Global Sports Eyewear Market Size, Share, Growth Analysis By Product (Non-prescription, Prescription), By Sport Type (Mountain Biking Glasses, Cycling Eyewear, Running & Outdoor Sports Eyewear, Water Sports Eyewear, SKi Sports Eyewear, Winter Sports Eyewear, Golf Eyewear, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143276

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

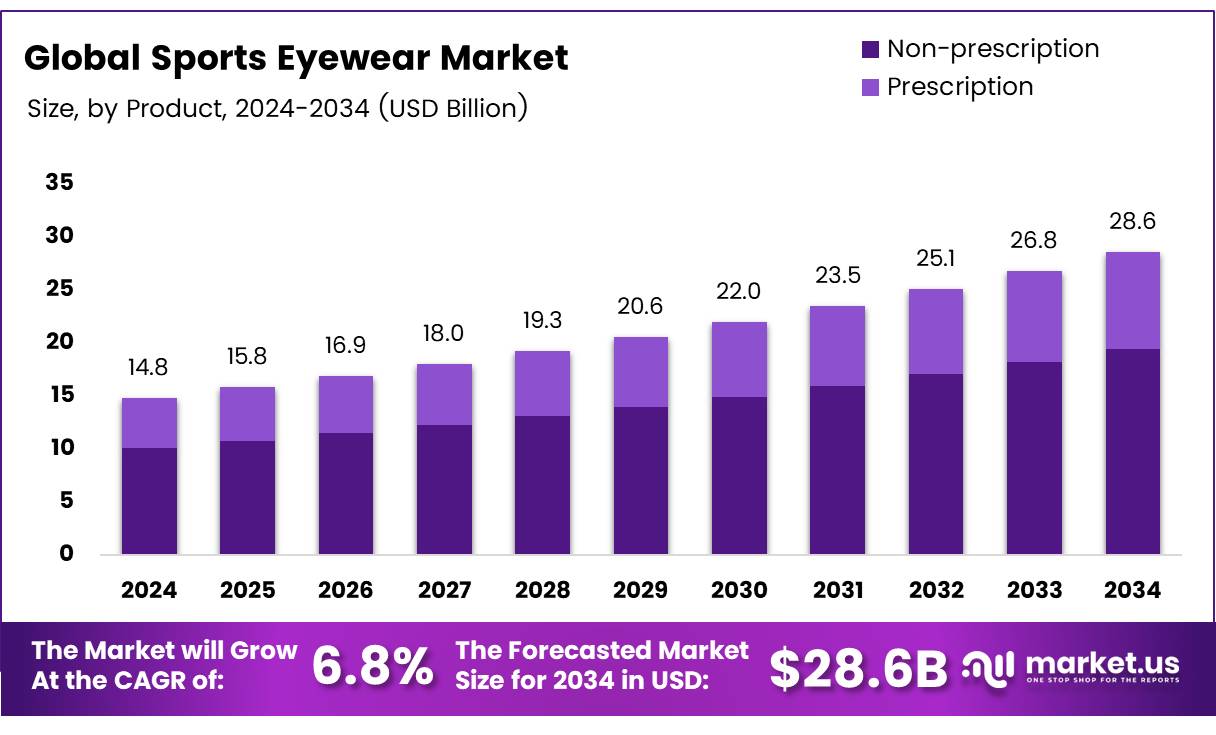

The Global Sports Eyewear Market size is expected to be worth around USD 28.6 Billion by 2034, from USD 14.8 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

Sports eyewear encompasses protective eyeglasses and goggles designed specifically for athletic activities to safeguard the eyes and enhance visual performance. The global sports eyewear market has expanded significantly, driven by increasing awareness of the importance of eye protection and technological advancements in eyewear design and materials.

According to the American Academy of Ophthalmology, annually, the United States alone witnesses over 40,000 sports-related eye injuries, underscoring the critical need for protective eyewear in reducing preventable harm. Additionally, the market’s growth is further propelled by consumer trends towards health, fitness, and the rising popularity of sports activities among all age groups.

