Global Volleyball Apparel And Equipment Market Size, Share, Growth Analysis By Product Type (Apparel, Outerwear, Footwear), By End-User (Men, Women, Kids), By Distribution Channel (Online Retail, Sports Specialty Stores, Supermarkets and Hypermarkets, Brand Outlets), By Application (Indoor Volleyball, Beach Volleyball, Outdoor Volleyball), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137334

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

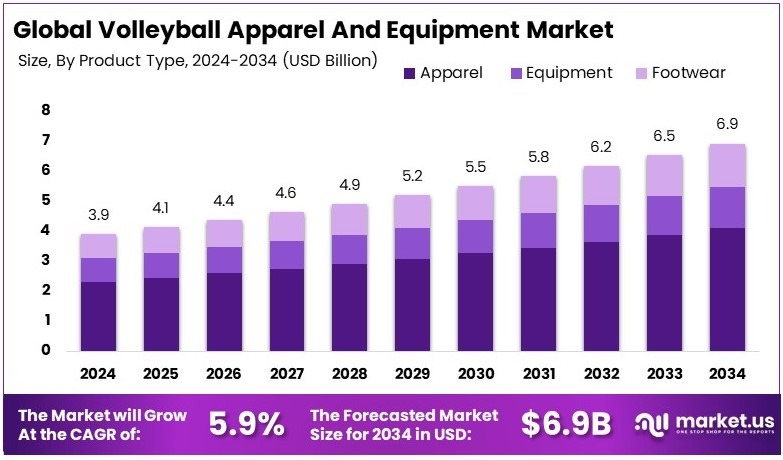

The Global Volleyball Apparel And Equipment Market size is expected to be worth around USD 6.9 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

Volleyball apparel and equipment include clothing and gear used in volleyball. Apparel features jerseys, shorts, socks, and shoes designed for comfort and performance. Equipment comprises knee pads, balls, and nets. The products are developed to enhance agility, safety, and support during play, following sport-specific requirements.

The volleyball apparel and equipment market covers the creation, distribution, and sale of clothing and gear for volleyball. It includes various brands, suppliers, and retail channels. Market participants prioritize quality materials, comfort, and durability. Consumer interest and sporting trends influence market development and product offerings.

Volleyball’s global participation is massive, with 998 million players worldwide. The sport’s governance by the Fédération Internationale de Volleyball (FIVB) extends across 220 national federations, demonstrating its broad international appeal. In the U.S., volleyball’s growth is highlighted by a record 470,488 high school participants in 2022-2023, showing a 3.6% increase from the previous year.

The volleyball apparel and equipment market benefits from these participation rates. As the sport grows, so does the demand for related gear, especially among youth and amateur leagues. The doubling of junior clubs in the U.S., from 1,750 in 2004-2005 to 3,880 in 2023-2024, showcases the expanding grassroots impact on equipment sales. This popularity supports a competitive market landscape, where brands strive to innovate and capture the loyalty of a global fan base of 900 million.

Market saturation varies by region, reflecting the sport’s uneven global spread. In places with a longstanding volleyball culture, market competition is fierce, while emerging markets offer new growth opportunities.

Government policies and investments in sports facilities and programs can influence market dynamics significantly, enhancing local participation and equipment demand. This interplay between global appeal and local activity shapes the strategic focus of industry stakeholders.

Key Takeaways

- The Volleyball Apparel And Equipment Market was valued at USD 3.9 Billion in 2024, and is expected to reach USD 6.9 Billion by 2034, with a CAGR of 5.9%.

- In 2024, Volleyball Apparel dominated the product segment with 59.2% due to its high demand and trend in athletic fashion.

- In 2024, Sporting Goods Retailers led the distribution channel with 55.3% attributed to their extensive product range and customer reach.

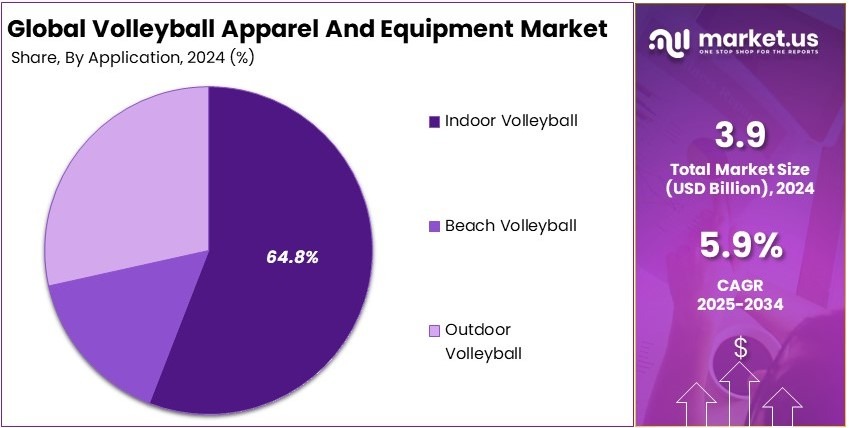

- In 2024, Indoor Volleyball Apparel & Equipment captured 64.8%, signifying a preference for indoor sporting activities.

