Global Recycling Trucks Market Size, Share, Growth Analysis By Truck (Rear Loaders, Side Loaders, Front Loaders, Automated Side Loaders, Grapple Trucks, Others), By Body Type (Compactor Trucks, Transfer Trucks, Roll-Off Trucks, Hoist Trucks), By Capacity (10 to 20 tons, Upto 10 tons, Above 20 tons), By Propulsion (ICE, Electric), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159689

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

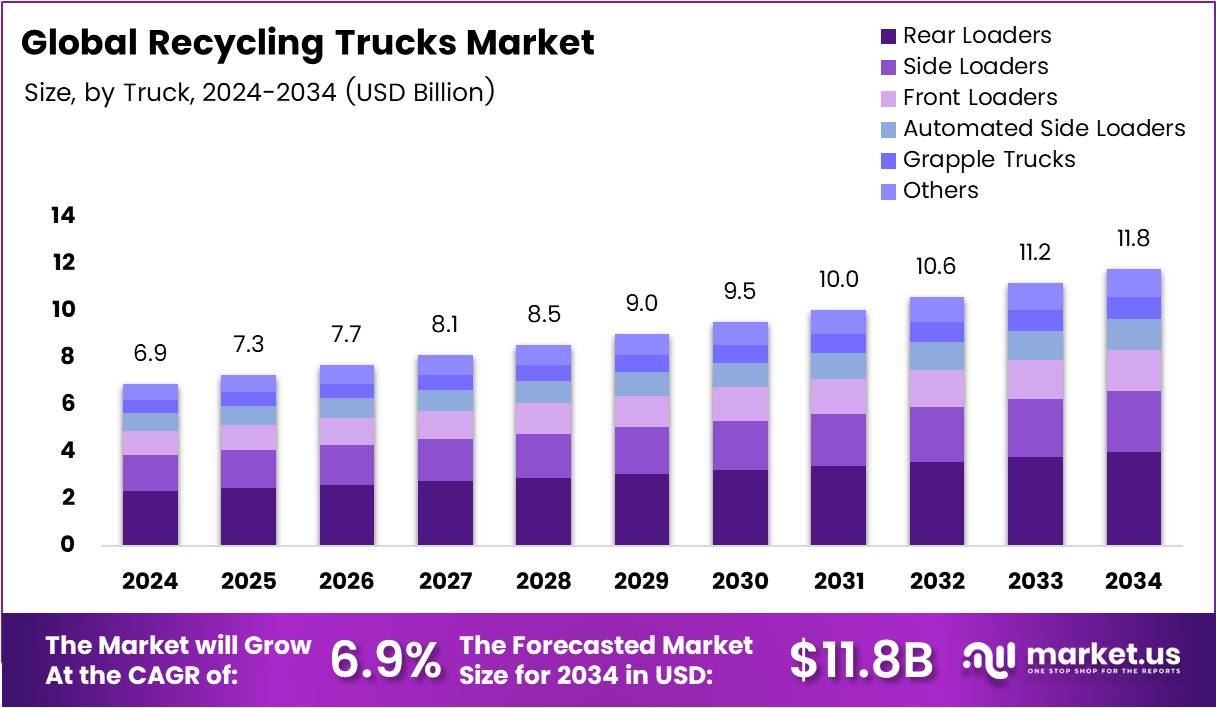

The Global Recycling Trucks Market size is expected to be worth around USD 11.8 Billion by 2034, from USD 6.9 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

The Recycling Trucks Market has grown in response to the increasing demand for efficient waste management solutions. These vehicles are designed to facilitate the collection, transport, and sorting of recyclable materials, making them essential to modern recycling infrastructure. With heightened awareness about sustainability, there is a rising need for advanced recycling trucks across various regions.

The market has substantial growth potential, driven by rising environmental concerns and government initiatives promoting sustainability. In particular, regions like Europe and North America are witnessing increased investments in recycling infrastructure. As the global push toward a circular economy accelerates, recycling trucks will play an integral role in waste management strategies.

Governments around the world have been increasingly supporting recycling efforts through various policies, grants, and investments. Public initiatives focus on improving recycling rates, with an emphasis on infrastructure and technology upgrades. The EU, for instance, continues to promote investments to enhance its recycling capacity, aiming to reduce landfill dependency and boost the reuse of materials.

Regulations also continue to evolve, ensuring that recycling processes are more efficient and environmentally friendly. These regulations push for stricter waste management policies that demand the use of modern recycling trucks with better sorting and separation capabilities. As regulations tighten, businesses in the recycling truck market will need to adapt to these new standards.

In 2023, 11.8% of materials used in the EU came from recycling, reflecting the region’s ongoing commitment to sustainable practices. This percentage is expected to grow, further fueling demand for more advanced recycling vehicles. Similarly, Germany has historically been a leader in recycling, with some sources citing rates above 65% in recent years, underscoring its strong recycling culture and infrastructure.

With these trends in place, the recycling trucks market presents lucrative opportunities for manufacturers, as they are poised to meet the increasing demand for more sustainable solutions. As governments continue to prioritize waste management and recycling, the market will likely expand, driven by both public sector investments and regulatory pressures.

