Global Library Furniture Market Size, Share, Growth Analysis By Product Type (Shelving Units, Reading Tables, Chairs and Seating, Library Desks, Storage Units, Book Carts, Others), By End-User (Public Libraries, Academic Libraries, Special Libraries, Private Libraries, Government Institutions, Others), By Distribution Channel (Online Retail, Offline Retail, Direct Sales, Wholesale), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139361

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Library Furniture Market size is expected to be worth around USD 5.7 Billion by 2034, from USD 3.7 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

Library furniture is designed for use in educational and public library settings. It includes items such as bookshelves, study tables, chairs, and collaborative spaces. The furniture is built for durability and functionality while supporting organized spaces and quiet environments. Its design meets both ergonomic and aesthetic needs in library settings.

The library furniture market involves companies producing and selling furniture for libraries. It covers a range of products from bookshelves and study desks to seating and display units. The market caters to institutions and public libraries seeking durable, functional, and well-designed furniture solutions for creating organized and inviting spaces globally.

Modern library furniture is evolving to meet changing user needs. Designers focus on ergonomic seating, flexible tables, and integrated technology. This upgrade supports study, research, and community events. According to the ALA, libraries received 1.53 billion visits, highlighting the need for innovative, durable furniture solutions that enhance learning and engagement.

The library furniture market is expanding amid rising capital investments. Increased funding supports modern library designs and upgrades. The Brookings Institution noted $90 billion spending on new infrastructure, representing 10% of education budgets. This growth creates opportunities for manufacturers to innovate and supply quality furniture for schools and libraries globally.

Government investments and reforms drive growth factors. The Government of India launched the PM SHRI Scheme in September 2022, upgrading over 14,500 schools. As of October 2024, 10,855 schools have been transformed. In South Australia, over $50 million in upgrades benefits local institutions, with $10 million allocated for one school.

Market saturation in library furniture is moderate. Many vendors compete regionally and internationally. As such, local players and global companies innovate continuously. Competition remains healthy. Suppliers focus on quality and cost efficiency. This dynamic environment drives product improvement and boosts consumer confidence, promoting steady market growth and competitiveness nationwide appeal.

Key Takeaways

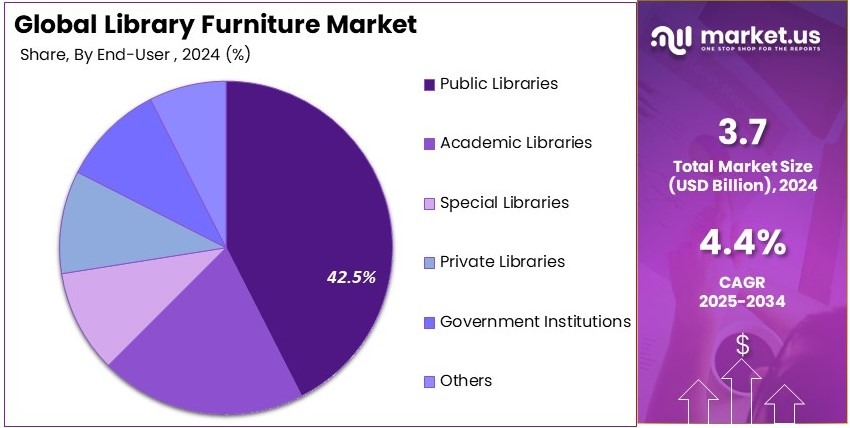

- The Library Furniture Market was valued at USD 3.7 billion in 2024 and is expected to reach USD 5.7 billion by 2034, with a CAGR of 4.4%.

- In 2024, Shelving Units dominated the product type segment with 38.2%, essential for efficient book organization and accessibility.

- In 2024, Public Libraries led the end-user segment with 42.5%, as they remain primary sources of knowledge and community engagement.

- In 2024, Offline Retail dominated the distribution channel with 45.3%, as institutions prefer hands-on selection for durable furniture.

