Global Silver Jewelry Market By Type (Rings, Necklaces, Earrings, Bracelets, Anklets, Others), By Material (Sterling Silver, Silver Plated, Gemstone-studded Silver, Oxidized Silver, Filigree Silver, Silver Alloy, Others), By Application (Everyday Wear, Formal Wear, Wedding and Special Occasions, Gifting, Others), By Gender (Women, Men, Unisex), By Price Range (Luxury, Economic), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139142

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

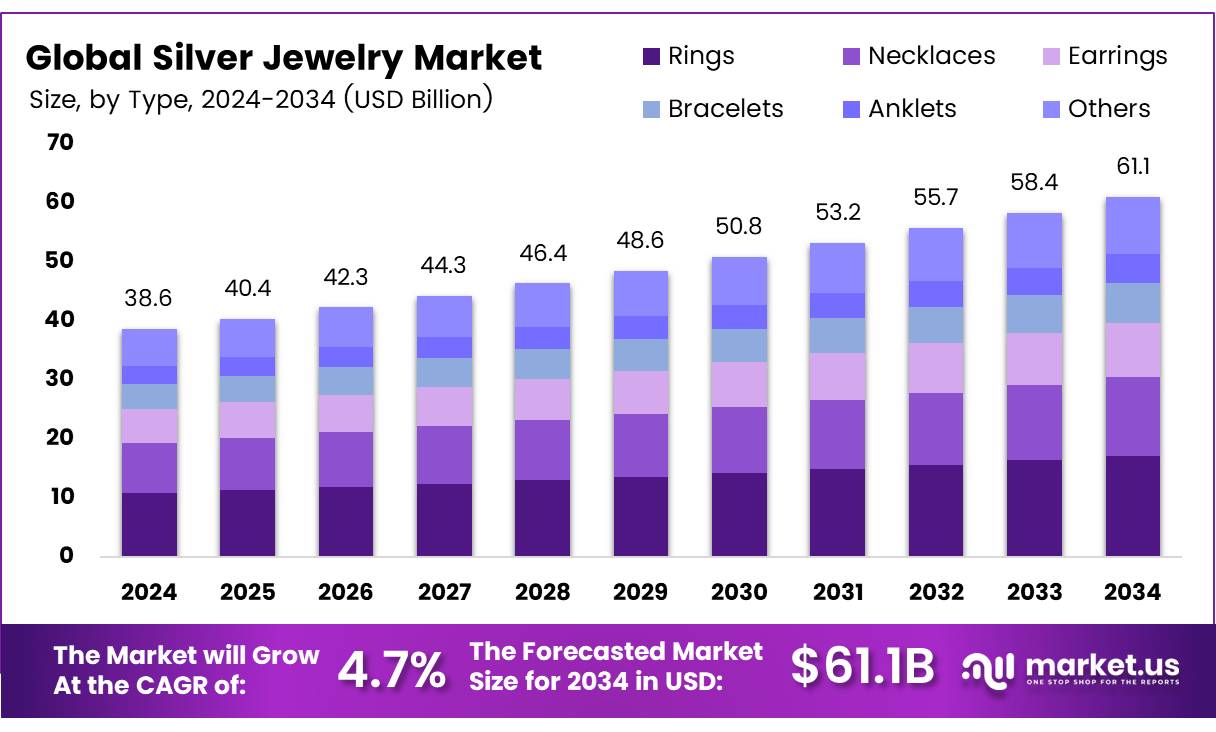

The Global Silver Jewelry Market size is expected to be worth around USD 61.1 Billion by 2034, from USD 38.6 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

Silver jewelry refers to accessories made primarily from silver, a precious metal, often in combination with other materials like gemstones, enamels, or other metals for design and functionality. Silver’s natural luster, malleability, and affordability compared to gold make it a popular choice in the fashion and luxury goods industries.