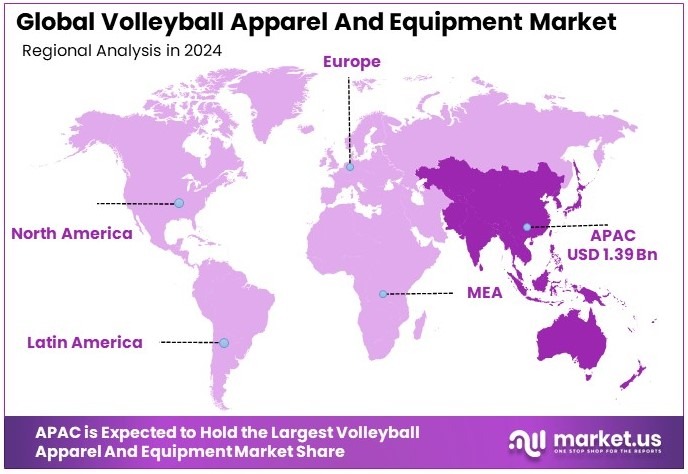

- In 2024, Asia Pacific dominated the region with 35.7% market share and contributed USD 1.39 Bn, reflecting robust market growth.

Product Type Analysis

Volleyball Apparel dominates with 59.2% due to its essential role in player performance and comfort.

Volleyball Apparel is the most significant sub-segment within the product type category, primarily due to its direct impact on players’ performance and comfort during games. This category includes jerseys, shorts, compression wear, socks, and outerwear, each designed to meet the rigorous demands of the sport. Jerseys and shorts are crucial for their breathability and fit, allowing for optimal movement and comfort, which explains their large market share.

Compression wear supports muscles and improves blood circulation, which is vital for players’ endurance and recovery. Socks are designed to offer cushioning and support, critical in a sport that involves frequent jumping and rapid movements. Outerwear provides players with necessary warmth and muscle protection before and after matches, contributing to their overall performance and safety.

Sports equipment, although essential, such as volleyballs, nets, knee pads, arm sleeves, shoes, ball pumps, and bags, supports the gameplay but does not share the apparel’s direct impact on player performance. Each piece of equipment has its role, from enhancing player safety with knee pads and arm sleeves to ensuring the game’s quality with high-standard volleyballs and durable nets.

Distribution Channel Analysis

Sports Specialty Stores dominate with 55.3% due to their targeted product offerings and expert customer service.

Sports Specialty Stores are the leading distribution channel, favored by consumers for their specialized product range and expert advice, which is particularly valuable in sports requiring specific equipment like volleyball. These stores offer a wide variety of volleyball apparel and equipment, enabling customers to find items that best fit their needs and preferences.

Online Retail, while convenient, offers a broad selection but lacks the personalized service that specialty stores provide. Supermarkets/Hypermarkets and Brand Outlets also play significant roles, offering accessibility and brand-specific merchandise, respectively, but they do not match the focused expertise of sports specialty stores.

Category Analysis

Indoor Volleyball Apparel & Equipment dominates with 64.8% due to its widespread popularity and indoor play settings.

Indoor Volleyball is the predominant form of the sport, played by both professionals and amateurs, which is why the apparel and equipment tailored for indoor settings dominate the market. The controlled environment of indoor volleyball allows for specific types of equipment and apparel, such as shoes designed for hardwood floors, which significantly influence product designs and materials.

Beach Volleyball and Outdoor Volleyball, while popular during the summer seasons, require different types of apparel and equipment, like sand-specific footwear and more weather-resistant nets. However, the more consistent year-round play and broader participation in indoor volleyball ensure its dominance in the market share.