The sports eyewear market is poised for considerable growth, fueled by a heightened focus on sports safety and health-conscious behaviors. Opportunities for market expansion include the integration of innovative technologies such as lightweight, impact-resistant materials, and enhanced UV protection features.

The government’s role in mandating protective eyewear in school and professional sports could further bolster market growth. Regulatory frameworks play a crucial role in enforcing safety standards that ensure the quality and effectiveness of sports eyewear.

According to EyeMed, 81% of eye doctors advocate for mandatory protective eyewear for children engaging in sports, highlighting a significant potential for increased adoption in the youth segment. Moreover, nearly 30,000 sports-related eye injuries are treated in U.S. emergency rooms annually, as reported by the American Academy of Ophthalmology, indicating a substantial market need for effective protective solutions.

Government regulations and investments are instrumental in shaping the sports eyewear market. Regulations ensure that manufacturers adhere to safety and quality standards critical for protective eyewear. These standards are designed to minimize eye injuries, which are not only prevalent but largely preventable with appropriate safety measures.

Governmental endorsements and funding for awareness campaigns about sports safety can significantly influence market dynamics, driving demand for sports eyewear. The push towards establishing rigorous standards and protocols for sports activities at both amateur and professional levels ensures a steady demand for high-quality sports eyewear, making it a priority for public health and safety agendas.

Key Takeaways

- The global sports eyewear market is projected to grow from USD 14.8 billion in 2024 to USD 28.6 billion by 2034, with a CAGR of 6.8%.

- Non-prescription sports eyewear dominated the market in 2024, holding a 66.3% share due to its convenience and immediate availability.

- Mountain biking glasses led the By Sport Type Analysis segment in 2024, capturing a 33.3% share, driven by the sport’s rising popularity.

