Global Spinal Imaging Market By Product Type (X-ray, Ultrasound, MRI, and CT), By Application (Vertebral Fractures, Spinal Infection, Spinal Cancer, and Spinal Cord & Nerve Compressions), By End-use (Hospital, Diagnostic Imaging Centers, and Ambulatory Care Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140545

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

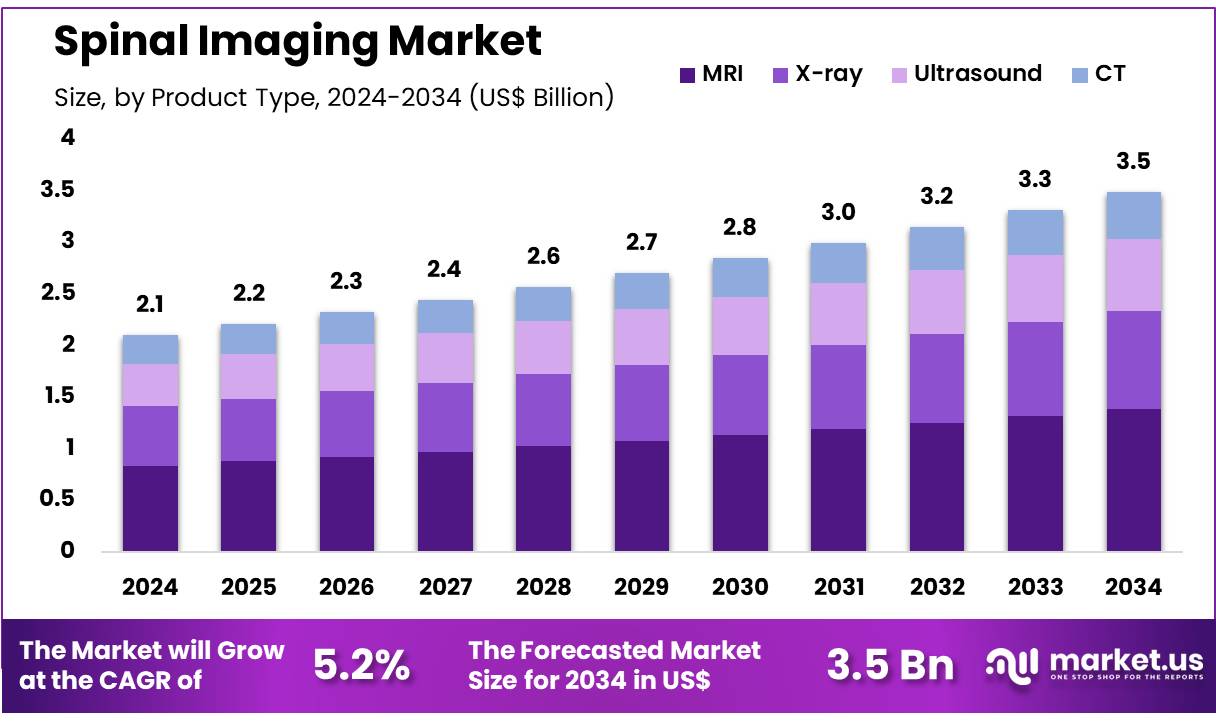

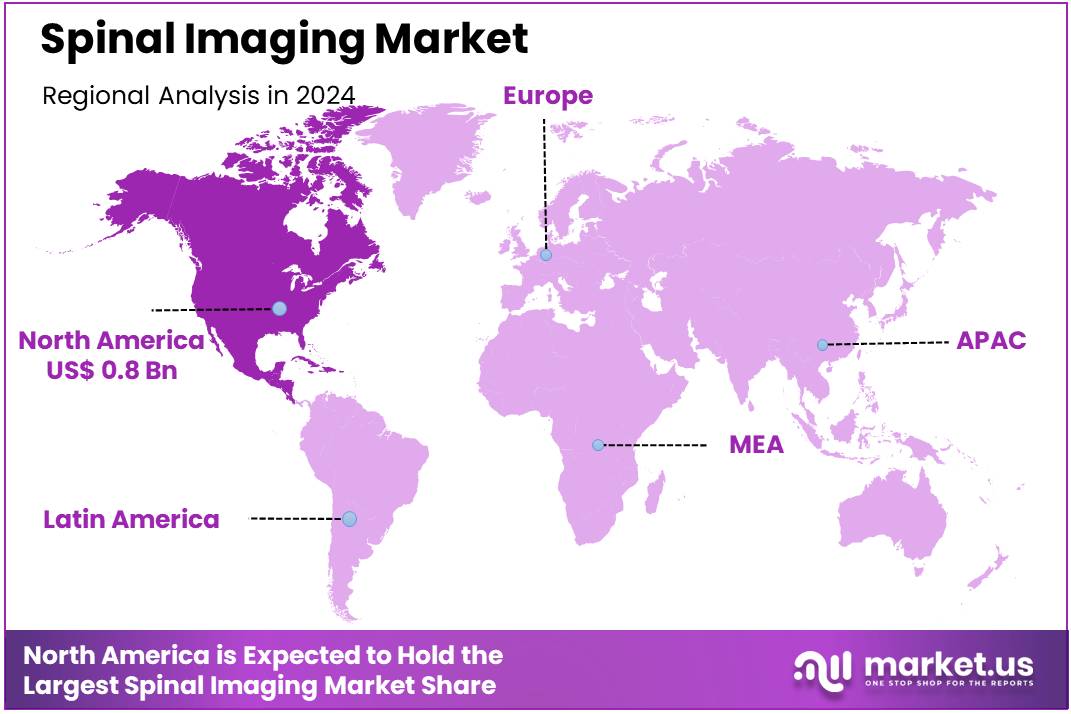

Global Spinal Imaging Market size is expected to be worth around US$ 3.5 billion by 2034 from US$ 2.1 billion in 2024, growing at a CAGR of 5.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 0.8 Billion.

Growing demand for advanced diagnostic tools in orthopedics and neurology is driving the expansion of the spinal imaging market. Spinal imaging technologies, such as magnetic resonance imaging (MRI), computed tomography (CT), and X-rays, are essential in diagnosing and monitoring a wide range of spinal disorders, including herniated discs, spinal stenosis, and degenerative diseases.

As the global population ages and the prevalence of spinal conditions increases, the need for accurate and efficient imaging solutions continues to rise. In January 2022, the FDA granted approval for expanded MRI compatibility of Abbott’s Proclaim XR Spinal Cord Stimulation (SCS) System with Octrode Leads, enhancing its usability for advanced imaging.

This approval highlights the ongoing trend of integrating spinal imaging with other therapeutic technologies to improve patient outcomes. Recent trends also show an increasing focus on non-invasive spinal imaging techniques, as well as advancements in 3D imaging and computer-aided design (CAD) that provide detailed and accurate representations of the spine.

Additionally, the rise in minimally invasive spine surgeries is driving demand for real-time, high-resolution imaging systems that guide surgical interventions. The growing adoption of hybrid imaging systems and AI-assisted diagnostics presents significant opportunities for innovation and market growth. As technological advancements continue to evolve, the spinal imaging market is poised for continued expansion, offering enhanced solutions for spinal health management.

Key Takeaways

- In 2023, the market for Spinal Imaging generated a revenue of US$ 2.1 billion, with a CAGR of 5.2%, and is expected to reach US$ 3.5 billion by the year 2033.

- The product type segment is divided into X-ray, ultrasound, MRI, and CT, with MRI taking the lead in 2023 with a market share of 39.7%.

