Global Rooibos Tea Market By Type (Bag, Loose Leaf, Instant, Others), By Nature (Organic, Conventional), By Packaging (Boxed, Pouches, Tins), By End Use (Beverages, Household, Health care, Others), By Distribution Channel (B2B, B2C, Hypermarket and Supermarket, Online Retailing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132707

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

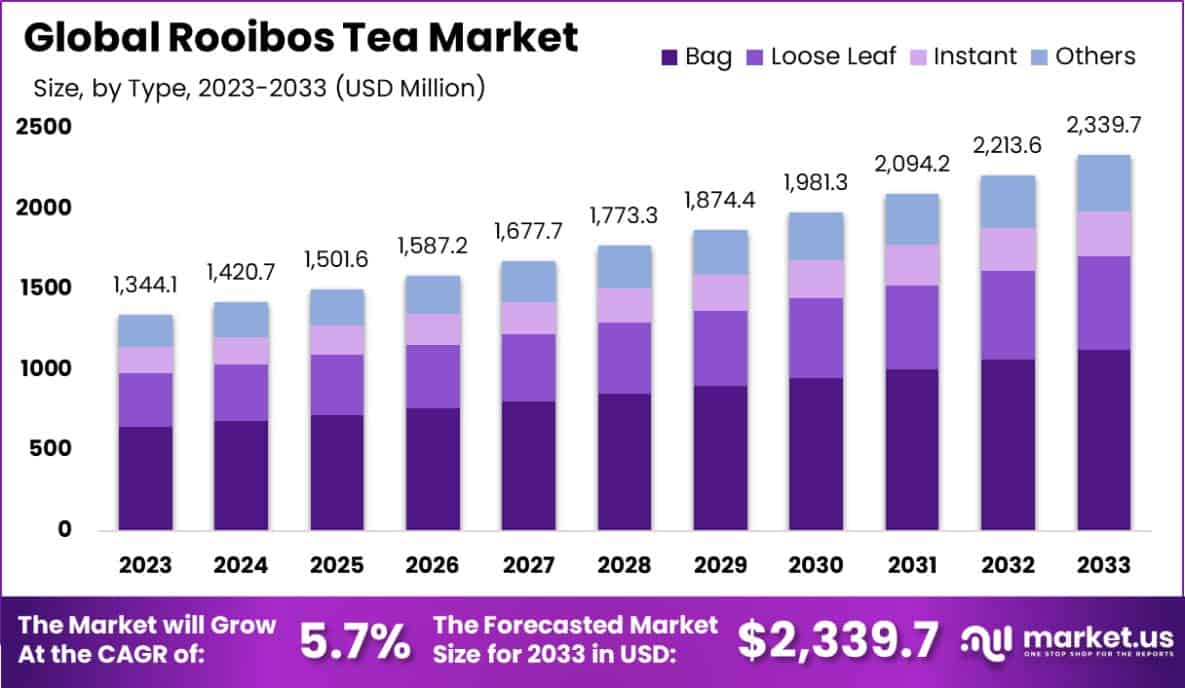

The Global Rooibos Tea Market is expected to be worth around USD 2,339.7 million by 2033, up from USD 1,344.1 million in 2023, and grow at a CAGR of 5.7% from 2024 to 2033.

Rooibos tea, also known as red bush tea, is an herbal tea made from the leaves of the Aspalathus linearis shrub, native to South Africa. Unlike traditional tea from the Camellia sinensis plant, Rooibos is naturally caffeine-free and rich in antioxidants. It boasts a distinct red color and a sweet, slightly nutty flavor.

The Rooibos Tea Market is experiencing growth driven by increasing consumer awareness of health and wellness. This market benefits from the global trend towards natural and organic products.

The market’s expansion is fueled by the rising demand for healthy beverages and the growing recognition of Rooibos tea’s antioxidant properties. These properties are believed to offer benefits such as stress relief and immune system support.

The Rooibos Tea Market is positioned for substantial growth, leveraging its unique health benefits and expanding consumer preference for wellness-oriented products. The natural, caffeine-free, and antioxidant-rich profile of Rooibos tea aligns with current consumer trends toward healthier, sustainable alternatives.

