Global Surface Water Sports Equipment Market Size, Share, Growth Analysis By Product Type (Surfing Equipment, Paddle Sports Equipment, Sailing & Yachting Equipment, Water Skiing & Wakeboarding Equipment), By Price (Mass, Premium), By Distribution Channel (Online, Sporting Goods Retailers, Supermarkets & Hypermarkets, Exclusive Brand Outlets, Others), By End-User (Individual Consumers, Professional Athletes & Sports Enthusiasts, Water Sports Training Centers, Tourism & Adventure Sports Companies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143677

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

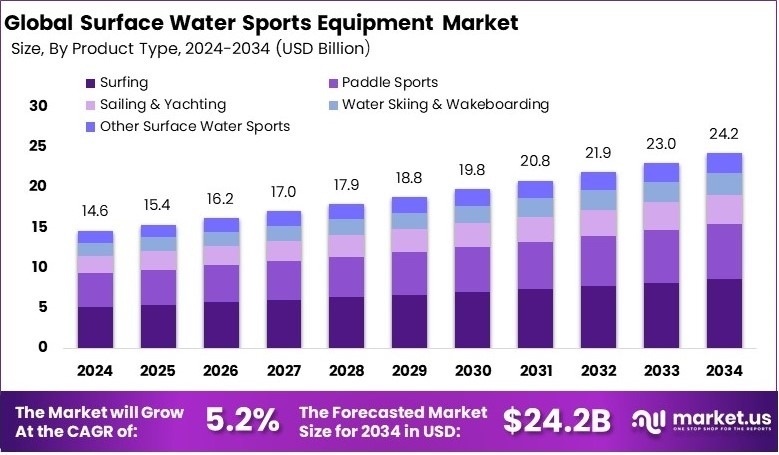

The Global Surface Water Sports Equipment Market size is expected to be worth around USD 24.2 Billion by 2034, from USD 14.6 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Surface Water Sports Equipment includes gear used for water-based sports on open surfaces. It comprises items such as paddleboards, kayaks, surfboards, and safety accessories. The equipment is designed for durability and performance in water conditions. It supports recreational and competitive activities and emphasizes safety and ease of use for enthusiasts.

Surface Water Sports Equipment Market represents the commercial segment that produces, distributes, and sells water sports gear. It involves manufacturers, retailers, and service providers. Market growth is driven by rising participation in water sports and recreational activities. Innovation and evolving consumer preferences shape competitive dynamics across this niche market globally.

According to the 2022 Watersports Participation Survey, 13.2 million UK adults engaged in boating activities, marking a 3% increase from 12.8 million in 2021. This statistic reflects a growing interest in surface water sports, as over 10 million participants engaged in boating once or twice, and 3.2 million engaged three or more times annually. This consistent participation underscores a strong and sustained demand within the surface water sports equipment market.

The market for surface water sports equipment is dynamically competitive but not yet saturated, offering considerable opportunities for both new and established companies. The growth of the market is significantly supported by local and government initiatives aimed at promoting water-based recreation. These programs not only increase the visibility of water sports but also encourage broader participation by improving access to necessary facilities and sports equipment.

Moreover, the increasing popularity of water sports on a broader scale is compelling more individuals to engage in these activities, thereby boosting the demand for related equipment. For instance, the visibility of boating and other water activities in media and public events continues to attract new enthusiasts every year, which in turn fuels the market growth. This upward trend is further supported by the development of innovative products that enhance safety and performance, meeting the evolving needs of water sports enthusiasts.

Key Takeaways

- Surface Water Sports Equipment Market was valued at USD 14.6 Billion in 2024 and is expected to reach USD 24.2 Billion by 2034, with a CAGR of 5.2%.

- In 2024, Surfing Equipment led the sports type segment with 53.1%, fueled by increasing global participation in recreational and professional surfing.

- In 2024, Mass Market dominated the price segment with 78.9%, driven by affordability and high consumer adoption.

