Global Second Generation Biofuel Market Size, Share Analysis Report By Fuel Type (Cellulosic Ethanol, Biodiesel, Bio-Butanol, Renewable Diesel, Bio-DME, Sustainable Aviation Fuel, and Others), By Feedstock (Lignocellulosic Biomass, Agricultural Residues, Forest Residues, Municipal Solid Waste (MSW), and Others), By End-User (Automotive and Road Transportation, Aviation, Marine, and Industrial And Power), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 160026

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

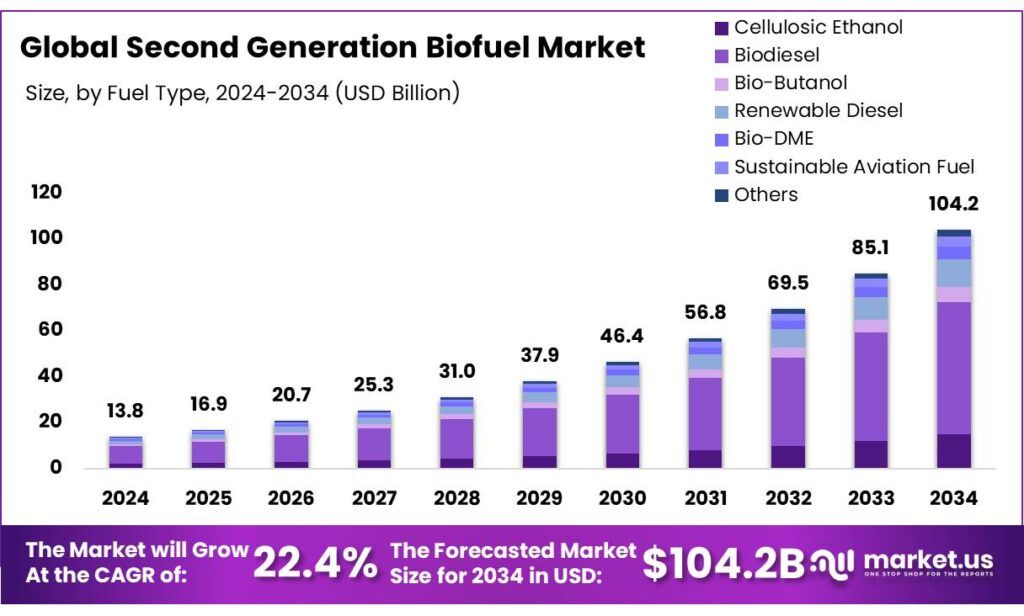

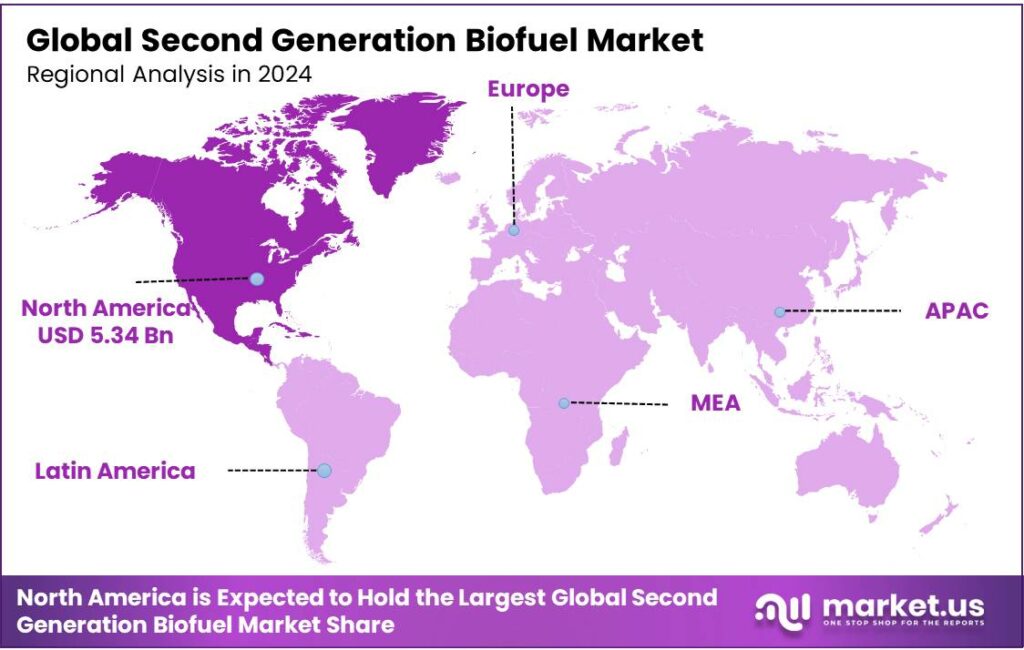

The Global Second-Generation Biofuel Market size is expected to be worth around USD 104.2 Billion by 2034, from USD 13.8 Billion in 2024, growing at a CAGR of 22.4% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 38.7% share, holding USD 5.34 Billion in revenue

Second-generation biofuels are a type of advanced fuel produced from non-food sources such as agricultural waste, forestry residues, or dedicated energy crops. These fuels, such as cellulosic ethanol and Fischer-Tropsch diesel, aim to avoid the food vs. fuel conflict of first-generation biofuels by using non-edible feedstocks and offer potential advantages over fossil fuels.

- In 2023, renewable fuel demand in industry, buildings, and transport stands at 22 EJ, which is 5% of global energy demand for these sectors.

As there is a global shift towards renewable energy, the demand for second-generation biofuels surges due to their help in climate change mitigation. Bioenergy, including liquid, gaseous, and solid fuels, is estimated to account for the vast majority, around 