The silver jewelry market refers to the commercial sector involved in the design, production, and sale of silver-based accessories. This market is influenced by global trends in fashion, shifts in consumer behavior, and fluctuations in the price of silver.

The silver jewelry market spans both retail and online sales channels, serving a broad demographic that includes different age groups, income levels, and geographic regions. As of recent reports, silver jewelry has emerged as a key segment within the broader global jewelry industry, with increasing interest driven by its aesthetic appeal and relatively lower price point compared to gold or platinum jewelry.

The silver jewelry market is seeing robust growth, largely driven by increased consumer demand for affordable luxury. According to the Silver Institute, 61% of retailers increased their silver jewelry inventory by 21% on average in the United States, indicating a growing interest in this segment.

Additionally, silver accounted for 28% of unit sales and 19% of dollar volume in jewelry stores, underscoring its popularity among consumers. The market is particularly thriving among younger buyers, with the 20-40 age group representing the highest percentage of silver jewelry purchases. This demographic seeks fashionable yet affordable accessories, making silver an attractive choice. Furthermore, silver jewelry’s versatility, durability, and ease of customization are also contributing factors to its increasing popularity.

Government investment in mining and silver production has been pivotal in meeting the growing demand. According to the U.S. Geological Survey (USGS), in 2023, the United States produced approximately 1,000 tons of silver, valued at around $760 million.

Moreover, regulations around mining practices, particularly environmental concerns and fair labor practices, are becoming more stringent. These regulations, while important for sustainability, can also impact production costs, which in turn affect jewelry prices. However, the rise in search interest for silver jewelry—such as a 300% month-on-month increase in search activity for silver jewelry—demonstrates that demand remains strong.

The growing popularity of silver jewelry can also be attributed to a shift in consumer preferences. A report from BlackTreeLab reveals that 87% of people regularly wear earrings, 64% wear necklaces, and 47% wear bracelets daily.

These statistics illustrate the high demand for versatile, daily-use silver jewelry. Additionally, data from the Silver Institute shows that searches for silver jewelry have been climbing steadily, with a 58.5% rise in searches for silver earrings and a 39% increase in searches for silver necklaces.

Key Takeaways

- Global Silver Jewelry Market is projected to reach USD 61.1 billion by 2034, growing at a CAGR of 4.7%.

- Rings dominate the Silver Jewelry Market, driven by engagement rings, wedding bands, and fashion rings.

- Sterling Silver leads the material segment due to its high purity, durability, and wide consumer appeal.

- Everyday wear holds the largest share in the application segment, driven by demand for versatile, durable pieces.

- Women account for the largest share in the gender segment, with a wide range of styles and designs.

- Asia Pacific dominates the global market with 35.2% market share, valued at approximately USD 13.5 billion.

Type Analysis

Rings Lead Silver Jewelry Market in 2024, Dominating the By Type Analysis Segment

In 2024, rings held a dominant market position in the By Type Analysis segment of the Silver Jewelry Market. Their strong market presence can be attributed to the timeless appeal and versatility rings offer, catering to both high-end luxury consumers and the broader mass market. Engagement rings, wedding bands, and fashion rings are consistently in demand, making them the most popular and widely purchased category in silver jewelry.

Necklaces, earrings, bracelets, and anklets followed in market share, each appealing to specific consumer preferences and occasions. While these jewelry types maintain solid demand, they do not match the universal appeal and frequency of rings in the market, which benefits from both cultural significance and ongoing fashion trends.

The dominance of rings reflects their role in significant life events, as well as their adaptability across various styles, from minimalist designs to more elaborate, customized pieces. The overall trend indicates that rings will continue to drive the growth of the silver jewelry sector, with consumers increasingly seeking both traditional and contemporary designs.

Material Analysis

Sterling Silver Leads Silver Jewelry Market in 2024, Dominating the By Material Analysis Segment

In 2024, Sterling Silver held a dominant market position in the By Material Analysis segment of the Silver Jewelry Market. Known for its high purity and durability, sterling silver remains the preferred material in the silver jewelry industry. Its timeless appeal, coupled with its ability to cater to both high-end and budget-conscious consumers, ensures its continued dominance in the market.

