoing development of eco-friendly alternatives, such as biodegradable plastics, is driving growth, as consumers and businesses increasingly prioritize sustainability. The healthcare and pharmaceutical sectors, with their heightened focus on protective and tamper-evident packaging, also present a promising area for growth, as safety and quality standards continue to evolve.

Furthermore, strategic collaborations and mergers can help companies expand their production capabilities, streamline operations, and increase market access. These strategic moves can provide companies with the resources needed to meet the growing demand for rigid thermoform plastic packaging, positioning them well for long-term success in both mature and emerging markets. By tapping into these opportunities, businesses can strengthen their position in the market and capitalize on evolving consumer and industry trends.

Emerging Trends

Growing Focus on Sustainability in U.S. Rigid Thermoform Plastic Packaging Market

The U.S. rigid thermoform plastic packaging market is experiencing notable trends, driven by evolving consumer expectations and industry innovations. One of the major driving forces is the increasing focus on sustainability. Companies are shifting towards more eco-friendly practices, such as incorporating recycled materials and conducting lifecycle assessments to reduce environmental impact. This is in line with the rising demand for packaging solutions that contribute to a circular economy.

Customization and personalization are also growing in popularity, with consumers seeking packaging that caters to their specific preferences and enhances the product’s appeal. In parallel, smart packaging technologies are transforming the sector, with advancements like RFID, QR codes, and freshness indicators offering consumers a more interactive and informative experience.

These innovations not only improve user engagement but also help in tracking product quality throughout the supply chain. Lastly, increased health awareness is fueling demand for packaging that preserves the nutritional value of products, while also incorporating safety features to ensure the freshness and integrity of food and beverages.

Key Players Analysis

The global U.S. rigid thermoform plastic packaging market in 2024 is set to experience notable growth, driven by the increasing demand for sustainable and cost-efficient packaging solutions across various industries.

Among the key players in this space, companies like Sonoco Products Company, Amcor plc, and Huhtamaki Group are expected to dominate, leveraging their extensive product portfolios and strong market presence. These players are focusing on enhancing product offerings with environmentally friendly and recyclable materials in response to the growing trend of sustainability in packaging.

Sonoco Products Company, known for its innovation and strong customer relationships, continues to make strides in product development, ensuring that its rigid thermoform packaging solutions meet the latest market demands for sustainability and functionality. Similarly, Amcor plc has been at the forefront of developing high-quality, eco-friendly packaging solutions, and its ongoing investments in advanced technologies for packaging efficiency position it as a leader in the market.

Huhtamaki Group, a prominent player in the food packaging segment, continues to enhance its rigid thermoform offerings to cater to the increasing demand for food safety, convenience, and environmental friendliness. Companies like Sealed Air, Pactiv Evergreen Inc., and WINPAK LTD. are focusing on technological innovation and sustainability to increase market share.

Smaller yet significant players such as Sabert Corporation, Placon, and Genpak LLC are expected to capitalize on niche markets, offering tailored, cost-effective thermoformed plastic packaging solutions. As competition intensifies, these companies will likely focus on differentiation through innovation, eco-friendly materials, and operational efficiency to maintain a competitive edge in the market.

Top Key Players in the Market

- Sonoco Products Company

- EasyPak.

- Amcor plc

- Constantia Flexibles

- Huhtamaki Group

- Sealed Air

- Pactiv Evergreen Inc.

- D&W Fine Pack LLC

- WINPAK LTD.

- Display Pack.

- Sabert Corporation

- Genpak LLC

- Anchor Packaging LLC

- Placon.

Recent Developments

- In January 2025, the U.S. Department of Commerce announced $1.4 billion in final awards aimed at enhancing the next generation of U.S. semiconductor advanced packaging, supporting innovation and strengthening the domestic semiconductor supply chain.

- In November 2024, CHIPS for America introduced up to $300 million in funding to boost U.S. semiconductor packaging efforts, aiming to accelerate domestic production and improve packaging technologies for next-gen chips.

- In October 2024, ORBIS Corporation expanded its custom packaging capabilities by acquiring Creative Techniques, enhancing its product offerings and advancing its position in the advanced packaging industry.

- In November 2024, Amcor completed an $8.4 billion acquisition of Berry Global, reshaping the packaging industry landscape by combining their expertise to offer innovative and sustainable packaging solutions.

Report Scope

Report Features Description Market Value (2024) USD 12.7 Billion Forecast Revenue (2034) USD 19.3 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polyethylene Terephthalate, Polystyrene, Polypropylene, Polyethylene, Polyvinyl Chloride, Others), By Product (Containers, Blister Pack, Clamshells, Trays & Lids, Others), By Application (Electronics, Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Homecare, Others) Competitive Landscape Sonoco Products Company, EasyPak., Amcor plc, Constantia Flexibles, Huhtamaki Group, Sealed Air, Pactiv Evergreen Inc., D&W Fine Pack LLC, WINPAK LTD., Display Pack., Sabert Corporation, Genpak LLC, Anchor Packaging LLC, Placon. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  U.S. Rigid Thermoform Plastic Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

U.S. Rigid Thermoform Plastic Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sonoco Products Company

- EasyPak.

- Amcor plc

- Constantia Flexibles

- Huhtamaki Group

- Sealed Air

- Pactiv Evergreen Inc.

- D&W Fine Pack LLC

- WINPAK LTD.

- Display Pack.

- Sabert Corporation

- Genpak LLC

- Anchor Packaging LLC

- Placon.