Global Billiards and Snooker Equipment Market Size, Share, Growth Analysis By Product Type (Tables, Cues, Balls, Accessories), By Material (Wood, Metal, Composite Materials, Others), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137347

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

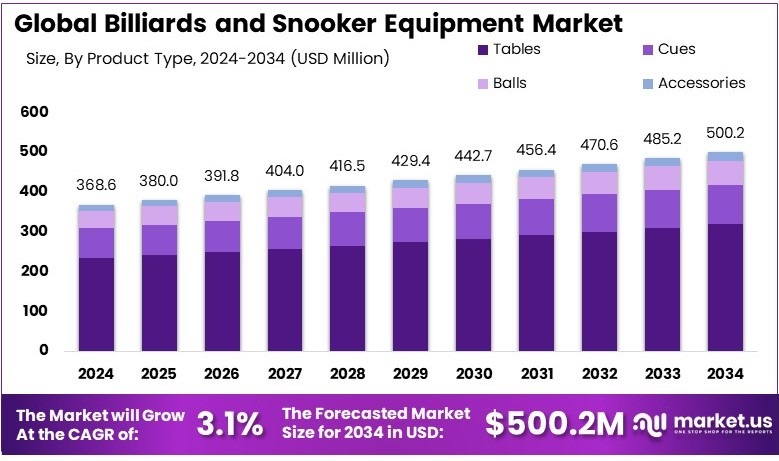

The Global Billiards and Snooker Equipment Market size is expected to be worth around USD 500.2 Million by 2034, from USD 368.6 Million in 2024, growing at a CAGR of 3.1% during the forecast period from 2025 to 2034.

Billiards and snooker equipment encompasses tables, cues, balls, chalk, and racks used for the games. The equipment is crafted from quality materials to ensure precision, durability, and optimal performance. Designs adhere to standardized dimensions and weight specifications to meet the needs of players at all levels.

The billiards and snooker equipment market involves the production and sale of tables, cues, balls, and accessories. It includes various manufacturers, distributors, and retailers. The market emphasizes craftsmanship, material quality, and adherence to standards. Consumer demand and recreational trends determine the range of products available.

In England, approximately 19,300 people actively participate in snooker, showcasing its niche yet dedicated following. Snooker’s global reach is substantial, with the World Snooker Federation encompassing over 90 member countries. This widespread international interest suggests a stable demand for snooker equipment across diverse markets.

The billiards and snooker equipment market benefits from the sport’s rich variety and high-end appeal. For instance, Bugatti’s release of a £217,000 ‘self-levelling’ pool table caters to the luxury segment, particularly superyacht owners. Additionally, the variety in billiards games, totaling over 30 official types, and large tournaments like the BCA Pool League World Championships with 500 tables, indicate both a broad consumer base and diverse product demand.

Government investment in sports facilities and regulatory standards can significantly influence market dynamics, affecting everything from equipment quality to market access. On a broader scale, innovations like high-tech, luxury equipment demonstrate the market’s potential for high-value products, while on a local scale, community tournaments and clubs drive steady sports equipment sales.

Key Takeaways

- The Billiards and Snooker Equipment Market was valued at USD 368.6 Million in 2024, and is expected to reach USD 500.2 Million by 2034, with a CAGR of 3.1%.

- In 2024, Tables dominated the product type segment with 63.7% due to the central role they play in billiards and snooker games.

- In 2024, Wood led the material segment with 58.2% because of its preferred quality and traditional use in manufacturing.

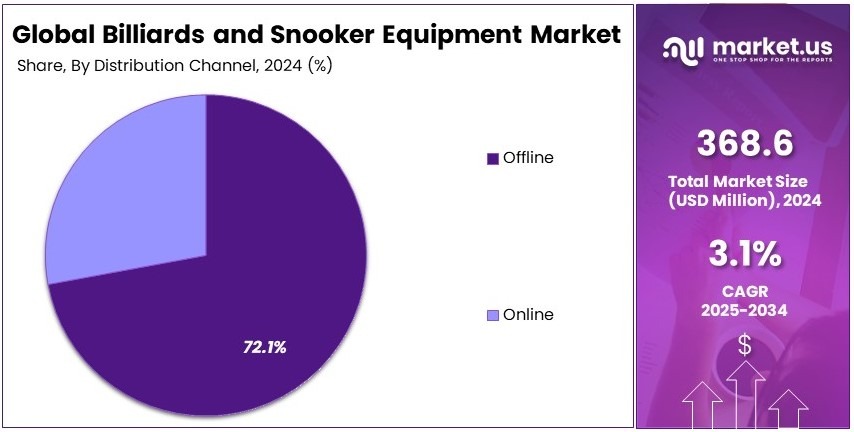

- In 2024, Offline retail channel dominated with 72.1%, reflecting customer preference for hands-on product examination.

