Incretin Mimetics Market By Drug Type (Exenatide, Sitagliptin, Liraglutide, Saxagliptin, Alogliptin, and Others), By Route of Administration (Oral, Parenteral, and Others), By Application (Weight Management, Type 2 Diabetes Mellitus (T2DM), and Others), By Distribution Channel (Online Pharmacies, Hospital Pharmacies, and Retail Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132842

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

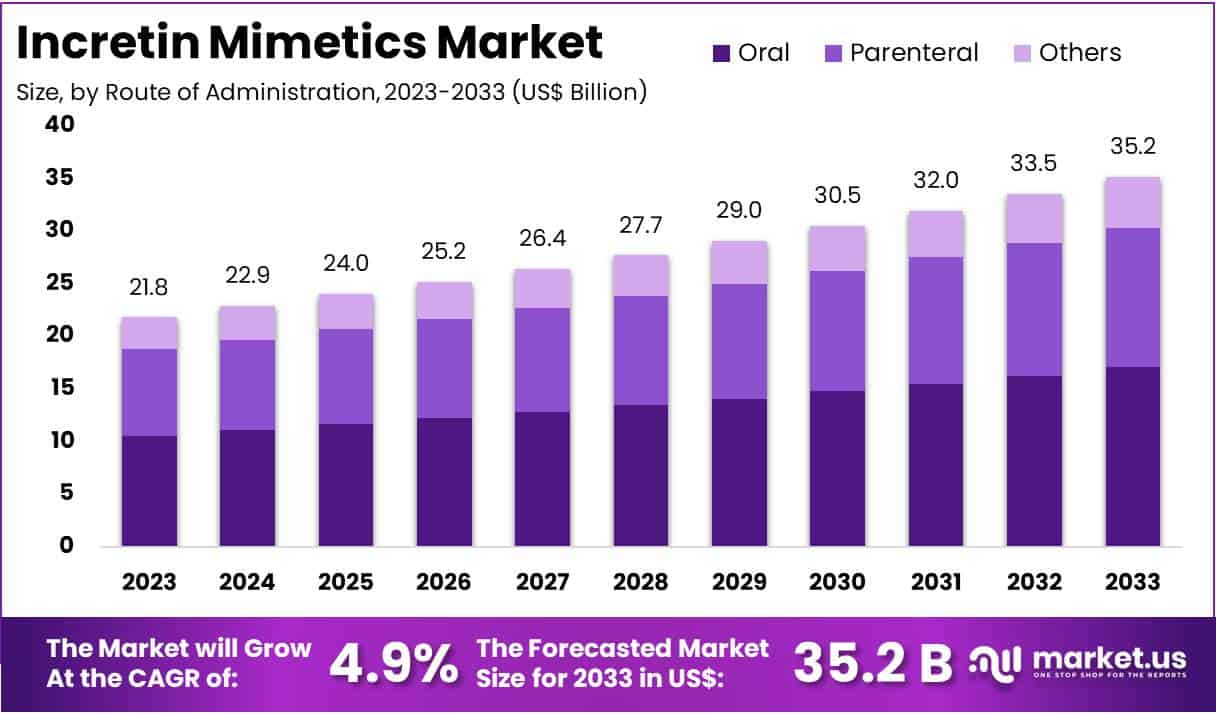

The Global Incretin Mimetics Market Size is expected to be worth around US$ 35.2 Billion by 2033, from US$ 21.8 Billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2024 to 2033.

Increasing prevalence of type 2 diabetes significantly drives the growth of the incretin mimetics market, as healthcare providers seek innovative treatments to manage this complex condition. Incretin mimetics, including GLP-1 receptor agonists, play a crucial role in improving glycemic control, promoting weight loss, and reducing cardiovascular risks in patients with type 2 diabetes.

