Global Reusable Baby Diapers And Training Pants Market Size, Share, Growth Analysis By Product Type (Reusable Baby Diapers, Training Pants), By Distribution Channel (Online Retail, Supermarkets or Hypermarkets, Specialty Stores, Baby Boutiques, Pharmacy or Drug Stores), By Size (Small, Medium, Large, Extra-Large), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144679

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

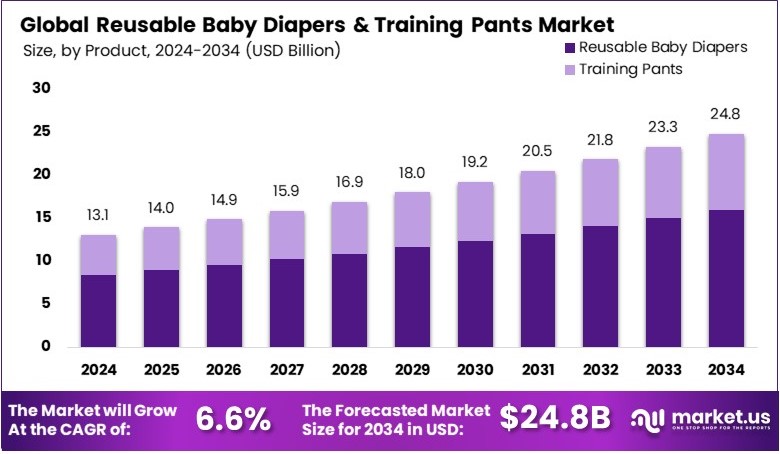

The Global Reusable Baby Diapers and Training Pants Market size is expected to be worth around USD 24.8 Billion by 2034, from USD 13.1 Billion in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034.

Reusable baby diapers and training pants are washable and reusable cloth-based products. They are designed to absorb moisture while keeping the baby comfortable. These products reduce waste compared to disposable options. They are made from materials like cotton, bamboo, or microfiber. Parents choose them for cost-effectiveness and environmental benefits.

The market for reusable baby diapers and training pants is growing. This growth is driven by rising environmental awareness and cost-saving preferences among parents. Demand is increasing as consumers seek sustainable baby personal care products. The market includes various brands offering eco-friendly, washable diapers. Innovations in fabric and design are boosting market expansion.

Reusable baby diapers and training pants are becoming increasingly popular. This shift is mainly due to rising environmental awareness and the financial benefits of reusable options. Traditional disposable diapers significantly impact the environment, contributing approximately 3.3 million tons of landfill waste annually. Each diaper can take up to 500 years to decompose, releasing harmful chemicals and gases. In contrast, reusable diapers offer a sustainable alternative.

Consequently, more families are opting for cloth diapers to reduce waste. Financially, disposable diapers can be a burden, with families spending around $1,000 per year. In comparison, investing in cloth diapers costs between $500 to $800, providing long-term savings despite higher initial expenses. Therefore, the cost-effectiveness and environmental benefits make reusable options appealing.

In the United States, the reusable diaper market is growing steadily. This trend is driven by increased awareness of environmental issues and rising disposable incomes, especially among eco-conscious families. Companies are also investing in manufacturing facilities to meet the demand. For example, Drylock’s new plant in Reidsville, NC, aims to enhance the supply chain for the North American market.

Similarly, First Quality is expanding its product range, focusing on quality and affordability. Moreover, online retail platforms have made reusable diapers more accessible, allowing consumers to explore a wide variety of products. As a result, the market is witnessing a gradual but consistent rise in adoption.

Despite these positive trends, market penetration remains varied across regions. Urban areas with higher disposable incomes are seeing more adoption compared to rural areas, where awareness is still low. However, the market is far from saturated, as new brands continue to introduce innovative and affordable options.

Consequently, companies that focus on raising awareness and offering competitive pricing are likely to succeed. Furthermore, as consumer preferences continue to shift towards sustainability, market players are increasingly focusing on eco-friendly materials and convenient product features. Therefore, companies that align their strategies with environmental trends will likely gain a competitive edge.