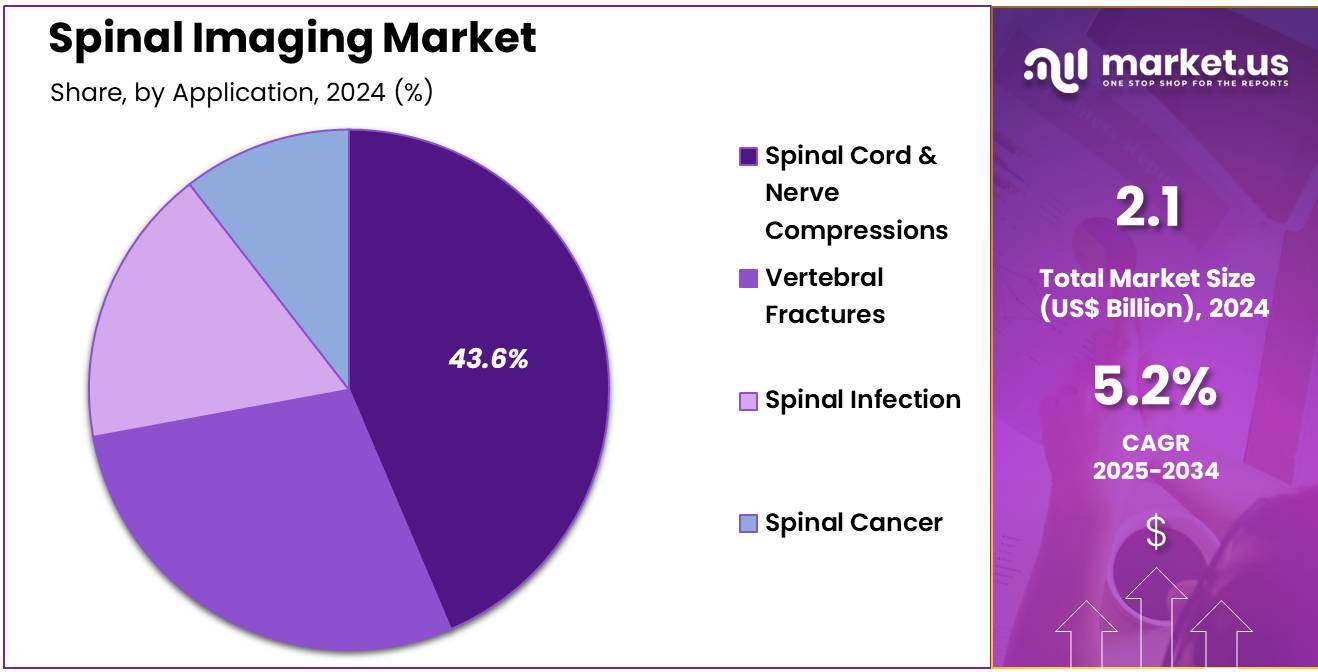

- Considering application, the market is divided into vertebral fractures, spinal infection, spinal cancer, and spinal cord & nerve compressions. Among these, spinal cord & nerve compressions held a significant share of 43.6%.

- Furthermore, concerning the end-use segment, the market is segregated into hospital, diagnostic imaging centers, and ambulatory care centers. The hospital sector stands out as the dominant player, holding the largest revenue share of 56.3% in the Spinal Imaging market.

- North America led the market by securing a market share of 39.6% in 2024.

Product Type Analysis

The MRI segment led in 2023, claiming a market share of 39.7% owing to its superior ability to provide detailed, non-invasive images of soft tissues such as spinal discs, nerves, and the spinal cord. MRI technology allows for more precise detection of spinal disorders, including herniated discs, nerve damage, and other conditions affecting the spinal cord.

The segment’s growth is anticipated to be driven by advancements in MRI technology, such as higher-resolution imaging, improved contrast agents, and more patient-friendly systems. Additionally, the rising prevalence of spinal diseases, such as degenerative disc diseases and spinal cord injuries, is likely to increase the demand for MRI-based spinal imaging.

Application Analysis

The spinal cord & nerve compressions held a significant share of 43.6% due to the increasing incidence of spinal cord injuries and nerve compression disorders. These conditions often require precise imaging to diagnose the severity of nerve involvement, as well as to plan appropriate treatments or surgical interventions.

The segment’s growth is expected to be fueled by a growing geriatric population, increased sports-related injuries, and rising awareness of spine health. As healthcare providers emphasize early diagnosis and treatment of spinal cord and nerve compression issues, the demand for advanced imaging technologies like MRI and CT scans is likely to continue rising.

End-Use Analysis

The hospital segment had a tremendous growth rate, with a revenue share of 56.3% as hospitals remain the primary providers of advanced diagnostic services. Hospitals offer a wide range of diagnostic imaging modalities, including MRI, CT, and X-ray, all crucial for evaluating spinal conditions such as fractures, infections, and degenerative diseases.

The growth of this segment is expected to be driven by the increasing healthcare investments, the expansion of hospital infrastructures, and the rising demand for non-invasive diagnostic tools. Furthermore, the prevalence of chronic back pain, spinal injuries, and age-related spinal conditions is anticipated to further fuel the demand for spinal imaging services in hospitals, making them key end-users of these technologies.

Key Market Segments

Product Type

- X-ray

- Ultrasound

- MRI

- CT

Application

- Vertebral Fractures

- Spinal Infection

- Spinal Cancer

- Spinal Cord & Nerve Compressions

End-use

- Hospital

- Diagnostic Imaging Centers

- Ambulatory Care Centers

Drivers

Growing Prevalence of Spinal Cord Injuries Driving the Spinal Imaging Market

Growing prevalence of spinal cord injuries is anticipated to drive the spinal imaging market significantly. In 2021, an article by the National Center for Biotechnology Information reported that approximately 17,000 individuals in the United States sustain spinal cord injuries annually. These injuries often require precise diagnostic imaging to assess the extent of damage and guide treatment strategies.

