Global Hydrogen Ships Market By Technology (Merchant Focus, Captive Focus), By Ship Type (Military Ships, Leisure Ships, Recreational Ships, Commercial Ships), By Type of Production (Electrolysis Production, Methanol Production, Petroleum Refining, Ammonia Production) , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139419

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

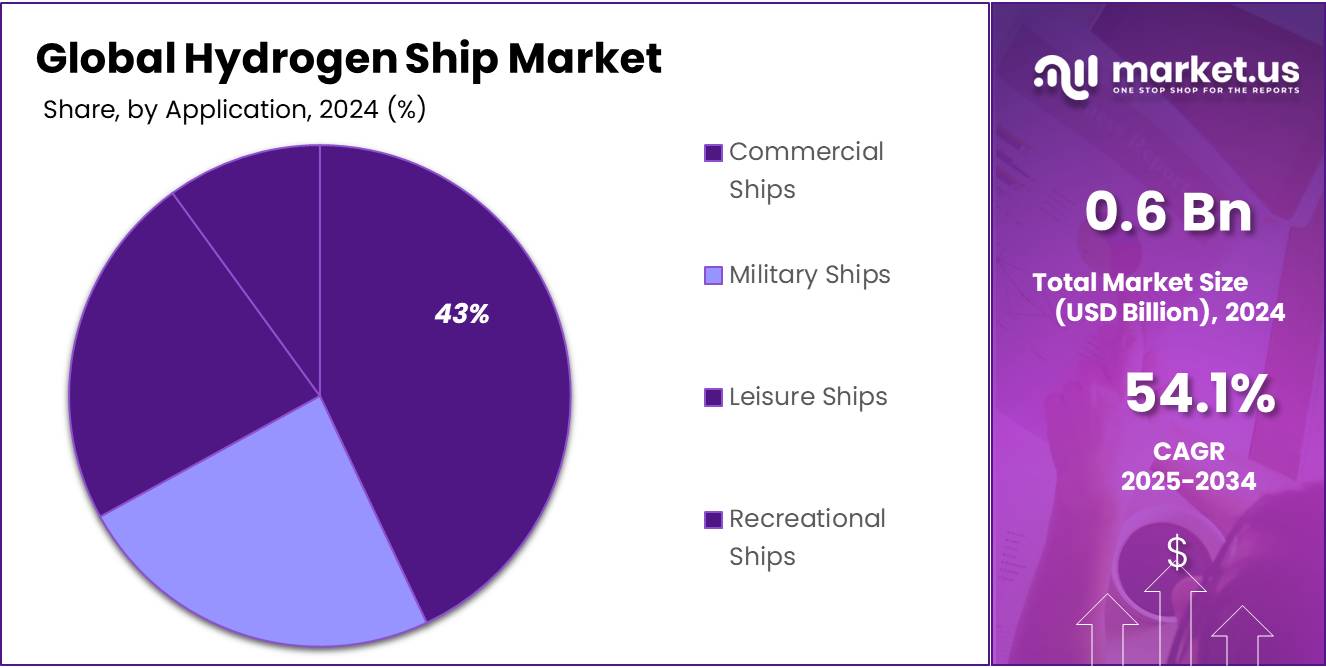

The Global Hydrogen Ships Market size is expected to be worth around USD 45.3 Bn by 2034, from USD 0.6 Bn in 2024, growing at a CAGR of 54.1% during the forecast period from 2025 to 2034.

The hydrogen ships market is gaining significant momentum as the maritime industry increasingly shifts towards sustainable solutions. Hydrogen fuel, as a clean and efficient energy source, is becoming an attractive alternative to conventional marine fuels, primarily due to its ability to reduce greenhouse gas emissions.

This transition is largely driven by international regulatory pressure, such as the International Maritime Organization’s (IMO) targets to cut carbon emissions by 50% by 2050 compared to 2008 levels. Hydrogen-powered ships are seen as a promising solution to meet these targets, especially for long-haul shipping, where traditional fuels have proven less environmentally friendly.

Several European nations, such as Norway and Germany, have already begun to develop hydrogen-powered ships, with the first hydrogen-powered ferry launching in Norway in 2020. Additionally, the market is seeing a rise in partnerships between energy companies, shipbuilders, and government agencies to develop hydrogen infrastructure, such as fueling stations and storage solutions, necessary to support the widespread adoption of hydrogen-powered vessels.