According to the World Health Organization, over 420 million people worldwide suffer from diabetes, with a large percentage diagnosed with type 2 diabetes, highlighting the urgent need for effective therapies. AstraZeneca has intensified its focus on combination therapies, integrating GLP-1 agonists with SGLT-2 inhibitors.

In early 2023, the company launched additional trials to evaluate the dual benefits of these combinations in managing blood glucose levels and enhancing cardiovascular health. This approach exemplifies the industry’s shift toward comprehensive treatment strategies that address multiple facets of diabetes.

Recent trends in the market reveal an emphasis on patient-centric solutions, including once-weekly dosing and oral formulations, aimed at improving compliance and quality of life. Opportunities in the incretin mimetics market also emerge from expanding research into the role of these therapies in preventing diabetes-related complications, such as renal disease and neuropathy.

Key Takeaways

- In 2023, the market for incretin mimetics generated a revenue of US$ 21.8 billion, with a CAGR of 4.9%, and is expected to reach US$ 35.2 billion by the year 2033.

- The drug type segment is divided into exenatide, sitagliptin, liraglutide, saxagliptin, alogliptin, and others, with exenatide taking the lead in 2023 with a market share of 27.4%.

- Considering route of administration, the market is divided into oral, parenteral, and others. Among these, oral held a significant share of 48.5%.

- Furthermore, concerning the application segment, the type 2 diabetes mellitus sector stands out as the dominant player, holding the largest revenue share of 62.3% in the incretin mimetics market.

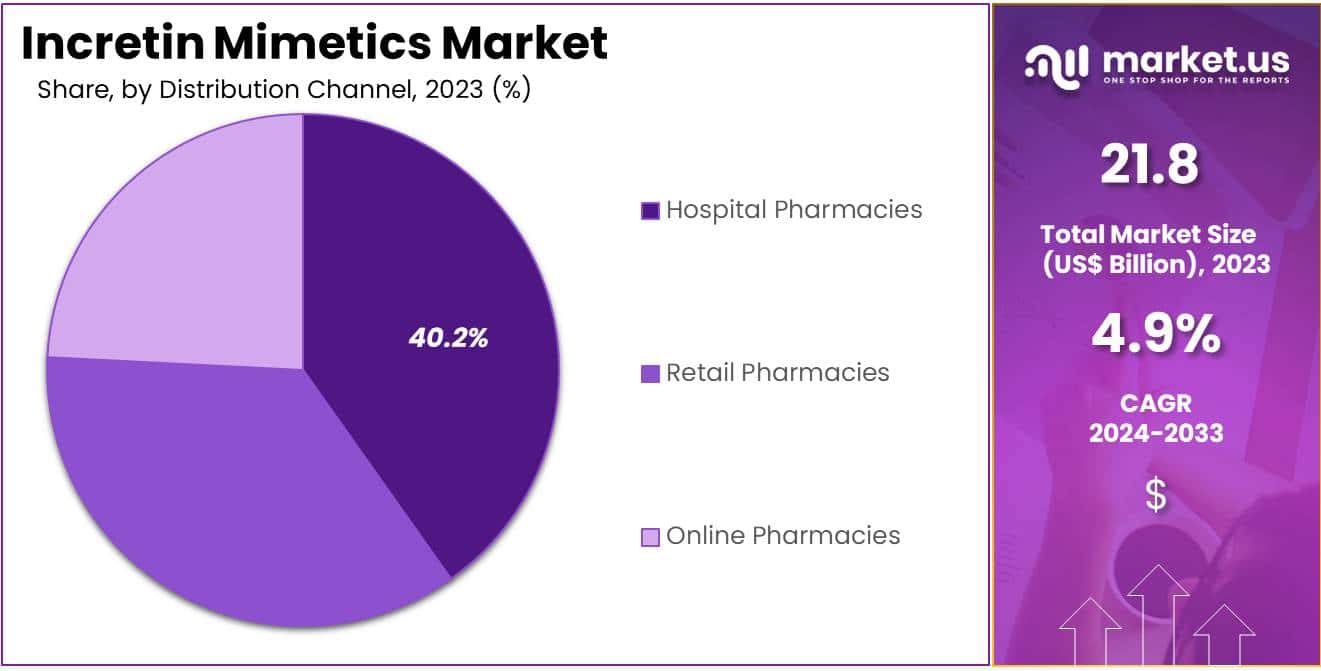

- The distribution channel segment is segregated into online pharmacies, hospital pharmacies, and retail pharmacies, with the hospital pharmacies segment leading the market, holding a revenue share of 40.2%.

