Global Seed Packaging Market Size, Share, Growth Analysis By Material (Plastic, Fabric, Jute, Paper & Paperboard), By Product (Bags, Pouches, Containers, Bottles & Jars), By End Use (Agriculture, Forestry, Oil Production, Gardening), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 150650

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

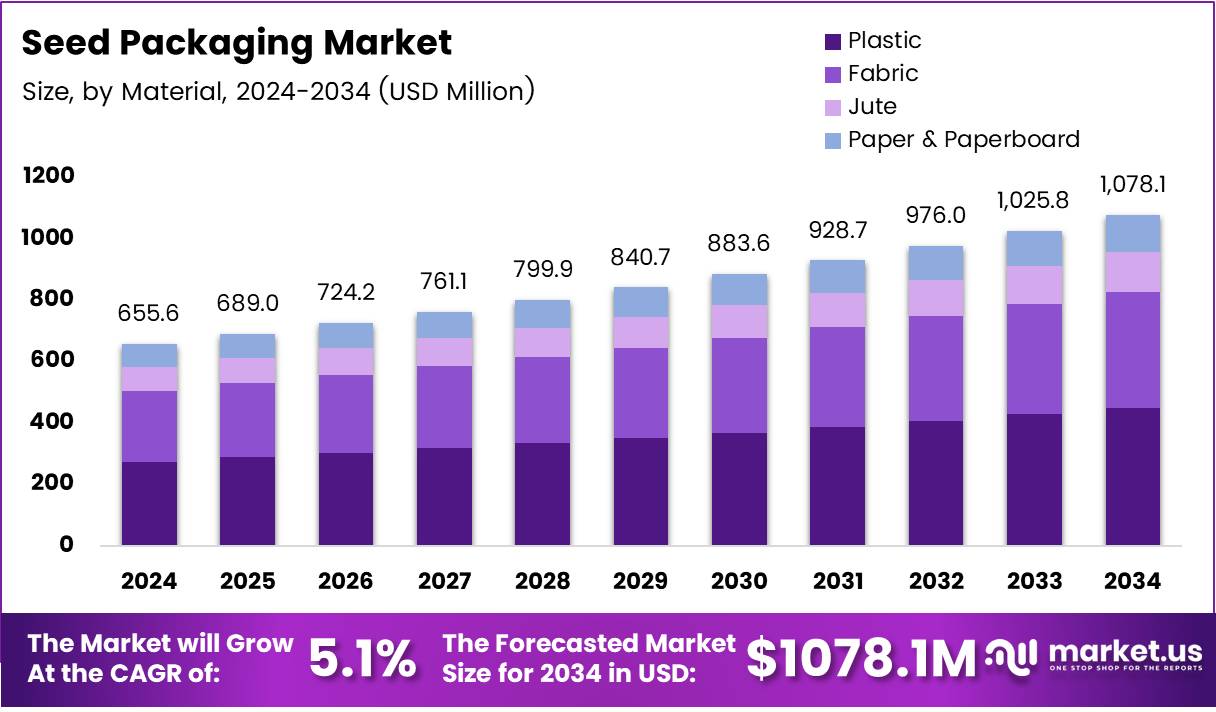

The Global Seed Packaging Market size is expected to be worth around USD 1078.1 Million by 2034, from USD 655.6 Million in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The Seed Packaging Market plays a critical role in preserving seed quality, extending shelf life, and facilitating transportation. It involves using materials like polythene, cloth, paper, and foil to maintain seed integrity from production to sowing. As seed quality directly influences agricultural output, the market supports both commercial and subsistence farming sectors.

In recent years, the seed packaging market has witnessed steady growth due to rising global food demand and improved awareness among farmers. Government initiatives to support high-yield and hybrid seeds further fuel this growth. Additionally, export-oriented seed production increases the demand for durable, high-quality packaging.

According to ICAR, polythene bags maintained acceptable seed germination in eggplant for up to 15 months, while cloth bags retained it for up to 12 months. This highlights the direct impact of packaging type on seed viability and supports the trend toward more advanced material use in seed packaging.

Furthermore, as per SSRN, packaging materials significantly affect (P<0.05) seed characteristics like germination rate, moisture content, and seed weight. This underscores the importance of research-backed material selection, which is becoming a key differentiator for market players.

Government investments in agriculture, particularly in developing regions, are boosting demand for quality seed packaging. Policies promoting seed preservation and storage infrastructure are positively impacting market expansion and standardization of packaging norms.

