Global Shared Mobility Market By Service Type (Ride Hailing, Bike Sharing, Ride Sharing, Car Sharing, Other Service Types), By Vehicle Type (Cars, Two-Wheelers, Other Vehicle Types), By Business Model (P2P, B2B, B2C), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 104120

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

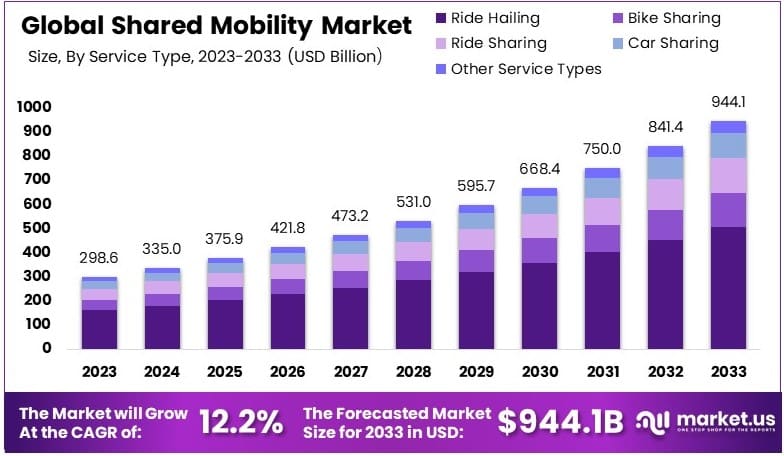

The Global Shared Mobility Market size is expected to be worth around USD 944.1 Billion by 2033, from USD 298.6 Billion in 2023, growing at a CAGR of 12.2% during the forecast period from 2024 to 2033.

Shared mobility refers to the use of transportation services and resources shared among users, reducing the need for private vehicle ownership. Services include car-sharing, bike-sharing, and ride-hailing, offering convenient, on-demand access to vehicles. This model promotes efficient transport and supports urban mobility without adding more private cars.

The shared mobility market includes platforms and companies providing access to shared vehicles, such as cars, bikes, and e-scooters. It caters to urban commuters seeking flexible, cost-effective transport options. This market has grown as cities embrace shared solutions to manage congestion and reduce emissions, with major players driving expansion.

In 2022, riders in the U.S. and Canada took 130 million trips on shared bikes and e-scooters, according to NACTO. Shared micromobility trips have risen 40% since 2018 and increased 35-fold from 2010, indicating strong growth in demand for shared transportation, especially in urban areas.

Car-sharing services continue to grow. Zipcar, a major platform, operates in over 500 cities globally, serving one million members. Car2Go, before merging into Share Now, managed a fleet of 14,000 vehicles across 26 cities in Europe and North America, demonstrating the popularity of flexible, shared car access.

Ride-hailing is another key area of shared mobility. Uber, active in over 900 cities worldwide, reported 93 million monthly users in 2022, reflecting strong demand for on-demand rides. In 2019, consumers globally completed over 15 billion ride-hailing trips, underscoring its essential role in modern urban transport.

Government regulations and urban policies support shared mobility. Smart cities are promoting shared transportation to ease congestion and lower emissions. Public and private investments in shared mobility infrastructure are also increasing, enhancing options for users and encouraging sustainable transport solutions for urban areas.

Key Takeaways

- The Shared Mobility Market was valued at USD 298.6 Billion in 2023 and is projected to reach USD 944.1 Billion by 2033, with a CAGR of 12.2%.

- In 2023, Ride Hailing dominates the service type with 53.7%, fueled by convenience and accessibility.

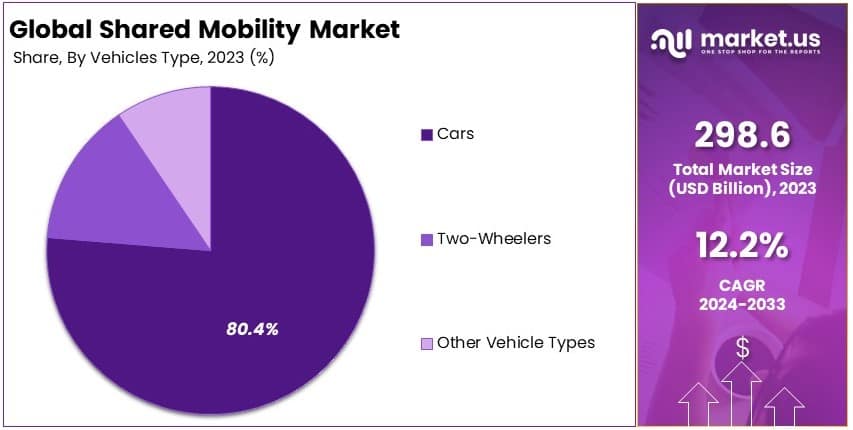

- In 2023, Cars lead the vehicle type with 80.4%, being the most commonly used for shared mobility.

