Global Snow Goggles Market Size, Share, Growth Analysis By Type (Ordinary Lenses, Myopic Lenses, Presbyopia Glasses), By Application (Competition, Entertainment, Others), By Lens Shape (Spherical, Cylindrical, Toric), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 138776

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

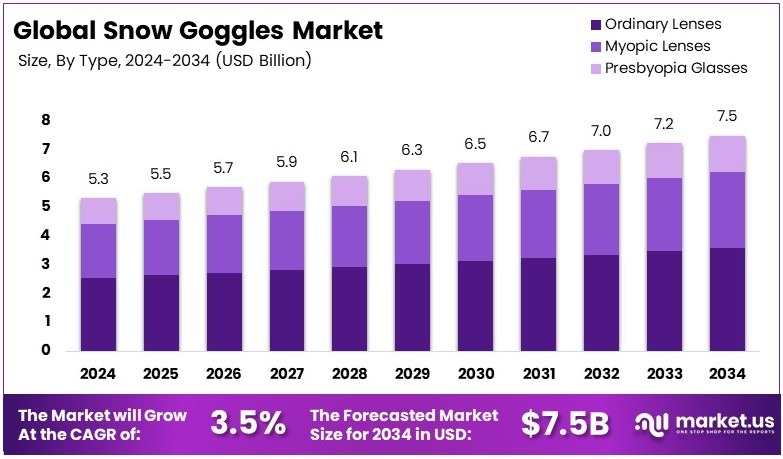

The Global Snow Goggles Market size is expected to be worth around USD 7.5 Billion by 2034, from USD 5.3 Billion in 2024, growing at a CAGR of 3.5% during the forecast period from 2025 to 2034.

Snow Goggles are safety eyewear designed for winter sports like skiing and snowboarding. They help shield the eyes from snow, wind, and harmful UV rays. Snow goggles are equipped with specialized lenses to improve visibility in snowy environments and provide comfort by reducing glare and preventing fogging.

Snow Goggles Market refers to the industry focused on the production and sale of goggles used in winter sports. It includes manufacturers, distributors, and retailers offering various types of snow goggles. The market serves both recreational users and professional athletes, catering to demand for performance and safety in winter sports.

The snow goggles market is seeing growth driven by the increasing popularity of winter sports. In the U.S., 29.9 million people participated in winter sports during the 2022-2023 season, a notable increase from previous years. This growth indicates a rising demand for quality snow goggles and related equipment.

As the number of skiers and snowboarders continues to grow, the demand for snow goggles also rises. In the 2022-2023 season, there were 11.6 million active skiers and snowboarders in the U.S. This growing participation provides opportunities for brands to expand their product offerings and reach a wider audience in the snow sports market.

Market saturation is moderate, especially in mature markets like North America. However, competition remains strong, with both established and new brands innovating for better performance. Global participation in winter sports is growing, but localized markets may still face challenges with product differentiation and customer loyalty.

Government investment in winter sports infrastructure and events helps boost market growth. In the U.S., participation in outdoor recreation, including winter sports, grew by 2.3% in 2022, adding 14.5 million participants since 2020. This increase in overall outdoor activity is driving demand for gear like snow goggles, benefiting both local and global markets.

Key Takeaways

- The Snow Goggles Market was valued at USD 5.3 billion in 2024 and is expected to reach USD 7.5 billion by 2034, with a CAGR of 3.5%.

- In 2024, Ordinary Lenses dominate the lens type segment with 48.2% as they are most commonly used for general snow sports.

