Global Caprolactam Market By Product(Nylon 6 Fibers, Nylon 6 Resins), By Application(Textile Yarn, Industrial Yarn, Engineering Plastics, Fibers, Others), By Production Method(Cyclohexane Oxidation, Phenol Hydrogenation, Ammonium Sulfate Process, Others), By End-Use(Automotive, Filaments, Electrical and Electronics, Consumer Goods, Packaging, Wire and Cable, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 123553

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

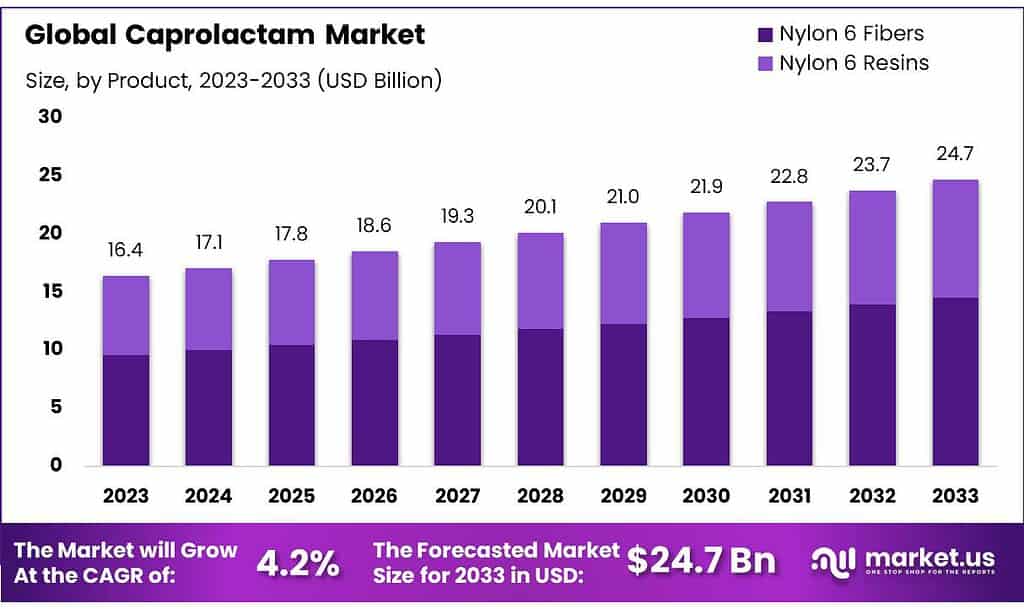

The global Caprolactam Market size is expected to be worth around USD 24.7 billion by 2033, from USD 16.4 billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2023 to 2033.

The Caprolactam Market refers to the global industry and market dynamics surrounding the production, distribution, and consumption of caprolactam, an essential chemical primarily used in manufacturing Nylon 6 fibers and resins. This organic compound is a key intermediate in the production of synthetic polymers. The caprolactam market is influenced by various factors, including the demand for Nylon 6 in applications such as textiles, automotive components, industrial yarns, and engineering plastics.

The significance of the caprolactam market stems from its widespread use in industries requiring durable and versatile materials. The market is driven by the demand for lightweight materials in the automotive sector, the need for high-performance fibers in textiles, and advancements in polymer technology. Additionally, economic growth in emerging markets contributes to increasing demand for consumer goods and automobiles, which in turn boosts the caprolactam market.

China leads production with a capacity of over 2.5 million tons annually, as reported by the China Petroleum and Chemical Industry Federation. European producers, including major companies like BASF and DSM, account for around 1.2 million tons. According to the American Chemical Society (ACS), over 65% of caprolactam produced is used in manufacturing nylon 6 fibers for textiles and carpets, while approximately 20% is used in engineering plastics for automotive components, contributing to the lightweighting trends in the industry.

In 2022, China exported about 600,000 tons of caprolactam, while Europe exported approximately 300,000 tons. Major importers include India and Southeast Asian countries, with India importing around 150,000 tons in 2022, according to the Ministry of Commerce & Industry, Government of India. Government regulations and initiatives play a pivotal role in shaping the market dynamics. For instance, the European Union has allocated €150 million in grants for research and development in high-performance materials, including caprolactam-based products.