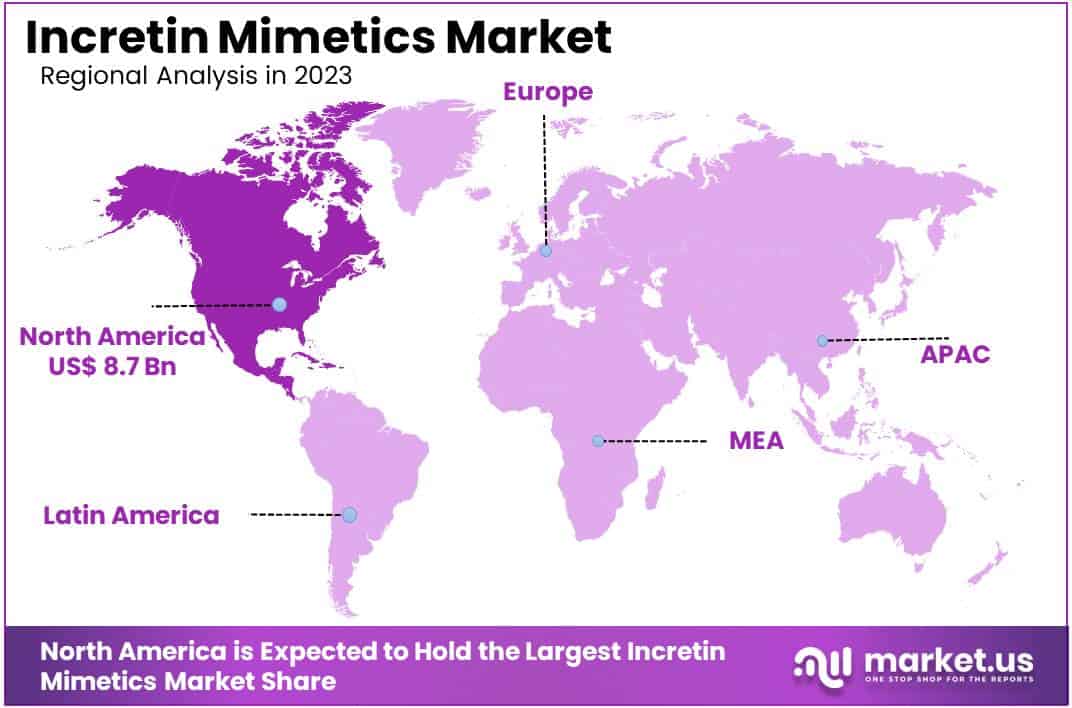

- North America led the market by securing a market share of 39.7% in 2023.

Drug Type Analysis

The exenatide segment led in 2023, claiming a market share of 27.4% owing to exenatide’s proven efficacy in managing blood glucose levels and its ability to promote weight loss in patients with type 2 diabetes mellitus (T2DM). Healthcare providers increasingly prescribe exenatide due to its dual benefits of glycemic control and cardiovascular risk reduction.

Moreover, advancements in drug delivery, including once-weekly formulations, enhance patient adherence, further boosting demand. The growing prevalence of T2DM globally also drives the need for effective treatment options, positioning exenatide as a preferred choice. Expanding clinical research highlighting exenatide’s long-term safety and efficacy further strengthens its market presence. As awareness of incretin-based therapies grows, the exenatide segment is anticipated to expand substantially.

