Chaple Syndrome Market By Product Type (Eculizumab, Ravulizumab, Veopoz), By Applications (Gastrointestinal Symptoms, Hypoalbuminemia, Edema, Hypogammaglobulinemia, and Malnutrition), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132055

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

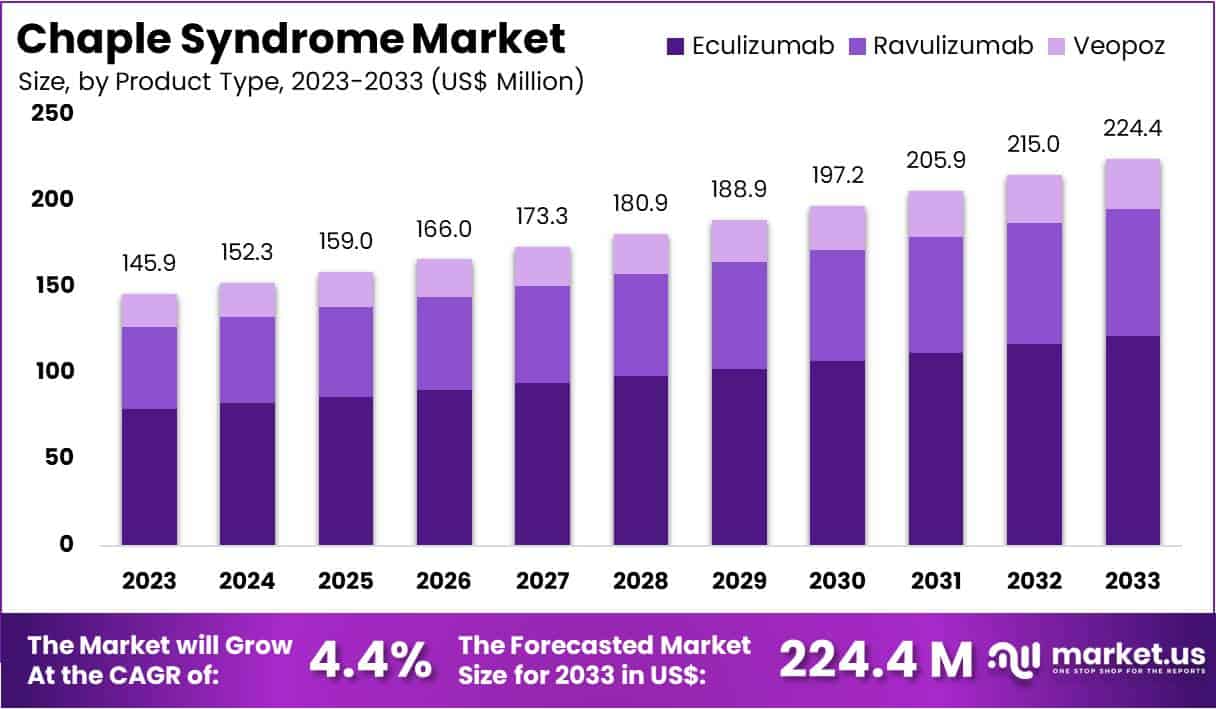

The Global Chaple Syndrome Market Size is expected to be worth around US$ 224.4 Million by 2033, from US$ 145.9 Million in 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

Rising awareness and recent medical advancements drive interest in the CHAPLE syndrome market, a rare and often life-threatening disease marked by immune dysfunction due to CD55 deficiency. Patients with CHAPLE syndrome frequently experience severe gastrointestinal symptoms, including abdominal pain and protein-losing enteropathy, which can lead to malnutrition and growth delays from early childhood.

This ultra-rare condition, with fewer than 100 documented cases globally, saw a major advancement in August 2023 when the FDA approved Veopoz (pozelimab-bbfg), a monoclonal antibody developed by Regeneron Pharmaceuticals. Veopoz offers the first targeted treatment for CHAPLE syndrome, marking a critical step toward improved patient care.

Regeneron’s collaboration with Orsini Specialty Pharmacy positions Orsini as the exclusive provider of Veopoz, enabling specialized support for patients navigating this complex treatment process. Such partnerships exemplify the increasing role of specialty pharmacies in rare disease management, ensuring that patients receive continuous, tailored care and guidance.