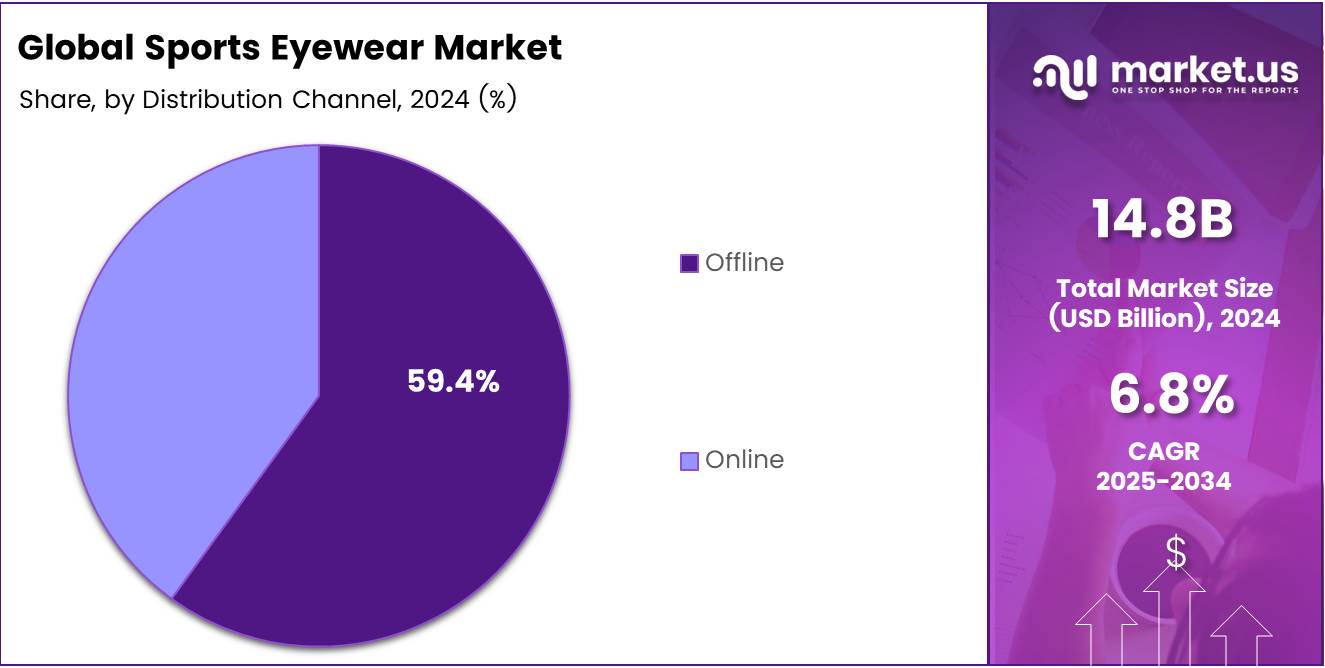

- Offline distribution channels were preferred in 2024, taking up a 59.4% share, favored for their tactile purchasing experience.

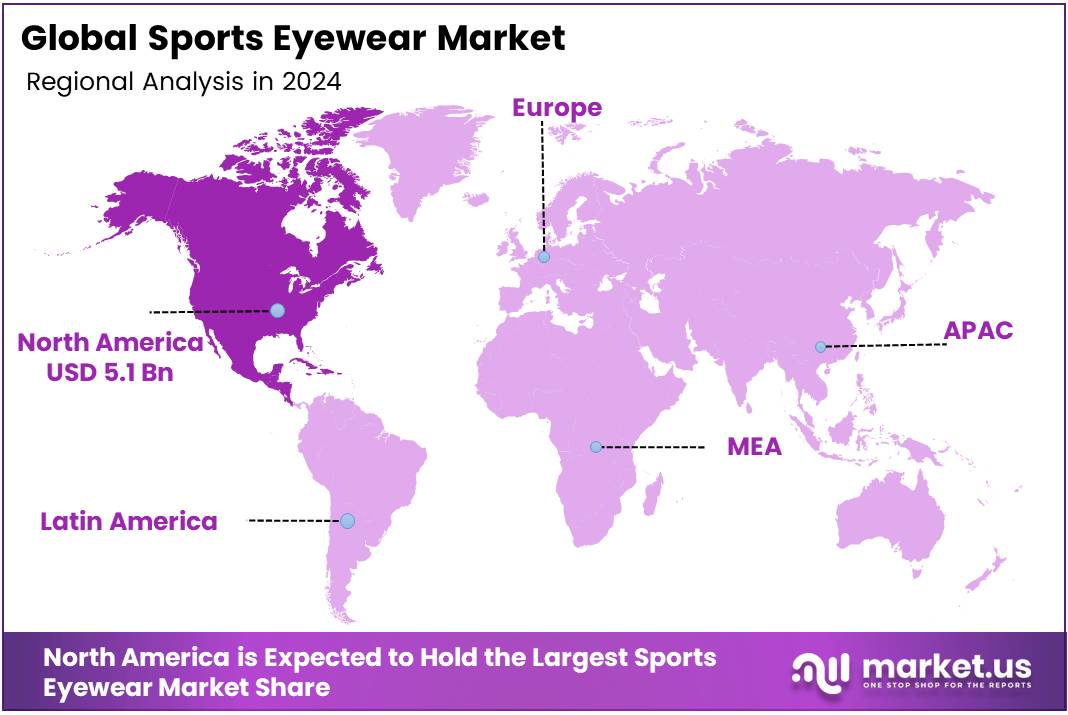

- North America held a substantial market share of 35.5%, valued at USD 5.18 billion, attributed to high awareness of eye health and active participation in outdoor sports.

Product Analysis

Non-Prescription Sports Eyewear Maintains a Strong Hold with 66.3% Market Share in 2024

In 2024, the By Product Analysis segment of the sports eyewear market observed that non-prescription sports eyewear secured a leading position, capturing 66.3% of the market. This substantial share can be attributed to the widespread adoption of non-prescription eyewear among athletes and recreational users who prioritize convenience and immediate availability.

Non-prescription eyewear offers the flexibility of use without the need for custom vision correction, making it a preferred choice for consumers seeking quick and hassle-free options in sports settings.

On the other hand, prescription sports eyewear, while smaller in market share, addresses a specific consumer segment that requires vision correction combined with the protective attributes of sports eyewear.

