US Medical Imaging Market By Modality (X-rays, Ultrasound, Nuclear medicine scans, MRI scans, Mammography, and CT scans), By End-use (Hospitals, Diagnostic Imaging Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148458

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

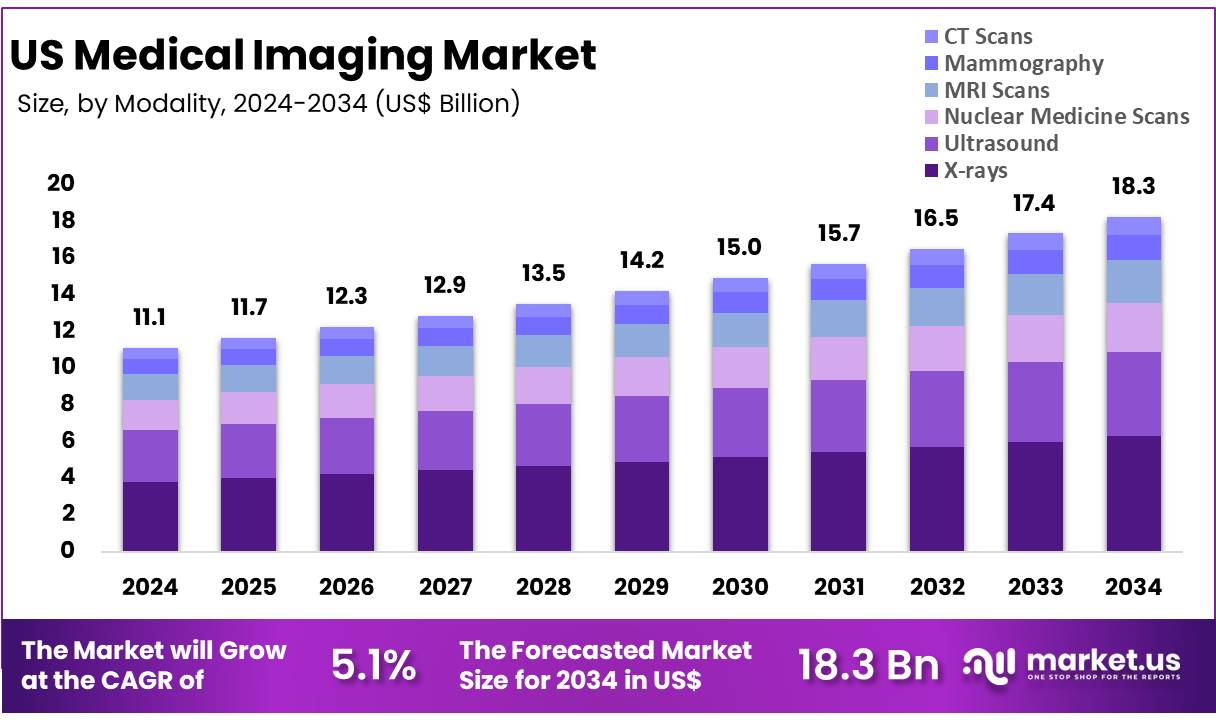

The US Medical Imaging Market size is expected to be worth around US$ 18.3 Billion by 2034 from US$ 11.1 Billion in 2024, growing at a CAGR of 5.1% during the forecast period 2025 to 2034.

Growing demand for early disease detection and minimally invasive procedures is driving the expansion of the US medical imaging market. Medical imaging plays a critical role in diagnosing and monitoring a wide range of conditions, from cancer and cardiovascular diseases to musculoskeletal disorders and neurological conditions. The increasing adoption of advanced imaging technologies, such as MRI, CT scans, ultrasound, and X-rays, enables healthcare providers to deliver more accurate and timely diagnoses, improving patient outcomes.

Rising healthcare expenditures and a growing focus on personalized medicine create significant opportunities for market growth. In October 2024, a partnership was formed between IKS Health and Radiology Partners to improve radiology services through IKS Health’s AI-driven Care Enablement Platform. This collaboration aims to streamline workflow, reduce administrative burdens, and enhance access to imaging services, allowing over 3,900 radiologists to focus more on patient care.

