Global Spinal Injectable Market By Product Type (Epidural Injection, Trigger Point Injection, Sacroiliac Joint Injection, Provocation Discography and Facet Joint Injection), By Spinal Region (Thoracic, Cervical and Lumber), By Application (Therapeutic and Diagnostic), By End-user (Hospitals, Specialty Clinics, Diagnostic Centers, Regenerative Sports and Spine Centers and Ambulatory Surgical Centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170846

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

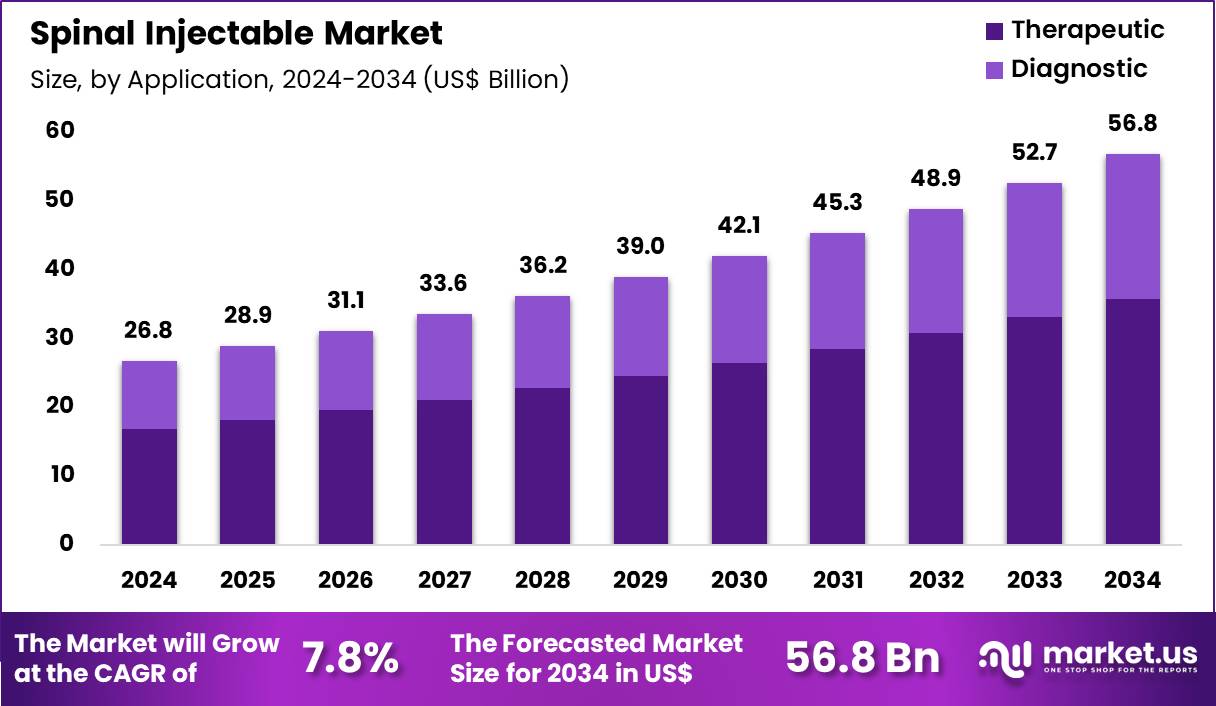

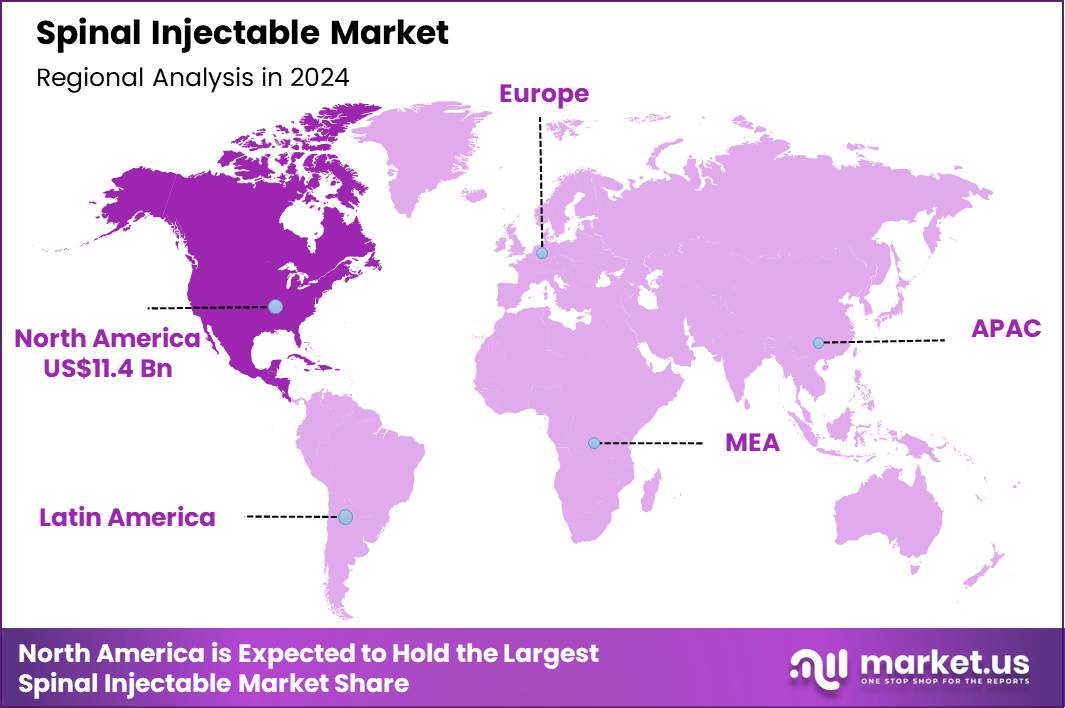

The Global Spinal Injectable Market size is expected to be worth around US$ 56.8 Billion by 2034 from US$ 26.8 Billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.5% share with a revenue of US$ 11.4 Billion.

Increasing prevalence of chronic spinal conditions propels the Spinal Injectable market, as physicians increasingly turn to targeted injections to manage pain and inflammation without invasive surgery. Pharmaceutical companies develop corticosteroid, hyaluronic acid, and biologic formulations that deliver sustained relief directly to affected sites, reducing systemic side effects.

These injectables serve in epidural steroid administration for lumbar radiculopathy to alleviate nerve compression symptoms, facet joint injections for osteoarthritis-induced axial back pain, sacroiliac joint therapy for inflammatory spondyloarthropathies, and discography with contrast agents for precise diagnostic localization of degenerative disc disease.

Regulatory advancements in companion devices create opportunities for integrated delivery systems that enhance procedural accuracy and patient outcomes. On May 9, 2025, The Trendlines Group Ltd. received FDA approval for EpiFinder, a smart device that assists in accurate epidural needle placement using loss-of-resistance technique, marking a significant milestone in improving injection precision and safety. This innovation directly supports the market’s evolution toward reliable, technology-assisted spinal therapies.

Growing adoption of regenerative medicine approaches accelerates the Spinal Injectable market, as clinicians explore platelet-rich plasma and stem cell suspensions to promote tissue repair in early-stage spinal pathologies. Biotechnology firms refine viscosity-modulated injectables that ensure even distribution within spinal structures, optimizing cellular engraftment.

Applications include intradiscal injections for early degenerative disc disease to stimulate extracellular matrix regeneration, paravertebral blocks for myofascial pain syndromes using autologous growth factors, nerve root sleeves for post-herniation inflammation control, and zygapophyseal joint supplementation with viscosupplements for mobility restoration.