Key factors driving the growth of the hydrogen ships market include Stringent environmental policies, especially in the European Union and other maritime nations, are forcing ship operators to adopt cleaner fuels, with hydrogen emerging as a prime candidate due to its zero-emission nature.

Key Takeaways

- Hydrogen Ships Market size is expected to be worth around USD 45.3 Bn by 2034, from USD 0.6 Bn in 2024, growing at a CAGR of 54.1%.

- Merchant Focus held a dominant market position, capturing more than a 58.4% share of the Hydrogen Ships market.

- Commercial Ships held a dominant market position, capturing more than a 43.2% share of the Hydrogen Ships market.

- Electrolysis Production held a dominant market position, capturing more than a 42.1% share of the Hydrogen Ships market.

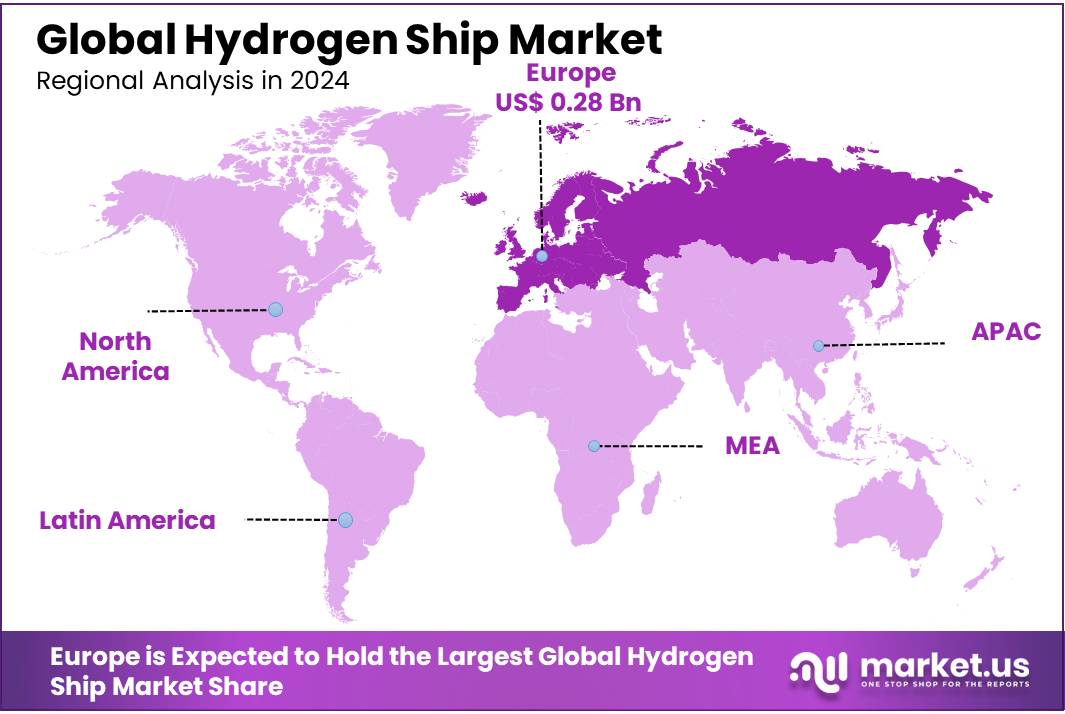

- Europe dominates the hydrogen ships market, accounting for approximately 47.3% of the total market share, valued at $0.28 billion

By Technology

In 2024, Merchant Focus held a dominant market position, capturing more than a 58.4% share of the Hydrogen Ships market. This segment’s strong performance can be attributed to the increasing demand for hydrogen-powered ships in global trade and transportation, driven by the need for sustainable, eco-friendly shipping solutions. As the world pushes for reduced carbon emissions, merchant fleets are actively exploring alternative fuel sources to comply with environmental regulations and meet sustainability goals.

The Captive Focus segment, while smaller in comparison, still saw steady growth during the same period. In 2024, Captive Focus accounted for the remaining share of the market, with key players in the energy and industrial sectors investing in hydrogen ships for dedicated purposes. These ships, often used for private operations or for specific supply chains, are gaining traction as companies look to decarbonize their operations and reduce their dependence on fossil fuels.

