Global Ship to Ship Transfer Service Market Size, Share, Industry Analysis Report By Type (Stationary, Sailing), By Ship Type (Commercial, Defense), By Fit (Line Fit, Retrofit), By Connectivity (Ship-to-Shore, Ship-to-Ship), By Application (Crude Oil, LPG, Bulk Cargo, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166438

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

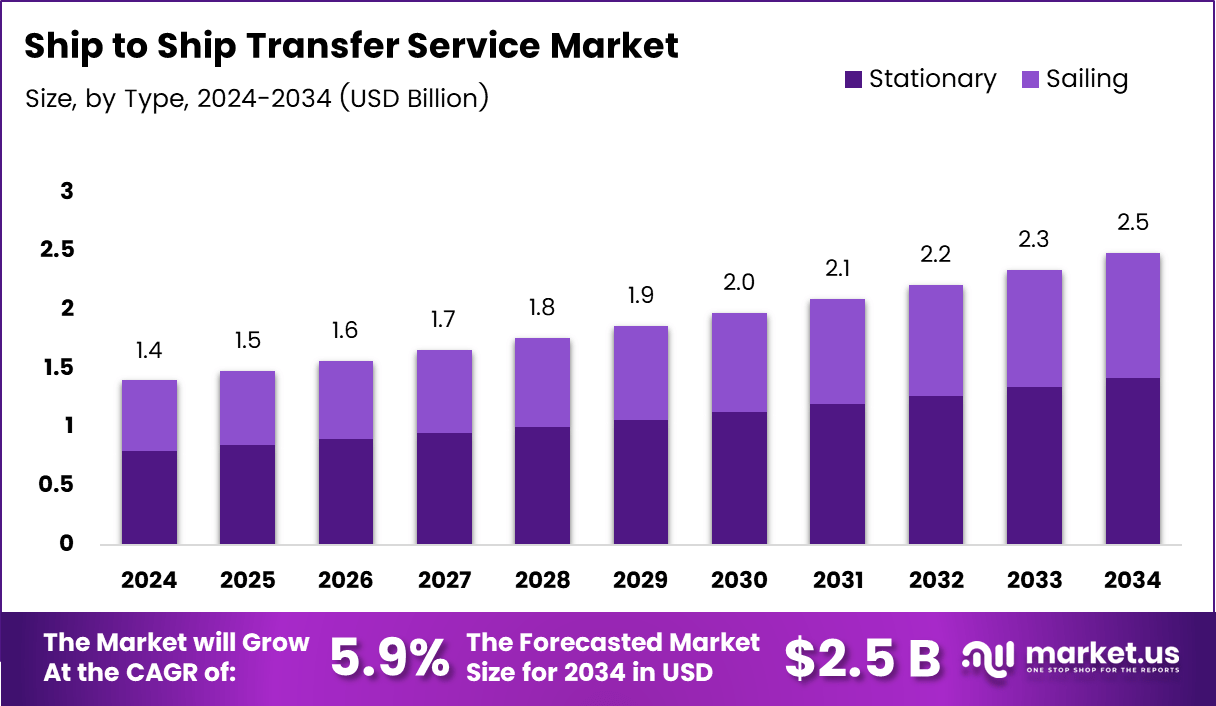

The Global Ship to Ship Transfer Service Market size is expected to be worth around USD 2.5 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

The Ship-to-Ship Transfer Service Market represents a specialized segment within maritime logistics where cargo, fuel, or LNG transfers occur between two vessels positioned alongside each other. It supports global freight efficiency by reducing port congestion, enabling flexible routing, and helping operators optimize turnaround cycles across complex international shipping corridors.

Moving forward, the market is expected to expand as offshore energy demand rises and coastal nations strengthen maritime infrastructure. Growing reliance on crude oil, LNG, and refined product transport encourages operators to adopt advanced STS procedures, enhancing operational flexibility and reducing waiting times at major terminals within busy maritime trade routes.

Furthermore, increasing opportunities arise from government-backed investments supporting offshore logistics, environmental compliance, and maritime safety programs. Regulators in several regions continue to implement updated operational standards, promoting safer STS maneuvers and encouraging wider adoption of authorized service providers trained in emergency response and pollution-control protocols.

