Global Transcatheter Embolization & Occlusion Devices Market By Product Type (Non-Coil Devices (Flow Diverting Devices, Embolization Particles, Liquid Embolics, and Others) and Coils (Pushable Coils and Detachable Coils)), By Application (Oncology, Peripheral Vascular Disease, Neurology, Urology, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 99768

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

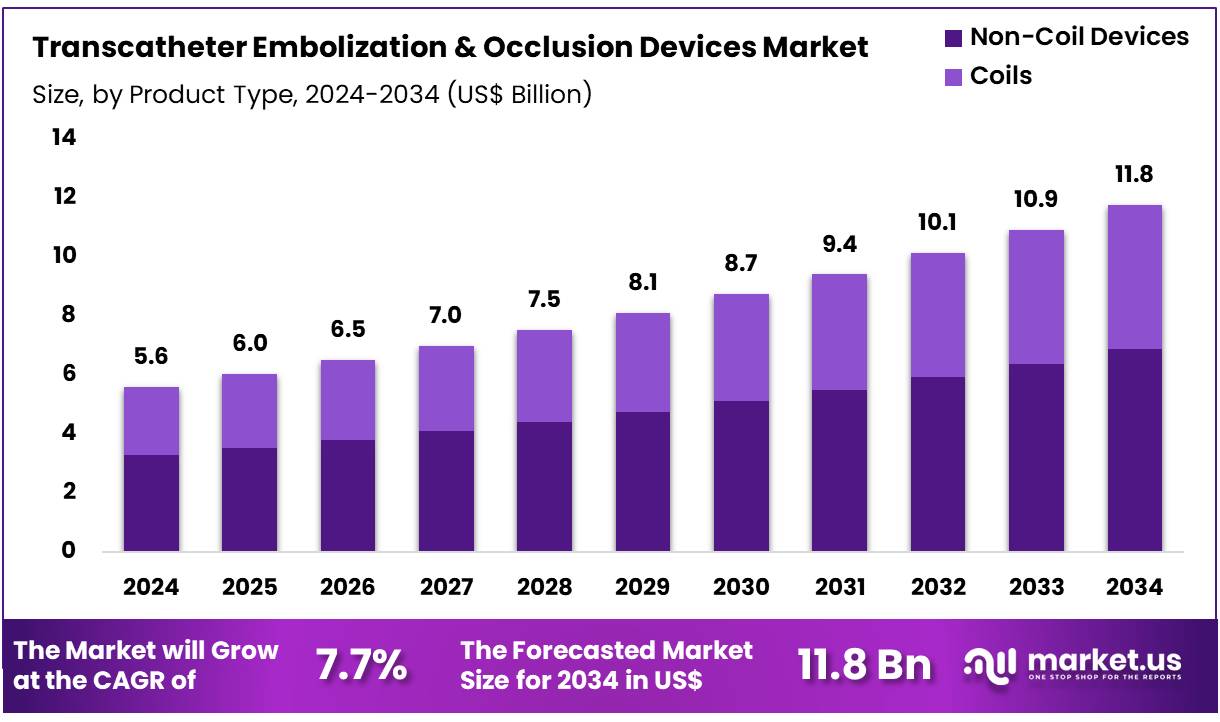

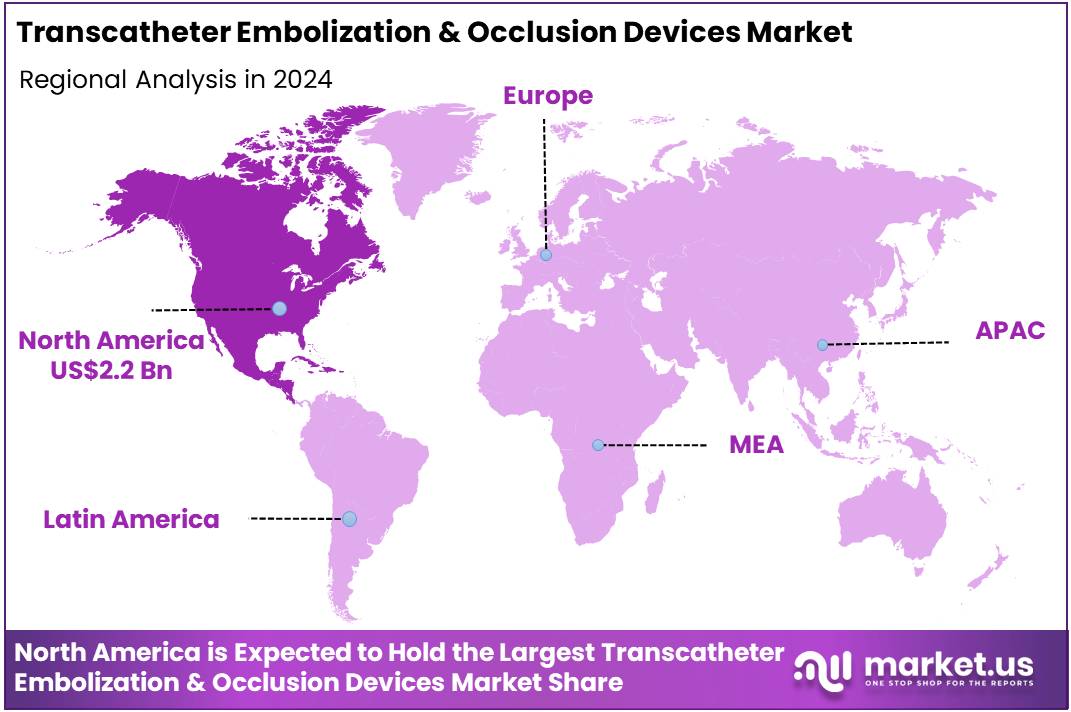

Global Transcatheter Embolization & Occlusion Devices Market size is expected to be worth around US$ 11.8 Billion by 2034 from US$ 5.6 Billion in 2024, growing at a CAGR of 7.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.5% share with a revenue of US$ 2.2 Billion.

Increasing demand for minimally invasive procedures and the rising incidence of vascular conditions are driving the growth of the transcatheter embolization and occlusion devices market. These devices play a crucial role in the treatment of various diseases, including cancer, uterine fibroids, and arteriovenous malformations, by blocking blood vessels to reduce blood flow to tumors or other abnormal growths. The shift toward non-surgical treatments that reduce recovery times and complications has significantly fueled market expansion.

In particular, transcatheter embolization is increasingly being used for the management of malignant tumors, including liver and kidney cancers, offering a less invasive alternative to traditional surgery. As per a 2022 report from Cleveland Clinic, approximately 76,000 individuals in the United States face a diagnosis of malignant kidney tumors annually, underscoring the considerable incidence of this disease and highlighting the need for effective treatment options such as embolization.

Recent trends show a growing preference for advanced embolization techniques using microspheres, coils, and liquid embolics, which provide more precise targeting and improved patient outcomes. Additionally, the increasing use of interventional radiology procedures in clinical settings presents significant opportunities for the market. The rise in healthcare infrastructure development, especially in emerging markets, coupled with advances in imaging technologies, creates further growth potential.

The market is also benefiting from ongoing research into new embolic agents and the integration of robotic-assisted procedures, improving the precision and safety of transcatheter embolization treatments. As the medical community continues to prioritize minimally invasive therapies, the transcatheter embolization and occlusion devices market is expected to see continued innovation and demand.

Key Takeaways

- In 2024, the market for transcatheter embolization & occlusion devices generated a revenue of US$ 5.6 billion, with a CAGR of 7.7%, and is expected to reach US$ 11.8 Billion by the year 2034.

- The product type segment is divided into non-coil devices and coils, with non-coil devices taking the lead in 2024 with a market share of 58.5%.

- Considering application, the market is divided into oncology, peripheral vascular disease, neurology, urology, and others. Among these, oncology held a significant share of 47.2%.

