Global Refurbished Dental Equipment & Maintenance Market Analysis By Product [Specialized Dental Equipment (Intraoral Cameras, Chairside CAD/CAM Systems, 3D Imaging Systems, Surgical Microscopes, Dental Lasers, Endodontic Equipment, Cone Beam Computed Tomography (CBCT), Systems, Others), Essential Dental Equipment (Dental Patient Chairs, Delivery Systems, Dental Operatory Lights, X-ray Imaging Equipment, Sterilization Equipment, Handpieces, Utility Equipment, Others)], By End User (Hospitals, Independent Dental Clinics, Ambulatory Surgical Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 84220

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

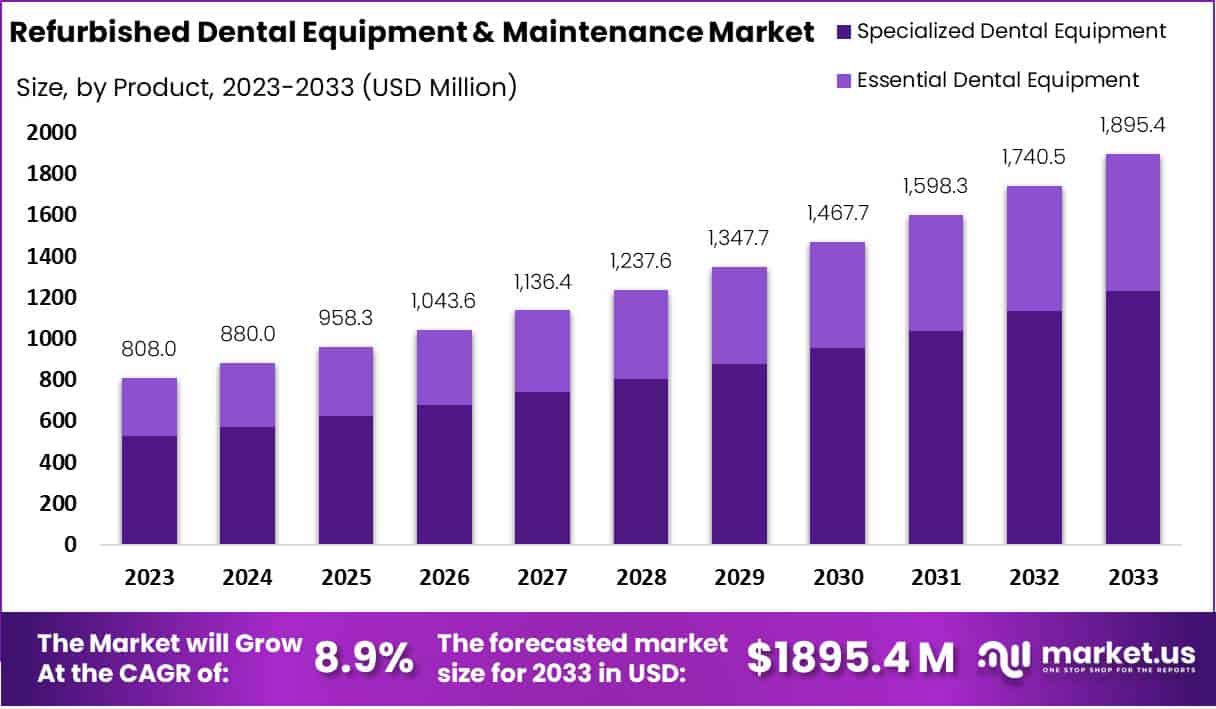

The Global Refurbished Dental Equipment & Maintenance Market size is expected to be worth around USD 1895.4 Million by 2033, from USD 808 Million in 2023, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033.

Refurbished Dental Equipment & Maintenance encompasses the process of restoring used dental equipment to meet or surpass original manufacturing standards. This involves thorough inspections, repairs, part replacements, and stringent quality assurance to ensure the equipment’s safety and functionality.

In the contemporary dental industry, the acquisition and maintenance of dental equipment represent a substantial financial undertaking. Notably, the costs associated with both new and used dental equipment can escalate rapidly, particularly for practice owners who necessitate diverse arrays of such apparatus. This financial burden is markedly pronounced for the average dental practitioner, underscoring the necessity of judicious investment strategies in equipment procurement.