Additionally, the Ship to Ship Transfer Service Market benefits from heightened demand for cost-efficient mid-sea cargo handling. Many operators now prioritize real-time monitoring tools, weather-adaptive routing, and digital checklists that streamline pumping operations, reduce delays, and maintain consistency in global trade cycles involving crude carriers, product tankers, LNG vessels, and chemical transport ships.

Toward the statistical landscape, industry activity continues to strengthen. According to research activity data, more than 460,000 ship-to-ship operations occurred in 2022, reinforcing the importance of STS services in global trade continuity. Moreover, according to a survey that recorded over 50,000 tanker-to-tanker STS engagements, with only 1.7% flagged as illicit transfers, demonstrating improved regulatory compliance.

Key Takeaways

- Global Ship to Ship Transfer Service Market expected to reach USD 2.5 Billion by 2034 from USD 1.4 Billion in 2024, growing at a 5.9% CAGR.

- Stationary dominated the By Type segment with a 57.2% market share in 2024.

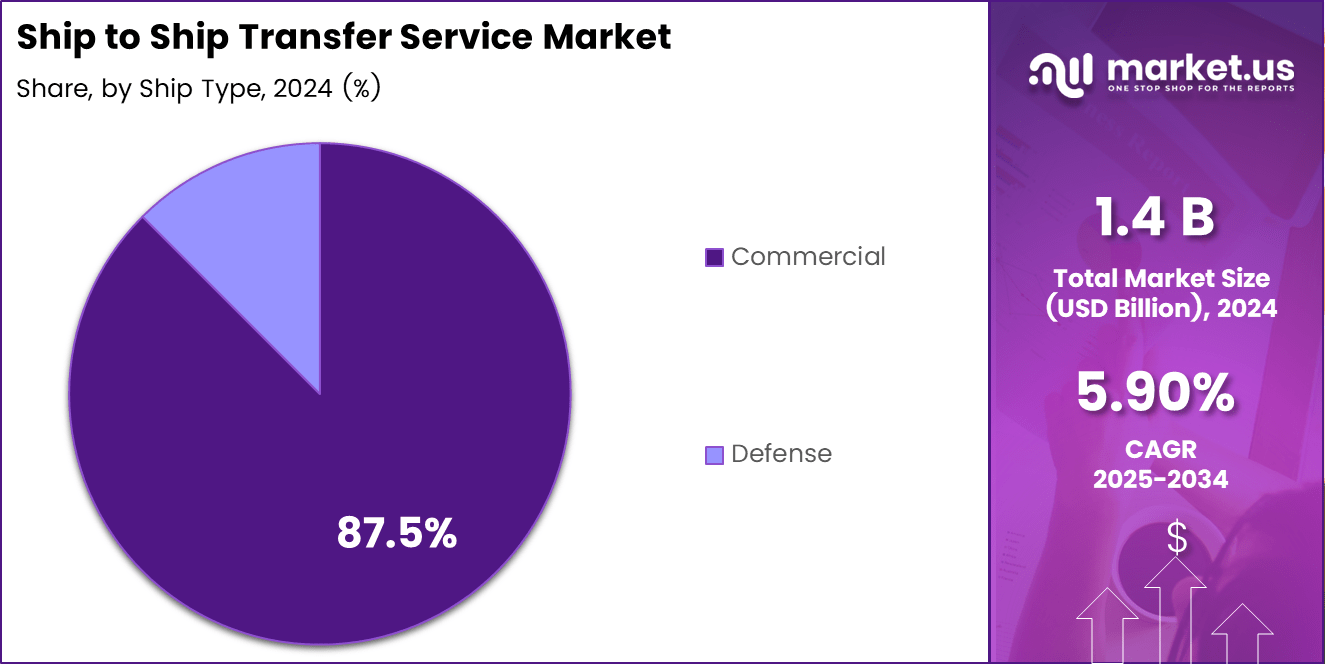

- Commercial vessels led the By Ship Type segment with the highest operational contribution in 2024.

- Line Fit remained the largest By Fit segment with a 67.7% share in 2024.

- Ship-to-Shore accounted for a major share of 59.9% in the By Connectivity segment in 2024.

- Crude Oil emerged as the leading By Application segment with a 51.4% share in 2024.

