Global Seaweed Packaging Market Size, Share, Upcoming Investments Report By Source (Plant, Animal), By Product Format (Sheets, Films, Pouches, Boxes, Trays, Other), By Packaging Type (Primary, Secondary, Tertiary), By Packaging Process (Antimicrobial, Nanotechnology, Electro hydrodynamic, Coatings, Microorganisms), By End-Use (Food, Personal Care, Cosmetics, Pharmaceuticals, Healthcare, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135388

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

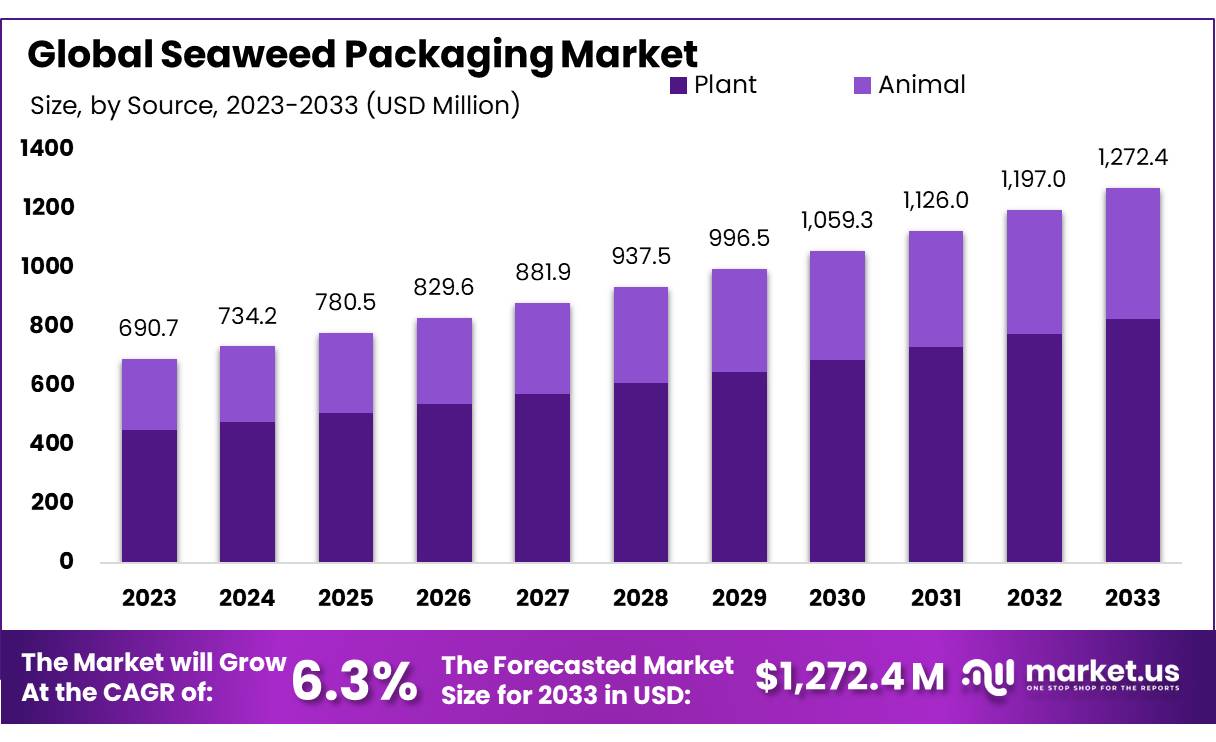

The Global Seaweed Packaging Market size is expected to be worth around USD 1272.4 Mn by 2033, from USD 690.7 Mn in 2023, growing at a CAGR of 6.3% during the forecast period from 2024 to 2033.

Seaweed Packaging refers to a type of sustainable packaging made from seaweed, which is increasingly being used as an alternative to plastic packaging. Seaweed is a renewable resource, and when processed, it can be molded into various forms like films, bags, and containers, making it a biodegradable and environmentally-friendly option.

The key advantage of seaweed packaging is that it decomposes naturally without leaving harmful waste behind, unlike traditional plastics. Additionally, seaweed is abundant, can be harvested without the need for freshwater or fertilizers, and is highly adaptable for different packaging needs.

This innovative packaging solution is expected to play a significant role in reducing plastic waste, with the potential to significantly cut down on the 8 million tons of plastic that enter the oceans each year.

Governments worldwide have imposed stricter regulations on plastic usage, boosting the demand for alternatives like seaweed packaging. The European Union’s directive to reduce single-use plastics is a key driver. In 2021, the EU enacted a law to reduce plastic packaging waste by 50% by 2030, creating a significant push for companies to adopt biodegradable and renewable alternatives such as seaweed.