Minimally invasive techniques open avenues for outpatient procedures that lower healthcare costs and recovery times. Diagnostic imaging integrations further drive precision, allowing real-time guidance for optimal deposition. This regenerative focus positions the market for expanded use in preventive spinal care strategies.

Rising emphasis on multimodal pain management invigorates the Spinal Injectable market, as integrated protocols combine injectables with neuromodulation to address multifaceted neuropathic components in spinal disorders. Innovators launch long-acting anesthetic-lidocaine hybrids that provide immediate analgesia alongside anti-inflammatory benefits.

These solutions apply in selective nerve root blocks for sciatica relief during physical rehabilitation, medial branch blocks for facet-mediated chronic low back pain, sympathetic chain injections for complex regional pain syndrome, and caudal epidurals for postpartum pelvic girdle dysfunction.

Patient-specific dosing algorithms create opportunities for tailored formulations that account for metabolic variations and comorbidity profiles. Clinical guidelines increasingly endorse injectables as first-line alternatives to opioids, fostering reimbursement expansions. This holistic trend establishes the market as a cornerstone of comprehensive, non-narcotic spinal intervention paradigms.

Key Takeaways

- In 2024, the market generated a revenue of US$ 26.8 Billion, with a CAGR of 7.8%, and is expected to reach US$ 56.8 Billion by the year 2034.

- The product type segment is divided into epidural injection, trigger point injection, sacroiliac joint injection, provocation discography and facet joint injection, with epidural injection taking the lead in 2024 with a market share of 39.7%.