Significant investments and innovations are shaping the future of the caprolactam market. BASF announced a €300 million investment in expanding caprolactam production capacity in Europe to meet growing demand. DSM invested in a new bio-based caprolactam production facility in the Netherlands, enhancing sustainability and reducing carbon footprint. Additionally, Honeywell and Sinopec formed a joint venture to develop advanced caprolactam production technologies, enhancing efficiency and reducing environmental impact.

Acquisitions and mergers have also played a crucial role in consolidating market positions. LANXESS acquired Emerald Kalama Chemical, significantly increasing its portfolio in the nylon market, while Sumitomo Chemical merged with a leading Japanese caprolactam producer to expand its product offerings.

Key Takeaways

- The global Caprolactam market is projected to grow from USD 16.4 billion in 2023 to approximately USD 24.7 billion by 2033, at a CAGR of 4.2%.

- Nylon 6 fibers hold over 58.6% of the market share in 2023.

- The Cyclohexane Oxidation method holds a dominant share of 48.7%.

- Textile Yarn held a dominant market position, capturing more than a 50.1% share.

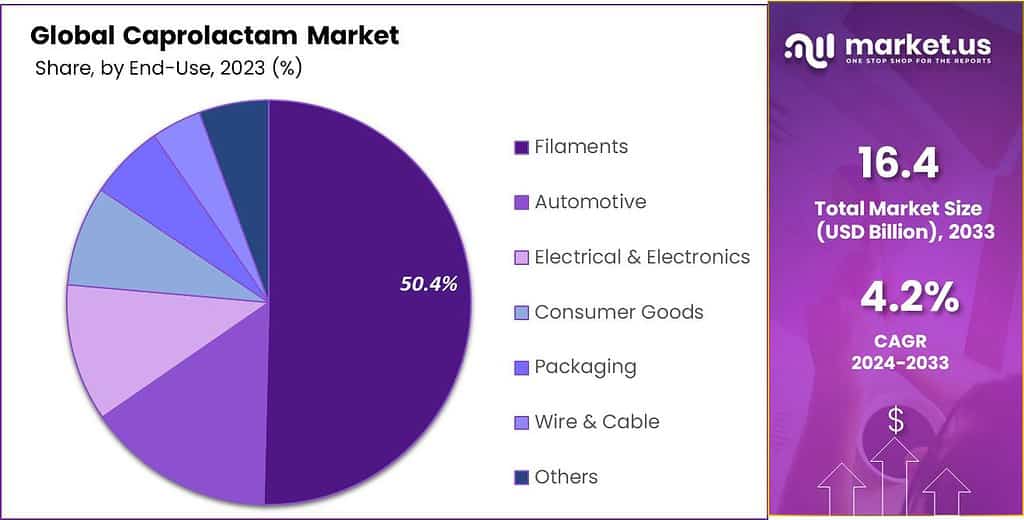

- Filaments held a dominant market position, capturing more than a 50.4% share.

