Global Premium Sportswear Market By Product (Top Wear, Bottom Wear, Underwear and Base Layers), By Distribution Channel (Sporting Goods Retailers, Online, Supermarkets and Hypermarkets, Exclusive Brand Outlets, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140067

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

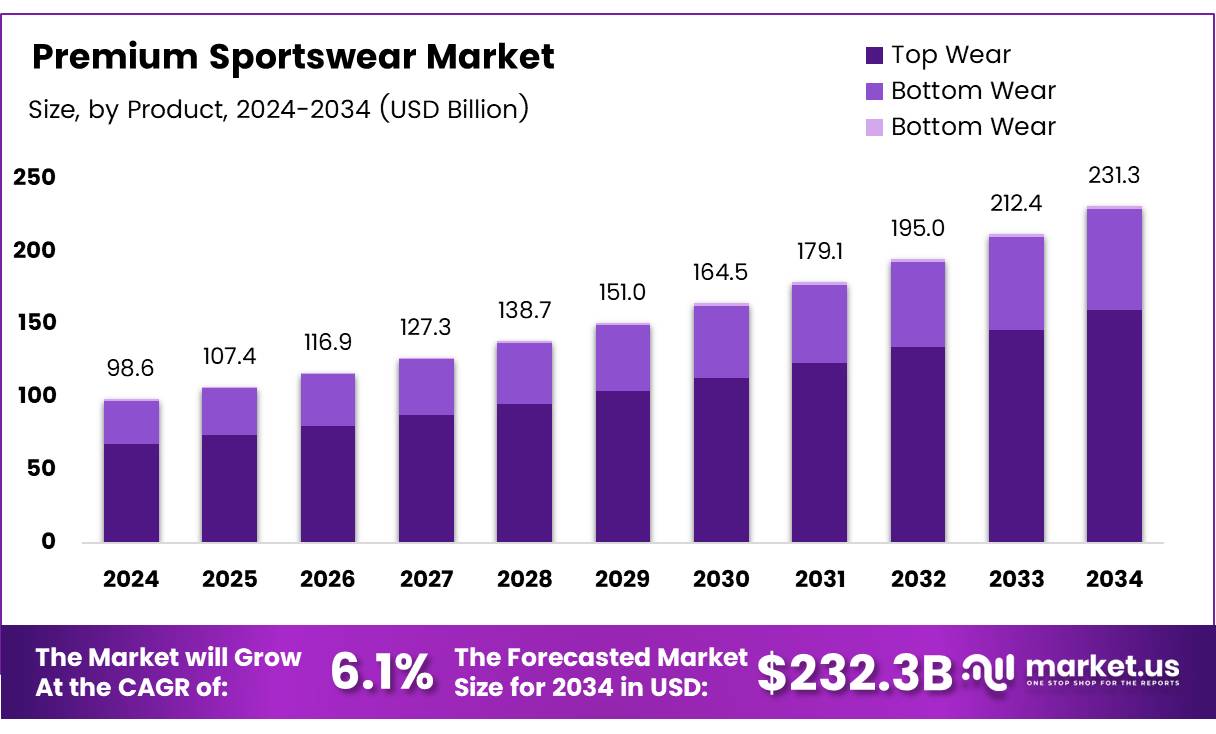

The Global Premium Sportswear Market size is expected to be worth around USD 231.3 Billion by 2034, from USD 98.6 Billion in 2024, growing at a CAGR of 8.9% during the forecast period from 2025 to 2034.

The premium sportswear market comprises high-end athletic apparel and accessories designed for both performance and lifestyle use. This segment caters to a demographic that values quality, brand prestige, and the latest in fabric technology and design aesthetics.

Over the last decade, there has been a significant shift towards premiumization in sportswear, driven by consumer demand for products that offer both functionality and style. The rise of athleisure clothing that can be worn for both exercise and everyday activities has further propelled the premium segment, making it a staple in the wardrobes of fitness enthusiasts and fashion-forward consumers alike.

The premium sportswear market is poised for continued growth, fueled by increasing health awareness and a growing interest in fitness activities among all age groups, particularly Millennials and Gen-Z. These younger demographics are not only fitness conscious but also prioritize sustainable and versatile fashion, driving demand for high-quality sportswear that aligns with their ethical and aesthetic values.

According to Business of Fashion, by 2024, two in three Millennial and Gen-Z customers are expected to wear athleisure multiple times per week, underlining the robust potential for growth in this segment. Moreover, innovations in fabric technology and garment manufacturing, which enhance the performance and appeal of sportswear, present further opportunities for market expansion.