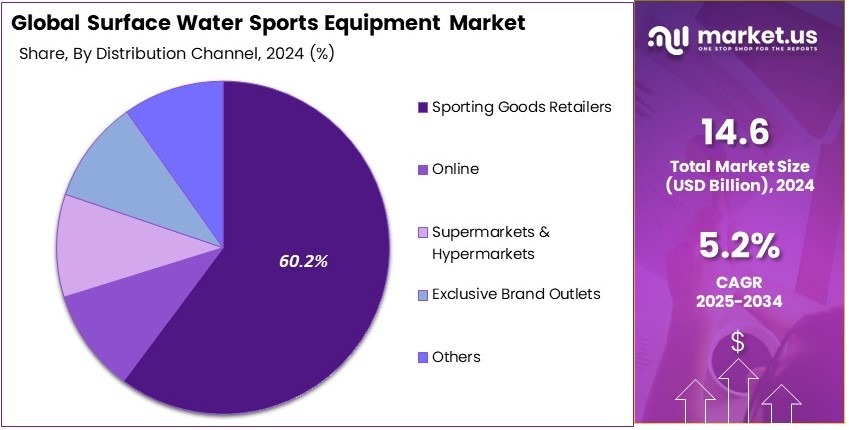

- In 2024, Sporting Goods Retailers held 60.2% of the distribution channel, benefiting from in-store product testing and expert recommendations.

- In 2024, Professional Athletes & Sports Enthusiasts emerged as the key end-user segment, reflecting growing interest in competitive and adventure water sports.

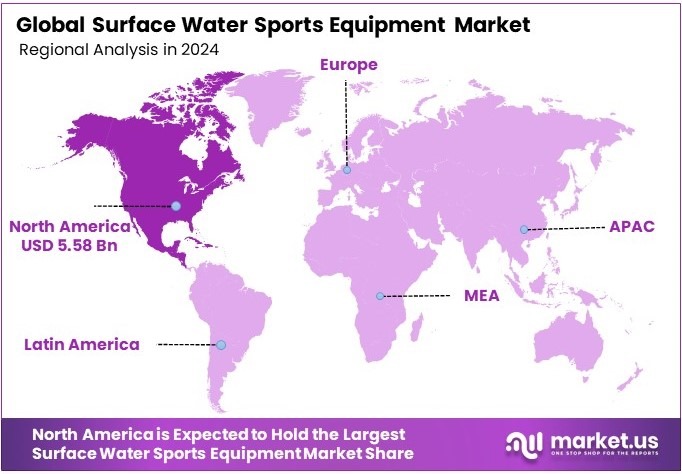

- In 2024, North America dominated the market with 38.2% and a value of USD 5.58 Billion, supported by strong coastal tourism and a high number of water sports facilities.

Sports Type Analysis

Surfing Equipment dominates with 53.1% due to its widespread popularity and versatility in water sports activities.

The Surface Water Sports Equipment market is segmented by various sports types, among which Surfing Equipment emerges as the dominant sub-segment, holding a significant 53.1% of the market share. This category includes Surfboards, Wetsuits & Rash Guards, Surf Leashes, and Traction Pads.

Its dominance is attributed to the global popularity of surfing, which appeals to both casual beachgoers and professional athletes. The versatility of the equipment, suitable for different skill levels and water conditions, contributes significantly to its market share.

Surfboards and Wetsuits are essential for surfers, providing the necessary tools and protection in various marine environments. Rash Guards and Surf Leashes enhance the surfing experience by offering safety and convenience, which are crucial for both learning and advanced maneuvers. Traction Pads improve board grip, increasing performance and safety.

Price Analysis

Mass market dominates with 78.9% due to affordability and broader consumer reach.

In the pricing segment of the Surface Water Sports Equipment market, Mass products hold the largest share at 78.9%. This segment’s dominance is due to its affordability, which makes water sports more accessible to a wider audience, including beginners and occasional users. The lower price point does not necessarily compromise quality but makes the sport more inclusive.

Premium products, though smaller in market share, cater to enthusiasts and professional athletes who demand high-performance equipment tailored to specific needs and conditions. This segment’s customers are willing to invest in higher-priced items for better quality and enhanced features.