Key Takeaways

- The Global Recycling Trucks Market is projected to reach USD 11.8 Billion by 2034, growing at a CAGR of 5.5% from 2025 to 2034.

- Rear Loaders dominate the By Truck Analysis segment in 2024 with a 33.8% market share.

- Compactor Trucks lead the By Body Type Analysis segment in 2024 with a 44.7% market share.

- Trucks with a 10 to 20 tons capacity dominate the By Capacity Analysis segment in 2024 with a 51.9% market share.

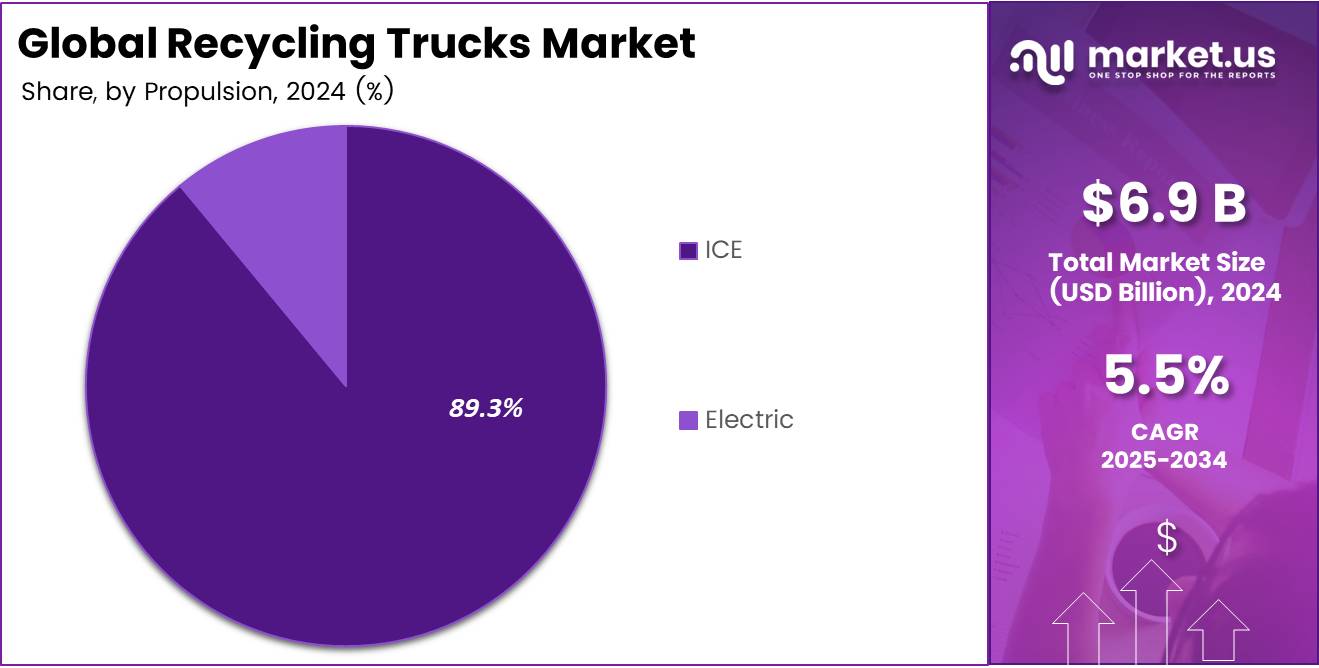

- ICE (Internal Combustion Engine) trucks dominate the By Propulsion Analysis segment in 2024 with an 89.3% market share.