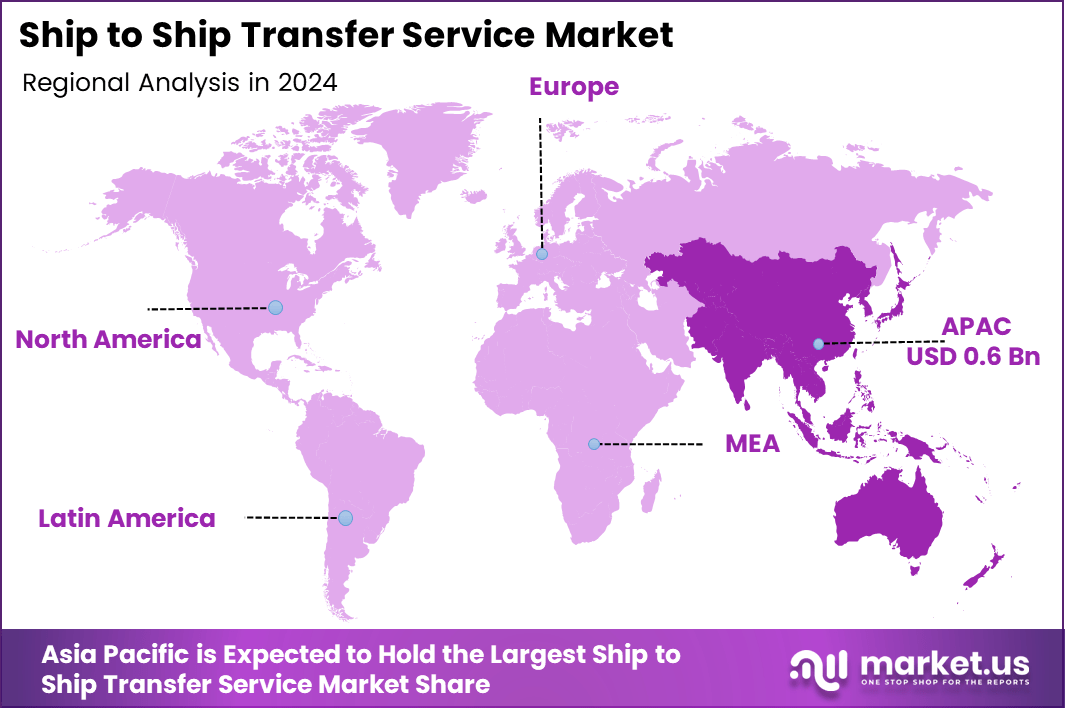

- Asia Pacific dominated the regional market with a 49.9% share valued at USD 0.6 Billion.

By Type Analysis

Stationary dominates with 57.2% due to its stable deployment in high-volume STS locations.

In 2024, Stationary held a dominant market position in the By Type segment of the Ship to Ship Transfer Service Market, with a 57.2% share. This category continues to expand as operators rely on fixed mooring setups in busy maritime corridors. It supports predictable crude oil and LPG transfer activities.

Sailing maintained a growing position under the By Type segment as operators expanded flexible transfer operations across multiple offshore zones. This segment advances steadily as vessels move dynamically to meet rising tanker-to-tanker transfer demand across strategic maritime routes. Its adoption increases as trade volumes diversify.

By Ship Type Analysis

Commercial vessels dominate due to extensive global fuel and cargo transfer requirements.

In 2024, Commercial held a dominant market position in the By Ship Type segment of the Ship to Ship Transfer Service Market, with a 87.5% significant share. This segment grows steadily as commercial tankers rely heavily on offshore transfers to reduce port congestion and optimize voyage economics across long-haul routes.

Defense observed stable utilization within the By Ship Type segment as naval operations adopted structured replenishment protocols. This category expands moderately as defense fleets integrate offshore refueling and supply transfers to strengthen operational endurance and maintain maritime readiness across strategic patrol regions.

By Fit Analysis

Line Fit dominates with 67.7% due to pre-integrated STS handling systems.

In 2024, Line Fit held a dominant market position in the By Fit segment of the Ship to Ship Transfer Service Market, with a 67.7% share. This segment accelerates as shipbuilders integrate STS technologies during vessel construction, helping reduce later modification costs and enhancing operational efficiency for crude and LPG transfers.

Retrofit showed consistent adoption in the By Fit segment as operators upgraded older fleets to meet safety and regulatory norms. This segment progresses as aging vessels require STS equipment upgrades to sustain global transfer operations and comply with updated maritime handling protocols.