Route of Administration Analysis

The oral held a significant share of 48.5% due to the convenience and improved patient compliance associated with oral formulations. The rising demand for non-invasive treatment options for managing T2DM propels the adoption of oral incretin mimetics. Technological advancements in drug formulation have enabled the development of effective oral delivery systems for peptides, traditionally administered via injection.

Additionally, increasing patient preference for oral medications due to reduced discomfort and ease of use supports the expansion of this segment. Pharmaceutical companies are investing heavily in research and development to enhance the bioavailability and efficacy of oral incretin therapies. As these innovations continue to gain traction, the oral segment is likely to play a pivotal role in the growth of the incretin mimetics market.

Application Analysis

The type 2 diabetes mellitus segment had a tremendous growth rate, with a revenue share of 62.3% owing to the escalating global prevalence of T2DM, attributed to factors such as sedentary lifestyles, unhealthy diets, and aging populations. Incretin mimetics offer effective glycemic control and address comorbidities commonly associated with T2DM, such as obesity and cardiovascular diseases.

The increasing adoption of these drugs in clinical practice stems from their ability to improve postprandial glucose levels and enhance insulin secretion without causing significant hypoglycemia. Additionally, growing awareness about the benefits of incretin-based therapies among healthcare professionals and patients boosts the segment’s growth. As healthcare systems worldwide prioritize managing the diabetes epidemic, the T2DM segment in the incretin mimetics market is projected to expand significantly.

Distribution Channel Analysis

The hospital pharmacies segment grew at a substantial rate, generating a revenue portion of 40.2% due to the increasing number of hospital visits for diabetes management, where specialists often prescribe incretin-based therapies. Hospital pharmacies ensure timely access to these medications, particularly for newly diagnosed or high-risk patients who require immediate and supervised treatment.

Additionally, hospitals provide comprehensive care, including routine monitoring and patient education, which promotes adherence to prescribed therapies. The expansion of healthcare infrastructure, especially in emerging economies, further supports the growth of hospital pharmacies. Regulatory initiatives aimed at improving access to advanced diabetes treatments also contribute to this trend. As the demand for specialized diabetes care continues to rise, hospital pharmacies are anticipated to play a critical role in the distribution of incretin mimetics.

Key Market Segments

By Drug Type

- Exenatide

- Sitagliptin

- Liraglutide

- Saxagliptin

- Alogliptin

- Others

By Route of Administration

- Oral

- Parenteral

- Others

By Application

- Weight Management

- Type 2 Diabetes Mellitus

- T2DM

- Others

By Distribution Channel

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Drivers

Growing Prevalence of Diabetes

The increasing global prevalence of diabetes drives significant growth in the incretin mimetics market as healthcare providers seek advanced therapies to manage this chronic condition. According to the International Diabetes Federation (IDF) Diabetes Atlas, over 537 million adults aged 20-79 lived with diabetes in 2021. This figure is anticipated to rise to 643 million by 2030 and further to 783 million by 2045, highlighting an urgent need for effective treatment options.

Incretin-based therapies, which enhance insulin secretion and suppress glucagon release, play a vital role in controlling blood glucose levels. As the diabetes burden escalates, patients and healthcare systems increasingly rely on incretin mimetics for improved glycemic control and reduced risk of complications. The shift towards innovative and patient-friendly treatments reinforces the demand for these therapies. This growing market reflects not only the rising prevalence of diabetes but also the need for more efficient and sustainable solutions to combat the disease.

Restraints

High Cost of Treatment

Rising treatment costs significantly impede the growth of the incretin mimetics market, particularly in low- and middle-income countries. These therapies, while effective, often come with high price tags that place a considerable financial burden on healthcare systems and patients. The need for long-term treatment further exacerbates the cost challenge, as patients with diabetes typically require sustained therapy to manage their condition.

