Global Specialty Oil Crops Market Size, Share, And Industry Analysis Report By Crop Type (Olive Oil Crops, Coconut Oil Crops, Sesame Oil Crops, Safflower Oil Crops, Camelina Oil Crops), By Processing Method (Cold-Pressed Oils, Solvent Extraction, Supercritical CO₂ Extraction, Enzyme-Assisted Extraction), By Application (Food and Beverages, Cosmetics and Personal Care, pharmaceuticals and Nutraceuticals, Biofuels and Energy), By Distribution Channel (Specialty Stores, Hypermarkets and Supermarkets, Food Service), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174659

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

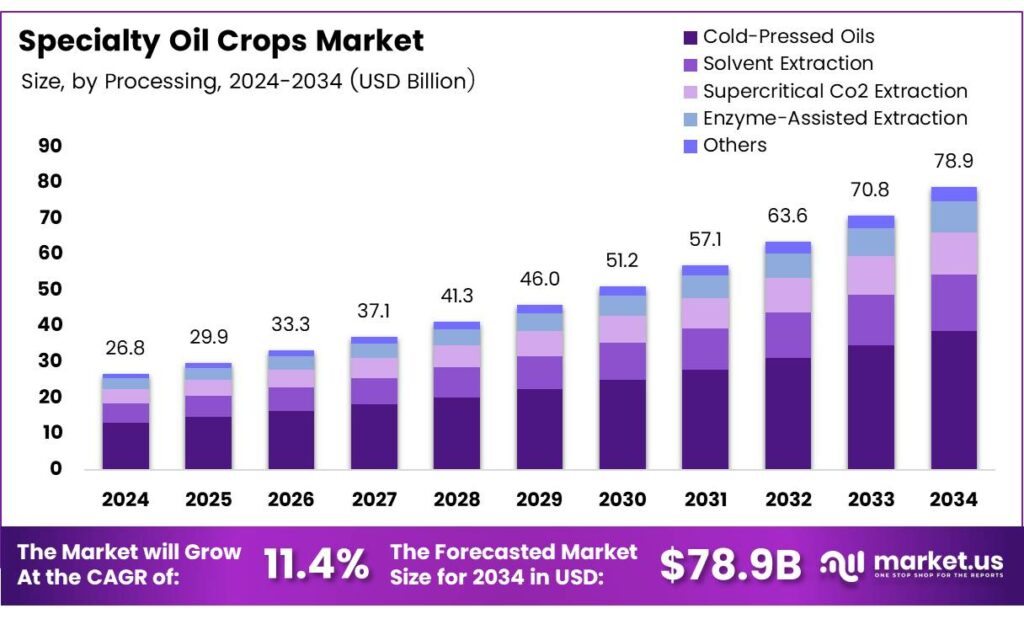

The Global Specialty Oil Crops Market size is expected to be worth around USD 78.9 billion by 2034, from USD 26.8 billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034.

The Specialty Oil Crops Market refers to high-value oilseed crops such as sesame, flaxseed, safflower, camelina, hempseed, and coconut, cultivated for premium edible oils, personal care formulations, nutraceuticals, and clean-label food ingredients. These crops deliver unique functional properties, healthier fatty acid profiles, and strong product differentiation across global specialty food and wellness markets.

The market has expanded steadily as consumers shift toward premium plant-based oils offering balanced nutrition, higher stability, and natural antioxidants. Demand rises further as food processors explore specialty oils for bakery, spreads, snacks, and fortification applications. Additionally, emerging cosmetic and aromatherapy brands increasingly adopt cold-pressed oils for skin-health benefits, boosting long-term market potential.

- Vegetable oil pressing generates protein-rich meals containing 40–50% proteins in sunflower and 50–60% in peanut meals, while other meals hold 35–45%. Major crops—soybean, rapeseed, cottonseed, sunflower, and peanut—contribute 69%, 12%, 7%, 5%, and 3% to world protein-meal output, respectively. World oilseed production has reached 380 million metric tonnes, supported by crops accumulating 15–45% fats and 6–45% proteins, reinforcing long-term demand for specialty oilseed cultivation.

The market shows rising opportunities as new dietary trends highlight omega-rich, allergen-friendly, and minimally processed oils. Specialty oil crops also benefit from fast-growing demand in vegan foods and herbal supplements, creating multi-sector scalability. As global diets shift, producers leveraging quality standards and modern processing methods gain a strategic advantage.

Key Takeaways

- The Global Specialty Oil Crops Market reached USD 26.8 billion in 2024 and is projected to hit USD 78.9 billion by 2034, at a CAGR of 11.4% between 2025 and 2034.