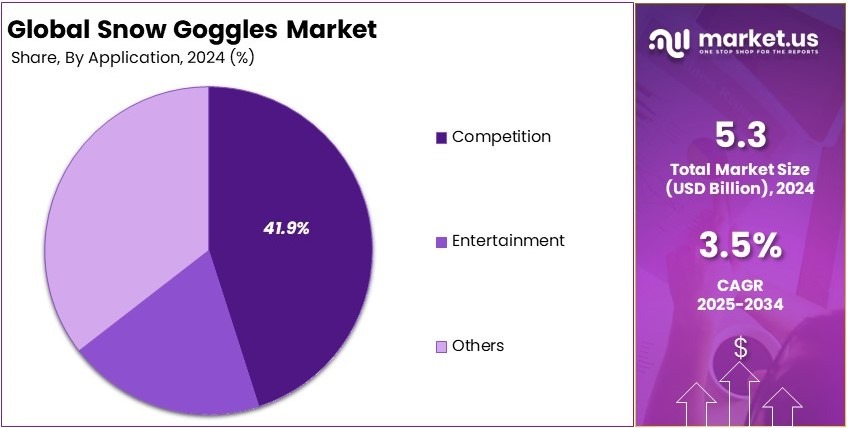

- In 2024, Competition leads the application segment with 41.9%, highlighting the demand for high-performance goggles in competitive snow sports.

- In 2024, Spherical Lenses dominate the lens shape segment with 52.4%, offering better peripheral vision and anti-fog benefits.

- In 2024, Offline dominates the distribution channel segment with 62.7%, as most customers prefer to purchase snow goggles in-person for fit and quality check.

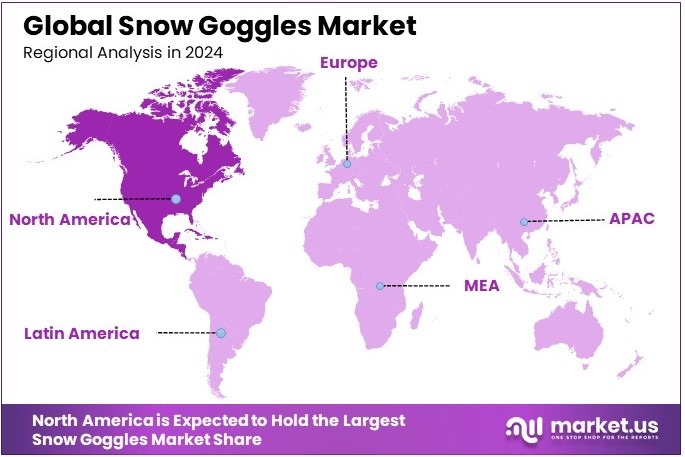

- In 2024, North America leads the regional market with 40.1%, benefiting from a high number of winter sports enthusiasts in regions like the U.S. and Canada.

Type Analysis

Ordinary Lenses dominate with 48.2% due to their broad use and cost-effectiveness.

The ordinary lenses segment is the largest in the Snow Goggles market, making up 48.2% of the market share. Ordinary lenses are popular because they serve the general snow sports audience. Whether for casual skiing, snowboarding, or other snow-related activities, these lenses offer reliable protection from UV rays and snow glare.

They also provide good visibility in various snow conditions, which is a major reason for their widespread use. Their cost-effectiveness compared to specialized lenses makes them a preferred choice for most people, especially beginners and occasional snow sports participants.

On the other hand, myopic lenses are specialized lenses for individuals who need correction for nearsightedness. Although this group is smaller, the demand for myopic lenses is growing as more people with vision problems take part in snow sports.

These lenses provide clearer vision for athletes who would otherwise struggle with ordinary lenses. Presbyopia glasses are designed for people over 40 who have difficulty focusing on close objects. Though their market is niche, the rise of aging athletes and recreational skiers may drive demand for presbyopia-specific snow goggles in the future.

Application Analysis

Competition dominates with 41.9% due to the high demand for professional-level gear.

The “Competition” application segment dominates the Snow Goggles market, holding a 41.9% share. Competitive athletes, especially those involved in high-level skiing and snowboarding events, require goggles that offer superior optical clarity and performance. These goggles often come with advanced lens technology that enhances visibility in varying weather conditions, such as snow, fog, or bright sunlight.

The competitive market has a high demand for precision, and the increasing number of snow sports events worldwide has fueled the need for specialized gear. Additionally, professional athletes often collaborate with brands to improve the design and functionality of snow goggles, which keeps this segment dynamic and growing.

The “Entertainment” segment, which caters to casual skiers and snowboarders, holds a smaller portion of the market. While entertainment users require good-quality goggles, they generally do not need the high-end features found in competitive goggles. This segment makes up a significant part of the market, but it is overshadowed by the demand from competitive athletes.

