Global Social Gaming Market Size, Share, Statistics Analysis Report By Platform (Mobile Gaming, PC Gaming, Console Gaming, Web-based Gaming), By Game Type (Casual Games, Multiplayer Online Battle Arenas (MOBA), Role-playing Games (RPG),, Strategy Games, Sports Games, Others), By Revenue Model (Advertisements, Virtual Goods, Lead Generation, In-App Purchases, Subsciption-base), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 25

- Report ID: 142291

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Scope

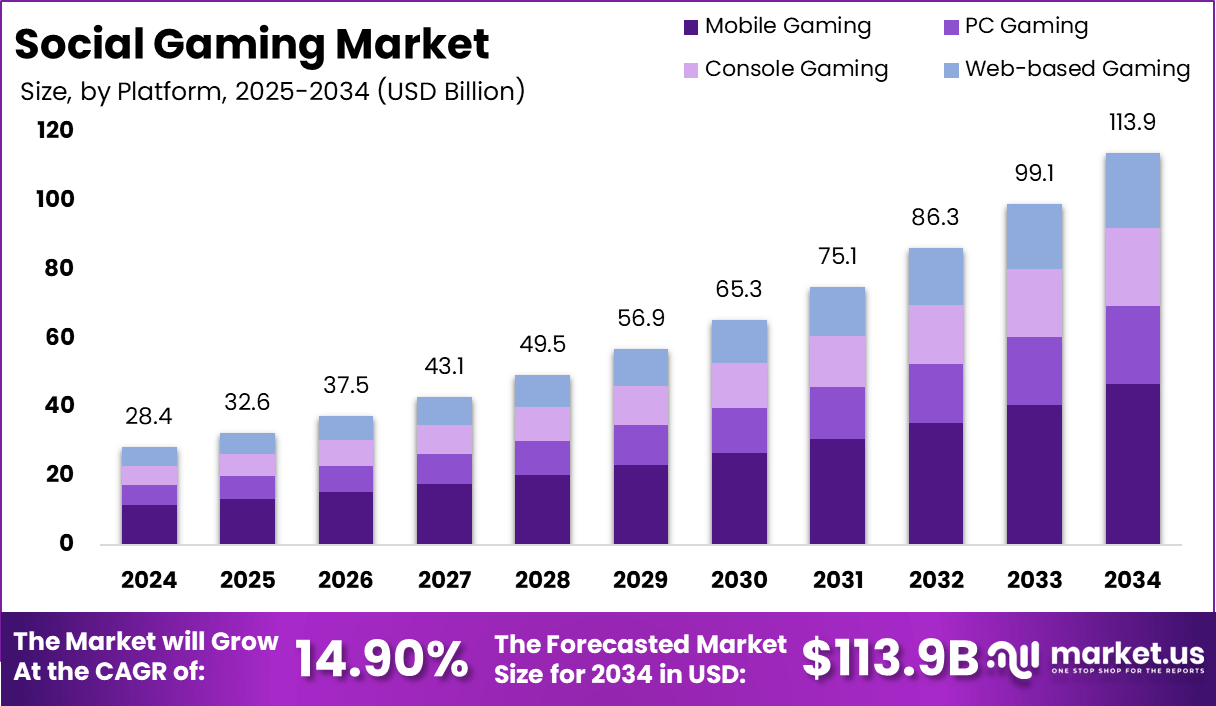

The Global Social Gaming Market is expected to be worth around USD 36.0 Billion by 2034, up from USD 28.4 Billion in 2024. It is expected to grow at a CAGR of 14.90% from 2025 to 2034.