The demand for prescription sports eyewear is driven by consumers who cannot compromise on vision quality during sports activities, necessitating tailored solutions that integrate corrective lenses with sport-specific design features.

Despite the dominance of non-prescription variants, the prescription segment is poised for growth, driven by advancements in optical technology and an increasing number of sports enthusiasts who require vision correction.

Manufacturers are responding by expanding their offerings to include more innovative and aesthetically appealing prescription options, tailored to the diverse needs and preferences of active consumers. This trend underscores a dynamic shift towards personalized sports eyewear solutions, enhancing both performance and comfort for users requiring prescription lenses.

Sport Type Analysis

Mountain Biking Glasses Lead the Sports Eyewear Segment with a 33.3% Share in 2024

In 2024, Mountain Biking Glasses held a dominant market position in the By Sport Type Analysis segment of the Sports Eyewear Market, capturing a significant 33.3% share. This segment outperformed others due to the increasing popularity of mountain biking as both a recreational activity and a competitive sport, driving demand for specialized eyewear that offers both protection and performance enhancement.

Following closely, Cycling Eyewear accounted for a substantial market portion, benefiting from the global rise in cycling activities, both urban commuting and competitive events. Running & Outdoor Sports Eyewear also saw notable growth, supported by the widespread participation in outdoor fitness activities.

Water Sports and Ski Sports Eyewear segments targeted niche markets, focusing on sports-specific features like water resistance and anti-fogging, which cater to enthusiasts and professional athletes alike. Winter Sports Eyewear continued to progress, driven by seasonal sports activities in colder regions.

Golf Eyewear, although smaller in market share, remained critical due to the precision and clarity required in golfing, which directly influences demand for specialized glasses. The Others category, which includes sports like tennis and cricket, held a modest share, reflecting the diverse yet fragmented nature of less common sports eyewear demands. Each segment uniquely contributes to the overarching growth and diversification of the Sports Eyewear Market.

Offline Channels Analysis

Offline Channels Command a Major Share in Sports Eyewear Distribution with a 59.4% Market Dominance

In 2024, the distribution landscape of the sports eyewear market exhibited a pronounced skew towards offline channels, which commanded a 59.4% share, underscoring their dominant market position. This predominance can be attributed to consumers’ preference for a tactile purchasing experience, where they can physically assess the fit, comfort, and style of eyewear, an essential aspect in sports-related accessories.

Offline outlets like optician’s stores, sports goods stores, and department stores enhance customer trust through immediate product authenticity and post-purchase services, which are pivotal for high-involvement products like sports eyewear.

Conversely, the online segment, though smaller, is demonstrating vigorous growth dynamics, fueled by the escalating penetration of e-commerce platforms and the evolving consumer inclination towards digital channels. This segment benefits from the expansive reach, often transcending geographical barriers, and the convenience of home shopping.

However, challenges such as the inability to try products before purchase and concerns over product authenticity somewhat temper its growth prospects.

Together, these distribution channels form a complementary framework that not only serves varying consumer preferences but also stabilizes the sports eyewear market’s expansion trajectory by leveraging distinct competitive advantages inherent to each channel.

Key Market Segments

By Product

- Non-prescription

- Prescription

By Sport Type

- Mountain Biking Glasses

- Cycling Eyewear

- Running & Outdoor Sports Eyewear

- Water Sports Eyewear

- SKi Sports Eyewear

- Winter Sports Eyewear

- Golf Eyewear

- Others

By Distribution Channel

- Offline

- Online

Drivers

Rising Awareness of Eye Protection Boosts Sports Eyewear Market

The growth of the sports eyewear market can be attributed to several key factors. Firstly, heightened awareness about the necessity of eye protection during sports activities is significantly boosting demand.

Individuals are increasingly recognizing the importance of safeguarding their eyes from potential injuries and harmful ultraviolet rays during physical activities, propelling the uptake of sports eyewear.

Furthermore, advancements in technology are enhancing the functionality and appeal of these products.Today’s sports eyewear often features impact-resistant lenses and superior UV protection, catering to the rigorous demands of various outdoor activities. Additionally, the growing popularity of outdoor sports such as cycling, skiing, and running is further driving the market. These activities require specialized eyewear that not only protects the eyes but also enhances athletic performance.