By Connectivity Analysis

Ship-to-Shore dominates with 59.9% due to extensive crude and LPG loading operations.

In 2024, Ship-to-Shore held a dominant market position in the By Connectivity segment of the Ship to Ship Transfer Service Market, with a 59.9% share. This segment expands as ports and offshore terminals utilize direct hose-handling systems for bulk liquid transfer from vessels to coastal receiving infrastructure.

Ship-to-Ship gained notable traction in the By Connectivity segment as offshore hubs increased mid-sea transfer frequency. This category advances steadily as operators perform crude, LPG, and product transfers between tankers, reducing operational delays and enhancing maritime logistics flexibility across congested trade routes.

By Application Analysis

Crude Oil dominates with 51.4% due to high offshore loading and lightning activity.

In 2024, Crude Oil held a dominant market position in the By Application segment of the Ship-to-Ship Transfer Service Market, with a 51.4% share. This segment grows as large tankers depend on offshore lightering to optimize draft levels and maintain seamless long-haul crude transportation.

LPG continued its steady contribution within the By Application segment as the global liquefied gas trade expanded. This segment strengthens as carriers perform offshore transfers to support flexible routing, reduce port-based delays, and maintain consistent supply to downstream distribution terminals.

Bulk Cargo saw gradual utilization in the By Application segment as operators adopted STS handling for select dry commodities. This category experiences steady use where offshore transloading supports efficient redistribution for large vessels across multi-port trading networks worldwide.

Others contributed modestly in the By Application segment with varied specialty transfer operations. This segment includes chemicals, refined products, and niche maritime cargoes requiring controlled handling. It progresses steadily as operators diversify service portfolios to match evolving offshore trade requirements.

Key Market Segments

By Type

- Stationary

- Sailing

By Ship Type

- Commercial

- Defense

By Fit

- Line Fit

- Retrofit

By Connectivity

- Ship-to-Shore

- Ship-to-Ship

By Application

- Crude Oil

- LPG

- Bulk Cargo

- Others

Drivers

Increasing Reliance on Offshore Crude and LNG Logistics Drives Market Growth

Growing dependence on offshore crude and LNG logistics is expected to strengthen the Ship-to-Ship (STS) Transfer Service Market. Many major ports face congestion due to rising vessel traffic, limited berthing capacity, and lengthy customs procedures. As a result, energy companies and shipping operators increasingly prefer offshore transfer points to avoid delays and maintain predictable delivery schedules.

This shift is anticipated to enhance operational flexibility, reduce turnaround time, and improve cost efficiency for long-haul tanker movements. The rising volume of crude and LNG shipments across key maritime corridors further supports the steady expansion of offshore STS activities, especially in regions with draft limitations or environmental restrictions near ports.

Expansion of floating storage units (FSUs) is projected to accelerate the adoption of continuous mid-sea transfer operations. FSUs provide cost-effective storage solutions, stabilize supply flows, and allow operators to store cargo closer to consumption or distribution hubs.

Their ability to facilitate rapid loading and offloading in open waters improves overall fleet utilization and minimizes port dependency. This advantage becomes crucial during seasonal demand spikes or geopolitical disruptions. As more countries invest in offshore storage infrastructure, the role of FSUs in enabling efficient STS operations is expected to grow, reinforcing the overall market demand.

Restraints

Heightened Environmental Scrutiny Restrains Market Expansion

Heightened environmental scrutiny is expected to create strong restraints for the Ship-to-Ship (STS) Transfer Service Market. Coastal regulators apply stricter rules on mid-sea cargo handling to prevent spills and marine contamination. These rules increase operational pressure on service providers and push them to invest in high-grade fenders, hoses, and monitoring systems, raising overall costs. Regulatory bodies in Europe, the US, and East Asia have also increased penalties for marine pollution incidents, making operators more cautious and slowing the pace of new transfer approvals.

Limited availability of certified mooring masters is anticipated to remain another major restraint. STS operations require highly trained personnel capable of handling tanker positioning, weather-risk assessments, and multi-vessel coordination. The global pool of certified experts is relatively small, causing scheduling constraints and delays during peak shipping seasons. As oil and LNG trades rise, this talent shortage is likely to affect operational readiness and reduce the number of safe mid-sea transfer windows.