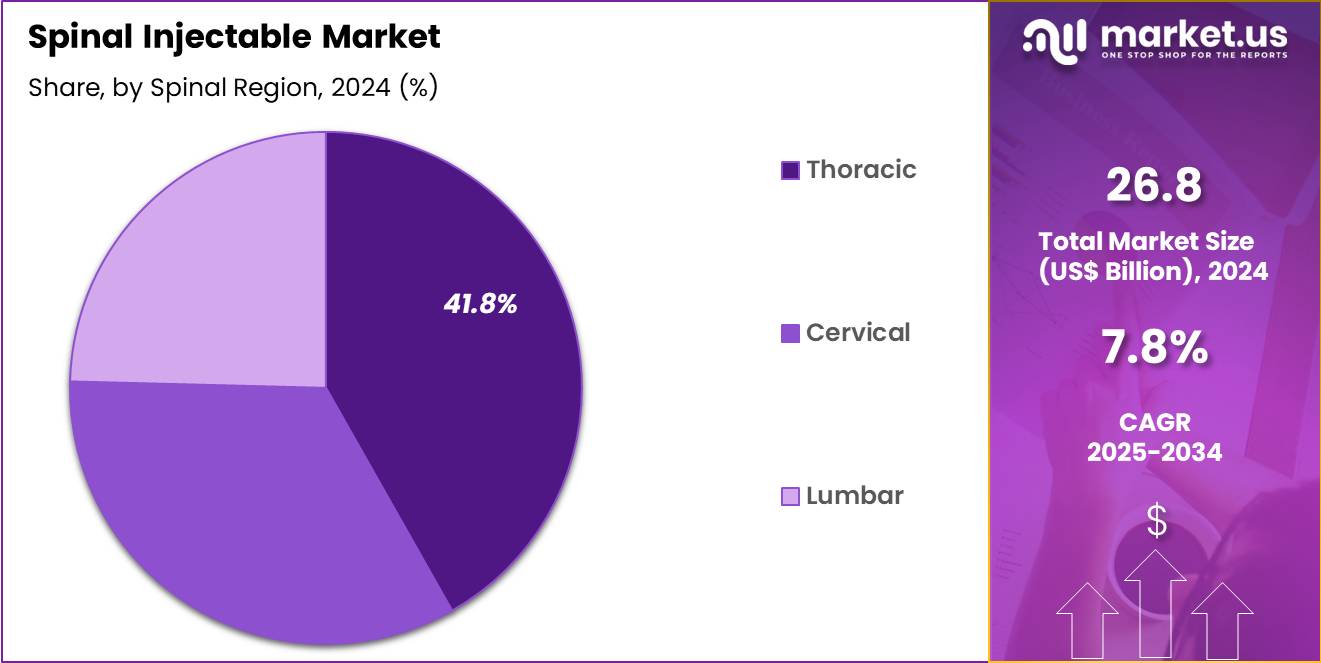

- Considering spinal region, the market is divided into thoracic, cervical and lumber. Among these, thoracic held a significant share of 41.8%.

- Furthermore, concerning the application segment, the market is segregated into therapeutic and diagnostic. The therapeutic sector stands out as the dominant player, holding the largest revenue share of 62.9% in the market.

- The end-user segment is segregated into hospitals, specialty clinics, diagnostic centers, regenerative sports and spine centers and ambulatory surgical centers, with the hospitals segment leading the market, holding a revenue share of 47.5%.

- North America led the market by securing a market share of 42.5% in 2024.

Product Type Analysis

Epidural injection, holding 39.7%, is expected to dominate because it remains the most widely used intervention for managing chronic spinal pain, radiculopathy, and inflammation. Rising global prevalence of degenerative spinal conditions strengthens reliance on epidural corticosteroid and anesthetic injections for symptom relief. Clinicians favor epidural delivery due to its ability to target affected nerve roots precisely, improving functional outcomes and reducing disability.

The growing aging population increases the number of patients seeking minimally invasive pain-management options as alternatives to surgery. Advancements in fluoroscopy and ultrasound imaging improve injection accuracy, enhancing patient safety and treatment efficacy. These factors keep epidural injections anticipated to remain the leading product type in the spinal injectable market.

Spinal Region Analysis

Thoracic, holding 41.8%, is projected to dominate because mid-spine pain associated with posture abnormalities, trauma, and occupational strain continues to rise. Increasing diagnostic awareness of thoracic radiculopathy encourages clinicians to recommend targeted injectable therapies. The thoracic region frequently responds well to epidural and facet joint injections, strengthening demand within this anatomical category.

Growing prevalence of kyphosis-related pain in older adults drives clinical intervention volumes. Improved imaging-guided injection techniques support safer access to the thoracic spine, historically considered more complex due to anatomical constraints. These drivers keep thoracic applications expected to remain the dominant spinal region in this market.

Application Analysis

Therapeutic applications, holding 62.9%, are anticipated to dominate because injectable interventions provide rapid symptom relief for patients with chronic spinal disorders. The shift toward non-surgical pain management increases utilization of therapeutic injections in routine clinical practice. Rising incidence of disc degeneration, arthritis, and spinal stenosis creates ongoing demand for targeted anti-inflammatory and analgesic solutions.

Rehabilitation programs incorporate injectable therapies to accelerate functional recovery and reduce long-term dependence on oral medications. Advances in biologics and regenerative injectables also support therapeutic growth. These factors keep therapeutic applications expected to remain the leading segment.

End-User Analysis

Hospitals, holding 47.5%, are projected to dominate because they most frequently manage complex spinal conditions requiring imaging-guided injections and multidisciplinary care. Patients with severe or persistent pain often receive referrals to hospital-based pain management units for advanced intervention. Hospitals maintain high-quality imaging platforms, ensuring procedure accuracy and safety.

Growing surgical wait times encourage clinicians to offer injection-based pain relief through hospital outpatient programs. Increased healthcare spending strengthens hospital infrastructure for spine care. These drivers keep hospitals expected to remain the dominant end-user segment in the spinal injectable market.