Opportunities in this market also arise from ongoing research into gene therapies and further targeted immune therapies, which may enhance future treatment options for CHAPLE and similar rare immune disorders. As innovations in rare disease treatments continue, the CHAPLE syndrome market is expected to benefit from increased collaboration and advancements in targeted therapies designed for precision care.

Key Takeaways

- In 2023, the market for chaple syndrome generated a revenue of US$ 145.9 Million, with a CAGR of 4.4%, and is expected to reach US$ 224.4 Million by the year 2033.

- The product type segment is divided into eculizumab, ravulizumab, veopoz, with eculizumab taking the lead in 2023 with a market share of 54.3%.

- Considering applications, the market is divided into gastrointestinal symptoms, hypoalbuminemia, edema, hypogammaglobulinemia, and malnutrition. Among these, hypoalbuminemia held a significant share of 38.4%.

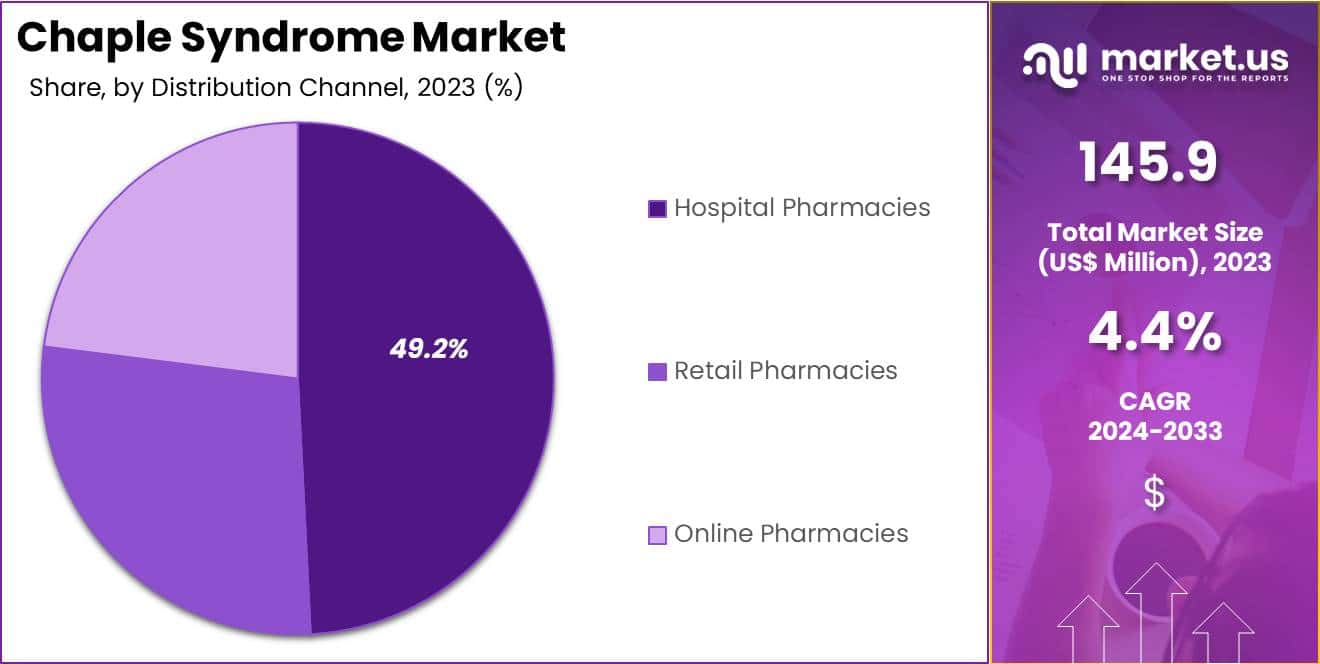

- Furthermore, concerning the distribution channel segment, the hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 49.2% in the chaple syndrome market.