- Olive Oil Crops dominate the Crop Type segment with a 34.8% market share.

- Cold-Pressed Oils lead the Processing Method segment with a 39.3% share.

- Food and Beverages hold the largest Application share at 61.2%.

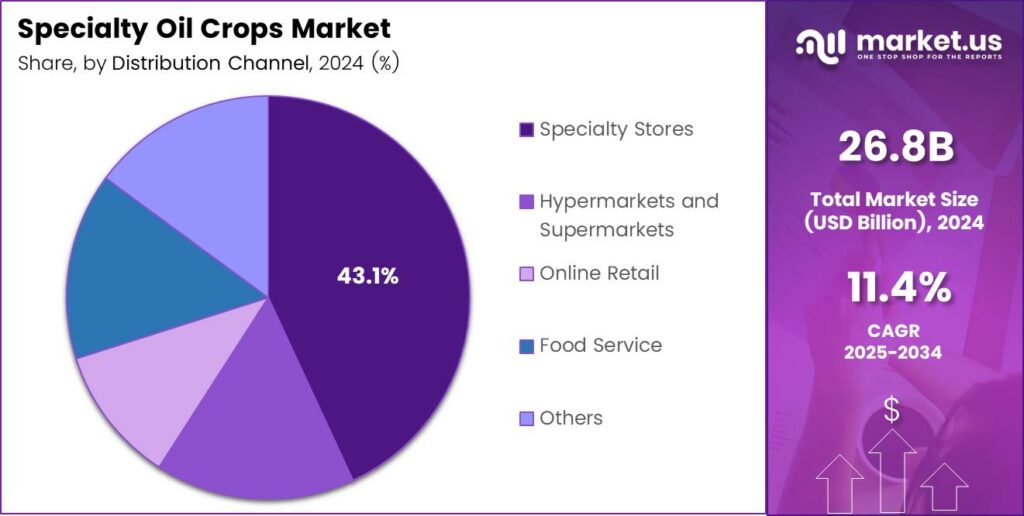

- Specialty Stores dominate distribution with a leading 43.1% share.

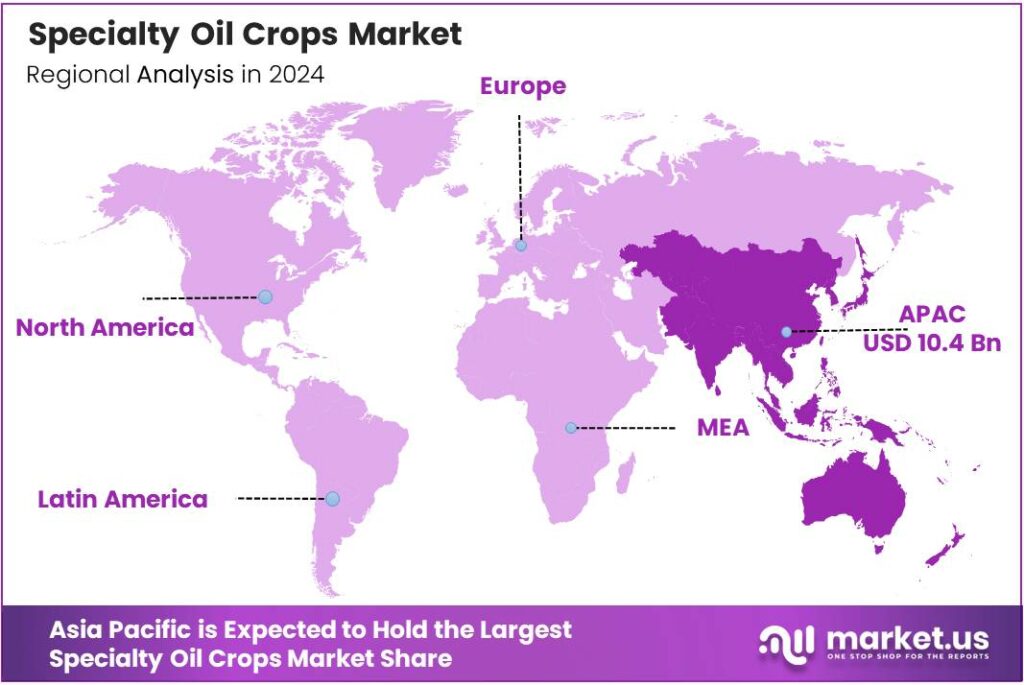

- Asia Pacific is the top regional market with a 38.9% share, valued at USD 10.4 billion.

By Crop Type Analysis

Olive Oil Crops dominate the segment with 34.8% due to rising demand for premium and healthier oils.