95%, of renewable fuel growth in the coming decade. Additionally, the market is characterized by the policy frameworks in countries, government investments, and technological advancements in the production of these fuels. The growth of biofuels is concentrated in the United States, Europe, Brazil, Indonesia, and India, which together account for 85%.

- According to the International Energy Agency (IEA), in 2022, global biofuel demand reached a record high of 4.3 EJ, which is approximately 170,000 million liters, surpassing pre-pandemic levels from 2019, highlighting their growing importance in the push for sustainable transportation.

Biodiesel is the most used second-generation fuel due to its production capacities. In addition, these fuels are mostly used in automotive and transportation applications. Globally, road biofuel demand expanded by 27 billion liters, 0.8 EJ, and aviation and maritime fuel use increased to nearly 9 billion liters, 0.3 EJ. However, according to the IEA, by 2030, aviation and shipping are estimated to be responsible for more than 75% of new biofuel demand.

Key Takeaways

- The global second-generation biofuel market was valued at USD 13.8 billion in 2024.

- The global second-generation biofuel market is projected to grow at a CAGR of 22.4% and is estimated to reach USD 104.2 billion by 2034.

- Based on the type of fuel, biodiesel dominated the second-generation fuel market in 2024, comprising about 55.4% share of the total global market.

- Based on the feedstock, biofuel produced from lignocellulosic biomass led the second-generation fuel market with 35.6% of the total global consumption.