- In 2023, P2P is the dominant business model, emphasizing user-driven vehicle sharing.

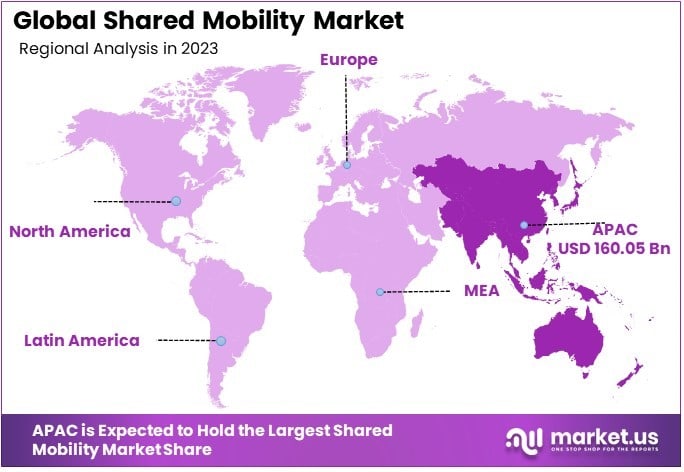

- In 2023, the Asia Pacific region dominates with 53.6% of the market, driven by urbanization and technological advancements.

Service Type Analysis

Ride Hailing dominates with 53.7% due to its convenience and widespread availability.

In the shared mobility market, Ride Hailing is the most significant segment, accounting for 53.7% of the market share. This dominance is primarily due to the ease and convenience of booking rides through mobile applications, which cater to the immediate transportation needs of consumers.

Major players in this segment have enhanced their user interfaces and expanded their services to various regions, significantly boosting user adoption.

Bike Sharing offers an eco-friendly alternative for short-distance travel, rapidly gaining popularity in urban areas where traffic congestion and environmental concerns are significant. This segment contributes to market growth by providing flexible and cost-effective transportation solutions.

Ride Sharing facilitates cost savings and reduced carbon emissions by allowing multiple passengers to share a single vehicle trip. Although smaller in market share compared to ride hailing, its importance is growing among environmentally conscious consumers.

Car Sharing enables users to rent cars for short periods, often by the hour, making it ideal for consumers who do not own vehicles but occasionally need them. The flexibility and economic benefits of car sharing continue to support its growth within the shared mobility market.

Other Service Types include various niche services such as scooter sharing and carpooling, which address specific market needs and contribute to the diversification and resilience of the shared mobility ecosystem.

Vehicle Type Analysis

Cars lead with 80.4% due to their versatility and comfort.

Cars are the dominant vehicle type in the shared mobility market, holding an 80.4% share. This dominance is driven by the widespread preference for cars due to their versatility, comfort, and suitability for varying distances and consumer needs. The availability of different types of cars, from economy to luxury travel, allows service providers to cater to a broad audience.

Two-Wheelers are essential in congested urban areas where navigating traffic quickly and parking conveniently are priorities. They are particularly popular in densely populated cities in Asia and Europe, where high traffic congestion and narrow streets are common.

Other Vehicle Types include electric scooters and motorcycle, which are increasingly popular in cities focused on reducing vehicular emissions. These vehicles support the expansion of shared mobility services into new market segments focused on sustainability.

Business Model Analysis

Peer-to-Peer (P2P) is the leading business model, empowering individuals to monetize their vehicles.

The P2P business model has become a critical component of the shared mobility landscape. In this model, private car owners can rent out their vehicles when they are not in use, effectively turning personal assets into income-generating resources. This model has gained traction due to its mutual benefits for vehicle owners and renters, offering flexibility and a wide variety of vehicles to choose from.

Business-to-Business (B2B) involves agreements between companies, such as those offering company cars to employees or logistic firms using shared fleets for delivery services. This segment is vital for its contribution to operational flexibility and cost efficiency in various industries.

Business-to-Consumer (B2C) is where service providers own the vehicles and rent them directly to consumers. This model is prevalent in traditional car rental services and is integral to maintaining steady revenue streams and controlling service quality directly.

Key Market Segments

By Service Type

- Ride Hailing

- Bike Sharing

- Ride Sharing

- Car Sharing

- Other Service Types

By Vehicles Type

- Cars

- Two-Wheelers

- Other Vehicle Types

By Business Model

- P2P

- B2B

- B2C

Drivers

Urbanization and Increased Population Density Drives Market Growth

Urbanization significantly drives the Shared Mobility Market. As cities grow and population density increases, the demand for efficient transportation solutions rises.

Additionally, higher population density leads to greater congestion, making shared mobility options like car-sharing and ride-hailing more attractive. This shift helps reduce traffic and lowers the overall carbon footprint.

