Global Solar Vehicle Market Size, Share, Growth Analysis By Type (Passenger Cars, Two Wheelers, Three Wheelers, Commercial Cars), By Battery (Lithium Ion, Lead Acid, Others), By Solar Panel (Monocrystalline Solar Panel, Polycrystalline Solar Panel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141807

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

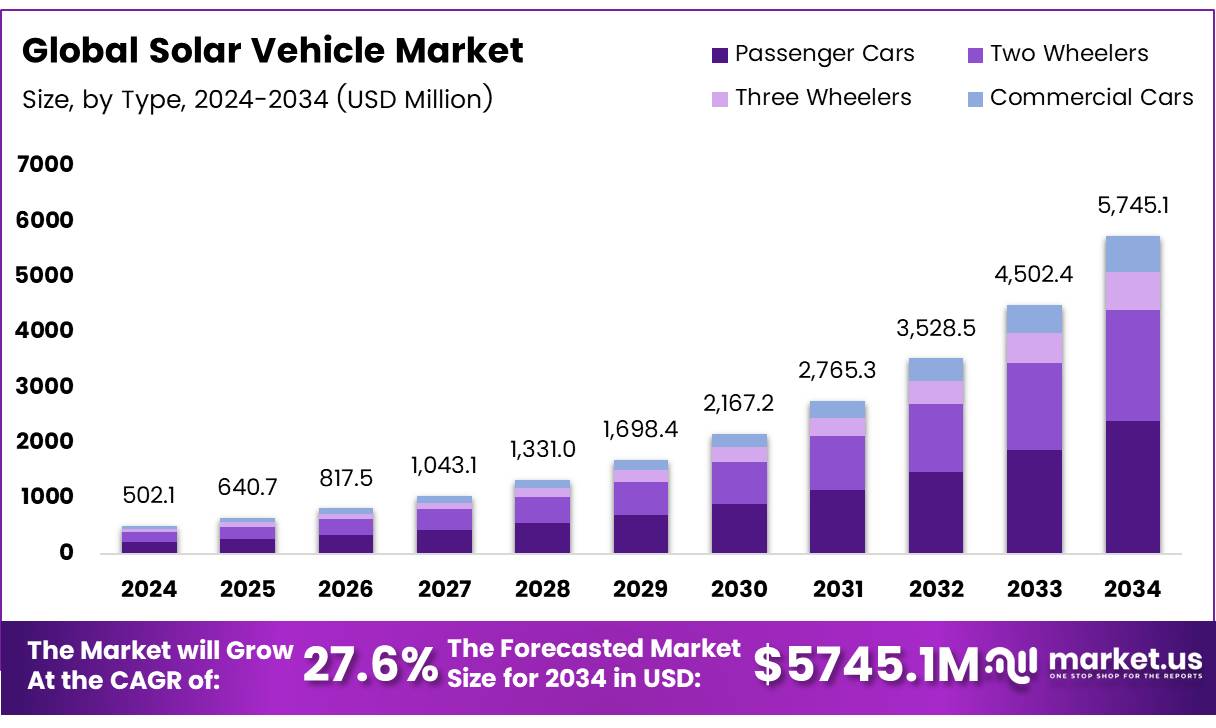

The Global Solar Vehicle Market size is expected to be worth around USD 5745.1 Million by 2034, from USD 502.1 Million in 2024, growing at a CAGR of 27.6% during the forecast period from 2025 to 2034.

The Solar Vehicle Market encompasses a niche yet rapidly expanding segment of the automotive industry, focused on integrating solar energy technology with vehicular design. Essentially, solar vehicles harness photovoltaic cells to convert sunlight into electricity, thereby augmenting the vehicle’s battery power and extending its range.

As environmental concerns and sustainable practices gain prominence, solar vehicles represent a transformative approach towards green transportation solutions. This market is characterized by innovations in solar panel efficiency, battery technology, and vehicular design, tailored to maximize energy absorption and utilization.

Solar vehicles stand at the cusp of technological innovation and environmental stewardship. The integration of solar panels with electric vehicles (EVs) not only promises enhanced energy efficiency but also extends the driving range without the need for frequent recharging. This innovation is particularly crucial as the automotive industry shifts towards sustainable energy solutions.