Seaweed, primarily harvested from coastal regions in Asia, particularly in countries like China, Japan, and Indonesia, is a significant component of the global seaweed packaging supply chain. In 2021, the global seaweed market was valued at USD 15.5 billion, with an annual growth rate of 7.5%.

As of 2023, the seaweed export market, particularly from Asia, has seen a 6-8% growth, with key players exporting raw seaweed materials to markets in Europe and North America for use in packaging production.

In 2022, the UK government launched the UK Plastics Pact to cut plastic packaging waste, with an aim to make 100% of packaging reusable, recyclable, or compostable by 2025.

This initiative has been a catalyst for adopting biodegradable packaging solutions such as seaweed-based products. Additionally, South Korea has been supporting the development of seaweed-based packaging through research grants aimed at promoting eco-friendly materials in the packaging industry.

The innovation in seaweed packaging has attracted significant investments. In 2023, Notpla secured USD 13 million in funding to scale up production of seaweed-based packaging, with a focus on food packaging.

Similarly, in 2022, DSM, a global science-based company, announced a strategic partnership with Algama, a company pioneering seaweed-based packaging, to jointly explore solutions for sustainable food packaging. These collaborations reflect the increasing interest from both private and public sectors to invest in seaweed-based alternatives.

The demand for seaweed packaging has spurred innovations in material science, with companies focusing on improving the strength, flexibility, and shelf-life of seaweed-based products. In 2023, Algaia, a French company specializing in seaweed-based solutions, expanded its manufacturing capacity to meet the growing demand from packaging manufacturers. The expansion is expected to increase production capacity by 20% by the end of 2024, supporting the wider adoption of seaweed-based packaging in global markets.

Key Takeaways

- Seaweed Packaging Market size is expected to be worth around USD 1272.4 Mn by 2033, from USD 690.7 Mn in 2023, growing at a CAGR of 6.3%.

- Plant segment held a dominant position in the seaweed packaging market, capturing more than a 65.4% share.

- Sheets held a dominant market position in the seaweed packaging market, capturing more than a 29.6% share.

- Primary packaging held a dominant market position in the seaweed packaging industry, capturing more than a 56.6% share.

- Antimicrobial processes held a dominant market position in the seaweed packaging sector, capturing more than a 39.5% share.