Moreover, urban areas typically have better infrastructure to support shared mobility services. The availability of designated parking spots and pick-up/drop-off locations facilitates the seamless operation of shared mobility platforms.

Furthermore, increased population density creates a larger customer base for shared mobility providers. This concentration of users enables companies to optimize their services and achieve economies of scale, further driving market growth.

Restraints

Regulatory Challenges and Compliance Issues Restraints Market Growth

Regulatory challenges pose significant restraints on the Shared Mobility Market. Navigating varying local laws and obtaining necessary permits can be complex and time-consuming for providers.

Additionally, compliance with safety standards and data protection regulations requires substantial investment. These requirements can increase operational costs and limit the ability of companies to expand quickly.

Furthermore, stringent regulations in certain regions may restrict the types of services that can be offered. This limitation can hinder innovation and prevent providers from fully capitalizing on market opportunities.

Moreover, inconsistent regulatory frameworks across different jurisdictions create uncertainty for shared mobility companies. This uncertainty can deter investment and slow down the overall growth of the market.

Opportunity

Expansion into Emerging Markets Provides Opportunities

Expansion into emerging markets presents substantial opportunities for the Shared Mobility Market. These regions often have rapidly growing urban populations that are increasingly adopting shared mobility solutions.

Additionally, emerging markets may have less developed transportation infrastructure, making shared mobility services more appealing and necessary. This demand creates a fertile ground for new entrants and established players to expand their operations.

Moreover, partnerships with local businesses and governments can enhance market penetration and acceptance. Collaborative efforts can help tailor services to meet the unique needs of these markets, fostering growth and sustainability.

Furthermore, the rising middle class in emerging economies boosts the affordability and accessibility of shared mobility services. As disposable incomes increase, more consumers are likely to opt for convenient and cost-effective transportation alternatives.

Challenges

Data Privacy and Cybersecurity Threats Challenges Market Growth

Data privacy and cybersecurity threats pose significant challenges to the Shared Mobility Market. Protecting user data from breaches and unauthorized access is crucial for maintaining trust and credibility.

Additionally, cyberattacks can disrupt operations and lead to financial losses, affecting the overall stability of shared mobility providers. Ensuring robust security measures requires continuous investment in technology and expertise.

Moreover, concerns over data privacy can deter users from adopting shared mobility services. Consumers are increasingly aware of their digital footprints and may hesitate to share personal information without assurances of protection.

Furthermore, regulatory requirements around data security are becoming more stringent. Compliance with these regulations necessitates ongoing efforts and resources, which can strain the capabilities of shared mobility companies.

Growth Factors

Increasing Investment in Shared Mobility Startups Are Growth Factors

Increasing investment in shared mobility startups acts as a key growth factor for the Shared Mobility Market. Venture capital and private equity firms are recognizing the potential of shared mobility solutions and are funding innovative startups.

Additionally, financial backing enables startups to scale their operations, develop new technologies, and expand into new markets. This influx of capital accelerates the growth and adoption of shared mobility services.

Moreover, investments drive competition, prompting companies to enhance their offerings and improve service quality. This competitive environment fosters innovation and leads to the development of more efficient and user-friendly mobility solutions.

Furthermore, strategic partnerships and acquisitions fueled by investment can strengthen the market position of shared mobility providers. These collaborations facilitate the integration of complementary services and technologies, further driving market growth.

Emerging Trends

Rise of Micromobility Options Is Latest Trending Factor

The rise of micromobility options is the latest trending factor driving the Shared Mobility Market. Solutions like e-scooters and bike-sharing services are gaining popularity, especially in urban areas.

Additionally, micromobility offers a convenient and eco-friendly alternative for short-distance travel. This trend aligns with the growing consumer preference for sustainable transportation options.

Moreover, the integration of micromobility with existing shared mobility platforms enhances the overall user experience. Seamless connectivity between different modes of transport provides greater flexibility and convenience for users.

Furthermore, advancements in technology have made micromobility options more accessible and efficient. Innovations such as GPS tracking and mobile app integrations facilitate easy access and usage, contributing to the trend’s momentum.

Regional Analysis

Asia Pacific Dominates with 53.6% Market Share

Asia Pacific leads the Shared Mobility Market with a 53.6% share, totaling USD 160.05 billion. This dominance is driven by rapid urbanization, high population density, and strong adoption of ride-hailing, car-sharing, and bike-sharing services. Key markets include China, India, and Japan, where shared mobility is a popular solution for daily commuting.

The region benefits from supportive government policies, cost-effective transportation, and increasing smartphone penetration. Additionally, rising environmental awareness and heavy investment in smart city initiatives support market performance. The presence of major players and tech start-ups further accelerates the adoption of shared mobility services.

Asia Pacific’s presence in the shared mobility market is expected to strengthen. Ongoing developments in electric vehicles (EVs), expanding digital infrastructure, and government initiatives for sustainable transport will drive further growth.