Companies venturing into this space are not only partaking in the environmental benefits but are also tapping into a growing market demand for greener transportation options. The future of solar vehicles looks promising as advancements in photovoltaic technology continue to improve the cost-effectiveness and performance of solar integrations in vehicles.

The solar vehicle market is poised for significant growth, driven by a confluence of technological advancements, increasing government investments, and evolving regulatory frameworks. According to the National Renewable Energy Laboratory (NREL), solar accounted for 54% of new U.S. electric generation capacity in 2023, a dramatic rise from just 6% in 2010. This surge underscores the growing reliance on solar power, which directly impacts the adoption rates and development of solar vehicles.

Further fueling this growth, the electric vehicle market itself has witnessed an exponential rise, with sales hitting nearly 14 million in 2023, marking a substantial increase from 4% of total car sales in 2020 to 18% in 2023, as reported by industry report. Such trends illustrate a robust consumer appetite for electric vehicles, which solar vehicle innovations stand to benefit from.

Moreover, the economic incentives of incorporating solar technology in vehicles are increasingly apparent. According to Solbian, a solar system on a heavy-duty vehicle can save approximately 5% on fuel over a standard day. Additionally, Sunburnsolar notes that a typical 6.5kW rooftop solar system can charge a standard electric vehicle from 20 to 80 percent capacity during a prolonged sunny day, enhancing charging accessibility and efficiency.

Given these dynamics, the solar vehicle market presents substantial opportunities for stakeholders. Governmental policies and incentives aimed at reducing carbon footprints further bolster market growth, making investments in solar vehicle technology both viable and potentially lucrative. As regulations tighten and consumer preferences shift towards sustainable solutions, the solar vehicle market is expected to expand, providing significant opportunities for industry participants to innovate and grow.

Key Takeaways

- Global Solar Vehicle Market projected to grow from USD 5745.1 Million in 2024 to USD 502.1 Million by 2034 at a CAGR of 27.6%.

- Passenger cars dominated the market type in 2024 with a 40.2% share due to increasing preference for eco-friendly transportation.

- Lithium Ion batteries were the leading choice in the Solar Vehicle Market’s Battery Analysis in 2024.

- Monocrystalline solar panels dominated the Solar Panel Analysis segment in 2024, valued for their efficiency and durability.

- North America holds a significant market share of 35.3%, driven by renewable energy targets and advanced EV infrastructure, with the U.S. leading in growth.

Type Analysis

Passenger Cars Lead with 40.2% in Solar Vehicle Market’s By Type Analysis

In 2024, the solar vehicle market witnessed significant dominance by passenger cars in the By Type Analysis segment, capturing a 40.2% market share. This substantial presence is attributed to the growing consumer preference for eco-friendly and cost-efficient transportation solutions. Passenger cars equipped with solar panels benefit from extended travel ranges and reduced reliance on traditional charging methods, enhancing their appeal in an increasingly environment-conscious market.

Meanwhile, two-wheelers are also gaining traction, particularly in urban areas where congestion and parking limitations make larger vehicles less practical. The appeal of solar two-wheelers lies in their affordability and the added convenience of solar-powered charging stations.

Three-wheelers, often used in commercial activities in dense metropolitan areas, are seeing modest growth. Their utility in short-distance transport makes them a viable candidate for solar conversion, particularly in regions with high solar insolation.

Commercial cars, although lagging slightly behind in adoption, are expected to catch up soon due to the potential for significant cost savings in operational expenses and governmental incentives for sustainable practices. This segment is poised for growth as businesses look to reduce their carbon footprint and capitalize on the branding benefits of using green technology.

These trends suggest a robust trajectory for the solar vehicle market, with diverse opportunities across different vehicle types.

Battery Analysis

Lithium Ion Leads the Charge with Dominance in Solar Vehicle Market

In 2024, Lithium Ion batteries held a dominant market position in the By Battery Analysis segment of the Solar Vehicle Market, underscoring their pivotal role in this burgeoning industry.