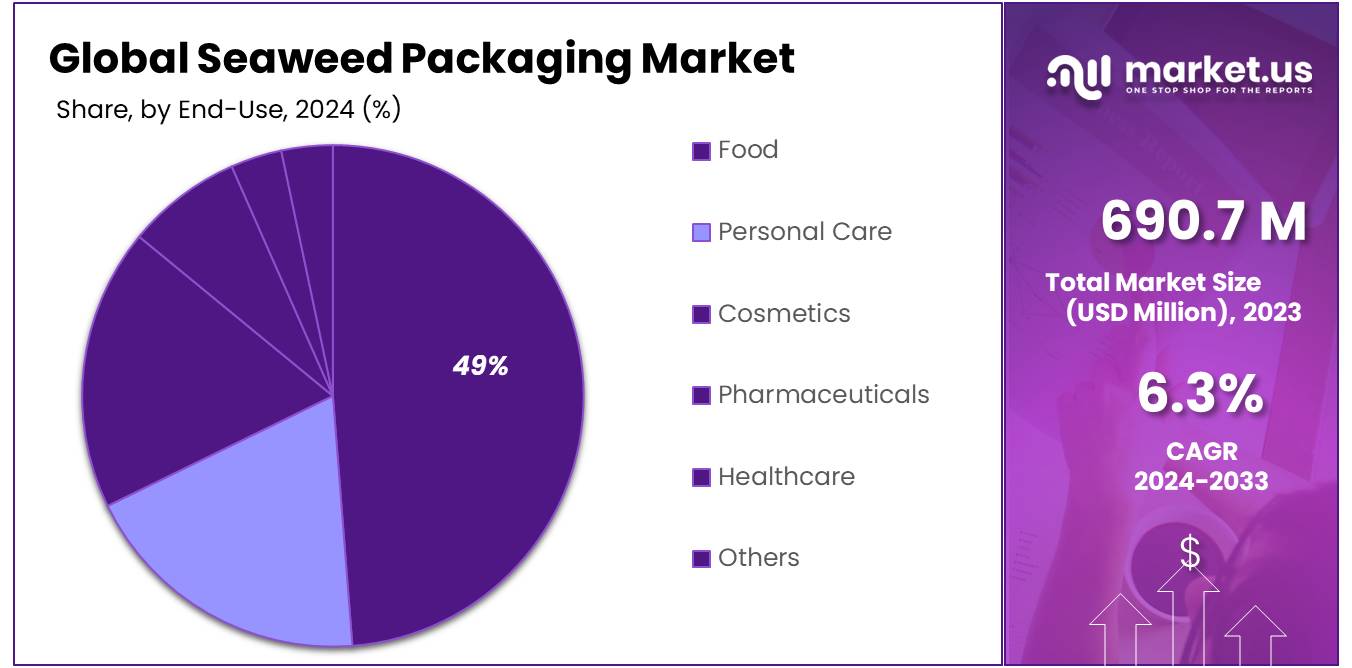

- Food sector held a dominant market position in seaweed packaging, capturing more than a 47.4% share.

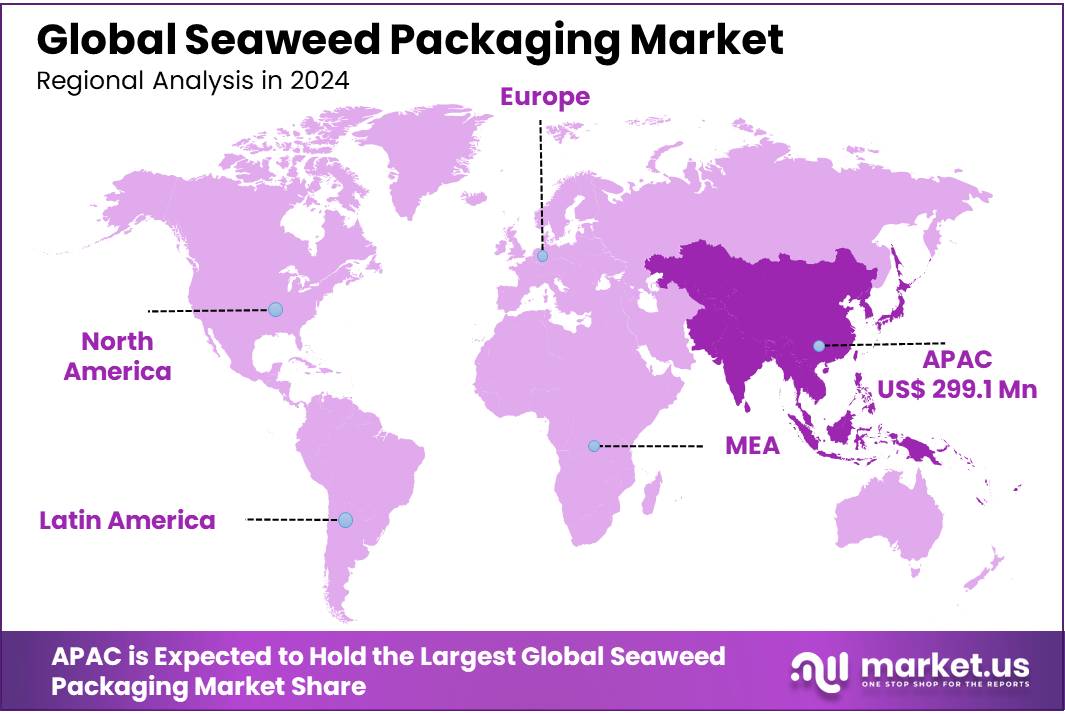

- Asia Pacific (APAC) region dominated the global seaweed packaging market, capturing a 43.3% market share and generating USD 299.1 million.

By Source

In 2023, the plant segment held a dominant position in the seaweed packaging market, capturing more than a 65.4% share. This segment benefits from the abundant availability and eco-friendly nature of plant-based sources.

The increasing consumer preference for sustainable and biodegradable packaging solutions has significantly boosted the demand for plant-derived seaweed packaging. This trend is propelled by heightened environmental awareness and efforts to reduce plastic pollution, making plant-based options highly favored across industries such as food, health care, and personal care.

Conversely, the animal segment, though smaller, remains integral to the market. It leverages animal-derived materials known for their superior durability and moisture resistance. Despite its smaller market share, ongoing innovations in processing and material science could enhance its attractiveness and expand its application in niche packaging needs where robustness and specific material properties are paramount.

By Product Format

In 2023, sheets held a dominant market position in the seaweed packaging market, capturing more than a 29.6% share. This format is highly favored for its versatility and ease of use, making it suitable for a wide range of applications, from food wrapping to product covers. The simplicity of integrating sheets into existing packaging lines without significant adjustments further enhances their appeal among manufacturers seeking sustainable solutions.

