Global Licensed Sports Merchandise Market Size, Share, Growth Analysis By Product Type (Apparel, Footwear, Headwear, Accessories, Collectibles & Memorabilia, Toys and Games, Home Decor, Equipment), By Sport Type (Football (Soccer), American Football, Basketball, Baseball, Ice Hockey, Cricket, Tennis, Others), By Distribution Channel (Online Retail, Specialty Sports Stores, Department Stores, Hypermarkets & Supermarkets, Brand Outlets), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 138975

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

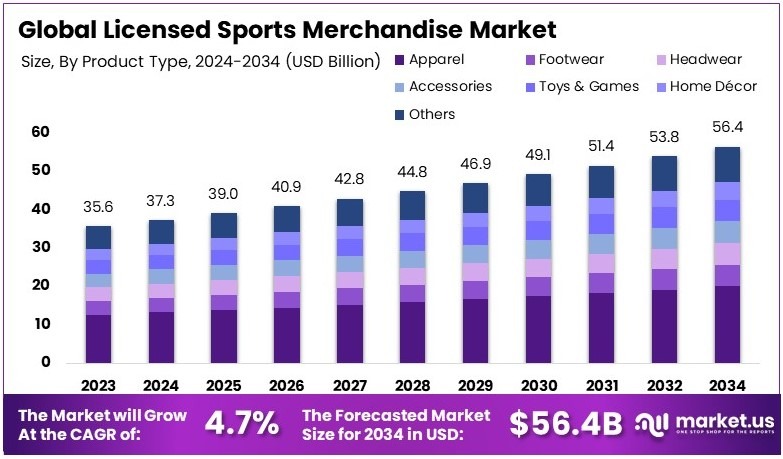

The Global Licensed Sports Merchandise Market size is expected to be worth around USD 56.4 Billion by 2034, from USD 35.6 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

Licensed sports merchandise refers to branded products that feature the logos, names, or trademarks of sports teams, leagues, or athletes. These products include apparel, accessories, collectibles, and equipment, and are officially authorized by the sports organizations to be sold. They allow fans to show support for their favorite teams or athletes.

The licensed sports merchandise market involves the buying and selling of officially licensed products that represent sports teams, leagues, or athletes. This market caters to sports fans looking to purchase team-branded apparel, memorabilia, and accessories. Growth in the market is fueled by the increasing popularity of sports events and fan culture worldwide.

The licensed sports merchandise market continues to grow as more fans engage with their favorite teams. For instance, 65% of Gen-Z sports fans prefer brands that support their teams, creating strong demand for team-related products. The rise of digital platforms also fuels sales, with 95.5 million people in the U.S. watching sports online in 2023.

As the market expands, brands have a significant opportunity to tap into a loyal consumer base. Merchandise, including sportswear, accessories, and memorabilia, sees consistent demand, particularly during major events. With fan engagement growing, there is room for further innovation in product offerings, creating opportunities for brands to meet evolving customer needs.

The market is competitive but not saturated. Major brands dominate, yet smaller players find space by offering unique or limited-edition products. The rise of direct-to-consumer online sales channels allows new companies to reach fans without traditional retail costs. This, in turn, makes the market dynamic and full of potential.

Governments play a role too. Regulations on intellectual property protect the licensed merchandise market, ensuring that brands can legally profit from team affiliations. Additionally, increasing sports tourism and government-backed events help drive consumer interest in licensed merchandise, further stimulating local and national economies.

Key Takeaways

- The Licensed Sports Merchandise Market was valued at USD 35.6 Billion in 2024, and is expected to reach USD 56.4 Billion by 2034, with a CAGR of 4.7%.

- In 2024, Apparel dominates the product type segment with 35.4%, as fans prefer to wear team-branded clothing to show support for their favorite sports.

- In 2024, Football (Soccer) leads the sport type segment with 40.7%, reflecting the global popularity of soccer and the high demand for related merchandise.

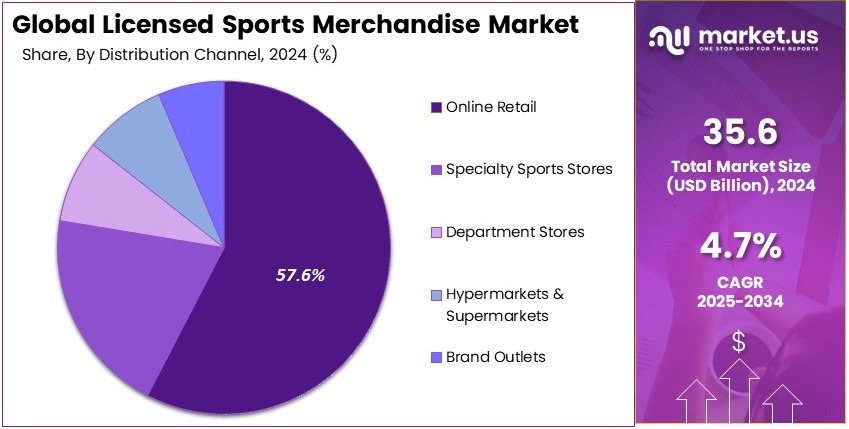

- In 2024, Online Retail leads the distribution channel segment with 57.6%, due to the convenience and accessibility of shopping for sports merchandise online.