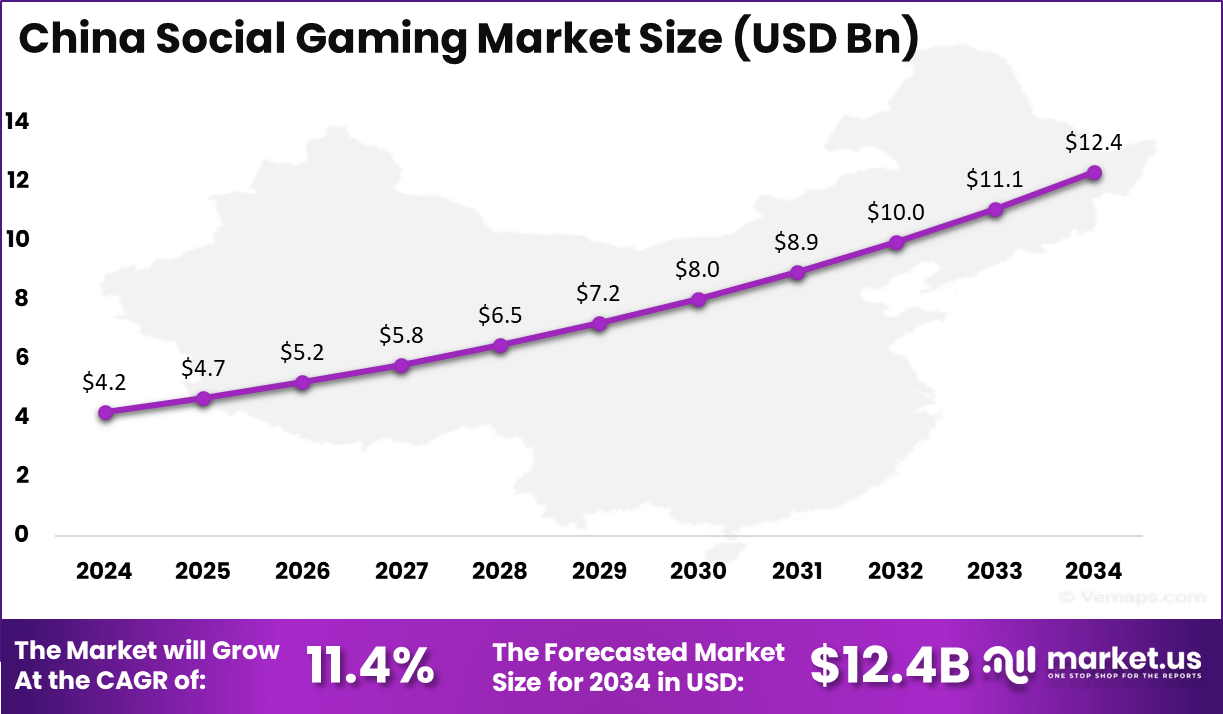

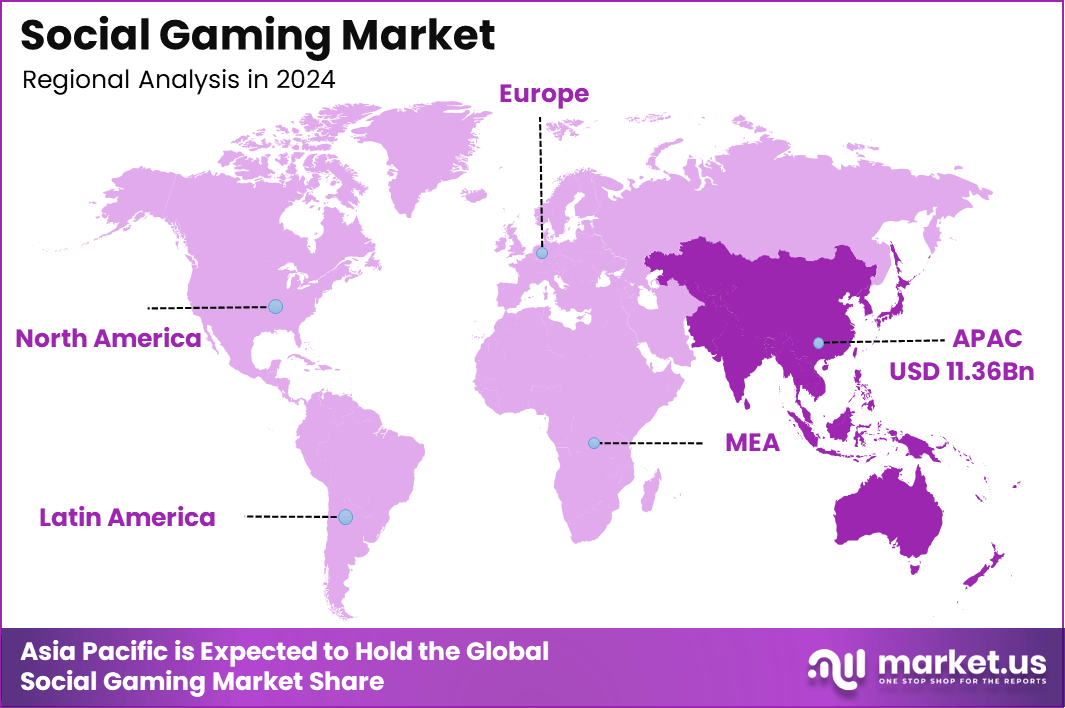

In 2024, Asia-Pacific held a dominant market position, capturing over a 40% share and earning USD 11.36 Billion in revenue. Further, China dominates the market by USD 4.2 Billion, steadily holding a strong position with a CAGR of 11.4%.

The social gaming market has seen significant growth, transforming from basic online games to sophisticated platforms where entertainment and social interaction blend seamlessly. This shift has been driven by technological advancements and evolving consumer behavior, with social gaming emerging as a major component of the gaming industry. Social gaming enables players to interact with friends and strangers in virtual spaces, offering an experience that combines fun, competition, and community-building.

Several key factors have contributed to the rapid growth of the social gaming market. The widespread use of smartphones has made gaming more accessible to a global audience, allowing players to enjoy games anytime and anywhere.

Additionally, many social games are integrated with social media platforms, enabling players to share achievements, challenge friends, and engage in competitions. Free-to-play models with in-app purchases have lowered the entry barriers, attracting a wide range of players. Regular updates, leaderboards, multiplayer modes, and other interactive features further enhance user engagement, driving retention rates.

Key Takeaways

- Market Value Growth: The social gaming market was valued at USD 28.4 billion in 2024 and is projected to reach USD 36.0 billion by 2034, growing at a CAGR of 14.90%.

- Platform Dominance: Mobile gaming accounts for the largest share, with 41% of the total market.