Distribution Channel Analysis

Sporting Goods Retailers dominate with 60.2% due to their specialized service and diverse product offerings.

Distribution Channels for Surface Water Sports Equipment are broadly categorized into Online, Sporting Goods Retailers, Supermarkets & Hypermarkets, Exclusive Brand Outlets, and Others. Sporting Goods Retailers dominate this category with a 60.2% share.

Their lead in the market can be attributed to the specialized services they offer, such as expert advice and the ability to try products before purchase, which are highly valued in the sports equipment industry.

Online channels are growing due to the convenience and competitive pricing they offer, but the tactile nature of buying sports equipment often leads consumers to prefer retail stores where they can get a feel for the product. Supermarkets and Hypermarkets offer convenience for casual buyers, whereas Exclusive Brand Outlets provide brand-specific merchandise that appeals to brand-loyal consumers.

End-User Analysis

Professional Athletes & Sports Enthusiasts dominate due to their demand for specialized, high-quality equipment.

End-users of Surface Water Sports Equipment include Individual Consumers, Professional Athletes & Sports Enthusiasts, Water Sports Training Centers, and Tourism & Adventure Sports Companies. Professional Athletes & Sports Enthusiasts form the dominant group, primarily because they require specialized equipment designed to enhance performance and withstand rigorous use.

Individual Consumers and Water Sports Training Centers also contribute to the market. Individuals look for affordability and versatility, while training centers need a range of equipment to cater to different skill levels. Tourism & Adventure Sports Companies capitalize on the growing trend of adventure tourism, offering various water sports activities to enhance the tourist experience.

Key Market Segments

By Product Type

- Surfing Equipment

- Surfboards

- Wetsuits & Rash Guards

- Surf Leashes & Traction Pads

- Paddle Sports Equipment

- Stand-up Paddleboards (SUPs)

- Kayaks & Canoes

- Paddles & Oars

- Sailing & Yachting Equipment

- Sailboats

- Life Jackets & Safety Gear

- Rigging & Accessories

- Water Skiing & Wakeboarding Equipment

- Water Skis

- Wakeboards & Kneeboards

- Tow Ropes & Handles

- Other Surface Water Sports Equipment

By Price

- Mass

- Premium

By Distribution Channel

- Online

- Sporting Goods Retailers

- Supermarkets & Hypermarkets

- Exclusive Brand Outlets

- Others

By End-User

- Individual Consumers

- Professional Athletes & Sports Enthusiasts

- Water Sports Training Centers

- Tourism & Adventure Sports Companies

Driving Factors

Growth in Water Sports Tourism and Recreational Activities Drive Market Expansion

The increasing popularity of water sports as a leisure activity is fueling demand for surface water sports equipment. More individuals are engaging in recreational water sports, such as kayaking, paddleboarding, and jet skiing, as part of their fitness and adventure routines. This rising interest is encouraging manufacturers to develop user-friendly and high-performance equipment.

Additionally, global tourism activities near coastal areas, lakes, and rivers are boosting the market. Popular tourist destinations are investing in water sports infrastructure, attracting both beginners and experienced athletes. As a result, demand for rental services and high-quality water sports gear is rising, creating growth opportunities for equipment providers.

Technological advancements are also playing a significant role in market expansion. Innovations such as lightweight paddleboards, hydrodynamic surfboards, and smart sensors for performance tracking enhance user experience and improve safety. These developments make water sports more accessible to a wider audience, including first-time users.

Furthermore, the growing number of water sports schools and training centers is driving equipment sales. These institutions require a continuous supply of reliable and durable gear for instruction and practice. As more people take up water sports through structured programs, the market for professional and beginner-friendly equipment continues to expand.

Restraining Factors

Weather Dependence and High Costs Restrain Market Growth

The seasonal nature of water sports limits market growth, as participation is largely dependent on weather conditions. Cold winters and unpredictable weather patterns reduce water sports activities, leading to lower equipment sales during off-peak seasons. This challenge affects both manufacturers and rental service providers.