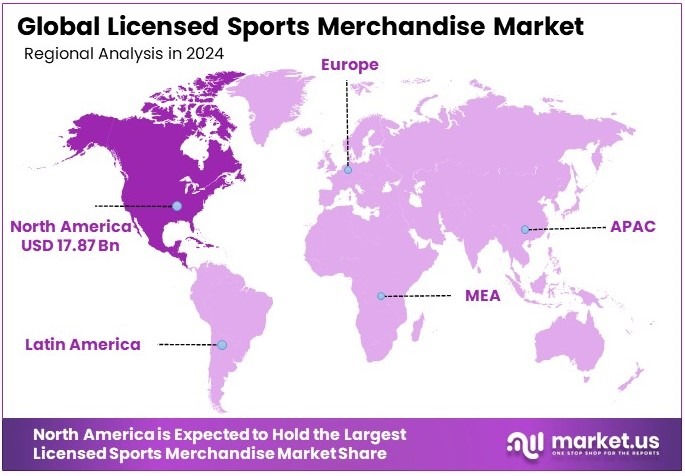

- In 2024, North America dominates the regional market with 50.2% share, valued at USD 17.87 Billion, driven by high fan engagement and widespread merchandise consumption.

Product Type Analysis

Apparel sub-segment dominates with 35.4% due to wide consumer appeal and variety.

In the Licensed Sports Merchandise Market, Apparel stands out as the dominant sub-segment, holding a 35.4% market share. This dominance is attributed to the broad appeal of sports jerseys, jackets, and hats that fans wear to support their favorite teams and players. Apparel items are versatile, used in casual wear or at sporting events, making them a popular choice among consumers.

Footwear includes sneakers and cleats associated with sports brands and athletes. Headwear, like caps and beanies, is also significant for fans showing team pride. Accessories such as belts, bags, and scarves cater to a niche but loyal customer base.

Collectibles & Memorabilia are important for hardcore fans and collectors. Toys & Games engage younger audiences, while Home Décor items like branded bedding and curtains extend fan engagement into personal spaces. Equipment, though smaller in share, includes items like balls and bats branded with team logos.

Sport Type Analysis

Football (Soccer) dominates with 40.7% due to its global popularity and extensive fan base.

In the Sport Type segment, Football (Soccer) commands the largest market share at 40.7%, reflecting its status as the world’s most popular sport with a vast global fan base. This popularity drives significant demand for soccer-related merchandise, especially during international tournaments like the FIFA World Cup and regional leagues.

American Football, particularly popular in the United States, sees high sales of team jerseys and helmets. Basketball is another major segment, driven by NBA’s global reach and star power. Baseball, with a deep-rooted fan base, especially in the U.S. and Japan, focuses on caps and jerseys.

Ice Hockey is dominant in colder regions with fan gear like jerseys and pucks. Cricket is crucial in the Commonwealth countries, driving demand for team India and England merchandise. Tennis and other sports like golf and motorsports also contribute with their niche, yet lucrative merchandise offerings.

Distribution Channel Analysis

Online Retail dominates with 57.6% due to convenience and global reach.

The Distribution Channel segment is crucial in understanding how sports merchandise reaches consumers. Online Retail is the leading sub-segment, holding a 57.6% market share, fueled by the convenience of shopping from home and the ability to access a wide range of products globally. This channel’s growth is supported by the increasing use of smartphones and the internet.

Specialty Sports Stores offer personalized service and immediate product availability, which is especially important for fitting sports footwear and trying on high-end apparel. Department Stores provide a broad selection of merchandise, appealing to general shoppers.

Hypermarkets & Supermarkets, though less specialized, attract customers seeking convenience and competitive pricing. Brand Outlets are essential for providing authentic, high-quality merchandise directly from the sports brands.

Key Market Segments

By Product Type

- Apparel

- Footwear

- Headwear

- Accessories

- Collectibles & Memorabilia

- Toys & Games

- Home Décor

- Equipment

By Sport Type

- Football (Soccer)

- American Football

- Basketball

- Baseball

- Ice Hockey

- Cricket

- Tennis

- Others

By Distribution Channel

- Online Retail

- Specialty Sports Stores

- Department Stores

- Hypermarkets & Supermarkets

- Brand Outlets

Driving Factors

Driving Factors Propel Market Expansion

The growing popularity of major sports leagues and global fan engagement has significantly boosted demand for licensed sports merchandise. Fans worldwide eagerly follow their favorite teams and athletes, which drives consistent interest in authentic merchandise. In addition, the increasing demand for athlete-endorsed and team-branded apparel further fuels market growth. For example, fans often purchase jerseys and caps to show their support at games and on social media.