The seed packaging industry is also responding to regulatory shifts aimed at reducing plastic waste. This opens new opportunities for biodegradable and recyclable packaging solutions, catering to both sustainability and functionality demands.

Transitioning to digital farming and e-commerce seed platforms is increasing the need for branded, informative, and tamper-proof seed packaging. This trend is further supported by traceability requirements in global seed trade regulations.

Opportunities are also growing in climate-resilient seed packaging, particularly in regions prone to moisture, pests, and temperature fluctuations. Vendors are investing in R&D to develop packaging with enhanced barrier properties and extended shelf-life capabilities.

Growth in hybrid and genetically modified (GM) seed markets is pushing packaging providers to ensure safe handling, identity preservation, and regulatory compliance. These segments offer higher profit margins and long-term business potential.

Additionally, expansion of contract farming and seed banks is adding pressure to develop standardized packaging systems that support efficient storage and bulk distribution across geographies.

Key Takeaways

- The Global Seed Packaging Market is projected to reach USD 1078.1 Million by 2034, up from USD 655.6 Million in 2024.

- The market is expected to grow at a CAGR of 5.1% from 2025 to 2034.

- In 2024, Plastic accounted for a 46.2% share in the By Material segment, driven by its cost-effectiveness and protective properties.

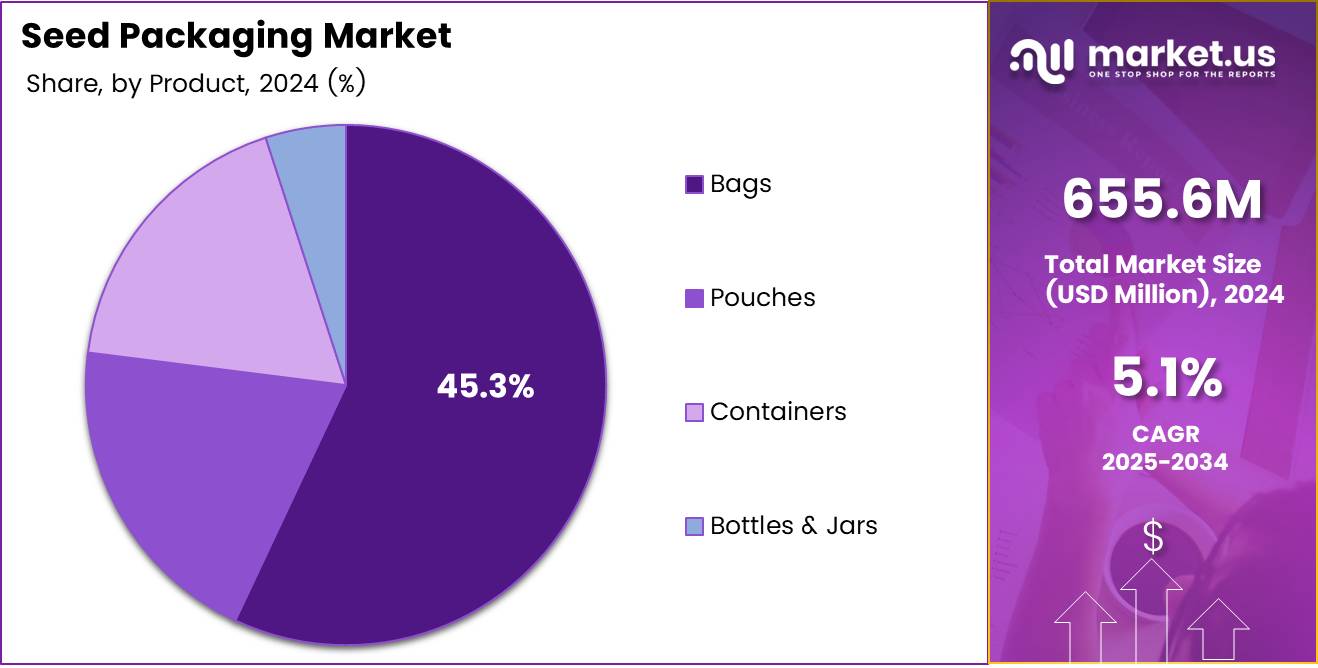

- Bags led the By Product segment in 2024 with a 45.3% market share, favored for their flexibility and ease of use.

- Agriculture dominated the By End Use segment with a 60.1% share in 2024, owing to high-volume seed usage in commercial farming.

