Global RORO Shipping Market Size, Share, Growth Analysis By Type (New Car Shipping, Used Car Shipping), By Application (International Shipping, Domestic Shipping), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 141560

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

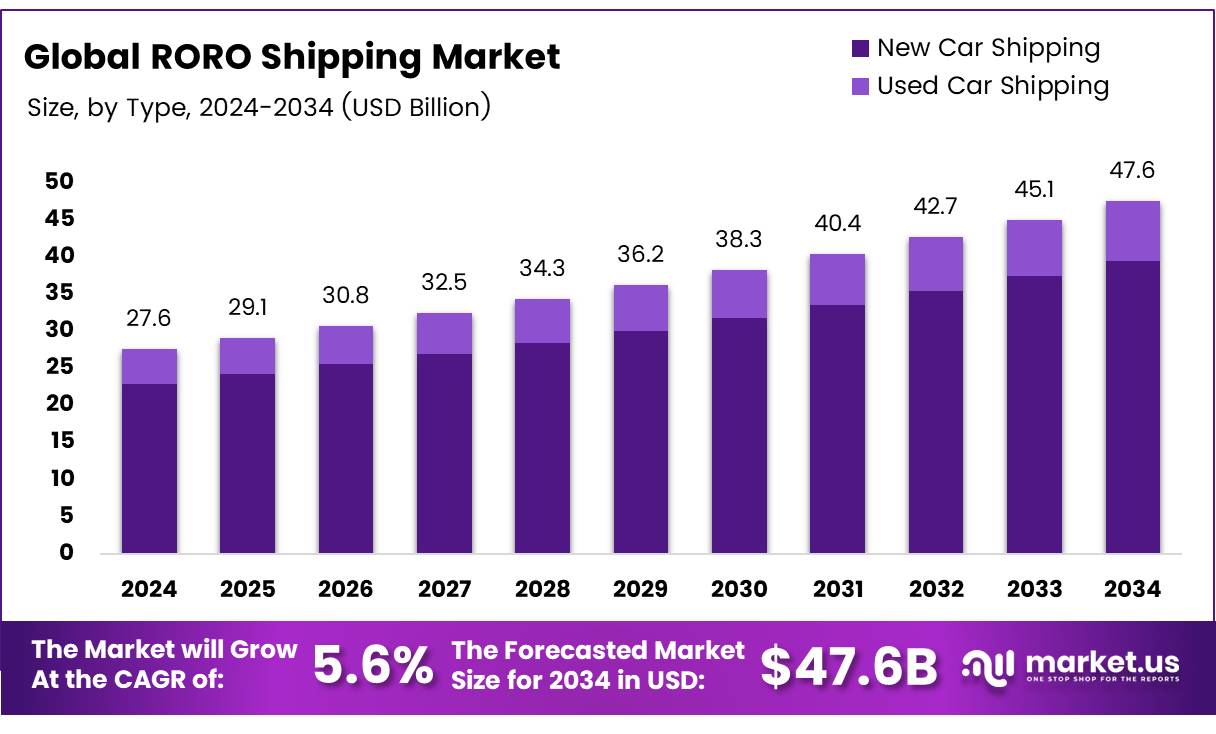

The Global RORO Shipping Market size is expected to be worth around USD 47.6 Billion by 2034, from USD 27.6 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Roll-on/Roll-off (RoRo) shipping is a method where vehicles and machinery are loaded onto large ocean vessels via built-in ramps. This method is crucial for transporting wheeled and heavy machinery since it simplifies the handling process, reducing loading and unloading times, and minimizes the risk of damage.

The RoRo shipping market serves a pivotal role in global trade, facilitating efficient and cost-effective transport of cars, trucks, trailers, and other heavy equipment across seas.

The RoRo shipping sector has demonstrated resilience and adaptability in the face of global supply chain disruptions. With advancements in vessel design and increased capacity, modern RoRo ships, such as those reaching a capacity of 4,000 to 5,000 CEUs (Car Equivalent Units), offer enhanced efficiency and environmental benefits. This evolution reflects a broader industry trend towards larger, more sophisticated vessels capable of meeting the growing demands of international trade.

The RoRo shipping market is poised for significant growth, driven by robust global automotive trade and heightened demand for agricultural and construction machinery. According to the Australian Bureau of Statistics, RoRo cargo tonnage has seen an impressive 15% increase in the past year, signaling a rebound and expansion in international trade volumes.