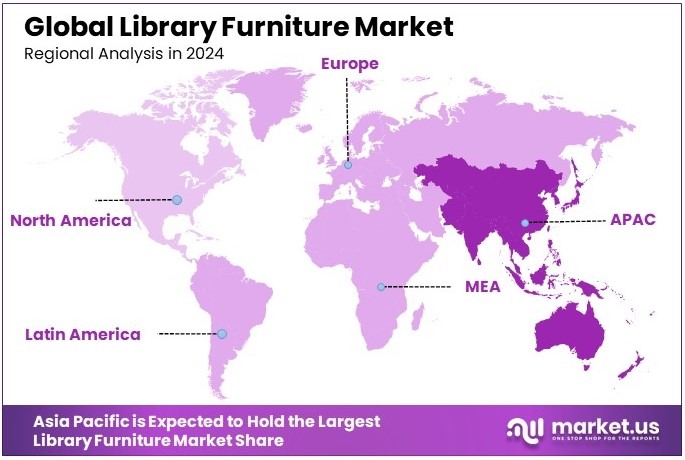

- In 2024, Asia Pacific held the largest market share, driven by growing investments in public and academic libraries.

Product Type Analysis

Shelving Units dominate with 38.2% due to their essential role in library organization and storage.

Shelving Units hold the largest share in the Library Furniture Market, accounting for 38.2% of the market. This is because shelving is a core requirement in any library, providing storage space for books and other media.

As libraries focus on optimizing space and ensuring easy access to materials, the demand for high-quality, durable shelving units has remained high. Shelving systems can be modular, allowing libraries to adjust the layout based on their specific needs, which adds to their versatility and popularity.

Reading Tables follow as the second-largest segment, driven by the importance of providing spaces for users to read or study in comfort.

Libraries continue to emphasize creating quiet spaces, especially in academic settings where students require a place to read, research, and work. Chairs & Seating also contribute to the overall demand, as comfortable seating is crucial for library patrons who spend extended periods reading or working.

Library Desks are another important segment, catering to librarians or users who need designated workspaces within the library. Storage Units serve to organize and protect other library materials, such as documents, multimedia items, and rare collections. Finally, Book Carts, though not as large in share, have seen demand due to the need for mobile storage solutions for sorting and moving books.

End-User Analysis

Public Libraries dominate with 42.5% due to the broad usage and community-driven nature of libraries.

Public Libraries lead the Library Furniture Market with 42.5% of the market share. This is primarily because public libraries cater to a wide range of people in various communities. They need large quantities of furniture to accommodate high foot traffic and diverse needs.

Public libraries are key community hubs for literacy programs, study groups, and public events, all of which require a diverse range of furniture options, from seating and tables to shelving and storage.

Academic Libraries follow as the second-largest end-user, driven by the significant number of students, researchers, and educators who require library spaces. Academic libraries tend to demand specialized furniture that supports both individual study and group work.

Special Libraries, which serve specific industries or professions, make up a smaller but notable share. These libraries often require specialized furniture based on the field they cater to, such as archival storage systems or ergonomic workstations.

Private Libraries and Government Institutions represent niche segments. Private Libraries are typically smaller and less frequent but still demand high-quality furniture for personal or organizational use.

Government Institutions require library furniture for archives, public records, and research purposes, but their market share is smaller in comparison. The “Others” category captures the unique and less common users, contributing a smaller proportion to the market.

Distribution Channel Analysis

Offline Retail dominates with 45.3% due to the preference for physical inspection and immediate purchase.

Offline Retail holds the largest share in the Library Furniture Market at 45.3%. Libraries, particularly public and academic ones, often prefer to view and test furniture in person before purchasing. In addition, the need for specific dimensions, material quality, and ergonomic features makes in-person inspections essential.

Furniture stores and distributors who specialize in library furniture provide an important service, offering customization options and expert advice, which drives offline sales. Additionally, libraries may want to physically examine the durability of products before committing to large purchases, especially when outfitting entire buildings.

Online Retail, while growing in importance, represents a smaller portion of the market. The rise of e-commerce has made it easier for smaller libraries or private users to purchase furniture online, but libraries still prefer the security of traditional retail channels when making large-scale investments.

Direct Sales, where manufacturers sell directly to institutions, also contribute to the market. This model allows for bulk purchasing and often comes with better deals, especially for larger libraries needing custom furniture. Wholesale, although important, holds the smallest share, as it typically serves smaller retailers or specialized businesses, rather than directly catering to end-user libraries.

Key Market Segments

By Product Type

- Shelving Units

- Reading Tables

- Chairs & Seating

- Library Desks

- Storage Units

- Book Carts

- Others

By End-User

- Public Libraries

- Academic Libraries

- Special Libraries

- Private Libraries

- Government Institutions

- Others

By Distribution Channel

- Online Retail

- Offline Retail

- Direct Sales

- Wholesale

Driving Factors

Increasing Investments in Educational Infrastructure Drives Market Growth

The rising investments in educational infrastructure, including public libraries, play a pivotal role in expanding the library furniture market. Governments and private organizations are increasing funding for the development and upgrading of libraries, with a focus on creating modern, comfortable spaces for learning. These investments drive demand for high-quality library furniture, such as ergonomic seating, study desks, and reading stations, that meets the needs of today’s library visitors.