Government policies and investments in public health initiatives that promote physical activities have a positive impact on the sportswear market. By facilitating sports programs and constructing public sports facilities, governments boost the population’s participation in physical activities, subsequently increasing the demand for athletic apparel.

Furthermore, regulations concerning product quality and sustainability standards are becoming stricter, pushing companies to innovate and produce more environmentally friendly and higher-quality products. This regulatory environment helps maintain high standards in the premium segment, ensuring consumer trust and brand loyalty.

Consumer preferences in the premium sportswear market are heavily influenced by the dual demands for comfort and functionality. According to Sportwear Statistics from Coolest Gadgets, about 53% of consumers stated that comfort was their primary consideration in sportswear purchases.

Additionally, in China, a significant proportion of sportswear buyers 56.18% according to News Market US cite gym workouts as their main reason for purchasing these garments, highlighting the importance of performance-oriented features.

Key Takeaways

- Global Premium Sportswear Market projected to reach USD 231.3 Billion by 2034, growing at a CAGR of 8.9% from 2025 to 2034.

- Top Wear dominates the Product Analysis segment with a 69.1% market share due to diverse offerings and consumer appeal.

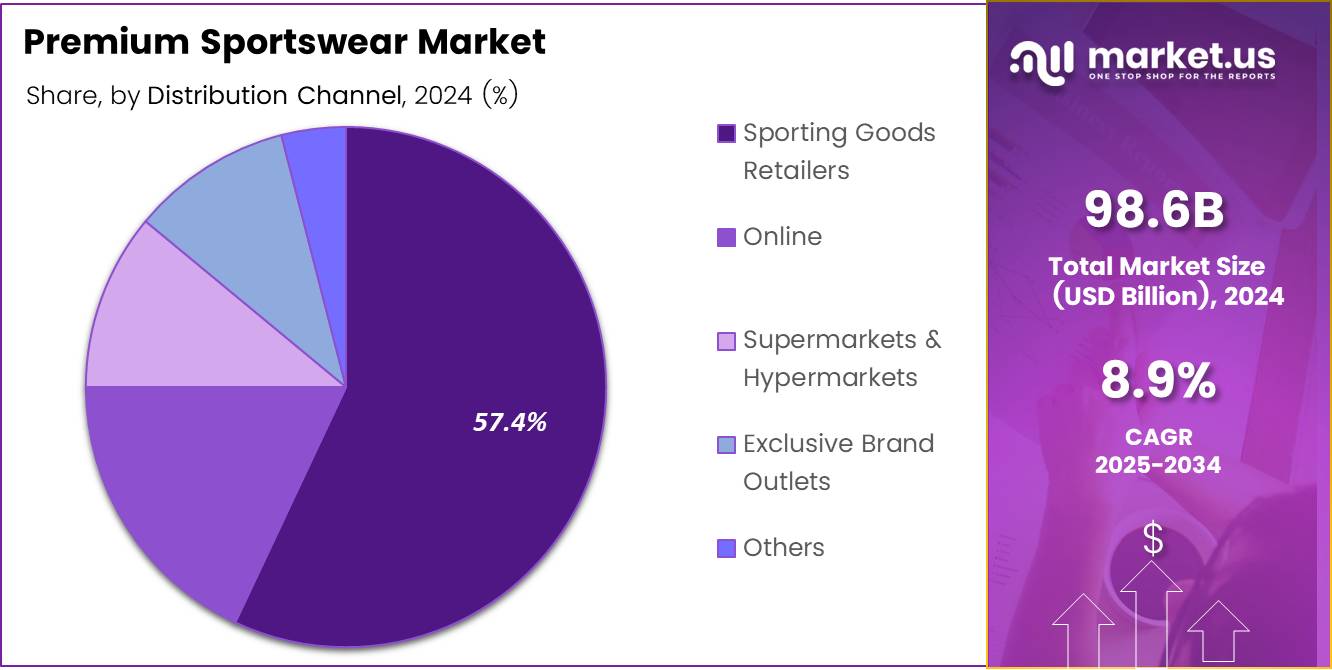

- Sporting Goods Retailers lead the Distribution Channel segment, holding a 57.4% share, benefiting from broad geographic reach and product variety.

