Global Solvent-Borne Wood Coatings Market Size, Share, And Business Benefits By Product (Polyurethane, Acrylic, Others), By Application (Furniture, Cabinets, Sidings, Flooring and Decking, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151015

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

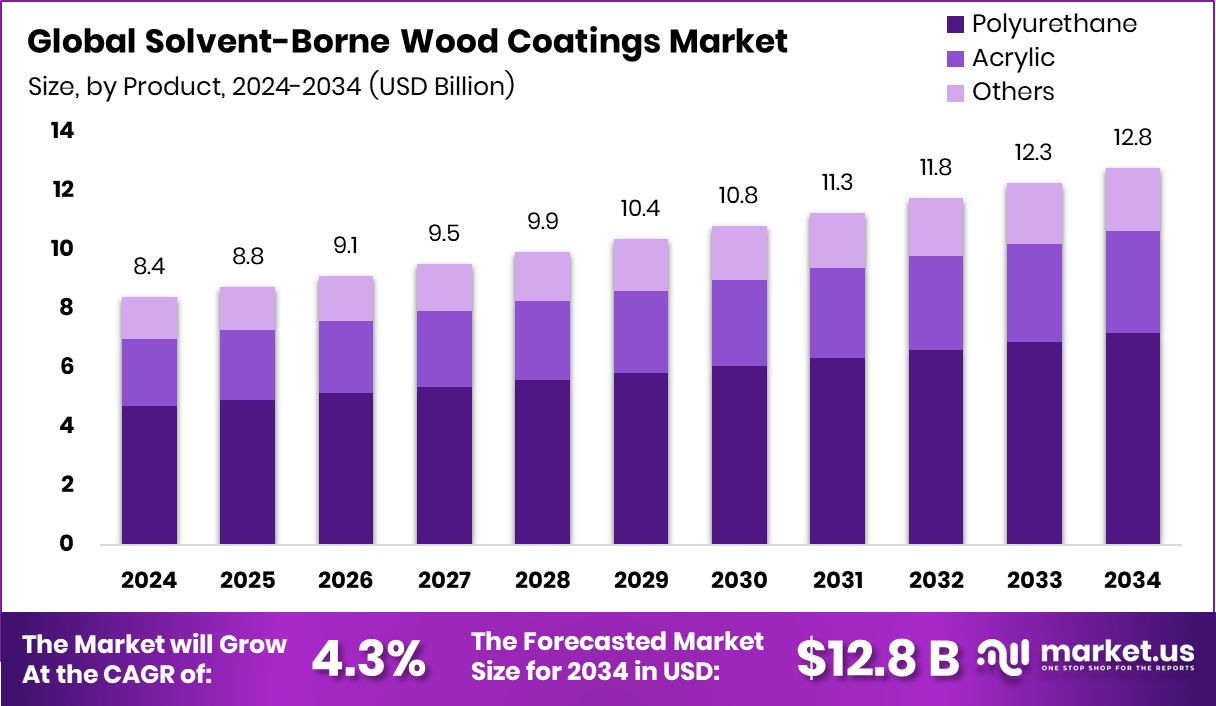

Global Solvent-Borne Wood Coatings Market is expected to be worth around USD 12.8 billion by 2034, up from USD 8.4 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034. Rapid urbanization and rising furniture demand support Asia-Pacific’s 41.8% market share growth.

Solvent-borne wood Coatings are protective finishes used on wooden surfaces that rely on organic solvents as a medium to dissolve resins and other components. These coatings are known for their excellent durability, quick drying time, and strong resistance to environmental factors such as moisture, UV rays, and chemicals. They offer a smooth finish and are widely used in both interior and exterior wood applications, including furniture, flooring, doors, and decorative woodwork.

The Solvent-Borne Wood Coatings Market refers to the global trade and consumption of these coatings across various sectors, such as construction, furniture, and decorative interiors. The market is driven by growing demand for premium furniture and wood-based interiors, especially in emerging economies where urbanization and disposable incomes are rising.