Furthermore, the new vessels entering the market, which can cruise at speeds up to 18.3 knots, are set to enhance service offerings, reduce transit times, and increase the turnover rate of shipments as per World Cargo News.

Opportunities within the RoRo shipping sector are abundant, particularly in emerging markets where industrialization and infrastructural developments are accelerating demand for heavy machinery and vehicles.

Government investments in port infrastructure and regulatory frameworks supporting maritime logistics have also propelled the market forward. These investments not only facilitate smoother operations but also ensure compliance with international safety and environmental standards, crucial for sustaining long-term growth.

The regulatory landscape for RoRo shipping is becoming increasingly stringent, focusing on safety and environmental sustainability. Governments worldwide are implementing policies that require ships to reduce emissions and enhance safety protocols.

These regulations not only support global sustainability efforts but also encourage innovation within the industry, leading to the development of greener and more efficient shipping practices. This regulatory push, coupled with substantial government investments in port infrastructure, is crucial in supporting the RoRo shipping market’s expansion and operational efficiency.

Key Takeaways

- Global RORO Shipping Market projected to reach USD 27.6 Billion by 2034, with a CAGR of 5.6% from 2025 to 2034.

- New Car Shipping leads the market by type with an 82.8% share in 2024.

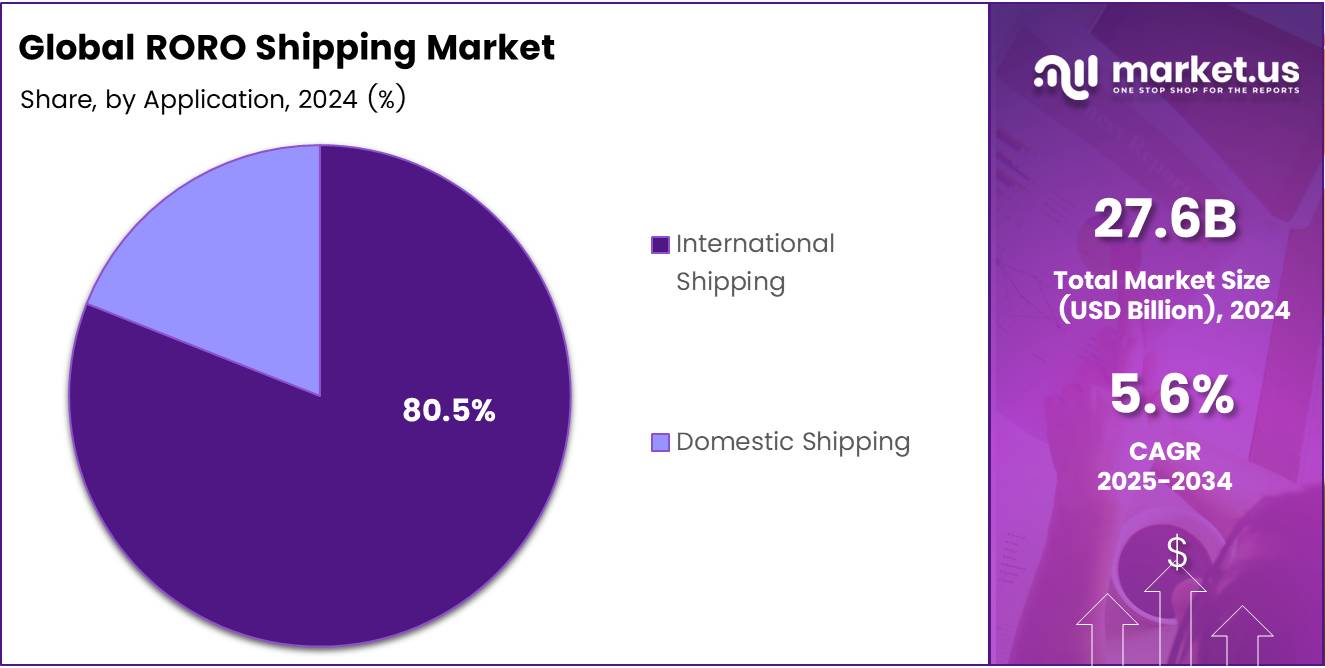

- International Shipping dominates the application segment with an 80.5% share in 2024.