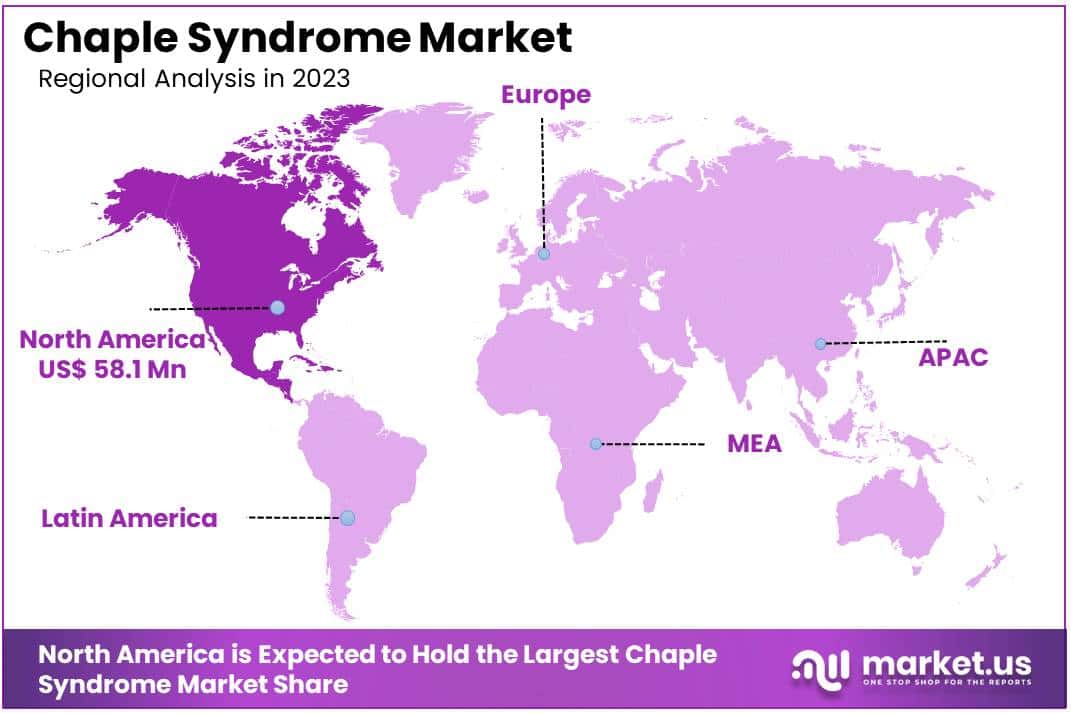

- North America led the market by securing a market share of 39.8% in 2023.

Product Type Analysis

The eculizumab segment led in 2023, claiming a market share of 54.3% owing to its efficacy as a treatment for this rare condition. As an FDA-approved complement inhibitor, eculizumab effectively targets the underlying immune dysfunction in CHAPLE syndrome, which makes it a critical option for patients.

Increasing recognition and diagnosis of CHAPLE syndrome, a rare genetic disorder, are likely to drive demand for proven therapies like eculizumab. Clinicians and healthcare providers prefer eculizumab for its ability to significantly improve patient quality of life, reducing symptoms and complications.

Additionally, ongoing clinical research supports the development of refined eculizumab formulations, enhancing its therapeutic potential. Government initiatives that support treatments for rare diseases further bolster the accessibility and growth of eculizumab in this market. These factors position the eculizumab segment for continued expansion, as it remains a cornerstone therapy for CHAPLE syndrome.

Applications Analysis

The hypoalbuminemia held a significant share of 38.4% due to its prevalence among patients with this condition. Hypoalbuminemia, characterized by low levels of albumin in the blood, is a common and serious complication in CHAPLE syndrome, necessitating focused therapeutic management. Increasing awareness and improved diagnostic techniques help identify hypoalbuminemia earlier, allowing for timely intervention and targeted treatment options.

Healthcare providers increasingly recognize hypoalbuminemia as a critical factor in CHAPLE syndrome management, driving demand for therapies that can effectively stabilize albumin levels. Pharmaceutical advancements in albumin supplements and supportive therapies also contribute to this segment’s growth.

Moreover, government and health organization support for rare diseases underscores the need for effective hypoalbuminemia treatment strategies, facilitating market expansion. This segment’s projected growth reflects a broader trend towards comprehensive management approaches in CHAPLE syndrome.

Distribution Channel Analysis

The hospital pharmacies segment had a tremendous growth rate, with a revenue share of 49.2% as hospital settings remain primary providers of specialized treatments for rare diseases. Hospital pharmacies are well-equipped to manage the complex therapeutic requirements of CHAPLE syndrome patients, including administering drugs like eculizumab.