One of the primary growth factors is the expanding construction and housing sector, which drives demand for high-performance wood finishes. Consumers increasingly seek durability and aesthetic appeal, which solvent-based coatings readily provide. Additionally, these coatings perform well under extreme temperatures, making them ideal for various climatic conditions.

Demand is also boosted by rising interest in wooden aesthetics in modern interiors. Wood coatings not only enhance the appearance but also extend the life of the material, making them a staple in the renovation and remodeling industry. This continued consumer interest helps maintain steady market demand.

Key Takeaways

- Global Solvent-Borne Wood Coatings Market is expected to be worth around USD 12.8 billion by 2034, up from USD 8.4 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034.

- Polyurethane dominates the Solvent-Borne Wood Coatings Market at 56.2% share.

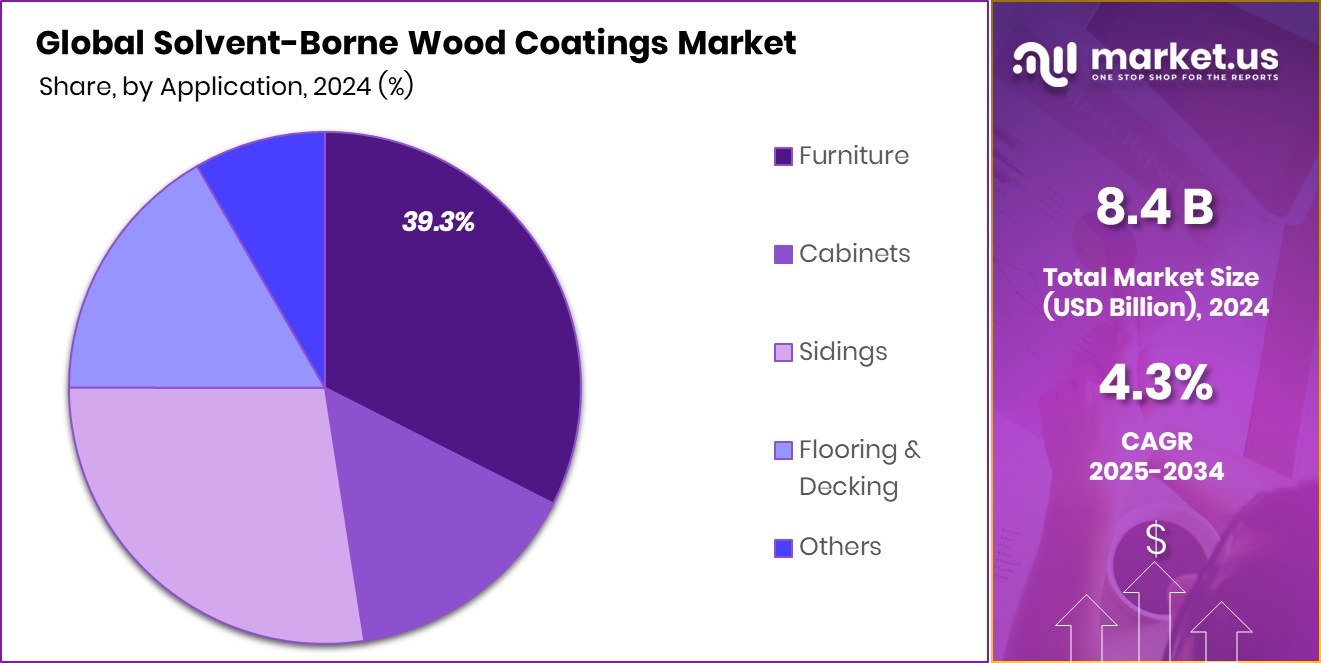

- Furniture leads the Solvent-Borne Wood Coatings Market with 39.3% application share.