Key Market Segments

By Product Type

- Apparel

- Jerseys

- Shorts

- Compression Wear

- Socks

- Outerwear

- Equipment

- Volleyballs

- Nets

- Knee Pads

- Arm Sleeves

- Shoes

- Ball Pumps

- Bags

- Footwear

By End-User

- Men

- Women

- Kids

By Distribution Channel

- Online Retail

- Sports Specialty Stores

- Supermarkets/Hypermarkets

- Brand Outlets

By Application

- Indoor Volleyball

- Beach Volleyball

- Outdoor Volleyball

Driving Factors

Increasing Popularity Drives Market Growth

The Volleyball Apparel and Equipment Market is expanding due to the increasing popularity of volleyball as both a recreational and competitive sport. For instance, community centers and schools worldwide are incorporating volleyball in their sports programs, prompting demand for uniforms, nets, and shoes.

Growth of amateur and professional volleyball leagues worldwide, such as national leagues in Brazil and professional circuits in Europe, further boosts sales. Rising participation of women and youth in volleyball is evident when high schools in California introduce specialized volleyball clinics, increasing the need for quality gear.

Development of volleyball training centers and facilities in cities like Tokyo and Los Angeles also drives demand. These centers host tournaments and workshops that require a consistent supply of equipment. This trend not only increases revenue for manufacturers but also encourages innovation and improved product standards across the industry.

For example, a new training facility in Chicago that offers summer camps for youth players often partners with equipment brands to supply gear, demonstrating how infrastructure development and rising popularity directly contribute to market growth.

Restraining Factors

Limited Awareness and Seasonal Challenges Restraints Market Growth

The market faces restraints such as limited awareness of volleyball in non-traditional markets. In regions where the sport is less known, like parts of Africa, fewer people purchase volleyball gear. Seasonal demand for volleyball equipment in outdoor sports also presents a challenge.

For example, beach volleyball gear sees high sales during summer but drops off in winter. High maintenance and repair costs for volleyball equipment can deter schools from upgrading equipment frequently.

In addition, counterfeit products affecting brand loyalty and market share harm consumer trust. Fake volleyball shoes and jerseys often appear in local markets in Southeast Asia, misleading consumers and reducing genuine sales. These issues make it harder for brands to maintain steady growth.

Companies may need to invest in marketing and education campaigns to raise awareness and implement quality assurance measures to combat counterfeiting. Seasonal promotions and local partnerships might help stabilize demand. Addressing these restraints with targeted strategies can improve market penetration and long-term sustainability.

Growth Opportunities

Eco-Friendly Innovations Provide Opportunities

Opportunities arise from the development of eco-friendly and sustainable volleyball gear. Manufacturers using recycled materials in volleyballs and uniforms, like biodegradable nets, appeal to environmentally conscious consumers.

Growing demand for women-specific volleyball apparel and equipment allows brands to design lighter, more comfortable gear suited to female athletes. For example, a sports brand may launch a line of breathable, form-fitting jerseys tailored for women, meeting both aesthetic and functional needs.

Increase in youth and school-level volleyball programs boosts equipment sales. A school district in Texas investing in new volleyball sets for its teams illustrates this growth. Opportunities in customizable team apparel for colleges and clubs open new revenue streams.

Offering personalized jerseys for university teams or club uniforms with custom logos and colors can enhance team spirit and brand loyalty. These developments encourage manufacturers to innovate and diversify their products, catering to evolving consumer demands and fostering market expansion.

Emerging Trends

Advanced Trends Are Latest Trending Factor

The Volleyball Apparel and Equipment Market is also shaped by emerging trends. Integration of advanced performance fabrics in volleyball apparel leads to enhanced comfort and durability. For instance, moisture-wicking shirts used by professionals in international tournaments keep players cool and dry.

Rising popularity of athleisure wear influenced by volleyball culture is seen when casual wear brands incorporate volleyball-inspired designs into their collections. Use of smart technologies for tracking performance metrics in equipment, like sensor-embedded volleyballs that measure spike speed, appeals to competitive players seeking data.

Growth of volleyball-influenced streetwear and casual fashion creates a crossover market where fans wear apparel off the court. For example, urban fashion labels may release hoodie designs featuring volleyball graphics.

These trends highlight a fusion of performance enhancement, style, and technology. They not only attract traditional players but also broaden the sport’s appeal to a wider audience. As a result, brands are adapting by blending high-tech features with contemporary fashion, ensuring they meet modern consumer expectations while driving continued market interest.

Regional Analysis

Asia Pacific Dominates with 35.7% Market Share

Asia Pacific commands the Volleyball Apparel and Equipment Market with a 35.7% share, totaling USD 1.39 billion. This dominance is fueled by the sport’s popularity in countries like China, Japan, and South Korea, where volleyball is a major part of school and club sports. High participation rates drive consistent demand for both amateur and professional gear.

The region’s strong manufacturing capabilities enable local brands to offer quality products at competitive prices, further enhancing market growth. The proliferation of volleyball leagues and events, coupled with government support for sports development, underpins the robust market dynamics.