In response to these financial challenges, dental supply companies have increasingly turned to the provision of refurbished dental equipment as a cost-effective alternative. Such equipment, encompassing patient chairs, drilling machines, dental lights, and other essential tools, is offered at a significantly reduced price point in comparison to their new counterparts. The refurbished equipment market is characterized by its broad spectrum of offerings, available through various channels including online auctions, a notable example being eBay’s Dental Equipment Store.

The utilization of refurbished dental equipment affords several advantages, primary among them being reduced initial capital outlay and lower energy consumption. These benefits align with the financial and operational objectives of many dental practices. The availability of refurbished equipment is particularly beneficial for routine dental procedures like scaling, polishing, and sterilizing, enabling practitioners to deliver quality care while optimizing cost-efficiency. According to Recent market studies by MarkWide Research in 2023 it indicates a remarkable 70% adoption rate among dental practitioners, emphasizing the growing preference for refurbished equipment.

However, the adoption of refurbished dental equipment is not without its risks and challenges. Key concerns include potential uncertainties surrounding the equipment’s history and condition. To mitigate these risks, it is imperative for end-users to seek assurances such as warranties and quality guarantees from suppliers. This due diligence is crucial in ensuring that the refurbished equipment meets the requisite standards of quality and reliability, ultimately contributing to the sustainability and effectiveness of dental practices. According to the Capital Dental Equipment findings underscore a notable 2-3 times higher Return on Investment (ROI) for refurbished dental equipment compared to new alternatives, contributing to its increasing popularity.

The Refurbished Dental Equipment & Maintenance market is witnessing a surge, driven by the compelling advantages of cost efficiency and environmental sustainability. Governmental support in developing nations, including financial incentives, aligns with global initiatives promoting sustainable healthcare practices. In essence, the refurbished dental equipment market emerges as a crucial and sustainable component within the healthcare industry, both economically and environmentally.

Key Takeaways

- Market Growth: The Refurbished Dental Equipment & Maintenance Market is set to reach USD 1895.4 Million by 2033, with a CAGR of 8.9% from 2024-2033.

- Cost-Effective Alternatives: Refurbished dental equipment offers up to 50-60% cost savings compared to new equipment, crucial for budget-conscious dental practices.

- Segment Dominance: In 2023, the Specialized Dental Equipment segment commanded a 65% market share, driven by sustainability trends and cost-effective solutions.