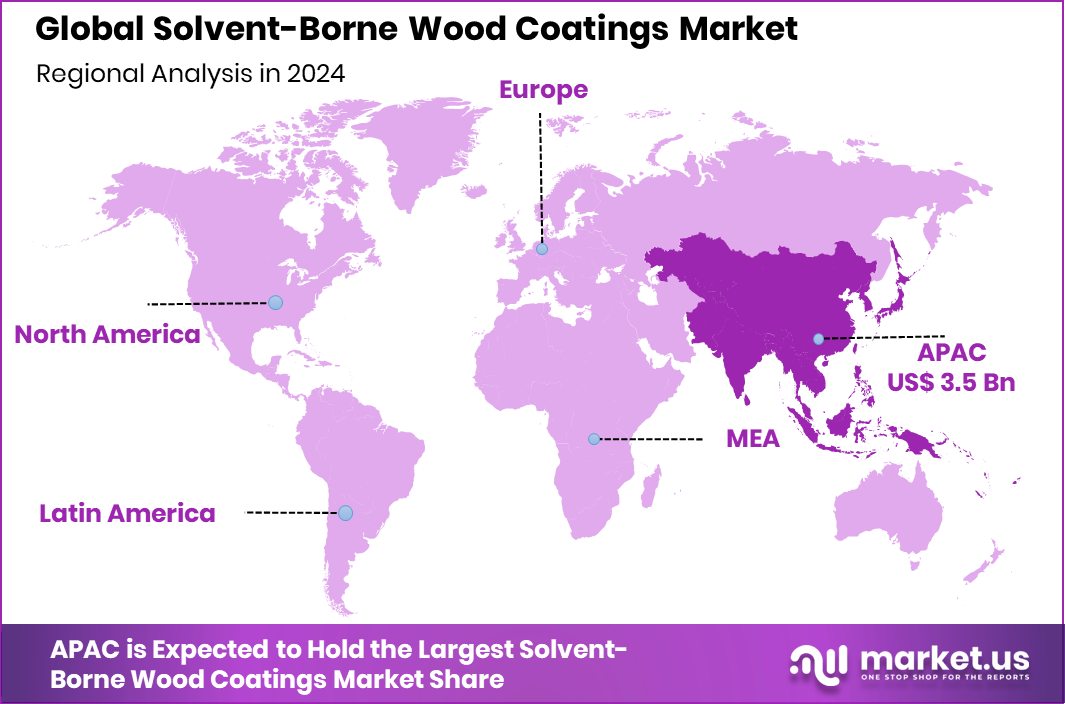

- The Asia-Pacific solvent-borne wood coatings market reached a value of USD 3.5 billion.

By Product Analysis

Polyurethane holds a 56.2% share in the Solvent-Borne Wood Coatings Market due to its durability.

In 2024, Polyurethane held a dominant market position in the By Product segment of the Solvent-Borne Wood Coatings Market, accounting for a significant 56.2% share. This dominance is largely attributed to polyurethane’s superior characteristics, including high durability, abrasion resistance, and its ability to form a tough, protective film over wooden surfaces. Its application extends widely across both residential and commercial wood finishing, offering long-lasting performance even under heavy use and varying environmental conditions.

Polyurethane coatings are particularly favored for their clear, glossy finish and fast curing time, which enhances productivity in industrial settings and offers a smooth, aesthetically pleasing look for furniture and interiors. These coatings also provide excellent chemical and moisture resistance, making them a preferred choice for kitchen cabinets, hardwood floors, and decorative wood products.

The substantial market share held by polyurethane highlights its widespread adoption across various end-use industries where high-performance and longevity are key. As wood remains a central material in both construction and décor, the continued preference for polyurethane-based coatings reinforces its leadership within this segment.

By Application Analysis

Furniture accounts for 39.3% of the Solvent-Borne Wood Coatings Market, driven by aesthetic demand.