Key Market Segments

By Product Type

- Epidural Injection

- Trigger Point Injection

- Sacroiliac Joint Injection

- Provocation Discography

- Facet Joint Injection

By Spinal Region

- Thoracic

- Cervical

- Lumber

By Application

- Therapeutic

- Diagnostic

By End-user

- Hospitals

- Specialty Clinics

- Diagnostic Centers

- Regenerative Sports and Spine Centers

- Ambulatory Surgical Centers

Drivers

Rising prevalence of low back pain among US workers is driving the market

The increasing occurrence of low back pain in occupational settings has heightened the reliance on spinal injectables for therapeutic management and symptom alleviation. This condition affects a substantial portion of the workforce, prompting healthcare providers to incorporate injectable interventions as frontline options in pain clinics. Diagnostic advancements, including magnetic resonance imaging, facilitate targeted delivery of corticosteroids or analgesics directly to affected sites.

Professional organizations underscore the productivity impacts, influencing employer-sponsored wellness programs to support access to these treatments. The transition toward ambulatory care models amplifies procedural volumes, as injectables offer outpatient convenience over surgical alternatives. Economic evaluations demonstrate reduced absenteeism through effective pain modulation, justifying expanded formulary inclusions.

Regional variations in ergonomic standards correlate with higher incidence rates, necessitating adaptive therapeutic strategies. Multidisciplinary approaches integrate injectables with physical therapy, optimizing functional recovery timelines. As labor markets evolve with aging demographics, sustained demand ensures procurement stability for pharmaceutical suppliers. This driver ultimately reinforces the foundational role of spinal injectables in occupational health frameworks.

Restraints

Reported neurological adverse events from epidural injections is restraining the market

Documented instances of serious complications following epidural steroid administrations have instilled caution among practitioners, curtailing routine prescribing practices. The U.S. Food and Drug Administration has identified 131 cases of neurological adverse events linked to these procedures, predominantly involving cervical transforaminal approaches. Such occurrences, including arachnoiditis and spinal infarcts, necessitate enhanced pre-procedural risk assessments and patient counseling.

Variability in steroid formulations contributes to inconsistent safety profiles, complicating standardization efforts. Post-injection monitoring protocols extend clinical oversight, escalating operational costs in outpatient facilities. Legal liabilities associated with adverse outcomes deter aggressive utilization, favoring conservative management paradigms.

Educational deficits in complication recognition among non-specialists perpetuate underreporting, undermining data-driven refinements. Reimbursement adjustments reflecting heightened risks further constrain accessibility for at-risk cohorts. These elements collectively foster a conservative therapeutic landscape, prioritizing alternative modalities. Addressing this restraint requires robust pharmacovigilance to restore procedural confidence.

Opportunities

Increasing number of clinical trials for mesenchymal stem cell injectables is creating growth opportunities

The proliferation of investigational studies evaluating mesenchymal stem cell-based injectables for degenerative spinal conditions signals a promising trajectory for regenerative applications. As of 2022, 106 trials were registered on ClinicalTrials.gov assessing these cells specifically for low back pain management. This volume reflects interdisciplinary collaborations bridging orthopedics and cellular biology, accelerating protocol validations.

Intradiscal delivery mechanisms enhance localization, potentially yielding superior outcomes over conventional pharmacologics. Funding from national institutes supports phase escalations, mitigating financial barriers to progression. Biomarker developments enable precise efficacy endpoints, informing adaptive trial designs. Scalability through autologous sourcing aligns with personalized medicine imperatives, broadening therapeutic windows.

Integration with imaging-guided techniques refines deposition accuracy, minimizing off-target effects. Global trial networks facilitate diverse population inclusions, enhancing generalizability. Collectively, these initiatives position mesenchymal injectables as harbingers of paradigm shifts in spinal therapeutics.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends invigorate the spinal injectable market as escalating healthcare budgets and aging populations worldwide fuel demand for corticosteroid and anesthetic injections that manage chronic back pain and surgical procedures effectively. Manufacturers aggressively innovate with longer-lasting formulations and precision delivery systems, capitalizing on the surge in minimally invasive treatments and outpatient care expansions.