In 2025, Olive Oil Crops held a dominant market position in the By Crop Type Analysis segment of the Specialty Oil Crops Market, with a strong 34.8% share. Their growing global acceptance in gourmet foods, natural cosmetics, and functional health formulations strengthens demand. Additionally, expanding Mediterranean-style dietary adoption continues to improve consumption trends.

Coconut Oil Crops continue gaining traction due to their versatile applications across food, beauty, and wellness products. The increasing preference for sustainable plant-based fats and natural moisturizers supports market expansion. Moreover, the product’s strong position in Asian food culture and global wellness trends further enhances its adoption.

Sesame Oil Crops benefit from their deep-rooted culinary relevance and medicinal value. These crops cater to rising demand for flavor-rich, nutrient-dense oils across Asian and Middle Eastern cuisines. Additionally, the increasing shift toward antioxidant-rich specialty oils pushes sesame oil into premium retail and food service channels globally.

Flax/Linseed Oil Crops, Safflower Oil Crops, Camelina Oil Crops, Hemp Seed Oil Crops, and Others collectively contribute to diversified market growth. These specialty oils appeal to consumers seeking plant-based omega sources and niche functional benefits. Increasing adoption in dietary supplements, artisanal foods, and environmentally conscious applications further supports their market presence.

By Processing Method Analysis

Cold-Pressed Oils dominate with 39.3% due to their purity and strong consumer preference for minimally processed products.

In 2025, Cold-Pressed Oils held a dominant market position in the By Processing Method Analysis segment of the Specialty Oil Crops Market, with a significant 39.3% share. This dominance is driven by increasing demand for natural, nutrient-rich oils. Consumers continue choosing cold-pressed options for their clean-label appeal and high retention of bioactive compounds.

Solvent Extraction remains widely used due to its efficiency in maximizing oil yield. This method supports large-scale commercial production where cost-effectiveness is essential. The technique is particularly popular for industrial applications, enabling producers to meet rising volume requirements across multiple specialty oil categories.

Supercritical CO2 Extraction is gaining attention for its ability to produce highly pure oils without chemical residues. The growing interest in premium and functional oils drives the adoption of this advanced extraction method. Its environmentally friendly nature also appeals to brands prioritizing sustainability and clean production processes.

Enzyme-Assisted Extraction and Others contribute to innovation within the segment by supporting gentle, eco-friendly, and efficient oil recovery. These methods help producers enhance oil quality while reducing processing waste. Their rising acceptance reflects the market’s gradual shift toward sustainable and technologically advanced extraction techniques.

By Application Analysis

Food and Beverages dominate with 61.2% due to the rising use of specialty oils in healthy, premium, and functional foods.

In 2025, Food and Beverages held a dominant market position in the By Application Analysis segment of the Specialty Oil Crops Market, with a remarkable 61.2% share. Increased consumer focus on healthier cooking alternatives and nutrient-rich oils fuels this strong demand. Specialty oils are increasingly used in gourmet, fortified, and organic food formulations.

Cosmetics and Personal Care applications continue expanding as natural oils become essential ingredients in skincare, haircare, and aromatherapy products. Rising preference for plant-based emollients and antioxidant-rich formulations supports market growth. The trend toward clean beauty and chemical-free personal care increases the usage of specialty oils across premium product lines.

Pharmaceuticals and Nutraceuticals benefit from the rising interest in natural therapeutic compounds. Specialty oils are increasingly incorporated into dietary supplements, topical treatments, and herbal formulations. Their functional benefits, including omega content and anti-inflammatory properties, support growing adoption in formulation development.

Biofuels, energy, and Energy and Others represent emerging opportunities as industries explore renewable feedstocks. Specialty oils are being evaluated for sustainable biodiesel, lubricants, and green industrial applications. Although currently niche, this segment is expected to grow steadily with increasing global focus on low-carbon energy solutions.

By Distribution Channel Analysis

Specialty Stores dominate with 43.1% due to strong consumer trust and availability of premium oil varieties.

In 2025, Specialty Stores held a dominant market position in the By Distribution Channel Analysis segment of the Specialty Oil Crops Market, with a leading 43.1% share. Consumers rely on these stores for high-quality, authentic, and premium specialty oils. Curated product selections and expert guidance further strengthen customer loyalty.

Hypermarkets and Supermarkets maintain a wide reach, making specialty oils accessible to mainstream consumers. Their extensive shelf space and competitive pricing support growing adoption. Rising placement of organic and gourmet oil brands in major retail chains continues to enhance visibility and purchase frequency in this segment.