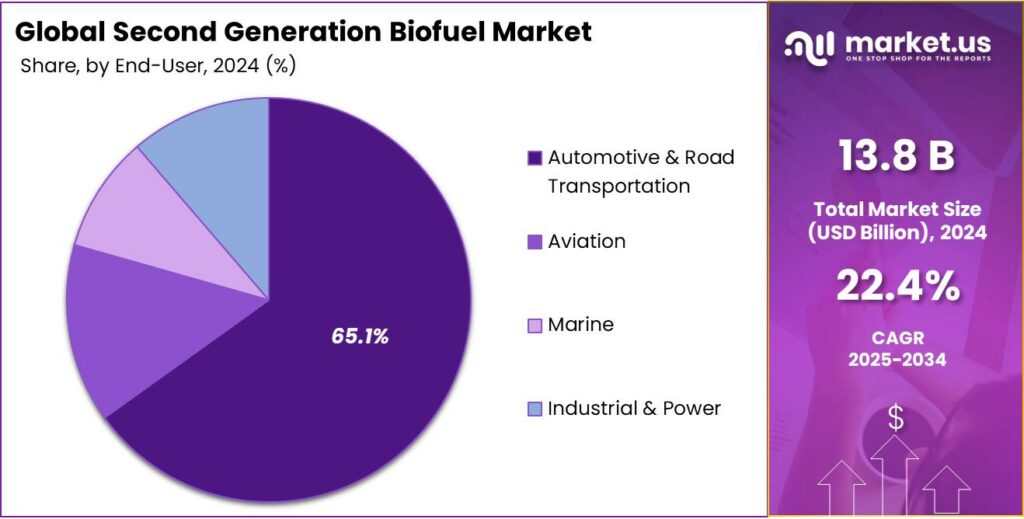

- Among the end-users of second-generation biofuel, automotive & road transportation dominated the market in 2024, accounting for around 65.1% of the market share.

- North America was the largest market for second-generation biofuel in 2024, accounting for around 38.7% of the total market share.

Fuel Type Analysis

Biodiesel Dominated the Second-Generation Biofuel Market in 2024.

On the basis of fuel type, the second-generation biofuel market is segmented into cellulosic ethanol, biodiesel, bio-butanol, renewable diesel, bio-DME, sustainable aviation fuel, and others. Biodiesel dominated the second-generation biofuel market in 2024 with a market share of 55.4%. In 2023, global FAME biodiesel production neared 50 billion liters. Indonesia led with 14 billion liters, followed by the EU at 13 billion liters and Brazil at 8 billion liters. It is the most widely used second-generation biofuel due to its relatively simpler production process and compatibility with existing diesel engines and infrastructure.

- Indonesia leads global biodiesel production with 13.65 billion liters, followed by Brazil, the U.S., and Germany.

- The U.S. is the third largest biodiesel producer globally and exported around 7.15 million barrels in 2022.

- Biodiesels production adds roughly $32,823 in profit to a 1,000-acre farm, according to the U.S. Department of Agriculture.

- The U.S. is on track to surpass 5 billion gallons of combined biodiesel and renewable diesel consumption in 2024.

It can be produced from a variety of non-food feedstocks such as used cooking oil, animal fats, and non-edible plant oils, which are more readily available and easier to process than lignocellulosic biomass required for cellulosic ethanol or bio-butanol. Additionally, biodiesel meets established fuel standards and can be blended easily with petroleum diesel, requiring no major engine modifications. Its lower production cost and faster commercialization have made it more accessible than other advanced fuels.

Feedstock Analysis

Fuels Produced from Lignocellulosic Biomass Led the Second-Generation Biofuel Market.

On the basis of feedstock, the second-generation biofuel market is segmented into lignocellulosic biomass, agricultural residues, forest residues, municipal solid waste (MSW), and others. Lignocellulosic biomass fuels dominated the market in 2024 with a market share of 35.6%. Second-generation biofuels are mostly produced from lignocellulosic biomass because it offers a more consistent, energy-dense, and abundant source of non-food organic material compared to agricultural residues, forest residues, or municipal solid waste (MSW).

Lignocellulosic biomass, such as dedicated energy crops like switchgrass, miscanthus, or fast-growing trees, is specifically cultivated or harvested for biofuel production, ensuring better control over quality and supply. In contrast, agricultural and forest residues are seasonal and scattered, making collection and transport more challenging, while MSW is highly heterogeneous and often contaminated, requiring complex sorting and pretreatment. This makes lignocellulosic biomass a more reliable and scalable feedstock for biofuel production.

End-User Analysis

In 2024, the Second-Generation Biofuel Market was Primarily Driven by Automotive & Road Transportation.

