Global Ice Hockey Equipment Market Size, Share, Growth Analysis By Product Type (Sticks, Skates, Protective Gear - Helmets, Shoulder Pads, Elbow Pads, Shin Guards, Gloves, Girdles; Pucks, Bags, Accessories), By End-User (Professional Players, Recreational Players, Youth Players), By Distribution Channel (Online Retail, Sports Specialty Stores, Supermarkets or Hypermarkets, Brand Outlets), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137325

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

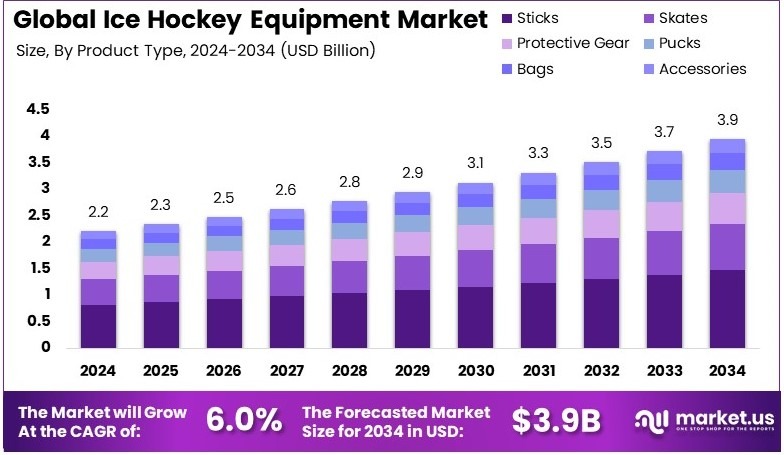

The Global Ice Hockey Equipment Market size is expected to be worth around USD 3.9 Billion by 2034, from USD 2.2 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

Ice hockey equipment consists of protective gear and gear needed for playing ice hockey. This includes helmets, pads, sticks, skates, and gloves. The equipment is designed to protect players from injuries while providing comfort and mobility on ice. The design follows rigorous safety standards to ensure athlete safety and performance.

The ice hockey equipment market involves the production and sale of protective gear and accessories used in ice hockey. It includes various brands, manufacturers, and suppliers. Market players focus on quality materials, safety features, and innovation. The market structure is shaped by consumer preferences, league requirements, and technological advancements.

In the Ice Hockey Equipment Market, player equipment preferences are crucial indicators of brand dominance and market trends. For instance, 139 NHL players currently use the CCM JetSpeed FT7 Pro stick, and 106 opt for the Bauer Vapor HyperLite 2.

On the skate front, the Bauer Vapor HyperLite 2 skates lead, chosen by 267 NHL athletes, followed by the Bauer Supreme Mach with 110. These preferences among professionals not only reflect performance satisfaction but also influence amateur player purchases, highlighting effective marketing and product quality.

The global landscape of ice hockey is robust, as evidenced by the 1.64 million registered players worldwide, according to the International Ice Hockey Federation. With Canada and the United States at the forefront, harboring over 630,000 and 550,000 registered players respectively, there is a significant, ongoing demand for high-quality ice hockey equipment.

This substantial player foundation provides a steady market for new and existing companies, fostering a competitive environment that encourages continual improvements in equipment technology and design.

Government involvement plays a pivotal role in shaping this market; regulations on safety and quality, along with investments in public ice hockey facilities and youth leagues, directly impact equipment sales.

These government actions not only support the sport’s infrastructure but also ensure a growing base of new players. Locally, such investments have led to increased economic activity, with more frequent purchases of equipment and related merchandise, thereby bolstering the overall market growth.

Key Takeaways

- The Ice Hockey Equipment Market was valued at USD 2.2 Billion in 2024, and is expected to reach USD 3.9 Billion by 2034, with a CAGR of 6.0%.

- In 2024, Sticks dominated the product type segment with 37.2% due to their essential role in gameplay and continuous innovation.

- In 2024, Professional Players dominated the end-user segment with 49.1% because of high performance and preference for premium equipment.

