Global Tube Packaging Market Size, Share, Growth Analysis By Product Type (Squeeze and Collapsible Tubes, Twist Tubes, Rigid Tubes), By Material Type (Plastic, Aluminum, Laminated, Paperboard), By End-User Industry, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135527

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Tube Packaging Market Key Insights

- Tube Packaging Business Environment Analysis

- Tube Type Analysis

- Material Type Analysis

- End-User Industry Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Emerging Trends and Innovations

- Technological Roadmap for Tube Packaging Market

- Regional Analysis of Tube Packaging Market

- Competitive Landscape of Tube Packaging Market

- Latest Advancements in Tube Packaging Market

- Report Scope

Report Overview

The Global Tube Packaging Market size is expected to be worth around USD 23.9 Billion by 2033, from USD 13.2 Billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

Tube Packaging is a type of packaging characterized by its cylindrical shape, commonly used for products like cosmetics, pharmaceuticals, and food items. It offers convenient dispensing and protects the product from contamination and damage. Tube packaging is available in various materials, including plastic and metal, catering to different industry needs.

The Tube Packaging Market involves the production and distribution of cylindrical packaging solutions for various products. It includes manufacturers of plastic, metal, and composite tubes used in industries such as beauty, healthcare, and food.

Tube packaging is increasingly favored for its convenience and versatility in various industries. 120 billion plastic packaging units from the beauty industry alone highlight its widespread use, according to Zero Waste Week. Consequently, manufacturers prioritize durable and innovative tube designs to meet diverse consumer needs, driving the sector’s growth.

The tube packaging market is growing steadily as demand for sustainable and efficient packaging solutions rises. According to the Consumer Brands Association, 20 of the largest FMCG manufacturers aim for 100% recycled packaging by 2030. Moreover, advancements in packaging materials and design are enhancing the market’s appeal, making it a competitive and lucrative field.

Growth factors include the push for sustainability and increasing consumer preference for eco-friendly packaging. For instance, California’s Assembly Bill 793 mandates plastic beverage containers to have 15% recycled content by 2022 and 50% by 2030. These regulations create opportunities for manufacturers to innovate and adopt greener practices, boosting market potential.

Locally, the tube packaging industry stimulates economic growth by creating jobs in manufacturing, design, and recycling sectors. For example, Italy’s packaging machinery industry saw a 10.5% increase in foreign turnover, reaching €7.2 billion in 2023. This growth supports local businesses and fosters innovation within communities, enhancing regional economies.

Government regulations are significantly shaping the tube packaging market. California’s Assembly Bill 793 requires 50% recycled content in plastic containers by 2030, driving manufacturers to adopt sustainable practices. Additionally, global initiatives like the EU’s PPWR and U.S. EPR laws encourage the use of recycled materials, zero waste packaging promoting a shift towards greener packaging solutions and ensuring long-term market sustainability.

Tube Packaging Market Key Insights

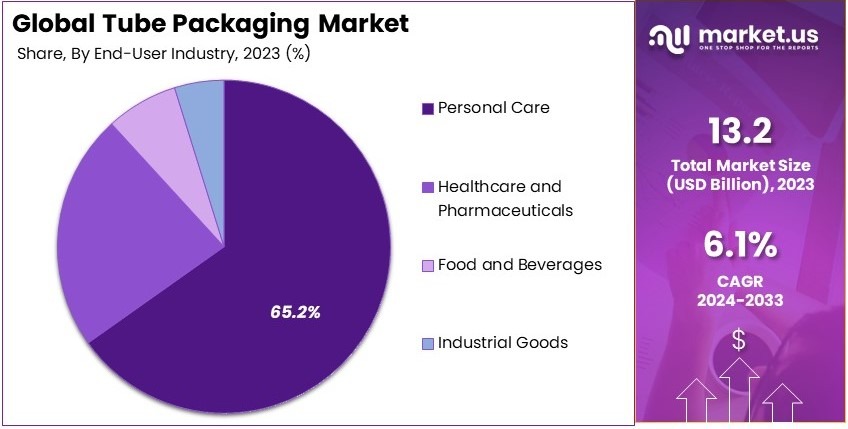

- The Tube Packaging Market was valued at USD 13.2 Billion in 2023 and is expected to reach USD 23.9 Billion by 2033, with a CAGR of 6.1%.