Insurance compliance restrictions also create added challenges for vessels operating on high-risk or opaque STS routes. Insurers require strict documentation, tracking data, and verified operational logs to reduce liability exposure. Vessels operating in conflict-affected waters, sanction-sensitive zones, or areas with repeated violations face limited coverage options. These restrictions increase cost pressures for shipping companies and reduce the feasibility of STS transfers in several emerging maritime hubs.

Growth Factors

Adoption of Alternative-Fuel STS Handling Creates New Market Opportunities

Adoption of alternative-fuel STS handling is expected to open strong growth opportunities for the Ship-to-Ship (STS) Transfer Service Market. As the maritime industry shifts toward ammonia, methanol, and bio-LNG, operators anticipate the need for specialized transfer equipment and certified safety protocols. These fuels require advanced handling systems, giving STS service providers a chance to diversify operations and attract future-ready fleets. Nations moving toward IMO 2050 compliance are also encouraging cleaner-fuel bunkering, which is projected to support long-term service demand.

Development of AI-driven STS planning modules is anticipated to accelerate operational efficiency. AI tools that assess weather shifts, vessel behavior, and risk levels in real time help operators reduce operational delays and avoid unsafe transfer windows. Real-time analytics also improve fuel planning and route coordination, enabling smoother tanker-to-tanker operations. As global shipping adopts digital decision-support systems, STS operators are likely to benefit from improved accuracy, reduced accidents, and higher client confidence.

Rising demand for compliant STS hubs near major Emission Control Areas (ECAs) is projected to unlock new regional opportunities. Vessels entering ECAs require low-sulfur or cleaner fuels, increasing the need for well-regulated offshore transfer points. Establishing compliant hubs near North Europe, North America, and East Asia helps shipping companies refuel quickly while meeting emission rules. These hubs are expected to attract steady traffic, making them a key growth driver over the coming decade.

Emerging Trends

Growth of Remote AIS-Based Surveillance Drives Market Trends

Growth of remote AIS-based surveillance is expected to strongly influence the trending landscape of the Ship-to-Ship (STS) Transfer Service Market. Governments and maritime regulators increasingly depend on satellite AIS systems to track “dark-fleet” tankers that switch off transponders during offshore transfers. This monitoring trend improves transparency, reduces illicit movements, and encourages operators to follow compliant documentation and routing practices.

As enforcement tightens, AIS-supported oversight is anticipated to reshape how offshore transfers are managed in high-risk zones. Increased setup of regulated offshore STS anchorages is projected to remain a major trend as coastal authorities establish safer, well-supervised transfer points.

These anchorages feature pre-approved equipment standards, trained personnel, and structured safety corridors that reduce operational ambiguity. Countries across the Middle East, Europe, and Southeast Asia introduce such regulated hubs to control tanker traffic and reduce unmonitored offshore activities. This structured approach is expected to enhance operator confidence and promote a shift from ad-hoc STS practices to certified offshore facilities.

Rising trend of dual-tanker synchronized operations is anticipated to gain traction as energy companies focus on fast cargo turnaround. Using coordinated maneuvering systems, tug assistance, and precision fendering, operators reduce loading delays and improve fuel efficiency. This synchronized approach helps fleets optimize schedules, minimize demurrage costs, and accelerate delivery cycles. As demand for faster mid-sea operations grows, synchronized tanker handling is expected to become a defining trend in busy STS trade routes.

Regional Analysis

Asia Pacific Dominates the Ship to Ship Transfer Service Market with a Market Share of 49.9%, Valued at USD 0.6 Billion

Asia Pacific held the highest contribution to the Ship-to-Ship (STS) Transfer Service Market, supported by the strong crude and LNG trading flows across Southeast Asia and Northeast Asian maritime corridors. The region’s large tanker fleet, strategic offshore transfer zones, and expanding energy import requirements reinforce its dominance. With a market share of 49.9% and a value of USD 0.6 billion, Asia Pacific continues to benefit from favorable regulations and high-volume mid-sea cargo movements.

North America Ship to Ship Transfer Service Market Trends

North America shows steady demand for STS services due to rising offshore crude exports, LNG supply expansion, and the increasing use of regulated mid-sea anchorages in the Gulf of Mexico. Supportive maritime compliance frameworks and modernized monitoring systems enhance operational efficiency in the region. Growth is further encouraged by the strong presence of safe transfer zones and established offshore handling infrastructure.