“Others” is a catch-all category that includes specialized applications such as goggles for military or professional mountain guides. While this segment is important, its contribution to the overall market is relatively minor compared to competition and entertainment.

Lens Shape Analysis

Spherical lenses dominate with 52.4% due to their superior clarity and reduced distortion.

In the Snow Goggles market, the “Spherical” lens shape dominates, holding a market share of 52.4%. Spherical lenses are curved both horizontally and vertically, which allows for a wider field of vision and less optical distortion.

These lenses are highly valued by competitive athletes and recreational skiers alike because they provide better peripheral vision and reduce glare from the snow. The superior performance of spherical lenses in terms of optical clarity makes them a preferred choice, especially in higher-end snow goggles.

In comparison, cylindrical lenses are more affordable and provide decent visibility but do not offer the same level of clarity and field of vision as spherical lenses. While cylindrical lenses are still widely used, they occupy a smaller portion of the market.

Toric lenses, which combine features of both spherical and cylindrical lenses, are more specialized. They cater to individuals with specific vision needs but represent a small niche in the snow goggles market.

Distribution Channel Analysis

Offline distribution dominates with 62.7% due to the preference for in-person purchases and hands-on experience.

The “Offline” distribution channel is the dominant one in the Snow Goggles market, holding 62.7% of the market share. This is primarily due to the shopping habits of consumers who prefer to try on their snow goggles before making a purchase.

Many snow sports enthusiasts want to test the comfort, fit, and visibility of goggles in person, which makes brick-and-mortar stores an important channel. Ski resorts, sports retailers, and specialized snow sports shops all contribute significantly to this segment. In addition, during the peak ski season, these physical stores tend to see a lot of traffic, making them key players in the market.

“Online” stores, while growing rapidly, still represent a smaller portion of the market at 37.3%. Despite the rise of e-commerce and the convenience it offers, many buyers prefer the tactile experience of purchasing snow goggles in person.

That said, the online segment is expected to grow as more consumers seek the convenience of purchasing snow sports gear from home. Online retailers offer competitive pricing and easy returns, which appeal to consumers who are comfortable with purchasing sportswear without trying it on first.

Key Market Segments

By Type

- Ordinary Lenses

- Myopic Lenses

- Presbyopia Glasses

By Application

- Competition

- Entertainment

- Others

By Lens Shape

- Spherical

- Cylindrical

- Toric

By Distribution Channel

- Offline

- Online

Driving Factors

Increasing Participation in Snow Sports Drives Snow Goggles Market Growth

Rising participation in snow sports, such as skiing and snowboarding, is one of the key driving factors for the snow goggles market. As more people take part in these thrilling activities, the demand for high-quality snow goggles increases. The importance of eye protection from UV rays and harsh weather conditions has become more widely recognized, prompting both amateurs and professionals to invest in better gear.

Additionally, the growth of adventure tourism and winter sports destinations worldwide contributes significantly to the demand for snow goggles. As ski resorts and snowboarding locations expand in popularity, more tourists are engaging in snow sports, leading to increased sales of goggles.

Technological advancements in lens coatings, anti-fog systems, and photochromic features have further fueled market growth, as consumers seek goggles that offer clear vision in changing conditions. These innovations improve the overall user experience, making goggles more comfortable and efficient for various weather conditions.

Restraining Factors

Seasonal Demand and Competition from Low-Cost Products Restrain Market Growth

The snow goggles market faces several challenges that slow its growth. One significant factor is the seasonal nature of the demand for snow goggles. As snow sports are predominantly winter activities, sales experience fluctuations throughout the year, leading to unpredictable revenue streams for manufacturers. This seasonality makes it difficult to maintain consistent growth and market stability.

Furthermore, there is limited awareness and use of snow goggles in non-snow regions, where consumers are less likely to invest in such equipment. In areas without consistent snowfall or ski resorts, demand remains low, limiting the overall market.