- In 2023, Squeeze and Collapsible Tubes dominated the tube type segment with 73.1%, owing to their convenience and adaptability.

- In 2023, Laminated Material accounted for 45.7% share due to its durability and cost-efficiency.

- In 2023, Personal Care led the end-user segment with 65.2%, driven by increasing demand for skincare and cosmetics products.

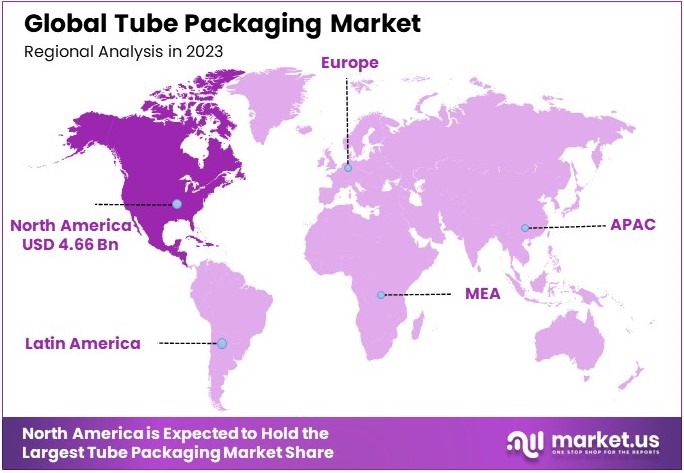

- In 2023, North America dominated the market with 35.3% share, valued at USD 4.66 Billion, supported by strong consumer spending on personal care.

Tube Packaging Business Environment Analysis

The tube packaging market shows moderate saturation, with 120 billion units from the beauty industry alone, according to Zero Waste Week. Consequently, companies must innovate to meet high demand and avoid overcrowding. This creates a balanced competitive environment.

Targeting primarily the beauty and FMCG sectors, 20 major FMCG manufacturers aim for 100% recycled packaging by 2030, as reported by the Consumer Brands Association. Additionally, the focus on sustainability attracts environmentally conscious consumers, expanding the market’s reach.

Product differentiation is crucial in this sector. For instance, UFlex developed aluminum-free tubes in October 2024, enhancing recyclability. Moreover, innovative designs like Colgate and Watsons’ recycling scheme in Hong Kong set brands apart, meeting consumer demands for eco-friendly solutions.

Analyzing the value chain, efficient integration of design, production, and recycling processes is essential. According to Supply Chain Today, partnerships with sustainable material suppliers and advanced manufacturing technologies streamline operations, ensuring high-quality and environmentally responsible packaging.

Investment opportunities are growing as sustainability trends rise. The packaging machinery industry achieved €9.2 billion in turnover in 2023, with €7.2 billion from exports, according to OEC. Furthermore, Italy’s sector saw a 10.5% increase in foreign turnover, highlighting robust growth prospects.

Export and import dynamics are vital for market expansion. According to World Integrated Trade Solution, global trade of paper containers reached $2.6 billion in 2022, an 8.56% increase from 2021. Additionally, plastic packaging exports totaled $2.16 billion, led by China and the United States, driving international growth.

Tube Type Analysis

Squeeze and Collapsible Tubes dominate with 73.1% due to their convenience and efficiency in product dispensing.

In the Tube Packaging Market, Squeeze and Collapsible Tubes have established themselves as the dominant sub-segment, commanding a significant 73.1% market share. This preference stems from the convenience and efficiency these tubes offer in dispensing products.

They are widely favored in industries like personal care, pharmaceuticals, and food due to their ease of use, which allows consumers to control the amount of product dispensed, minimizing waste and maximizing usage.