Environmental regulations and access restrictions also pose hurdles for the industry. Many water bodies, particularly in protected areas, have strict guidelines to prevent ecological damage. These restrictions limit the locations where water sports can be practiced, reducing potential customer bases in certain regions.

Another significant barrier is the high cost of advanced water sports equipment. High-performance gear, such as carbon fiber kayaks and motorized surfboards, can be expensive, making them less accessible to casual users. This cost factor limits consumer adoption, particularly in price-sensitive markets.

Safety concerns and the inherent risks involved in water sports further restrain market growth. Drowning risks, equipment malfunctions, and unpredictable water conditions deter some consumers from participating. To address this issue, companies must invest in safety innovations and awareness campaigns to build confidence among potential users.

Growth Opportunities

Eco-Tourism and Rental Services Create New Market Opportunities

Eco-tourism initiatives are providing new opportunities for the surface water sports equipment market. Many destinations are promoting sustainable tourism, incorporating water sports activities into environmentally friendly travel packages. This trend is encouraging the use of biodegradable materials and energy-efficient equipment, appealing to eco-conscious consumers.

Innovation in lightweight and high-durability materials is also driving market expansion. Manufacturers are developing inflatable paddleboards, reinforced surfboards, and ergonomic kayaking gear to enhance portability and user experience. These advancements cater to both professionals and recreational users, increasing adoption rates.

Expansion into new markets with untapped water sports potential is another key growth avenue. Countries with abundant lakes, rivers, and coastal regions are witnessing rising interest in water-based activities. By introducing affordable and accessible equipment, businesses can tap into these emerging markets and attract new customer segments.

Additionally, the development of rental services as a business model is opening new revenue streams. Many tourists and casual users prefer renting equipment instead of purchasing expensive gear. Rental service providers are capitalizing on this trend by offering high-quality water sports equipment at affordable rates, ensuring broader market accessibility.

Emerging Trends

Eco-Friendly Designs and Online Sales Shape Market Trends

The increasing popularity of stand-up paddleboarding and kite surfing is shaping the water sports equipment market. These activities are gaining traction among fitness enthusiasts and adventure seekers, leading to higher demand for specialized boards, paddles, and safety gear.

Integration of eco-friendly practices in equipment production is another emerging trend. Companies are focusing on sustainable materials such as recycled plastics, bamboo surfboards, and non-toxic coatings to reduce environmental impact. These innovations align with consumer preferences for sustainable outdoor activities.

The emphasis on inclusive designs is also influencing market trends. Manufacturers are developing adaptive equipment for individuals with disabilities, ensuring water sports are accessible to a wider audience. Adjustable paddle grips, stable sit-on-top kayaks, and buoyancy aids are being introduced to support diverse user groups.

Enhancement of online marketing and sales platforms is further driving industry growth. E-commerce platforms, social media promotions, and virtual product demonstrations are making water sports equipment more accessible. As digital engagement increases, manufacturers and retailers can reach global consumers, boosting overall market expansion.

Regional Analysis

North America Dominates with 38.2% Market Share in Surface Water Sports Equipment

North America leads the Surface Water Sports Equipment Market with a 38.2% share, valued at USD 5.58 billion. This dominance is largely due to the region’s extensive coastlines, well-established water sports culture, and high consumer spending capacity.

The region benefits from a variety of natural water bodies, including oceans, lakes, and rivers, which are ideal for water sports. The high participation rates in activities such as surfing, paddleboarding, and kayaking contribute to the strong demand for related equipment. Additionally, the presence of numerous manufacturers and a trend towards innovative, high-quality equipment support the market’s growth.

The future influence of North America on the global Surface Water Sports Equipment Market is expected to remain strong. Trends such as eco-friendly equipment and the increasing popularity of water sports among all age groups will likely drive further market expansion, keeping North America at the forefront of the industry.

Regional Mentions:

- Europe: Europe holds a substantial share in the Surface Water Sports Equipment Market, supported by its rich maritime traditions and active outdoor culture. The region’s focus on sustainability is driving innovations in eco-friendly water sports equipment.