This herbal tea, native to South Africa, is gaining a global footprint due to its potential health benefits, which include stress reduction and immune system support.

Recent investments in research underscore the market’s potential. According to stir-tea-coffee.com, ZAR 4.8 million (approximately USD 264,000) has been allocated for research into the efficacy of Rooibos as an alternative therapy for chronic diseases such as cancer and diabetes.

This funding is part of a broader initiative, totaling ZAR 10 million (USD 549,000), supported by contributions from the Rooibos Council, highlighting a significant commitment to enhancing the scientific understanding and therapeutic profile of Rooibos.

Furthermore, the industry demonstrates a strong commitment to ethical practices and community benefits. As reported by klipopmekaar.co.za, the Rooibos industry has disbursed R12.2 million (USD 668,000) to the Khoi and San communities under a benefit-sharing agreement, adhering to the Nagoya Protocol.

This not only supports the indigenous communities historically linked with Rooibos but also boosts the market’s image as socially responsible and sustainable.

The combination of health-driven consumer trends, increasing research backing, and ethical, sustainable practices presents lucrative opportunities for the Rooibos Tea Market to expand its global presence and consumer base.

Demand for Rooibos tea is bolstered by the health-conscious consumer base seeking natural and caffeine-free alternatives to traditional teas and coffees, which aligns with the global shift towards healthier lifestyles.

There is a significant opportunity for market growth in introducing Rooibos-based blends and flavor innovations, catering to a diverse audience seeking variety in herbal tea selections. Expanding distribution channels, especially in e-commerce, also presents a lucrative avenue for reaching a broader global market.

Key Takeaways

- The Global Rooibos Tea Market is expected to be worth around USD 2,339.7 million by 2033, up from USD 1,344.1 million in 2023, and grow at a CAGR of 5.7% from 2024 to 2033.

- Bagged Rooibos Tea dominates the market type with a share of 48.5%.

- Conventional Rooibos holds a significant majority at 73.3% of the market by nature.

- Boxed packaging is preferred for Rooibos Tea, accounting for 56.4% of the market.