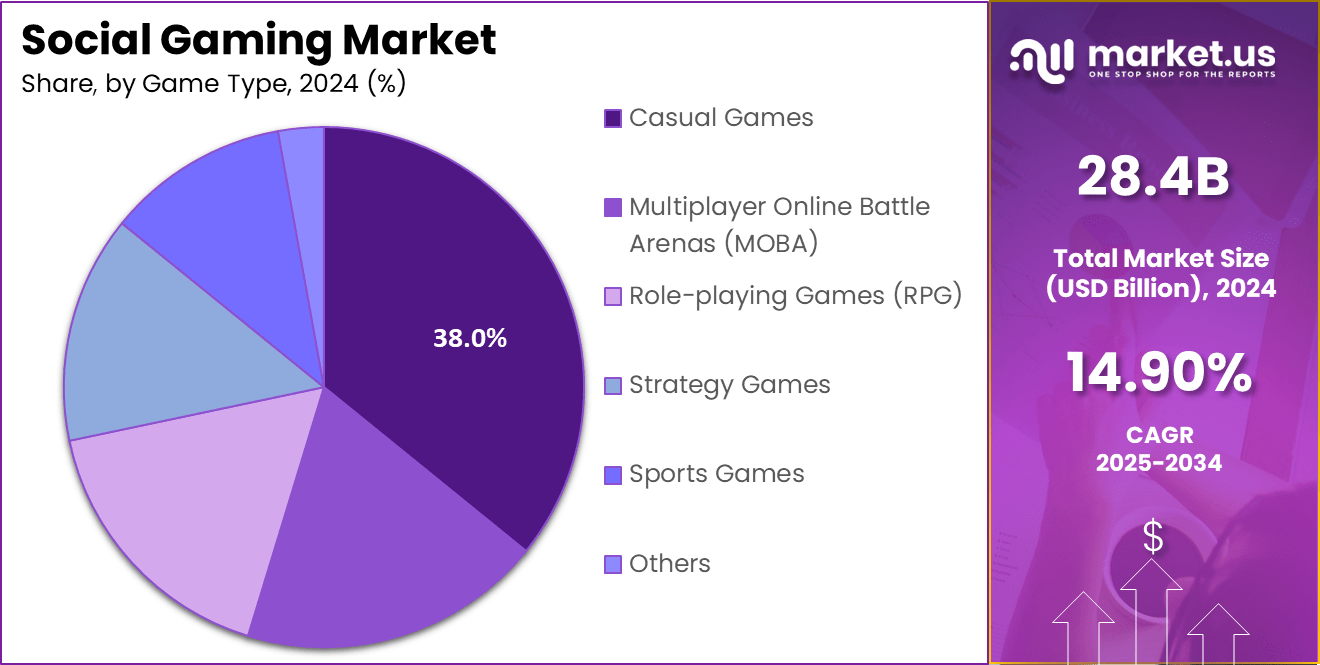

- Popular Game Type: Casual games lead the game types in the social gaming market, representing 38% of the market share.

- Revenue Model: The predominant revenue model in social gaming is in-app purchases, which contribute to 40% of the market revenue.

- Geographic Distribution: The Asia Pacific region holds the largest market share, making up 40% of the total social gaming market.

- China’s Market: China alone represents a significant portion of the market, valued at USD 4.2 billion.

- Growth in China: The social gaming market in China is growing at a CAGR of 11.4%, indicating steady expansion in the region.

Analysts’ Viewpoint

The demand for social gaming has surged, as games cater to a diverse range of interests, from casual puzzles to competitive eSports. Players are increasingly drawn to games that foster strong communities, offering spaces to connect, chat, and compete with others.

Monetization strategies have also evolved, with developers leveraging advertisements, in-game purchases, and virtual goods to capitalize on the growing player base. Social gaming’s ability to engage players for extended periods has made it an attractive market for both developers and advertisers.

In terms of opportunities, the social gaming sector is poised for continued expansion. Emerging markets with increasing internet access present a significant growth opportunity for developers. Cross-platform gaming, which allows players to engage seamlessly across various devices, is another area ripe for innovation.

Collaborations with influencers, brands, and media outlets can further enhance game visibility and appeal. Additionally, the rise of competitive gaming and eSports presents new avenues for growth, with tournaments and professional leagues becoming a key part of the social gaming ecosystem.

Technological advancements have played a pivotal role in shaping the social gaming landscape. Artificial intelligence (AI) is enhancing gameplay by making non-player characters (NPCs) more responsive and intelligent. For example, AI technologies like Nvidia’s “ACE” are revolutionizing NPC behavior, making them act and think like human players, providing a more dynamic gaming experience.

Virtual reality (VR) and augmented reality (AR) have also transformed social gaming, offering immersive environments where players can interact in novel ways. Cloud gaming has further expanded access, allowing players to stream games directly to their devices without the need for expensive hardware. Blockchain technology is introducing secure transactions and unique digital assets, like NFTs, to the social gaming space, offering new opportunities for both players and developers.

Key Statistics

User Statistics

- Demographics: Young adults (18-34 years old) make up about 40-50% of the social gaming population.

- Gender Distribution: Female gamers account for nearly 50% of the gaming population, with males making up the remainder.