Material Analysis

Plastic leads with 46.2% owing to its durability and moisture resistance.

In 2024, Plastic held a dominant market position in the By Material Analysis segment of the Seed Packaging Market, with a 46.2% share. The widespread use of plastic is attributed to its superior barrier properties, cost-effectiveness, and lightweight nature, making it highly suitable for long-distance transportation of seeds.

Fabric emerged as a sustainable yet niche solution in this category, offering breathability and strength. It appeals to businesses looking for reusable and environment-conscious packaging options.

Jute followed closely behind, benefiting from increasing demand for biodegradable and natural materials. Although it remains a smaller segment, jute packaging is being favored for its eco-friendly perception.

Paper & Paperboard contributed to the segment as an economical and recyclable option. It’s commonly used in smaller-scale or regional seed distribution where packaging aesthetics and printability are important.

Product Analysis

Bags dominate with 45.3% due to flexibility and ease of handling.

In 2024, Bags held a dominant market position in the By Product Analysis segment of the Seed Packaging Market, with a 45.3% share. Bags are preferred for their versatility, capacity range, and user convenience, especially in agricultural and industrial-scale operations.

Pouches offer a compact and modern alternative to traditional bags. Their re-sealable and easy-to-store nature has made them increasingly popular for retail-oriented seed packaging.

Containers provide rigid protection and are often used for premium seed products that require enhanced protection during transport or extended storage periods.

Bottles & Jars, though representing a smaller segment, cater to niche markets such as garden seeds or specialty plant varieties, where visual presentation and consumer appeal play a key role.

End Use Analysis

Agriculture leads the field with 60.1% driven by large-scale seed consumption.

In 2024, Agriculture held a dominant market position in the By End Use Analysis segment of the Seed Packaging Market, with a 60.1% share. This dominance is propelled by the scale and frequency of seed use in commercial farming, which demands durable, bulk packaging solutions.

Forestry accounted for a modest share, supporting the packaging needs of saplings and reforestation initiatives. The requirement for protective and moisture-resistant packaging is key in this segment.

Oil Production used seed packaging for specific crops such as sunflower or canola, where quality preservation and controlled storage conditions are crucial to maintain seed viability.

Gardening, while a smaller end-use category, plays a growing role in urban and home-scale cultivation. The packaging here emphasizes visual appeal, smaller volumes, and easy handling for consumers.

Key Market Segments

By Material

- Plastic

- Fabric

- Jute

- Paper & Paperboard

By Product

- Bags

- Pouches

- Containers

- Bottles & Jars

By End Use

- Agriculture

- Forestry

- Oil Production

- Gardening

Drivers

Rising Demand for Hybrid and Genetically Modified Seeds Drives Market Growth

The growing demand for hybrid and genetically modified (GM) seeds is a key driver of the seed packaging market. These seeds often require special packaging to maintain quality, prevent contamination, and ensure long shelf life. As farmers shift to high-yield varieties, the need for robust packaging is increasing.

Governments around the world are promoting advanced agricultural practices. Initiatives like subsidies and awareness campaigns are pushing farmers to use better-quality seeds. As a result, packaging companies are witnessing higher demand for efficient and protective seed packaging solutions.

E-commerce platforms are becoming popular channels for selling agricultural inputs, including seeds. With the rise of online seed purchases, the demand for tamper-proof and clearly labeled packaging has gone up, ensuring safe delivery and product authenticity.

Precision agriculture technologies are being adopted to increase productivity. These technologies often require specific seed types, which come with tailored packaging needs. This trend is boosting the market for innovative and smart seed packaging designs.

Restraints

Volatile Raw Material Prices for Packaging Materials Limit Market Expansion

Fluctuating prices of raw materials like plastic, paper, and bio-materials create cost pressures for seed packaging manufacturers. These uncertainties affect profitability and limit scalability, especially for small packaging firms.

In many emerging agricultural regions, infrastructure for modern packaging and logistics is lacking. This limitation slows down the market’s ability to expand and reach remote farming areas effectively.

Environmental issues related to plastic waste are becoming more serious. Since many seed packages are still plastic-based, companies face rising criticism and pressure to shift to eco-friendly materials, increasing overall production costs.

Global trade regulations related to seed packaging are complex and vary from one country to another. Complying with all these standards makes international expansion challenging for packaging providers.