Based on the end-users of second-generation biofuels, the market is divided into automotive & road transportation, aviation, marine, and industrial & power. These biofuels are used in large amounts in automotive and road transportation, with around 65.1% of the market share. Most second-generation biofuels are used in automotive and road transportation because these sectors have more flexible fuel infrastructure and engine compatibility compared to aviation, marine, or industrial power. Liquid biofuels, with over 1.1 EJ, account for the most growth in the transport sector, since they are compatible with the existing vehicle fleet with minimal modifications, making adoption easier and more cost-effective.

In contrast, aviation and marine fuels require very specific properties for safety, energy density, and performance, which advanced biofuels like sustainable aviation fuel or bio-DME are still developing at scale. Additionally, regulatory frameworks and incentives have historically focused more on road transport emissions, accelerating second-generation biofuel use in this sector. While biofuels for road transport dominate expansion, new policies for aviation and maritime biofuels spur nearly 30% of new demand in the transport sector overall.

Key Market Segments

By Fuel Type

- Cellulosic Ethanol

- Biodiesel

- Bio-Butanol

- Renewable Diesel

- Bio-DME

- Sustainable Aviation Fuel

- Others

By Feedstock

- Lignocellulosic Biomass

- Agricultural Residues

- Forest Residues

- Municipal Solid Waste (MSW)

- Others

By End-User

- Automotive & Road Transportation

- Aviation

- Marine

- Industrial & Power

Drivers

Demand for Climate Change Mitigation Drives the Second-Generation Biofuel Market.

The growing demand for effective climate change mitigation strategies is a key driver of the second-generation biofuel market. Unlike first-generation biofuels, which are produced from food crops such as corn and sugarcane, second-generation biofuels are derived from non-food lignocellulosic biomass such as agricultural residues, forest waste, and dedicated energy crops such as switchgrass and miscanthus.

This reduces competition for food resources and lowers greenhouse gas emissions significantly. Burning one gallon of gasoline produces approximately 8.89 kilograms of CO2, the primary greenhouse gas from fuel combustion. Depending on the type of advanced biofuel used, the lifecycle greenhouse gas emissions can be reduced by 40-85% compared to gasoline. For instance, in the best-case scenario, cellulosic ethanol can reduce greenhouse gas emissions by up to 86% compared to gasoline. Countries such as the United States, China, India, and Brazil are investing heavily in biorefineries that convert waste biomass into sustainable fuels.

Restraints

Limited Availability of Feedstock and Operational Challenge of Scaling Up Might Hamper the Growth of the Market.

Despite its potential, the second-generation biofuel market faces significant challenges related to feedstock availability and the complexities of scaling up production. Lignocellulosic biomass, such as agricultural residues, forestry waste, and dedicated energy crops, is not always readily available in sufficient quantities at consistent quality. Seasonal variability, logistical constraints, and competition with other uses such as animal bedding or soil enhancement limit its accessibility.

According to the U.S. Department of Energy, although over 1 billion tons of biomass are theoretically available annually in the United States, only a fraction is economically collectible due to infrastructure and transportation issues. Additionally, scaling up from pilot to commercial-scale bio-refineries presents technical and operational hurdles, including maintaining process efficiency, ensuring reliable enzyme performance at scale, and managing large volumes of heterogeneous feedstock. These issues could slow the market’s progress without targeted solutions.

Opportunity

Policy Frameworks Create Opportunities in the Second-Generation Biofuel Market.

Supportive policy frameworks play a crucial role in creating opportunities for the development and deployment of second-generation biofuels. Governments around the world are implementing mandates, subsidies, and regulatory incentives to encourage the production of low-carbon fuels from non-food biomass. For instance, the European Union’s Renewable Energy Directive (RED II) sets targets for renewable energy in transport, specifically promoting the use of advanced biofuels derived from agricultural and forestry residues.

Similarly, according to the IEA, meeting net-zero goals by 2050 would require biofuels to account for nearly 30% of total transport energy. The support policies vary by fuel, sector, and country, but often include a combination of mandates, GHG performance criteria, and direct production and CAPEX investment incentives. For instance, in September 2025, the federal government of Canada announced plans to invest CA$370 million in biofuel production incentives. These policy-driven initiatives are vital for scaling sustainable fuel alternatives.