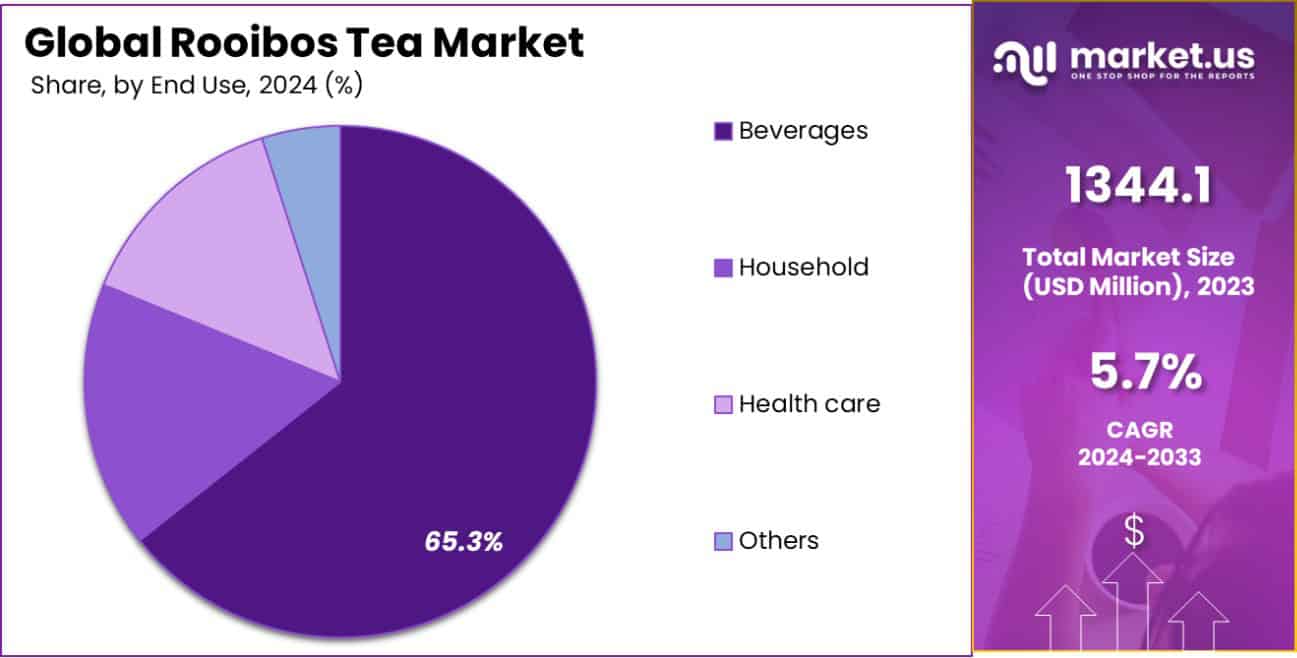

- Beverages remain the primary end use for Rooibos, comprising 65.3% of the market.

- Business-to-consumer (B2C) channels lead Rooibos distribution, capturing 52.3% of the market.

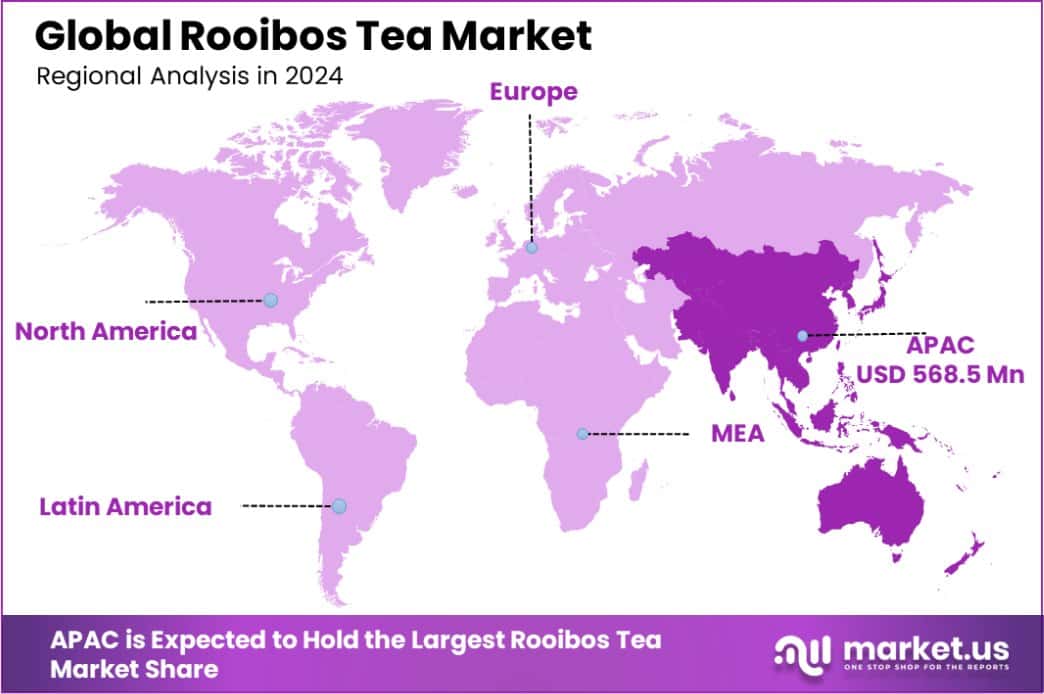

- Asia-Pacific Rooibos Tea Market holds 47.4%, valued at USD 568.5 million.

By Type Analysis

Bagged Rooibos Tea dominates the market, holding a 48.5% share.

In 2023, Bag held a dominant market position in the By Type segment of the Rooibos Tea Market, with a 48.5% share. This preference reflects the convenience and widespread consumer acceptance of bagged teas, which cater to fast-paced lifestyles.