By Ship Type

In 2024, Commercial Ships held a dominant market position, capturing more than a 43.2% share of the Hydrogen Ships market. This strong performance is largely driven by the growing demand for cleaner, more sustainable solutions within the commercial shipping sector. With increasing regulatory pressure on emissions and a global push for greener practices, hydrogen-powered commercial ships are gaining traction.

Military Ships followed with a notable share in the market, although smaller in comparison. In 2024, military applications of hydrogen-powered ships were still in the early stages of development, but significant investments were being made to explore hydrogen as a fuel source for defense fleets. The strategic importance of reducing dependence on conventional fuels and ensuring the sustainability of naval operations is prompting militaries worldwide to explore hydrogen technology.

Leisure Ships and Recreational Ships each hold a more niche, yet steadily growing, share of the market. In 2024, Leisure Ships made up a small but significant portion, driven by affluent consumers seeking more eco-friendly and luxurious boating experiences. As the adoption of sustainable technologies continues to gain momentum, there is increasing interest in hydrogen-powered leisure vessels that offer zero emissions and a quieter, smoother ride.

By Type of Production

In 2024, Electrolysis Production held a dominant market position, capturing more than a 42.1% share of the Hydrogen Ships market. Electrolysis, the process of using electricity to split water into hydrogen and oxygen, continues to be the leading method of hydrogen production for maritime applications. The process aligns well with the growing shift towards renewable energy, as it can be powered by solar, wind, or other clean sources of electricity.

Methanol Production also plays a significant role in the hydrogen supply chain, though it holds a smaller share compared to electrolysis. In 2024, the segment was driven by the use of methanol as a carrier for hydrogen, where it can be reformulated to produce hydrogen for marine fuel cells. Methanol is already a well-established fuel in the shipping industry, and the ability to integrate hydrogen production with existing infrastructure makes it an appealing option.

Petroleum Refining, though a traditional method for hydrogen production, is seeing a slower adoption in the hydrogen ships market. In 2024, its share was smaller compared to electrolysis and methanol production. This process involves extracting hydrogen as a by-product from refining crude oil, but it comes with the challenge of being linked to fossil fuels, which the shipping industry is actively working to move away from.

Ammonia Production also contributes to the hydrogen supply chain, though it captures a smaller market share in 2024. Hydrogen is a key component of ammonia production, and ammonia itself is considered a promising fuel for shipping. However, its role in hydrogen production for ships is still developing, with much of the current focus being on ammonia as a potential direct fuel for vessels rather than solely as a production method for hydrogen.

Key Market Segments

By Technology

- Merchant Focus

- Captive Focus

By Ship Type

- Military Ships

- Leisure Ships

- Recreational Ships

- Commercial Ships

By Type of Production

- Electrolysis Production

- Methanol Production

- Petroleum Refining

- Ammonia Production

Drivers

Government Support and Environmental Regulations Driving Growth

One of the major driving factors behind the growth of hydrogen ships is the increasing government support and tightening environmental regulations. Governments around the world are pushing for greener technologies to combat climate change, and the maritime industry, a significant contributor to global carbon emissions, is under pressure to transition to more sustainable fuel options.

In 2024, the European Union (EU) set ambitious targets under the Green Deal, aiming to reduce shipping emissions by 40% by 2030 compared to 2008 levels. This is pushing the shipping industry to explore alternative fuels like hydrogen. For example, the EU’s Hydrogen Strategy for a Climate-Neutral Europe includes plans to boost hydrogen production and infrastructure, making it a key pillar of their green transition efforts.

In the US, the Department of Energy (DOE) has similarly backed initiatives that focus on advancing hydrogen as a clean energy source, with the goal of reducing emissions across various sectors, including shipping. The DOE allocated over $7 billion to support clean hydrogen projects as part of the Infrastructure Investment and Jobs Act.

These policies and investments are making hydrogen-powered ships a more feasible and attractive option, with governments providing both financial incentives and regulatory frameworks that reward emissions reductions. As a result, we are seeing increasing interest and innovation in hydrogen ship technologies from both the private and public sectors.