In addition, the growth of digital libraries and digital comics and technological advancements in educational spaces require the installation of specialized furniture. This includes tech-enabled furniture solutions designed to integrate seamlessly with digital learning tools, making libraries more efficient and user-friendly.

As a result, furniture manufacturers are working closely with architects and designers to create furniture that not only enhances the aesthetic appeal of libraries but also supports new educational methods. The increasing investment in library spaces ensures that libraries are better equipped to serve communities, creating a steady demand for furniture designed to cater to the modern needs of students, educators, and the public.

Restraining Factors

High Initial Investment and Budget Constraints Restrain Market Growth

While the demand for quality library furniture is growing, several factors are limiting the market’s full potential. One of the main obstacles is the high initial investment required to purchase quality, durable furniture. Libraries, especially public and academic ones, may face budget constraints that make it difficult to afford the premium furniture needed to create modern, functional spaces.

Public and educational institutions often struggle to allocate sufficient funds for non-essential items like furniture, especially during periods of economic uncertainty. Budget cuts can further limit the ability of these institutions to invest in high-quality or specialized library furniture, impacting the overall demand for such products.

Another challenge is the limited awareness of the benefits offered by specialized library furniture. Many institutions may not fully understand how ergonomic, modular, or smart furniture can enhance the library experience for users. Without this awareness, libraries may hesitate to invest in these innovative products, thus slowing market growth.

Growth Opportunities

Digital and Flexible Learning Spaces Provide Growth Opportunities

The library furniture market has substantial growth opportunities, particularly with the rise of digital learning environments. As educational institutions embrace digital technologies and online learning platforms, there is a growing demand for advanced furniture solutions that integrate technology into library spaces. Digital libraries require specialized furniture to support tech-driven learning tools, such as computer stations, interactive tables, and multimedia setups.

Another key opportunity is the increasing trend of flexible and collaborative spaces within libraries. Many libraries are shifting toward open, dynamic environments where students, educators, and the community can engage in collaborative projects. To accommodate this shift, there is a rising demand for modular and customizable furniture that can be easily reconfigured to suit different purposes, such as group discussions or quiet study sessions.

Furthermore, private libraries and co-working spaces are emerging as new markets for custom library furniture. These spaces often demand unique, tailor-made furniture solutions that align with their specific needs and aesthetic preferences. This growth in the private sector and co-working spaces presents new avenues for furniture manufacturers to expand their product offerings and cater to a wider range of clients.

Emerging Trends

Modular and Eco-friendly Designs Are Latest Trending Factors

The library furniture market is influenced by several trends that are reshaping the design and functionality of library spaces. One of the most notable trends is the increasing use of modular and adaptive furniture designs. These pieces allow libraries to easily rearrange their spaces to meet the changing needs of users, whether for individual study, group work, or presentations.

Another growing trend is the focus on noise reduction and acoustic furniture, particularly in study spaces. As libraries evolve into multi-purpose hubs for learning and collaboration, there is an increasing need for furniture that helps manage sound, creating quieter and more productive environments.

The growing emphasis on sustainability is also shaping the library furniture market. More libraries are opting for furniture made from recycled or eco-friendly materials, in line with a global push for environmental responsibility. This trend aligns with the broader shift towards sustainability in public spaces.

Additionally, multi-functional furniture, which serves several purposes in a compact design, is gaining traction in modern libraries. These versatile pieces help maximize space while offering the flexibility to support various activities within a library.

Regional Analysis

Asia Pacific Dominates with Significant Market Share in the Library Furniture Market

Asia Pacific holds a dominant position in the Library Furniture Market, with a significant share driven by rapid urbanization, growing educational infrastructure, and an increasing focus on modern library spaces. The region contributes heavily to the demand for innovative and adaptable furniture in schools, universities, and public libraries. As of the latest data, Asia Pacific accounts for a large portion of the market’s growth, largely due to its diverse population and expanding middle class.

Key factors driving this dominance include the growing number of educational institutions, which require modern furniture solutions to enhance the learning environment. Additionally, the increasing emphasis on digital and interactive libraries has raised demand for specialized furniture like multimedia desks and flexible seating arrangements. China, India, and Japan are the leading players in the region, with extensive investment in both educational and public infrastructure.