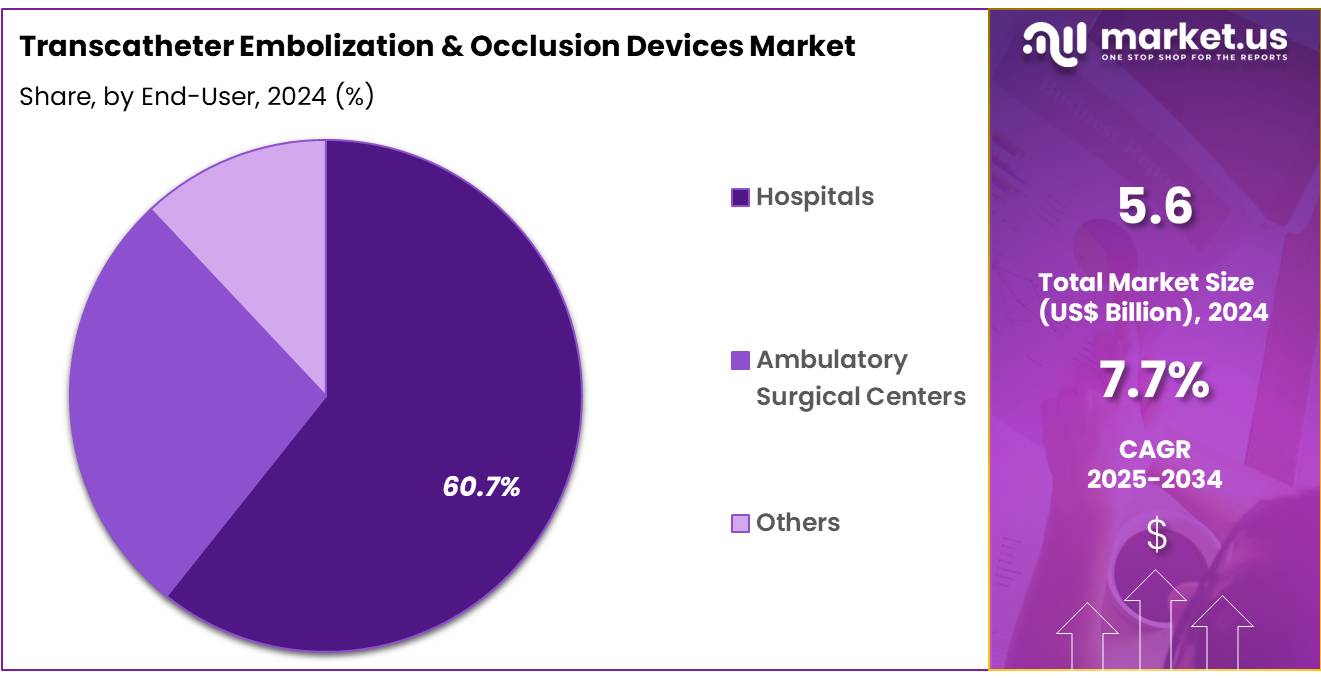

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, ambulatory surgical centers, and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 60.7% in the transcatheter embolization & occlusion devices market.

- North America led the market by securing a market share of 38.5% in 2024.

Product Type Analysis

Non-coil devices dominate the transcatheter embolization and occlusion devices market, holding 58.5% of the share. This growth is expected to continue as these devices provide a highly efficient method for achieving vessel occlusion, particularly in complex clinical procedures such as tumor embolization and vascular occlusions.

Non-coil devices, including liquid embolics and plugs, are gaining popularity due to their ability to offer more precise and controlled embolization compared to traditional coils. These devices are anticipated to be increasingly preferred in applications like oncology and peripheral vascular disease, where targeted embolization is crucial for minimizing damage to healthy tissues.