Twist Tubes are commonly used for products that require a smaller, more controlled dispensing, such as adhesives and art supplies. They contribute to market growth by offering precision and preventing product drying.

Rigid Tubes, typically used for more robust products or where shape retention is crucial, like certain cosmetics and healthcare items, provide structure and protection, supporting the integrity of the packaged goods.

Material Type Analysis

Laminated materials lead with 45.7% due to their barrier properties and durability.

Laminated materials, combining the benefits of both plastic and aluminum, are the leading choice in the material segment of the tube packaging market, holding a 45.7% share. The dual advantages of flexibility and excellent barrier properties against moisture, air, and contaminants make laminated tubes highly suitable for sensitive products in the healthcare, personal care, and food sectors.

Their durability and ability to preserve the contents’ freshness and efficacy without the use of preservatives enhance their appeal to manufacturers and consumers alike.

Plastic tubes, made from materials like Polyethylene (PE), Polypropylene (PP), and Polyethylene Terephthalate (PET), are valued for their versatility and cost-effectiveness, making them a popular choice for a variety of applications.

Aluminum tubes offer a high degree of protection and are completely recyclable, appealing to eco-conscious brands and consumers. Paperboard tubes are gaining popularity as a sustainable alternative, contributing to the market’s growth through innovation and environmental sustainability.

End-User Industry Analysis

Personal Care leads the market with 65.2% due to high consumer demand for hygiene and beauty products.

The Personal Care sector is the predominant end-user in the Tube Packaging Market, accounting for 65.2% of its usage. This segment’s dominance is driven by the consistent consumer demand for hygiene and beauty products, which often require precise application and protection from contamination.

Tube packaging is ideal for the personal care market as it provides convenience, portability, and ease of use, which are crucial for daily-use products like toothpaste, face creams, and shampoos.

Healthcare and Pharmaceuticals also rely heavily on tube packaging to ensure the protection and controlled dispensation of creams, ointments, and gels. The precise application facilitated by tube packaging is essential for dosage accuracy.

The Food and Beverages industry utilizes tubes for condiments and culinary pastes, benefiting from the same precise dispensation. Industrial goods often require specialized packaging solutions that tube packaging can provide, especially for adhesives, sealants, and lubricants, ensuring product efficacy and longevity.

Key Market Segments

By Product Type

- Squeeze and Collapsible Tubes

- Twist Tubes

- Rigid Tubes

By Material Type

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Aluminum

- Laminated (Plastic and Aluminum)

- Paperboard

By End-User Industry

- Personal Care

- Healthcare and Pharmaceuticals

- Food and Beverages

- Industrial Goods

Driving Factors

Increasing Demand in Personal Care Industry Drives Market Growth

The Tube Packaging Market is experiencing significant growth driven by the increasing demand in the personal care industry. As consumers prioritize personal hygiene and beauty products, the need for efficient and attractive packaging solutions rises. Personal care products such as shampoos, lotions, and creams often rely on tube packaging for its convenience and functionality.

Additionally, the growth in the pharmaceutical packaging sector contributes to the market’s expansion, as medications and health-related products require secure and tamper-evident packaging. Rising awareness of product protection also plays a crucial role, as businesses seek packaging solutions that ensure product integrity during transportation and storage.

Technological innovations in tube materials further enhance the market, allowing for the development of more durable, lightweight, and eco-friendly packaging options. These advancements enable manufacturers to meet the evolving demands of both consumers and regulatory bodies.

Restraining Factors

High Raw Material Costs and Environmental Regulations Restrain Market Growth

The Tube Packaging Market faces several restraining factors that impede its growth. High raw material costs are a significant barrier, as the expenses associated with producing quality tube packaging can increase overall production costs for manufacturers.

Additionally, stringent environmental regulations pose a considerable restraint, requiring manufacturers to adhere to strict guidelines regarding the use of sustainable and recyclable materials. Compliance with these regulations often necessitates additional investments in research and development, as well as modifications to existing production processes.