Additionally, the rise of low-cost, counterfeit products in the market affects both consumer confidence and sales. These products often lack the quality of well-known brands, leading to dissatisfaction among buyers. Compatibility issues between snow goggles and different helmet brands also reduce consumer satisfaction.

When goggles don’t fit well with helmets, it can affect comfort and performance, which in turn hinders the purchasing decision. These factors contribute to the slower pace of growth in the snow goggles market, despite rising interest in snow sports.

Growth Opportunities

Technological Innovations and Eco-Friendly Trends Provide Opportunities for Market Growth

The snow goggles market is seeing ample growth opportunities due to ongoing technological advancements and a rising trend toward sustainability. Smart snow goggles that feature augmented reality (AR) and heads-up display (HUD) technology are creating new prospects in the market. These innovations offer users real-time data, navigation, and performance analytics, enhancing the snow sports experience.

The increasing demand for lightweight and anti-fog goggles also provides an opportunity for manufacturers to cater to consumers who seek comfort, clarity, and performance. Additionally, the expansion of direct-to-consumer (DTC) brands has made it easier for consumers to access affordable and customizable snow goggles. These brands focus on offering high-quality products at competitive prices, attracting price-sensitive customers.

Another growing opportunity is the increasing preference for sustainable and eco-friendly snow goggles. With consumers becoming more environmentally conscious, there is a rising demand for goggles made from recycled materials.

Manufacturers that adopt these eco-friendly practices can appeal to this environmentally-aware customer base, positioning themselves as leaders in sustainable snow sports gear. These trends not only drive growth but also create a competitive edge for brands that are quick to innovate and adopt sustainability.

Emerging Trends

Trends in Lens Technology and Design Shape the Snow Goggles Market

Several new trends are shaping the snow goggles market, particularly in lens technology and design. The growing popularity of oversized and frameless lens designs is one such trend, offering wider visibility and improved aesthetics. These lenses provide a more immersive experience for snow sports enthusiasts, appealing to consumers who value both function and style.

Another key trend is the increasing demand for interchangeable lens systems, allowing users to quickly adapt their goggles to changing weather conditions. This flexibility is particularly valued by skiers and snowboarders who experience a range of conditions while on the slopes.

Additionally, the adoption of AI-powered lens tint adjustment technology is gaining traction. This technology adjusts the lens tint automatically based on the surrounding light, providing optimal visibility and comfort.

Another popular feature is the rising trend of photochromic and polarized lenses. These lenses enhance optical clarity by reducing glare and adjusting to changing light conditions, improving performance and safety for users. These trends in design and technology are driving the snow goggles market forward, making goggles more efficient, versatile, and appealing to a broader range of consumers. As these features become more common, the market is expected to continue expanding.

Regional Analysis

North America Dominates with Major Market Share

North America leads the Snow Goggles Market, holding a dominant share. This region’s significant market share is driven by a combination of factors, including the high popularity of winter sports like skiing and snowboarding, robust retail infrastructure, and a large number of established snow sports brands that cater to the growing demand for snow goggles.

Key factors contributing to North America’s strong market share include its well-developed winter sports culture, particularly in regions like Colorado, Utah, and British Columbia, where skiing and snowboarding are highly popular. The region also benefits from its extensive retail network and online sales platforms, making snow goggles easily accessible to a large consumer base. Moreover, the presence of leading brands like Oakley, Smith Optics, and Bolle has solidified North America’s position as a dominant player in the market.

In terms of market dynamics, North America is seeing a steady growth in the adoption of technologically advanced snow goggles, especially those with features like interchangeable lenses, anti-fog technology, and enhanced UV protection. As more consumers prioritize comfort, safety, and style, demand for high-performance goggles continues to increase. Additionally, the region’s colder climates and its hosting of major winter sports events such as the Winter Olympics and World Cup skiing events further boost the popularity of snow sports and related equipment.

Regional Mentions:

- Europe: Europe holds a strong position in the Snow Goggles Market, with countries like Switzerland, France, and Austria being major hubs for skiing and snowboarding. The region benefits from its well-established winter sports infrastructure and a strong emphasis on innovation in snow sports equipment.