Advanced imaging modalities, such as MRI and CT scans, offer detailed views of spinal structures, enabling accurate diagnosis and monitoring. Rising awareness about the benefits of early detection drives the demand for advanced spinal imaging technologies. Healthcare providers increasingly adopt these tools to enhance patient outcomes and reduce the risk of complications. Technological advancements, such as 3D imaging and AI-assisted diagnostics, improve the precision and efficiency of spinal assessments.

Expanding healthcare infrastructure in emerging economies supports the adoption of cutting-edge imaging systems. Collaborations between research institutions and imaging technology providers foster innovation in spinal imaging solutions. These trends emphasize the vital role of advanced imaging in managing spinal cord injuries effectively.

Restraints

High Costs Are Restraining the Spinal Imaging Market

High costs associated with spinal imaging technologies are restraining the market. Advanced imaging modalities, such as MRI and CT systems, involve significant upfront investments, making them inaccessible to smaller healthcare facilities. Maintenance and operational expenses further increase the financial burden on healthcare providers. Limited reimbursement policies for imaging procedures discourage the adoption of high-cost equipment, especially in low-income regions.

Patients in underfunded healthcare systems often face out-of-pocket expenses for spinal imaging, reducing accessibility. Training requirements for operating advanced imaging devices add to the operational costs for hospitals and clinics. Inconsistent availability of skilled professionals in rural areas further limits the use of advanced spinal imaging technologies. Addressing these challenges requires the development of cost-efficient systems and supportive reimbursement frameworks to enhance affordability and accessibility.

Opportunities

Increasing R&D Activities as an Opportunity for the Spinal Imaging Market

Increasing R&D activities are projected to create significant opportunities for the spinal imaging market. In January 2022, the University of British Columbia initiated a US$ 24 million project aimed at advancing treatments for spinal cord injuries. This funding supports the development of innovative imaging technologies that enhance diagnostic accuracy and therapeutic planning. Researchers focus on integrating AI and machine learning into imaging platforms to enable real-time analysis and improved diagnostic capabilities.

Advancements in portable and compact imaging systems cater to point-of-care applications, expanding market reach. Collaboration between academic institutions and imaging manufacturers accelerates the introduction of novel technologies tailored to spinal assessments. Expanding global investments in healthcare research foster the adoption of cutting-edge imaging modalities. Government initiatives and funding for spinal injury research further drive innovation in this sector. These developments highlight the transformative potential of R&D activities in advancing the spinal imaging market and improving patient care.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the spinal imaging market in several ways. On the positive side, increasing investments in healthcare infrastructure, particularly in developed regions, drive the demand for advanced imaging technologies, including those used for spinal diagnostics. The aging population and rising incidences of spinal disorders, such as osteoporosis and degenerative diseases, contribute to market growth.

However, economic downturns or healthcare budget cuts may limit the availability of advanced imaging systems, especially in developing countries. Geopolitical factors such as trade restrictions, regulatory differences, and political instability can disrupt supply chains, causing delays in product availability and increasing costs.

Furthermore, fluctuating tariffs and changing healthcare policies across regions may affect the affordability and accessibility of spinal imaging technologies. Despite these challenges, the continuous advancements in imaging technologies, such as AI integration for faster and more accurate diagnostics, ensure a positive long-term outlook for the market.

Latest Trends

Surge in Partnerships and Collaborations Driving the Spinal Imaging Market:

Rising partnerships and collaborations are playing a key role in driving the spinal imaging market. High levels of cooperation between imaging technology providers, research institutions, and healthcare organizations are expected to foster innovation, enhance product offerings, and improve the accessibility of advanced spinal imaging solutions. These collaborations help integrate new technologies like AI and machine learning into imaging devices, improving the speed, accuracy, and efficiency of spinal diagnostics.

Increasing demand for more accurate, non-invasive diagnostic tools for spinal conditions is likely to stimulate further growth. In July 2022, Calyx partnered with Qynapse to broaden the application of AI-driven neuroimaging tools in clinical trials targeting treatments for central nervous system (CNS) disorders, including brain and spinal cord conditions. As partnerships continue to rise, the market is expected to benefit from enhanced technological development and greater accessibility, fueling the expansion of spinal imaging solutions.