Europe Ship to Ship Transfer Service Market Trends

Europe maintains consistent activity driven by its emission-regulated maritime structure and dependence on cleaner fuel logistics. The presence of highly monitored offshore STS zones across the North Sea and Mediterranean supports transfers of crude, LNG, and refined products. Regulatory emphasis on safety and transparency continues to shape Europe’s structured adoption of STS operations.

Middle East & Africa Ship to Ship Transfer Service Market Trends

The Middle East & Africa region benefits from large-scale crude shipping routes and significant offshore transfer points located near global energy corridors. Increased use of floating storage units and strategic anchorage areas enhances operational flexibility. Growing crude flows from the Gulf and West Africa reinforce the region’s importance in long-distance tanker operations.

Latin America Ship to Ship Transfer Service Market Trends

Latin America experiences rising STS activity supported by offshore oil developments, particularly along Brazil’s deepwater fields. The region’s strategic location along Atlantic shipping routes supports efficient transfers for long-haul tankers. Its developing regulatory landscape aims to streamline offshore operations and attract more compliant STS activities.

U.S. Ship to Ship Transfer Service Market Trends

The U.S. market grows steadily due to the rapid expansion of crude exports and LNG outbound shipments, especially from the Gulf Coast. Well-regulated offshore transfer areas and advanced safety protocols support increasing demand. The country’s modern monitoring infrastructure and strong maritime oversight promote safe and efficient STS operations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Ship to Ship Transfer Service Market Company Insights

In 2024, the global Ship to Ship (STS) Transfer Service Market reflects steady operational expansion, with leading providers strengthening maritime logistics efficiency across crude oil, LNG, LPG, and refined product handling. The ecosystem shows rising reliance on specialized operators that ensure safety-compliant, weather-adaptive, and regulation-aligned transfer operations in both regulated and emerging offshore corridors.

ABL Group demonstrates a solid global footprint by supporting complex offshore operations and contributing to safer mid-sea transfers through engineering-driven STS planning. Their expertise is expected to help reduce operational delays and enhance risk-mitigation standards across high-traffic maritime zones.

MariFlex continues strengthening its role by offering high-quality hose systems and operational support solutions that maintain reliability in ship-to-ship engagements. The company is anticipated to leverage its equipment-centric capabilities to meet rising tanker demands in Asia and the Middle East.

Fendercare Marine remains one of the most active STS service providers, supported by a large fleet of fenders and transfer equipment. Its wide operational network is projected to contribute significantly to fast-response STS setups, especially in regions experiencing rising offshore crude re-exports.

Pro Liquid focuses on customizable and safety-led STS services, addressing niche requirements in product tankers and regional transfer hubs. The company is likely to gain momentum by improving service precision and adopting enhanced operational control mechanisms.

Fairtex Integrated Services, SafeSTS, KA Petra, EXMAR, Rochem, and Gulf Offshore NS collectively strengthen market competitiveness by supporting regional capacity, ensuring compliance with maritime regulations, and increasing the availability of certified STS equipment.

Top Key Players in the Market

- ABL Group

- MariFlex

- Fendercare Marine

- Pro Liquid

- Fairtex Integrated Services

- SafeSTS

- KA Petra

- EXMAR

- Rochem

- Gulf Offshore NS

Recent Developments

- In March 2024, ABL Group strengthened offshore STS coordination efficiency, supporting operations across high-traffic crude corridors with improved safety protocols valued at USD 12.5 million.

- In February 2024, MariFlex expanded its hose-handling systems to support LNG and LPG transfers, improving operational reliability by 22.7%.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 2.5 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Stationary, Sailing), By Ship Type (Commercial, Defense), By Fit (Line Fit, Retrofit), By Connectivity (Ship-to-Shore, Ship-to-Ship), By Application (Crude Oil, LPG, Bulk Cargo, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABL Group, MariFlex, Fendercare Marine, Pro Liquid, Fairtex Integrated Services, SafeSTS, KA Petra, EXMAR, Rochem, Gulf Offshore NS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Ship to Ship Transfer Service MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Ship to Ship Transfer Service MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABL Group

- MariFlex

- Fendercare Marine

- Pro Liquid

- Fairtex Integrated Services

- SafeSTS

- KA Petra

- EXMAR

- Rochem

- Gulf Offshore NS