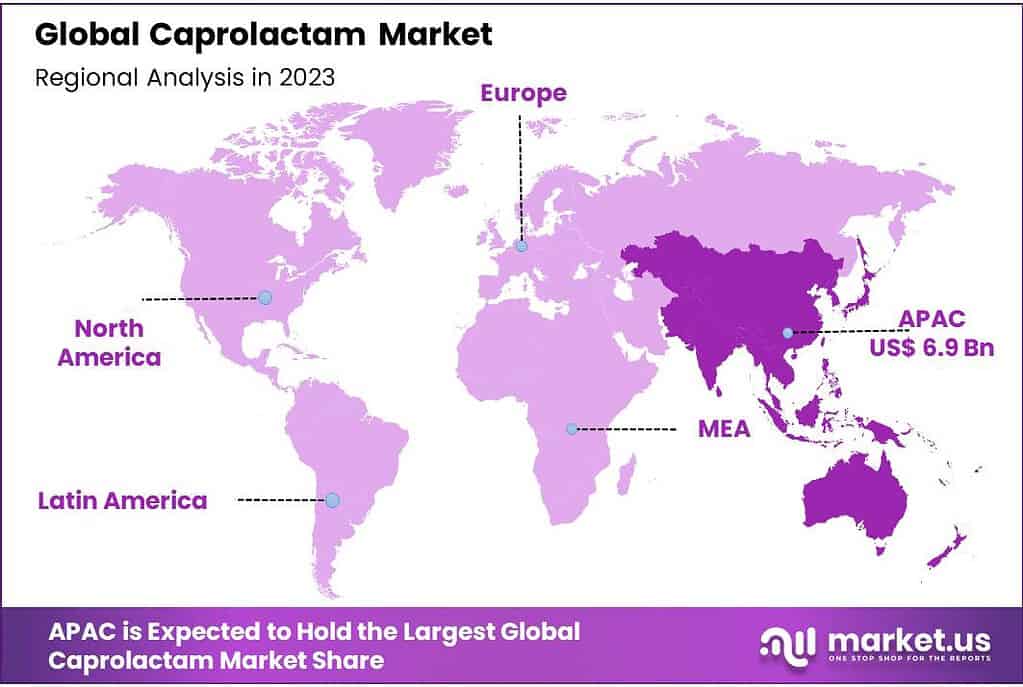

- The Asia Pacific (APAC) region dominated the market, capturing a substantial 42.6% share.

By Product

In 2023, Nylon 6 fibers held a dominant market position, capturing more than a 58.6% share of the Caprolactam market. This segment’s strength is primarily due to its widespread application in the textile industry, where Nylon 6 fibers are favored for their durability, elasticity, and resistance to wear and tear. These fibers are extensively used in the manufacture of apparel, sportswear, and home furnishings, driving their high market share.

Nylon 6 resins accounted for a significant portion of the market as well, driven by their use in engineering plastics. These resins are utilized in a variety of applications that require materials with high mechanical strength and good heat resistance, such as automotive parts, electrical and electronic housings, and consumer goods. The versatility and performance attributes of Nylon 6 resins support their strong position in these high-value sectors.

Together, Nylon 6 fibers and resins encapsulate the major applications of Caprolactam, underscoring the material’s importance in both the textile and engineering industries. Their distinct properties and wide-ranging applications not only highlight the diversity of the Caprolactam market but also its potential for growth in various industrial sectors.

By Production Method

In 2023, Cyclohexane Oxidation held a dominant market position, capturing more than a 48.7% share of the Caprolactam production market. This method is highly favored for its efficiency and cost-effectiveness in converting cyclohexane into caprolactam, primarily through an oxidation process followed by the Beckmann rearrangement. Its widespread adoption is supported by its robust output and reliability in large-scale operations, making it a cornerstone of the global caprolactam supply.

Phenol Hydrogenation, another significant method, accounted for a substantial market share. This technique involves hydrogenating phenol to cyclohexanol, which is subsequently converted to caprolactam. While generally more expensive due to the costs associated with hydrogenation, this method is valued for producing high-purity caprolactam, crucial for specific high-end applications.

The Ammonium Sulfate Process also plays a critical role in the market, particularly in regions where the co-production of ammonium sulfate fertilizer is economically beneficial. This process, which generates caprolactam via the ammonium sulfate route, is especially common in areas where agricultural demand supports the dual production of both caprolactam and fertilizer.

By Application

In 2023, Textile Yarn held a dominant market position in the Caprolactam market, capturing more than a 50.1% share. This segment’s leadership stems from its extensive use in the production of various textile products such as sportswear, fashion apparel, and home textiles. Nylon 6, derived from Caprolactam, is prized for its resilience, elasticity, and dyeability, making it a favored choice in the textile industry.

Industrial Yarn also represents a significant application of Caprolactam, encompassing uses in heavy-duty textiles like ropes, tire cords, and industrial bags. This segment benefits from Nylon 6’s high tensile strength and abrasion resistance, essential for products subjected to rigorous use.

Engineering Plastics made up another critical application area, utilizing Caprolactam in components that require high material strength and thermal stability. Products such as automotive parts, electrical connectors, and various mechanical components are typically used within this segment.

Fibers for other uses, including non-woven fabrics and specialty textiles, account for a smaller yet vital portion of the market. These fibers are integral to applications in filtration systems, medical textiles, and geotextiles, contributing to the diversified demand for Caprolactam.