- Age Groups: Social gaming attracts players across various age groups, including 13-18 years, 19-25 years, 26-35 years, 36-45 years, and 46 years and above.

Usage Statistics

- Time Spent Gaming: In the U.S., 16% of weekly leisure time is dedicated to gaming.

- Social Interaction: 40% of Gen Z and Millennials socialize more in video games than in the physical world.

- Device Preferences: Social gamers primarily use Nintendo and PlayStation consoles.

Financial and Transaction Statistics

- Household Income: Social gamers have an average annual household income of $108,030.

- In-App Purchases: 62% of Millennials and 61% of Gen Z make in-app purchases, with 17% of Gen Z making daily purchases.

Quantity and Engagement Statistics

- Active Users: Key metrics include Daily Active Users (DAU) and Monthly Active Users (MAU).

- Engagement Metrics: Session lengths, churn rates, and frequency of sessions are important for understanding player engagement.

Other Statistics

- Platform Preferences: Social gamers prefer platforms like TikTok, while other gamers may prefer LinkedIn or Facebook.

- Device Usage: The use of smartphones and tablets has increased due to advancements in mobile technology, enhancing social gaming experiences.

Regional Analysis

China Region Market Size

In Asia-Pacific, China dominates the social gaming market with a size of USD 4.2 billion, holding a strong position steadily with a robust CAGR of 11.4%. As one of the largest markets for gaming globally, China has seen a rapid adoption of social gaming, driven by its large and tech-savvy population.

The country’s growing internet penetration and the increasing popularity of mobile gaming have significantly contributed to this dominance. Chinese consumers are highly engaged with social gaming platforms, and the integration of social features with mobile games has amplified user participation.

The strong growth in China can also be attributed to the thriving mobile gaming ecosystem, where casual games and in-app purchases are widely popular. The presence of large gaming companies, along with an active eSports community, has further fueled this growth.

As China continues to be a key player in the Asia-Pacific region, its market share plays a pivotal role in the overall social gaming industry. The combination of technological advancements, a large player base, and an increasing focus on immersive social gaming experiences is expected to drive continued growth in the Chinese market for years to come.

Asia Pacific Market Size

In 2024, the Electronics segment held a dominant market position in the social gaming market, capturing more than a 52% share. This dominance is primarily attributed to the rapid advancement of mobile devices, gaming consoles, and other consumer electronics, which have become the primary platforms for social gaming.

With smartphones being the most widely used device for gaming, the electronics sector plays a crucial role in driving accessibility and engagement. The increasing demand for high-performance gaming devices, such as gaming smartphones and consoles, has further fueled the growth of this segment.

Additionally, the continuous improvements in hardware technology, such as better processors, graphics, and battery life, have significantly enhanced the user experience, making gaming more immersive and enjoyable.

The growing adoption of smart TVs and other connected devices also contributes to the rising demand within the electronics segment, as they offer seamless integration for social gaming experiences. As a result, electronics remain at the forefront of the social gaming market, with players increasingly relying on advanced electronic devices to access and participate in social gaming platforms.

By Platform

In 2024, the Mobile Gaming segment held a dominant market position, capturing more than a 41% share of the social gaming market. This leadership can be attributed to the widespread accessibility and convenience offered by mobile devices, such as smartphones and tablets.

Mobile gaming has become the most popular platform due to the ability to play games on-the-go, allowing users to engage with games anytime and anywhere. The growth of mobile gaming is further supported by the increasing global smartphone penetration, particularly in emerging markets where mobile devices are often the primary means of internet access.

Moreover, the rise of casual games, which are highly suitable for mobile platforms, has significantly contributed to the sector’s growth. The integration of social features, such as multiplayer options, leaderboards, and in-app purchases, also enhances user engagement and retention.

As mobile gaming continues to evolve with advancements in hardware and software, including improved graphics and faster processing, it is expected to maintain its leading position in the social gaming market. This makes mobile gaming the most accessible and influential platform in the industry today.