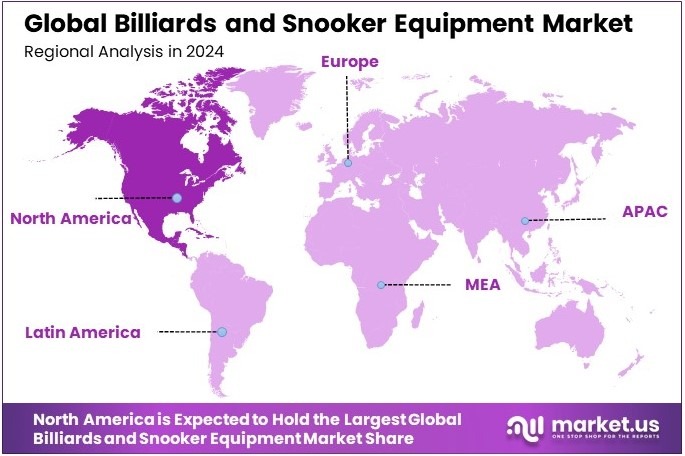

- In 2024, North America stood out as a significant region, although specific market share or value data was not provided, highlighting its established market base.

Product Type Analysis

Tables dominate with 63.7% due to their fundamental role in the game.

Tables are the cornerstone of billiards and snooker, essential for playing these games, hence their dominance in the product type category.

This segment includes billiards tables, snooker tables, and pool tables, each designed for specific game variants and widely used in sports clubs, event venues, and private homes. The quality and size of the table significantly affect the gameplay, making this segment critical for both casual and professional players.

Cues, while essential for striking balls, follow tables in market share. They vary in design, weight, and material, each type enhancing different aspects of player performance. Balls are uniform in requirements but vital, with sets specifically designed for billiards, snooker, or pool, differing slightly in size and weight. Accessories such as racks, covers, and chalk are smaller yet necessary components that support game integrity and equipment maintenance.

Material Analysis

Wood dominates with 58.2% due to its traditional use and superior aesthetics.

Wood is the most preferred material in the construction of billiards and snooker equipment, especially tables and cues, because of its durability, workability, and classic aesthetic appeal. Its dominance is reinforced by the traditional image of richly crafted wood tables and cues that define the sport’s heritage ambiance.

Metal is used primarily for structural components of tables and some mechanical parts in cues, valued for its strength and stability. Composite materials are increasingly popular for their versatility and weather resistance, especially in outdoor table models or cues designed for both performance and durability. Other materials, such as synthetic covers or rubber cushions, play supportive roles but are crucial for modern equipment standards.

Distribution Channel Analysis

Offline sales dominate with 72.1% due to the importance of firsthand product experience.

Offline channels, encompassing sports specialty stores, clubs, and direct sales, remain the dominant distribution method in the billiards and snooker equipment market. The tactile nature of purchasing these products, where customers prefer to feel the weight of a cue or see the finish of a table before buying, supports the prevalence of offline sales.

Online sales are growing, providing convenience and broader selection, especially in regions without specialty stores. However, the need for physical interaction when choosing high-investment items like tables or professional cues maintains the offline channel’s dominance.

Key Market Segments

By Product Type

- Tables

- Billiards Tables

- Snooker Tables

- Pool Tables

- Cues

- Balls

- Accessories

By Material

- Wood

- Metal

- Composite Materials

- Others

By Distribution Channel

- Offline

- Online

Driving Factors

Increasing Popularity Drives Market Growth

The Billiards and Snooker Equipment Market is on the rise, driven by the increasing popularity of these sports as recreational and competitive activities. For example, local bars and clubs in cities like London and New York are setting up dedicated snooker rooms, leading to a higher demand for quality tables and cues.