Furthermore, non-coil devices are projected to see higher demand as advancements in materials and technology improve their ease of use, safety, and effectiveness. With an increasing number of interventional procedures focusing on minimally invasive techniques, non-coil devices are likely to continue their dominant position in the market.

Application Analysis

Oncology holds the largest share of 47.2% in the application segment of the transcatheter embolization and occlusion devices market. This growth is driven by the rising prevalence of cancer, particularly tumors in the liver, lung, and kidneys, which require effective and minimally invasive treatment options. Transcatheter embolization and occlusion techniques are gaining traction in oncology as they allow for the targeted delivery of embolic agents to tumors, effectively cutting off their blood supply and inhibiting further growth.

The increasing adoption of these techniques in liver cancer, which often requires embolization to control tumor growth, is likely to drive continued growth in this segment. Additionally, the shift towards personalized treatment options in cancer care is anticipated to further support the use of embolization devices as part of multidisciplinary treatment plans. As cancer treatments become more targeted and less invasive, the demand for transcatheter embolization devices in oncology is projected to rise, ensuring the segment’s sustained dominance.

End-User Analysis

Hospitals are the leading end-user segment, holding 60.7% of the market share in the transcatheter embolization and occlusion devices market. This segment’s growth is expected to continue as hospitals remain the primary centers for complex interventional procedures. The increasing burden of chronic diseases and the growing incidence of cancers requiring embolization procedures will drive the continued adoption of transcatheter embolization devices in hospitals.

As healthcare systems focus on providing cutting-edge, minimally invasive treatments, hospitals are increasingly adopting advanced embolization devices for conditions like oncology, peripheral vascular disease, and neurology. The integration of embolization techniques with imaging systems, such as fluoroscopy and MRI, is likely to enhance procedural accuracy, driving further demand for these devices.

Additionally, as hospitals expand their interventional radiology departments and improve patient care, the need for more effective and efficient embolization devices is projected to rise, solidifying the role of hospitals as the largest end-user segment in this market.

Key Market Segments

By Product Type

- Non-Coil Devices

- Flow Diverting Devices

- Embolization Particles

- Liquid Embolics

- Others

- Coils

- Pushable Coils

- Detachable Coils

By Application

- Oncology

- Peripheral Vascular Disease

- Neurology

- Urology

- Others

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Growing Prevalence of Chronic Diseases Requiring Embolization is Driving the Market

The increasing global incidence of various chronic and acute conditions, such as peripheral artery disease, uterine fibroids, and certain types of tumors, which are amenable to treatment with transcatheter embolization and occlusion devices, is a significant driver propelling the market. These minimally invasive procedures offer patients several benefits over traditional open surgery, including reduced recovery times, less pain, and lower risk of complications, making them a preferred treatment option.

For example, conditions like benign prostatic hyperplasia and various vascular malformations are increasingly managed using these advanced techniques. The US Centers for Disease Control and Prevention (CDC) reported in May 2024 that approximately 20 million adults in the US currently live with peripheral artery disease (PAD), a condition that can lead to severe complications requiring interventions including embolization.

Furthermore, the rising number of cancer cases, particularly liver and kidney cancers where transcatheter arterial chemoembolization (TACE) and bland embolization are vital treatment modalities, further stimulates demand. The American Cancer Society estimated that in 2023, there were approximately 41,210 new cases of liver and intrahepatic bile duct cancer and 81,880 new cases of kidney and renal pelvis cancer in the US These substantial patient populations requiring targeted therapeutic interventions continuously drive the demand for sophisticated embolization and occlusion devices, expanding their application across diverse medical specialties.

Restraints

Stringent Regulatory Approval Processes and High Procedural Costs are Restraining the Market

The stringent and lengthy regulatory approval processes for novel transcatheter embolization and occlusion devices, coupled with the relatively high procedural costs, represent a considerable restraint on the market. Manufacturers face rigorous testing, extensive clinical trials, and complex documentation requirements to obtain approval from regulatory bodies like the US Food and Drug Administration (FDA) or European notified bodies. This protracted approval timeline increases development costs and delays market entry for innovative products.