Furthermore, the growth of collectibles and limited-edition sports memorabilia is driving market sales. Collectors and enthusiasts look for unique items that commemorate key moments in sports history. Consequently, brands release special editions that create buzz and high resale value. This trend attracts both casual fans and serious collectors.

Additionally, the rise of sports-themed fashion trends and streetwear collaborations has expanded the appeal of licensed merchandise beyond traditional sports fans. Collaborations between sports teams and fashion designers are creating stylish products that merge athletic heritage with modern aesthetics. As a result, merchandise now reaches a broader audience, including those interested in fashion.

Finally, marketing campaigns and celebrity endorsements help reinforce the appeal of licensed merchandise. High-profile athletes and influencers create excitement around new collections. This dynamic environment keeps the market vibrant and continuously evolving, ensuring that consumer interest remains high.

Restraining Factors

Restraining Factors Limit Market Growth

The proliferation of counterfeit and unlicensed sports products is a significant challenge for the market. These imitation items affect brand revenue and dilute the value of authentic merchandise. In addition, the widespread availability of fakes undermines consumer trust in licensed products. As a result, brands must invest more in verification and quality assurance.

Seasonal and event-based demand fluctuations also impact sales consistency. Major sporting events may drive temporary spikes in merchandise sales, but off-season periods often see reduced consumer spending. Consequently, retailers struggle with inventory management and revenue planning throughout the year. This seasonal pattern creates uncertainty in market growth.

Limited purchasing power in certain regions further restrains market expansion. In emerging markets, high-quality licensed merchandise may be viewed as a luxury, reducing overall demand. In contrast, wealthier regions tend to drive most of the sales, leading to imbalanced market penetration. Thus, economic disparities remain a challenge for global brands.

Strict licensing and copyright regulations increase compliance costs for manufacturers and distributors. Meeting these legal requirements demands significant investment in administrative processes and legal oversight. As a result, these added expenses can reduce profit margins and discourage smaller companies from entering the market. Consequently, compliance challenges continue to constrain growth.

Growth Opportunities

Innovation and Customization Offer Growth Opportunities

Expansion into sustainable and eco-friendly licensed sports merchandise offers promising growth opportunities. Consumers are increasingly aware of environmental issues, and many now prefer products made from recycled or renewable materials. Consequently, brands that innovate in sustainability can attract a broader, eco-conscious customer base.

Additionally, the increasing demand for digital and NFT-based sports collectibles is opening new revenue streams. Fans and collectors are exploring virtual memorabilia, which can offer exclusive digital experiences and investment potential. For instance, limited-edition NFT drops create buzz and engage tech-savvy consumers, driving digital innovation.

The rise of customization and personalization trends in team jerseys and fan gear is also reshaping the market. Consumers seek unique products that reflect their personal style or commemorate specific moments. In addition, customized items create a deeper connection between fans and their favorite teams, fostering loyalty and repeat purchases.

Moreover, the growth of women’s sports merchandise is emerging as a significant opportunity. As more female athletes gain prominence, the demand for gear designed specifically for women is increasing. Brands are expanding their product lines to include apparel and accessories that cater to female fans, thereby tapping into a larger and more diverse market segment.

Emerging Trends

Digital Trends and Interactive Engagement Are Latest Trending Factors

There is a surge in demand for vintage and throwback sports jerseys and memorabilia, as fans embrace nostalgia. These classic designs evoke memories of iconic moments in sports history and are highly sought after. For instance, re-releases of retro jerseys often become instant collectors’ items. This trend drives both primary sales and a vibrant secondary market.

Additionally, the rise of subscription-based and limited-edition sports merchandise boxes is capturing consumer interest. These curated boxes offer exclusive products and unique experiences delivered directly to fans. Consequently, they provide a steady revenue stream and keep consumers engaged over time. This model also encourages brand loyalty through recurring interactions.

The increasing popularity of athlete-branded footwear and signature sneaker collections is also shaping market trends. High-profile athletes lend their name and style to footwear lines that combine performance with fashion. As a result, these products generate significant media buzz and fan excitement, driving both sales and social media engagement.

Finally, the growth of augmented reality (AR) and interactive fan experiences in sports retail is revolutionizing how consumers interact with merchandise. Digital try-ons, virtual showrooms, and interactive product demos enhance the shopping experience. In summary, these innovative digital trends are not only trending but are also transforming consumer engagement in the licensed sports merchandise market.

