Global Ergonomic Chair Market Size, Share, Growth Analysis By Product Type (Task Chairs, Executive Chairs, Gaming Chairs, Conference Chairs, Lounge Chairs, Recliners), By Material (Fabric, Leather, Mesh, Plastic, Memory Foam), By End-User (Office Workers, Remote Workers, Gaming Enthusiasts, Students, Healthcare Professionals, Corporate Offices), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139504

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

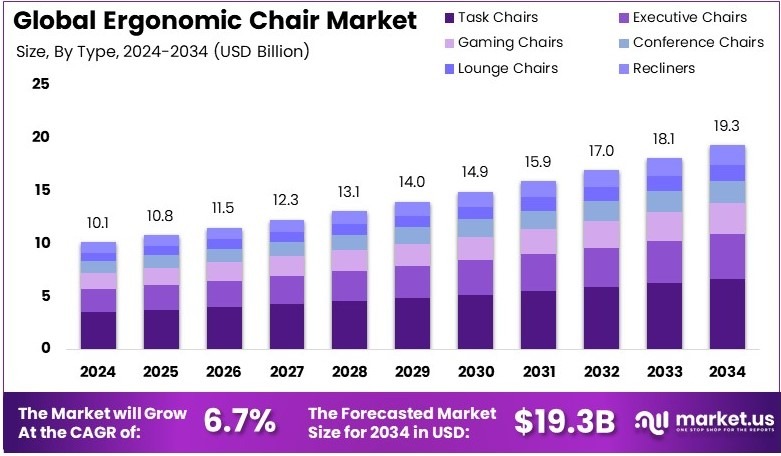

The Global Ergonomic Chair Market size is expected to be worth around USD 19.3 Billion by 2034, from USD 10.1 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

An ergonomic chair is a type of seating designed to support the body’s natural posture and reduce discomfort. It features adjustable components like seat height, backrest angle, and armrests. These chairs are ideal for promoting good posture and preventing strain during long hours of sitting.

The ergonomic chair market focuses on the production and sale of chairs designed for comfort and health. It caters to sectors like offices, home offices, and healthcare. The market includes various brands and designs that prioritize ergonomics, aiming to improve user comfort and reduce the risk of injury.

The ergonomic chair market is experiencing steady growth due to the rising demand for comfort and health-conscious office furniture. According to a study by Quantum Workplace, 32% of employees prefer to work fully remotely, while 41% favor a hybrid work setup. This shift in workplace dynamics is increasing the demand for ergonomic solutions, particularly chairs that support long hours of sitting.

The growth of this market is further fueled by the increasing awareness of the health risks associated with poor posture, such as back pain. Moreover, employees are increasingly seeking furniture that enhances comfort and supports flexibility in their work environments.

For instance, in 2024, HNI Corporation acquired Kimball International for $485 million, indicating strong investment in the office furniture sector. This acquisition highlights the market’s potential, providing further opportunities for both established brands and new entrants to expand their offerings.

Despite these opportunities, the ergonomic chair market is becoming more competitive. With increasing demand, companies are working to differentiate their products through innovative designs and advanced features. This heightened competition has led to higher market saturation, meaning there are more options available to consumers. However, this also drives product innovation as brands push to offer unique solutions that stand out in the crowded market.

Key Takeaways

- Ergonomic Chair Market was valued at USD 10.1 billion in 2024 and is expected to reach USD 19.3 billion by 2034, with a CAGR of 6.7%.

- In 2024, Executive Chairs dominate the product type segment with 34.5%, due to their premium comfort and design appeal in corporate settings.

- In 2024, Fabric leads the material segment with 38.3%, offering comfort and breathability for long hours of sitting.