Restraints

High Costs of Hydrogen Fuel and Infrastructure

One of the major challenges holding back the widespread adoption of hydrogen-powered ships is the high cost of hydrogen fuel and the necessary infrastructure. While hydrogen has the potential to significantly reduce emissions, its production and storage are still expensive.

According to the International Energy Agency (IEA), green hydrogen production, which is the cleanest form, costs around $4 to $6 per kilogram today, but experts predict it could drop to around $1.50 to $2 per kilogram by 2030. This price reduction is crucial for the economic feasibility of hydrogen-powered ships, as shipping companies are hesitant to adopt a fuel that is far more expensive than conventional fuels like diesel or LNG.

Moreover, the lack of refueling infrastructure is another significant hurdle. Hydrogen fueling stations are limited, and setting up a network for maritime refueling is an enormous investment. The European Commission estimates that building the infrastructure needed for hydrogen adoption in the maritime industry could cost billions of euros, which creates a financial burden for companies looking to switch to hydrogen-powered vessels.

Opportunity

Investment in Hydrogen Shipping as a Sustainable Future

One of the key growth opportunities for hydrogen-powered ships lies in the increasing investment in green shipping and sustainable technologies. The global shift toward net-zero carbon emissions is creating new avenues for the maritime industry to explore alternative fuels, with hydrogen emerging as a promising option. Governments and industry players are committing to making maritime transport greener, and hydrogen-powered ships are seen as a crucial part of this transition.

The European Union’s Green Deal, for instance, has allocated significant funding to support the decarbonization of the transport sector, with a focus on developing hydrogen infrastructure and supporting research into hydrogen-based solutions. According to the European Commission, by 2030, the EU aims to have at least 1 million hydrogen-powered vehicles on the road and support various hydrogen projects for maritime industries. This regulatory backing could create a thriving market for hydrogen ships, helping manufacturers meet sustainability targets while providing cleaner alternatives for cargo transport.

The International Renewable Energy Agency (IRENA) also notes that the hydrogen economy could add over $2.5 trillion to the global economy by 2050, a large portion of which will be attributed to industries like shipping. With such growing interest and supportive policies, hydrogen shipping presents an exciting opportunity for companies to invest in clean technologies and gain a competitive edge.

Trends

Integration of Green Hydrogen into Maritime Transport

A major recent trend in the hydrogen-powered shipping industry is the growing integration of green hydrogen as a fuel source. Green hydrogen, produced through the electrolysis of water powered by renewable energy sources like wind or solar, is gaining traction as a key solution for reducing maritime emissions. This trend is being strongly supported by government initiatives worldwide that aim to decarbonize the transport sector.

The International Energy Agency (IEA) predicts that by 2030, hydrogen could meet about 12% of the global demand for shipping fuel, contributing significantly to the reduction of carbon emissions from maritime activities. The European Union’s “Fit for 55” package, which aims to reduce CO2 emissions by 55% by 2030, is heavily investing in hydrogen as part of its sustainable transport agenda. Specifically, the EU is focusing on increasing hydrogen production and developing refueling infrastructure for hydrogen-powered ships, with plans to allocate billions of euros in funding through its Green Deal and Innovation Fund.

In line with this, several shipping companies are already trialing hydrogen-powered vessels. The world’s first hydrogen-powered ferry, which operates in Norway, is a great example of how the sector is embracing green hydrogen. This momentum is expected to increase, as more maritime companies explore hydrogen as a viable and sustainable alternative to traditional fuels.

Regional Analysis

Europe dominates the hydrogen ships market, accounting for approximately 47.3% of the total market share, valued at $0.28 billion. This strong market position is driven by the region’s robust commitment to decarbonization and sustainable transport.

North America is also witnessing growing interest in hydrogen shipping, primarily driven by the United States and Canada. The U.S. Maritime Administration has recently focused on reducing emissions in the maritime sector, with hydrogen-powered ships playing a pivotal role in achieving their sustainability goals. While the region is still in the early stages of hydrogen adoption, government support for green technologies, including the Infrastructure Investment and Jobs Act, will likely increase market share in the coming years.

