Global School Furniture Market Size, Share, Growth Analysis By Product Type (Desks, Chairs, Tables, Storage Units, Teacher’s Desk, Classroom Organizers, Classroom Partitions, Lockers), By Application (Classroom Furniture, Auditorium Furniture, Cafeteria Furniture, Library Furniture, Outdoor or Playground Furniture), By Distribution Channel (Online Retail, Direct Sales, Institutional or Wholesale, Specialty Stores, Furniture Showrooms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139818

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

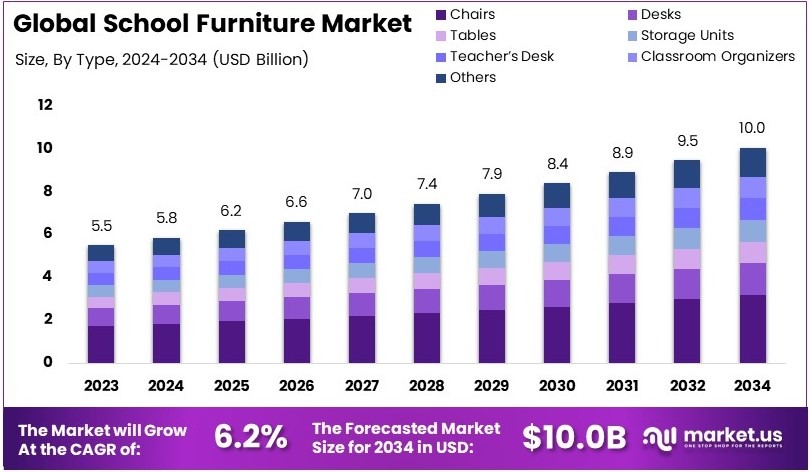

The Global School Furniture Market size is expected to be worth around USD 10.0 Billion by 2034, from USD 5.5 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034.

School furniture includes desks, chairs, storage units, and other essential classroom items designed for students and teachers. It provides comfort, promotes proper posture, and enhances learning environments. Modern school furniture focuses on durability, ergonomics, and flexibility, allowing students to stay engaged and comfortable throughout their academic activities.

The school furniture market includes the production, distribution, and sale of furniture used in educational institutions. It covers a wide range of products, from traditional wooden desks to modern ergonomic and modular designs. This market serves schools, colleges, and training centers, offering solutions that improve classroom functionality and student experience.

According to the Journal of Public Health, 70.5% of students reported musculoskeletal discomfort due to poor posture. Neck pain affected 86.4%, while 75.9% suffered from lower back pain. This highlights the need for ergonomic school furniture. Comfortable desks and chairs can improve student health, focus, and overall learning outcomes.

Furthermore, posture awareness remains low. A study at Isra University found that while 80% of medical students knew about ergonomics, only 34% understood proper posture techniques. Meanwhile, 66% used back support while studying. As a result, schools must invest in furniture that promotes good posture and reduces long-term health risks.

Additionally, government investments are driving market growth. The Rebuild America’s Schools Act proposes a $130 billion investment in school infrastructure. This funding will improve classroom conditions and create over 2 million jobs in five years. Consequently, the demand for modern and ergonomic school furniture is expected to rise significantly.

Moreover, rising student populations are fueling demand. Many schools face overcrowding, leading to inadequate seating arrangements. In response, institutions are upgrading furniture to improve comfort and optimize space. This shift benefits both students and teachers by creating a more effective learning environment.

Meanwhile, competition in the school furniture market is rising. Established brands focus on durability and ergonomic designs, while newer companies offer cost-effective solutions. Consequently, innovation in materials and flexible furniture designs is becoming a key differentiator in attracting school contracts.

Key Takeaways

- The School Furniture Market was valued at USD 5.5 billion in 2024 and is expected to reach USD 10.0 billion by 2034, with a CAGR of 6.2%.

- In 2024, Chairs dominated the product type segment with 31.4%, as ergonomic chair seating is crucial for student comfort.

- In 2024, Classroom Furniture led the application segment with 48.9%, as schools invest in durable and functional learning environments.