Key Takeaways

- The Reusable Baby Diapers and Training Pants Market was valued at USD 13.1 billion in 2024 and is expected to reach USD 24.8 billion by 2034, with a CAGR of 6.6%.

- In 2024, Reusable Baby Diapers dominated the type segment with 64.5%, driven by growing consumer preference for sustainable alternatives.

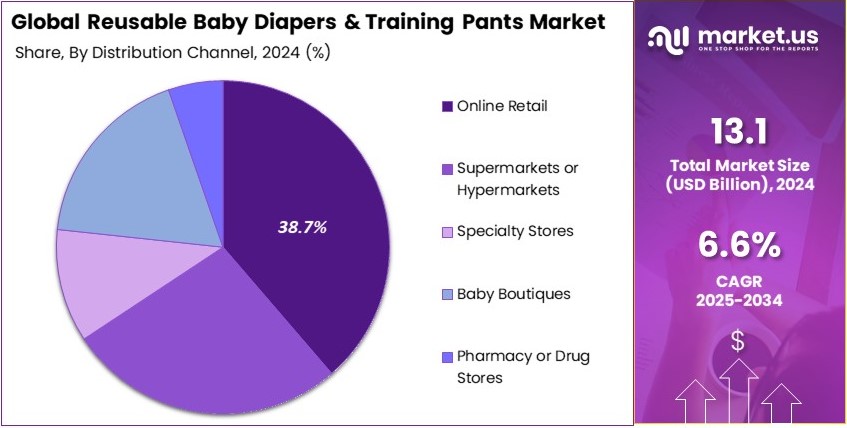

- In 2024, Online Retail led the distribution channel with 38.7%, benefiting from convenience and a wide product range.

- In 2024, Medium-sized diapers held the largest market share at 40.2%, catering to the most common infant age group.

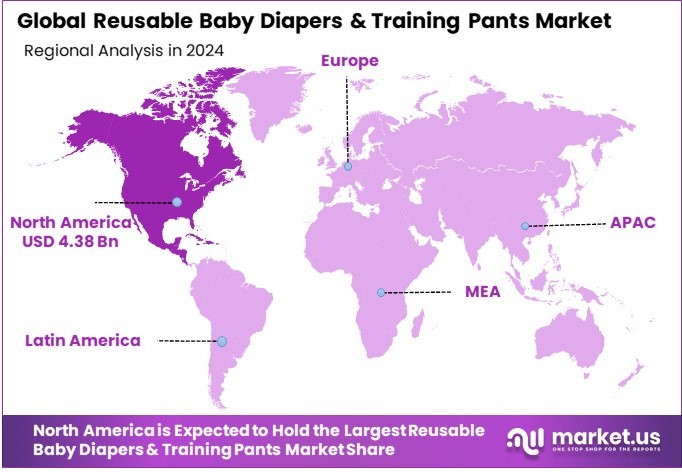

- In 2024, North America accounted for 33.4% of the market, reaching USD 4.38 billion, due to high awareness and demand for eco-friendly baby products.

Business Environment Analysis

The Reusable Baby Diapers and Training Pants Market is approaching saturation in developed countries, signaling limited growth potential for new market entrants without distinct innovations or niche targeting. Established brands dominate, making it crucial for new companies to find unique market spaces or offer innovative features.

In terms of the target demographic, eco-conscious parents, particularly in urban areas, are the main consumers. This group is rapidly growing and shows a strong preference for sustainable and healthy products for their children, with a notable emphasis on organic materials and environmentally-friendly practices.

Product differentiation in this market is key, with successful companies focusing on unique designs, organic materials, and additional features like enhanced comfort and easier clean-up options. These factors are essential in persuading parents to switch from disposable to reusable options, enhancing brand loyalty and market presence.

Value chain analysis indicates that efficiency in material sourcing and manufacturing processes can significantly affect profitability. Companies that invest in sustainable production technologies and maintain stringent quality control tend to perform better, as consumers are particularly sensitive to product safety and sustainability practices in this market.

There are significant investment opportunities in emerging markets such as Asia and Africa, where awareness and adoption of eco-friendly products are rising. The market in these regions is expected to grow at a CAGR of 10% over the next decade, driven by increasing income levels and urbanization.