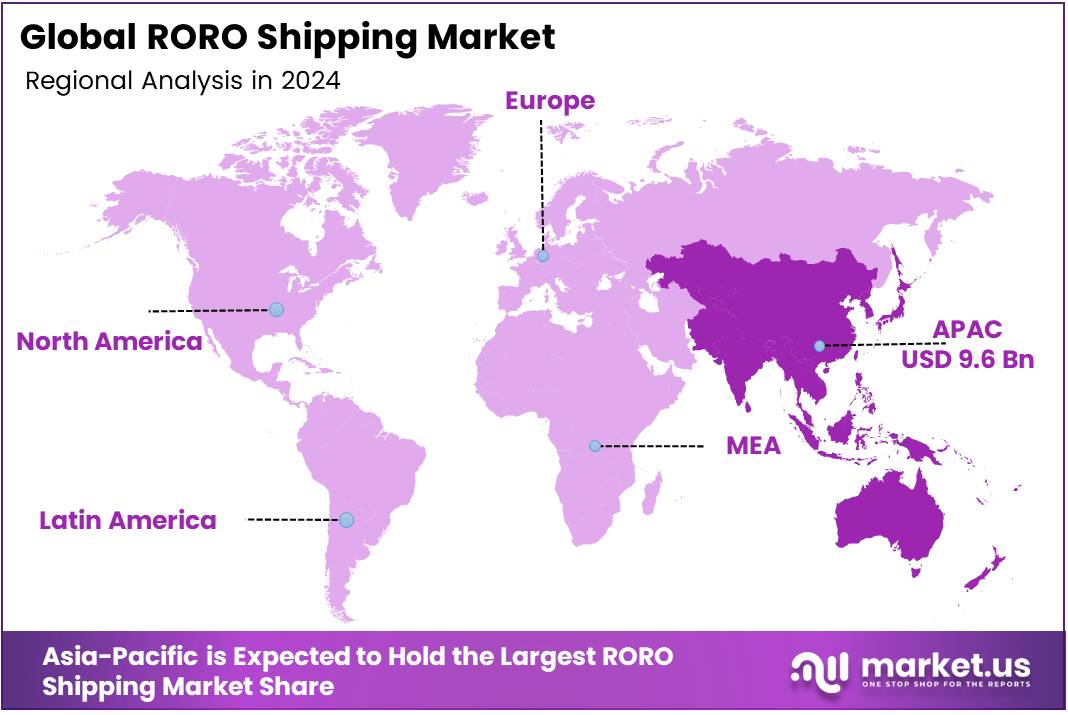

- Asia-Pacific is the largest market, accounting for 35.4% share and USD 9.6 billion in revenue in 2024.

Unique Selling Propositions

- In 2022, Japan exported new motor cars/vehicles valued at $7,673.5 US$ Mn and used motor cars/vehicles valued at $1,046.3 US$ Mn. Additionally, the country imported new motor cars/vehicles worth $78.9 US$ Mn and used motor cars/vehicles valued at $27.7 US$ Mn.

- In November 2023, the US exported cars valued at $5.22 Bn and imported cars totaling $18.6 Bn, leading to a trade deficit of $13.4 Bn. Over the period from November 2022 to November 2023, the US car exports saw a rise of $315 Mn, marking a 6.42% increase from $4.9 Bn to $5.22 Bn. Meanwhile, car imports surged by $4.61 Bn, reflecting a substantial 33% growth from $14 Bn to $18.6 Bn.

- In November 2023, the US exported cars valued at $5.22 Bn and imported cars totaling $18.6 Bn, leading to a trade deficit of $13.4 Bn. Over the period from November 2022 to November 2023, the US car exports saw a rise of $315 Mn, marking a 6.42% increase from $4.9 Bn to $5.22 Bn. Meanwhile, car imports surged by $4.61 Bn, reflecting a substantial 33% growth from $14 Bn to $18.6 Bn.

Type Analysis

New Car Shipping Captures 82.8% of RORO Shipping Market by Type in 2024

In 2024, New Car Shipping maintained a leading role in the Roll-on/Roll-off (RORO) Shipping Market’s By Type Analysis segment, commanding an impressive 82.8% market share. This dominant position underscores the robust demand for new vehicles across global markets, driven by economic recovery and increased consumer spending power post-pandemic.