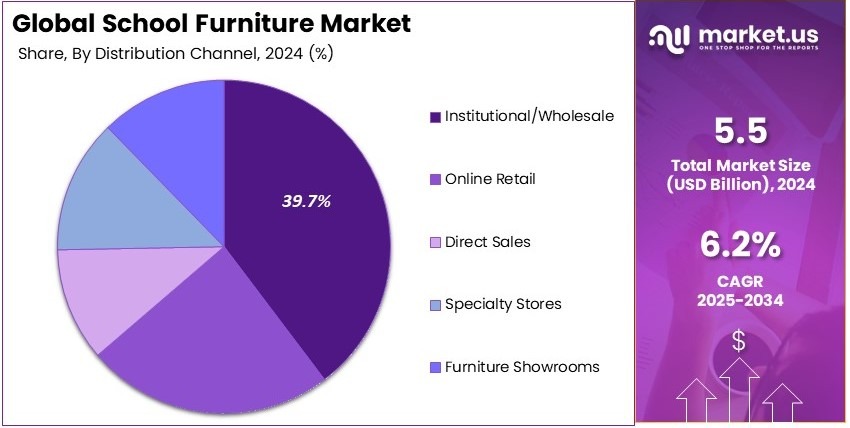

- In 2024, Institutional/Wholesale accounted for 39.7% of sales, driven by bulk purchasing by schools and educational institutions.

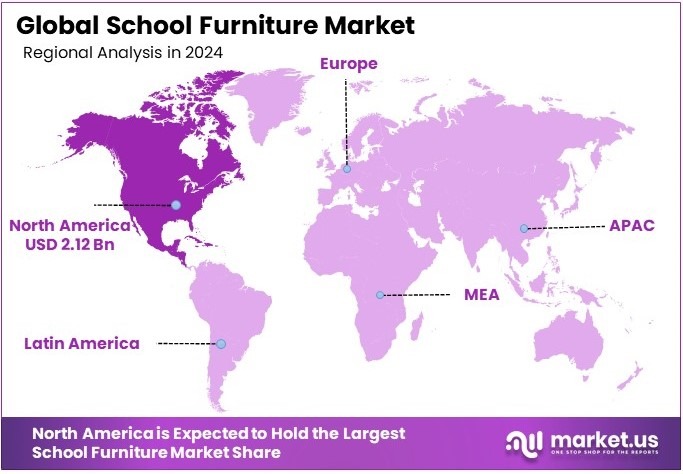

- In 2024, North America held 38.6% market share, valued at USD 2.12 billion, due to strong government investments in education infrastructure.

Product Type Analysis

Chairs dominate with 31.4% due to their essential role in student comfort and posture.

Chairs are the most critical piece of furniture in schools, holding the largest market share within the Product Type segment. Their design is crucial in supporting proper posture for students, which is vital for comfort and health during long school hours.

This segment’s prevalence is marked by innovations in ergonomic designs that help maintain student concentration and reduce fatigue, contributing to a significant market share of 31.4%. The ongoing emphasis on student health and educational outcomes drives continual investment in this sub-segment.

Desks are essential for providing students a suitable workspace, integrating storage solutions, and adapting to various educational activities. Tables are versatile, used for group work and various classroom activities, enhancing collaborative learning environments.

Storage units help organize learning materials and equipment, maintaining a clutter-free environment crucial for effective learning. Teacher’s desks are tailored for functionality and accessibility, while classroom organizers enhance efficiency and orderliness.

Classroom partitions offer flexible learning spaces, and lockers are critical for securing students’ personal belongings, each supporting the diverse needs of educational institutions.

Application Analysis

Classroom Furniture leads with 48.9% due to its fundamental need in educational environments.

Classroom furniture is the backbone of educational settings, occupying the largest share in the Application segment. This furniture is specifically designed to create an environment conducive to learning and engagement.

Chairs, desks, and storage units are tailored to suit the dynamic needs of modern classrooms, supporting various teaching methods and learning activities. The significant investment in classroom furniture, evident from its market share of 48.9%, underscores its importance in educational success and the well-being of students.

Auditorium furniture is specialized for accommodating large groups during school events and assemblies, enhancing comfort and visibility. Cafeteria furniture must be durable and easy to clean, catering to the social and dining needs of students.

Library furniture focuses on creating a quiet and comfortable reading environment, essential for student research and leisure reading. Outdoor and playground furniture is designed to withstand environmental elements while providing safe and enjoyable recreation spaces, each segment tailored to fulfill specific functional requirements within schools.

Distribution Channel Analysis

Institutional/Wholesale dominates with 39.7% due to bulk purchasing and cost-effectiveness.

The institutional/wholesale channel is predominant in the distribution of school furniture, marked by a 39.7% share. Schools and educational institutions often purchase in bulk, seeking cost-effective solutions without compromising on quality. This distribution channel offers competitive pricing and customized solutions, making it ideal for fulfilling the large-scale and diverse needs of educational institutions.

Online retail is growing in popularity, providing schools with the convenience of browsing and purchasing furniture remotely. Direct sales allow schools to deal directly with manufacturers, often resulting in better customization and pricing.

Specialty stores offer unique and high-quality furniture items that might not be available in larger stores, while furniture showrooms provide the opportunity to view multiple setups in a single visit, each channel playing a strategic role in servicing the varied needs of educational environments.