Films also play a significant role in the market, valued for their ability to form a tight, protective seal around products. This characteristic makes films ideal for preserving freshness and extending the shelf life of perishable goods. As technology advances, the functionality and performance of seaweed-based films continue to improve, driving their adoption in food packaging and other sensitive product categories.

Pouches are gaining traction due to their convenience and consumer-friendly design. Ideal for on-the-go snacks, health foods, and small consumer goods, seaweed-based pouches offer a biodegradable alternative that aligns with the growing demand for single-use, sustainable packaging options.

Boxes and trays are essential for bulk and retail packaging, where rigidity and durability are necessary. These formats are commonly used in the packaging of fresh produce, baked goods, and ready-to-eat meals, providing substantial protection while maintaining environmental sustainability.

By Packaging Type

In 2023, Primary packaging held a dominant market position in the seaweed packaging industry, capturing more than a 56.6% share. This type is directly in contact with the product, making its role crucial in protecting and preserving product quality. Its widespread use across various industries, particularly food and pharmaceuticals, is driven by the need for sustainable, direct-contact packaging solutions that meet strict safety standards.

Secondary packaging also plays a vital role, often used to group primary packages together. This type enhances the overall protection and marketing appeal of products. In retail settings, secondary seaweed packaging is valued for its strength and eco-friendly properties, helping brands communicate a commitment to sustainability.

Tertiary packaging, used for bulk handling and shipping, holds a smaller share of the market but is essential for the safe transportation of goods. Made from seaweed, this packaging type offers an environmentally friendly alternative to traditional shipping materials like plastic and cardboard, appealing to companies looking to reduce their environmental footprint in logistics.

By Packaging Process

In 2023, Antimicrobial processes held a dominant market position in the seaweed packaging sector, capturing more than a 39.5% share. This method is prized for its ability to enhance the shelf life of products by preventing the growth of bacteria and fungi on packaging surfaces. The high demand in food and pharmaceutical industries, where product safety and longevity are critical, underscores its market prominence.

Nanotechnology in seaweed packaging is also making significant strides, focusing on improving barrier properties and the mechanical strength of packaging materials. This technology is particularly valuable in creating ultra-thin, yet highly effective, layers that protect contents from moisture, UV rays, and other environmental factors, driving its adoption across various sectors.

Electrohydrodynamic techniques are utilized to create fine, uniform coatings on seaweed packaging, enhancing its texture and properties. Although more niche, this process is gaining attention for its precision and ability to improve film formation, crucial for high-quality packaging solutions.

Coatings are commonly applied to seaweed packaging to augment its functionality. These may include moisture barriers or flavor-enhancing coatings, broadening the utility of seaweed packaging in food services and consumer goods. The versatility of coatings ensures their continued importance in the market.

By End-Use

In 2023, the food sector held a dominant market position in seaweed packaging, capturing more than a 47.4% share. This segment benefits greatly from the natural, biodegradable properties of seaweed, making it an ideal choice for sustainable food packaging. The growing consumer demand for eco-friendly packaging in grocery stores and restaurants continues to drive its widespread adoption.

Personal care and cosmetics are also notable users of seaweed packaging, embracing the material for its unique aesthetic and protective qualities. The natural appeal of seaweed aligns well with brands that promote organic and natural products, enhancing brand image and consumer appeal.

In the pharmaceuticals sector, seaweed packaging is valued for its antimicrobial and non-toxic properties. These characteristics ensure that medications are kept safe and free from contamination, a crucial factor in pharmaceutical packaging.

Healthcare applications of seaweed packaging include its use in hospital supplies and equipment, where sterility and biocompatibility are essential. The inherent properties of seaweed that prevent bacterial growth make it suitable for sensitive environments.

Key Market Segments

By Source

- Plant

- Animal

By Product Format

- Sheets

- Films

- Pouches

- Boxes

- Trays

- Other

By Packaging Type

- Primary

- Secondary

- Tertiary

By Packaging Process

- Antimicrobial

- Nanotechnology

- Electro hydrodynamic

- Coatings

- Microorganisms

By End-Use

- Food

- Personal Care

- Cosmetics

- Pharmaceuticals

- Healthcare

- Others

Drivers

Government Regulations Promoting Sustainable Packaging

One of the major driving factors for the adoption of seaweed packaging is the increasing number of government regulations worldwide aimed at reducing plastic waste and promoting sustainable packaging solutions. In 2021, the European Union (EU) set a target to reduce plastic packaging waste by 50% by 2030, as part of its broader Circular Economy Action Plan.