Growth Factors

Development of Smart and Interactive Packaging Solutions Creates New Avenues

Smart packaging that monitors temperature, humidity, and other conditions can help ensure seed quality during storage and transport. As demand for high-value seeds grows, such intelligent packaging offers new growth opportunities.

Many markets in Sub-Saharan Africa and Southeast Asia remain untapped. As agriculture modernizes in these regions, the demand for reliable and protective seed packaging is expected to rise significantly.

Partnerships between agri-tech startups and packaging firms are becoming more common. These collaborations help create innovative, functional, and affordable seed packaging that meets both modern farming and environmental needs.

Using blockchain in seed packaging helps track the product from source to sale. This technology enhances transparency and builds trust among buyers, making it a promising area for market growth.

Emerging Trends

Surge in Use of Biodegradable and Compostable Packaging Materials Influences Market Trends

With growing environmental awareness, many companies are switching to biodegradable and compostable packaging. These alternatives reduce pollution and appeal to eco-conscious farmers and distributors.

QR codes and digital labeling are being widely adopted. They offer easy access to vital information like planting instructions, expiry dates, and authenticity checks, enhancing the customer experience.

Brands are customizing their packaging to stand out. Seed packages are now being designed not just for function but also for brand identity, which is becoming a key marketing tool in the agricultural sector.

Augmented Reality (AR) is finding its way into packaging. Through AR-enabled packaging, customers can view 3D visuals of planting guides and product information, improving engagement and education.

Regional Analysis

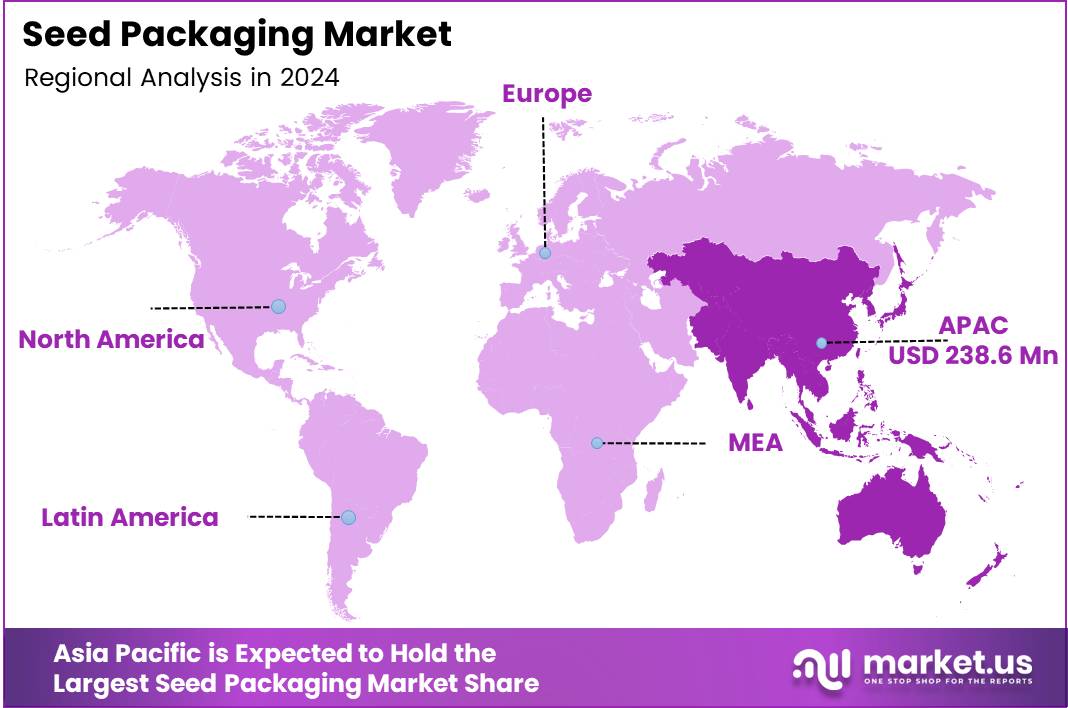

Asia Pacific Dominates the Seed Packaging Market with a Market Share of 36.4%, Valued at USD 238.6 Million

The Asia Pacific region leads the global seed packaging market, holding a significant share of 36.4%, and reaching a value of USD 238.6 million. The dominance is attributed to increasing agricultural activities, rising demand for high-yield seeds, and government initiatives to promote sustainable farming practices. Emerging economies such as India and China are central to this growth, driven by technological advancements in seed preservation and packaging.