Growth of amateur and professional tournaments worldwide, such as the World Snooker Championship held annually, fuels this trend further. Rising interest in billiards and snooker among younger generations is evident as schools in parts of Asia introduce cue sports clubs, increasing their equipment needs.

Additionally, the development of specialized clubs and venues in regions like Southeast Asia provides a structured environment for enthusiasts and professionals alike. These venues often host tournaments and training sessions, boosting sales of tables, cue sticks, and accessories.

The combination of recreational play and competitive events drives innovation, such as improved cue designs and better-quality cloth on tables, enhancing the playing experience. This expanding interest brings more players into the sport, increasing market penetration and fostering a community that values high-quality equipment, which in turn stimulates continuous growth in the market.

Restraining Factors

Limited Awareness and Participation Challenges Restraints Market Growth

The market faces restraints due to limited awareness of billiards and snooker in non-traditional areas. In many African regions, for instance, these sports have not yet gained mainstream appeal, limiting sales. The seasonal nature of cue sports participation also affects the market.

During summer, outdoor sports often take precedence over indoor games like snooker, reducing demand temporarily. Additionally, the risk of counterfeit products impacts brand reputation. Fake cue sticks and tables sold online can mislead customers, leading to dissatisfaction and loss of trust in authentic brands. Dependency on venue availability for events poses another challenge.

Cities without established clubs or tournaments struggle to foster a regular player base. For example, rural areas may lack proper facilities, limiting practice opportunities. These factors create hurdles for consistent market growth. Businesses must invest in marketing to raise awareness and work with local communities to establish venues. Offering warranties and quality guarantees can help combat counterfeits.

Growth Opportunities

Eco-Friendly Innovations Provide Opportunities

The Billiards and Snooker Equipment Market presents opportunities through eco-friendly innovations and customization. Development of eco-friendly and sustainable equipment, such as tables made from responsibly sourced wood, appeals to environmentally conscious consumers.

Rising demand for customizable and personalized cue sticks allows players to choose designs, weights, and engravings that reflect their style. For instance, a player in Birmingham might order a bespoke cue with a unique inlay that boosts confidence during tournaments.

Growth in amateur and youth competitions increases the need for entry-level yet quality gear, expanding the market for affordable, durable tables and cues. Collaborations between brands and professional players for exclusive product lines create buzz.

When a renowned snooker champion endorses a line of cues, fans are more likely to purchase them, trusting the quality and performance. These opportunities encourage manufacturers to innovate in design, materials, and sustainability, aligning with customer values and preferences.

Emerging Trends

Advanced Trends Are Latest Trending Factor

The Billiards and Snooker Equipment Market is also shaped by advanced trends that blend technology with tradition. Integration of advanced materials for durable and lightweight equipment is gaining ground. For example, carbon fiber cues offer enhanced control and longevity, appealing to serious players.

Adoption of smart cue sticks with performance tracking features is emerging, where sensors can record stroke speed and accuracy, similar to fitness trackers. Rising influence of esports and virtual billiards and snooker games offers a new platform for engagement. Virtual tournaments allow players from around the world to compete online, broadening the sport’s reach.

Growth of social media platforms in promoting cue sports creates viral trends; influencers sharing tips and showcasing new gear on Instagram spark interest among followers. These trends highlight the dynamic nature of the market, where tradition meets modernity. Companies blending classic craftsmanship with smart technology and online engagement strategies capture the attention of both longtime fans and newcomers.

Regional Analysis

North America Dominates the Billiards and Snooker Equipment Market

North America holds a substantial market share in the Billiards and Snooker Equipment Market, driven by widespread popularity of cue sports and a strong presence of professional leagues. This region is home to numerous enthusiasts and professional players, contributing to consistent equipment sales.

Key factors such as established clubs, high disposable income, and cultural affinity for billiards and snooker underpin this dominance. Additionally, North America hosts major tournaments and championships, which not only increase equipment demand but also elevate the sport’s visibility.

Looking forward, the region is expected to continue its market leadership due to ongoing investments in cue sports infrastructure and the growing popularity of high-end, technologically advanced equipment. The forecast for North America suggests a sustained interest and potential growth in amateur participation, further supporting the market.