The EU’s decision to restrict single-use plastics and push for sustainable alternatives has created a significant market for biodegradable and eco-friendly packaging solutions like seaweed packaging. Countries like the UK have also introduced bans on certain single-use plastic items, further pushing industries to seek alternatives.

In addition to the EU’s regulations, countries such as India and Japan have also introduced policies encouraging the use of biodegradable materials. India, for instance, implemented a nationwide ban on single-use plastics in 2022, which affects plastic packaging in the food, beverage, and healthcare industries.

The Indian government has committed to eliminating single-use plastics by 2025, urging companies to explore sustainable alternatives. This regulatory environment has created a robust demand for packaging solutions that are not only effective but also environmentally responsible, such as seaweed-based packaging. Similarly, the US has seen increasing support for sustainable packaging through initiatives like the Save Our Seas Act (2018), which seeks to reduce plastic waste in the oceans and encourages industries to adopt biodegradable alternatives.

Consumer Demand for Sustainable Packaging

Another key driving factor behind the rapid adoption of seaweed packaging is the rising consumer demand for environmentally friendly and sustainable products. According to the Food and Agriculture Organization (FAO), the global awareness around the environmental impact of plastic pollution has led to a 20% annual increase in consumer preference for eco-friendly packaging.

As consumers become more conscious of sustainability, they are increasingly prioritizing products that use biodegradable, recyclable, or renewable packaging. The food industry, in particular, has witnessed a shift in consumer behavior, with 55% of global consumers willing to pay more for products with sustainable packaging, according to Mintel.

Nestlé, for instance, has committed to making 100% of its packaging recyclable or reusable by 2025. This shift in consumer expectations has prompted food brands to invest in seaweed-based packaging as a way to align with market demands and enhance their sustainability credentials.

Additionally, as part of corporate social responsibility (CSR) efforts, many companies are embracing green packaging alternatives, not just to meet regulations but also to cater to an increasingly environmentally aware customer base.

This shift is driving a more rapid transition to sustainable packaging solutions, with seaweed emerging as a promising material to meet these needs. The growing consumer demand for sustainability is thus a key factor propelling the growth of the seaweed packaging market.

Investment and Strategic Partnerships

The growing interest in seaweed packaging has attracted significant investment from both the public and private sectors, further accelerating market growth. In 2023, the European Investment Bank (EIB) committed over EUR 100 million in funding for companies focusing on sustainable packaging technologies, including seaweed-based solutions. This investment highlights the growing confidence in the commercial viability of sustainable alternatives to plastic.

Private companies are also forming strategic partnerships to leverage the benefits of seaweed packaging. For example, in 2022, Notpla, a leading seaweed packaging company, secured $10 million in funding from investors like Google Ventures and Blue Horizon to scale its seaweed-based packaging solutions.

Partnerships like these are crucial for fostering innovation and bringing seaweed packaging to the mainstream. Additionally, collaborations between companies in the food, beverage, and packaging sectors are helping to accelerate the commercialization of seaweed packaging by sharing expertise and resources.

Restraints

High Production Costs and Scalability Issues

A major restraining factor for the widespread adoption of seaweed-based packaging is the high production costs and scalability challenges associated with manufacturing seaweed packaging materials on a large scale. Currently, seaweed-based packaging remains more expensive than traditional plastic alternatives.

According to industry reports, seaweed-based packaging can be 2 to 3 times more expensive than conventional plastic packaging in some cases. This cost disparity is primarily due to the relatively small-scale production of seaweed packaging and the complex processes involved in extracting, processing, and transforming seaweed into usable materials.

Moreover, the scalability of seaweed farming remains a challenge. While seaweed is a renewable resource, large-scale farming and harvesting require significant infrastructure investments. The global supply of seaweed is still limited, and its cultivation is not as established as traditional crops like corn or wheat.

According to the Food and Agriculture Organization (FAO), seaweed farming currently occupies only less than 1% of the global agriculture area, and much of the seaweed used for packaging is still harvested from the wild, making it unsustainable in the long term.

Limited Consumer Awareness and Market Acceptance

Another factor that restricts the growth of the seaweed packaging market is limited consumer awareness and market acceptance. While there is growing interest in sustainable packaging solutions, the average consumer still has limited knowledge of the benefits of seaweed packaging compared to other eco-friendly materials such as paper, glass, or bioplastics. According to a 2022 report by the Consumer Goods Forum, only 27% of consumers globally can identify sustainable packaging alternatives and understand their environmental benefits.