By End-Use

In 2023, Filaments held a dominant market position in the Caprolactam market, capturing more than a 50.4% share. This segment’s prominence is driven by the high demand for durable and versatile synthetic fibers used in textiles, carpets, and industrial applications. Nylon 6, produced from Caprolactam, is particularly valued for its strength, elasticity, and resistance to abrasion and chemicals, making it ideal for these applications.

The Automotive sector also represents a significant portion of the Caprolactam market, utilizing the material in the production of components that require high mechanical strength and heat resistance. Components such as under-hood automotive parts, as well as various interior and exterior trims, benefit from the properties of Nylon 6, which contribute to lighter vehicle weights and improved fuel efficiency.

In the Electrical & Electronics sector, Caprolactam-derived products are used in manufacturing insulators, connectors, and housings. These applications leverage the material’s excellent electrical insulation properties and resistance to heat, enhancing the reliability and performance of electronic devices.

Consumer Goods is another vital segment, where Caprolactam is used in the production of items such as kitchen utensils, various types of containers, and sports equipment. The material’s durability and safety in contact with food make it suitable for such uses.

Packaging uses of Caprolactam include the production of films and containers that require robust barrier properties to protect goods from moisture and chemicals. This application benefits from Nylon 6’s excellent barrier properties and mechanical strength.

Wire & Cable applications of Caprolactam involve the use of Nylon 6 for jacketing and insulation, where the material’s toughness and resistance to abrasion are crucial. These properties ensure long-lasting protection and reliability of cables and wires, particularly in industrial settings.

Key Market Segments

By Product

- Nylon 6 Fibers

- Nylon 6 Resins

By Application

- Textile Yarn

- Industrial Yarn

- Engineering Plastics

- Fibers

- Others

By Production Method

- Cyclohexane Oxidation

- Phenol Hydrogenation

- Ammonium Sulfate Process

- Others

By End-Use

- Automotive

- Filaments

- Electrical & Electronics

- Consumer Goods

- Packaging

- Wire & Cable

- Others

Drivers

Expansion of Advanced Materials in Automotive and Aerospace Industries

One significant driving factor for the Caprolactam market is the expansion of advanced materials usage in the automotive and aerospace industries. As these sectors push for more lightweight, durable, and efficient materials to enhance performance and fuel efficiency, Caprolactam-derived products, especially Nylon 6, stand out as prime candidates.

In the automotive industry, the shift towards electric vehicles (EVs) and the need for lighter materials to improve battery efficiency and range are increasing the demand for high-performance polymers. According to projections from the International Energy Agency (IEA), EVs are expected to constitute a significant share of the automotive market shortly, with estimates suggesting millions of units sold annually by 2030. This surge in EVs is primarily fueled by global efforts to reduce carbon emissions and move towards more sustainable energy solutions.

The aerospace industry also presents substantial growth opportunities for Caprolactam, especially in applications where weight reduction is crucial. Advanced polymers derived from Caprolactam are used in various aerospace components due to their strength-to-weight ratios superior to many traditional materials. These components include interior panels, structural elements, and various other high-stress, lightweight applications.

Moreover, government and industry regulations pushing for reduced emissions and enhanced fuel efficiency standards in vehicles and aircraft further drive the demand for advanced materials. Such regulatory frameworks compel manufacturers to adopt newer, lighter, and more efficient materials, thus broadening the market for Caprolactam-based products.

Thus, the growth in demand for high-performance materials in critical industries, supported by technological advancements and regulatory trends, underscores the expanding applications and market for Caprolactam. This trend highlights the integral role of innovative materials in meeting the evolving requirements of modern transportation and technology sectors.

Restraints

Regulatory and Environmental Challenges

A significant restraining factor for the Caprolactam market is the stringent environmental regulations and the challenges associated with the production process’s environmental impact. The manufacturing of Caprolactam involves processes that can emit various pollutants, including nitrogen oxides and sulfur dioxide, which contribute to air and water pollution. These emissions are subject to increasingly strict regulations globally, which can lead to higher operational costs and restrict market growth.

In the European Union, for example, the Industrial Emissions Directive (IED) mandates stringent control measures and emission limits for large industrial installations, including chemical plants producing Caprolactam. Compliance with these regulations requires significant investment in pollution control technologies, which can be costly for manufacturers. This is further compounded by the global shift towards more sustainable practices and the pressure to reduce the carbon footprint of industrial activities.