Adjacent markets like baby skincare products and eco-friendly baby clothing are also expanding as a result of trends in the reusable diapers market. These markets are benefiting from the increased attention to health and sustainability among parents, creating opportunities for cross-promotion and bundled product offerings.

Type Analysis

Reusable Baby Diapers dominate with 64.5% due to increased consumer awareness of environmental sustainability.

The segment analysis of Reusable Baby Diapers reveals a dominant position in the market, primarily driven by growing environmental concerns and a shift towards sustainable products. Consumers are increasingly aware of the environmental impact of disposable diapers, leading to a significant uptick in the adoption of reusable variants. This sub-segment’s growth is bolstered by innovations in diaper design, such as improved absorbency and user-friendly features, which enhance consumer acceptance and usage.

Training Pants, while not the dominant sub-segment, play a critical role in the market, especially for parents aiming for a smooth transition during their child’s potty training phase. These products offer convenience and help toddlers gain confidence with less dependency, contributing to gradual market growth.

Distribution Channel Analysis

Online Retail leads with 38.7% due to the convenience of home shopping and a wider range of choices.

Online retail channels have surged to the forefront of the distribution channels for reusable baby diapers and training pants. This dominance is facilitated by the ease of access to a broad range of products and the convenience of home delivery, which appeals to the modern consumer’s preference for shopping online. Additionally, online platforms often offer competitive pricing and detailed product reviews, which help consumers make informed decisions.

Supermarkets or Hypermarkets provide significant exposure to a variety of brands under one roof, making it easier for consumers to compare and purchase on the spot. Specialty Stores are pivotal in offering specialized products that may not be available in larger retail outlets, often focusing on eco-friendly and organic options.

Baby Boutiques cater to premium customers looking for bespoke designs and materials, while Pharmacy or Drug Stores are essential for immediate purchases and trust, especially endorsed by healthcare professionals.

Size Analysis

Medium-sized diapers and pants are most popular, with a market share of 40.2%, due to their fit for the largest age range of infants.

Medium-sized reusable baby diapers and training pants are the most sought-after size, primarily because they cater to a wide age range, offering a balance between fit and comfort for growing babies. This size typically sees the highest sales volume as it meets the needs of infants who are in the midpoint of needing diapers, making it a practical choice for parents.

Small sizes are essential for newborns, ensuring a snug fit and preventing leaks, which is crucial for the initial months. Large and Extra-Large sizes are indispensable as they cater to older or larger children, providing comfort and protection as they near the end of their diaper-wearing days. These segments, while smaller, are integral to covering the full spectrum of consumer needs throughout their diapering journey.

Key Market Segments

By Product Type

- Reusable Baby Diapers

- Training Pants

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Baby Boutiques

- Pharmacy/Drug Stores

By Size

- Small

- Medium

- Large

- Extra-Large

Driving Factors

Rising Awareness of Eco-Friendly Baby Care Drives Market Growth

Growing awareness of eco-friendly baby care is significantly boosting the market for reusable baby diapers and training pants. Parents are increasingly choosing sustainable options as they become more conscious of environmental issues.

Disposable diapers contribute to landfill waste, which has led many to explore reusable alternatives. For instance, cloth diapers made from organic cotton, bamboo, or hemp are gaining popularity.

In addition, rising concerns about skin sensitivities are prompting parents to switch to chemical-free diaper options. Traditional disposable diapers often contain irritants, while reusable variants are typically made from natural, skin-friendly fabrics.

Furthermore, the long-term cost-effectiveness of reusable diapers is appealing to budget-conscious families. Unlike disposables, which require continuous purchase, reusable diapers can last through multiple children, leading to significant savings.

As a result, parents see value in the initial investment despite the higher upfront cost. Additionally, organic and natural fabric-based reusable diapers are evolving to offer better absorbency and comfort. This innovation enhances their appeal, positioning them as a practical and sustainable solution.

Brands are increasingly highlighting these benefits in marketing campaigns, educating parents about both environmental impact and cost savings. Consequently, awareness and preference for reusable baby diapers are expected to continue growing, positively impacting the market.