Conversely, Loose Leaf varieties, appreciated by tea connoisseurs for their fuller flavor and traditional brewing style, captured a smaller segment of the market. Instant Rooibos options, which offer quick preparation without compromising too much on taste, also hold a niche yet steady share, appealing particularly to the on-the-go demographic.

In the By Nature category, Conventional Rooibos Tea commanded the market, accounting for 73.3% of total sales, highlighting its more accessible price point and broader availability. However, the Boxed packaging format led the By Packaging segment with a 56.4% market share, indicating a strong consumer preference for convenience and sustainability in packaging.

Regarding usage, the Beverages segment utilized a substantial 65.3% of Rooibos Tea, underscoring its primary consumption as a drink. Direct-to-consumer channels in the By Distribution Channel segment captured 52.3% of the market, emphasizing the growing trend towards online shopping and direct brand-consumer interactions.

This distribution trend is supported by the digital transformation and the increasing reliance on e-commerce platforms for food and beverage purchases.

By Nature Analysis

Conventional Rooibos Tea leads, comprising 73.3% of the market nature.

In 2023, Conventional held a dominant market position in the By Nature segment of the Rooibos Tea Market, with a 73.3% share. This substantial market share underscores the widespread consumer preference for conventionally farmed Rooibos, which is typically more affordable and readily available than its organic counterpart.

On the other hand, Organic Rooibos, which appeals to a niche but growing segment of health-conscious consumers looking for pesticide-free and environmentally friendly products, continues to carve out a significant presence in the market.

The dominance of Conventional Rooibos is further supported by its extensive distribution in mainstream retail channels where it benefits from established supply chains and large-scale production efficiencies. This segment’s robust performance is indicative of a market that values cost-effectiveness and product accessibility.

However, the increasing consumer awareness about health and sustainability is gradually amplifying the demand for Organic Rooibos. This shift is influencing manufacturers to expand their organic offerings to meet the rising preference for organic products, which promise a cleaner label and are perceived as healthier.

The growth trajectory for Organic Rooibos is expected to strengthen as more consumers pivot towards organic and eco-friendly products, reflecting broader trends within the global food and beverage industry.

By Packaging Analysis

Boxed packaging is preferred for Rooibos Tea, representing 56.4%.

In 2023, Boxed held a dominant market position in the By Packaging segment of the Rooibos Tea Market, with a 56.4% share. This format’s leading status highlights consumer preferences for packaging that combines convenience with sustainability, as boxed Rooibos tea is often seen as easy to store and recycle.

Meanwhile, Pouches, known for their lightweight nature and reduced shipping costs, captured a smaller yet significant portion of the market. Tins, appealing to premium segments, are favored for their aesthetic appeal and reusability, catering to consumers looking for high-quality, gift-worthy products.

The strong performance of Boxed packaging can be attributed to its widespread availability and consumer familiarity, making it a go-to choice in both retail and online markets. As eco-conscious consumer behaviors continue to rise, the demand for environmentally friendly boxed options that minimize waste without sacrificing quality is expected to grow.

Despite the dominance of boxed packaging, the increasing trend towards premiumization in the Rooibos tea market suggests that tins could see a rise in popularity. Manufacturers are likely to explore innovative, decorative tin designs that attract consumers seeking premium, sustainable products, potentially increasing their market share in the upcoming years.

By End Use Analysis

Rooibos Tea primarily used in beverages, accounting for 65.3%.

In 2023, Beverages held a dominant market position in the By End Use segment of the Rooibos Tea Market, with a 65.3% share. This prominent stance reflects the primary consumption of Rooibos as a drink, favored for its unique flavor and health benefits such as antioxidant properties and caffeine-free nature.

The Household category, which includes uses in cooking and personal consumption within homes, holds a smaller market share, illustrating Rooibos’s versatility beyond just being a beverage. In the Health care sector, Rooibos is increasingly incorporated into dietary supplements and wellness products, targeting health-conscious consumers.

The Beverages segment benefits from the broad appeal of Rooibos tea across various consumer demographics, from health enthusiasts to casual tea drinkers, due to its adaptability in both hot and cold preparations.