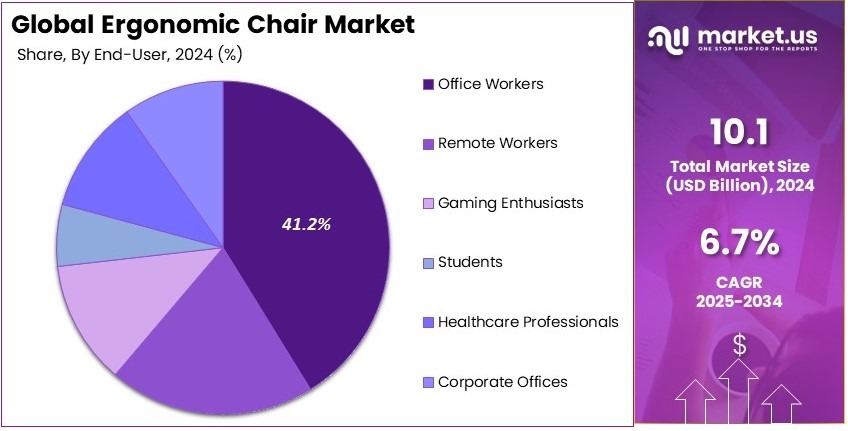

- In 2024, Office Workers dominate the end-user segment with 41.2%, reflecting the growing demand for ergonomic solutions in corporate environments.

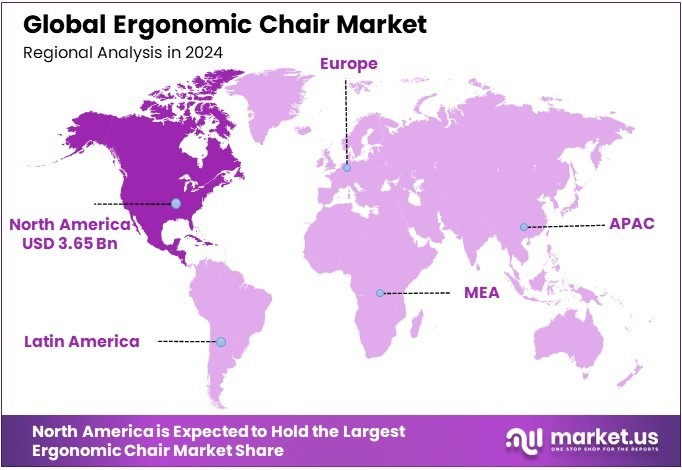

- In 2024, North America leads the regional market with 36.1% market share, contributing USD 3.65 billion, driven by widespread office ergonomics awareness.

Product Type Analysis

Executive Chairs dominate with 34.5% due to their premium design and comfort for long working hours.

In the Ergonomic Chair Market, executive chairs hold the largest share at 34.5%. These chairs are specifically designed for office workers, offering superior comfort and support for long hours of sitting. The ergonomic design of executive chairs helps prevent back pain and promotes good posture, making them highly sought after by individuals working long hours in office environments.

Features like adjustable armrests, lumbar support, and reclining capabilities make them ideal for professionals who require both comfort and style. The premium materials used in executive chairs, such as high-quality leather and memory foam, further enhance their appeal.

Task chairs also play a significant role in the market, with a strong focus on functionality and compact design. They are commonly used in offices, where employees spend shorter periods sitting but still need comfort and support.

Gaming chairs, on the other hand, have seen rapid growth, driven by the rise in esports and gaming culture. These chairs are designed for gamers who spend long hours sitting and require specialized support.

Conference chairs are essential for meeting rooms and corporate settings but capture a smaller market share compared to task and executive chairs. Lounge chairs and recliners are typically more associated with home offices or relaxation areas, so they hold a smaller share in the ergonomic chair market.

Material Analysis

Fabric dominates with 38.3% due to its breathability, comfort, and versatility in ergonomic chair designs.

Fabric remains the most popular material in the ergonomic chair market, capturing 38.3% of the market share. The breathable nature of fabric makes it ideal for long hours of sitting, especially in warmer climates. Fabric chairs are comfortable, soft, and available in various colors and patterns, making them a versatile option for both office and home use.