For instance, the FDA’s 510(k) clearance process for medical devices can take several months, while the more rigorous Premarket Approval (PMA) pathway for novel, high-risk devices often extends over a year, with associated costs running into millions of US dollars. Cook Medical, a key player in the interventional space, publishes guides detailing Medicare reimbursement for transcatheter peripheral embolization or occlusion procedures.

Their “2024 Medicare Reimbursement for Transcatheter Embolization or Occlusion Services” guide shows that national Medicare average facility payments for procedures like vascular embolization for tumors (CPT code 37243) can be around US$10,492.72 for an outpatient hospital setting. These high procedural costs, which include device cost, hospital stay, and professional fees, can limit accessibility, particularly in healthcare systems with cost containment pressures or for patients with insufficient insurance coverage.

Opportunities

Technological Advancements in Embolic Agents and Device Miniaturization are Creating Growth Opportunities

Ongoing technological advancements in embolic agents, including the development of new materials and formulations, coupled with continuous miniaturization of device delivery systems, are creating significant growth opportunities in the market. Innovations in embolic coils, particles, and liquid embolics offer improved precision, biocompatibility, and targeted delivery, leading to better clinical outcomes and expanded therapeutic applications. Smaller and more flexible catheters and guidewires allow for navigation through complex and tortuous vasculature, reaching previously inaccessible anatomical locations.

The US Food and Drug Administration (FDA) continued to approve innovative devices in this area; for example, in October 2024, Contego Medical received Premarket Approval (PMA) for its Neuroguard IEP System, which integrates an embolic filter, illustrating advancements in combined device functionality.

Furthermore, Boston Scientific’s acquisition activities reflect this trend; their acquisition of an interest in Acotec Scientific Holdings in December 2022, a company focusing on vascular interventions, indicates strategic investments in advanced technology. These advancements not only enhance the safety and efficacy of embolization procedures but also broaden the range of treatable conditions, allowing for more precise and less invasive interventions. The continuous evolution in material science and engineering miniaturization is expanding the scope and utility of these devices, driving their adoption across various interventional specialties.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the prioritization of healthcare spending by governments, significantly influence the transcatheter embolization & occlusion devices market by affecting healthcare infrastructure development and patient access to advanced procedures. Inflation can increase the manufacturing costs for these highly specialized devices, including complex raw materials, micro-electronics, and precision machining, potentially leading to higher prices for hospitals and clinics. This can strain healthcare budgets, especially in regions with limited resources.

However, governments and healthcare systems globally increasingly prioritize specialized interventions for conditions like cancer and vascular diseases, recognizing their impact on quality of life and long-term health outcomes. The World Health Organization (WHO) reported in May 2025 that global expenditure on health continued to rise, with many countries, including high-income nations, consistently allocating a significant portion of their GDP to healthcare.

For instance, France’s health expenditure was 11.33% of GDP in 2023, and Germany’s was 12.86% in 2023, showcasing substantial national commitments that support investments in advanced medical technologies. Geopolitical stability also plays a crucial role in maintaining robust supply chains for critical components. Despite economic pressures, the imperative to provide effective, minimally invasive treatments for a growing patient population ensures a sustained focus on and investment in advanced medical devices, fostering resilience and continued growth for the market.

Evolving US trade policies, including the imposition of tariffs on imported medical components and high-precision manufacturing equipment, are shaping the transcatheter embolization & occlusion devices market by directly influencing the cost of production and the strategic decisions related to sourcing. Manufacturers of these advanced devices frequently rely on a global supply chain for specialized materials and electronic sub-assemblies, which can originate from various international locations.

Tariffs on these specific imports directly increase the input costs for companies that either manufacture within the US or import finished components for assembly, potentially resulting in higher prices for the final medical devices. For instance, the US Customs and Border Protection (CBP) collected approximately US$92.3 billion in duties, taxes, and other fees in fiscal year 2023, a figure encompassing a wide array of imported goods, including those that contribute to medical technology manufacturing.