Limited recycling infrastructure further complicates the market landscape, as inadequate facilities for recycling tube packaging materials can lead to increased environmental impact and discourage the adoption of biodegradable packaging solutions.

Emerging Trends and Innovations

Eco-Friendly Tube Materials Are Latest Trending Factors

Current trends are significantly shaping the Tube Packaging Market, driving its evolution and appeal. Eco-friendly tube materials are at the forefront, as consumers and businesses increasingly seek sustainable packaging solutions that reduce environmental impact. This trend aligns with global sustainability goals and enhances brand reputation for companies adopting green practices.

Minimalist design trends are another key factor, emphasizing simplicity and functionality while reducing material usage. Minimalist packaging appeals to consumers who prefer clean and efficient designs that minimize waste and enhance product aesthetics.

Lightweight tube innovations are also trending, focusing on reducing the weight of packaging materials to lower transportation costs and environmental footprint. These lightweight solutions maintain the durability and protection required for products while contributing to sustainability efforts.

Technological Roadmap for Tube Packaging Market

Current Technological Developments

The tube packaging market is advancing with 3D printing for rapid design customization, reducing time and costs. Smart manufacturing using AI and robotics enhances efficiency and quality control. Additionally, advanced coatings and barrier technologies improve product protection for sectors like pharmaceuticals and food while optimizing material usage.

Emerging Technologies

Innovations include smart packaging with RFID and NFC for better tracking and supply chain management. Sustainable materials such as biodegradable plastics and compostable laminates meet eco-friendly demands. Enhanced digital printing allows for personalized, high-quality designs, while nano-coatings provide increased durability and protection in lightweight, cost-effective tubes.

Future Directions (5–10 Years)

Looking ahead, the tube packaging market is set to embrace fully circular packaging solutions, aiming for 100% recyclable tubes within closed-loop systems that reincorporate used materials back into production, thereby reducing waste and environmental impact. Intelligent tubes with IoT sensors will monitor product quality and usage in real-time. Advanced AI and machine learning will optimize manufacturing processes, while sustainable materials like bio-based polymers will offer durable, aesthetically pleasing, and eco-friendly packaging solutions.

Impact on the Market

Technological advancements drive sustainability, helping brands meet environmental regulations and consumer preferences. Cost reductions through automation make eco-friendly packaging more accessible. Enhanced customization fosters consumer engagement and brand differentiation. Smart packaging improves product safety and monitoring, particularly for pharmaceuticals and food, ensuring higher quality and reliability.

Regional Analysis of Tube Packaging Market

North America Dominates with 35.3% Market Share

North America leads the Tube Packaging Market with a 35.3% share and valued at USD 4.66 Billion, driven by robust consumer demand across diverse industries such as cosmetics, pharmaceuticals, and food. The region’s emphasis on sustainable and innovative packaging solutions significantly contributes to its dominance.

The dynamics of North America’s market are influenced by high consumer awareness and stringent regulatory standards, which promote the use of eco-friendly and advanced packaging technologies. These factors ensure that products are both appealing and compliant with environmental guidelines, enhancing the region’s market position.

Looking ahead, North America’s influence on the global Tube Packaging Market is poised to grow. The region’s ongoing commitment to sustainability and technological innovation in packaging is expected to attract more industries, potentially increasing its market share. The trend towards more personalized and environmentally friendly packaging is also likely to spur further developments and demand in this market.

Regional Mentions:

- Europe: Europe holds a substantial share in the Tube Packaging Market, with a strong focus on eco-friendly and recyclable materials. The region’s stringent regulations on packaging waste management drive innovation and sustainability in packaging designs.

- Asia Pacific: Asia Pacific is rapidly growing in the Tube Packaging Market due to increasing industrialization and consumer demand. The region benefits from cost-effective manufacturing processes and a vast consumer base, which are pivotal in driving its market growth.