Restraining Factors

High Upfront Costs and Maintenance Restraints Market Growth

The higher upfront cost of reusable baby diapers compared to disposable ones remains a significant restraint in the market. Many parents find it challenging to justify the initial investment, especially when disposable options are cheaper upfront.

This factor often discourages those who are unfamiliar with the long-term savings. Additionally, maintaining reusable diapers can be inconvenient for busy parents. Frequent washing, drying, and organizing take time, making disposable options more appealing for those with hectic schedules.

In urban areas where laundry facilities are limited, this inconvenience becomes even more pronounced. Another challenge is the limited awareness about the hygiene of reusable diapers. Many parents still believe that cloth diapers are less hygienic, despite advances in fabric technology. This misconception slows adoption, as parents prioritize perceived safety for their babies.

Furthermore, the availability of biodegradable disposable diapers poses a competitive threat. These products offer an eco-friendly option without requiring the maintenance that reusable diapers demand.

As a result, some parents opt for biodegradable disposables as a compromise between sustainability and convenience. Addressing these restraints through education and improved product design could encourage broader acceptance of reusable diapers.

Growth Opportunities

Innovation and Subscription Models Provide Opportunities

The reusable baby diapers and training pants market is ripe for growth, driven by innovation and evolving business models. One significant opportunity lies in the development of quick-dry and super-absorbent fabrics.

These improvements enhance comfort and usability, making reusable diapers more appealing to modern parents. Brands that invest in such innovations can capture a broader audience.

Additionally, subscription-based and rental models are emerging as practical solutions. These services offer parents a cost-effective way to access high-quality reusable diapers without a large initial expense. By allowing parents to try products before committing, brands can reduce barriers to adoption. Hybrid diapers, combining washable and disposable features, are also gaining traction.

These versatile products meet the needs of parents seeking both convenience and sustainability. Direct-to-consumer sales are another promising area. Customized diaper kits sold through e-commerce platforms allow parents to choose products that fit their preferences and budgets. This approach aligns with the increasing trend of personalized baby care solutions.

Emerging Trends

Fashionable and Smart Diapers Are Latest Trending Factor

Reusable baby diapers are experiencing a surge in popularity due to trendy designs and technological advancements. Fashionable prints and gender-neutral designs are attracting modern parents who value style in baby care products.

This trend is particularly strong in urban areas, where parents seek both functionality and aesthetics. Additionally, there is growing demand for diapers made from organic bamboo and hemp, known for their natural softness and absorbency.

These materials appeal to eco-conscious parents and those focused on reducing skin irritations. Another emerging trend is the integration of smart technology in diapers.

Innovations such as moisture-sensing and wetness indicators add convenience, especially for first-time parents who want reassurance. Brands incorporating these features are appealing to tech-savvy families.

Social media also plays a key role in popularizing reusable diapers. Parenting communities share experiences and product reviews, creating a positive buzz around sustainable choices.

As a result, social endorsement drives more parents to explore reusable options. With fashionable designs, natural materials, and tech-enhanced features, reusable diapers are positioned as both practical and stylish, fueling market growth.

Regional Analysis

North America Dominates with 33.4% Market Share in the Reusable Baby Diapers and Training Pants Market

North America holds a commanding position in the Reusable Baby Diapers and Training Pants Market with a 33.4% share, translating to USD 4.38 billion. This dominance is fueled by high consumer awareness regarding sustainable products and advanced retail infrastructure.

The region’s market leadership is bolstered by the presence of major global brands and a well-established distribution network, which ensures wide product availability. Moreover, cultural trends towards eco-friendly and health-conscious parenting further amplify demand for reusable diapers and training pants.

Looking ahead, North America’s influence on the global market is expected to remain strong. As environmental concerns continue to drive consumer choices, and as companies innovate with more user-friendly and sustainable products, the market share of this region could see further growth.

Regional Mentions:

- Europe: Europe maintains a robust market presence, supported by stringent environmental regulations and a high adoption rate of eco-friendly products. The region’s focus on sustainability and consumer health safety enhances its market stability and growth.

- Asia Pacific: Asia Pacific shows rapid market expansion, driven by increasing disposable incomes and growing awareness of child health and environmental issues. Emerging markets like China and India are pivotal, with their large population bases and increasing consumer spending on baby care products.