Additionally, the integration of artificial intelligence and machine learning in medical imaging systems is enhancing the accuracy and speed of diagnoses, further driving the market’s expansion. Increasing healthcare accessibility and the shift toward outpatient imaging centers also contribute to the market’s growth.

As the need for non-invasive diagnostic methods continues to rise, the medical imaging market will increasingly play a central role in both routine care and specialized treatments. Moreover, the ongoing development of portable and point-of-care imaging devices offers opportunities for expanding imaging applications in diverse healthcare settings.

Key Takeaways

- In 2024, the market for US medical imaging generated a revenue of US$ 11.1 billion, with a CAGR of 5.1%, and is expected to reach US$ 18.3 billion by the year 2033.

- The modality segment is divided into X-rays, ultrasound, nuclear medicine scans, MRI scans, mammography, and CT scans, with X-rays taking the lead in 2024 with a market share of 34.5%.

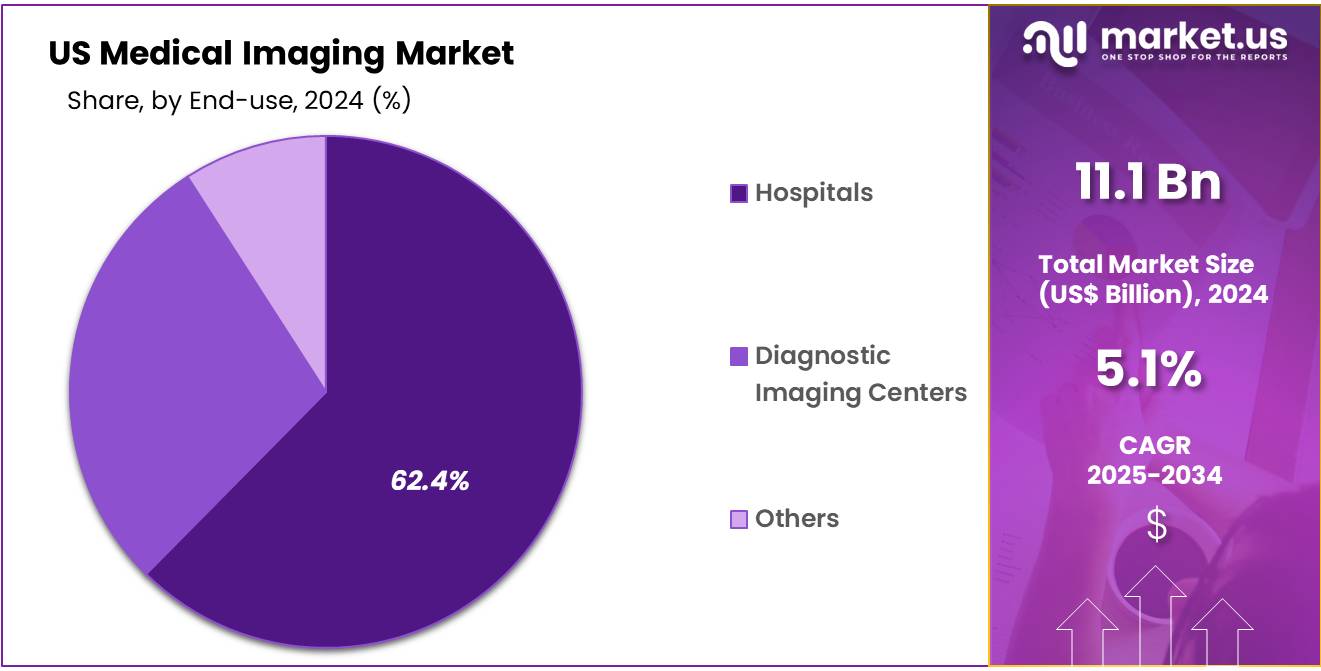

- Considering end-use, the market is divided into hospitals, diagnostic imaging centers, and others. Among these, hospitals held a significant share of 62.4%.

Modality Analysis

The X-rays segment led in 2023, claiming a market share of 34.5% owing to the continued advancement in X-ray technologies, such as digital X-rays and fluoroscopy. The increasing prevalence of chronic diseases, including cardiovascular conditions and cancers, is anticipated to drive the demand for X-ray imaging as a primary diagnostic tool.