By Game Type

In 2024, the Casual Games segment held a dominant market position, capturing more than a 38% share of the social gaming market. This leadership is primarily driven by the widespread appeal of casual games, which are easy to play, accessible to all age groups, and require minimal commitment.

These games are designed to be user-friendly, often featuring simple mechanics and short play sessions, making them ideal for players looking for quick entertainment. The rise of mobile gaming has significantly boosted the growth of casual games, as they are particularly well-suited to smartphones, allowing players to enjoy them on-the-go.

Additionally, casual games often include social features such as leaderboards, multiplayer modes, and social media integration, which enhance user engagement and foster community-building. The freemium model, where games are free to play with optional in-app purchases, has also contributed to the widespread success of casual games.

Their ability to attract a broad audience, combined with low barriers to entry and high user retention, makes casual games the leading segment in the social gaming market. As the demand for easy-to-access gaming experiences grows, casual games are expected to maintain their dominant position.

By Revenue Model

In 2024, the In-App Purchases segment held a dominant market position, capturing more than a 40% share of the social gaming market. This segment’s leadership is primarily due to its ability to generate consistent revenue from a large and diverse player base.

In-app purchases allow developers to offer games for free while monetizing through optional purchases, such as virtual goods, upgrades, and cosmetic items. This model is highly effective in engaging players and encouraging continued spending over time.

The flexibility of in-app purchases is a key factor in its success. Players can enjoy the game without any initial financial commitment, making it accessible to a broad audience. Meanwhile, those who are more engaged can opt for premium content, enhancing their gaming experience.

This model also benefits from the growing trend of microtransactions, where small, frequent purchases accumulate over time. The ease of making purchases directly within the game through mobile payment systems further drives this segment’s dominance. As the gaming industry continues to evolve, in-app purchases are expected to remain the most lucrative revenue model in social gaming.

Key Market Segments

By Platform

- Mobile Gaming

- PC Gaming

- Console Gaming

- Web-based Gaming

By Game Type

- Casual Games

- Multiplayer Online Battle Arenas (MOBA)

- Role-playing Games (RPG)

- Strategy Games

- Sports Games

- Others

By Revenue Model

- Advertisements

- Virtual Goods

- Lead Generation

- In-App Purchases

- Subsciption-based

Driving Factor

Mobile Gaming Accessibility

The increasing accessibility of mobile gaming is one of the primary driving factors in the growth of the social gaming market. With smartphones being a ubiquitous part of daily life, players can now enjoy social games anytime and anywhere, whether they are commuting, waiting in line, or at home.

The convenience of gaming on a mobile device, combined with advancements in mobile internet and processing power, has led to a significant rise in mobile gaming adoption. This has greatly expanded the audience for social games, as mobile gaming eliminates the need for specialized hardware or expensive equipment.

Moreover, mobile platforms are often more affordable and provide easy access to a wide variety of social games, from casual to competitive titles. Social features like in-game messaging, leaderboards, and multiplayer modes further enhance the experience, driving user engagement and retention. As mobile gaming continues to dominate, it plays a crucial role in shaping the overall trajectory of the social gaming market.

Restraining Factor

Regulatory Challenges

One of the key restraining factors in the social gaming market is the regulatory landscape, which varies significantly across different regions. In many countries, there is a lack of clear and consistent regulations surrounding online gaming, especially when it comes to issues like loot boxes, gambling mechanics, and data privacy.

For instance, in some countries, the inclusion of in-app purchases, particularly loot boxes, has raised concerns about the potential for gambling addiction, leading to government intervention and regulatory scrutiny. Additionally, countries like China and India have implemented stringent regulations, including game content restrictions and limits on gaming time, particularly for minors.

These regulatory hurdles create uncertainty for developers and operators, making it challenging to design games that can meet the requirements of multiple jurisdictions. Compliance with varying laws requires considerable investment in legal resources and can delay the launch of games, limiting revenue potential. The inconsistent regulatory environment remains a major barrier to market expansion.

