Global Swimming Sports Apparel & Accessories Market Size, Share, Growth Analysis By Category (Apparel, Accessories), By Distribution Channel (Supermarkets & Hypermarkets, Sporting Goods Retailers, Exclusive Brand Outlets, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146285

- Number of Pages: 385

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

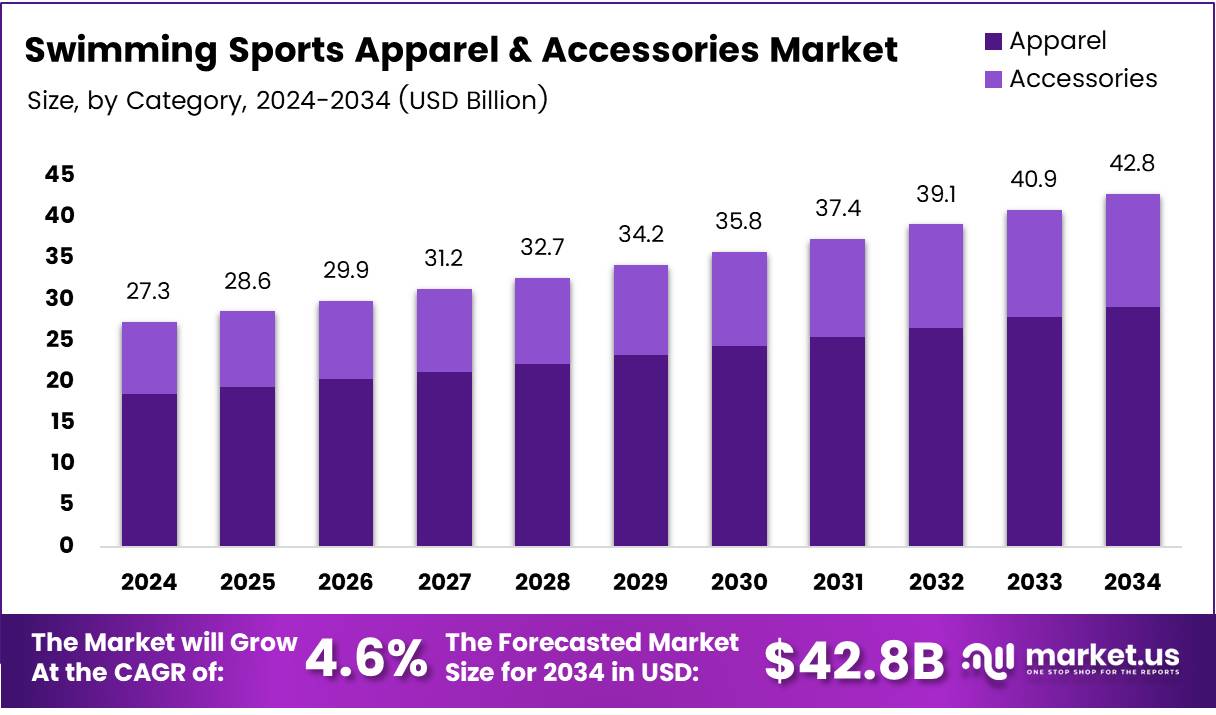

The Global Swimming Sports Apparel & Accessories Market size is expected to be worth around USD 42.8 Billion by 2034, from USD 27.3 Billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The Swimming Sports Apparel & Accessories market refers to the industry that manufactures and sells products designed specifically for swimming activities. This includes swimwear, swimsuits, swim caps, goggles, fins, earplugs, and other accessories that cater to recreational swimmers, professional athletes, and competitive swimmers. These products are engineered for comfort, durability, and enhanced performance, with a focus on materials that support water resistance, body contouring, and mobility in the water.

Additionally, a growing trend in technological advancements such as performance-enhancing swimwear like tech suits, which improve speed and buoyancy, is boosting demand in the market. This segment caters to various consumers, including individuals engaging in leisure swimming, training athletes, and competitive swimmers. The growing participation in swimming sports, especially in developed countries, is driving the market growth for swimwear and associated accessories.

The Swimming Sports Apparel & Accessories market has seen significant growth, driven by increasing awareness about the benefits of swimming as a sport, along with rising participation rates. According to Playtoday, 34% of Americans follow swimming as a sport, the highest globally, highlighting a strong demand for swimming-related products.

Technological advancements in swimwear, particularly tech suits, have also contributed to market growth. As reported by Swimming World Magazine, swim performance improved by 3.2% when swimmers wore a tech suit compared to a regular training suit, which drives competitive swimmers to invest in high-performance swimwear.