Silver Plated jewelry followed closely, attracting consumers looking for an affordable alternative while maintaining the aesthetic of real silver. Gemstone-studded Silver also garnered significant attention, driven by growing demand for unique and personalized jewelry pieces that combine the elegance of silver with the allure of precious stones.

Oxidized Silver and Filigree Silver captured niche market segments, with their distinctive, artistic designs appealing to consumers seeking vintage or intricately crafted pieces. Meanwhile, Silver Alloy, though less prominent, provided specific functional advantages, catering to those in search of added strength or design customization.

Sterling Silver’s position as the dominant material is reinforced by its versatile nature, offering a broad range of designs from minimalist to ornate, and its sustained appeal across various consumer segments globally.

Application Analysis

Everyday Wear Dominates Silver Jewelry Market in 2024, Leading the By Application Analysis Segment

In 2024, Everyday Wear held a dominant market position in the By Application Analysis segment of the Silver Jewelry Market. This segment accounted for the largest share, driven by consumers’ preference for versatile, durable, and affordable jewelry pieces that can be worn daily.

The rising trend of minimalist and comfortable designs, which seamlessly integrate into daily outfits, has propelled the demand for silver jewelry in everyday wear. With its ability to complement a wide variety of styles and occasions, sterling silver jewelry continues to be a popular choice for casual and office wear.

Formal Wear and Wedding & Special Occasions followed in market share, reflecting the ongoing demand for more elaborate and luxurious pieces for specific events. Jewelry for formal occasions remains a key area of growth, with consumers seeking statement pieces to complement their outfits.

Wedding and Special Occasion jewelry, typically characterized by high-quality designs and gemstone embellishments, also contributes significantly to the silver jewelry market as consumers prioritize significant milestones.

The Gifting segment saw steady demand, with silver jewelry continuing to be a popular choice for presents due to its timeless appeal. Other applications captured smaller segments of the market, reflecting more niche or seasonal demand. The overall trend emphasizes the significant role of everyday wear in driving the growth of the silver jewelry market.

Gender Analysis

Women Lead Silver Jewelry Market in 2024, Dominating the By Gender Analysis Segment

In 2024, women held a dominant market position in the By Gender Analysis segment of the Silver Jewelry Market. Women’s silver jewelry continues to account for the largest share, driven by the broad variety of styles, designs, and trends available to female consumers.

The demand for silver jewelry among women is further fueled by increasing consumer interest in customization, fashion accessories, and pieces that align with both personal expression and cultural significance. From everyday wear to special occasions, silver jewelry remains an essential component of women’s fashion, offering a wide range of designs from delicate to statement-making pieces.

Men’s silver jewelry, while accounting for a smaller share, has seen steady growth in recent years. The increasing popularity of minimalist, bold, or vintage-inspired designs has contributed to a rise in demand for men’s silver rings, bracelets, and necklaces. Silver jewelry for men is often seen as both a fashion accessory and a symbol of personal identity.

Unisex silver jewelry has also gained traction, with growing interest in gender-neutral designs that appeal to all consumers. This segment represents a flexible approach to jewelry, offering versatility and inclusivity across a wide audience. Overall, women’s dominance in the silver jewelry market remains strong, but the growth of men’s and unisex segments indicates a broader, evolving market landscape.

Price Range Analysis

In 2024, Luxury Segment Leads Silver Jewelry Market by Price Range with 58% Share

In 2024, the luxury segment of the silver jewelry market holds a dominant 58% market share, driven by a growing preference for high-quality, exclusive designs among affluent consumers. Luxury silver jewelry appeals to those seeking premium craftsmanship, unique styles, and prestigious branding.