As wellness trends continue to influence consumer choices, the role of Rooibos in beverages is expected to grow, supported by innovations in flavor blends and packaging that cater to a diverse, global market.

Despite the dominance of beverages, there is an evolving opportunity in the Health care segment, where Rooibos’s potential therapeutic benefits are being explored further, possibly leading to increased market penetration in nutritional supplements and holistic health products.

By Distribution Channel Analysis

Direct-to-consumer sales constitute 52.3% of Rooibos Tea distribution.

In 2023, B2C held a dominant market position in the By Distribution Channel segment of the Rooibos Tea Market, with a 52.3% share. This segment includes direct sales to consumers through retail stores and online platforms, highlighting the strong consumer preference for purchasing Rooibos tea directly.

B2B transactions, which involve sales to businesses such as cafes, restaurants, and hotels, captured a significant portion of the market but trailed behind B2C due to the personalized nature of consumer purchases.

Hypermarkets and supermarkets are crucial in this distribution channel, offering wide visibility and accessibility to a variety of Rooibos tea products, though they share the space with growing online retailing platforms that cater to digital-savvy consumers seeking convenience.

The prominence of B2C distribution is driven by the growing trend of health and wellness, where consumers are increasingly seeking out specialty teas that offer health benefits directly from retail outlets or through e-commerce platforms. This trend is supported by the rise in consumer knowledge and the desire for a diverse range of products readily available at their convenience.

With online retailing rapidly expanding, opportunities for direct-to-consumer sales are expected to increase, potentially reshaping distribution dynamics in the Rooibos Tea Market as brands leverage digital channels to enhance consumer engagement and satisfaction.

Key Market Segments

By Type

- Bag

- Loose Leaf

- Instant

- Others

By Nature

- Organic

- Conventional

By Packaging

- Boxed

- Pouches

- Tins

By End Use

- Beverages

- Household

- Health care

- Others

By Distribution Channel

- B2B

- B2C

- Hypermarket and Supermarket

- Online Retailing

- Others

Driving Factors

Health Awareness Fuels Rooibos Tea Consumption

As health consciousness rises globally, more consumers are turning to Rooibos tea for its health benefits. Known for being naturally caffeine-free and rich in antioxidants, Rooibos tea is associated with numerous health advantages, including improved heart health and reduced stress levels.

This trend towards health and wellness continues to drive significant demand in the Rooibos tea market, with individuals seeking healthier beverage alternatives to traditional caffeinated drinks.

Growth in Organic Product Demand Boosts Rooibos Sales

The demand for organic products is soaring as consumers increasingly prioritize sustainability and health. Rooibos tea, available in both conventional and organic forms, benefits from this trend, with organic Rooibos seeing a significant uptick in sales.

Organic Rooibos is perceived as a cleaner and healthier option, free from pesticides and artificial chemicals, aligning with the global shift towards organic and natural food products. This shift not only supports market growth but also encourages producers to adopt more sustainable farming practices.

Expansion of E-Commerce Enhances Market Accessibility

The expansion of online retailing has revolutionized how Rooibos tea is distributed and sold. E-commerce platforms offer consumers the convenience of exploring a wide range of Rooibos tea products from the comfort of their homes.

This ease of access has opened new avenues for market growth, allowing Rooibos tea brands to reach a broader audience. Additionally, the digital marketing strategies employed by these platforms further stimulate consumer interest and drive sales in the Rooibos tea market.

Restraining Factors

Limited Awareness Outside Core Markets Stifles Growth

Despite its popularity in certain regions, Rooibos tea’s market penetration globally remains limited. The lack of awareness outside its core South African and health-conscious markets restricts its broader consumer base development.

This limited recognition can slow market expansion, as new potential markets remain untapped due to unfamiliarity with Rooibos tea’s benefits and properties.

Competition from Other Herbal Teas Limits Market Share

The herbal tea market is highly competitive, with numerous alternatives like chamomile, peppermint, and green tea vying for consumer attention. These established teas often overshadow Rooibos in markets where consumers are less aware of its specific benefits.