In addition, seaweed packaging is still perceived as an emerging technology, and many consumers remain skeptical about its functionality and sustainability in comparison to established packaging materials. This lack of consumer trust can hinder the widespread adoption of seaweed packaging, especially in industries like food and beverage, where packaging plays a crucial role in product preservation and convenience. The reluctance to switch to a new, untested packaging material could delay the transition to more sustainable solutions.

Limited Infrastructure for Seaweed Cultivation and Processing

The lack of infrastructure for large-scale seaweed cultivation and processing is a significant challenge for the seaweed packaging industry. As mentioned earlier, the global supply of seaweed is still limited, and much of the current seaweed used in packaging comes from wild harvests rather than sustainable farming. To meet growing demand, the seaweed industry would need substantial investment in infrastructure to expand seaweed farming operations.

Currently, only 0.6% of global seaweed farming is done on a commercial scale, according to the FAO. Establishing large-scale seaweed farming and processing plants requires significant capital investment and research to ensure the seaweed is farmed sustainably and in sufficient quantities to meet the needs of the packaging industry. The absence of established supply chains for seaweed farming limits the ability to scale production of seaweed packaging.

Opportunity

Increasing Government Support for Sustainable Packaging

For instance, the European Union introduced the Single-Use Plastics Directive in 2019, which mandates the reduction of single-use plastics by 50% by 2030. This directive specifically targets plastic packaging, driving industries to adopt biodegradable and renewable alternatives like seaweed-based packaging. The EU’s emphasis on circular economy principles encourages companies to explore innovative packaging solutions that are both sustainable and cost-effective.

In the United States, the Save Our Seas Act (2018) and state-level regulations in places like California, which passed the California Plastic Pollution Reduction Act in 2022, further emphasize reducing plastic waste in the oceans and pushing for greener alternatives. With such strong regulatory frameworks in place, industries are more likely to increase their investment in sustainable packaging solutions.

In Asia, countries like India have set ambitious targets for eliminating single-use plastics. India’s Plastic Waste Management Rules (2022) advocate the use of biodegradable alternatives, creating a significant market for seaweed packaging. The Indian government’s commitment to eliminating single-use plastics by 2025 further strengthens the opportunity for seaweed-based packaging solutions to replace traditional plastic materials.

Consumer Demand for Eco-Friendly Products

Consumer awareness regarding environmental issues and plastic pollution is at an all-time high, which presents a strong growth opportunity for seaweed packaging. Consumers are increasingly prioritizing sustainability, and this shift in consumer behavior is driving demand for products that use environmentally friendly packaging.

The Food and Beverage industry, one of the largest markets for packaging, is experiencing a marked shift towards sustainability. According to Unilever, over 50% of consumers globally are now choosing brands based on their sustainability practices, especially in packaging. This consumer preference for eco-friendly packaging is pushing companies to look for alternatives to plastic.

As a result, companies like Coca-Cola, Nestlé, and PepsiCo are investing heavily in sustainable packaging initiatives. Coca-Cola, for example, has pledged to use 50% recycled materials in its packaging by 2030, and Nestlé aims to make all of its packaging 100% recyclable or reusable by 2025.

In the personal care and cosmetics industries, the trend is similarly pronounced. Consumers are seeking brands that align with their values of sustainability, which is driving a shift towards alternative packaging materials.

Companies like L’Oréal and Procter & Gamble have set aggressive sustainability targets, such as making all packaging recyclable or reusable by 2025. This shift in consumer behavior presents a growing market opportunity for seaweed packaging, which aligns with both environmental goals and consumer demand.

Technological Advancements in Seaweed Processing

Technological advancements in seaweed harvesting and processing techniques present a significant growth opportunity for the seaweed packaging market. New innovations are making it possible to process seaweed into more durable, flexible, and cost-effective packaging materials, addressing some of the scalability and cost challenges faced by the industry.

In recent years, electro-hydrodynamic (EHD) processing and nanotechnology have been increasingly applied to seaweed packaging to enhance its functionality. EHD processing, which involves the use of high-voltage electric fields to produce thin, flexible fibers from seaweed, is showing promising results in improving the strength and barrier properties of seaweed-based materials.

According to a study published in Nature Sustainability, the use of EHD in packaging production can reduce material usage by 20% to 30% while maintaining or improving the performance of the packaging.

Trends

Emerging Trend of Seaweed Packaging in the Food and Beverage Sector

A major latest trend in the seaweed packaging market is the growing adoption of seaweed-based packaging in the food and beverage industry. The global demand for sustainable packaging solutions is increasing rapidly, especially in sectors like food, where packaging plays a crucial role in preserving product quality and shelf life.