Growth Opportunity

Technological Innovations

Technological innovations present significant growth opportunities for the social gaming market, particularly with advancements in augmented reality (AR), virtual reality (VR), and 5G connectivity. AR and VR technologies are revolutionizing how players interact with games, creating immersive, interactive environments that were once unimaginable.

These technologies allow players to step into their favorite games, enhancing the social experience and deepening engagement. For example, VR gaming allows players to interact with virtual worlds in a way that feels incredibly real, making games more captivating and fun. Additionally, the rollout of 5G networks is expected to further boost mobile gaming by offering faster download speeds and lower latency, enabling more fluid and responsive gameplay, particularly for multiplayer games.

This advancement opens new possibilities for real-time gaming experiences, such as live-streamed events, eSports, and global competitions. The integration of these technological innovations will not only enhance gameplay but also attract a broader audience, fueling further growth in the social gaming market.

Challenging Factor

Market Saturation

As the social gaming market continues to grow, one of the major challenges is the increasing saturation of the market. The proliferation of gaming platforms, titles, and developers means that consumers now have an overwhelming number of options to choose from, making it more difficult for new games to stand out.

The rise of app stores and digital marketplaces has lowered the barrier to entry, allowing smaller developers to release games. However, this also means that players are bombarded with an abundance of games, leading to intense competition for attention and downloads. For developers, this saturation translates into higher marketing costs and the need for innovative game designs to capture and retain players.

Without distinctive gameplay or strong social features, games can quickly fade into obscurity. Furthermore, the sheer volume of new releases means that player loyalty is harder to maintain, as many players hop from one game to another. Developers must navigate this crowded landscape by offering unique, high-quality experiences that stand out in an increasingly competitive market.

Growth Factors

The social gaming market has experienced remarkable growth, propelled by several key factors. One significant driver is the increasing accessibility of mobile gaming. With smartphones becoming ubiquitous, players can engage in social games anytime and anywhere. This convenience has led to a surge in mobile gaming adoption, expanding the social gaming audience.

Additionally, the proliferation of affordable smartphones and widespread internet access has opened new markets, particularly in emerging regions. For instance, Southeast Asia’s gaming market generated over $4.4 billion in revenues in 2023, with mobile gaming accounting for approximately 70% of this figure. This growth in emerging markets presents significant opportunities for developers to reach a broader audience.

Emerging Trends

Several emerging trends are shaping the future of social gaming. A notable trend is the integration of gamification elements into various platforms. Over 70% of Forbes Global 2000 companies surveyed in 2013 planned to use gamification for marketing and customer retention, indicating its growing importance.

For example, companies like Ikea have launched virtual stores on platforms like Roblox, attracting significant user engagement. Another trend is the adoption of live-service models, where games receive continuous updates and content to keep players engaged. This approach has proven financially successful, with companies like Electronic Arts earning $2 billion from live-service game transactions in 2018.

Business Benefits

Engaging in social gaming offers numerous business benefits. One primary advantage is enhanced brand visibility and engagement. Integrating products or services into popular games allows companies to reach a vast and diverse audience. For instance, brands like McDonald’s have created virtual experiences within games, fostering positive brand associations and increased consumer engagement.

Moreover, the social aspect of gaming encourages community building, leading to increased customer loyalty and retention. The interactive nature of games fosters a sense of belonging among players, translating to sustained engagement with brands. Additionally, the data analytics capabilities within gaming platforms provide valuable insights into consumer behavior, enabling businesses to tailor their marketing strategies effectively.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In 2020, Zynga expanded its portfolio by acquiring Peak Games, the developer behind popular titles like “Toon Blast” and “Toy Blast,” for $1.8 billion. This acquisition significantly bolstered Zynga’s presence in the mobile gaming market. In 2021, Zynga further enhanced its offerings by acquiring the Turkish mobile game studio Rollic Games, known for hyper-casual games like “Go Knots 3D” and “Tangle Master 3D.”