This intense competition can hinder Rooibos tea’s market share, as consumers have a wide array of choices, potentially preferring more commonly known or locally produced herbal teas.

Volatility in Rooibos Crop Yields Affects Supply

Rooibos tea is exclusively grown in South Africa, making it susceptible to local agricultural conditions that can significantly affect crop yields. Factors such as climate change, water scarcity, and agricultural pests can lead to unpredictable Rooibos production levels, leading to supply instability.

This volatility can restrain market growth by causing fluctuations in availability and price, potentially deterring both consumers and distributors who seek consistent supply chains.

Growth Opportunity

Global Health Trends Open New International Markets

The growing global focus on health and wellness presents a significant opportunity for the Rooibos tea market to expand internationally. As consumers worldwide increasingly seek out natural, health-promoting products, Rooibos tea, known for its antioxidant properties and absence of caffeine, stands out as an attractive option.

Capitalizing on these health trends by enhancing marketing efforts and education about Rooibos tea’s benefits can open up new markets and increase its global consumption.

Innovative Product Offerings to Attract Younger Consumers

Introducing innovative Rooibos tea-based products, such as ready-to-drink beverages, Rooibos-infused health drinks, and Rooibos energy drinks, can attract a younger demographic. The younger generation looks for convenience and novel products.

By diversifying the product range to include these innovative offerings, the market can tap into a new customer segment and drive growth through product differentiation.

Strategic Partnerships with Health and Wellness Brands

Forming strategic partnerships with health and wellness brands can provide a robust avenue for Rooibos tea’s market expansion. By aligning with companies that promote health and wellness, Rooibos can leverage these partnerships to enhance its visibility and appeal among health-conscious consumers.

Collaborating on joint marketing campaigns or co-branded products can broaden its reach and reinforce its position as a healthy beverage choice.

Latest Trends

Eco-Friendly Packaging Gains Traction in Tea Industry

Sustainability trends are influencing consumer preferences, leading to increased demand for eco-friendly packaging within the Rooibos tea market. Brands are now transitioning to biodegradable and recyclable materials to align with consumer expectations for environmental responsibility.

This shift not only appeals to environmentally conscious consumers but also helps companies reduce their ecological footprint, fostering a positive brand image and potentially increasing market share among a growing segment of environmentally aware shoppers.

Rise of Specialty Rooibos Blends Enhances Market Appeal

The Rooibos tea market is witnessing a trend towards specialty blends that incorporate a variety of flavors and additional health benefits. These innovative blends, combining Rooibos with spices, fruits, or herbal infusions, cater to evolving consumer palates seeking unique and diverse flavors.

This trend is expanding the consumer base by appealing to taste adventurers and health enthusiasts alike, driving growth and differentiation in a competitive market.

Collaborations with Health Influencers Boost Brand Visibility

Tea brands, including those in the Rooibos market, are increasingly collaborating with health and wellness influencers to promote their products. These partnerships leverage the influencers’ extensive reach and credibility to educate potential consumers about the health benefits of Rooibos tea.

As social media continues to influence purchasing decisions, these collaborations can significantly enhance brand visibility and consumer trust, leading to increased sales and market penetration.

Regional Analysis

In Asia-Pacific, the Rooibos Tea Market holds a 47.4% share, valued at USD 568.5 million.

In the global Rooibos Tea Market, Asia-Pacific emerges as the dominating region, commanding a 47.4% market share with a value of USD 568.5 million. This leadership is attributed to growing health awareness and increasing consumer affinity towards herbal and wellness products in populous countries such as China and India.

North America follows, with a substantial market presence, driven by health-conscious consumers and a robust natural products market. Europe, with its preference for organic and fair-trade products, also presents a significant share, reflecting the region’s stringent health and safety regulations and a strong cafe culture that embraces diverse tea varieties.

The Middle East & Africa region, particularly South Africa—the birthplace of Rooibos—maintains a steady growth trajectory, supported by traditional consumption and export of Rooibos tea.

Latin America, though smaller in market share, is witnessing gradual growth as herbal tea consumption begins to rise, influenced by global health trends and cultural integration of tea drinking habits.