Limited insurance coverage and out-of-pocket expenses also restrict access, creating disparities in treatment availability. In regions where healthcare budgets are constrained, the adoption of these advanced therapies faces additional hurdles. The high cost of manufacturing and the stringent regulatory requirements for approval contribute to the elevated pricing of incretin-based drugs.

Consequently, the financial barrier is projected to restrain market growth, despite the recognized benefits of these treatments. Addressing this challenge will require collaborative efforts to improve affordability and broaden access to life-saving therapies.

Opportunities

Rising Innovation and Product Launches

Increasing innovation and the launch of new products present a significant growth opportunity for the incretin mimetics market. Companies continuously invest in developing advanced formulations and delivery systems to enhance patient convenience and compliance. In April 2024, Novo Nordisk introduced a groundbreaking once-weekly formulation of its incretin mimetic, Victoza (liraglutide), marking a major advancement in diabetes care.

This innovative approach simplifies treatment regimens, improving adherence and offering better long-term outcomes for patients. The growing emphasis on research and development, coupled with a robust pipeline of incretin-based therapies, is anticipated to expand treatment options and improve efficacy.

Additionally, emerging technologies in drug delivery and formulation optimization provide a competitive edge in addressing unmet needs. These advancements highlight the market’s dynamic nature, fostering an environment where innovation drives substantial growth. As more products gain regulatory approval, the availability of next-generation therapies is likely to increase, reinforcing the market’s expansion trajectory.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a critical role in shaping the growth of the incretin mimetics market. Economic expansion in developed regions increases healthcare spending, driving the adoption of advanced diabetes management therapies. However, inflationary pressures and fluctuating currency exchange rates raise production costs, impacting pricing strategies and affordability, particularly in emerging markets.

Geopolitical tensions and trade disruptions complicate the global supply chain, delaying the distribution of key pharmaceutical products and raw materials. Additionally, stringent regulatory frameworks in developed regions require substantial investments in compliance and clinical trials, which could slow down product approvals.

Despite these challenges, growing awareness of diabetes management and supportive healthcare policies in developing regions create opportunities for market expansion. Companies continue to innovate and expand their product portfolios to meet the rising demand for effective treatment options.

Trends

Impact of Increasing Implementation of Biosimilars

Increasing implementation of biosimilars is anticipated to drive the growth of the incretin mimetics market. Biosimilars offer cost-effective alternatives to branded biologics, making advanced diabetes treatments more accessible, especially in price-sensitive regions. In January 2024, Glenmark Pharmaceuticals launched Lirafit, a biosimilar of the popular anti-diabetic drug Liraglutide, after receiving approval from the Drug Controller General of India (DCGI). This launch marked the first availability of a Liraglutide biosimilar in India, reflecting a growing trend of introducing affordable alternatives in emerging markets.

High demand for cost-efficient therapies and increasing regulatory support for biosimilar development encourage more pharmaceutical companies to invest in this space. Rising adoption of biosimilars not only broadens patient access but also fosters competition, which ultimately stimulates innovation and strengthens the overall market.

Regional Analysis

North America is leading the Incretin Mimetics Market

North America dominated the market with the highest revenue share of 39.7% owing to the rising prevalence of type 2 diabetes and increasing demand for advanced therapeutic options. The growing diabetic population in the region, coupled with greater awareness of effective glycemic control solutions, has spurred the adoption of these medications.

A key development in August 2023 was the launch of Saxagliptin and Metformin Hydrochloride Extended-Release Tablets by Dr. Reddy’s Laboratories Ltd., a generic version of KOMBIGLYZE XR approved by the U.S. Food and Drug Administration. This introduction has expanded access to cost-effective treatment options for patients managing type 2 diabetes.

Additionally, advancements in drug delivery technologies and supportive regulatory frameworks have further encouraged pharmaceutical companies to invest in the development of novel incretin-based therapies. The North American market’s growth is also attributed to increasing healthcare expenditures and widespread adoption of combination therapies that improve patient compliance and treatment outcomes.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rising incidence of type 2 diabetes and expanding healthcare infrastructure. Rapid urbanization and lifestyle changes in countries such as China, India, and Japan have contributed to an increasing diabetic population, boosting demand for innovative treatments.