North America Seed Packaging Market Trends

North America holds a substantial share in the seed packaging market due to its advanced agricultural infrastructure and early adoption of innovative farming techniques. The region is witnessing consistent demand for eco-friendly and high-performance packaging materials. In addition, regulatory support for quality assurance in seed production further strengthens market growth in the region.

Europe Seed Packaging Market Trends

Europe’s seed packaging market is bolstered by a growing focus on sustainable agricultural practices and strict quality standards. The demand is further amplified by technological innovation in biodegradable and recyclable packaging materials. Countries like Germany and France are leading contributors, benefiting from strong agri-tech support systems and research facilities.

Middle East and Africa Seed Packaging Market Trends

The Middle East and Africa region is showing gradual growth in the seed packaging market, mainly driven by expanding agricultural activities in parts of Sub-Saharan Africa and government efforts to boost food security. Although still emerging, the adoption of better seed packaging methods is on the rise to combat climatic challenges and improve crop yields.

Latin America Seed Packaging Market Trends

Latin America is experiencing moderate growth in the seed packaging sector, supported by the expansion of commercial farming in countries like Brazil and Argentina. The rising demand for genetically modified and hybrid seeds is encouraging the use of durable and efficient packaging solutions. Improvements in rural logistics and export capabilities also contribute to market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Seed Packaging Company Insights

In 2024, the global Seed Packaging Market is witnessing strategic developments and product innovations driven by key players aiming to enhance sustainability, durability, and efficiency in seed protection and logistics.

J&C Packaging continues to strengthen its position through eco-friendly packaging solutions, catering to the rising demand for sustainable materials. Their focus on customized seed pouches has helped address niche agricultural needs.

ProAmpac leverages its advanced flexible packaging technology to offer moisture-resistant and light-protective seed packaging. The company is also actively investing in recyclable and compostable formats to meet global regulatory pressures.

Jam Jams Group is expanding its international reach, providing cost-effective and high-quality packaging for seeds in emerging markets. Their adaptability in serving both large-scale agriculture and small-scale farmers boosts their competitiveness.

Berry Global Inc. remains a dominant force through innovation in multi-layer film technologies that extend seed shelf life. Their robust distribution network and R&D investment enable consistent product enhancements aligned with agricultural demands.

These companies are collectively pushing the market toward greater sustainability, innovation, and geographic expansion, reflecting broader shifts in consumer expectations and regulatory environments in the seed industry.

Top Key Players in the Market

- J&C Packaging

- ProAmpac

- Jam Jams Group

- Berry Global Inc.

- Marudhar Industries Limited

- Amcor plc

- Advanced Industries Packaging

- SÜDPACK

- JBM Packaging

- GT Packers

- NNZ

- Giriraj Flexipack

- Dune Packaging Limited

- XIFA Group

- BYD Company

Recent Developments

- In Dec 2024, Bpacks logs €1M pre-seed funding to develop the world’s first bark-based, 100% compostable packaging.

This investment underscores growing investor confidence in sustainable packaging solutions driven by natural raw materials. - In Sep 2024, the biotech-driven startup secures ₹24.8 crores in seed funding to accelerate innovation in eco-friendly, biodegradable materials.

The funds will support research, scaling production, and expanding into new sustainable markets globally. - In Oct 2023, seed packaging using woven bags gained attention for providing a complete barrier to gas and moisture.

These woven bags also protect the seeds from direct light, enhancing shelf life and maintaining quality.

Report Scope

Report Features Description Market Value (2024) USD 655.6 Million Forecast Revenue (2034) USD 1078.1 Million CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastic, Fabric, Jute, Paper & Paperboard), By Product (Bags, Pouches, Containers, Bottles & Jars), By End Use (Agriculture, Forestry, Oil Production, Gardening) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape J&C Packaging, ProAmpac, Jam Jams Group, Berry Global Inc., Marudhar Industries Limited, Amcor plc, Advanced Industries Packaging, SÜDPACK, JBM Packaging, GT Packers, NNZ, Giriraj Flexipack, Dune Packaging Limited, XIFA Group, BYD Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- J&C Packaging

- ProAmpac

- Jam Jams Group

- Berry Global Inc.

- Marudhar Industries Limited

- Amcor plc

- Advanced Industries Packaging

- SÜDPACK

- JBM Packaging

- GT Packers

- NNZ

- Giriraj Flexipack

- Dune Packaging Limited

- XIFA Group

- BYD Company