Renowned for their high energy density and longer lifespan compared to alternatives, Lithium Ion batteries are the preferred choice for manufacturers aiming to enhance the range and efficiency of solar vehicles. These batteries not only offer better performance in terms of energy retention and rechargeability but also align with the market’s move towards more sustainable and environmentally friendly technologies.

Lead Acid batteries, while being cost-effective and reliable for shorter range applications, lag behind due to their heavier weight and lower energy efficiency. They continue to be utilized in specific markets where initial cost considerations outweigh performance metrics.

The Others category, which includes emerging technologies like solid-state and hydrogen fuel cells, is also gaining traction. These technologies promise to deliver improvements in safety and energy capacity, though they currently represent a smaller fraction of the market due to higher production costs and developmental stages.

As the solar vehicle market evolves, the shift towards more advanced and efficient battery technologies, particularly Lithium Ion, is expected to grow, driven by ongoing advancements and decreasing costs in battery technology.

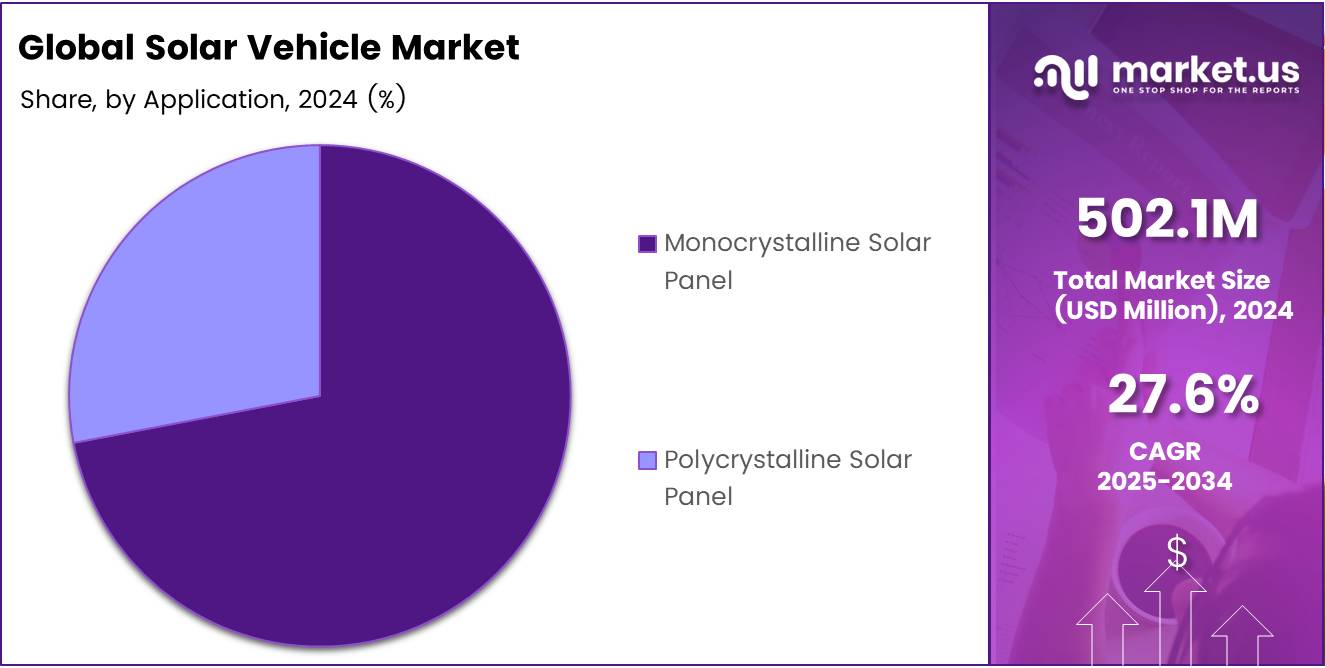

Solar Panel Analysis

Monocrystalline Solar Panels Lead with Robust Market Share in Solar Vehicle Sector

In 2024, the monocrystalline solar panel held a dominant market position within the By Solar Panel Analysis segment of the Solar Vehicle Market. Known for their high efficiency and durability, monocrystalline panels have been pivotal in enhancing the performance of solar-powered vehicles.