Looking ahead, Asia Pacific is poised to maintain its lead, with ongoing investments in sports infrastructure and youth programs continuing to stimulate market expansion. For instance, the establishment of new volleyball academies and tournaments in the region supports sustained interest and equipment upgrades.

Regional Mentions:

- North America: North America maintains a significant presence in the Volleyball Apparel and Equipment Market, supported by strong collegiate and professional leagues. The U.S. particularly shows robust market engagement with initiatives to promote the sport at various levels.

- Europe: Europe’s market is driven by well-established volleyball cultures in countries like Italy and Poland. These nations host influential leagues and have a rich history of competitive play, which supports sustained equipment demand.

- Middle East & Africa: Volleyball is gaining traction in the Middle East & Africa, with increased participation at the school and community levels. Regional tournaments and active promotion are gradually building a market for volleyball products.

- Latin America: Latin America shows growth in volleyball participation, especially in Brazil, where the sport ranks highly in popularity. This popularity is mirrored in increased local market demand for volleyball apparel and equipment.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Volleyball Apparel and Equipment Market, the most influential companies include Mizuno Corporation, Asics Corporation, Molten Corporation, and Mikasa Sports USA. These brands are central to shaping market trends through their specialized volleyball products.

Mizuno Corporation is highly regarded for its high-quality volleyball apparel and shoes, offering advanced technologies that enhance player comfort and performance. Mizuno’s products are popular among both professional athletes and recreational players for their durability and innovative designs.

Asics Corporation is another leader, known for its volleyball shoes and sportswear that combine comfort, style, and functionality. Asics invests heavily in research and development to provide volleyball players with products that improve mobility and performance on the court.

Molten Corporation is a key player in volleyball equipment, particularly volleyballs. It is the brand of choice for numerous international competitions, recognized for its top-tier volleyballs that offer superior performance and consistency.

Mikasa Sports USA rounds out the top four, with its volleyballs being synonymous with international play, including official game balls for major tournaments. Mikasa’s commitment to quality and game enhancement makes its products a staple within the sport.

These companies collectively dominate the Volleyball Apparel and Equipment Market, driving innovation and setting high standards for product quality. Their dedication to developing specialized volleyball gear has made significant contributions to the sport’s global growth and popularity.

Major Companies in the Market

- Mizuno Corporation

- Asics Corporation

- Molten Corporation

- Mikasa Sports USA

- Wilson Sporting Goods Co.

- Tachikara USA Inc.

- Adidas AG

- Nike Inc.

- Under Armour, Inc.

- Spalding

- Baden Sports, Inc.

- Decathlon S.A.

- Dunlop Sports

Recent Developments

- Revolve: On November 2024, Revolve and League One Volleyball (LOVB) announced a partnership aimed at merging sports and fashion for women. The collaboration seeks to empower female athletes with stylish and functional apparel.

- Avoli: On July 2023, Avoli launched its inaugural performance collection for female volleyball athletes. The product line includes a low-top volleyball shoe, recovery slides, knee pads, and sleeves designed for improved fit, ventilation, and cushioning.

- REN Athletics: On October 2023, REN Athletics became the official uniform and apparel partner for the Pro Volleyball Federation. As the largest volleyball-only apparel company in the U.S., they will supply custom-designed uniforms and gear for the league’s inaugural season.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 6.9 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Apparel – Jerseys, Shorts, Compression Wear, Socks, Outerwear; Equipment – Volleyballs, Nets, Knee Pads, Arm Sleeves, Shoes, Ball Pumps, Bags; Footwear), By End-User (Men, Women, Kids), By Distribution Channel (Online Retail, Sports Specialty Stores, Supermarkets/Hypermarkets, Brand Outlets), By Application (Indoor Volleyball, Beach Volleyball, Outdoor Volleyball) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mizuno Corporation, Asics Corporation, Molten Corporation, Mikasa Sports USA, Wilson Sporting Goods Co., Tachikara USA Inc., Adidas AG, Nike Inc., Under Armour, Inc., Spalding, Baden Sports, Inc., Decathlon S.A., Dunlop Sports Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Volleyball Apparel And Equipment MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Volleyball Apparel And Equipment MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mizuno Corporation

- Asics Corporation

- Molten Corporation

- Mikasa Sports USA

- Wilson Sporting Goods Co.

- Tachikara USA Inc.

- Adidas AG

- Nike Inc.

- Under Armour, Inc.

- Spalding

- Baden Sports, Inc.

- Decathlon S.A.

- Dunlop Sports