Furthermore, the rise of government-led initiatives promoting water safety and the reduction of drowning incidents has fueled the need for swimming apparel designed for children. According to Step Into Swim, 70% of childhood drowning victims were not wearing swimsuits, underlining the importance of providing accessible and safe swimwear for children.

The Swimming Sports Apparel & Accessories market is poised for substantial growth, driven by expanding participation in swimming at both the recreational and competitive levels. The sector stands to benefit from the increasing number of individuals adopting swimming as their preferred form of exercise. With technological innovations such as faster-drying materials, UV protection, and hydrodynamic designs, manufacturers can tap into new opportunities, particularly in the premium segment of the market.

Additionally, government investments aimed at promoting water safety and providing better facilities for swimming lessons and competitions are fueling demand for specialized swimwear. Governments worldwide are also focusing on drowning prevention, which is particularly important for children. Policies that encourage families to invest in high-quality swimwear and safety accessories are likely to drive long-term demand.

Regulatory frameworks related to product safety, material standards, and the environment will also impact the market, but they offer opportunities for manufacturers who can adapt to stringent regulations while meeting customer demands for high-quality and sustainable products.

Key Takeaways

- Global Swimming Sports Apparel & Accessories Market size is expected to reach USD 42.8 Billion by 2034, growing from USD 27.3 Billion in 2024.

- Market is projected to grow at a CAGR of 4.6% during the forecast period from 2025 to 2034.

- Apparel held a dominant market position in 2024 with a 67.8% share in the By Category Analysis segment.

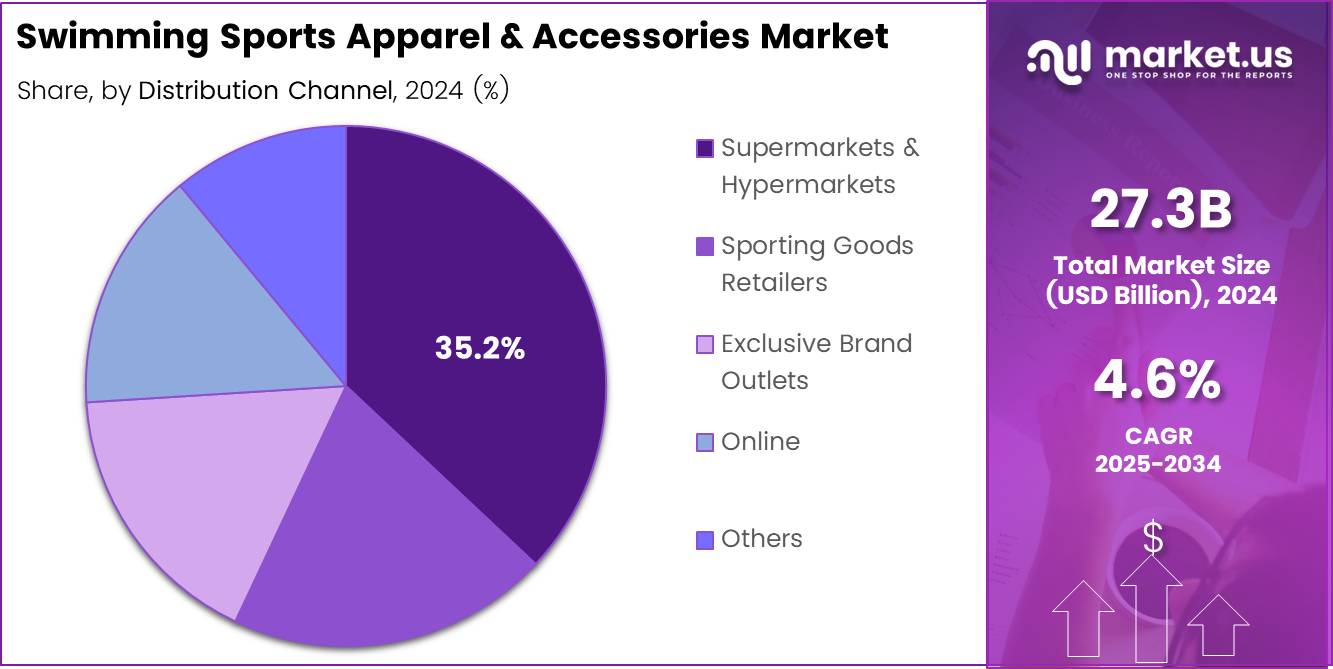

- Supermarkets & Hypermarkets dominated the By Distribution Channel segment in 2024 with a 35.2% share.