Regional Mentions:

- North America: North America maintains steady growth, driven by high adoption of ride-hailing and car-sharing services, along with strong digital connectivity.

- Europe: Europe sees significant demand due to government incentives for shared mobility and a strong focus on reducing carbon emissions through public transport alternatives.

- Middle East & Africa: The region shows moderate growth, supported by increasing urbanization and growing investments in infrastructure, particularly in cities like Dubai and Riyadh.

- Latin America: Latin America shows potential, driven by expanding urban centers and increasing adoption of ride-hailing services in major markets like Brazil and Mexico.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The shared mobility market is expanding, fueled by rising urbanization, convenience, and the shift towards sustainable transportation. The top four companies in this sector are Grab Holdings Inc., Uber Technologies Inc., Beijing Xiaoju Technology Co., Ltd. (Didi), and Lyft Inc. They maintain strong positions through diverse services, extensive networks, and strategic partnerships.

Grab Holdings Inc. leads the Southeast Asian market, offering ride-hailing, car rentals, and bike-sharing services. It has built a robust network, leveraging digital payment systems and localized services to enhance user experience and convenience.

Uber Technologies Inc. is a global leader, offering a wide range of mobility options, including ridesharing, micromobility, and car rentals. Its focus on technology, autonomous vehicle development, and global expansion reinforces its position.

Beijing Xiaoju Technology Co., Ltd. (Didi) dominates the Chinese market, providing diverse mobility solutions. It emphasizes AI-based ride-matching and safety features, boosting user satisfaction and market share.

Lyft Inc. is a key player in the North American market, focusing on ridesharing, e-scooters, and bike-sharing. Its commitment to sustainable transportation, combined with strategic collaborations, supports its growth.

These companies drive growth through continuous innovation, local adaptation, and a focus on sustainable mobility, making them leaders in the shared mobility market.

Top Key Players in the Market

- Grab Holdings Inc.

- Uber Technologies Inc.

- Beijing Xiaoju Technology Co, Ltd.

- Lyft Inc.

- Zipcar Inc.

- Bolt Technology OÜ

- Enterprise Holdings Inc.

- HERTZ SYSTEM, INC.

- Deutsche Bahn Connect GmbH

- ANI Technologies Private Limited

- Polaris Inc.

- Careem Inc.

- Blu-Smart Mobility Pvt. Ltd.

- Meru Mobility Tech Pvt. Ltd.

- Other Key Players

Recent Developments

- Yulu: In April 2024, Yulu, an electric mobility startup, introduced a franchise-led model in Indore, India, through its Yulu Business Partner (YBP) program. This approach combines Yulu’s technology with local market knowledge, enabling entrepreneurs to operate Yulu’s shared mobility services and expand its presence across India.

- May Mobility and CCTA: In September 2024, May Mobility and the Contra Costa Transportation Authority launched PRESTO, a shared autonomous vehicle service in Martinez, California, to enhance healthcare access by providing transportation to the Contra Costa Regional Medical Center. This service highlights the role of autonomous technology in public transit.

- Tata Motors: In August 2024, Tata Motors unveiled the Tata Ultra EV 7M, a zero-emission intra-city electric bus, at the Prawaas 4.0 event, underscoring Tata’s commitment to sustainable urban mobility. The Ultra EV 7M addresses the demand for eco-friendly transportation in urban areas.

Report Scope

Report Features Description Market Value (2023) USD 298.6 Billion Forecast Revenue (2033) USD 944.1 Billion CAGR (2024-2033) 12.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Ride Hailing, Bike Sharing, Ride Sharing, Car Sharing, Other Service Types), By Vehicle Type (Cars, Two-Wheelers, Other Vehicle Types), By Business Model (P2P, B2B, B2C) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Grab Holdings Inc., Uber Technologies Inc., Beijing Xiaoju Technology Co, Ltd., Lyft Inc., Zipcar Inc., Bolt Technology OÜ, Enterprise Holdings Inc., HERTZ SYSTEM, INC., Deutsche Bahn Connect GmbH, ANI Technologies Private Limited, Polaris Inc., Careem Inc., Blu-Smart Mobility Pvt. Ltd., Meru Mobility Tech Pvt. Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Grab Holdings Inc.

- Uber Technologies Inc.

- Beijing Xiaoju Technology Co, Ltd.

- Lyft Inc.

- Zipcar Inc.

- Bolt Technology OÜ

- Enterprise Holdings Inc.

- HERTZ SYSTEM, INC.

- Deutsche Bahn Connect GmbH

- ANI Technologies Private Limited

- Polaris Inc.

- Careem Inc.

- Blu-Smart Mobility Pvt. Ltd.

- Meru Mobility Tech Pvt. Ltd.

- Other Key Players