In 2024, Furniture held a dominant market position in the By Application segment of the Solvent-Borne Wood Coatings Market, capturing a notable 39.3% share. This leadership position is primarily driven by the consistent and high-volume demand for wooden furniture in both residential and commercial spaces. The application of solvent-borne coatings in furniture manufacturing ensures enhanced surface protection, superior finish, and long-lasting durability, all of which are essential qualities in frequently used items like chairs, tables, cabinets, and beds.

The preference for solvent-borne coatings in the furniture segment stems from their ability to deliver smooth application, fast drying, and strong resistance to wear and environmental exposure. These coatings offer high gloss retention and improve the aesthetic appeal of wooden furniture, meeting the growing consumer demand for both visual quality and functional performance.

As interior design trends continue to favor natural wood elements, the need for reliable and durable coatings has become more pronounced. Solvent-borne coatings meet these expectations, ensuring furniture maintains its appearance and integrity over time.

Key Market Segments

By Product

- Polyurethane

- Acrylic

- Others

By Application

- Furniture

- Cabinets

- Sidings

- Flooring and Decking

- Others

Driving Factors

Rising Demand for Durable and Long-Lasting Wood Finishes

One of the top driving factors of the Solvent-Borne Wood Coatings Market is the growing demand for strong and long-lasting finishes on wooden products. People want their furniture, doors, floors, and wooden decorations to look good and last longer without wearing out. Solvent-borne coatings are known for their durability, smooth finish, and ability to protect wood from moisture, scratches, and everyday damage.

This makes them a preferred choice for both home and commercial use. As more consumers look for products that offer both beauty and strength, especially in furniture and interior design, the demand for high-performance coatings like solvent-borne wood coatings keeps increasing. This strong preference is helping drive the market steadily forward.

Restraining Factors

Environmental Concerns Due to High VOC Emissions

A major restraining factor for the Solvent-Borne Wood Coatings Market is the environmental concern over high levels of VOCs (volatile organic compounds) released during application and drying. These chemicals can pollute indoor and outdoor air, contributing to health problems and environmental damage. As awareness grows about the harmful effects of VOCs, many governments and regulatory bodies are introducing stricter rules to limit their use.

This is making it harder for manufacturers to continue using traditional solvent-based coatings without making changes to their formulas. As a result, some users and industries are shifting to water-based or low-VOC alternatives, which could slow the growth of the solvent-borne segment despite its advantages in performance and durability.

Growth Opportunity

Innovation in Low-VOC Solvent-Based Coating Formulations

A key growth opportunity in the Solvent-Borne Wood Coatings Market lies in the development of low-VOC (volatile organic compound) formulations. As environmental regulations become stricter, there is a rising demand for products that are safer for both people and the environment. Manufacturers have the chance to create new types of solvent-borne coatings that maintain the same strong performance—like durability and fast drying—but with reduced emissions.

By focusing on eco-friendly innovations, companies can meet regulatory standards while still offering the benefits that make solvent-based coatings popular. This creates a unique market advantage and opens doors in regions with tight environmental laws, giving manufacturers a chance to grow sustainably without losing the appeal of solvent-borne performance.

Latest Trends

Growing Use of Solvent Coatings in Custom Furniture

A leading trend in the Solvent-Borne Wood Coatings Market is the increasing use of these coatings in custom-made furniture. As more people look for unique, handcrafted, and personalized wooden pieces for their homes and offices, the demand for high-quality finishes has gone up. Solvent-borne coatings are preferred in this space because they provide a rich, smooth finish and protect wood surfaces from damage over time.

Artisans and small furniture makers often rely on these coatings for their fast drying and excellent performance. This trend shows how solvent-borne coatings are being valued not just for industrial uses but also for creative and design-focused furniture, making them a top choice in modern custom woodwork.

Regional Analysis

Asia-Pacific held the largest market share of 41.8% in solvent-borne coatings.