Unlike leather, fabric doesn’t heat up as quickly, offering a more comfortable experience over extended periods. Additionally, fabric is easier to clean and maintain compared to leather, which makes it a popular choice for budget-conscious consumers.

Leather chairs follow closely in popularity, with their luxurious feel and sleek appearance. Leather is often found in higher-end executive chairs, where comfort and style are top priorities. Mesh chairs are popular for their lightweight and breathable properties, which makes them ideal for long work hours, particularly in offices.

However, mesh doesn’t have the plushness of fabric or leather, so it’s typically seen in task chairs or mid-range ergonomic models. Plastic and memory foam are also used in ergonomic chair designs. Plastic is mainly used for chair frames, while memory foam provides enhanced cushioning for comfort and is found in higher-end models.

End-User Analysis

Office Workers dominate with 41.2% due to the growing need for ergonomic solutions in long working hours.

Office workers represent the largest end-user segment in the ergonomic chair market, holding a share of 41.2%. The demand for ergonomic chairs is especially high in office environments where employees sit for extended periods. The need to prevent health issues like back pain, poor posture, and repetitive strain injuries has led to a surge in the adoption of ergonomic chairs.

Offices are investing in these chairs to improve employee well-being and productivity. With the rising awareness about the importance of ergonomics, companies are upgrading their office furniture to provide better support for their staff.

Remote workers are another growing segment, especially with the increase in work-from-home trends. As remote workers create home offices, the need for comfortable and supportive ergonomic chairs has surged. Gaming enthusiasts represent a booming market segment as well.

Students are increasingly using ergonomic chairs for studying at home, while healthcare professionals require specialized ergonomic chairs for clinics or hospitals to provide comfort during long shifts. Corporate offices are investing heavily in ergonomic chairs to ensure their employees have optimal working conditions.

Key Market Segments

By Product Type

- Task Chairs

- Executive Chairs

- Gaming Chairs

- Conference Chairs

- Lounge Chairs

- Recliners

By Material

- Fabric

- Leather

- Mesh

- Plastic

- Memory Foam

By End-User

- Office Workers

- Remote Workers

- Gaming Enthusiasts

- Students

- Healthcare Professionals

- Corporate Offices

Driving Factors

Health Awareness and Work Trends Drive Market Growth

The rising awareness of health and wellness among office workers is driving demand for advanced ergonomic seating solutions. Many employees now recognize the importance of proper posture and spinal support during long work hours, leading to increased investment in high-quality chairs that reduce discomfort and fatigue.

The shift to remote and hybrid work models has further elevated the need for ergonomic chairs in home offices. As more professionals work from home, they require seating that supports productivity and well-being. Without proper chairs, individuals face increased risks of back pain and musculoskeletal disorders, prompting higher demand for ergonomic solutions.

Integration of biomechanical and adjustable features has significantly enhanced comfort and productivity. Chairs with lumbar support, headrests, and multiple adjustment points allow users to customize their seating experience. These innovations not only improve workplace ergonomics but also increase efficiency by reducing strain and discomfort.

Additionally, the rising focus on preventing work-related musculoskeletal disorders is promoting further investment in ergonomic chair innovations. Businesses are prioritizing employee health by incorporating ergonomics into workplace design. As a result, manufacturers continue to refine designs to meet evolving demands, ensuring the ergonomic chair market experiences steady and sustainable growth.

Restraining Factors

High Costs and Market Challenges Restrain Growth

The high production costs and premium pricing of advanced ergonomic chairs are limiting market penetration among cost-sensitive consumers. Many buyers hesitate to invest in high-end models due to budget constraints, opting instead for conventional seating options that are more affordable but lack necessary ergonomic support.

Customization complexities also pose a challenge. Ergonomic chairs must cater to diverse body types, but a one-size-fits-all approach does not work for every user. Designing adjustable features that accommodate all individuals while maintaining affordability remains a difficult task for manufacturers.