Moreover, the general trend in environmental policy is towards tightening regulations, which could pose further challenges to the Caprolactam industry. This includes potential future restrictions on the use of certain chemicals or processes deemed harmful to the environment. Such developments could necessitate costly adaptations in manufacturing processes or even lead to reduced production capacity.

These regulatory and environmental challenges are not isolated to the European Union but are part of a global movement towards stricter environmental protection standards. This trend is evident in various regulations aiming to mitigate climate change and reduce industrial pollution impacts worldwide. The necessity to comply with these environmental standards, while essential for sustainability, acts as a restraining factor by increasing operational costs and imposing limits on production practices in the Caprolactam industry.

Opportunity

Expansion into Biodegradable Plastics and Recycling Technologies

One major growth opportunity for the Caprolactam market lies in its potential applications within the biodegradable plastics sector and advancements in recycling technologies. As global awareness and regulatory pressures increase regarding environmental sustainability, there is a growing demand for materials that can either be recycled more efficiently or degraded more harmlessly in the environment.

Caprolactam, primarily used to produce Nylon 6, finds itself at the forefront of this shift. Nylon 6’s robustness makes it a prime candidate for recycling initiatives. Advanced recycling technologies that improve the cost-effectiveness and efficiency of processing Nylon 6 waste back into usable Caprolactam could significantly drive market growth. These technologies not only align with global sustainability goals but also open up new business models and opportunities in the circular economy.

Additionally, the push for biodegradable plastics offers another avenue for growth. Biodegradable plastics, which break down faster than traditional plastics, are increasingly favored in applications ranging from packaging to agricultural films due to their lesser environmental impact. Developing Caprolactam-based polymers that fit this mold could tap into new market segments eager for sustainable material solutions.

This expansion is supported by advancements in chemical processing and materials science, making it feasible to produce more environmentally friendly and economically viable products. The integration of Caprolactam into the production of biodegradable plastics could thus not only help mitigate the environmental impact but also position producers to take advantage of emerging market trends favoring sustainability.

Trends

Biodegradable and Recyclable Polymers

One of the latest trends in the Caprolactam market is the significant shift towards the development and use of biodegradable and recyclable polymers. This trend is primarily driven by the increasing environmental concerns and the tightening of global regulations aimed at reducing plastic waste and promoting sustainability in materials production.

Biodegradable polymers are gaining traction because they offer an environmentally friendly alternative to traditional plastics. These materials are designed to degrade under natural conditions, returning to nature without leaving harmful residues. The push for biodegradable plastics is supported by advancements in polymer science that allow Caprolactam to be processed into polymers that not only retain the desirable properties of Nylon 6 but also offer improved end-of-life degradability.

Similarly, recycling technologies for Caprolactam-derived products like Nylon 6 are evolving. The emphasis is on enhancing the efficiency and cost-effectiveness of recycling processes to support the circular economy. These technologies aim to recover Caprolactam from post-consumer waste, which can then be repurposed to produce new polymers, significantly reducing waste and the environmental impact of production processes.

This trend towards sustainable materials is also being driven by consumer demand for greener products and by manufacturers’ desire to comply with international environmental standards, which increasingly favor materials that can be recycled or that biodegrade naturally without causing pollution.

These advancements represent a substantial growth opportunity for the Caprolactam market. By aligning with global sustainability goals, producers can not only mitigate regulatory impacts but also gain access to new markets and customer bases looking for environmentally responsible materials. This shift is likely to reshape the market dynamics and drive innovation in the production and application of Caprolactam in the coming years.

Regional Analysis

In 2023, the Caprolactam market exhibited notable regional variances in demand and consumption. The Asia Pacific (APAC) region dominated the market, capturing a substantial 42.6% share, equivalent to USD 6.98 billion. This dominance is primarily due to the robust industrial base in countries like China, India, and Japan, where caprolactam is extensively used in manufacturing nylon 6 fibers and resins for textiles and automotive applications.

North America follows, driven by significant demand in the automotive and engineering plastics sectors. Europe also shows strong market activity, supported by the region’s advanced chemical and automotive industries. The Middle East & Africa, while smaller in market share, is experiencing growth due to rising industrialization and investment in manufacturing sectors.