The strong demand is fueled by an increasing desire for personal expression and investment in timeless pieces. Additionally, celebrity endorsements and trends in the fashion industry have bolstered the appeal of luxury silver jewelry.

While the economic segment remains important, it is the luxury market that continues to lead, benefiting from higher profit margins and a focus on sustainability and exclusivity. Consumers in this segment are willing to pay a premium for intricate designs and high-end materials, solidifying its dominance in the silver jewelry landscape.

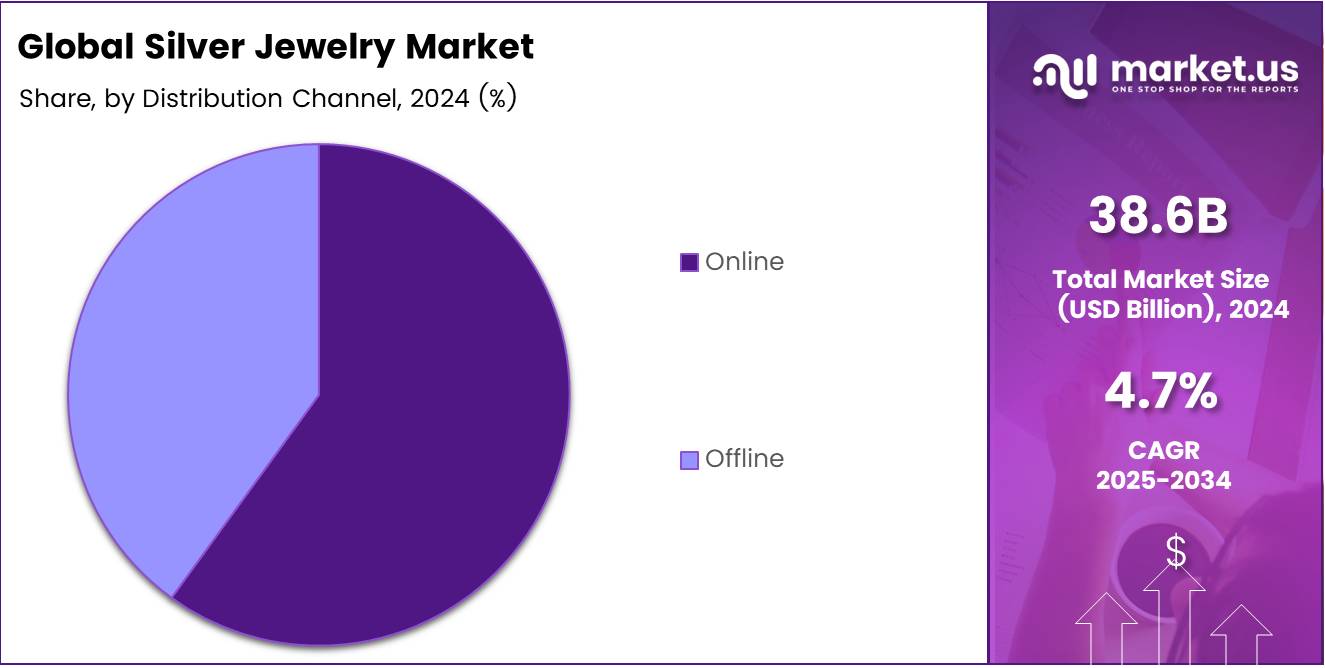

Distribution Channel Analysis

Luxury Segment Leads the Silver Jewelry Market by Price Range Due to Strong Demand for Premium Products

In 2024, the luxury segment of the silver jewelry market has established a dominant position, driven by an increasing consumer preference for high-end, exclusive pieces. This segment is characterized by intricate designs, superior craftsmanship, and the allure of brand prestige, appealing to affluent customers seeking to make a statement or invest in timeless jewelry.