Asia-Pacific’s dominance is fueled not only by volume but also by significant investments in tea production innovations and marketing strategies tailored to local consumer preferences, setting the pace for market expansion and competitive dynamics across all regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global Rooibos Tea Market in 2023, several key players have positioned themselves prominently, each contributing uniquely to the industry’s growth and innovation. Among these, Rooibos Ltd., Celestial Seasonings, and The Republic of Tea stand out due to their strategic initiatives and expansive product portfolios.

Rooibos Ltd. continues to be a leading force, primarily due to its deep roots in South Africa, the origin of Rooibos tea. The company excels in sustainable farming practices and has extensive control over its supply chain, ensuring high-quality products. Its focus on authentic, pure Rooibos resonates well with consumers seeking natural and organic tea options.

Celestial Seasonings, a veteran in the herbal tea market, has successfully capitalized on the growing trend towards wellness and natural products. With its innovative blends and strong marketing strategies, Celestial Seasonings has maintained its market presence by offering unique Rooibos products that cater to a diverse consumer base looking for health and flavor in their tea selections.

The Republic of Tea is another notable player, known for its premium positioning and wide range of Rooibos offerings, including organic and non-GMO options. The company’s commitment to health and luxury appeals to a niche market segment that prefers upscale, wellness-oriented products.

These companies, through their dedication to quality, innovation, and market adaptability, not only drive their own growth but also significantly influence the global trends in the Rooibos Tea Market.

Their strategies often involve expanding product lines, enhancing sustainability efforts, and engaging with consumers through effective marketing campaigns, all of which are crucial for staying competitive in a market that is becoming increasingly crowded and diverse.

Top Key Players in the Market

- Big Five Rooibos Company

- Cape Natural Tea Products (CNTP)

- Celestial Seasonings

- Coetzee & Coetzee

- Harney & Sons

- Khoisan Tea

- King’s Products

- Maskam Redbush

- Mighty Leaf Tea

- Numi Organic Tea

- Red T Company

- Rishi Tea

- Rooibos Ltd.

- Tazo Tea

- Teapigs

- Teavana

- Tega Organic Tea

- The Republic of Tea

- Twinings

- Yogi Tea

Recent Developments

- In 2023, Celestial Seasonings the brand introduced several Rooibos varieties, such as Madagascar Vanilla and Moroccan Pomegranate, which have been well-received for their distinctive flavors and health benefits. These teas are enriched with minerals like calcium and magnesium and are known for their sweet notes of toffee and vanilla.

- In 2023, Khoisan Tea has continued to expand its global export activities while emphasizing the health benefits and unique flavors of their Rooibos offerings, ensuring that each cup reflects their commitment to excellence and customer satisfaction.

Report Scope

Report Features Description Market Value (2023) USD 1,344.1 Million Forecast Revenue (2033) USD 2,339.7 Million CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bag, Loose Leaf, Instant, Others), By Nature (Organic, Conventional), By Packaging (Boxed, Pouches, Tins), By End Use (Beverages, Household, Health care, Others), By Distribution Channel (B2B, B2C, Hypermarket and Supermarket, Online Retailing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Big Five Rooibos Company, Cape Natural Tea Products (CNTP), Celestial Seasonings, Coetzee & Coetzee, Harney & Sons, Khoisan Tea, King’s Products, Maskam Redbush, Mighty Leaf Tea, Numi Organic Tea, Red T Company, Rishi Tea, Rooibos Ltd., Tazo Tea, Teapigs, Teavana, Tega Organic Tea, The Republic of Tea, Twinings, Yogi Tea Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Big Five Rooibos Company

- Cape Natural Tea Products (CNTP)

- Celestial Seasonings

- Coetzee & Coetzee

- Harney & Sons

- Khoisan Tea

- King’s Products

- Maskam Redbush

- Mighty Leaf Tea

- Numi Organic Tea

- Red T Company

- Rishi Tea

- Rooibos Ltd.

- Tazo Tea

- Teapigs

- Teavana

- Tega Organic Tea

- The Republic of Tea

- Twinings

- Yogi Tea