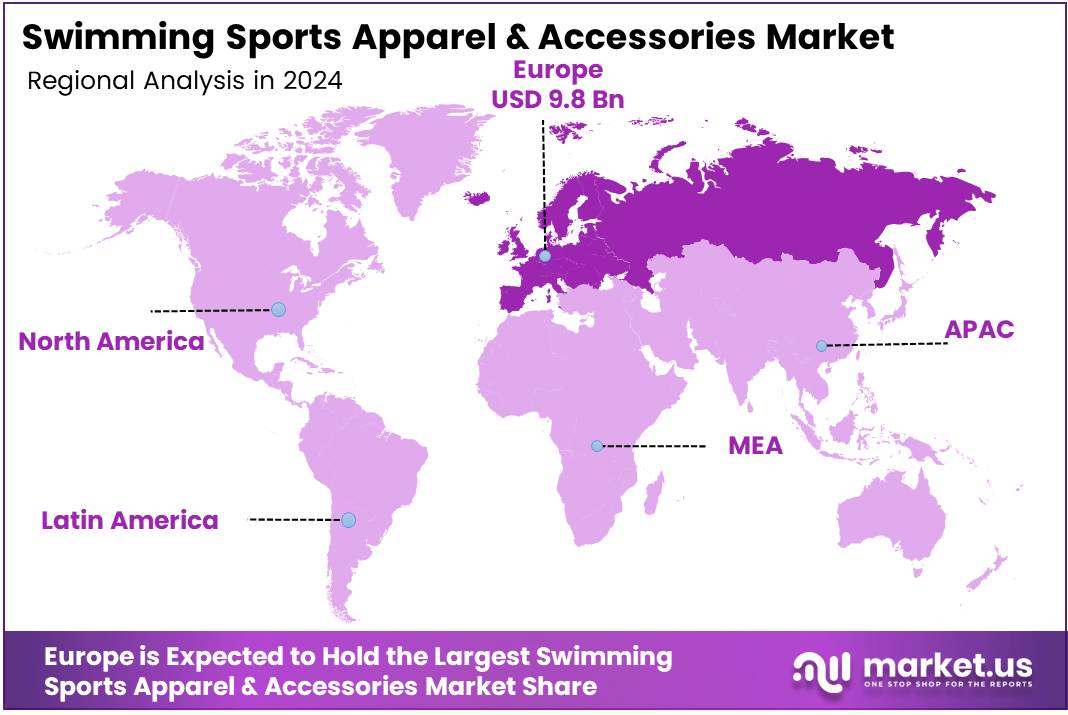

- Europe is the leading region, accounting for 36.1% of the total market share with a value of USD 9.8 billion.

Category Analysis

In 2024, Apparel held a dominant market position in the By Category Analysis segment of Swimming Sports Apparel & Accessories Market, with a 67.8% share

In 2024, the apparel category significantly outperformed other segments in the Swimming Sports Apparel & Accessories Market. It captured a substantial share of the market, contributing to the overall growth and development in the sector. The strong market presence of swimming apparel, driven by increasing consumer demand for high-performance and fashionable swimwear, played a crucial role in this dominance.

The apparel segment’s growth is also supported by the rising participation in swimming sports across various age groups and fitness enthusiasts. Additionally, the introduction of technologically advanced fabrics and designs, catering to both professional swimmers and casual users, further boosts the market’s appeal.

On the other hand, accessories in the Swimming Sports Apparel & Accessories Market also play a significant role, though they hold a smaller portion compared to apparel. Accessories such as swim caps, goggles, and swim fins are indispensable for swimming performance and comfort. While their share is notably lower than apparel, they continue to experience steady growth due to increased interest in swim training and recreational activities.

Distribution Channel Analysis

Supermarkets & Hypermarkets lead Swimming Sports Apparel & Accessories Market with a 35.2% share in 2024.

In 2024, Supermarkets & Hypermarkets held a dominant market position in the By Distribution Channel segment of the Swimming Sports Apparel & Accessories Market, with a 35.2% share. These retail formats continue to be favored by consumers due to their wide product range, convenience, and strategic locations. Their ability to cater to a diverse customer base with various price points drives their significant market share.

Sporting Goods Retailers also play a crucial role, offering specialized products that cater specifically to sports enthusiasts. While their market share is not as extensive as supermarkets and hypermarkets, they provide a targeted shopping experience, which appeals to consumers looking for high-quality or branded swimming gear.

Exclusive Brand Outlets contribute a niche but valuable segment in the distribution channel, offering exclusive collections and personalized shopping experiences. These outlets are particularly popular among brand-conscious customers who are willing to pay a premium for superior quality and design.

The Online segment has been increasingly gaining traction, driven by convenience and the growing trend of e-commerce. Consumers are now more inclined to purchase sports apparel and accessories online, where they can compare products and prices with ease.