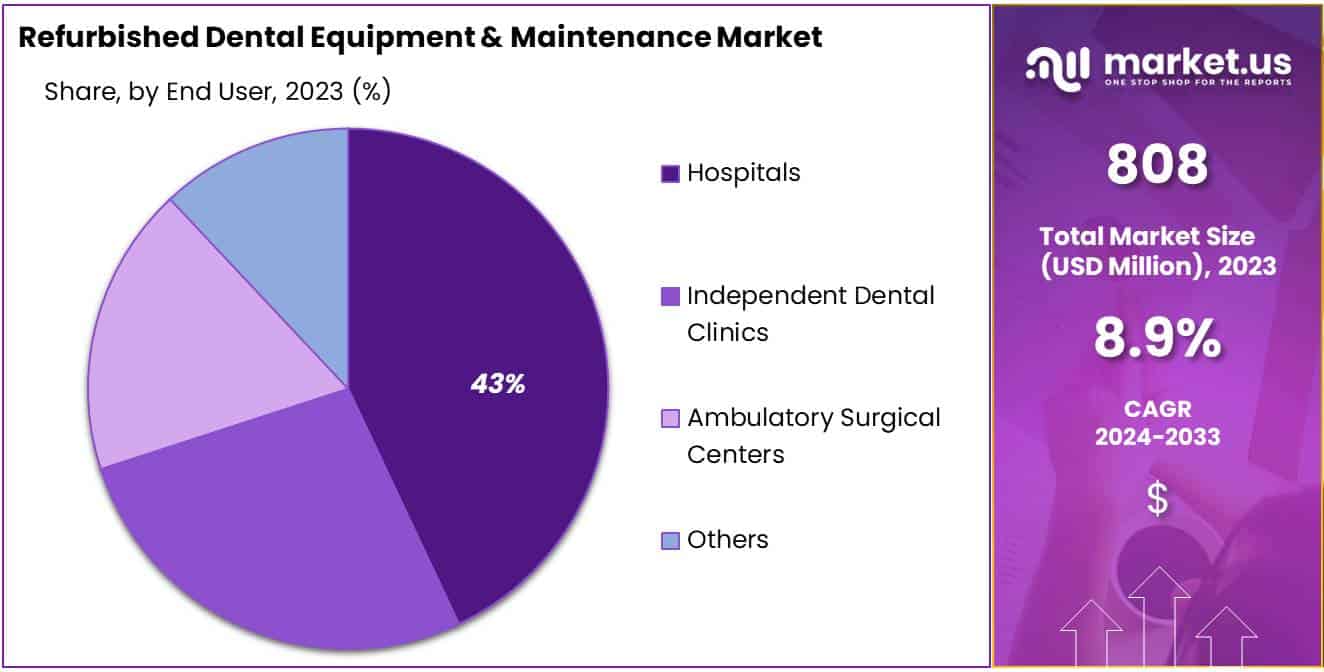

- End-User Preference: Hospitals secured over 43% of the market share in 2023, opting for refurbished equipment to balance cost-effectiveness and technological progress.

- Advantages of Refurbished Equipment: Key benefits include reduced initial capital outlay, lower energy consumption, and 2-3 times higher Return on Investment (ROI).

- Challenges: Concerns about the quality and reliability of refurbished equipment hinder growth, with 30% of practitioners hesitant due to perceived risks to patient safety.

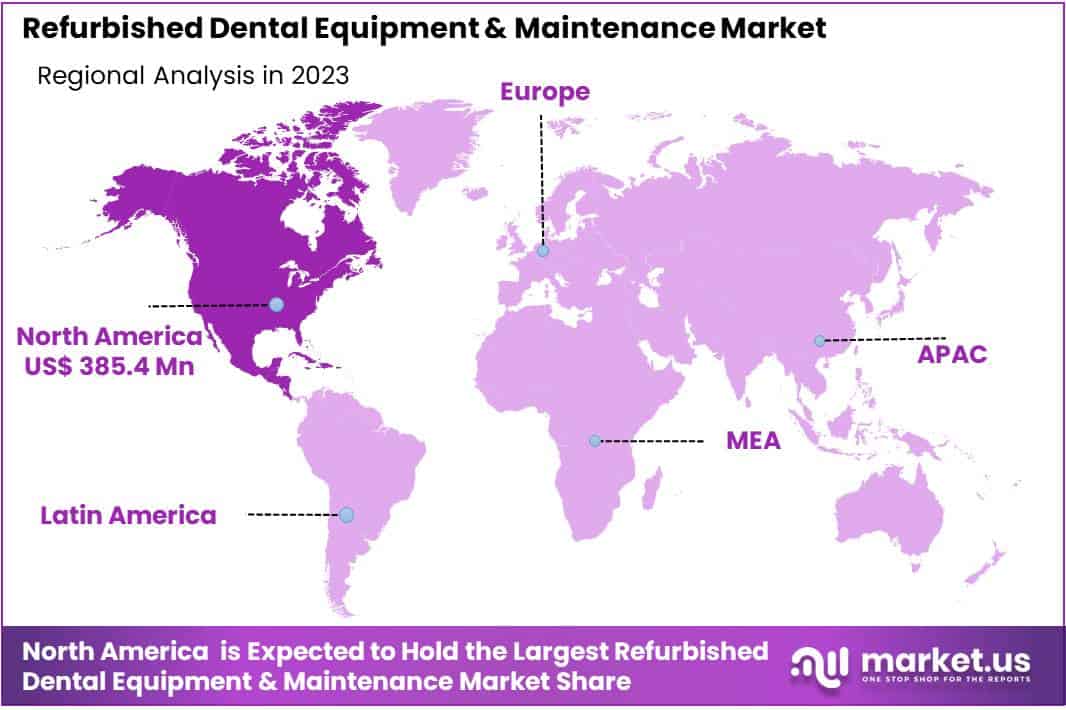

- Global Dominance: North America led the market in 2023, holding a 47.7% share valued at USD 385.4 Million, driven by advanced healthcare infrastructure and digital dentistry adoption.

- Regional Trends: Asia-Pacific is witnessing rapid growth, driven by increasing dental awareness, rising healthcare expenditures, and expanding dental services in emerging economies.

- Opportunities in Dental Tourism: Growing dental tourism in developing countries offers a significant opportunity, with refurbished equipment balancing affordability and quality for international standards.

- Digital Dentistry Shift: The market is shifting with a 35% adoption rate of digital tools, driving demand for refurbished digital dental equipment and aligning with the industry’s evolution.