These panels are preferred for their ability to produce more power per square foot, making them ideal for the limited spaces available on vehicle surfaces. This efficiency is primarily due to the high purity of silicon used, which facilitates better electron flow, thereby increasing the energy output.

Contrastingly, polycrystalline solar panels, while beneficial for their lower cost and less energy-intensive production process, have captured a smaller share of the market. These panels typically have a lower heat tolerance compared to monocrystalline types, which slightly reduces their efficiency, particularly in warmer climates.

Despite these challenges, polycrystalline panels remain a viable choice for manufacturers focusing on reducing costs and for consumers in cooler regions, thereby sustaining a balanced market presence alongside their monocrystalline counterparts.

The preference for monocrystalline over polycrystalline panels highlights a market trend towards optimizing efficiency and durability in solar vehicle design, reflecting broader consumer expectations and technological advancements in solar energy applications.

Key Market Segments

By Type

- Passenger Cars

- Two Wheelers

- Three Wheelers

- Commercial Cars

By Battery

- Lithium Ion

- Lead Acid

- Others

By Solar Panel

- Monocrystalline Solar Panel

- Polycrystalline Solar Panel

Drivers

Technological Advancements Fueling Solar Vehicle Market Growth

The solar vehicle market is gaining momentum, primarily driven by significant technological advancements in photovoltaic cells, battery efficiency, and innovative vehicle designs, making these eco-friendly alternatives more practical and appealing.

As the world becomes increasingly aware of the environmental impacts of traditional fossil fuels, the shift towards sustainable solutions like solar vehicles is accelerating. This shift is further spurred by rising fuel prices, which make the cost-efficiency of solar vehicles an attractive proposition for consumers.

Additionally, there is a growing consumer fascination with cutting-edge and environmentally conscious technologies, which not only supports the market growth but also propels continuous innovation within the sector. Together, these factors are shaping a robust pathway for the expansion of the solar vehicle market.

Restraints

Weather Dependency Limits Solar Vehicle Market Growth

The solar vehicle market is notably hindered by its dependence on weather conditions, which restricts its effectiveness in less sunny regions. This reliance on ample sunlight limits where these vehicles can operate efficiently, slowing their adoption in areas that could greatly benefit from renewable energy solutions.

Furthermore, limited consumer awareness adds another layer of challenge, as skepticism about solar vehicles’ practicality and efficiency persists. To expand this market, focused efforts on educating consumers and improving vehicle technology to perform well in varied weather conditions are essential. This approach could increase acceptance and drive growth across diverse regions.

Growth Factors

Emerging Markets Fuel Solar Vehicle Expansion

As the global landscape leans towards sustainable practices, the solar vehicle market is poised for significant growth, especially in emerging economies. These regions are witnessing rapid urbanization coupled with increased investments in renewable energy infrastructure, creating a fertile ground for the adoption of solar vehicles.

Innovations in battery technology are set to revolutionize this sector by enhancing the range and efficiency of these eco-friendly vehicles. Furthermore, the market is experiencing a surge in new product launches, featuring vehicles that not only perform better but also boast superior aesthetics and functionality.

Collaborations with technology firms are also pivotal, as they bring advanced tech to the forefront of solar vehicle design, improving connectivity and overall vehicle performance. These developments promise to open new avenues for market expansion and attract a broader consumer base, keen on embracing green transportation solutions.

Emerging Trends

Lightweight Materials Boost Solar Vehicle Efficiency

In the burgeoning solar vehicle market, several key trends are steering its expansion and appealing to a progressively eco-conscious consumer base. Foremost among these is the adoption of advanced lightweight materials, crucial for augmenting vehicle efficiency and maximizing solar energy conversion. This trend not only promises extended range and better performance but also aligns with global sustainability goals.

Concurrently, the integration with renewable energy grids is gaining traction, allowing vehicles to potentially feed excess energy back into the grid, thus supporting energy sustainability. Moreover, self-charging capabilities represent a significant leap forward, offering convenience by enabling vehicles to recharge autonomously while parked or in motion.