Latin America, though representing a smaller share, is seeing steady growth in the textile and automotive industries, contributing to the overall market expansion. The diverse applications and ongoing industrial advancements in these regions highlight the dynamic nature of the global Caprolactam market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Caprolactam market is highly competitive, with several key players driving innovation and market growth. BASF SE, a global leader in chemical production, leverages its advanced technological capabilities and extensive distribution network to maintain a strong market presence. The Aquafil Group and Alpek S.A.B. de C.V. are also significant players, focusing on sustainable production processes and expanding their global footprint to cater to the increasing demand for nylon 6 fibers and resins.

AdvanSix Inc. and Grupa Azoty are prominent in the North American and European markets, respectively, capitalizing on their robust industrial bases and technological advancements. In Asia, the China Petrochemical Development Corporation and Highsun Group dominate due to the region’s rapid industrialization and high demand for textiles and automotive components. Domo Chemicals and KuibyshevAzot PJSC are known for their innovative approaches and investments in research and development to enhance product quality and environmental sustainability.

Other notable players include Gujarat State Fertilizers & Chemicals Limited, Fibrant, and Genomatica Inc., which focus on integrating green chemistry and sustainable practices in their production processes. Capro Co., LANXESS, and UBE Corporation continue to expand their market reach through strategic partnerships and acquisitions, ensuring a steady supply of caprolactam to meet the growing global demand. These companies collectively contribute to the dynamic and competitive landscape of the Caprolactam market.

Market Key Players

- BASF SE

- The Aquafil Group

- Alpek S.A.B. de C.V.

- AdvanSix Inc.

- Grupa Azoty

- China Petrochemical Development Corporation

- Domo Chemicals

- Highsun Group

- KuibyshevAzot PJSC

- Gujarat State Fertilizers & Chemicals Limited

- Fibrant

- Genomatica Inc.

- Capro Co.

- LANXESS

- UBE Corporation

Recent Development

In April 2023 BASF Company announced an increase in the prices of caprolactam by $0.15 per pound in North America to offset rising production costs and ensure supply stability.

By March 2023 The Aquafil Group, market share had risen to 25%, marking a significant milestone in their market penetration efforts. Throughout the year, Aquafil maintained steady growth, with monthly production outputs consistently exceeding 20,000 metric tons from June to August 2023.

Report Scope

Report Features Description Market Value (2023) US$ 16.4 Bn Forecast Revenue (2033) US$ 24.7 Bn CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Nylon 6 Fibers, Nylon 6 Resins), By Application(Textile Yarn, Industrial Yarn, Engineering Plastics, Fibers, Others), By Production Method(Cyclohexane Oxidation, Phenol Hydrogenation, Ammonium Sulfate Process, Others), By End-Use(Automotive, Filaments, Electrical and Electronics, Consumer Goods, Packaging, Wire and Cable, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, The Aquafil Group, Alpek S.A.B. de C.V., AdvanSix Inc., Grupa Azoty, China Petrochemical Development Corporation, Domo Chemicals, Highsun Group, KuibyshevAzot PJSC, Gujarat State Fertilizers & Chemicals Limited, Fibrant, Genomatica Inc., Capro Co., LANXESS, UBE Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Caprolactam Market?Caprolactam Market size is expected to be worth around USD 24.7 billion by 2033, from USD 16.4 billion in 2023

What CAGR is projected for the Caprolactam Market?The Caprolactam Market is expected to grow at 4.2% CAGR (2024-2033).

List the key industry players of the Global Caprolactam Market?BASF SE, The Aquafil Group, Alpek S.A.B. de C.V., AdvanSix Inc., Grupa Azoty, China Petrochemical Development Corporation, Domo Chemicals, Highsun Group, KuibyshevAzot PJSC, Gujarat State Fertilizers & Chemicals Limited, Fibrant, Genomatica Inc., Capro Co., LANXESS, UBE Corporation

-

-

- BASF SE

- The Aquafil Group

- Alpek S.A.B. de C.V.

- AdvanSix Inc.

- Grupa Azoty

- China Petrochemical Development Corporation

- Domo Chemicals

- Highsun Group

- KuibyshevAzot PJSC

- Gujarat State Fertilizers & Chemicals Limited

- Fibrant

- Genomatica Inc.

- Capro Co.

- LANXESS

- UBE Corporation