Lastly, the global trend towards health and fitness is contributing to an increased demand for sports eyewear, as more people participate in sports activities as part of a healthy lifestyle. These dynamics are collectively fostering a robust expansion of the sports eyewear market.

Restraints

High Costs Limit Accessibility to Premium Sports Eyewear

Several restraints are identified in the sports eyewear market that could potentially hinder its growth. The most significant of these is the high price point of premium sports eyewear products, which are designed to enhance performance and safety for athletes and enthusiasts.

However, their elevated cost may limit their accessibility to broader consumer segments, particularly those with limited disposable income. Additionally, the market faces competition from substitutes such as regular sunglasses, which are often utilized for sports activities.

While not specifically engineered for sports, these alternatives offer basic eye protection at a significantly lower cost, making them an attractive option for budget-conscious consumers. This competition could lead to a dilution of market share for specialized sports eyewear, posing a challenge to manufacturers aiming to expand their reach within this niche market.

Growth Factors

Personalization in Sports Eyewear Enhances Market Appeal

The sports eyewear market stands poised for considerable growth, fueled by several pivotal opportunities. Foremost among these is the potential for personalized and customizable eyewear. By offering customers the ability to tailor their eyewear in terms of frame design, lens color, and fit, companies can cater to a more diverse consumer base, enhancing user satisfaction and brand loyalty.

Additionally, expanding into emerging markets could prove lucrative, particularly with the rising middle-class populations in these regions who are increasingly engaging in sports activities. Partnerships with sports teams and events also present a substantial opportunity for growth, as such collaborations can significantly boost brand visibility and consumer engagement.

Moreover, integrating smart features like augmented reality lenses and fitness tracking into sports eyewear taps into the expanding wearable technology trend, meeting modern consumer expectations for multifunctionality in sports accessories. Collectively, these strategies not only broaden market reach but also reinforce the sports eyewear market’s position in a competitive landscape.

Emerging Trends

Specialized Eyewear Boosts Sports Performance

In the sports eyewear market, several key trends are shaping its current trajectory and future growth. First and foremost, there is a significant rise in the demand for specialized eyewear tailored to specific activities, such as cycling glasses and ski goggles, which enhance performance and safety for athletes.

Additionally, the market is witnessing a surge in the popularity of performance and functional lenses. These lenses are engineered to improve vision clarity, diminish glare, and augment contrast, catering to the precise needs of sports enthusiasts who prioritize optical excellence. Another prominent trend is the fusion of fashion-forward designs with functional features.

Consumers are increasingly opting for eyewear that combines style with practicality, ensuring that their sports gear is both fashionable and effective. Moreover, the growing interest in virtual and esports is propelling the development of eyewear designed to mitigate eye strain caused by prolonged exposure to screens.

This trend highlights a broader movement towards integrating technology with user comfort and health in the design of sports eyewear. These factors collectively indicate a robust expansion in the sports eyewear market, driven by consumer demands for specialization, performance, style, and digital era adaptability.

Regional Analysis

North America Leads Sports Eyewear Market with 35.5% Share, Valued at USD 5.18 Billion

The sports eyewear market is segmented across various regions, each displaying distinct characteristics and growth patterns. In North America, the market is particularly robust, holding a dominant share of 35.5% with a valuation of USD 5.18 billion. This region’s strong performance can be attributed to a heightened awareness of eye health, coupled with a high participation rate in outdoor sports.

Regional Mentions:

In Europe, the market benefits from advanced product innovations and a strong presence of leading eyewear manufacturers. The adoption of sports eyewear is further bolstered by stringent safety regulations and a growing trend towards stylish, functional eyewear among athletes.

The Asia Pacific region is witnessing rapid growth in the sports eyewear market, driven by increasing disposable incomes and a burgeoning interest in sports activities. Countries like China and India are significant contributors to this growth, with young populations showing increased interest in sports and fitness activities.

In the Middle East & Africa, the market is emerging, with growth driven by rising health consciousness and an increasing number of sporting events. The region shows potential for significant market expansion as sports participation and international tourism increase.