Online Retail grows rapidly as consumers prefer convenient ordering and access to diverse specialty oil options. Digital platforms enable brands to showcase product origin, purity, and benefits more transparently. The shift toward e-commerce-driven grocery and wellness shopping significantly boosts online sales.

Food Service and Others contribute steadily as restaurants, cafés, and institutional buyers incorporate specialty oils into culinary and nutritional offerings. Growing demand for premium cooking oils and health-driven menus fuels usage. These channels help expand overall market consumption through bulk purchasing and continuous supply requirements.

Key Market Segments

By Crop Type

- Olive Oil Crops

- Coconut Oil Crops

- Sesame Oil Crops

- Flax Linseed Oil Crops

- Safflower Oil Crops

- Camelina Oil Crops

- Hemp Seed Oil Crops

- Others

By Processing Method

- Cold-Pressed Oils

- Solvent Extraction

- Supercritical CO2 Extraction

- Enzyme-Assisted Extraction

- Others

By Application

- Food and Beverages

- Cosmetics and Personal Care

- Pharmaceuticals and Nutraceuticals

- Biofuels and Energy

- Others

By Distribution Channel

- Specialty Stores

- Hypermarkets and Supermarkets

- Online Retail

- Food Service

- Others

Emerging Trends

Shift Toward Organic Farming and Clean-Label Ingredients Shapes Market Trends

A major trend influencing the Specialty Oil Crops Market is the rapid shift toward organic and clean-label ingredients. Consumers actively search for oils that are minimally processed and free from synthetic additives, boosting demand for cold-pressed and organic specialty oils.

- The rise of plant-based diets. As more people reduce consumption of animal fats, specialty oils become key alternatives, particularly for cooking, baking, and nutritional supplementation. In Europe, organic farming is no longer a small corner of agriculture. The EU reported 16.9 million hectares under organic production, equal to 10.5% of total utilised agricultural area.

The growth of premium beauty products also drives interest in natural oils. Brands highlight ingredients like cold-pressed coconut oil, sesame oil, and flaxseed oil to meet customer expectations for natural skincare. Technological advances in oil extraction are creating additional momentum. Efficient methods preserve nutrients and increase oil yield, making high-quality specialty oils more accessible to global markets.

Drivers

Rising Preference for Natural and Nutrient-Rich Oils Drives Market Expansion

The Specialty Oil Crops Market is growing steadily as consumers increasingly prefer natural, nutrient-rich oils such as sesame, flaxseed, coconut, and hempseed. These oils are seen as healthier alternatives because they contain beneficial fatty acids and antioxidants. As people become more aware of clean-label products, the demand for specialty oils continues to rise.

Producers are also investing in better farming practices to maintain high-quality oil crops. This includes improving seed varieties and adopting sustainable farming to support long-term market growth. Food companies now use these specialty oils for snacks, bakery items, and premium cooking products, adding further momentum.

The rising use of these oils in personal care and cosmetic products. Their natural moisturizing and anti-inflammatory properties make them desirable ingredients in skincare formulas. The market also benefits from innovation in oil extraction methods. Improved cold-pressed and enzymatic technologies help retain nutritional value, making the final product more appealing to health-conscious buyers.

Restraints

Limited Yield Stability and High Production Costs Restrict Market Growth

The Specialty Oil Crops Market faces restraints because many of these crops have lower yields compared to traditional oilseeds. Their sensitivity to climate conditions increases the risk of inconsistent harvests, making supply planning difficult for producers and processors.

- High production costs also limit large-scale expansion. Specialty oil crops often require manual handling, targeted irrigation, and strict quality control, all of which increase operational expenses. The EU’s Green Deal/Farm to Fork direction sets a headline target of 25% of agricultural land under organic farming by 2030.

The limited availability of processing facilities. Cold pressing, enzymatic extraction, and high-quality refining require specialized equipment that is not widely accessible, particularly in developing regions. Fluctuating global prices of specialty oils further restrict adoption by food manufacturers.

Growth Factors

Growing Use of Specialty Oils in Health, Beauty, and Functional Foods Creates New Opportunities

The Specialty Oil Crops Market is positioned for strong opportunities driven by the increasing popularity of functional foods. Consumers now seek products enriched with omega-3, lignans, and natural antioxidants, which specialty oils naturally provide. This opens new avenues for food manufacturers to develop premium health-focused products.

Cosmetic and personal care brands are also expanding their use of plant-based oils. Cold-pressed oils from hempseed, flaxseed, and sesame are finding a place in moisturizers, hair serums, and natural skincare solutions. This expansion creates consistent demand for high-quality oil crops.