According to the Food and Agriculture Organization (FAO), the food and beverage sector represents about 40% of the total packaging market, making it one of the key drivers for the adoption of innovative, sustainable materials like seaweed.

Leading companies, such as Coca-Cola, Unilever, and Nestlé, have made significant moves towards adopting sustainable packaging solutions. Coca-Cola has committed to ensuring that 100% of its packaging is recyclable by 2025, which has led to increased investments in alternative packaging materials, including seaweed-based packaging. Similarly, Unilever has pledged to reduce plastic waste by making 50% of its packaging reusable or recyclable by 2025, further promoting sustainable packaging alternatives.

In 2023, Notpla, a prominent player in the seaweed packaging industry, expanded its partnerships with several major food brands to introduce seaweed-based packaging for various products, such as sauces and condiments. This collaboration underscores the growing shift towards biodegradable packaging, driven by both consumer demand and regulatory pressures to reduce plastic waste.

Innovations in Seaweed Packaging Materials for Enhanced Functionality

Another prominent trend in seaweed packaging is the continuous innovation in seaweed materials aimed at improving packaging performance. Companies are experimenting with new formulations and technologies to enhance the strength, flexibility, and barrier properties of seaweed-based packaging, making it more suitable for a wide range of applications.

For example, seaweed packaging has started incorporating nano-coating technology, which improves its resistance to moisture, oxygen, and UV light, all crucial factors for preserving food products.

In 2023, companies like Notpla and Loliware have introduced innovative seaweed-based products that provide enhanced durability while still being completely biodegradable. Notpla’s seaweed films are now used for packaging products in the food industry, and these films can decompose within 4-6 weeks in natural environments. Additionally, innovations are focused on creating edible seaweed packaging that can be consumed along with the product, reducing waste even further.

This innovation aligns with the growing consumer preference for environmentally friendly packaging that also offers superior product protection. The potential for seaweed packaging to serve as an all-in-one solution—combining sustainability with functional benefits—positions it as a strong contender in various industries beyond just food, including cosmetics, pharmaceuticals, and personal care products.

Consumer Demand for Eco-Friendly Products

A key factor contributing to the rise of seaweed packaging is the increasing consumer demand for eco-friendly products. As consumers become more aware of the environmental impact of plastic waste, they are actively seeking brands that prioritize sustainability in their products and packaging.

According to a report by the Environmental Protection Agency (EPA), 75% of consumers are more likely to choose products with eco-friendly packaging, such as biodegradable or recyclable materials. This demand is especially evident in the food and beverage industry, where packaging not only needs to be functional but also align with consumers’ sustainability values.

Leading food companies are responding to this consumer shift by exploring and implementing alternative materials like seaweed packaging. For example, Danone, a global leader in dairy and plant-based products, has committed to making 50% of its packaging recyclable or reusable by 2025, aligning with growing consumer expectations for sustainable packaging.

The rise of zero-waste stores and sustainability-focused food startups further boosts the demand for sustainable packaging solutions, opening new opportunities for companies to innovate and lead in the market for eco-friendly packaging alternatives.

Regional Analysis

In 2023, the Asia Pacific (APAC) region dominated the global seaweed packaging market, capturing a 43.3% market share and generating USD 299.1 million in revenue. This dominance is attributed to the abundant availability of raw materials, particularly in countries like China, Japan, and Indonesia, which are major producers of seaweed.

The region’s strong manufacturing base, coupled with growing consumer awareness about sustainable packaging solutions, has fueled significant demand. Additionally, government initiatives promoting eco-friendly practices and reducing single-use plastics have further accelerated the adoption of seaweed-based packaging in APAC.

Europe holds the second-largest share in the market, driven by strict regulations on plastic use and a strong focus on sustainability. Countries such as Germany, France, and the UK are at the forefront of this trend, with many businesses transitioning to biodegradable packaging solutions to align with the EU’s Green Deal targets. The European market is supported by robust R&D efforts and consumer preference for environmentally conscious products.

North America also represents a significant market, with the United States leading the region’s adoption of seaweed packaging. The growing demand for sustainable packaging in the food and personal care industries, along with corporate commitments to reducing plastic waste, has contributed to steady growth.

The Middle East & Africa and Latin America are emerging markets for seaweed packaging. These regions are witnessing increasing investments in sustainable packaging technologies, driven by rising environmental concerns and the global shift toward greener packaging alternatives. While these markets currently hold smaller shares, they are expected to grow significantly in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The seaweed packaging market is highly competitive, with several key players driving innovation and adoption of eco-friendly packaging solutions. Leading companies in the market include Notpla Limited, which has formed partnerships with major food and beverage brands like Coca-Cola and Unilever to create sustainable, seaweed-based packaging alternatives.