Within this total, CBP also reported collecting more than US$38 billion in Section 301 duties from China in FY 2023, tariffs that specifically target various manufacturing sectors, including electronics and machinery often integral to medical devices. These policies, while sometimes aimed at bolstering domestic manufacturing capabilities and addressing trade imbalances, primarily create a more expensive and intricate operational environment for companies. The critical demand for innovative and effective interventional tools, however, motivates manufacturers to strategically manage their supply chains and absorb some costs, ensuring continued access to essential components for patient care.

Latest Trends

Growing Adoption of Minimally Invasive Procedures and Image-Guided Interventions is a Recent Trend

A prominent recent trend shaping the transcatheter embolization & occlusion devices market in 2024 and continuing into 2025 is the accelerating shift towards minimally invasive surgical procedures and sophisticated image-guided interventions. Patients and healthcare providers increasingly prefer procedures that offer reduced pain, shorter hospital stays, and faster recovery times compared to traditional open surgery. Embolization and occlusion procedures inherently fall under this category, relying heavily on real-time imaging modalities like fluoroscopy, CT, and ultrasound for precise device placement and targeted treatment.

The global shift towards minimally invasive surgery is evident across various medical fields. While specific global statistics for embolization procedures for 2024 are still emerging, data from the American Hospital Association (AHA) shows a continuing trend of shifting procedures to outpatient settings or minimally invasive approaches to improve patient experience and reduce costs.

For example, in 2023, many hospitals continued to adapt their surgical suites to accommodate more minimally invasive interventional procedures, reflecting a consistent strategic priority. This emphasis on minimally invasive, image-guided techniques directly drives the demand for specialized transcatheter devices, as they are integral to performing these procedures with accuracy and safety, reflecting a fundamental evolution in interventional medicine.

Regional Analysis

North America is leading the Transcatheter Embolization & Occlusion Devices Market

The transcatheter embolization and occlusion devices market in North America, holding a significant 38.5% share, experienced substantial growth in 2024. This expansion was primarily driven by the increasing prevalence of conditions requiring minimally invasive interventions, such as aneurysms, peripheral artery disease, and various tumors, coupled with technological advancements enhancing procedural safety and efficacy.

Peripheral artery disease (PAD) is a critical global health challenge, particularly affecting older adults; the number of people aged 40 years and older with PAD reached 113 million globally in 2019, according to a study published in BMC Public Health in May 2025, underscoring the significant patient population that can benefit from these devices. The shift towards less invasive procedures, which offer benefits like reduced recovery times and lower patient morbidity compared to traditional open surgeries, continues to fuel adoption.

Leading medical device manufacturers have reported strong performance in segments relevant to these devices. Boston Scientific’s Cardiovascular segment, which includes interventional cardiology solutions, achieved a 27.4% organic sales growth in 2024 compared to the prior year. Penumbra, Inc., a key player in this space, reported a total revenue of US$1,194.6 million for the full year 2024, an increase of 12.9% compared to 2023, with its global embolization and access products contributing significantly to this growth. Medtronic’s Coronary & Peripheral Vascular division also demonstrated robust performance, indicating strong demand for devices used in these procedures.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The transcatheter embolization and occlusion devices market in Asia Pacific is expected to grow considerably during the forecast period. This anticipated expansion is primarily driven by a rising burden of chronic diseases, increasing healthcare expenditure, and a growing adoption of advanced medical technologies within the region’s developing healthcare infrastructure. The incidence and mortality rates of cardiovascular diseases, which often necessitate interventional procedures, are still increasing in China, as highlighted in the “Report on Cardiovascular Health and Diseases in China 2022,” indicating a substantial and growing patient pool.

Governments across Asia Pacific are actively promoting minimally invasive techniques and investing in healthcare advancements. For instance, by 2024, it is estimated that over 50% of new hospital construction projects globally will incorporate hybrid operating rooms equipped for advanced interventional radiology procedures, a trend that will likely benefit the region. Major medical technology companies are strategically expanding their footprint in Asia Pacific to capitalize on these opportunities.