As trends shift towards personalized, high-quality silver jewelry, the luxury market benefits from its association with luxury fashion trends, celebrity influence, and rising interest in fine jewelry as both an accessory and an investment. Additionally, with growing disposable incomes in regions such as North America, Europe, and parts of Asia, demand for luxury silver jewelry remains strong, particularly among younger, fashion-forward generations.

On the other hand, the economic segment, which offers more affordable silver jewelry, continues to cater to budget-conscious consumers who prioritize value over exclusivity. Although this segment remains an essential part of the market, it has seen slower growth compared to its luxury counterpart. As a result, the economic segment is expected to maintain steady, but modest, market traction moving forward.

Key Market Segments

By Type

- Rings

- Necklaces

- Earrings

- Bracelets

- Anklets

- Others

By Material

- Sterling Silver

- Silver Plated

- Gemstone-studded Silver

- Oxidized Silver

- Filigree Silver

- Silver Alloy

- Others

By Application

- Everyday Wear

- Formal Wear

- Wedding and Special Occasions

- Gifting

- Others

By Gender

- Women

- Men

- Unisex

By Price Range

- Luxury

- Economic

By Distribution Channel

- Online

- Offline

Drivers

Increasing Disposable Income Fuels Silver Jewelry Market Growth

The silver jewelry market is experiencing significant growth, largely driven by rising disposable incomes, especially in emerging economies. As more consumers in these regions achieve greater financial stability, they are increasingly able to invest in luxury and semi-luxury items like silver jewelry. This surge in purchasing power is particularly important for silver, which is perceived as an affordable alternative to more expensive metals such as gold and platinum.

Moreover, the rising demand for fashion jewelry has made silver an attractive option for consumers who seek trendy yet budget-friendly accessories. Silver’s versatility also caters to the growing consumer preference for custom and personalized jewelry.

The metal’s malleability allows for a wide range of designs, meeting the rising demand for unique, one-of-a-kind pieces. In addition to aesthetics, silver’s inherent hypoallergenic and antibacterial properties are boosting its popularity, especially among health-conscious buyers who value high-quality, safe products.

The cultural and symbolic importance of silver in various societies further adds to its appeal, making it a desirable choice for consumers looking for meaningful jewelry. Overall, these factors collectively contribute to the robust expansion of the silver jewelry market, as more people seek out pieces that offer a combination of style, health benefits, and affordability.

Restraints

Fluctuating Silver Prices Create Market Uncertainty

Despite the growing demand for silver jewelry, the market faces several key restraints, notably the fluctuating prices of silver. As silver is a precious metal, its price can experience significant volatility, influenced by factors such as global economic conditions, market speculation, and supply-demand imbalances.

This price instability can lead to unpredictable costs for manufacturers, making it difficult to forecast profit margins and set competitive prices. For consumers, the uncertainty around silver’s price can make it a less attractive option compared to more stable commodities.

Additionally, the silver jewelry market is under constant pressure from competition, particularly from other precious metals like gold and platinum. These metals often have strong brand associations, making them popular choices for higher-end jewelry, which limits silver’s market share in the luxury segment.

On the other hand, non-precious metals such as stainless steel and titanium are increasingly used in jewelry production due to their durability, affordability, and growing acceptance in the fashion world. This competition from both precious and non-precious materials is a significant challenge for the silver jewelry industry.

As a result, manufacturers must constantly innovate and find ways to maintain competitive pricing and appeal to a broad consumer base in an increasingly crowded market.

Growth Factors

Expansion in Emerging Markets Unlocks Silver Jewelry Growth Potential

The silver jewelry market is poised for substantial growth, with emerging markets presenting key opportunities. In regions like Asia-Pacific, Latin America, and Africa, rapid urbanization and increasing disposable incomes are creating a new wave of consumers seeking affordable luxury items.

As more people in these areas gain financial stability, demand for silver jewelry is expected to rise significantly. Another growth avenue lies in the rising consumer preference for sustainable and ethically sourced products. With more buyers becoming environmentally conscious, silver jewelry brands that use recycled or ethically sourced materials have the chance to attract a dedicated consumer base that values responsible production practices.