Asia Pacific’s favorable manufacturing capabilities also contribute to its growth. Countries like China and India have strong manufacturing sectors that allow for cost-effective production of high-quality library furniture. The demand for smart, multifunctional furniture solutions, which can cater to digital learning and collaborative spaces, is also growing in these markets.

Regional Mentions:

- North America: North America has a stable position in the Library Furniture Market, driven by the strong demand for ergonomic and comfortable furniture in academic institutions. The focus on sustainability and green designs also boosts market growth, particularly in the U.S. and Canada.

- Europe: Europe is a key player, with a focus on designing modular and eco-friendly library furniture. The region is known for integrating advanced design into its educational systems, particularly in countries like the UK, Germany, and France.

- Asia Pacific: Asia Pacific remains the largest market, driven by rapid urbanization, growing educational infrastructure, and an expanding middle class. The region leads in demand for modern, adaptable library furniture, especially in China, India, and Japan.

- Middle East & Africa: The Middle East and Africa are emerging markets, with increasing investments in educational infrastructure. The demand for library furniture is on the rise, particularly in countries like the UAE and South Africa, where there is a push to modernize schools and public libraries.

- Latin America: Latin America is experiencing growth, with countries like Brazil and Mexico investing in educational facilities. The demand for library furniture in public institutions is increasing, driven by a focus on improving the educational environment.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Library Furniture Market is shaped by the innovative and functional designs provided by leading companies such as Demco, KI Furniture, Scholastic, and Virco. These companies are instrumental in defining the standards for library furniture, focusing on durability, ergonomic comfort, and the effective utilization of space.

Demco stands out as a leading provider with its comprehensive range of library furniture that includes shelving, displays, and seating solutions tailored for public and educational library settings. The company’s focus on producing furniture that combines functionality with aesthetic appeal makes it a preferred choice for libraries looking to create inviting and efficient spaces.

KI Furniture is renowned for its innovative designs that address the dynamic needs of modern libraries. Its products are designed to facilitate collaboration and learning, featuring modular and flexible furniture pieces that can be reconfigured to suit different activities and environments within libraries.

Scholastic is not only a powerhouse in publishing but also offers a variety of furniture products designed to enhance educational environments. Its focus is on creating engaging and comfortable reading areas for students, which supports literacy and learning in school libraries.

Virco supplies furniture that is durable and designed to withstand the rigors of daily use in busy library environments. Its products include chairs, tables, and shelving units that are both functional and comfortable, catering to the needs of library users of all ages.

These top companies in the Library Furniture Market play critical roles in supporting educational and public institutions by providing products that enhance the usability and appeal of library spaces, adapting to evolving educational needs and technologies.

Major Companies in the Market

- Demco

- KI Furniture

- Scholastic

- Virco

- Mackin Educational Resources

- Smith System

- Office Depot

- Dutailier

- Bibliotheca

- The Library Furniture Co.

- Global Furniture Group

- Furnispace

Recent Developments

- LibraFurn Solutions and EduShelf Innovations: On February 2024, LibraFurn Solutions, a leading manufacturer of library and academic furniture, announced the acquisition of EduShelf Innovations, a niche provider of modular shelving systems and ergonomic study carrels. The $12 million deal is expected to increase LibraFurn’s annual revenue by 10% and expand its portfolio with more adaptable and space-efficient solutions.

- National Library Furnishings: On March 2024, National Library Furnishings launched a new eco-friendly modular furniture collection designed for modern libraries. Featuring sustainable materials, ergonomic seating, and adaptable storage units, the collection aims to meet the rising demand for green solutions in public and academic institutions, with company forecasts predicting an 8% boost in quarterly revenue.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 5.7 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Shelving Units, Reading Tables, Chairs and Seating, Library Desks, Storage Units, Book Carts, Others), By End-User (Public Libraries, Academic Libraries, Special Libraries, Private Libraries, Government Institutions, Others), By Distribution Channel (Online Retail, Offline Retail, Direct Sales, Wholesale) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Demco, KI Furniture, Scholastic, Virco, Mackin Educational Resources, Smith System, Office Depot, Dutailier, Bibliotheca, The Library Furniture Co., Global Furniture Group, Furnispace Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Library Furniture MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Global Library Furniture MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Demco

- KI Furniture

- Scholastic

- Virco

- Mackin Educational Resources

- Smith System

- Office Depot

- Dutailier

- Bibliotheca

- The Library Furniture Co.

- Global Furniture Group

- Furnispace