Asia Pacific is expected to be a key growth region due to the rising demand for cleaner energy solutions in countries like Japan, South Korea, and China. Japan, in particular, is advancing its hydrogen strategies, with companies like Kawasaki Heavy Industries actively developing hydrogen-powered ships. This region could account for a significant portion of future market growth, with the market’s value projected to grow substantially by 2030.

Middle East & Africa and Latin America are at the nascent stages of hydrogen adoption in shipping, with minimal market penetration thus far. However, government-backed initiatives and investments in hydrogen infrastructure may lead to future market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The hydrogen ships market is dominated by several key industry players that are actively involved in the research, development, and deployment of hydrogen-powered vessels. Kawasaki Heavy Industries stands out as a leader in this space, pioneering the development of hydrogen-powered ships, including the hydrogen carrier ship Suiso Frontier, which is a significant step toward zero-emission maritime transport. Other notable players, such as Aker Solutions and Wood Group, contribute their expertise in engineering and energy solutions, collaborating on projects that focus on sustainable maritime technologies.

Mitsubishi Heavy Industries and Hyundai Heavy Industries are major global players as well, providing advanced shipbuilding technologies and leading efforts to integrate hydrogen systems into large-scale vessels. Samsung Heavy Industries and Daewoo Shipbuilding & Marine Engineering (DSME) are actively involved in hydrogen-related projects, with DSME already securing contracts for designing vessels powered by alternative fuels like hydrogen.

China Shipbuilding Industry Corporation (CSIC) is also making significant strides, aligning with China’s push for green shipping solutions. STX Offshore Shipbuilding and Fincantieri are similarly positioning themselves to capitalize on the growing demand for hydrogen ships by exploring green technologies and collaborating on innovative vessel designs.

Companies like thyssenkrupp and Babcock International focus on developing the critical infrastructure and technology needed to support hydrogen-based maritime transport, such as fuel cells, storage solutions, and refueling stations. As government policies and regulations continue to push the adoption of low-emission solutions, these companies are expected to lead the market’s evolution toward sustainable hydrogen-powered shipping solutions.

Top Key Players

- Kawasaki Heavy Industries

- Aker Solutions

- Wood Group

- Babcock Internationa

- TechnipFMC

- STX Offshore Shipbuilding

- Daewoo Shipbuilding Marine Engineering

- Kvaerner

- Samsung Heavy Industries

- thyssenkrupp

- Fincantieri

- Mitsubishi Heavy Industries

- China Shipbuilding Industry Corporation

- Hyundai Heavy Industries

Recent Developments

In 2023, Kawasaki announced an investment of $100 million to enhance hydrogen production and storage technologies, aiming to support the large-scale adoption of hydrogen vessels in the coming years.

In 2024, Aker Solutions continued to expand its role, focusing on providing hydrogen fueling infrastructure and offering technical expertise to shipbuilders. The company also reported that its hydrogen projects contributed to a $350 million increase in revenue, driven by growing demand for sustainable shipping technologies.

In 2024, Wood Group has secured contracts worth over $200 million to provide engineering services for hydrogen projects, further solidifying its position as a key player in the hydrogen maritime sector.

Report Scope

Report Features Description Market Value (2024) USD 0.6 Bn Forecast Revenue (2034) USD 45.3 Bn CAGR (2025-2034) 54.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Merchant Focus, Captive Focus), By Ship Type (Military Ships, Leisure Ships, Recreational Ships, Commercial Ships), By Type of Production (Electrolysis Production, Methanol Production, Petroleum Refining, Ammonia Production) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kawasaki Heavy Industries, Aker Solutions, Wood Group, Babcock Internationa, TechnipFMC, STX Offshore Shipbuilding, Daewoo Shipbuilding Marine Engineering, Kvaerner, Samsung Heavy Industries, thyssenkrupp, Fincantieri, Mitsubishi Heavy Industries, China Shipbuilding Industry Corporation, Hyundai Heavy Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kawasaki Heavy Industries

- Aker Solutions

- Wood Group

- Babcock Internationa

- TechnipFMC

- STX Offshore Shipbuilding

- Daewoo Shipbuilding Marine Engineering

- Kvaerner

- Samsung Heavy Industries

- thyssenkrupp

- Fincantieri

- Mitsubishi Heavy Industries

- China Shipbuilding Industry Corporation

- Hyundai Heavy Industries