Persistent inflation and erratic economic recoveries, however, elevate raw material costs for active pharmaceutical ingredients, compelling clinics to curb elective procedures and stretch supplies in financially strained environments. Geopolitical tensions, particularly U.S.-China trade conflicts and regional instabilities, routinely disrupt global shipments of sterile components and vials, igniting shortages and price volatility for suppliers dependent on international networks.

Current U.S. tariffs impose a 100 percent duty on imported branded pharmaceuticals, driving up procurement expenses for American healthcare providers and challenging affordability amid heavy reliance on overseas production. These tariffs provoke retaliatory measures in foreign markets that restrict U.S. exports of advanced injectables and complicate collaborative clinical trials. Nevertheless, the policies accelerate investments in domestic manufacturing facilities and localized R&D incentives, forging resilient supply chains that will enhance innovation and ensure long-term market stability.

Latest Trends

FDA approval for Phase III evaluation of injectable disc progenitor cell therapy is a recent trend

In July 2024, the U.S. FDA cleared DiscGenics to progress its IDCT allogeneic disc progenitor cell therapy into both Phase III pivotal and confirmatory studies for patients with symptomatic lumbar degenerative disc disease. The authorization reflects FDA’s confidence in the therapy’s safety profile and encouraging early efficacy signals from previous trials. IDCT is delivered through a single intradiscal injection designed to promote disc height restoration and reduce inflammation through cell-mediated activity.

FDA agreement on key clinical endpoints including improvements in visual analog scale pain scores and Oswestry Disability Index outcomes enables more efficient data capture across study sites. The decision also signals a growing regulatory willingness to support biologic solutions for chronic axial pain that does not respond to conventional treatment. The multicenter trial structure across U.S. sites strengthens statistical robustness for eventual licensure applications.

Stratifying participants based on disc pathology enhances clinical relevance and supports future label-expansion planning. Incorporating companion diagnostic tools helps refine patient selection and improve trial enrollment. With several sites initiating protocols in 2024, the program is advancing toward an accelerated commercialization timeline. Overall, this marks an important shift in regulatory oversight for intradiscal cell-based therapies and is expected to stimulate broader innovation in the management of degenerative spine disorders.

Regional Analysis

North America is leading the Spinal Injectable Market

In 2024, North America commanded a 42.5% share of the global spinal injectable market, propelled by escalating incidences of degenerative spinal conditions and innovations in targeted drug delivery systems. Aging demographics intensify the need for corticosteroid and anesthetic formulations administered via epidural routes, enabling precise analgesia for herniated discs and stenosis in ambulatory settings. Federal reimbursements through Medicare expansions facilitate broader access to biologics like hyaluronic acid injectables, supporting outpatient procedures that reduce surgical interventions.

Pharmaceutical leaders advance sustained-release depots, minimizing repeat administrations while enhancing patient compliance in chronic radiculopathy management. Collaborative clinical trials sponsored by the National Institutes of Health validate neuromodulatory agents, optimizing outcomes for neuropathic components in multifaceted back pathologies. Heightened occupational health initiatives address work-related ergonomics, driving corporate sponsorships for prophylactic injections among high-risk professions.

Supply chain enhancements ensure sterile, single-dose vials meet pharmacopeial standards, mitigating contamination risks in high-volume clinics. These factors coalesce to reinforce interventional spine care, mitigating disability trajectories through efficacious pharmacotherapeutics. The Centers for Disease Control and Prevention indicated that 24.3% of U.S. adults experienced chronic pain in 2023, underscoring the demand for advanced spinal therapies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Healthcare leaders project sustained acceleration in spinal injection solutions throughout Asia Pacific over the forecast period, as demographic expansions exacerbate musculoskeletal strains. Ministries in Malaysia and New Zealand allocate resources to train anesthesiologists on ultrasound-guided facet joint infiltrates, curbing opioid dependencies in postoperative scoliosis cohorts.