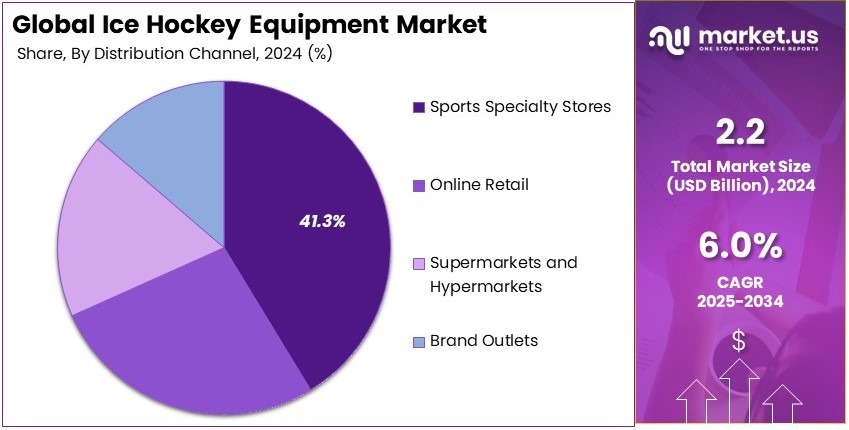

- In 2024, Sports Specialty Stores led the distribution channel with 41.3% owing to their dedicated sporting goods sections and expert advice.

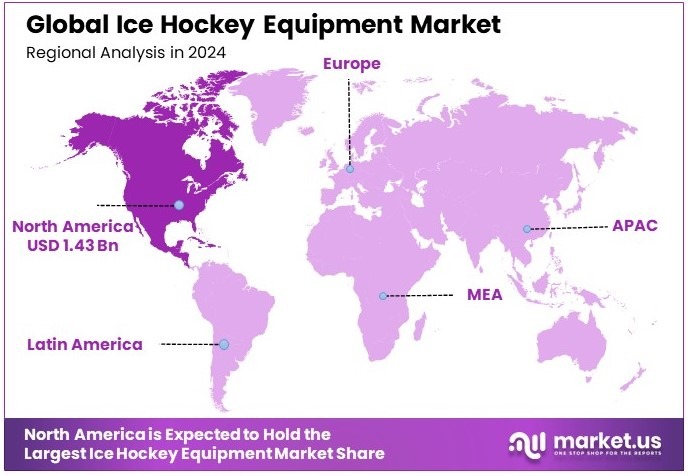

- In 2024, North America dominated the region with 65.2% market share and contributed USD 1.43 Bn, highlighting its market significance.

Type Analysis

Sticks dominate with 37.2% due to their fundamental role in gameplay.

Sticks are the most critical equipment in ice hockey, making them the dominant sub-segment within the Product Type category. Their design, tailored to enhance handling and accuracy, directly impacts players’ performance, making them a significant focus for innovation and marketing.

The evolution of stick technology, including materials like carbon fiber, enhances lightweight properties and durability, attracting both new players and professionals to invest in high-quality options.

Skates, crucial for mobility on ice, do not dominate but are indispensable for speed and agility. Protective gear, including helmets, shoulder pads, elbow pads, shin guards, gloves, and girdles, is essential for safety, driving its necessity despite a smaller share.

Pucks and bags, while fundamental, hold lesser attention but are integral to the sport. Accessories like tape and blade protectors are critical for maintaining sports equipment but contribute minimally to total sales.

End-User Analysis

Professional Players dominate with 49.1% due to their high-performance equipment needs.

Professional players represent the largest end-user segment, as their requirements for top-tier, performance-enhancing equipment drive significant sales. This group’s demand for advanced technology and premium quality in ice hockey equipment supports continuous innovation and high price points, sustaining industry growth.

Recreational players, although they participate widely, typically seek cost-effective equipment, focusing less on cutting-edge technology but more on durability and comfort.

Youth players, essential for the sport’s growth, need equipment that ensures safety and fits well, as they are in their developmental stages. Both segments, while smaller in market share, are crucial for expanding the sport’s base and driving long-term participation.

Distribution Channel Analysis

Sports Specialty Stores dominate with 41.3% due to tailored service and expertise.

The Ice Hockey Equipment Market distributes products through various channels, and Sports Specialty Stores lead the way. These stores capture 41.3% of the market share. Their dominance comes from offering specialized products and knowledgeable staff. Players and fans visit these stores for expert advice and custom fittings.

The personalized service and product range attract both professional players and serious enthusiasts. In addition, sports specialty stores often host events and product demonstrations. These activities foster a community feel and build brand loyalty.

Other distribution channels also serve important roles. Online retail offers convenience and a wide selection. Supermarkets and hypermarkets provide accessibility for casual buyers. Brand outlets allow companies to control product presentation and customer experience.

Despite the growth of online platforms, sports specialty stores maintain a strong position because of their focused expertise. They act as centers for advice, fitting, and demonstration, which online retailers cannot fully replicate.