The segment benefits significantly from streamlined logistics and the efficiency of handling large volumes of new cars, which are transported from manufacturers to global markets, ensuring minimal handling and reduced risk of damage.

Global RORO Shipping Market, By Type, 2020-2024 (USD Billion)

Type 2020 2021 2022 2023 2024 Used Car Shipping 3.6 4.3 4.2 4.5 4.8 New Car Shipping 17.6 21.0 20.6 21.7 22.9 Used Car Shipping, while smaller in scale, complements this sector by addressing the market for pre-owned vehicles. Although it captures a lesser share, it is crucial for balancing supply chains and fulfilling market demands in regions where cost considerations favor used vehicles.

Together, these segments illustrate a comprehensive overview of the RORO Shipping Market dynamics, highlighting the critical role of new car logistics in shaping shipping strategies and market growth trajectories.

Application Analysis

International Shipping Leads with an 80.5% Share in RORO Shipping’s Application Analysis for 2024

In 2024, the RORO (Roll-on/Roll-off) Shipping Market witnessed a significant market dominance by the International Shipping sector within the By Application Analysis segment, commanding an impressive 80.5% share. This dominance underscores the pivotal role of international shipping routes in facilitating global trade and commerce.

The sector’s robust performance is primarily driven by increasing global demand for automotive transport and heavy machinery, essential components of international trade infrastructures.

Global RORO Shipping Market, By Application, 2020-2024 (USD Billion)

Application 2020 2021 2022 2023 2024 International Shipping 17.1 20.4 20.0 21.1 22.3 Domestic Shipping 4.1 4.9 4.8 5.1 5.4 Conversely, Domestic Shipping, while essential, occupies a smaller segment of the market. This is attributed to the more localized nature of its operations, which, although crucial for intra-country trade and logistics, do not match the scale and volume handled by international routes.

The disparity highlights the critical dependence on international shipping channels, which are instrumental in connecting producers and consumers across continents, thereby fostering an interconnected global economy.

This significant market share held by International Shipping not only reflects its indispensable role in global logistics but also suggests a trend towards increasing globalization and reliance on efficient, large-scale transport solutions to meet the demands of a growing international market.

Key Market Segments

By Type

- New Car Shipping

- Used Car Shipping

By Application

- International Shipping

- Domestic Shipping

End-User Companies

- Toyota Motor Corporation

- Volkswagen Group

- General Motors Company

- Hyundai Motor Company

- Ford Motor Company

- The Mercedes-Benz Group AG

- Caterpillar Inc.

- Hitachi Construction Machinery Co., Ltd.

- Dr. Ing. h.c. F. Porsche AG

- Tesla, Inc.

- Honda Motor Co., Ltd

- MAN Truck & Bus SE

- Other End-User Companies

Drivers

Enhanced Safety Protocols Boost RORO Shipping Market

The RORO (Roll-On/Roll-Off) shipping market is experiencing significant growth driven by several key factors. Enhanced safety measures, including advanced protocols and systems, have substantially reduced the risk of damage to cargo, positioning RORO as a safer transportation option and attracting more businesses. This shift is crucial as global trade continues to expand, with a notable increase in the transport of vehicles and heavy machinery, sectors that heavily rely on the integrity of cargo handling.

Furthermore, the automotive industry’s expansion, particularly in emerging markets, demands more efficient and reliable logistical solutions, and RORO shipping stands out as a prime candidate.

Additionally, ongoing infrastructural developments in major ports have improved their capacity to accommodate larger RORO vessels, thereby supporting larger-scale operations and smoother handling processes. These advancements collectively enhance the RORO shipping market, making it an increasingly preferred choice for international shippers.

Restraints

Economic Downturns Pose Challenges to RORO Shipping Demand

The RORO (Roll-On/Roll-Off) shipping market, it’s important to note several key restraints that can impact its growth and efficiency. Economic fluctuations stand out as a significant challenge; during economic downturns, there is a noticeable reduction in the demand for the transport of vehicles and heavy equipment, which are primary cargoes for RORO shipping. This decline in demand directly affects revenue streams and can lead to underutilization of shipping capacities.

Furthermore, the market faces hurdles related to operational costs. High fuel prices and the ongoing need for maintenance escalate operating expenses, thereby squeezing profit margins.