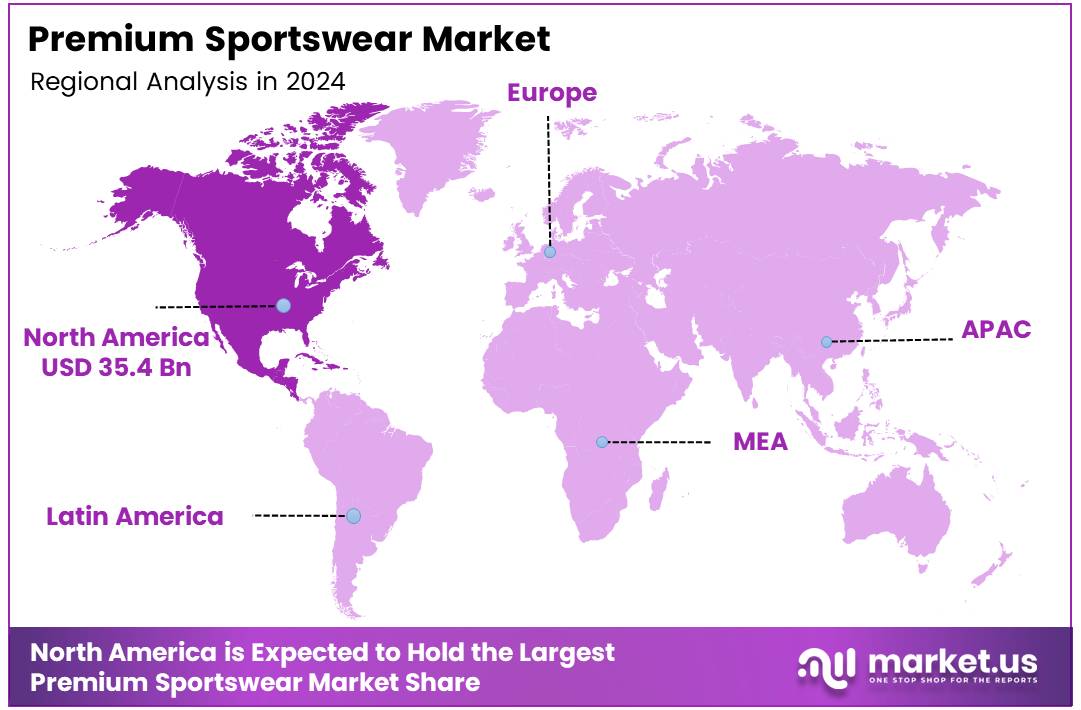

- North America leads regional markets with a 36.3% share, valued at USD 35.4 billion, indicating robust market control.

Product Analysis

Top Wear Continues to Dominate Premium Sportswear with a 69.1% Market Share

In 2024, the Premium Sportswear Market witnessed significant growth, with Top Wear maintaining its stronghold in the By Product Analysis segment. Capturing a dominant market share of 69.1%, this category outperformed others due to its diverse offerings and widespread consumer appeal.

Top Wear encompasses a range of products including T-shirts & Tops, Hoodies & Sweatshirts, Jackets, among others, each tailored to meet the varied demands of active consumers seeking both style and functionality.

This segment’s success can be attributed to ongoing innovations in fabric technology and design, which enhance the performance and comfort of sportswear, making it suitable for a wide array of physical activities. Market trends indicate a growing consumer preference for versatile and durable garments that cater to both athletic and casual wear needs, thereby supporting the sustained popularity of Top Wear.

Comparatively, Bottom Wear, which includes Pants & Leggings and Shorts & Skorts, and Underwear/Base Layers also showed growth, albeit at a slower pace. These segments are evolving with consumer lifestyles and preferences, focusing on comfort, performance, and sustainability. However, Top Wear remains the frontrunner, driving the premium sportswear market forward with its broad appeal and continuous innovation.

Distribution Channel Analysis

Sporting Goods Retailers Lead with 57.4% in Premium Sportswear Distribution

In 2024, Sporting Goods Retailers maintained a dominant market position in the By Distribution Channel Analysis segment of the Premium Sportswear Market, capturing a 57.4% share.

This substantial market share underscores the pivotal role that these retailers play in the sportswear landscape, attributing their success to a combination of extensive geographical reach and the ability to offer a diverse range of products tailored to sports enthusiasts.

The next prominent distribution channel, Online, has shown robust growth due to the increasing consumer preference for convenience and the expanded accessibility of global brands through e-commerce platforms.

Supermarkets & Hypermarkets also contribute significantly, offering convenience and immediate product availability which appeals to a broad consumer base. Exclusive Brand Outlets provide a curated experience that emphasizes brand value and customer loyalty through personalized services.

Other emerging channels include specialized boutiques and department stores, which although smaller in scale, are significant for targeting niche markets and providing high-end products.

Each channel’s effectiveness is influenced by factors such as consumer behavior trends, technological advancements, and the strategic placement of retail outlets. These dynamics are crucial for stakeholders aiming to enhance market penetration and optimize sales strategies in the evolving landscape of premium sportswear.