Key Market Segments

By Product Type

- Sticks

- Skates

- Protective Gear

- Helmets

- Shoulder Pads

- Elbow Pads

- Shin Guards

- Gloves

- Girdles

- Pucks

- Bags

- Accessories

By End-User

- Professional Players

- Recreational Players

- Youth Players

By Distribution Channel

- Online Retail

- Sports Specialty Stores

- Supermarkets/Hypermarkets

- Brand Outlets

Driving Factors

Increasing Popularity Drives Market Growth

The Ice Hockey Equipment Market sees strong growth from the increasing popularity of ice hockey in emerging markets. For example, countries in Asia like South Korea and China show growing interest, leading to a rise in equipment sales.

The growth of professional ice hockey leagues worldwide, such as the NHL expansion into new markets, further fuels demand. This trend reaches grassroots levels where rising participation of women in ice hockey sports plays a crucial role. More women joining leagues increases the need for specialized gear. Development of ice hockey infrastructure in developing regions also supports market expansion.

New rinks and training facilities emerge in cities that previously lacked resources. These factors create a robust pipeline for equipment providers to innovate and cater to diverse customer needs. The combined effect increases market penetration, drives investments in new product lines, and encourages partnerships.

Real-world examples include community programs in Canada that promote youth hockey and drive equipment sales. In addition, professional leagues hosting exhibition matches in untapped markets spur local interest. This network of drivers creates a sustainable growth model for the ice hockey equipment industry by intertwining grassroots initiatives, professional influence, and regional development.

Restraining Factors

High Costs and Accessibility Restraints Market Growth

The Ice Hockey Equipment Market faces several challenges that restrain growth. High cost of ice hockey equipment and gear prevents many aspiring players from purchasing quality products. For instance, a beginner may find the price of full protective gear overwhelming. Limited access to ice hockey facilities in certain regions adds another barrier.

Rural areas in countries like India may not have ready access to ice rinks, reducing demand. The seasonal nature of ice hockey participation means that interest and sales peak only at certain times of the year. Off-season periods often see a decline in activity and revenue.

Risk of counterfeit products affecting market revenue is another concern. Fake gear not only harms brand reputation but also poses safety risks. These factors make it challenging for manufacturers and retailers to maintain consistent growth. Companies must work on pricing strategies and facility development. They could also invest in quality assurance to combat counterfeits.

Addressing these restraints might involve engaging local communities, improving access, and educating consumers on authentic purchases. Overcoming these hurdles is vital for sustaining long-term market growth and creating more inclusive participation.

Growth Opportunities

Development of Advanced Equipment Provides Opportunities

The Ice Hockey Equipment Market offers promising opportunities. Development of lightweight and high-performance equipment using advanced materials opens new pathways. For example, carbon fiber composites in sticks reduce weight and improve performance.

Rising demand for women-specific ice hockey gear and apparel broadens the market. More women players need gear designed for their fit and style, increasing niche product lines. Growth of amateur ice hockey leagues and community events drives localized demand. These grassroots activities encourage bulk purchases for local teams.

Opportunities in eco-friendly and sustainable equipment manufacturing appeal to environmentally conscious consumers. Using recycled materials in helmets and pads can resonate with modern buyers. These opportunities enable manufacturers to diversify and innovate.

Companies can invest in research and development to create products that meet specific needs. By focusing on advanced materials, tailored designs, and sustainability, brands can capture new market segments. Engaging with amateur leagues and communities fosters loyalty and long-term growth. As a result, these strategic moves can enhance competitiveness and secure market leadership in a dynamic industry.

Emerging Trends

Smart Technology Trends Are Latest Trending Factor

The Ice Hockey Equipment Market is shaped by several trending factors. Adoption of smart sensors in protective gear for enhanced safety captures attention. These sensors track impacts and alert players to potential injuries, improving player welfare.

Demand for lightweight and durable hockey sticks and skates drives technological innovation. Manufacturers use advanced materials to balance strength and weight. Increasing popularity of retro and heritage ice hockey equipment designs brings nostalgia to consumers.

Fans and players often seek classic styles that recall legendary players or eras. Influence of social media and esports in driving ice hockey equipment trends is notable. Platforms like Instagram and Twitch showcase new gear and engage younger audiences.

These trends reflect a shift towards integrating technology, tradition, and digital influence. Companies blend smart features with classic designs to appeal to diverse customer bases. As trends evolve, staying attuned to smart technology and heritage appeal becomes essential.

Regional Analysis

North America Dominates with 65.2% Market Share

North America holds a commanding 65.2% share in the Ice Hockey Equipment Market, valued at USD 1.43 billion. The region’s dominance is fueled by a strong ice hockey tradition, high participation rates, and extensive professional leagues. These factors ensure continuous demand for high-quality equipment.