Technological advancements are also providing growth opportunities. Innovations like 3D printing and laser technology in jewelry manufacturing allow for more intricate and customized designs, giving consumers greater options for personalization. This trend aligns with the growing desire for unique and one-of-a-kind pieces.

Additionally, collaborations between established silver jewelry brands and high-fashion designers offer another opportunity for growth. These partnerships often result in limited-edition collections, which can generate excitement and appeal to fashion-forward consumers. By tapping into these diverse opportunities, silver jewelry brands can expand their market presence and better meet the evolving demands of a global, trend-driven consumer base.

Emerging Trends

Minimalist Jewelry Designs Lead Silver Jewelry Trends

One of the key trends shaping the silver jewelry market is the growing popularity of minimalist designs, particularly among younger consumers who prefer subtle, elegant pieces over bold, flashy accessories. Simple silver jewelry, such as delicate rings, thin chains, and small hoop earrings, aligns with the modern aesthetic that favors understated beauty.

Alongside minimalism, bohemian (boho) and tribal-inspired designs are also gaining traction, as consumers look for unique, vintage-style jewelry that speaks to personal style and cultural influences. Silver’s ability to complement these intricate, earthy designs makes it a top choice for designers.

Sustainability and ethical production practices are becoming increasingly important, with more consumers demanding eco-friendly and socially responsible sourcing of silver.

Brands that focus on using recycled silver or adhere to fair-trade standards are seeing rising interest from ethically-minded buyers. Another trend making waves is the rise of layered jewelry, where silver is used to create stackable rings, layered necklaces, and multiple bracelets. This trend allows consumers to express individuality through versatile and customizable pieces.

Lastly, the combination of silver with rose gold plating has emerged as a fashionable hybrid, offering a modern twist and appealing to those seeking unique, contemporary jewelry. These trending factors are reshaping consumer preferences and guiding the future direction of the silver jewelry market.

Regional Analysis

Asia Pacific leads the silver jewelry market with a 35.2% share, valued at USD 13.5 billion

Asia Pacific remains the dominating region in the global silver jewelry market, accounting for 35.2% of the total market share, valued at approximately USD 13.5 billion. This region’s dominance is primarily driven by the large consumer base, cultural affinity for silver jewelry, and increasing disposable income in key markets like India and China.

The robust growth of the middle class in these countries, along with the rising trend of jewelry as an investment, further fuels demand. Additionally, the growing e-commerce penetration has expanded the reach of silver jewelry brands, contributing to market expansion in Asia Pacific.

Regional Mentions:

North America holds a significant share of the market, driven by high consumer spending on luxury goods, including silver jewelry. The United States, in particular, is a major contributor to market growth, with silver jewelry being a popular choice for both fashion and investment purposes. The market is projected to experience steady growth, driven by consumer demand for ethical and sustainable sourcing practices, as well as increasing popularity among millennials and Gen Z consumers.

In Europe, silver jewelry is an integral part of the region’s fashion culture, particularly in countries like Italy, Spain, and the United Kingdom. The European market is expected to grow at a moderate pace, driven by demand from both local artisans and well-established luxury jewelry brands. Additionally, the growing trend of personalized and customized jewelry is boosting the demand for silver jewelry in Europe.

The Middle East & Africa market for silver jewelry is relatively smaller but is growing at a faster rate due to increasing demand for affordable luxury, especially in the GCC countries. The region’s strong cultural tradition of wearing jewelry, coupled with a young, affluent population, is driving this growth.

In Latin America, silver jewelry holds cultural significance, particularly in countries like Mexico, where silver has long been a part of the national heritage. The market in Latin America is expanding, driven by both domestic consumption and export opportunities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global silver jewelry market is expected to be dominated by a blend of traditional luxury powerhouses and modern, innovative jewelry brands. Key players like Tiffany & Co., Harry Winston Inc., and Cartier remain strong due to their long-standing heritage, craftsmanship, and global brand recognition.