- Middle East & Africa: The Middle East and Africa are steadily progressing in the Tube Packaging Market. The growth is fueled by increasing urbanization and improvements in retail infrastructure, which enhance the availability and variety of packaged goods.

- Latin America: Latin America is experiencing moderate growth in the Tube Packaging Market. The region is enhancing its packaging capabilities to meet the rising demand from its growing pharmaceutical and cosmetic sectors, fostering market expansion.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape of Tube Packaging Market

In the Tube Packaging Market, Amcor Limited, Berry Global Inc., Huhtamäki Group, and Mondi Group stand out as the top players. Each company brings a unique set of strengths that bolster their positions and influence within the market.

Amcor Limited is renowned for its diverse range of flexible packaging solutions. Specializing in both plastic and aluminum tubes, Amcor focuses on innovative packaging designs that enhance user experience and sustainability, making it a preferred partner for global brands in pharmaceuticals, food, and cosmetics industries.

Berry Global Inc. excels in producing high-quality plastic packaging solutions. Its commitment to sustainability is evident through its use of recycled materials and focus on creating recyclable tube packaging options. Berry Global serves a variety of sectors, ensuring broad market reach and high consumer recognition.

Huhtamäki Group is recognized for its expertise in molded fiber and plastic packaging solutions. The company leverages cutting-edge technology to produce highly functional and aesthetically pleasing tube packaging that meets the stringent requirements of the health care and food industries.

Mondi Group focuses on innovation and sustainability, producing both plastic and laminate tube solutions that offer excellent barrier properties and user-friendliness. Mondi’s commitment to eco-friendly practices and high-quality materials positions it well among brands looking for responsible packaging partners.

These companies lead the Tube Packaging Market through their innovative approaches, extensive product ranges, and commitment to sustainability. Their leadership drives the market towards more sustainable practices and innovative packaging solutions that cater to evolving consumer demands.

Major Companies in the Market

- Amcor Limited

- Berry Global Inc.

- Huhtamäki Group

- Mondi Group

- Essel Propack Ltd.

- Sonoco Products Company

- Albea S.A.

- Viva Healthcare Packaging

- CTL Packaging Ltd.

- Unette Corporation

- Shandong Huanri Packaging

- Landa Corporation

Latest Advancements in Tube Packaging Market

- Hoffmann Neopac AG: In October 2024, Hoffmann Neopac introduced its Polyfoil® Mono-Material Barrier (MMB) Mini tubes at CPHI Milan. These tubes address the increasing demand for sustainable and recyclable packaging solutions in the cosmetics and pharmaceutical industries. The MMB Mini tubes offer improved product protection while being fully recyclable, aligning with global sustainability trends.

- Pringles: In March 2024, Pringles launched its ‘Designed for Recycling’ paper-based tube packaging. This initiative underscores the company’s commitment to sustainability and reducing environmental impact. The launch reflects a broader industry shift toward eco-friendly materials in food packaging.

Report Scope

Report Features Description Market Value (2023) USD 13.2 Billion Forecast Revenue (2033) USD 23.9 Billion CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Squeeze and Collapsible Tubes, Twist Tubes, Rigid Tubes), By Material Type (Plastic: Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET); Aluminum, Laminated (Plastic and Aluminum), Paperboard), By End-User Industry (Personal Care, Healthcare and Pharmaceuticals, Food and Beverages, Industrial Goods) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor Limited, Berry Global Inc., Huhtamäki Group, Mondi Group, Essel Propack Ltd., Sonoco Products Company, Albea S.A., Viva Healthcare Packaging, CTL Packaging Ltd., Unette Corporation, Shandong Huanri Packaging, Landa Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amcor Limited

- Berry Global Inc.

- Huhtamäki Group

- Mondi Group

- Essel Propack Ltd.

- Sonoco Products Company

- Albea S.A.

- Viva Healthcare Packaging

- CTL Packaging Ltd.

- Unette Corporation

- Shandong Huanri Packaging

- Landa Corporation