Regional Analysis

North America Dominates with 50.2% Market Share

North America leads the Licensed Sports Merchandise Market with a commanding 50.2% share, totaling USD 17.87 billion. This dominant position is driven by the region’s deep-seated sports culture, extensive professional leagues, and widespread fan base across various sports.

Key factors contributing to this high market share include the commercial power of major leagues like the NFL, NBA, MLB, and NHL, which have deeply integrated merchandising into their operations. High consumer spending power and a penchant for sports memorabilia further fuel sales.

Market dynamics in North America are characterized by innovative marketing strategies, such as limited-edition releases and collaborations with popular brands, which significantly boost consumer interest and sales. The development and use of online platforms for merchandise sales have also expanded market reach and convenience, appealing to a tech-savvy consumer base.

Regional Mentions:

- Europe: Europe maintains a robust Licensed Sports Merchandise Market, driven by soccer’s immense popularity. The region capitalizes on global football events and club-based fan loyalty to drive sales of jerseys, accessories, and other fan gear.

- Asia Pacific: The Asia Pacific region is rapidly growing in this market, with rising interest in European football leagues, NBA, and local sports. Increased media exposure and rising disposable incomes contribute to higher merchandise sales.

- Middle East & Africa: In the Middle East and Africa, increasing sports investments and hosting of major sporting events are gradually enhancing the market for licensed sports merchandise, albeit from a smaller base.

- Latin America: Latin America showcases strong growth potential, fueled by football’s popularity and increasing professionalization of sports leagues which boost regional merchandise sales.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Licensed Sports Merchandise Market features strong competition among top players like VF Corporation, Nike, Inc., Adidas AG, and Puma SE.

VF Corporation excels in the market with its diverse portfolio of brands and its strong presence in outdoor and action sports apparel. Their licensed merchandise is well-known for quality and innovation, appealing to a broad consumer base.

Nike, Inc. is a dominant force with its extensive range of sports apparel and equipment. Nike leverages its global brand strength and wide market reach to drive sales in licensed sports merchandise, continually innovating to meet consumer demands.

Adidas AG is renowned for its high-quality sports apparel and footwear. Adidas combines cutting-edge technology and fashion to create merchandise that appeals to sports fans and athletes alike, reinforcing its position in the market.

Puma SE makes significant contributions with its focus on design and lifestyle, integrating sports into everyday fashion. Puma’s approach to sports licensing is centered around combining functionality with style to attract younger demographics.

These leading companies are pivotal in shaping the Licensed Sports Merchandise Market through strategic brand partnerships, innovative product offerings, and global marketing campaigns, ensuring they remain at the top of consumer preferences.

Major Companies in the Market

- VF Corporation

- Nike, Inc.

- Adidas AG

- Puma SE

- Under Armour, Inc.

- Hanesbrands Inc.

- DICK’S Sporting Goods Inc.

- Sports Direct International plc

- G-III Apparel Group, Ltd.

- Fanatics Inc.

Recent Developments

- World Rugby: On November 2024, World Rugby announced a global partnership with Fanatics to launch an official retail and licensing program for the sport, including major events like the Women’s Rugby World Cups (2025 and 2029) and the Men’s Rugby World Cup 2027. This collaboration aims to expand rugby’s global reach and improve fan engagement by offering a unified “always on” merchandise destination, leveraging Fanatics’ digital platform and extensive market presence.

- Foresight Sports: On September 2024, Foresight Sports and Uneekor, Inc. announced an agreement granting Uneekor a license for several Foresight Sports patents related to portable golf launch monitor technology. This partnership acknowledges Foresight’s ongoing innovation in the industry and will allow Uneekor to continue advancing its portable technology while respecting established intellectual property.

Report Scope

Report Features Description Market Value (2024) USD 35.6 Billion Forecast Revenue (2034) USD 56.4 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Apparel, Footwear, Headwear, Accessories, Collectibles & Memorabilia, Toys & Games, Home Décor, Equipment), By Sport Type (Football (Soccer), American Football, Basketball, Baseball, Ice Hockey, Cricket, Tennis, Others), By Distribution Channel (Online Retail, Specialty Sports Stores, Department Stores, Hypermarkets & Supermarkets, Brand Outlets) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape VF Corporation, Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Hanesbrands Inc., DICK’S Sporting Goods Inc., Sports Direct International plc, G-III Apparel Group, Ltd., Fanatics Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Licensed Sports Merchandise MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Licensed Sports Merchandise MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- VF Corporation

- Nike, Inc.

- Adidas AG

- Puma SE

- Under Armour, Inc.

- Hanesbrands Inc.

- DICK’S Sporting Goods Inc.

- Sports Direct International plc

- G-III Apparel Group, Ltd.

- Fanatics Inc.