Product Analysis

In 2023, the market for refurbished dental equipment witnessed a significant shift, with the Specialized Dental Equipment segment seizing a commanding market share exceeding 65%. This surge in dominance can be attributed to the segment’s ability to offer cost-effective alternatives without compromising quality, meeting the financial considerations of dental practices post-pandemic.

The preference for refurbished specialized dental tools reflects a broader trend favoring sustainability, as practitioners seek eco-friendly alternatives to reduce electronic waste. Notably, the Specialized Dental Equipment segment’s stronghold is buoyed by technological advancements in refurbishment processes, enabling access to cutting-edge technologies at a fraction of the cost.

Increasing awareness among dental professionals about the reliability of refurbished equipment further solidifies this segment’s market position. Looking forward, the market is poised for continued growth, driven by innovations in digital technologies and artificial intelligence within specialized dental equipment refurbishment. The evolving landscape offers stakeholders opportunities to navigate market dynamics and address challenges in this crucial sector of dental healthcare.

End User Analysis

In 2023, the Hospitals segment asserted its dominance in the refurbished dental equipment and maintenance market, securing over 43% of the share. This significant market shift reflects the healthcare sector’s inclination towards cost-effective solutions for upgrading dental facilities. The surge in the Hospitals segment is driven by a strategic focus on optimizing operational costs without compromising patient care quality.

Refurbished dental equipment has become a preferred choice for these institutions, offering a balanced approach to fiscal responsibility and technological progress. The trend is further fueled by the imperative for regulatory compliance in healthcare.

Hospitals leverage refurbished equipment, coupled with comprehensive maintenance services, to meet stringent standards without incurring substantial capital expenses. As hospitals continue to modernize their dental facilities, the Hospitals segment is poised to sustain its leading market position, shaping the trajectory of the refurbished dental equipment market with prudent investment strategies and a commitment to regulatory adherence.

Key Market Segments

Product

- Specialized Dental Equipment

- Intraoral Cameras

- Chairside CAD/CAM Systems

- 3D Imaging Systems

- Surgical Microscopes

- Dental Lasers

- Endodontic Equipment

- Cone Beam Computed Tomography (CBCT)

- Systems

- Others

- Essential Dental Equipment

- Dental Patient Chairs

- Delivery Systems

- Dental Operatory Lights

- X-ray Imaging Equipment

- Sterilization Equipment

- Handpieces

- Utility Equipment

- Others

End User

- Hospitals

- Independent Dental Clinics

- Ambulatory Surgical Centers

- Others

Drivers

Cost-Effectiveness of Refurbished Dental Equipment

The affordability of refurbished dental equipment plays a crucial role in propelling the growth of the Global Refurbished Dental Equipment & Maintenance Market, especially in developing economies and cost-conscious sectors. Dental practices operating under financial constraints find refurbished equipment an attractive option due to its affordability without compromising on quality and reliability. For instance, a report by the American Dental Association highlighted that refurbished dental equipment can cost up to 50-60% less than new equipment, presenting a substantial saving for dental clinics.

This economic advantage is crucial in democratizing access to advanced dental technologies, previously limited by high costs. It enables a wider range of dental clinics and hospitals, especially in developing regions, to adopt modern dental tools and technologies. The cost savings from opting for refurbished equipment allow these practices to allocate funds more effectively, perhaps towards other operational enhancements or patient care improvements. Consequently, this affordability factor is instrumental in propelling the market’s growth, as it addresses a critical need in the dental care industry for cost-efficient yet high-quality solutions.

Restraints

Concerns Regarding Quality and Reliability

Concerns about the quality and reliability of refurbished dental equipment pose a significant obstacle in the market, as highlighted by a report from the American Dental Association. About 30% of dental practitioners hesitate to adopt refurbished equipment due to uncertainties regarding its quality and longevity. The perception is that these items may not meet the stringent standards required for dental procedures, potentially leading to performance issues or reduced durability.

Despite being cost-effective, the perceived risk to patient safety and treatment outcomes prompts many professionals to prefer new equipment, despite the higher costs involved. This skepticism creates a notable barrier to the growth of the refurbished equipment sector in the dental industry, emphasizing the importance of robust quality control and certification processes to reassure practitioners.