These brands are increasingly focusing on sustainability and ethical sourcing, aligning their operations with consumer demand for responsibly produced luxury goods. Tiffany’s commitment to sustainable practices, for example, enhances its appeal among eco-conscious consumers while maintaining its status as a premium player in the market.

Pandora A/S and Swarovski Group, on the other hand, represent more accessible luxury and fashion-forward styles. Pandora’s broad market appeal and its ability to combine customization with affordability has solidified its position as one of the largest silver jewelry brands globally. Swarovski’s focus on crystal embellishments, combined with its growing presence in fine jewelry, keeps it competitive in both the high-end and fashion jewelry segments.

In contrast, Mikimoto Co. Ltd., Buccellati Holding Italia, and Bulgari S.p.A. continue to capitalize on their refined, artisanal designs and the demand for opulence among high-net-worth individuals. These companies are expected to benefit from a growing market for premium and haute couture jewelry, especially in Asia, which is a key region for luxury goods consumption.

The competitive landscape is further complicated by the rise of e-commerce platforms like Blue Nile Inc., which is leveraging online retail and digital tools to reach a wider, tech-savvy audience, offering a more personalized and cost-effective shopping experience.

Top Key Players in the Market

- Tiffany & Co.

- Harry Winston Inc.

- Buccellati Holding Italia

- Cartier

- Pandora A/S

- Bulgari S.p.A.

- Mikimoto Co. Ltd.

- Roberto Coin S.p.A.

- David Yurman Enterprises LLC

- Chow Tai Fook Jewellery Group Limited

- Signet Jewelers Limited

- Richemont SA

- Swarovski Group

- Blue Nile Inc.

- Graff Diamonds

- Others

Recent Developments

- In October 2024, GIVA Jewellery raised ₹255 crore from a group of investors, with Premji Invest leading the funding round, positioning the company for growth in the Indian jewellery market.

- In February 2024, Silver One completed the full acquisition of its Phoenix Silver Project in Arizona, marking a significant milestone in its strategic focus on expanding its silver mining assets in the U.S.

- In October 2023, Avery Dennison signed a definitive agreement to acquire Silver Crystal Group, strengthening its portfolio in the packaging and labeling sector and expanding its global market presence.

- In September 2024, First Majestic announced shareholder approval for its acquisition of Gatos Silver, a move aimed at enhancing its silver production capabilities and operational scale in the mining industry.

Report Scope

Report Features Description Market Value (2024) USD 38.6 Billion Forecast Revenue (2034) USD 61.1 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Rings, Necklaces, Earrings, Bracelets, Anklets, Others), By Material (Sterling Silver, Silver Plated, Gemstone-studded Silver, Oxidized Silver, Filigree Silver, Silver Alloy, Others)), By Application (Everyday Wear, Formal Wear, Wedding and Special Occasions, Gifting, Others), By Gender (Women, Men, Unisex), By Price Range (Luxury, Economic), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tiffany & Co., Harry Winston Inc., Buccellati Holding Italia, Cartier, Pandora A/S, Bulgari S.p.A., Mikimoto Co. Ltd., Roberto Coin S.p.A., David Yurman Enterprises LLC, Chow Tai Fook Jewellery Group Limited, Signet Jewelers Limited, Richemont SA, Swarovski Group, Blue Nile Inc., Graff Diamonds, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Tiffany & Co.

- Harry Winston Inc.

- Buccellati Holding Italia

- Cartier

- Pandora A/S

- Bulgari S.p.A.

- Mikimoto Co. Ltd.

- Roberto Coin S.p.A.

- David Yurman Enterprises LLC

- Chow Tai Fook Jewellery Group Limited

- Signet Jewelers Limited

- Richemont SA

- Swarovski Group

- Blue Nile Inc.

- Graff Diamonds

- Others