The need for close monitoring and precise dosage adjustments in CHAPLE syndrome treatment supports the role of hospital pharmacies in delivering quality care. Increased hospital admissions related to rare diseases, combined with a rise in specialized treatments, boosts demand for reliable pharmaceutical distribution in hospitals.

As healthcare systems expand access to treatments for rare conditions, hospital pharmacies benefit from strengthened supply chains and favorable insurance policies that cover expensive drugs. Furthermore, initiatives that enhance patient access to hospital-based care contribute to the segment’s anticipated growth. These factors position hospital pharmacies as a key distribution channel for CHAPLE syndrome therapies.

Key Market Segments

By Product Type

- Eculizumab

- Ravulizumab

- Veopoz

By Applications

- Gastrointestinal Symptoms

- Hypoalbuminemia

- Edema

- Hypogammaglobulinemia

- Malnutrition

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Increasing Healthcare Expenditure

Increasing healthcare expenditure significantly drives the CHAPLE syndrome market. In 2022, Canada allocated approximately US$ 331 billion to healthcare spending, equating to roughly US$ 8,563 per citizen and representing 12.2% of the country’s GDP. This trend mirrors a global increase in health budgets, allowing for more advanced and specialized treatments for rare conditions like CHAPLE syndrome.

Higher healthcare spending supports the development and adoption of innovative therapies, expanding research in genetic and rare diseases. Countries with robust healthcare budgets are more likely to invest in advanced treatments, early diagnostics, and genetic research that benefit individuals with CHAPLE syndrome.

The commitment to healthcare improvements is expected to open pathways for effective, targeted therapies. As healthcare expenditures rise worldwide, the CHAPLE syndrome market is likely to witness more funding opportunities for comprehensive patient care, early interventions, and improved treatment outcomes.

Restraints

Long Approval Timelines

One major restraint in the Chaple syndrome market is the lengthy approval process for new treatments, which creates challenges for both developers and patients. Typically, approval timelines from organizations like the FDA or EMA span between 8 to 12 years, considering the extensive pre-clinical, clinical trials, and regulatory reviews required.

This prolonged process restricts timely access to potentially life-saving therapies, which is particularly concerning for Chaple syndrome patients who often have limited or no alternative treatments. For rare diseases such as Chaple syndrome, a small patient population further complicates data collection, delaying approvals. These regulatory delays impact patients’ quality of life, while also affecting investor interest, given the high costs and uncertain returns on investment.

Opportunities

Government Support is an Opportunity in the Chaple Syndrome Market

Expanding government support and funding represent a significant opportunity within the Chaple syndrome market, especially for research and treatment development. With the high cost and complexity of developing therapies for rare diseases, government initiatives play a critical role in encouraging innovation.

For instance, healthcare expenditure in Canada reached $331 billion in 2022, which included increased funding for rare disease research and healthcare infrastructure improvements. Such initiatives, including tax incentives, grants, and regulatory flexibility, create a favorable environment for pharmaceutical companies. They encourage research into Chaple syndrome treatments and reduce barriers to bringing new therapies to market, ultimately benefiting both developers and patients.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert both positive and negative influences on the CHAPLE syndrome market. Economic downturns, inflation, and trade disruptions can limit healthcare funding, reducing resources for rare disease research and treatment development. Political instability in some regions also impacts regulatory environments, causing delays in drug approval and restricting access to innovative therapies.

On the positive side, global health initiatives and international partnerships often receive strong support from stable economies, which can accelerate research and enable wider access to treatment. Countries with solid trade agreements and economic growth tend to have higher healthcare budgets, which supports rare disease research and patient assistance programs. Growing global awareness and cross-border healthcare collaborations are expected to mitigate some negative impacts, helping create a more resilient, accessible market for CHAPLE syndrome therapies.

Trends

Mergers and Acquisitions are Driving Growth in the Chaple Syndrome Market

Increasing mergers and acquisitions within the Chaple syndrome market underscore a recent trend driven by the need to expand therapeutic options and accelerate research. Major pharmaceutical companies have pursued acquisitions to enhance their rare disease portfolios, leveraging advanced gene therapies and targeted treatments.