Additionally, the development of multi-energy hybrid systems is enhancing vehicle reliability and range by combining solar power with other energy sources. These innovations are pivotal in driving the solar vehicle market forward, promising a blend of efficiency, sustainability, and advanced technology that appeals to modern consumers and investors alike.

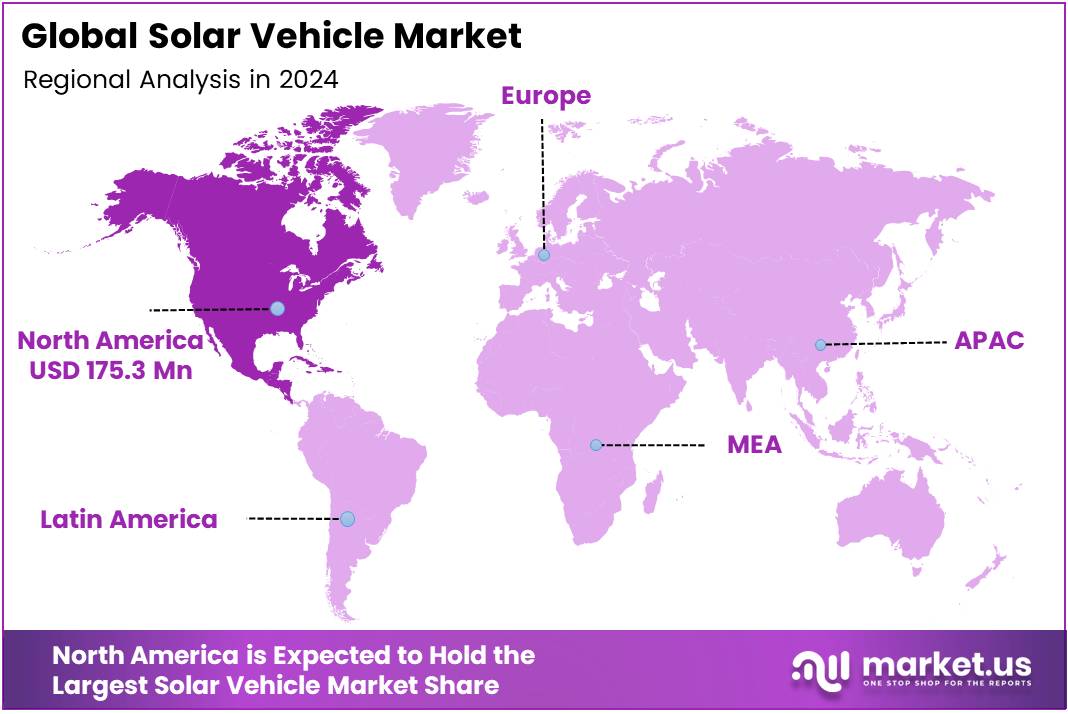

Regional Analysis

North America Leads Solar Vehicle Market with 35.3% Share, Valued at $175.3 Million

The solar vehicle market exhibits varied dynamics across different regions, reflecting their economic, environmental, and technological landscapes. In North America, the market is robust, holding a dominant share of 35.3% with a valuation of USD 175.3 Million.

This prominence is driven by aggressive renewable energy targets, substantial investments in EV infrastructure, and high consumer awareness about sustainability. The U.S. leads this charge, with numerous incentives for solar-powered and electric vehicles, underpinning strong projected growth.

Regional Mentions:

In Europe, the market is driven by stringent EU regulations on carbon emissions and heavy investments in renewable technologies, including solar-powered vehicles. Countries like Germany and the Netherlands showcase high adoption rates, supported by well-established automotive industries pivoting towards solar integration in vehicle designs. Europe’s commitment to reducing its carbon footprint further accelerates the adoption of solar vehicles.

The Asia-Pacific region is anticipated to experience the fastest growth in the solar vehicle market. This surge is fueled by the expanding automotive manufacturing sector, rising environmental concerns, and supportive government policies, particularly in China and India. These countries are investing heavily in solar technology and manufacturing capabilities, making solar vehicles more accessible and affordable.