In 2016, Activision Blizzard acquired King Digital Entertainment, the maker of “Candy Crush,” for $5.9 billion, significantly enhancing its mobile gaming portfolio. In 2022, Activision Blizzard announced plans to acquire the gaming division of the social media company King, aiming to expand its mobile gaming presence. Additionally, in 2022, Activision Blizzard acquired Proletariat, a Boston-based game developer known for “Spellbreak,” to bolster its World of Warcraft development team.

In 2005, EA acquired mobile game developer Jamdat Mobile for $680 million, marking its entry into mobile gaming. In 2007, EA purchased BioWare and Pandemic Studios, known for titles like “Mass Effect” and “Star Wars: Battlefront,” for $775 million, enhancing its RPG and action-adventure game offerings. In 2011, EA acquired PopCap Games, the creator of “Plants vs. Zombies,” for $750 million, expanding its casual gaming portfolio.

Top Key Players in the Market

- Zynga Inc.

- Activision Blizzard, Inc.

- Electronic Arts Inc. (EA)

- Supercell Oy

- GREE, Inc.

- King Digital Entertainment

- Take-Two Interactive Software, Inc. (Socialpoint)

- Miniclip SA

- Wooga GmbH

- Behaviour Interactive, Inc.

- Tencent Holdings Limited

- Niantic, Inc.

- Roblox Corporation

- Epic Games, Inc.

- Playtika Holding Corp.

- Gameloft SE

- Bandai Namco Entertainment Inc.

- NetEase, Inc.

- Square Enix Holdings Co., Ltd.

- Ubisoft Entertainment S.A.

- Other Key Players

Recent Developments

- In 2024: Zynga launched a new mobile game, “Farmville 3,” which rapidly gained popularity and contributed to the company’s growth in the casual gaming segment.

- In 2024: Activision Blizzard introduced new social gaming features in “World of Warcraft,” including cross-platform play and enhanced social interaction tools, increasing player engagement.

Report Scope

Report Features Description Market Value (2024) USD 28.4 Billion Forecast Revenue (2034) USD 36.0 Billion CAGR (2025-2034) 14.90% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Platform (Mobile Gaming, PC Gaming, Console Gaming, Web-based Gaming), By Game Type (Casual Games, Multiplayer Online Battle Arenas (MOBA), Role-playing Games (RPG),, Strategy Games, Sports Games, Others), By Revenue Model (Advertisements, Virtual Goods, Lead Generation, In-App Purchases, Subsciption-base) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Zynga Inc., Activision Blizzard, Inc., Electronic Arts Inc. (EA), Supercell Oy, GREE, Inc., King Digital Entertainment, Take-Two Interactive Software, Inc. (Socialpoint), Miniclip SA, Wooga GmbH, Behaviour Interactive, Inc., Tencent Holdings Limited, Niantic, Inc., Roblox Corporation, Epic Games, Inc., Playtika Holding Corp., Gameloft SE, Bandai Namco Entertainment Inc., NetEase, Inc. Square Enix Holdings Co., Ltd., Ubisoft Entertainment S.A., Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zynga Inc.

- Activision Blizzard, Inc.

- Electronic Arts Inc. (EA)

- Supercell Oy

- GREE, Inc.

- King Digital Entertainment

- Take-Two Interactive Software, Inc. (Socialpoint)

- Miniclip SA

- Wooga GmbH

- Behaviour Interactive, Inc.

- Tencent Holdings Limited

- Niantic, Inc.

- Roblox Corporation

- Epic Games, Inc.

- Playtika Holding Corp.

- Gameloft SE

- Bandai Namco Entertainment Inc.

- NetEase, Inc.

- Square Enix Holdings Co., Ltd.

- Ubisoft Entertainment S.A.

- Other Key Players