Biotech enterprises craft affordable viscosupplementation gels, equipping district hospitals in Bangladesh to alleviate osteoarthritis burdens among agrarian laborers. Regional summits under the Asia-Pacific Orthopaedic Association disseminate protocols for botulinum toxin applications, empowering surgeons to manage spastic paraparesis in trauma survivors. Affluent cohorts in Hong Kong embrace regenerative platelet-rich plasma infusions, fueling private sector booms in minimally invasive discogenic protocols.

Harmonized pharmacovigilance frameworks expedite biosimilar approvals, enabling scalable distribution of anti-inflammatory suspensions across archipelago nations. Extension programs educate community paramedics on caudal blocks, bridging urban-rural divides in acute lumbago responses. These maneuvers cultivate resilience, equipping systems to navigate proliferative spinal afflictions. The World Health Organization documented 619 million global cases of low back pain in 2020, with substantial regional contributions amplifying intervention imperatives.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key companies in the spinal-injectable therapeutics segment expand growth by developing targeted formulations for pain management, inflammation control, and regenerative support, addressing rising demand from aging populations and patients seeking minimally invasive alternatives to surgery. They strengthen clinical adoption by partnering with spine centers, interventional pain specialists, and ambulatory surgical facilities to embed standardized injection protocols across care pathways.

R&D teams refine viscosupplementation agents, corticosteroid blends, and biologic injectables to improve safety profiles and extend clinical durability. Commercial groups differentiate through integrated offerings that combine injectables with delivery needles, imaging-guided accessories, and post-procedure care materials, improving workflow efficiency for clinicians.

They accelerate market expansion by securing reimbursement alignment, conducting real-world outcome studies, and entering fast-growing regions with high rates of musculoskeletal disorders. Medtronic exemplifies this strategy with its broad spine-care portfolio, global clinical partnerships, and continuous investment in interventional pain-management solutions that support providers in delivering precise and effective spinal injections.

Top Key Players

- Medtronic

- Johnson & Johnson (DePuy Synthes)

- Stryker Corporation

- Boston Scientific

- B. Braun Melsungen

- Zimmer Biomet

- Abbott

- Merit Medical Systems

Recent Developments

- On March 25, 2025, the U.S. FDA approved a generic version of the Ztlido lidocaine patch for Aveva Drug Delivery Systems, Inc. Although delivered through a topical patch, this development supports the wider non-surgical spine care landscape by offering a cost-effective, non-invasive option for managing post-herpetic neuralgia and other localized pain conditions traditionally treated with injectable anesthetics.

- In January 2024, Medtronic plc introduced the INFUSE Elite Total Disc Replacement system following its FDA approval in late 2023. While this is an implant device, its arrival reflects ongoing innovation in spinal treatment technologies—advances that often align with or influence diagnostic and therapeutic approaches such as spinal injections and discography.

Report Scope

Report Features Description Market Value (2024) US$ 26.8 Billion Forecast Revenue (2034) US$ 56.8 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Epidural Injection, Trigger Point Injection, Sacroiliac Joint Injection, Provocation Discography and Facet Joint Injection), By Spinal Region (Thoracic, Cervical and Lumber), By Application (Therapeutic and Diagnostic), By End-user (Hospitals, Specialty Clinics, Diagnostic Centers, Regenerative Sports and Spine Centers and Ambulatory Surgical Centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Medtronic, Johnson & Johnson (DePuy Synthes), Stryker Corporation, Boston Scientific, B. Braun Melsungen, Zimmer Biomet, Abbott, Merit Medical Systems Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Medtronic

- Johnson & Johnson (DePuy Synthes)

- Stryker Corporation

- Boston Scientific

- B. Braun Melsungen

- Zimmer Biomet

- Abbott

- Merit Medical Systems