- Asia Pacific: The Asia Pacific region is growing steadily in the Snow Goggles Market, with countries like Japan, China, and South Korea increasingly embracing winter sports. The market is further supported by the rising popularity of ski resorts and snowboarding events in these countries.

- Middle East & Africa: The Middle East & Africa has a niche presence in the Snow Goggles Market, with limited but growing demand in countries with ski resorts, such as Lebanon and Morocco. Regional interest is expected to rise as winter sports become more accessible and popular.

- Latin America: Latin America’s Snow Goggles Market is in a developing stage, with countries like Argentina and Chile becoming prominent in the winter sports scene. The demand for snow sports equipment, including goggles, is expected to rise as tourism and winter sports infrastructure expand in these regions.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Snow Goggles Market is dominated by several key players, with Oakley, Inc., Smith Optics, Anon Optics (Burton Snowboards), and Spy Optic leading the way in innovation and product offerings.

Oakley, Inc. is one of the most recognized brands in the snow goggles market. Known for its advanced lens technology, Oakley provides goggles that deliver exceptional clarity, comfort, and durability. The company is popular among both professional athletes and recreational users, often using cutting-edge designs and materials to stay ahead in the competitive market.

Smith Optics is another major player, offering a wide range of high-performance goggles. Known for their interchangeable lenses and customizable fit, Smith goggles are designed to meet the needs of skiers and snowboarders in various weather conditions. The brand’s reputation for quality and innovation, particularly in lens technology, helps it maintain a strong market position.

Anon Optics (Burton Snowboards) specializes in producing goggles that combine style, performance, and value. As a subsidiary of Burton, a leading snowboard brand, Anon benefits from strong brand recognition within the snow sports community. Its goggles are designed for both casual and professional athletes, featuring high-quality lenses, excellent field of vision, and superior comfort.

Spy Optic is another key player, offering stylish and functional goggles for snow sports enthusiasts. Known for their bold designs and performance features, Spy goggles often include advanced anti-fog and UV protection technology. The brand’s focus on comfort and innovation has made it a popular choice among snowboarders and skiers.

These companies dominate the snow goggles market by focusing on advanced technology, comfort, and design. Their products are widely recognized for enhancing the performance and experience of snow sports participants, ensuring they remain market leaders.

Major Companies in the Market

- Oakley, Inc.

- Smith Optics

- Anon Optics (Burton Snowboards)

- Spy Optic

- Giro Sport Design

- Bolle Brands

- POC Sports

- Dragon Alliance

- VonZipper

- Electric California

- Uvex Group

- Julbo Eyewear

- Revo

- OutdoorMaster

- Zeal Optics

Recent Developments

- ZEISS: On December 2023, ZEISS launched its 2023/2024 collection of ski goggles, combining advanced optical technology, UV protection, and stylish designs. The collection includes cylindrical, interchangeable, and junior models, featuring ZEISS Sonar lenses for enhanced visibility, sophisticated ventilation, and a lightweight structure for added comfort and style.

- 100percent: On December 2023, 100percent previewed their 2024/25 snow goggle collection, highlighting products like the Norg and Snowcraft series. The new collection features enhanced magnetic lens technology, HiPER lens options, and emphasizes sustainability through eco-friendly packaging and production methods.

Report Scope

Report Features Description Market Value (2024) USD 5.3 Billion Forecast Revenue (2034) USD 7.5 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ordinary Lenses, Myopic Lenses, Presbyopia Glasses), By Application (Competition, Entertainment, Others), By Lens Shape (Spherical, Cylindrical, Toric), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oakley, Inc., Smith Optics, Anon Optics (Burton Snowboards), Spy Optic, Giro Sport Design, Bolle Brands, POC Sports, Dragon Alliance, VonZipper, Electric California, Uvex Group, Julbo Eyewear, Revo, OutdoorMaster, Zeal Optics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Oakley, Inc.

- Smith Optics

- Anon Optics (Burton Snowboards)

- Spy Optic

- Giro Sport Design

- Bolle Brands

- POC Sports

- Dragon Alliance

- VonZipper

- Electric California

- Uvex Group

- Julbo Eyewear

- Revo

- OutdoorMaster

- Zeal Optics