Latin America’s sports eyewear market is growing steadily, supported by an enthusiasm for sports and outdoor activities. The region benefits from a youthful demographic and a cultural inclination towards sports, which propels the demand for sports eyewear.

Overall, while North America currently leads the market, the Asia Pacific region is expected to witness the highest growth rate in the coming years due to its large population base and increasing health awareness among consumers. This diverse regional landscape highlights the importance of tailored marketing strategies and product offerings to cater to the unique demands and preferences of each regional market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global sports eyewear market projected for 2024, EssilorLuxottica is expected to maintain a prominent position due to its comprehensive portfolio and strong brand equity. As a leader in the eyewear industry, EssilorLuxottica combines expertise in lens technology with stylish frame design, appealing to a wide range of sports enthusiasts who prioritize both functionality and fashion.

Maui Jim stands out for its superior polarized lens technology, which enhances visual clarity and comfort in various lighting conditions, making it a preferred choice among outdoor sports athletes. The brand’s dedication to quality and customer satisfaction continues to strengthen its market presence.

Safilo Group, with its subsidiary Smith Optics, focuses on innovative technologies such as ChromaPop lens technology that offers enhanced color and clarity. This innovation drives their competitiveness in sports where vision precision is critical, such as skiing and cycling.

Nike Vision leverages its global brand reputation in sports to cater to a diverse consumer base, offering eyewear that complements its footwear and apparel lines. This integrated approach helps in maintaining a strong connection with its consumer base.

Adidas Sport Eyewear and Under Armour Eyewear both emphasize durability and performance. Their products often feature lightweight, impact-resistant materials suited for high-intensity sports, aligning with their brand ethos of high performance.

Rudy Project and Bollé are noted for their focus on specific niches within the sports community, offering specialized designs that cater to unique consumer needs, such as enhanced aerodynamics and modifiable components for triathletes and winter sports enthusiasts, respectively.

Tifosi Optics and Julbo offer competitive price points and versatile designs, making them accessible to amateur athletes and casual wearers, which helps in expanding their market reach.

The Others category, consisting of emerging brands and regional players, contributes to market diversity, introducing innovative and cost-effective solutions that challenge the established players and stimulate market dynamics.

Top Key Players in the Market

- EssilorLuxottica

- Maui Jim

- Safilo Group (Smith Optics)

- Nike Vision

- Adidas Sport Eyewear

- Under Armour Eyewear

- Rudy Project

- Bollé

- Tifosi Optics

- Julbo

- Others

Recent Developments

- In January 2025, Longstreth Sporting Goods announced its acquisition of Kimsports CC, aiming to broaden its market reach and enhance its product offerings in the sports equipment sector.

- In February 2025, EA SPORTS acquired TRACAB Technologies, enhancing their sports gaming products with advanced realism and innovative tracking technologies.

- In May 2024, MODO, the eyewear company, expanded its portfolio by acquiring LOWERCASE, a New York-based eyewear brand known for its craftsmanship and style.

- In September 2023, the Lisbon-based investment firm APEX launched a new €50 million fund driven by athlete investors, targeting opportunities within sports, media, and entertainment sectors.

Report Scope

Report Features Description Market Value (2024) USD 14.8 Billion Forecast Revenue (2034) USD 28.6 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Non-prescription, Prescription), By Sport Type (Mountain Biking Glasses, Cycling Eyewear, Running & Outdoor Sports Eyewear, Water Sports Eyewear, SKi Sports Eyewear, Winter Sports Eyewear, Golf Eyewear, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape EssilorLuxottica, Maui Jim, Safilo Group (Smith Optics), Nike Vision, Adidas Sport Eyewear, Under Armour Eyewear, Rudy Project, Bollé, Tifosi Optics, Julbo, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- EssilorLuxottica

- Maui Jim

- Safilo Group (Smith Optics)

- Nike Vision

- Adidas Sport Eyewear

- Under Armour Eyewear

- Rudy Project

- Bollé

- Tifosi Optics

- Julbo

- Others