Key Market Segments

By Product

- Top Wear

- T-shirts & Tops

- Hoodies & Sweatshirts

- Jackets

- Others

- Bottom Wear

- Pants & Leggings

- Shorts & Skorts

- Underwear/ Base Layers

By Distribution Channel

- Sporting Goods Retailers

- Online

- Supermarkets & Hypermarkets

- Exclusive Brand Outlets

- Others

Drivers

Rising Health Awareness Fuels Premium Sportswear Market Expansion

As a market analyst observing the premium sportswear sector, it’s clear that a growing consciousness about health and fitness is significantly propelling the demand for high-quality athletic apparel. This trend is supported by several key drivers.

Firstly, the expansion of e-commerce and direct-to-consumer sales channels is making these specialized garments more accessible to a global audience, ensuring that consumers anywhere can obtain the latest in athletic fashion and functionality.

Additionally, technological innovations in fabric production, such as smart textiles that offer moisture-wicking, temperature control, and antibacterial properties, are elevating the performance and comfort of sportswear, aligning with consumer expectations for premium products.

Furthermore, brand loyalty remains strong in this market segment, with consumers showing a marked preference for established, reputable brands that promise not only style and durability but also a status symbol reflecting their personal values and lifestyle choices. This synergy of health awareness, technological progress, and brand prestige is dynamically shaping the premium sportswear market.

Restraints

High Costs Challenge Premium Sportswear Market Accessibility

Analyzing the premium sportswear market reveals significant restraints that could hinder its growth. The primary challenge is the high cost associated with luxury sportswear brands, which inherently limits their affordability and accessibility for the average consumer. These high prices often reflect the quality, technological innovation, and brand prestige of the products but can restrict the customer base to a more affluent segment.

Moreover, the market is also contending with the prevalence of counterfeit and unbranded products that appeal to cost-conscious consumers. These cheaper alternatives not only compete with genuine premium brands in terms of price but also saturate the market, potentially confusing customers and diluting brand value.

This competition from lower-priced and counterfeit sportswear poses a persistent threat to the integrity and financial success of established premium brands, impacting their market share and consumer trust.

Growth Factors

Tapping into Emerging Markets Fuels Growth in the Premium Sportswear Sector

As an analyst, it’s clear that the premium sportswear market is poised for substantial growth, particularly through strategic expansion into emerging markets. Countries in Asia-Pacific, Latin America, and Africa present a fertile ground for market penetration due to their rising middle-class populations and increasing interest in health and fitness.

Additionally, there is a significant opportunity in customization and personalization trends. Consumers are increasingly seeking products that reflect their personal style and meet specific performance needs, which premium brands can cater to with customized fits and unique designs. The advent of innovative smart sportswear is another growth avenue.

By integrating AI, IoT, and smart sensors, brands can offer apparel that enhances athletic performance through precise tracking and analysis, appealing to tech-savvy consumers. Moreover, the shift towards sustainability is reshaping consumer preferences.

There is a growing demand for eco-friendly sportswear made from recycled materials, pushing brands to innovate in recyclable and sustainable apparel production. These opportunities, if leveraged correctly, could define the future trajectory of the premium sportswear market, leading to increased market share and higher profitability.

Emerging Trends

Rising Demand for Home-Based and Hybrid Workout Wear Propels Premium Sportswear Market

In the premium sportswear market, several trends are reshaping consumer preferences and driving growth. First, there’s an escalating demand for comfortable yet stylish attire suitable for home workouts and virtual fitness classes, reflecting the ongoing shift towards remote and hybrid fitness regimes. This trend has been amplified by the pandemic but continues as a preference for many.

Additionally, the growth of direct-to-consumer (D2C) brands is revolutionizing the market, as more companies bypass traditional retail channels to engage directly with customers, offering them personalized experiences and often, superior product quality.

The rise of gender-neutral sportswear is another significant trend, with consumers increasingly opting for unisex and inclusive designs that defy traditional gender norms. Moreover, the integration of wearable technology into performance apparel is gaining momentum.

These smart garments feature embedded fitness tracking and biometric monitoring, catering to a growing consumer base that values technology-assisted fitness insights. Collectively, these trends are setting the stage for a dynamic evolution in the premium sportswear industry, with a clear focus on comfort, inclusivity, direct consumer relationships, and technological integration.

Regional Analysis

North America Leads Premium Sportswear Market with 36.3% Share Worth USD 35.4 Billion

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each presenting unique growth trajectories and market dynamics. North America is the dominating region, holding a substantial 36.3% market share valued at USD 35.4 billion.