Regional Analysis

North America is leading the Spinal Imaging Market

North America dominated the market with the highest revenue share of 39.6% owing to advancements in diagnostic technologies and the increasing prevalence of spine-related health issues. According to an NCBI report, the U.S. has over 2 million intravenous drug users, many of whom are at risk for spinal infections. MRI, as the preferred imaging technique for diagnosing these conditions, witnessed heightened demand due to its unparalleled accuracy and ability to identify infections and structural abnormalities.

The growing aging population also contributed to market growth, with higher incidences of degenerative spinal disorders like herniated discs and spinal stenosis. Expanding access to advanced healthcare services and the presence of state-of-the-art medical facilities in the U.S. and Canada supported market growth. Increased awareness about early diagnosis and treatment for spinal conditions among healthcare providers and patients further fueled adoption.

Collaborations between medical device manufacturers and hospitals enhanced the integration of new imaging systems. Technological advancements, including higher-resolution imaging and AI-assisted diagnostic tools, drove the development of innovative spinal imaging solutions. Substantial healthcare expenditure and insurance coverage for diagnostic procedures further strengthened market expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising healthcare investments and increasing incidences of spinal disorders. The aging population in countries like Japan and China is anticipated to elevate demand for advanced diagnostic tools as age-related spinal conditions become more prevalent. Expanding healthcare infrastructure across emerging economies is likely to enhance accessibility to imaging technologies.

Government initiatives promoting advanced medical equipment adoption and improving patient outcomes are expected to support market growth. Increasing medical tourism in the region, particularly for affordable diagnostic and treatment services, is likely to attract more patients. Collaborations between global imaging technology companies and local distributors are projected to boost product availability. Rising awareness about non-invasive diagnostic methods among patients and healthcare professionals is anticipated to further stimulate adoption.

Advances in imaging modalities, such as AI-powered MRI and 3D imaging systems, are expected to enhance diagnostic precision and efficiency. The growing focus on research and development within the region is likely to result in the introduction of innovative and cost-effective solutions, supporting strong market growth in Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the spinal imaging market focus on advancing diagnostic technologies like high-resolution MRI and CT systems to improve the accuracy of detecting spinal disorders. Companies invest in R&D to enhance imaging speed, reduce radiation exposure, and integrate artificial intelligence for better diagnostic insights.

Strategic collaborations with hospitals and research centers help expand the clinical utility of advanced imaging systems. Geographic expansion into regions with rising healthcare investments strengthens market reach. Many players also emphasize providing cost-effective solutions to increase adoption in emerging markets.

GE Healthcare is a leading company in this market, offering cutting-edge imaging solutions such as advanced MRI systems tailored for spinal diagnostics. The company focuses on innovation by integrating AI-driven tools and enhancing image clarity to improve clinical outcomes. GE Healthcare’s strong global presence and commitment to advancing diagnostic technologies make it a key player in the spinal imaging industry.

Top Key Players

- Siemens Healthineers AG

- Shimadzu Corporation

- Mediso Ltd.

- Koninklijke Philips N.V.

- GE HealthCare

- Canon Medical Systems Corporation

- Bruker

- Abbott

Recent Developments

- In March 2024, Siemens Healthineers debuted a cutting-edge self-driving C-arm system for surgical imaging. This advanced solution eliminates the need for manual configuration, significantly easing the workload of technologists during procedures.

- In March 2023, Philips introduced a comprehensive suite of integrated radiology workflow tools and smart imaging systems. These interoperable solutions connect radiology, oncology, pathology, and cardiology teams, aiming to enhance diagnostic precision and streamline treatment planning for improved patient care.

- In January 2022, Abbott received FDA approval for expanded MRI compatibility for its Proclaim XR Spinal Cord Stimulation (SCS) System equipped with Octrode leads. This upgrade allows patients to benefit from improved MRI imaging with reduced scan times, enhancing diagnostic efficiency and patient care.

Report Scope

Report Features Description Market Value (2024) US$ 2.1 billion Forecast Revenue (2034) US$ 3.5 billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (X-ray, Ultrasound, MRI, and CT), By Application (Vertebral Fractures, Spinal Infection, Spinal Cancer, and Spinal Cord & Nerve Compressions), By End-use (Hospital, Diagnostic Imaging Centers, and Ambulatory Care Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens Healthineers AG, Shimadzu Corporation, Mediso Ltd., Koninklijke Philips N.V., GE HealthCare, Canon Medical Systems Corporation, Bruker, and Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Siemens Healthineers AG

- Shimadzu Corporation

- Mediso Ltd.

- Koninklijke Philips N.V.

- GE HealthCare

- Canon Medical Systems Corporation

- Bruker

- Abbott