Government initiatives aimed at improving diabetes management and early diagnosis are anticipated to further support market expansion. The growing focus on personalized medicine and advancements in drug formulation technologies are expected to enhance the efficacy and convenience of incretin-based therapies.

Additionally, increasing collaborations between international pharmaceutical companies and regional players are likely to accelerate the introduction of affordable and effective treatment options. As awareness about diabetes and its complications rises, the Asia Pacific region is estimated to witness strong growth in the adoption of these therapies, particularly in urban centers with higher healthcare access.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the incretin mimetics market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the incretin mimetics market focus on developing innovative formulations to enhance efficacy and patient compliance, such as extended-release options and combination therapies.

Companies invest heavily in clinical trials to expand the approved indications of their products, targeting broader patient populations. Strategic collaborations with research institutions and biotech firms enable access to advanced technologies, accelerating drug development. Businesses also prioritize market expansion in regions with rising diabetes prevalence and increasing healthcare access. Comprehensive marketing campaigns and physician education programs help raise awareness and drive adoption of these treatments.

Top Key Players in the Incretin Mimetics Market

- Takeda Pharmaceutical Company Limited

- Sanofi

- Novartis AG

- Johnson & Johnson

- Eli Lilly

- Boehringer Ingelheim GmbH

- Biocon Limited

- AstraZeneca

- Amgen Inc.

Recent Developments

- In November 2024: Eli Lilly announced positive trial results for tirzepatide (Mounjaro), which demonstrated substantial weight loss and improved glycemic control in patients with type 2 diabetes. The drug’s ability to reduce HbA1c levels and promote weight loss reinforces Eli Lilly’s competitive position in the incretin mimetics market, further driving its growth as demand for effective diabetes management solutions increases.

- In November 2022: Biocon Limited signed a semi-exclusive partnership agreement with Zentiva to commercialize Liraglutide, a complex formulation for treating type 2 diabetes and obesity. This collaboration supports market expansion by leveraging both companies’ strengths to deliver innovative incretin-based therapies to a broader audience in Europe.

- In July 2022: Sanofi reported promising clinical trial results for efpeglenatide, a once-weekly GLP-1 receptor agonist, demonstrating significant reductions in blood sugar and weight loss. Sanofi’s increased investment in this late-stage candidate underscores its commitment to advancing patient-friendly, non-injectable treatments, contributing to the growth of the incretin mimetics market.

- In July 2021: The U.S. FDA approved AstraZeneca’s BYDUREON BCise (exenatide extended-release) for pediatric patients aged 10 to 17 with type 2 diabetes. This expansion of the drug’s indication enhances AstraZeneca’s product offerings. It also supports the incretin mimetics market by meeting the previously unaddressed needs of a younger demographic.

Report Scope

Report Features Description Market Value (2023) US$ 21.8 billion Forecast Revenue (2033) US$ 35.2 billion CAGR (2024-2033) 4.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type (Exenatide, Sitagliptin, Liraglutide, Saxagliptin, Alogliptin, and Others), By Route of Administration (Oral, Parenteral, and Others), By Application (Weight Management, Type 2 Diabetes Mellitus (T2DM), and Others), By Distribution Channel (Online Pharmacies, Hospital Pharmacies, and Retail Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Takeda Pharmaceutical Company Limited, Sanofi, Novartis AG, Johnson & Johnson, Eli Lilly , Boehringer Ingelheim GmbH, Biocon Limited, AstraZeneca, and Amgen Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Takeda Pharmaceutical Company Limited

- Sanofi

- Novartis AG

- Johnson & Johnson

- Eli Lilly

- Boehringer Ingelheim GmbH

- Biocon Limited

- AstraZeneca

- Amgen Inc.