Market saturation with conventional office chairs is another key restraint. Many workplaces still rely on traditional seating, delaying the transition to specialized ergonomic solutions. Businesses often prioritize cost-saving measures over ergonomic upgrades, further slowing adoption rates.

Stringent quality and certification standards also delay the introduction of new ergonomic chair models. Manufacturers must comply with strict regulations before launching new products, increasing development time and costs. These regulatory hurdles make it harder for innovative solutions to reach the market quickly, restricting overall growth.

Growth Opportunities

Innovation and Market Expansion Provide Opportunities

The expansion of research and development in smart ergonomic technologies is opening new opportunities. Advanced chairs with real-time posture monitoring and automatic adjustments enhance user comfort and reduce long-term health risks. These innovations appeal to tech-savvy consumers looking for intelligent seating solutions.

Strategic partnerships with health and wellness experts are also shaping the market. By collaborating with medical professionals, manufacturers can develop data-driven ergonomic chair designs tailored to specific user needs. These partnerships add credibility to products and increase consumer trust in their effectiveness.

Leveraging advanced materials and lightweight composites is another key opportunity. By using durable yet lightweight materials, manufacturers can create high-performance chairs that offer both comfort and longevity. This shift makes ergonomic chairs more accessible while maintaining high design and quality standards.

Expanding into untapped global markets further strengthens market potential. As workplace ergonomics gain recognition in emerging economies, demand for high-quality seating is increasing. Companies that enter these markets early can establish strong customer bases, benefiting from rising health awareness and evolving office culture worldwide.

Emerging Trends

Customization and Smart Features Are Latest Trending Factor

Customization trends are reshaping the ergonomic chair market. Consumers now prefer personalized seating adjustments based on individual work patterns. Chairs with memory settings, adjustable armrests, and posture-tracking features cater to diverse user needs, enhancing comfort and efficiency.

Sustainability is also influencing manufacturing processes. Many companies are adopting eco-friendly materials and production methods to align with environmental standards. Recycled plastics, biodegradable fabrics, and energy-efficient manufacturing processes are becoming more common, reflecting growing consumer demand for sustainable office furniture.

Aesthetic-driven ergonomic designs are gaining traction as well. Today’s buyers seek chairs that not only provide comfort but also complement modern office decor. Sleek designs, color variations, and minimalist aesthetics are now essential in appealing to style-conscious professionals.

The integration of IoT and connectivity features is further enhancing ergonomic chairs. Smart seating solutions provide real-time data insights on posture and sitting habits, helping users maintain healthier work routines. These advancements position ergonomic chairs as essential tools for both comfort and workplace efficiency, driving continuous innovation in the market.

Regional Analysis

North America Dominates with 36.1% Market Share

North America leads the Ergonomic Chair Market with a dominant 36.1% share, valued at USD 3.65 billion. This market leadership can be attributed to the region’s high awareness of health and wellness, a booming remote work culture, and an increasing focus on employee comfort and productivity. Companies and consumers alike are prioritizing ergonomic solutions for long-term health benefits, driving the demand for ergonomic chairs.

Key factors driving North America’s high market share include rising healthcare awareness, where the prevention of musculoskeletal disorders is a key focus. In addition, remote work and hybrid working models have further fueled the demand for ergonomic office furniture, including chairs designed to provide better posture support.

Market dynamics in North America reflect a robust competitive environment, with numerous players offering a wide range of ergonomic chairs. High disposable incomes, technological advancements in chair designs (such as lumbar support, adjustable armrests, and seat depth), and the growing emphasis on comfortable work environments are all contributing to the region’s market dominance.

Regional Mentions:

- Europe: Europe holds a significant share in the ergonomic chair market, driven by a strong emphasis on employee health and well-being. The rise of flexible office spaces and remote working arrangements across countries like Germany, France, and the UK supports ongoing growth in this region.