Additionally, the ongoing efforts to improve healthcare accessibility and affordability are projected to boost the adoption of X-ray systems in both urban and rural healthcare settings. The rise in outpatient care and emergency services is also likely to contribute to the growth of this segment, as X-ray technology is widely used in diagnostic imaging for quick and efficient results. Furthermore, advancements in portable X-ray devices and enhanced imaging quality are expected to further accelerate market growth.

End-use Analysis

The hospitals held a significant share of 62.4% as hospitals increasingly invest in advanced imaging technologies to improve diagnostic accuracy and patient outcomes. The demand for sophisticated imaging systems, including MRI, CT scans, and X-rays, is expected to rise as hospitals adopt more integrated healthcare solutions to address a growing patient population and complex medical conditions. The shift toward outpatient procedures and non-invasive diagnostic methods is likely to contribute to the expansion of imaging services within hospitals.

Additionally, the rising focus on preventive healthcare and early detection is anticipated to drive hospitals to enhance their medical imaging capabilities. The increasing adoption of artificial intelligence (AI) in medical imaging is also projected to support the growth of this segment by enabling faster and more accurate diagnoses in hospital settings.

Key Market Segments

By Modality

- X-rays

- Ultrasound

- Nuclear medicine scans

- MRI scans

- Mammography

- CT scans

By End-use

- Hospitals

- Diagnostic imaging centers

- Others

Drivers

The aging US population and rising prevalence of chronic diseases is driving the market

The aging US population and rising prevalence of chronic diseases is driving the US medical imaging market. As the number of individuals aged 65 and older increases, so does the incidence of age-related conditions like cardiovascular disease, cancer, and neurological disorders, all of which require medical imaging for diagnosis, staging, and monitoring.

Medical imaging techniques such as MRI, CT, PET, and X-ray play a crucial role in the detection and management of these prevalent health issues. The demand for imaging procedures naturally grows as the population requiring these diagnostic tools expands.

According to America’s Health Rankings, over 59 million adults aged 65 and older lived in the US in 2023, representing nearly 18% of the nation’s population, a demographic trend directly increasing the need for diagnostic services including imaging.

Restraints

The high cost of imaging equipment and reimbursement challenges is restraining the market

The high cost of imaging equipment and reimbursement challenges is restraining the US medical imaging market. Advanced medical imaging systems like MRI and CT scanners represent significant capital investments for hospitals and imaging centers. The substantial upfront cost, coupled with ongoing maintenance and operational expenses, can be a barrier to acquiring the latest technology, particularly for smaller facilities.

Furthermore, changes and reductions in reimbursement rates from payers, including government programs like Medicare and Medicaid, directly impact the profitability of imaging procedures and can influence investment decisions in new equipment.

The American Hospital Association reported that from 2022 to 2024, general inflation rose by 14.1%, while Medicare inpatient payment rates increased by only 5.1%, highlighting financial pressures on hospitals that can constrain capital spending on expensive imaging systems.

Opportunities

Technological advancements and integration of AI is creating growth opportunities

Technological advancements and integration of AI is creating growth opportunities in the US medical imaging market. Continuous innovation in imaging technology leads to improved image quality, faster scan times, reduced radiation dose, and enhanced patient comfort. The integration of artificial intelligence (AI) into imaging workflows offers opportunities for automated image analysis, improved detection of abnormalities, streamlined reporting, and optimized scheduling, increasing efficiency and potentially improving diagnostic accuracy.

These technological advancements make imaging more powerful and versatile, expanding its applications and utility in various clinical settings. The FDA actively reviews and approves new medical devices, including those incorporating AI; by December 2023, nearly 700 AI and machine learning-enabled medical devices had received marketing authorization via various pathways.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors impact the US medical imaging market. Economic downturns can lead to reduced healthcare spending as individuals may postpone elective procedures and hospitals might delay capital investments in new imaging equipment due to budget constraints. Inflation increases the cost of manufacturing medical imaging systems, including components and raw materials, potentially leading to higher purchase prices for healthcare providers.