Evo & Co., through its subsidiary Evoware, is another prominent player, known for developing edible and biodegradable seaweed packaging that has gained significant attention in the food industry. Algopack and Bloom are also playing crucial roles in the development of seaweed-based films and coatings, particularly for food packaging, by leveraging seaweed’s natural properties to replace plastic.

Other significant players include Cascadia Seaweed and Seaweed Energy Solutions, which are pioneering efforts in large-scale seaweed farming and processing for packaging purposes. Companies like Marine Innovation and FlexSea focus on harnessing seaweed’s biodegradable properties to offer sustainable packaging solutions in various industries.

AlgaePac, Amtrex Nature Care Pvt. Ltd., and Monosol LLC are innovating by exploring different formats, such as pouches, films, and trays, made from seaweed-based materials for the food and personal care sectors. The involvement of these key players is essential to the market’s growth, driven by increasing demand for sustainable packaging solutions and the adoption of eco-friendly alternatives across industries.

Additionally, emerging players like Sway Innovation Co., Regeno, and ZEROCIRCLE ALTERNATIVES PVT. LTD. are contributing to the growing number of innovations in the seaweed packaging space, while companies like LOLIWARE Inc. and Sea6 are gaining recognition for their environmentally-conscious product designs. As the demand for biodegradable, sustainable packaging solutions grows, these key players will continue to shape the direction of the seaweed packaging market.

Top Key Players in the Market

- AGreenPlus

- AlgaePac

- Algopack

- Amtrex Nature Care Pvt. Ltd.

- Bloom

- BZEOS

- Cascadia Seaweed

- CuanTec

- Devro

- Energy

- EnviGreen

- Evo &Co.

- Evoware

- FlexSea

- JRF Technology, LLC

- KELP INDUSTRIES LTD

- LOLIWARE Inc.

- Marine Innovation

- Monosol LLC

- Montrose UK Ltd.

- Notpla Limited

- Oceanium

- PT Seaweedtama Biopac Indonesia

- Regeno

- Sea6

- Seamore

- Searo

- Seaweed Energy Solutions

- Sway Innovation Co.

- ZEROCIRCLE ALTERNATIVES PVT. LTD.

Recent Developments

In 2023, AGreenPlus expanded its operations and launched several new products, including seaweed-based films and wraps for food packaging. The company reported a growth of 18.5% in revenue from seaweed-based packaging products, reaching USD 35.7 million in sales.

In 2024, AlgaePac plans to expand its production capacity by 30%, aiming for a projected revenue of USD 27.8 million.

Report Scope

Report Features Description Market Value (2023) USD 690.7 Mn Forecast Revenue (2033) USD 1272.4 Mn CAGR (2024-2033) 6.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Plant, Animal), By Product Format (Sheets, Films, Pouches, Boxes, Trays, Other), By Packaging Type (Primary, Secondary, Tertiary), By Packaging Process (Antimicrobial, Nanotechnology, Electro hydrodynamic, Coatings, Microorganisms), By End-Use (Food, Personal Care, Cosmetics, Pharmaceuticals, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AGreenPlus, AlgaePac, Algopack, Amtrex Nature Care Pvt. Ltd., Bloom, BZEOS, Cascadia Seaweed, CuanTec, Devro, Energy, EnviGreen, Evo &Co., Evoware, FlexSea, JRF Technology, LLC, KELP INDUSTRIES LTD, LOLIWARE Inc., Marine Innovation, Monosol LLC, Montrose UK Ltd., Notpla Limited, Oceanium, PT Seaweedtama Biopac Indonesia, Regeno, Sea6, Seamore, Searo, Seaweed Energy Solutions, Sway Innovation Co., ZEROCIRCLE ALTERNATIVES PVT. LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AGreenPlus

- AlgaePac

- Algopack

- Amtrex Nature Care Pvt. Ltd.

- Bloom

- BZEOS

- Cascadia Seaweed

- CuanTec

- Devro

- Energy

- EnviGreen

- Evo &Co.

- Evoware

- FlexSea

- JRF Technology, LLC

- KELP INDUSTRIES LTD

- LOLIWARE Inc.

- Marine Innovation

- Monosol LLC

- Montrose UK Ltd.

- Notpla Limited

- Oceanium

- PT Seaweedtama Biopac Indonesia

- Regeno

- Sea6

- Seamore

- Searo

- Seaweed Energy Solutions

- Sway Innovation Co.

- ZEROCIRCLE ALTERNATIVES PVT. LTD.