Regional Mentions:

- Europe: Europe maintains a competitive edge in the Billiards and Snooker Equipment Market, with a rich history in cue sports. Countries like the UK are central to the market’s dynamics, with numerous established venues and a strong fan base.

- Asia Pacific: Asia Pacific is rapidly growing in billiards and snooker participation. Increasing interest in China and Southeast Asia, coupled with rising income levels, supports market expansion.

- Middle East & Africa: While still developing, the Middle East & Africa show potential for growth in billiards and snooker equipment due to the gradual introduction of cue sports in luxury hotels and resorts.

- Latin America: Latin America sees emerging interest in billiards and snooker, with gradual market development driven by increasing leisure activities and sports diversification.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Billiards and Snooker Equipment Market, Brunswick Corporation, Diamond Billiard Products Inc., Riley England, and Peradon & Fletcher Ltd. are recognized as the top players, each significantly influencing the industry with their specialized products and long-standing reputations.

Brunswick Corporation is a leader known for its high-quality billiards tables and comprehensive range of accessories. The company has a rich history that enhances its brand prestige, making its products sought after for both professional settings and luxury home installations. Brunswick’s commitment to quality and design excellence cements its status as a top player in the market.

Diamond Billiard Products Inc. specializes in innovative billiard table designs and is favored among professional players for its precision and durability. The company’s focus on high-performance equipment tailored to competitive play allows it to maintain a strong presence in both tournament and high-end consumer markets.

Riley England stands out for its craftsmanship in snooker tables and cues, boasting traditional British quality that appeals to purists and professionals alike. The company’s dedication to maintaining classic aesthetics while integrating modern technology appeals to a niche market that values heritage and performance.

Peradon & Fletcher Ltd. is one of the oldest cue makers, known for handcrafted cues that combine artisan skill with the latest in cue technology. Their products are highly regarded in the snooker community for performance and sophistication, reflecting the company’s deep roots in the sport’s history.

These key players in the Billiards and Snooker Equipment Market drive innovation and uphold high standards that shape consumer expectations and market trends. Their influence is evident in their ability to maintain brand loyalty and command premium pricing, reinforcing their leadership positions in a competitive industry.

Major Companies in the Market

- Brunswick Corporation

- Diamond Billiard Products Inc.

- Riley England

- Peradon & Fletcher Ltd.

- Olhausen Billiard Manufacturing, Inc.

- Valley-Dynamo, Inc.

- Fury Cues

- Predator Group

- Balabushka Cue Company

- McDermott Cue Manufacturing LLC

- J. Pechauer Custom Cues

- Simonis Cloth

- Aramith (Saluc S.A.)

Recent Developments

- World Snooker Tour (WST): On February 2024, the World Snooker Tour announced a 10-year agreement with Saudi Arabia to host the Saudi Arabia Snooker Masters in Riyadh. The inaugural event featured a £2.3 million prize fund and was won by Judd Trump.

- Mansion Sports: On May 2024, UK-based private equity firm Mansion Sports announced a partnership with billiards legend Efren ‘Bata’ Reyes to launch Mansion Sports Billiards, an eCommerce platform offering premium billiard products globally.

Report Scope

Report Features Description Market Value (2024) USD 368.6 Million Forecast Revenue (2034) USD 500.2 Million CAGR (2025-2034) 3.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Tables – Billiards Tables, Snooker Tables, Pool Tables; Cues, Balls, Accessories), By Material (Wood, Metal, Composite Materials, Others), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Brunswick Corporation, Diamond Billiard Products Inc., Riley England, Peradon & Fletcher Ltd., Olhausen Billiard Manufacturing, Inc., Valley-Dynamo, Inc., Fury Cues, Predator Group, Balabushka Cue Company, McDermott Cue Manufacturing LLC, J. Pechauer Custom Cues, Simonis Cloth, Aramith (Saluc S.A.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Billiards and Snooker Equipment MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Billiards and Snooker Equipment MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Brunswick Corporation

- Diamond Billiard Products Inc.

- Riley England

- Peradon & Fletcher Ltd.

- Olhausen Billiard Manufacturing, Inc.

- Valley-Dynamo, Inc.

- Fury Cues

- Predator Group

- Balabushka Cue Company

- McDermott Cue Manufacturing LLC

- J. Pechauer Custom Cues

- Simonis Cloth

- Aramith (Saluc S.A.)