Boston Scientific’s Asia-Pacific (APAC) region reported an 18.0% reported sales growth in the second quarter of 2025, demonstrating strong regional demand for its cardiovascular products. Penumbra, Inc. also projects continued growth, with its global embolization and access products contributing to its overall revenue. These developments collectively indicate a robust and expanding market for interventional devices in Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the transcatheter embolization and occlusion devices market employ several strategies to drive growth. These include investing in research and development to innovate and enhance product offerings, thereby improving patient outcomes. Strategic mergers and acquisitions enable companies to expand their product portfolios and enter new markets. Collaborations with healthcare providers and research institutions facilitate the development of advanced technologies and broaden market reach.

Geographic expansion into emerging markets allows companies to tap into new customer bases and increase revenue streams. Adherence to regulatory standards ensures product safety and efficacy, building trust with healthcare professionals and patients. Additionally, companies focus on marketing and educational initiatives to raise awareness about the benefits of transcatheter procedures, thereby driving demand.

Cook Medical, a prominent player in this market, specializes in providing medical devices for various procedures, including transcatheter embolization and occlusion. The company offers a comprehensive range of products designed to treat vascular conditions, such as embolization coils and liquid embolic agents. Cook Medical emphasizes innovation and quality in its product development, aiming to improve patient outcomes and support healthcare professionals in delivering effective treatments. Through continuous research and collaboration, Cook Medical strives to advance the field of interventional radiology and expand its global presence.

Top Key Players

- Terumo Corporation

- Stryker

- Sirtex SIR-Spheres Pty Ltd.

- Shape Memory Medical, Inc

- Pfizer Inc

- Penumbra, Inc

- Nordion (Canada) Inc

- Merit Medical Systems, Inc

- Medtronic

- LEPU Medical

- DePuy Synthes (Johnson & Johnson)

- Cordis

- Boston Scientific Corporation

- Abbott

Recent Developments

- In June 2022, the US Food and Drug Administration granted Boston Scientific 510(k) approval for their EMBOLD Fibered Detachable Coil. This medical device is specifically engineered to occlude or significantly reduce blood flow in peripheral blood vessels, offering a notable advancement as a less invasive alternative for a range of vascular interventions.

- In July 2021, Terumo Medical introduced its AZUR Vascular Plug, an innovative device designed to operate in conjunction with a microcatheter. This groundbreaking plug provides the capability to effectively block arteries measuring up to 8mm in diameter, thereby enhancing the efficacy of peripheral vascular procedures by precisely managing blood flow within targeted arterial segments.

Report Scope

Report Features Description Market Value (2024) US$ 5.6 Billion Forecast Revenue (2034) US$ 11.8 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Non-Coil Devices (Flow Diverting Devices, Embolization Particles, Liquid Embolics, and Others) and Coils (Pushable Coils and Detachable Coils)), By Application (Oncology, Peripheral Vascular Disease, Neurology, Urology, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Terumo Corporation, Stryker, Sirtex SIR-Spheres Pty Ltd., Shape Memory Medical, Inc, Pfizer Inc, Penumbra, Inc, Nordion (Canada) Inc, Merit Medical Systems, Inc, Medtronic, LEPU Medical, DePuy Synthes (Johnson & Johnson), Cordis, Boston Scientific Corporation, Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Transcatheter Embolization And Occlusion Devices MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Transcatheter Embolization And Occlusion Devices MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Terumo Corporation

- Stryker

- Sirtex SIR-Spheres Pty Ltd.

- Shape Memory Medical, Inc

- Pfizer Inc

- Penumbra, Inc

- Nordion (Canada) Inc

- Merit Medical Systems, Inc

- Medtronic

- LEPU Medical

- DePuy Synthes (Johnson & Johnson)

- Cordis

- Boston Scientific Corporation

- Abbott