Local manufacturers also play a crucial role by innovating and supplying advanced gear. The region’s deep-rooted ice hockey culture and supporting infrastructure significantly contribute to its market leadership.

The expectation is for North America to maintain its lead in the global market. The introduction of youth programs and increasing interest in ice hockey will likely attract new players, sustaining equipment sales. For instance, initiatives like ‘Try Hockey for Free’ days increase sport participation, further boosting equipment demand.

Regional Mentions:

- Europe: Europe is a key player in the Ice Hockey Equipment Market, with robust demand in countries like Sweden and Russia. The region’s strong ice hockey clubs and international tournaments stimulate market growth.

- Asia Pacific: Asia Pacific is growing in the Ice Hockey Equipment Market. Nations like China are investing in winter sports, particularly ahead of events like the Winter Olympics, enhancing regional market potential.

- Middle East & Africa: The Middle East & Africa are slowly entering the ice hockey scene, with initiatives to build ice rinks and introduce the sport to new audiences, which may gradually increase market share.

- Latin America: Latin America remains a smaller market for ice hockey equipment due to limited ice sports culture. However, niche markets in countries like Argentina show potential for growth with targeted development programs.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Ice Hockey Equipment Market, the prominent leaders include Bauer Hockey, LLC, CCM Hockey, Warrior Sports, Inc., and Sher-Wood Hockey Inc. These companies are pivotal in shaping the market, known for their quality, innovation, and strong brand reputations.

Bauer Hockey, LLC is a leading figure, renowned for its cutting-edge technology and wide range of products that cater to all levels of ice hockey from amateurs to professionals. Bauer’s continuous innovation in safety and performance equipment makes it a preferred choice among players.

CCM Hockey is another key player that combines tradition and technology, offering a broad array of equipment including high-quality skates, protective gear, and sticks. CCM is celebrated for customizing equipment to fit the diverse needs of players, enhancing both performance and protection.

Warrior Sports, Inc., primarily known for its innovative sticks and protective gear, has carved out a significant niche in the market. Warrior’s focus on design and functionality appeals particularly to younger players looking for modern, high-performance equipment.

Sher-Wood Hockey Inc., while smaller than Bauer and CCM, holds a loyal customer base due to its rich history in manufacturing quality wooden sticks and its expansion into modern composite technologies.

These top companies are instrumental in driving the development and popularity of ice hockey equipment worldwide. Their commitment to quality, coupled with ongoing technological advancements, ensures that they remain at the forefront of the market, continually enhancing the safety and performance of ice hockey players.

Major Companies in the Market

- Bauer Hockey, LLC

- CCM Hockey

- Warrior Sports, Inc.

- Sher-Wood Hockey Inc.

- Easton Hockey

- Graf Skates AG

- True Temper Sports

- STX LLC

- Grit Inc.

- Mylec, Inc.

- Franklin Sports Inc.

- Winnwell Inc.

- Reebok-CCM Hockey

Recent Developments

- Ice Hockey League: On January 2025, the second edition of the Ice Hockey League commenced in Leh, Ladakh, featuring 10 men’s and five women’s teams. The tournament aims to build on the momentum from its inaugural edition with a 10-day span.

- PWHL: On January 2024, the Professional Women’s Hockey League (PWHL) launched its inaugural season in North America. The league comprises six teams across the United States and Canada, with a schedule including over 20 regular season games and playoffs.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Billion Forecast Revenue (2034) USD 3.9 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sticks, Skates, Protective Gear – Helmets, Shoulder Pads, Elbow Pads, Shin Guards, Gloves, Girdles; Pucks, Bags, Accessories), By End-User (Professional Players, Recreational Players, Youth Players), By Distribution Channel (Online Retail, Sports Specialty Stores, Supermarkets/Hypermarkets, Brand Outlets) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bauer Hockey, LLC, CCM Hockey, Warrior Sports, Inc., Sher-Wood Hockey Inc., Easton Hockey (a subsidiary of Performance Sports Group), Graf Skates AG, True Temper Sports, STX LLC, Grit Inc., Mylec, Inc., Franklin Sports Inc., Winnwell Inc., Reebok-CCM Hockey (formerly a division of Adidas) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ice Hockey Equipment MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Ice Hockey Equipment MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bauer Hockey, LLC

- CCM Hockey

- Warrior Sports, Inc.

- Sher-Wood Hockey Inc.

- Easton Hockey

- Graf Skates AG

- True Temper Sports

- STX LLC

- Grit Inc.

- Mylec, Inc.

- Franklin Sports Inc.

- Winnwell Inc.

- Reebok-CCM Hockey