Key Market Segments

By Product Type

- Desks

- Chairs

- Tables

- Storage Units

- Teacher’s Desk

- Classroom Organizers

- Classroom Partitions

- Lockers

By Application

- Classroom Furniture

- Auditorium Furniture

- Cafeteria Furniture

- Library Furniture

- Outdoor/Playground Furniture

By Distribution Channel

- Online Retail

- Direct Sales

- Institutional/Wholesale

- Specialty Stores

- Furniture Showrooms

Driving Factors

Modern Educational Investments and Ergonomic Design Drive Market Growth

The increasing investments in educational infrastructure are driving demand for modern school furniture. Many governments and private institutions are focusing on upgrading classrooms with advanced seating and desks to improve student learning experiences.

As part of this effort, schools are shifting toward ergonomic furniture that promotes proper posture and reduces discomfort during long hours of study. Adjustable desks and chairs that accommodate different student heights and learning needs are becoming more common.

Another key driver is the growing emphasis on collaborative and flexible learning spaces. Traditional classroom layouts with fixed seating arrangements are being replaced by modular setups that encourage group activities and interactive learning. Schools are investing in movable desks and adaptable seating that support a dynamic classroom environment.

Additionally, government initiatives supporting smart classrooms are fueling market expansion. With the rise of digital learning, furniture is being designed to integrate with technology, such as desks with built-in tablet holders or cable management systems. These developments ensure that school furniture aligns with evolving educational trends.

Restraining Factors

Budget Constraints and Durability Issues Restrain Market Growth

One of the major challenges in the school furniture market is the budget limitations faced by public schools. Many institutions, particularly in developing regions, struggle to allocate sufficient funds for high-quality furniture. As a result, they often opt for lower-cost alternatives, which may lack durability and ergonomic benefits. This restricts the adoption of premium furniture solutions.

Another significant issue is supply chain disruptions. Manufacturing and delivery delays can affect the timely availability of school furniture, especially when institutions need bulk orders before the start of a new academic year. Material shortages and transportation costs further complicate the situation, causing price fluctuations.

Durability concerns also pose a restraint on market growth. School furniture experiences heavy daily use, and low-quality products may require frequent replacements. The high costs of maintenance and replacement discourage schools from investing in modern furniture, leading to continued reliance on traditional wooden or metal desks and chairs.

Resistance to change is another limiting factor. Many schools, especially in older institutions, prefer traditional fixed furniture setups and are reluctant to transition to modern, flexible designs. This hesitance slows market expansion, particularly in regions where educational methods have not yet fully adapted to interactive and digital learning models.

Growth Opportunities

Emerging Markets and Smart Solutions Provide Opportunities

The school furniture market presents strong growth opportunities in developing regions with rising student enrollments. Countries experiencing population growth and expanding educational access are investing in new schools and upgrading existing institutions. This creates a steady demand for classroom furniture, particularly in Asia, Africa, and Latin America.

Another major opportunity lies in the adoption of smart furniture. Schools are increasingly integrating technology into learning environments, leading to demand for IoT-enabled desks and seating solutions. Features such as built-in charging ports, connectivity hubs, and interactive desks enhance digital learning experiences. Companies investing in smart school furniture are well-positioned to capture this growing segment.

Sustainability is also becoming a priority in the education sector. Many institutions are looking for eco-friendly furniture made from recyclable materials such as bamboo, recycled plastic, and non-toxic coatings. The push for green-certified furniture aligns with broader environmental initiatives in schools. Manufacturers that adopt sustainable production practices can differentiate themselves in the market.

Customization trends are further shaping the industry. Schools are seeking furniture solutions tailored to specific learning needs, including adjustable desks for younger students, collaborative workstations, and sound-absorbing materials for quiet study areas. Companies offering customizable designs can attract educational institutions aiming to create optimal learning environments.

Emerging Trends

Modular and Tech-Integrated Furniture Are Latest Trending Factors

The demand for modular and reconfigurable classroom furniture is on the rise. Schools are moving away from fixed seating arrangements and adopting flexible designs that allow teachers to adjust the layout for different activities. Movable desks, foldable chairs, and stackable seating options provide versatility in classroom management.

Ergonomics is another key trend shaping the market. Height-adjustable desks and chairs are becoming popular as schools prioritize student comfort. These designs accommodate children of different ages and ensure proper posture, reducing strain and fatigue during long learning hours. Institutions are increasingly recognizing the link between ergonomic seating and academic performance.

Technology integration is further influencing school furniture trends. Many desks and chairs now feature built-in charging ports, USB outlets, and cable management systems to support digital learning. As classrooms become more tech-driven, the need for smart furniture will continue to grow.