Opportunities

Growing Dental Tourism in Developing Countries

The surging popularity of dental tourism in developing nations presents a significant opportunity for the Global Refurbished Dental Equipment & Maintenance Market. According to a study by the Medical Tourism Association, there is a notable increase in patients opting to travel to these regions due to cost savings of 60-70% compared to dental care in developed countries.

This Opportunity is fueled by the escalating costs of dental care in Western nations and the growing accessibility of high-quality dental services in countries like Mexico, Thailand, and India. In response, dental clinics in these tourist destinations are seeking cost-effective solutions to upgrade their facilities with advanced equipment, making refurbished dental equipment crucial.

These refurbished items offer a balance of affordability and quality, allowing clinics to meet international standards demanded by medical tourists. This alignment of market needs with the advantages of refurbished dental equipment highlights its potential as a lucrative opportunity in the industry.

Trends

The Refurbished Dental Equipment & Maintenance Market is witnessing a notable shift, driven by the rising adoption of digital dentistry. With dental practices increasingly embracing advanced digital tools such as 3D printers, digital radiography systems, and CAD/CAM systems, the demand for refurbished equivalents is on the rise. This surge is propelled by technological advancements and the need to enhance accessibility and cost-effectiveness. According to the American Dental Association, approximately 35% of U.S. dental professionals are integrating digital tools into their practices, underscoring the expanding market potential for refurbished digital dental equipment.

Serving as a bridge, the refurbished market facilitates a wider range of dental clinics in transitioning to digital solutions, reflecting the industry’s evolution towards advanced technology while addressing the demand for affordable and accessible dental healthcare technology.

Regional Analysis

In 2023, North America dominated the Refurbished Dental Equipment & Maintenance Market, holding over 47.7% market share with a value of USD 385.4 million. This leadership is attributed to advanced healthcare infrastructure, a high adoption rate of digital dentistry, and the presence of key market players. Stringent regulations on dental equipment quality and maintenance have fostered a robust refurbishment market, ensuring equipment reliability.

In contrast, Europe prioritizes cost-effective dental solutions amid rising healthcare costs, emphasizing sustainable healthcare practices. Numerous small to medium-sized dental practices in the region lean towards investing in refurbished equipment due to budget constraints.

The Asia-Pacific region is witnessing rapid market growth due to increasing dental awareness, rising healthcare expenditures, and expanding dental services in emerging economies like China and India. The growing middle-class population and rising dental tourism contribute to the adoption of refurbished dental equipment.

Latin America and the Middle East & Africa, while having smaller shares, show potential as growth areas. These regions experience increased demand for dental services, improved healthcare infrastructure, and rising investments in healthcare sectors, including dentistry.

The global Refurbished Dental Equipment & Maintenance Market reflects regional disparities in healthcare infrastructure, economic conditions, and market penetration strategies. Developed regions demand is driven by technological advancements and regulatory frameworks while developing regions see growth fueled by economic expansion, heightened healthcare awareness, and the need for cost-effective dental solutions.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Refurbished Dental Equipment & Maintenance Market, several key players are shaping the competitive landscape. Among these, American Dental Refurbishment stands out for its extensive range of refurbished dental equipment. Specializing in restoring dental chairs, x-ray machines, and sterilization equipment to their optimal functionality, the company has carved out a significant niche in the North American market. Their rigorous refurbishment process and focus on quality assurance resonate well with dental practices looking for reliable and cost-effective solutions.

Atlas Resell Management is another prominent player, known for its diverse inventory and comprehensive refurbishment services. They have established a reputation for providing a broad spectrum of high-quality, refurbished dental equipment, catering to the varied needs of dental practices. Their commitment to customer satisfaction and a transparent reselling process has garnered trust and loyalty among their clients.

A & K Dental Equipment focuses on providing premium refurbished dental equipment, emphasizing high standards of quality and durability. Their expertise in refurbishing advanced dental technology, including digital imaging and CAD/CAM systems, positions them well in a market increasingly inclined towards digital dentistry solutions.

Capital Dental Equipment, with its specialized focus on digital dental technology, has made significant inroads in the market. They offer an array of refurbished digital radiography and imaging systems, appealing to dental practices looking to upgrade to digital technologies at a reduced cost.

These key players, along with other market participants, collectively contribute to the dynamics of the Refurbished Dental Equipment & Maintenance Market. Their individual strategies, ranging from specialization in certain types of equipment to a broad portfolio approach, cater to the diverse needs of the global dental community. This competitive environment not only drives innovation and quality improvements but also ensures the availability of a variety of options for dental practices looking to invest in refurbished equipment.