In the global Solvent-Borne Wood Coatings Market, Asia-Pacific emerged as the dominating region, capturing the largest share of 41.8%, with a market value of USD 3.5 billion in 2024. This dominance is primarily driven by rapid urbanization, growth in residential and commercial construction, and increasing demand for furniture and interior wood applications across countries like China, India, and Southeast Asia. The expanding middle-class population and rising consumer preference for aesthetically appealing wooden interiors have further boosted regional consumption.

North America continues to show steady demand due to the presence of well-established wood product industries and a focus on high-performance coatings in home renovation and remodeling. Europe, with its emphasis on quality and durability, maintains a significant market presence, supported by demand for traditional wood furniture and architectural woodwork.

The Middle East & Africa region is witnessing gradual growth as construction and infrastructure investments increase, particularly in urban centers. Latin America shows modest expansion, supported by economic development and rising interest in decorative wood finishes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Axalta Coating Systems LLC, BASF SE, and Eastman Chemical Company played pivotal roles in shaping the competitive landscape of the global Solvent-Borne Wood Coatings Market. Each of these companies brought unique strengths and strategic direction to support the market’s growth and address evolving consumer needs.

Axalta Coating Systems LLC continued to focus on expanding its portfolio of durable, high-performance coatings tailored for wood applications. With its strong presence in industrial coatings, Axalta emphasized formulations that offer fast drying, chemical resistance, and a superior finish, aligning with market demand for quality and efficiency in furniture and flooring applications.

BASF SE, known for its chemical innovation, maintained its leadership by focusing on solvent-borne technologies that balance performance with sustainability goals. The company leveraged its expertise in resin and polymer development to create advanced coating systems that provide long-lasting protection and visual appeal for wood surfaces, even under high-usage conditions.

Eastman Chemical Company played a strategic role by supporting the formulation of solvent-borne coatings through its specialized chemical ingredients. Eastman’s focus on enhancing coating performance, particularly in terms of clarity, adhesion, and drying time, allowed coating manufacturers to improve product reliability and aesthetics.

Top Key Players in the Market

- Akzo Nobel NV

- Asian Paints

- Axalta Coating Systems LLC

- BASF SE

- Eastman Chemical Company

- Heubach GmbH

- Kansai Nerolac Paints

- Nippon Paint Holdings Co Ltd

- PPG Industries, Inc.

- Sirca S.p.A.

- Teknos Group

- The Sherwin-Williams Company

- Tikkurila

Recent Developments

- In February 2025, Akzo Nobel’s Sikkens Wood Coatings division introduced RUBBOL WF 3350, a sprayable wood coating featuring 20% bio‑based raw materials, verified via C‑14 testing. It offers durable protection for both interior and exterior wood applications while supporting a more sustainable product line.

- In May 2024, Axalta introduced its Zenamel™ range, specifically designed for cabinet manufacturers. This new solvent-borne wood coating line includes two variants—Zenamel SP and Zenamel T—offering faster application times and exceptional surface protection.

Report Scope

Report Features Description Market Value (2024) USD 8.4 Billion Forecast Revenue (2034) USD 12.8 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Polyurethane, Acrylic, Others), By Application (Furniture, Cabinets, Sidings, Flooring and Decking, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Akzo Nobel NV, Asian Paints, Axalta Coating Systems LLC, BASF SE, Eastman Chemical Company, Heubach GmbH, Kansai Nerolac Paints, Nippon Paint Holdings Co Ltd, PPG Industries, Inc., Sirca S.p.A., Teknos Group, The Sherwin-Williams Company, Tikkurila Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Solvent-Borne Wood Coatings MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Solvent-Borne Wood Coatings MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Akzo Nobel NV

- Asian Paints

- Axalta Coating Systems LLC

- BASF SE

- Eastman Chemical Company

- Heubach GmbH

- Kansai Nerolac Paints

- Nippon Paint Holdings Co Ltd

- PPG Industries, Inc.

- Sirca S.p.A.

- Teknos Group

- The Sherwin-Williams Company

- Tikkurila