Other channels, grouped under Others, include smaller independent retailers and specialty stores, which contribute to the market but hold a smaller overall share.

Key Market Segments

By Category

- Apparel

- Swimsuits

- Baby

- Women

- Kids

- Men

- Teens

- Tops and Watershirts

- Baby

- Kids

- Men

- Women

- Swimsuits

- Accessories

- Swim Goggles

- Adults

- Junior

- Swim Caps

- Adults

- Junior

- Fins

- Adults

- Junior

- Towels

- Adults

- Junior

- Water Shoes

- Flipflops

- Men

- Women

- Junior

- Sandals

- Men

- Women

- Junior

- Aquashoes

- Men

- Women

- Junior

- Flipflops

- Aqualearning Products

- Sun Shelters

- Swim Goggles

By Distribution Channel

- Sporting Goods Retailers

- Supermarkets & Hypermarkets

- Exclusive Brand Outlets

- Online

- Others

Drivers

Growing Popularity of Swimming as a Fitness Trend is Driving the Market Forward

The swimming sports apparel and accessories market is experiencing solid growth, thanks to a rise in people turning to swimming as a preferred fitness activity. Urban populations, in particular, are embracing swimming for its low-impact benefits and overall wellness appeal. This shift in lifestyle is increasing the demand for both performance and recreational swimwear.

Additionally, the market is being boosted by technological innovations in swimwear materials. Brands are investing in high-quality, water-resistant, and fast-drying fabrics that not only improve performance but also offer greater comfort. These tech-driven products are especially popular among fitness swimmers and professionals.

Moreover, there’s been noticeable growth in competitive swimming—both at local and international levels. As a result, demand for specialized gear like racing suits, goggles, and training accessories has gone up. Overall, the combination of fitness trends, better materials, and competitive enthusiasm is driving this market upward steadily.

Restraints

Seasonal Nature of Swimming Limits Year-Round Demand

Despite the strong market drivers, the swimming sports apparel and accessories market faces a few challenges. One major limitation is the seasonality of swimming activities. In many parts of the world, swimming is mostly done during warmer months. This seasonal trend leads to inconsistent demand throughout the year, especially in colder regions where indoor swimming isn’t as common.

Another challenge is growing competition from other water sports. Activities like surfing, kayaking, and paddleboarding are becoming more popular, and they often require different types of gear. This splits consumer attention and spending, reducing the exclusive growth potential for swimming-specific products. As a result, brands need to find ways to maintain visibility and relevance beyond the peak swimming season and across a broader sports audience.

Growth Factors

Expansion in Emerging Economies Creates New Growth Pathways

The swimming sports apparel and accessories market holds strong potential in emerging regions such as Asia-Pacific, Latin America, and the Middle East. With rising income levels and growing awareness about health and wellness, more people in these areas are engaging in recreational and professional swimming. This opens doors for global and regional brands to tap into new consumer segments.

Another exciting opportunity lies in sustainability. As consumers become more eco-conscious, there is increasing demand for swimwear made from recycled materials or using sustainable manufacturing practices. Companies that lead in green innovation are likely to gain a competitive edge.

Lastly, the future may also be shaped by smart swimwear. Integrating wearable technology—such as fitness tracking sensors—into swimsuits could appeal to tech-loving users who want more data from their workouts. These opportunities signal a promising future for the market, especially for brands willing to innovate and expand.

Emerging Trends

Gender-Neutral Swimwear and Smart Features are Shaping Consumer Preferences

Trends in the swimming sports apparel market are evolving fast, with consumers now looking for more than just style. One major trend is the rise of gender-neutral swimwear. More brands are focusing on inclusive designs that cater to all body types and identities, which helps them connect with a wider audience. Alongside inclusivity, functionality is also gaining attention.

Swimwear with built-in UV protection, chlorine resistance, and anti-odor features is becoming a top choice for both casual swimmers and professionals. These practical benefits enhance user experience and increase product value. Moreover, celebrity endorsements and collaborations with influencers are boosting brand appeal.

When a well-known athlete or content creator showcases a swimwear line, it immediately draws interest and trust from consumers. All these factors—diversity, tech-forward features, and social media influence—are shaping the way people choose and relate to swimwear today.

Regional Analysis

Europe Dominates the Swimming Sports Apparel & Accessories Market with 36.1% Share, Valued at USD 9.8 Billion

The global swimming sports apparel and accessories market is characterized by regional variations that reflect diverse consumer preferences, economic conditions, and market dynamics. Europe stands out as the dominant region, accounting for 36.1% of the total market share, with a market value of USD 9.8 billion.