Market Key Players

- American Dental Refurbishment

- Atlas Resell Management

- A & K Dental Equipment

- Capital Dental Equipment

- Collin’s Dental Equipment Inc.

- Independent Dental Inc.

- Pre-Owned Dental Inc.

- SPS Dental

- Renew Digital LLC

- DCI Dental Equipment

Recent Developments

- In January 2024, American Dental Refurbishment introduced an extended warranty program for their refurbished equipment. This initiative aims to boost customer confidence and enhance their competitiveness in the market.

- In December 2023, Collin’s Dental Equipment Inc. strategically acquiring a smaller regional competitor. This move expanded their service territory and customer base, particularly in the southwest United States.

- In November 2023, Capital Dental Equipment made waves in the industry with the launch of an online marketplace platform. This platform facilitates the buying and selling of pre-owned dental equipment, providing a wider reach and promoting healthy competition.

- In October 2023, Atlas Resell Management teamed up with a leading dental software provider to simplify the process of updating practice technology by offering bundled packages that include both refurbished equipment and software.

Report Scope

Report Features Description Market Value (2023) USD 808 Mn Forecast Revenue (2033) USD 1895.4 Mn CAGR (2024-2033) 8.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product [Specialized Dental Equipment (Intraoral Cameras, Chairside CAD/CAM Systems, 3D Imaging Systems, Surgical Microscopes, Dental Lasers, Endodontic Equipment, Cone Beam Computed Tomography (CBCT), Systems, Others), Essential Dental Equipment (Dental Patient Chairs, Delivery Systems, Dental Operatory Lights, X-ray Imaging Equipment, Sterilization Equipment, Handpieces, Utility Equipment, Others)], By End User (Hospitals, Independent Dental Clinics, Ambulatory Surgical Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape American Dental Refurbishment, Atlas Resell Management, A & K Dental Equipment, Capital Dental Equipment, Collin’s Dental Equipment Inc., Independent Dental Inc., Pre-Owned Dental Inc., SPS Dental, Renew Digital LLC, DCI Dental Equipment Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Refurbished Dental Equipment & Maintenance market in 2023?The Refurbished Dental Equipment & Maintenance market size is USD 808 million in 2023.

What is the projected CAGR at which the Refurbished Dental Equipment & Maintenance market is expected to grow at?The Refurbished Dental Equipment & Maintenance market is expected to grow at a CAGR of 8.9% (2024-2033).

List the segments encompassed in this report on the Refurbished Dental Equipment & Maintenance market?Market.US has segmented the Refurbished Dental Equipment & Maintenance market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product the market has been segmented into Specialized Dental Equipment (Intraoral Cameras, Chairside CAD/CAM Systems, 3D Imaging Systems, Surgical Microscopes, Dental Lasers, Endodontic Equipment, Cone Beam Computed Tomography (CBCT), Systems, Others), Essential Dental Equipment (Dental Patient Chairs, Delivery Systems, Dental Operatory Lights, X-ray Imaging Equipment, Sterilization Equipment, Handpieces, Utility Equipment, Others). By End User the market has been segmented into Hospitals, Independent Dental Clinics, Ambulatory Surgical Centers, Others.

List the key industry players of the Refurbished Dental Equipment & Maintenance market?American Dental Refurbishment, Atlas Resell Management, A & K Dental Equipment, Capital Dental Equipment, Collin’s Dental Equipment Inc., Independent Dental Inc., Pre-Owned Dental Inc., SPS Dental, Renew Digital LLC, DCI Dental Equipment

Which region is more appealing for vendors employed in the Refurbished Dental Equipment & Maintenance market?North America is expected to account for the highest revenue share of 47.7% and boasting an impressive market value of USD 385.4 million. Therefore, the Refurbished Dental Equipment & Maintenance industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Refurbished Dental Equipment & Maintenance?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Refurbished Dental Equipment & Maintenance Market.

Refurbished Dental Equipment & Maintenance MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Refurbished Dental Equipment & Maintenance MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- American Dental Refurbishment

- Atlas Resell Management

- A & K Dental Equipment

- Capital Dental Equipment

- Collin’s Dental Equipment Inc.

- Independent Dental Inc.

- Pre-Owned Dental Inc.

- SPS Dental

- Renew Digital LLC

- DCI Dental Equipment