Trends

Focus on Technological Advancements.

Technological advancements continue to be a key trend shaping the second-generation biofuel market, enabling more efficient and cost-effective production. For instance, the use of algae for producing bio-oils and renewable diesel. Industries in the aviation and marine sectors are recognizing the potential of algae-based fuels, as they solve a major problem of feedstock availability. Similarly, innovations in pretreatment processes, such as pyrolysis, have significantly improved the breakdown of organic waste into bio-oil, biochar, and gases rich in carbon monoxide and hydrogen. These outputs serve as building blocks for various end products, such as liquid transportation fuels and green chemicals.

Furthermore, startups and biotech giants alike are employing synthetic biology to create genetically modified organisms (GMOs). The approach is trying to develop microbes and enzymes that can efficiently convert biomass and waste materials into advanced biofuels. Moreover, emerging technologies like consolidated bioprocessing (CBP) integrate enzyme production, hydrolysis, and fermentation into a single step, streamlining the biofuel production chain. These innovations are essential to improving scalability and commercial viability in the second-generation biofuel sector.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Second-Generation Biofuel Market.

Geopolitical tensions can significantly impact the second-generation biofuel market by disrupting supply chains, altering trade policies, and shifting energy security priorities. Conflicts or diplomatic strains can hinder the global movement of critical components such as enzymes, catalysts, or specialized machinery required for bio-refinery operations.

- For instance, amidst the Israel-Iran conflict, in the Middle East, low sulfur gas oil (LSGO) prices surged from US$84/mt to US$716/mt, reflecting broader energy market volatility stemming from the conflict.

Similarly, used cooking oil (UCO) markets displayed regional variations, with Netherlands EXW prices holding steady at EUR 1,033/mt while Chinese FOB prices moderated to US$990/mt from US$1,000/mt. However, current US import tariffs of 55% on Chinese goods create significant cost barriers for UCO imports. On the other hand, global instability can redirect public funds away from renewable energy initiatives toward immediate defense or humanitarian needs. For instance, the Russia-Ukraine conflict disrupted agricultural output and trade in Europe, affecting biomass availability like wheat straw, a key feedstock for second-generation biofuels in the region.

Regional Analysis

North America was the Largest Market for Second-Generation Biofuel in 2024.

North America held the major share of the global second-generation biofuel market, valued at around US$5.34 billion, commanding an estimated 38.7% of the total revenue share. The U.S. and Brazil produced 80% of the total ethanol produced globally. The region has emerged as the largest market for biofuels, largely due to strong policy support, technological leadership, and abundant biomass resources. The United States, in particular, has implemented comprehensive regulations such as the Renewable Fuel Standard (RFS), which mandates that the transportation fuel sold in the United States contain a minimum volume of renewable fuels.

- According to IEA, in 2023, ethanol production reached 116 billion liters, which was around 70% of liquid biofuels, and the U.S. and Brazil, combined, produced 80% of it.

Additionally, the country produces large quantities of agricultural residues with estimates around over 140 million dry tons per year from major crops alone, including corn stover and wheat straw, that serve as key feedstocks for lignocellulosic biofuel production. Similarly, leading bio-refineries such as POET-DSM’s Project LIBERTY in Iowa and DuPont’s Nevada plant in Iowa, although closed, have played a pioneering role in commercializing cellulosic ethanol.

Furthermore, Canada is advancing in the sector, with supportive federal and provincial clean fuel standards encouraging the development of low-carbon fuel alternatives. The combination of favorable policy frameworks, research & development investment, and feedstock availability positions North America at the forefront of second-generation biofuel innovation and adoption.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major global participants in the second-generation biofuel market are Neste Oyj, POET-DSM Advanced Biofuels, Abengoa Bioenergy, INEOS Bio, Valero/Green Diesel JV, TotalEnergies, Clariant AG, GranBio, DuPont Industrial Biosciences, Enerkem, Beta Renewables, Gevo Inc., Algenol Biofuels, LanzaTech, Verbio Vereinigte BioEnergie, Cosan-Raizen, Aemetis, REG-Chevron (Renewable Energy Group), and Fulcrum BioEnergy.