Geopolitical instability can disrupt global supply chains for electronic components, rare earth elements used in MRI magnets, and other specialized parts, causing production delays and increased costs for manufacturers. Despite these negative impacts, government initiatives aimed at strengthening domestic supply chains for medical devices and enhancing healthcare infrastructure can provide a positive impetus, fostering investment and resilience in the US medical imaging sector.

Current US tariff policies also impact the US medical imaging market. Tariffs on imported medical imaging equipment, such as CT, MRI, and X-ray machines from various countries, or on key electronic components and specialized materials used in their manufacture, can increase the cost of these systems for US hospitals and clinics. This directly impacts healthcare providers’ capital budgets, potentially slowing down the rate of equipment upgrades and adoption of advanced imaging technologies.

For instance, reports indicate that import tariffs on Class I & II diagnostic equipment have averaged 15–25%. Conversely, these tariff policies could encourage domestic manufacturing of medical imaging equipment and components, fostering job growth and potentially enhancing the security and reliability of the US supply chain for these critical healthcare technologies over the long term.

Latest Trends

The shift towards value-based care and teleradiology is a recent development in the market

The shift towards value-based care and increased adoption of teleradiology is a recent development in the US medical imaging market. Healthcare providers are increasingly focusing on delivering high-quality care efficiently and at a lower cost, a core principle of value-based care models. This drives efforts to optimize the use of imaging resources, avoid unnecessary scans, and improve the appropriateness of imaging orders.

Concurrently, the adoption of teleradiology allows remote interpretation of images by radiologists, improving turnaround times, expanding access to subspecialty expertise, and enhancing workflow flexibility for healthcare facilities across different locations. The Centers for Medicare & Medicaid Services (CMS) aims for 100% of Medicare beneficiaries to participate in accountable-care relationships by 2030, reflecting a broader push towards value-based models that influence imaging utilization and practices.

Market Key Players

Key players in the US medical imaging market pursue growth through strategic investments in advanced technologies, geographic expansion, and strategic partnerships. They focus on developing portable and AI-enhanced imaging solutions to meet the increasing demand for efficient diagnostics. Companies also emphasize expanding their service offerings and enhancing customer experience to stay competitive.

Geographical expansion, particularly in emerging markets, allows these players to tap into new opportunities and broaden their customer base. Additionally, collaborations with academic institutions and biotechnology firms facilitate access to cutting-edge research and development capabilities.

GE HealthCare is a prominent player in the US medical imaging market, offering a wide range of imaging solutions, including MRI, CT, ultrasound, and molecular imaging systems. The company focuses on integrating AI and cloud-based technologies into its products to enhance diagnostic accuracy and workflow efficiency.

GE HealthCare has a significant presence in the US, with a substantial portion of its revenue generated from the domestic market. The company continues to invest in research and development to drive innovation and maintain its leadership position in the industry.

Top Key Players

- Rayus Radiology

- Radnet, Inc

- Novant Health

- Medica Group

- Inhealth Group

- Ezra

- Dignity Health

- Alliance Medical

Recent Developments

- In July 2024, Rayus Radiology collaborated with Ezra, an AI technology startup, to introduce comprehensive whole-body MRI services in Seattle. This effort aims to facilitate the early detection of cancers and more than 500 other health conditions affecting 13 organs, addressing the increasing demand for thorough health monitoring.

- In February 2023, Radnet, Inc. launched an improved program for identifying breast cancer in the states of New Jersey and New York. This network of imaging services will provide patients with a more advanced screening mammography service aimed at detecting cancer.

Report Scope

Report Features Description Market Value (2024) US$ 11.1 billion Forecast Revenue (2034) US$ 18.3 billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Modality (X-rays, Ultrasound, Nuclear medicine scans, MRI scans, Mammography, and CT scans), By End-use (Hospitals, Diagnostic Imaging Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Rayus Radiology, Radnet, Inc, Novant Health, Medica Group, Inhealth Group, Ezra, Dignity Health, Alliance Medical. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rayus Radiology

- Radnet, Inc

- Novant Health

- Medica Group

- Inhealth Group

- Ezra

- Dignity Health

- Alliance Medical