- Asia Pacific: The Asia Pacific region is experiencing rapid growth in the Surface Water Sports Equipment Market, fueled by increasing tourism and recreational activities. Countries like Australia are at the forefront, with their vast coastlines and active water sports communities.

- Middle East & Africa: The Middle East and Africa are gradually increasing their presence in the market, with coastal countries investing in water sports infrastructure to boost tourism and local participation.

- Latin America: Latin America is witnessing growth in surface water sports participation, thanks to its tropical climate and extensive coastlines that are ideal for water sports. This is positively impacting the equipment market in the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Surface Water Sports Equipment Market, major influences include Marine Products Corp., Airhead Sports Group, Aqua Lung International, and Body Glove. These companies have been pivotal in developing and distributing equipment that enhances the experience and safety of water sports enthusiasts.

Marine Products Corp. specializes in manufacturing boats used in various water sports, which are central to sports like water skiing and wakeboarding. Airhead Sports Group offers a diverse range of products, including water tubes, life vests, and wakeboards, known for their innovation and safety.

Aqua Lung International is renowned for its high-quality diving gear, providing everything from snorkels to wetsuits, which are crucial for safe and efficient underwater activities. Body Glove also plays a critical role in the market with its line of wetsuits, rash guards, and water sports accessories that combine functionality with comfort and style.

These leading companies drive the Surface Water Sports Equipment Market by continuously enhancing product quality and integrating advanced safety features, catering to both casual enthusiasts and professional athletes. Their commitment to innovation and quality has solidified their positions as top players in the market.

Major Companies in the Market

- Johnson & Johnson

- Marine Products Corp.

- Airhead Sports Group

- Aqua Lung International

- Beuchat

- Body Glove

- Cressi

- Hobie Cat Company

- Hurley

- Liquid Force

- Mares

- Naish International

- O’Brien Watersports

Recent Developments

- Amer Sports: In November 2024, Amer Sports, known for brands like Arc’teryx, Salomon, and Wilson, reported that its quarterly revenue from Greater China surpassed $280 million, reflecting a 40% growth compared to the previous year. This surge is attributed to the rising popularity of adventure hobbies such as biking and hiking in the region.

- RAVE Sports: In April 2022, RAVE Sports was honored with the Water Sports Industry Association’s (WSIA) “Innovative Product of the Year” Leadership Award for its new Big Easy boat towable. This recognition underscores the company’s commitment to innovation in the surface water sports equipment sector.

Report Scope

Report Features Description Market Value (2024) USD 14.6 Billion Forecast Revenue (2034) USD 24.2 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Surfing Equipment: Surfboards, Wetsuits & Rash Guards, Surf Leashes & Traction Pads; Paddle Sports Equipment: Stand-up Paddleboards (SUPs), Kayaks & Canoes, Paddles & Oars; Sailing & Yachting Equipment: Sailboats, Life Jackets & Safety Gear, Rigging & Accessories; Water Skiing & Wakeboarding Equipment: Water Skis, Wakeboards & Kneeboards, Tow Ropes & Handles; Other Surface Water Sports Equipment), By Price (Mass, Premium), By Distribution Channel (Online, Sporting Goods Retailers, Supermarkets & Hypermarkets, Exclusive Brand Outlets, Others), By End-User (Individual Consumers, Professional Athletes & Sports Enthusiasts, Water Sports Training Centers, Tourism & Adventure Sports Companies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Johnson & Johnson, Marine Products Corp., Airhead Sports Group, Aqua Lung International, Beuchat, Body Glove, Cressi, Hobie Cat Company, Hurley, Liquid Force, Mares, Naish International, O’Brien Watersports Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Surface Water Sports Equipment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Surface Water Sports Equipment MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Johnson & Johnson

- Marine Products Corp.

- Airhead Sports Group

- Aqua Lung International

- Beuchat

- Body Glove

- Cressi

- Hobie Cat Company

- Hurley

- Liquid Force

- Mares

- Naish International

- O'Brien Watersports