Neste is the leading producer of renewable diesel and SAF, utilizing waste and residue feedstocks. By using waste and residues, the company supports the transition to a circular economy by providing sustainable raw materials for the plastics and chemicals industries.

Fulcrum Bioenergy is a company that converts non-recyclable waste into low-carbon, net-zero transportation fuels, including Sustainable Aviation Fuel (SAF) and diesel, using a proprietary thermochemical process. The company is advancing a large commercial growth program with planned production capacity across North America and in selected international markets.

Chevron Renewable Energy Group (CREG) is a leading producer of advanced biofuels and lower-carbon transportation fuels, specializing in converting waste products like fats, oils, and greases into high-quality, low-carbon fuels, including biodiesel and renewable diesel. The company conducts research to identify new materials and improve catalytic processes for creating advanced biofuels.

The major players in the industry

- Neste Oyj

- POET-DSM Advanced Biofuels

- Abengoa Bioenergy

- INEOS Bio

- Valero/Green Diesel JV

- TotalEnergies

- Clariant AG

- GranBio

- DuPont Industrial Biosciences

- Enerkem

- Beta Renewables

- Gevo Inc.

- Algenol Biofuels

- LanzaTech

- Verbio Vereinigte BioEnergie

- Cosan-Raizen

- Aemetis

- REG-Chevron (Renewable Energy Group)

- Fulcrum BioEnergy

- Other Key Players

Key Developments

- In June 2025, Neste and Amazon signed a deal to provide 7,500 metric tons of Neste MY SAF to Amazon Air, expanding the fuel’s availability at San Francisco International Airport and Ontario International Airport.

- In July 2025, Rayonier Advanced Materials, the global leader in cellulose specialty products, announced that it signed an MoU with GranBio LLC, a pioneer in biochemicals and biofuels, to explore the development of a small-scale commercial cellulosic Sustainable Aviation Fuel (SAF) facility co-located at RYAM’s Jesup, Georgia site.

Report Scope

Report Features Description Market Value (2024) USD 13.8 Bn Forecast Revenue (2034) USD 104.2 Bn CAGR (2025-2034) 22.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fuel Type (Cellulosic Ethanol, Biodiesel, Bio-Butanol, Renewable Diesel, Bio-DME, Sustainable Aviation Fuel, Others), By Feedstock (Lignocellulosic Biomass, Agricultural Residues, Forest Residues, Municipal Solid Waste (MSW), Others), By End-User (Automotive & Road Transportation, Aviation, Marine, Industrial & Power) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Neste Oyj, POET-DSM Advanced Biofuels, Abengoa Bioenergy, INEOS Bio, Valero/Green Diesel JV, TotalEnergies, Clariant AG, GranBio, DuPont Industrial Biosciences, Enerkem, Beta Renewables, Gevo Inc., Algenol Biofuels, LanzaTech, Verbio Vereinigte BioEnergie, Cosan-Raizen, Aemetis, REG-Chevron (Renewable Energy Group), Fulcrum BioEnergy, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Second Generation Biofuel MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Second Generation Biofuel MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Neste Oyj

- POET-DSM Advanced Biofuels

- Abengoa Bioenergy

- INEOS Bio

- Valero/Green Diesel JV

- TotalEnergies

- Clariant AG

- GranBio

- DuPont Industrial Biosciences

- Enerkem

- Beta Renewables

- Gevo Inc.

- Algenol Biofuels

- LanzaTech

- Verbio Vereinigte BioEnergie

- Cosan-Raizen

- Aemetis

- REG-Chevron (Renewable Energy Group)

- Fulcrum BioEnergy

- Other Key Players