In the Middle East & Africa, the market is still nascent but growing, driven by the Middle Eastern countries’ increasing focus on diversifying energy sources and reducing reliance on oil. Initiatives to modernize infrastructure and promote sustainable energy practices are slowly paving the way for future market expansion in this region.

Latin America shows potential for growth in the solar vehicle market, with countries like Brazil leading in renewable energy initiatives. The region benefits from abundant solar resources, which could drive the adoption of solar vehicles as part of broader efforts to combat climate change and promote energy independence.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the evolving landscape of the global solar vehicle market, key players such as Lightyear, Hyundai Motor Company, GENERAL MOTORS, Sono Motors, Aptera Motors Corp., Kandi America, Inc., Fisker, Inc., Cruise LLC, Squad Mobility B.V., and Tesla are poised to redefine automotive standards by 2024. Each of these companies brings unique strengths and strategies to harness solar energy for vehicle propulsion, indicating a transformative phase in eco-friendly transportation.

Lightyear leads with its innovative solar integration technology that maximizes energy efficiency, making it a frontrunner in long-range solar vehicles. Hyundai Motor Company, a veteran in the automotive industry, is leveraging its extensive R&D capabilities to integrate solar panels into its existing electric vehicle (EV) lineup, enhancing energy efficiency without compromising vehicle design.

GENERAL MOTORS and Fisker, Inc. are focusing on scalability and mainstreaming solar vehicles, aiming to make them accessible to a broader market. Their strategies likely include developing cost-effective solar solutions that can be integrated into a wide range of vehicle models.

Sono Motors and Aptera Motors Corp. are niche players with a strong focus on ultra-efficient, lightweight solar vehicles. Their approach might not only cater to environmental enthusiasts but also tech-savvy consumers looking for cutting-edge sustainable technology.

Emerging players like Squad Mobility B.V. and Kandi America, Inc. are expected to target urban mobility with compact solar solutions, ideal for city commuting with minimal carbon footprints.

Tesla’s role in this market could be particularly pivotal, given its dominant presence in the EV market and ongoing innovations in battery technology. Integrating solar technology could further solidify its market leadership by offering extended range and reduced charging needs.

Overall, the competitive dynamics in the solar vehicle market by 2024 will likely emphasize technological innovation, cost efficiency, and market expansion strategies, with each player aiming to overcome the technical challenges associated with solar energy in automotive applications.

Top Key Players in the Market

- Lightyear

- Hyundai Motor Company

- GENERAL MOTORS

- Sono Motors

- Aptera Motors Corp.

- Kandi America, Inc.

- Fisker, Inc.

- Cruise LLC

- Squad Mobility B.V.

- Tesla

Recent Developments

- In September 2024, Lightyear successfully secured over $10 million in funding to develop advanced solar systems for vehicles. This investment aims to enhance the efficiency and range of electric cars by integrating solar technology.

- In January 2025, Vayve Mobility unveiled a new solar-powered electric car priced at Rs 3.25 lakh. The launch marks a significant step towards affordable and sustainable transportation options in the market.

- In February 2024, a start-up specializing in solar-powered electric vehicles secured $33 million in funding. This financial boost is intended to accelerate the production and deployment of their innovative solar vehicle solutions.

Report Scope

Report Features Description Market Value (2024) USD 502.1 Million Forecast Revenue (2034) USD 5745.1 Million CAGR (2025-2034) 27.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Passenger Cars, Two Wheelers, Three Wheelers, Commercial Cars), By Battery (Lithium Ion, Lead Acid, Others), By Solar Panel (Monocrystalline Solar Panel, Polycrystalline Solar Panel) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lightyear, Hyundai Motor Company, GENERAL MOTORS, Sono Motors, Aptera Motors Corp., Kandi America, Inc., Fisker, Inc., Cruise LLC, Squad Mobility B.V., Tesla Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lightyear

- Hyundai Motor Company

- GENERAL MOTORS

- Sono Motors

- Aptera Motors Corp.

- Kandi America, Inc.

- Fisker, Inc.

- Cruise LLC

- Squad Mobility B.V.

- Tesla