These financial pressures make it difficult for shipping companies to maintain competitiveness and can hinder the overall profitability of the RORO shipping sector. Understanding these restraints is crucial for stakeholders to strategize effectively and navigate the complexities of the market.

Growth Factors

Exploring Emerging Markets to Fuel Growth in the RORO Shipping Industry

The RORO (Roll-On/Roll-Off) shipping market is poised for significant expansion by venturing into emerging markets across Asia, Africa, and South America, where rapid industrialization and infrastructure developments are increasing demand for efficient large-scale transport solutions.

Capitalizing on this growth opportunity involves adapting to regional shipping needs and overcoming logistical challenges, which could markedly enhance market presence and revenue streams.

Furthermore, the industry stands to gain by integrating green technologies into fleet operations to not only comply with evolving global environmental regulations but also to appeal to a growing segment of eco-conscious clients. Offering comprehensive end-to-end logistics solutions, including inland transportation and warehousing, could further solidify customer relationships and expand market share.

Additionally, developing customized solutions for handling non-standard cargo and specialized projects can cater to a niche yet lucrative market segment, thus broadening the scope of services and attracting diverse client bases in these promising regions.

Emerging Trends

Shift Towards LNG-Fueled Ships Spurs RORO Shipping Market Growth

The RORO (Roll-On/Roll-Off) shipping market is currently experiencing significant trends that promise to reshape the industry. A major shift is underway towards LNG-fueled ships, driven by the need for cleaner, more sustainable marine transport solutions. This transition not only supports environmental goals but also aligns with stricter global emissions standards.

Alongside this, there is a strong focus on digitalization, which is streamlining operations through enhanced route optimization, fleet management, and customer service innovations. These digital tools are crucial in improving efficiency and responsiveness. Additionally, the industry is prioritizing resilience planning to better withstand global disruptions such as pandemics and geopolitical tensions, ensuring continuous service and reliability.

Furthermore, the adoption of advanced tracking systems is revolutionizing cargo management by providing real-time updates on cargo status and location, greatly enhancing transparency and trust between shippers and clients. These developments collectively propel the RORO shipping market towards a more efficient and robust future.

Regional Analysis

Asia-Pacific Leads RORO Shipping Market with 35.4% Share Worth $9.6 Billion

The Roll-on/Roll-off (RORO) shipping market is witnessing significant growth, with Asia-Pacific leading the charge, accounting for 35.4% of the global market and generating revenues of USD 9.6 billion. This region’s dominance is driven by robust automotive manufacturing and exports, particularly in countries like China, Japan, and South Korea.

Enhanced port infrastructure and strategic maritime routes further support the high volume of RORO traffic in this area, making it a pivotal hub for international trade and vehicle shipping.

Regional Mentions:

In North America, the RORO shipping market benefits from a well-established automotive industry and a rebound in trade activities. The United States and Canada are major contributors, leveraging advanced logistics and port facilities to streamline the import and export of heavy machinery, trucks, and automobiles. The market is also supported by a rise in online car sales and the need for efficient distribution logistics, fostering growth in the RORO shipping sector.

Europe remains a key player in the RORO shipping market due to its strong automotive sector and extensive trade links within the European Union and beyond. Major ports in Germany, Belgium, and the Netherlands serve as critical nodes for the region’s RORO shipping operations, which are essential for the transport of both passenger vehicles and commercial equipment. Regulatory support for reducing carbon emissions is prompting the adoption of greener and more efficient RORO vessels, contributing to market expansion.

The Middle East and Africa (MEA) region shows promising growth in the RORO shipping market, facilitated by economic diversification efforts and infrastructure development, particularly in the Gulf Cooperation Council (GCC) countries. Investments in port modernization and the expansion of trade routes are enhancing RORO shipping capabilities in the region, with a focus on accommodating larger RORO vessels.

Latin America’s RORO shipping market is gradually expanding, with Brazil and Mexico leading the way. Improvements in trade agreements and regional cooperation are boosting the market, as these countries aim to enhance their automotive manufacturing capacities and export capabilities. The region’s strategic geographical positioning for maritime trade further supports the growth of RORO shipping operations.