This dominance is largely driven by a strong sporting culture, a high level of participation in swimming activities, and increasing investment in aquatic sports infrastructure. Additionally, the region benefits from a well-established retail environment and leading brands, which further contribute to the growth of swimming sports apparel and accessories.

Regional Mentions:

North America follows closely, with a substantial market share supported by a robust sports culture, high consumer spending, and the widespread popularity of swimming in both recreational and competitive settings. This region also benefits from a highly developed retail sector, including both online and offline channels, making swimming apparel and accessories easily accessible to a broad consumer base.

Asia Pacific is the fastest-growing market, driven by the rising popularity of swimming sports in countries like China, Japan, and India, alongside a growing middle-class population with increased disposable income. In this region, both the demand for recreational swimming and the expansion of swimming as a competitive sport are fueling market growth.

The Middle East & Africa and Latin America markets are smaller in comparison, but both regions show significant potential due to increasing urbanization, rising awareness of fitness, and government initiatives to improve sports facilities. While swimming is not as entrenched as in other regions, there is a growing inclination toward adopting swimming as a key fitness activity, supporting demand for related apparel and accessories.

Thus, Europe’s stronghold in the market is projected to continue, though other regions, particularly Asia Pacific, are expected to see rapid expansion in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global Swimming Sports Apparel & Accessories Market has remained competitive and dynamic, with key players adopting innovative strategies to consolidate their market presence.

Speedo International Ltd. and Arena Italia S.p.A. continue to lead the market due to their strong brand legacy, broad product portfolios, and consistent investments in high-performance swimwear. Their focus on elite swimming gear designed for competitive athletes positions them favorably in professional circuits.

TYR Sport Inc. and Finis Inc. have concentrated on research-driven designs, introducing technologically advanced products such as hydrodynamic suits and training aids, thus reinforcing their influence in the performance segment.

Adidas AG and Nike, Inc., as global sportswear giants, maintain a significant foothold through their expansive retail reach and endorsement of top-tier athletes. Their diversification across product categories and integration of sustainable materials have further enhanced their brand perception among environmentally conscious consumers.

Decathlon S.A., with its value-driven offerings and private-label strategies, continues to dominate in the mid-range and entry-level segments, appealing to recreational swimmers and beginners. Mizuno Corporation and Aqua Sphere are focusing on niche innovations and regional market expansions, particularly in Asia-Pacific and Europe, where swimming is gaining popularity as a fitness activity.

Zoggs International Ltd. leverages its strong distribution networks and emphasis on children’s swim gear and safety accessories to target the growing family and leisure segment. Collectively, these players are shaping the market through product innovation, brand partnerships, and a rising focus on sustainability and performance enhancement in aquatic sports.

Top Key Players in the Market

- Mizuno Corporation

- Zoggs International Ltd.

- Aqua Sphere

- Decathlon S.A

- Arena Italia S.p.A.

- TYR Sport Inc

- Adidas AG

- Nike, Inc.

- Speedo International Ltd.

- Finis Inc.

Recent Developments

- In August 2024, Decathlon announced plans to tap into India’s rapidly growing sports market with a significant €100 million investment aimed at enhancing its presence and expanding its product offerings in the country.

- In January 2024, Platinum Equity successfully acquired Augusta Sportswear Brands and Founder Sport Group, strengthening its portfolio in the sportswear sector and positioning itself to leverage new growth opportunities in the apparel market.

- In November 2024, Avenue Sports and Playmaker formed a strategic partnership to increase their private equity investments in sports, focusing on expanding their reach and influence across the global sports industry.

- In December 2023, Agilitas Sports secured a significant Rs 100 crore investment from Nexus Venture, providing the company with the resources to accelerate its growth and further develop its sports-focused ventures.

Report Scope

Report Features Description Market Value (2024) USD 27.3 Billion Forecast Revenue (2034) USD 42.8 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Category (Apparel, Accessories), By Distribution Channel (Supermarkets & Hypermarkets, Sporting Goods Retailers, Exclusive Brand Outlets, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mizuno Corporation, Zoggs International Ltd., Aqua Sphere, Decathlon S.A, Arena Italia S.p.A., TYR Sport Inc, Adidas AG, Nike, Inc., Speedo International Ltd., Finis Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Swimming Sports Apparel and Accessories MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Swimming Sports Apparel and Accessories MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mizuno Corporation

- Zoggs International Ltd.

- Aqua Sphere

- Decathlon S.A

- Arena Italia S.p.A.

- TYR Sport Inc

- Adidas AG

- Nike, Inc.

- Speedo International Ltd.

- Finis Inc.