This strategic consolidation allows companies to access innovative technologies and diversify their offerings in rare disease markets. For instance, acquisitions among pharmaceutical firms specializing in orphan diseases have enabled collaborative R&D efforts, promoting faster development timelines and broadening market access for new Chaple syndrome treatments. As the industry prioritizes rare disease management, such consolidations are anticipated to continue, driving growth in targeted therapies for Chaple syndrome.

Regional Analysis

North America is leading the Chaple Syndrome Market

North America dominated the market with the highest revenue share of 39.8% owing to advancements in healthcare infrastructure and increased funding for rare disease research. CHAPLE syndrome, a rare genetic disorder affecting immune and digestive systems, has drawn growing attention among healthcare providers and researchers, driving demand for specialized treatments.

U.S. government organizations have focused on strengthening healthcare support systems, notably through initiatives to increase funding, establish supportive legislation, and set essential standards for the Medicaid program, as outlined by the International Health Care System in June 2020. These efforts have improved access to treatments and encouraged investment in rare disease research.

Additionally, collaborations between pharmaceutical companies and research institutions have led to advancements in therapies specifically designed for CHAPLE syndrome, enhancing patient care options. Rising awareness of the disease among healthcare professionals has also contributed to earlier diagnoses and more targeted interventions, establishing a strong growth trajectory for the CHAPLE syndrome market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increased awareness of rare diseases and improvements in healthcare access. Regional governments are anticipated to support rare disease treatment initiatives, boosting funding and creating frameworks to encourage early diagnosis and effective treatment of genetic disorders.

Healthcare providers across countries like Japan, China, and South Korea are likely to adopt advanced diagnostic tools, allowing for earlier detection and targeted care for conditions like CHAPLE syndrome. Additionally, collaborative efforts between Asian pharmaceutical companies and international research institutions are expected to lead to innovative therapies tailored to meet local needs.

Rising healthcare expenditure and initiatives to improve patient care are projected to make treatments for CHAPLE syndrome more accessible across the region, supporting overall market expansion. These factors position the Asia Pacific region as a growing hub for advancements in rare disease management and treatment.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the chaple syndrome market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the CHAPLE syndrome treatment market employ various strategies to drive growth and support patient care advancements.

They invest heavily in research and development to innovate therapies that target the underlying causes of this rare genetic disorder, aiming for more effective treatment options. Collaborating with genetic research institutions and healthcare organizations accelerates discovery efforts and enhances clinical trial efficiency. Companies expand their global presence, especially in regions with advanced rare disease programs, to better serve affected populations.

Additionally, they focus on raising awareness among healthcare providers and patients through education initiatives, facilitating earlier diagnosis and intervention.

Top Key Players in the Chaple Syndrome Market

- Regeneron

- Novartis AG

- Hoffmann-La Roche Ltd

- CinnaGen Co.

- Apellis Pharmaceuticals

- Amgen Inc.

- Akari Therapeutics

Recent Developments

- In August 2023: the FDA granted approval for Regeneron’s pozelimab, marking it as the first treatment for CHAPLE (complement hyperactivation, angiopathic thrombosis, and protein-losing enteropathy), a rare hereditary disorder. This approval is pivotal to the growth of the CHAPLE syndrome market, as it introduces the first therapeutic option for patients aged one and older with this condition, addressing a critical unmet medical need and expanding treatment access.

- In June 2023: Amgen completed its acquisition of Horizon Therapeutics plc for $116.50 per share in a transaction valued at nearly $27.8 billion. This acquisition is relevant to the CHAPLE syndrome market as it enhances Amgen’s portfolio of rare disease treatments, positioning the company to support innovative therapies like pozelimab and other potential treatments targeting ultra-rare conditions, fostering growth in niche therapeutic markets like CHAPLE syndrome.

Report Scope

Report Features Description Market Value (2023) US$ 145.9 Million Forecast Revenue (2033) US$ 224.4 Million CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Eculizumab, Ravulizumab, Veopoz), By Applications (Gastrointestinal Symptoms, Hypoalbuminemia, Edema, Hypogammaglobulinemia, and Malnutrition), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Regeneron, Novartis AG, Hoffmann-La Roche Ltd, CinnaGen Co., Apellis Pharmaceuticals, Amgen Inc., and Akari Therapeutics. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Regeneron

- Novartis AG

- Hoffmann-La Roche Ltd

- CinnaGen Co.

- Apellis Pharmaceuticals

- Amgen Inc.

- Akari Therapeutics