This dominance is attributed to high consumer spending power and a strong presence of major sportswear brands that innovate continuously while expanding their digital and retail footprints. The U.S. leads in this region, with trends showing an increasing inclination towards athleisure and premium sports apparel driven by health and wellness trends among millennials and Gen Z consumers.

Regional Mentions:

In Europe, the premium sportswear market thrives due to high health consciousness and an established sporting culture, particularly in countries like Germany, the UK, and France. The market is bolstered by the region’s strong fashion industry influence, integrating high-end aesthetics with functional sportswear.

Asia Pacific is witnessing the fastest growth, fueled by increasing disposable incomes and a burgeoning middle class. Countries like China and India are pivotal, with their vast populations embracing fitness regimes and international sports brands, which is expanding the market at an accelerated pace.

The Middle East & Africa region, though smaller in comparison, is rapidly emerging as a lucrative market for premium sportswear. The growth is spurred by increasing urbanization, young demographics, and growing expatriate communities with high spending capabilities, particularly in Gulf countries like the UAE and Saudi Arabia.

Latin America, with its passionate sports culture, especially in countries like Brazil and Argentina, shows promising growth in the premium sportswear sector. The region benefits from the popularity of football and other sports, which drives demand for high-quality sports apparel.

Overall, while North America currently leads the market in revenue and market share, Asia Pacific is expected to challenge this dominance in the coming years with its rapid growth rate and expanding consumer base seeking premium sportswear solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global premium sportswear market, the competition among key players is intensifying as consumer preferences shift towards high-quality, sustainable, and technologically advanced athletic apparel. For 2024, companies like Nike, Inc., Adidas AG, and Under Armour, Inc. are expected to maintain their leadership positions through strategic innovations and global branding initiatives.

Nike, Inc. continues to dominate the premium segment with its strong brand recognition and wide-ranging product offerings. The company’s focus on digital transformation and direct-to-consumer sales channels is enhancing its market presence and customer engagement. Nike’s commitment to sustainability, evident in its Move to Zero initiative, also resonates well with the growing consumer demand for eco-friendly products.

Adidas AG is another significant contender, known for its quality, innovation, and sustainability. The company’s investment in digital capabilities and its ability to rapidly respond to market trends through initiatives like its Speedfactory are expected to bolster its competitive edge. Additionally, Adidas’s collaboration with celebrities and designers continues to enhance its brand appeal and market penetration.

Under Armour, Inc., with its focus on performance-enhancing sportswear, is strategically expanding its footprint in international markets. The company’s investment in innovation, particularly in connected fitness and wearable technology, is likely to attract tech-savvy consumers.

Emerging trends such as athleisure wear and an increased focus on wellness are influencing product development and marketing strategies across these companies. Players like Lululemon Athletica Inc. and The North Face are capitalizing on these trends by diversifying their product lines to include casual, yet functional sportswear, appealing to a broader audience.

Top Key Players in the Market

- Columbia Sportswear Company

- Puma SE

- Lululemon Athletica Inc.

- Nike, Inc.

- Reebok International Ltd.

- The North Face

- Adidas AG

- Under Armour, Inc.

- New Balance Athletics, Inc.

- Asics Corporation

Recent Developments

- In January 2024, French sportswear retailer Decathlon announced plans to invest €100 million in expanding its operations in India, aiming to enhance its market presence and increase its number of stores across the country.

- In September 2024, Agilitas Sports secured strategic funding from Spring Marketing Capital, which will be used to boost their marketing efforts and expand their sports apparel and equipment lines.

- In November 2023, British sportswear brand Castore received a £145 million investment from The Raine Group, Hanaco Ventures, and Felix Capital to accelerate their global growth and enhance product innovation.

- In November 2024, American lifestyle and performance wear brand Vuori announced a substantial $825 million investment led by General Atlantic and Stripes, intended to support international expansion and increase their digital presence.

Report Scope

Report Features Description Market Value (2024) USD 98.6 Billion Forecast Revenue (2034) USD 231.3 Billion CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Top Wear, Bottom Wear, Underwear and Base Layers), By Distribution Channel(Sporting Goods Retailers, Online, Supermarkets & Hypermarkets, Exclusive Brand Outlets, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Columbia Sportswear Company, Puma SE, Lululemon Athletica Inc., Nike, Inc., Reebok International Ltd., The North Face, Adidas AG, Under Armour, Inc., New Balance Athletics, Inc., Asics Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Columbia Sportswear Company

- Puma SE

- Lululemon Athletica Inc.

- Nike, Inc.

- Reebok International Ltd.

- The North Face

- Adidas AG

- Under Armour, Inc.

- New Balance Athletics, Inc.

- Asics Corporation