Sustainability is also gaining momentum. Schools are opting for environmentally friendly furniture made from recycled materials, low-emission coatings, and FSC-certified wood. Green-certified classroom furniture aligns with sustainability goals and ensures a healthier learning environment. As educational institutions prioritize eco-friendly initiatives, demand for sustainable school furniture is expected to increase.

Regional Analysis

North America Dominates with 38.6% Market Share in the School Furniture Market

North America leads the School Furniture Market with a 38.6% share, valued at USD 2.12 billion. This dominant position is driven by substantial educational investments and a strong focus on ergonomic designs that enhance learning environments.

The key factors propelling this market share include significant government spending on education, a growing number of educational institutions, and heightened awareness about the importance of ergonomics in student furniture. These elements ensure that schools are equipped with furniture that supports students’ health and engagement, making it a priority in the region’s education policy.

Looking forward, North America’s role in the global School Furniture Market is expected to maintain its momentum. The increasing focus on STEM education and collaborative learning spaces will likely fuel the demand for innovative and flexible furniture designs. As education systems continue to evolve, the emphasis on creating effective learning environments will further enhance the market strength of this region.

Regional Mentions:

- Europe: Europe focuses on sustainable and modular school furniture, reflecting its commitment to environmental concerns and adaptable learning environments. This approach drives continuous growth in the region’s school furniture market.

- Asia Pacific: Rapid educational expansion and infrastructure development in Asia Pacific boost its school furniture market. The region is investing heavily in educational facilities to accommodate its growing student population.

- Middle East & Africa: The Middle East and Africa are gradually enhancing their educational infrastructure, leading to increased demand for modern school furniture. Investments in education by government and private sectors are significant growth drivers.

- Latin America: Latin America is seeing growth in the school furniture market as educational reforms and investments increase. The region is focusing on improving educational quality and infrastructure, stimulating demand for new school furniture.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

Within the School Furniture Market, Hertz Furniture, Steelcase, Herman Miller, and Virco Manufacturing Corporation lead by providing innovative, durable, and ergonomic solutions for educational environments.

Hertz Furniture offers a wide range of school furniture that emphasizes durability and adaptability, catering to diverse educational settings from kindergartens to universities. Their products are designed for long-term use and versatility.

Steelcase focuses on research-driven school furniture solutions that enhance collaborative learning and comfort. Their furniture is built to accommodate the changing dynamics of modern classrooms and is widely respected for its quality and ergonomic design.

Herman Miller brings its expertise in ergonomic design to the educational sector with furniture that supports the physical well-being of students and teachers. Their innovative designs are aimed at creating flexible learning environments that encourage engagement and active learning.

Virco Manufacturing Corporation is a leading provider of school furniture in the United States, known for its cost-effective and robust furniture solutions. Virco’s commitment to sustainability and USA-made products make it a popular choice among educational institutions for furniture that withstands the demands of daily student use.

These companies are pivotal in shaping the landscape of educational environments, offering products that support both learning and sustainability in schools.

Major Companies in the Market

- Hertz Furniture

- Steelcase

- Herman Miller

- Virco Manufacturing Corporation

- KI Furniture

- VS Vereinigte Spezialmöbelfabriken GmbH

- Scholastic Furniture

- Global Industries

- SCHOOL DESK

- MityLite

- Smith System

- The School Outfitters

- Fleetwood Group

Recent Developments

- Ironbridge Equity Partners: In September 2024, Ironbridge Equity Partners, a Toronto-based private equity firm, acquired a Canadian classroom furniture manufacturer. This acquisition aims to expand U.S. sales operations and enhance the company’s product offerings, strengthening its presence in the North American educational furniture market.

Report Scope

Report Features Description Market Value (2024) USD 5.5 Billion Forecast Revenue (2034) USD 10.0 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Desks, Chairs, Tables, Storage Units, Teacher’s Desk, Classroom Organizers, Classroom Partitions, Lockers), By Application (Classroom Furniture, Auditorium Furniture, Cafeteria Furniture, Library Furniture, Outdoor or Playground Furniture), By Distribution Channel (Online Retail, Direct Sales, Institutional or Wholesale, Specialty Stores, Furniture Showrooms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hertz Furniture, Steelcase, Herman Miller, Virco Manufacturing Corporation, KI Furniture, VS Vereinigte Spezialmöbelfabriken GmbH, Scholastic Furniture, Global Industries, SCHOOL DESK, MityLite, Smith System, The School Outfitters, Fleetwood Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hertz Furniture

- Steelcase

- Herman Miller

- Virco Manufacturing Corporation

- KI Furniture

- VS Vereinigte Spezialmöbelfabriken GmbH

- Scholastic Furniture

- Global Industries

- SCHOOL DESK

- MityLite

- Smith System

- The School Outfitters

- Fleetwood Group