The RORO Shipping Market, By Region, 2020-2024 (USD Billion)

Region 2020 2021 2022 2023 2024 Asia-Pacific 7.2 8.7 8.6 9.2 9.8 North America 5.6 6.7 6.5 6.8 7.2 Europe 6.0 7.2 7.0 7.4 7.7 Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global Roll-On/Roll-Off (RORO) shipping market remains highly competitive with several key players influencing market dynamics. CMA CGM Group, originally renowned for its container shipping, has increasingly penetrated the RORO sector, capitalizing on its global network to offer enhanced flexibility in handling rolling cargo. Their strategic acquisitions and investments in port infrastructure significantly bolster their RORO operations.

NYK Line and Mitsui O.S.K. Lines, traditional powerhouses in the Japanese shipping industry, continue to innovate in eco-friendly technologies, emphasizing the deployment of LNG-fueled vessels and advanced onboard safety systems. Their commitment to sustainability aligns with global regulatory pressures and client demands for greener logistics solutions.

K Line and Wallenius Wilhelmsen remain pivotal in expanding RORO services in emerging markets, particularly in Asia and Africa. Wallenius Wilhelmsen’s investment in digital tools for cargo handling and tracking systems enhances operational efficiencies and customer service.

Höegh Autoliners and UECC stand out for their specialized transport services, focusing on electric vehicles and other new automotive technologies. This positions them well as the automotive industry shifts towards electric vehicles, requiring specific handling and storage solutions.

American Roll-On Roll-Off Carrier and Sallaum Lines focus on the North American and African corridors, respectively, catering to the buoyant auto export and import markets in these regions. Their strategic routes and reliable services fortify their market positions.

Smaller players like Auto Exports Shipping, Inc. and Spliethoff Group cater to niche markets, offering customized services that appeal to specific regional needs or specialized cargo. This adaptability allows them to remain competitive against larger conglomerates.

Stena RoRo and Grimaldi Group continue to expand their fleets with versatile vessels capable of handling a wide range of cargoes, which is crucial as global trade patterns evolve and demand for varied cargo shipping increases.

Top Key Players in the Market

- CMA CGM Group

- NYK Line (Nippon Yusen Kaisha)

- Mitsui O.S.K. Lines

- K Line (Kawasaki Kisen Kaisha)

- Wallenius Wilhelmsen

- Höegh Autoliners

- UECC (United European Car Carriers)

- American Roll-On Roll-Off Carrier

- Cargomax International

- Sallaum Lines

- Auto Exports Shipping, Inc. (AES Inc.)

- Spliethoff Group

- Stena RoRo

- Grimaldi Group

- Other Key Players

Recent Developments

- In January 2023, Wallenius Wilhelmsen secured €9 million in EU funding to support their development of wind-powered roll-on/roll-off (ro-ro) vessels, aimed at enhancing sustainable maritime transport.

- In February 2025, India declared a significant $2.9 billion investment to enhance its maritime sector, focusing on improving infrastructure and increasing capacity across its ports.

- In February 2025, WALLENIUS SOL announced the acquisition of a British roll-on/roll-off operator, expanding its footprint in the European logistics market.

- In February 2025, the Maritime Industry Authority (MARINA) of the Philippines put a hold on the procurement of landing craft tank (LCT)-type vessels for ro-ro and passenger services, citing safety and regulatory concerns.

Report Scope

Report Features Description Market Value (2024) USD 27.6 Billion Forecast Revenue (2034) USD 47.6 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (New Car Shipping, Used Car Shipping), By Application (International Shipping, Domestic Shipping) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CMA CGM Group, NYK Line (Nippon Yusen Kaisha), Mitsui O.S.K. Lines, K Line (Kawasaki Kisen Kaisha), Wallenius Wilhelmsen, Höegh Autoliners, UECC (United European Car Carriers), American Roll-On Roll-Off Carrier, Cargomax International, Sallaum Lines, Auto Exports Shipping, Inc. (AES Inc.), Spliethoff Group, Stena RoRo, Grimaldi Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CMA CGM Group

- NYK Line (Nippon Yusen Kaisha)

- Mitsui O.S.K. Lines

- K Line (Kawasaki Kisen Kaisha)

- Wallenius Wilhelmsen

- Höegh Autoliners

- UECC (United European Car Carriers)

- American Roll-On Roll-Off Carrier

- Cargomax International

- Sallaum Lines

- Auto Exports Shipping, Inc. (AES Inc.)

- Spliethoff Group

- Stena RoRo

- Grimaldi Group

- Other Key Players