There is also rising interest from nutraceutical companies. Capsules, supplements, and herbal formulations increasingly incorporate specialty oils due to their therapeutic benefits. This trend supports steady long-term growth across multiple industries.

Regional Analysis

Asia Pacific Dominates the Specialty Oil Crops Market with a Market Share of 38.9%, Valued at USD 10.4 billion

Asia Pacific leads the Specialty Oil Crops Market due to strong agricultural output and rising domestic consumption of edible and functional oils. In this region, the market reached 38.9%, reflecting its dominant contribution to global demand. The market value stood at USD 10.4 billion, supported by expanding food processing industries and export-oriented oil crop cultivation.

North America represents a mature yet steadily evolving market for specialty oil crops, driven by demand for premium, organic, and non-GMO oils. The region benefits from advanced farming practices and strong adoption of value-added oil products. Increasing use of specialty oils in health-focused food applications continues to support stable market expansion across the region.

Europe shows consistent growth in specialty oil crops, supported by sustainability-focused agricultural policies and consumer preference for cold-pressed oils. The region emphasizes traceability and quality standards, which enhances demand for high-value oil crops. Expanding applications in cosmetics and nutraceuticals further contribute to market development.

The Middle East and Africa market is gradually expanding, driven by rising imports and improving local oilseed cultivation initiatives. Growth is supported by increasing food security efforts and diversification of agricultural output. Specialty oils are gaining traction in urban food markets and traditional cooking applications.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, ADM is viewed as a steady, scale-driven player in specialty oil crops because it can connect origination, processing, and global distribution under one operating model. Its advantage typically shows up in consistent supply, quality control, and the ability to support food manufacturers that want reliable volumes across multiple oil types.

Agropur stands out more for focused, value-added positioning than pure volume, leaning on product stewardship and process discipline to meet tighter customer specifications. From an analyst lens, this type of player benefits when buyers prioritize traceability, stable sensory profiles, and predictable batch-to-batch performance.

Borges International Group is often associated with branded, consumer-facing pull—especially in olive and specialty culinary oils—where packaging, origin storytelling, and quality cues influence purchase decisions. The business case is strongest when premiumization holds, and shoppers accept higher prices for perceived authenticity and taste.

Bunge Limited is typically assessed as a large-scale enabler across oilseed value chains, using trading depth and processing reach to manage volatility and maintain supply continuity. Strategically, it can win by optimizing crush capacity, logistics efficiency, and customer contracts that reduce exposure to short-term price swings.

Top Key Players in the Market

- ADM

- Agropur

- Borges International Group

- Bunge Limited

- California Olive Ranch

- Cargill Inc.

- Golden Agri-Resources

- Gramiyum

- IOI Group

- La Tourangelle

Recent Developments

- In 2024, ADM continues to expand its portfolio in edible and specialty oils, focusing on sustainable and plant-based solutions for food, feed, and industrial applications. Corporate Sustainability Report, which highlights progress in sustainability goals, such as reducing risks in South American soy and palm supply chains through enhanced traceability and supplier engagement.

- In 2024, Agropur, primarily a dairy cooperative, has limited direct involvement in specialty oil crops but participates in broader sustainable agriculture initiatives. The company reported processing over liters of milk and joining programs like the Sustainable Agriculture Initiative and Sustainable Dairy Partnership to reduce greenhouse gases and promote regenerative agriculture.

Report Scope

Report Features Description Market Value (2024) USD 26.8 Billion Forecast Revenue (2034) USD 78.9 Billion CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Crop Type (Olive Oil Crops, Coconut Oil Crops, Sesame Oil Crops, Flax Linseed Oil Crops, Safflower Oil Crops, Camelina Oil Crops, Hemp Seed Oil Crops, Others), By Processing Method (Cold-Pressed Oils, Solvent Extraction, Supercritical CO₂ Extraction, Enzyme-Assisted Extraction, Others), By Application (Food and Beverages, Cosmetics and Personal Care, pharmaceuticals and Nutraceuticals, Biofuels and Energy, Others), By Distribution Channel (Specialty Stores, Hypermarkets and Supermarkets, Online Retail, Food Service, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ADM, Agropur, Borges International Group, Bunge Limited, California Olive Ranch, Cargill Inc., Golden Agri-Resources, Gramiyum, IOI Group, La Tourangelle Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Specialty Oil Crops MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Specialty Oil Crops MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- Agropur

- Borges International Group

- Bunge Limited

- California Olive Ranch

- Cargill Inc.

- Golden Agri-Resources

- Gramiyum

- IOI Group

- La Tourangelle