- Middle East & Africa: The Middle East and Africa are gradually increasing their market share, with urbanization and rising awareness of sustainable products. Investments in retail infrastructure and health awareness campaigns are key growth drivers.

- Latin America: Latin America is witnessing growth in this market as consumer awareness and income levels rise. The region is seeing more adoption of eco-friendly and sustainable baby care practices, which are becoming more prevalent in the consumer mindset.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Reusable Baby Diapers and Training Pants Market, several leading companies play critical roles in shaping industry dynamics. Among them, Procter & Gamble Company, Babee Greens, Thirsties Baby, and Cotton Babies Inc. stand out due to their market reach, product innovation, and brand loyalty.

Procter & Gamble Company, known for its extensive range of baby care products, leverages its global brand presence and marketing prowess to dominate the market. The company focuses on continuous product innovation to meet the increasing demand for eco-friendly and skin-friendly reusable diapers.

Babee Greens makes its mark with a commitment to sustainability, producing diapers that are both environmentally friendly and gentle on babies’ skin. Their products are made using organic and natural materials, appealing to eco-conscious parents.

Thirsties Baby excels in offering a wide variety of patterns and designs, combined with effective moisture-wicking fabric technology. Their focus on producing high-quality, durable, and absorbent diapers has garnered a loyal customer base.

Cotton Babies Inc. is recognized for its affordability and accessibility, making reusable diapers more accessible to a broader audience. Their innovative designs and easy-to-use features ensure that they remain competitive in a market that values both functionality and environmental sustainability.

These companies are pivotal in driving the growth of the reusable diapers market through their focus on sustainability, customer-centric innovations, and robust marketing strategies. As the market continues to evolve, these key players are expected to lead the way in terms of market trends and consumer preferences.

Major Companies in the Market

- Procter & Gamble Company

- Babee Greens

- Thirsties Baby

- Cotton Babies Inc.

- Modern Cloth Nappies

- LittleLamb

- Kinder Cloth Diaper Co.

- Domtar Corporation

- First Quality Enterprises Inc.

- Ontex Group NV

- ABENA

- Charlie Banana

- BumGenius

Recent Developments

- Kimberly-Clark and Kimberly-Clark Brazil: In March 2024, Kimberly-Clark introduced a hybrid-style diaper in Brazil. The new product merges the benefits of both cloth and disposable diapers, aiming to cater to the increasing consumer demand for sustainable hygiene solutions. This innovative design features a reusable outer cover complemented by disposable absorbent inserts, providing both convenience and a reduced environmental footprint.

- Charlie Banana: In June 2023, Charlie Banana launched a new collection of reusable diapering products. The release includes 13 additional diaper designs, expanding the total to 32 available prints and colors. The packaging for these products has also been upgraded to fully recyclable FSC-certified paper, underscoring the brand’s commitment to sustainability. This initiative further solidifies Charlie Banana’s reputation in the eco-friendly product market.

Report Scope

Report Features Description Market Value (2024) USD 13.1 Billion Forecast Revenue (2034) USD 24.8 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reusable Baby Diapers, Training Pants), By Distribution Channel (Online Retail, Supermarkets or Hypermarkets, Specialty Stores, Baby Boutiques, Pharmacy or Drug Stores), By Size (Small, Medium, Large, Extra-Large) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Procter & Gamble Company, Babee Greens, Thirsties Baby, Cotton Babies Inc., Modern Cloth Nappies, LittleLamb, Kinder Cloth Diaper Co., Domtar Corporation, First Quality Enterprises Inc., Ontex Group NV, ABENA, Charlie Banana, BumGenius Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Reusable Baby Diapers And Training Pants MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Reusable Baby Diapers And Training Pants MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Procter & Gamble Company

- Babee Greens

- Thirsties Baby

- Cotton Babies Inc.

- Modern Cloth Nappies

- LittleLamb

- Kinder Cloth Diaper Co.

- Domtar Corporation

- First Quality Enterprises Inc.

- Ontex Group NV

- ABENA

- Charlie Banana

- BumGenius