- Asia Pacific: Asia Pacific is witnessing growing demand for ergonomic chairs, especially in countries like Japan and China, as urbanization and the workforce shift to more office-based jobs. Rising disposable incomes and an increasing focus on wellness are propelling the market forward.

- Middle East & Africa: The Middle East & Africa region is seeing gradual growth in ergonomic chair adoption, especially in corporate offices and government spaces. As remote working becomes more common in countries like the UAE, the demand for ergonomic office furniture is rising.

- Latin America: Latin America is experiencing steady growth in the ergonomic chair market, with countries like Brazil and Mexico increasing their focus on employee comfort. As remote work continues to gain traction, ergonomic furniture is becoming a necessity in both home and office settings.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Ergonomic Chair Market is characterized by a competitive landscape where innovation, design, and comfort are at the forefront. Leading the market are Herman Miller, Steelcase, Haworth Inc., and Knoll Inc., each contributing significantly to the industry’s dynamics.

Herman Miller is renowned for its Aeron chair, a staple in ergonomic seating. Their chairs are designed with advanced ergonomics, focusing on spinal support and breathability, which makes them popular in both corporate and home offices. Herman Miller’s commitment to research in ergonomic health transforms workplace seating into a wellness solution.

Steelcase offers a range of ergonomic chairs that are highly customizable and designed to adapt to the user’s movements. Their Leap chair series, for instance, has gained acclaim for its ability to reduce back stress while accommodating a range of postures. Steelcase’s focus on technology and user-centric design keeps them at the industry’s edge.

Haworth Inc. designs chairs that blend style with functionality. Their Zody chair, globally recognized for its comfort and lower back support, showcases Haworth’s commitment to delivering comprehensive ergonomic benefits, focusing on comfort, body alignment, and refined aesthetics.

Knoll Inc. is known for ergonomic chairs that offer sophisticated design combined with functionality. Their Generation chair provides responsive movement and adjusts to the user’s changing positions. Knoll’s approach emphasizes creating healthy work environments with stylish, modern furniture that meets the ergonomic needs of diverse users.

These companies dominate the market through constant innovation and by providing ergonomic solutions that enhance user comfort and health, promoting not just productivity but also well-being in office environments.

Major Companies in the Market

- Herman Miller

- Steelcase

- Haworth Inc.

- Knoll Inc.

- Humanscale

- Okamura Corporation

- HNI Corporation

- X-Chair

- Kinnarps

- Global Furniture Group

Recent Developments

- Pelican Essentials: On February 2025, Pelican Essentials launched PelicanWork, a new line of ergonomic office furniture for the Indian market. The furniture, designed for hybrid and remote work environments, incorporates patented shipping mechanisms and world-class functionality, with prices starting at INR 17,000.

- Quersus and Audi: On August 2024, Quersus, a European ergonomic chair manufacturer, partnered with Audi to launch two exclusive chair models. The Quersus VAOS Audi RS Q e-tron and Quersus ICOS Audi combine Audi’s automotive design with superior ergonomic features like memory foam and 4-directional lumbar support.

Report Scope

Report Features Description Market Value (2024) USD 10.1 Billion Forecast Revenue (2034) USD 19.3 Billion CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Task Chairs, Executive Chairs, Gaming Chairs, Conference Chairs, Lounge Chairs, Recliners), By Material (Fabric, Leather, Mesh, Plastic, Memory Foam), By End-User (Office Workers, Remote Workers, Gaming Enthusiasts, Students, Healthcare Professionals, Corporate Offices) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Herman Miller, Steelcase, Haworth Inc., Knoll Inc., Humanscale, Okamura Corporation, HNI Corporation, X-Chair, Kinnarps, Global Furniture Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Ergonomic Chair MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Global Ergonomic Chair MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Herman Miller

- Steelcase

- Haworth Inc.

- Knoll Inc.

- Humanscale

- Okamura Corporation

- HNI Corporation

- X-Chair

- Kinnarps

- Global Furniture Group