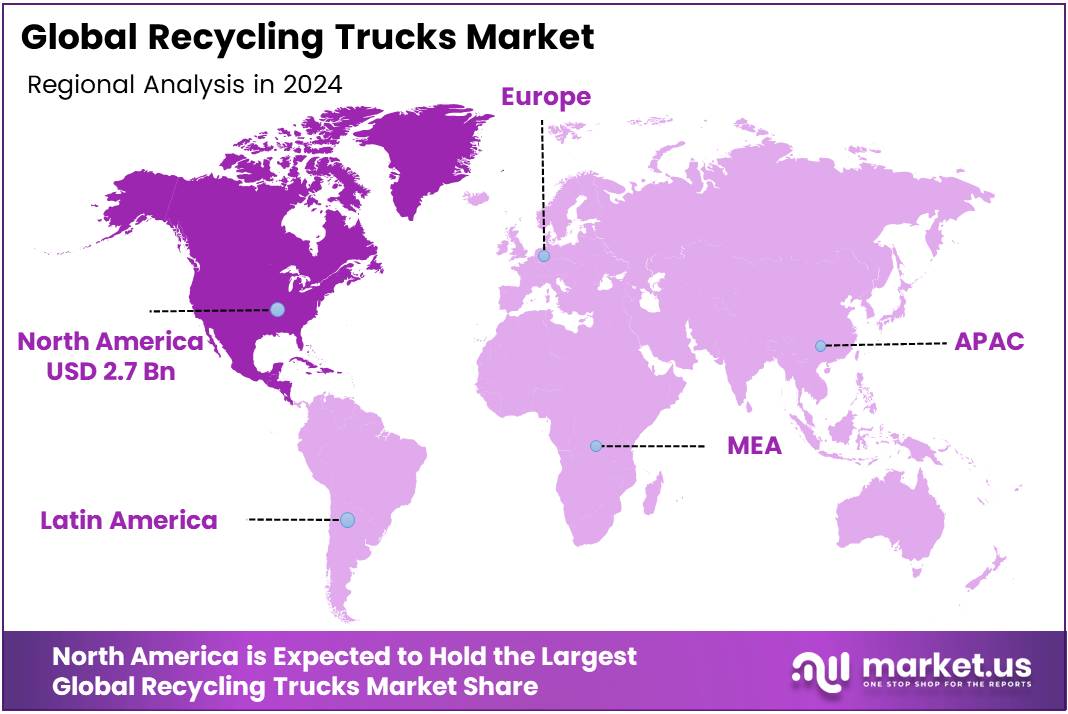

- North America holds a 39.4% share of the Recycling Trucks market in 2024, valued at USD 2.7 billion.

By Truck Analysis

Rear Loaders dominate with 33.8% due to their widespread adoption in residential and commercial waste collection.

In 2024, Rear Loaders held a dominant market position in the By Truck Analysis segment of the Recycling Trucks Market, with a 33.8% share. Their popularity stems from their versatile design and cost-effectiveness in collecting waste from curbside bins, making them ideal for urban and suburban areas.

Side Loaders, though not as dominant as Rear Loaders, are widely used for automated waste collection, offering enhanced efficiency. These trucks are highly valued for their ability to operate autonomously, minimizing manual labor. Side Loaders hold a significant portion of the market, catering to both residential and commercial waste management.

Front Loaders are preferred for industrial waste collection. They offer efficient loading with the ability to handle large containers, particularly in commercial and industrial environments. Their robust design supports heavy-duty usage, contributing to their share of the market.

Automated Side Loaders are rapidly growing due to their advanced automation features, which reduce labor costs. These trucks can be operated remotely, reducing human intervention and increasing safety, thus attracting investment for sustainable solutions.

Grapple Trucks are used for collecting bulky waste items, such as tree branches and large debris. Though niche, their importance in specialized waste collection applications gives them a unique, smaller share in the market.

Others comprise niche or less common truck types used for various specific waste management needs.

By Body Type Analysis

Compactor Trucks dominate with 44.7% due to their efficiency in compressing waste during collection.

In 2024, Compactor Trucks held a dominant market position in the By Body Type Analysis segment of the Recycling Trucks Market, with a 44.7% share. These trucks are known for their ability to compress waste, increasing storage capacity and reducing the frequency of trips to disposal sites, making them ideal for urban waste management.

Transfer Trucks play a key role in transferring waste from collection points to disposal facilities. They are commonly used for bulk transport of recyclable materials. Despite their importance in the recycling chain, Transfer Trucks hold a smaller share compared to Compactor Trucks, which offer enhanced efficiency during collection.

Roll-Off Trucks are mainly used for handling large containers, often for construction or industrial waste. While these trucks are vital for specific types of waste management, they capture a smaller portion of the market. Their specialized design and usage contribute to a distinct, niche segment.

Hoist Trucks are designed for lifting and moving large containers. Although they are less commonly used in residential waste collection, they serve crucial roles in industrial settings, supporting heavy-duty waste management needs.

By Capacity Analysis

10 to 20 tons dominate with 51.9% due to their versatility across both urban and industrial applications.

In 2024, 10 to 20 tons held a dominant market position in the By Capacity Analysis segment of the Recycling Trucks Market, with a 51.9% share. These trucks offer an ideal balance between size and hauling capacity, making them suitable for a wide range of applications, from residential waste collection to industrial recycling operations.

Upto 10 tons trucks are commonly used for smaller, more frequent waste collection tasks. They are particularly efficient in areas with high residential density, where smaller trucks are needed for maneuverability and accessibility. While they represent a significant portion of the market, they are less versatile than the 10 to 20 tons trucks.

Above 20 tons trucks are designed for large-scale industrial waste collection, capable of handling heavy and bulky materials. Although they are crucial for certain waste management needs, they hold a smaller market share due to their specialized application, catering mostly to industries rather than residential areas.

By Propulsion Analysis

ICE dominates with 89.3% due to its long-standing presence and established infrastructure.

In 2024, ICE (Internal Combustion Engine) held a dominant market position in the By Propulsion Analysis segment of the Recycling Trucks Market, with a 89.3% share. This is due to the well-established infrastructure and the ability of ICE trucks to handle long-haul trips and heavy loads, which makes them a reliable choice for waste management.

Electric trucks are emerging in the market as an environmentally friendly alternative to traditional ICE trucks. However, they currently capture a smaller share due to the higher cost of technology and limited charging infrastructure. As electric vehicle adoption increases, these trucks are expected to grow in market presence.

Key Market Segments

By Truck

- Rear Loaders

- Side Loaders

- Front Loaders

- Automated Side Loaders

- Grapple Trucks

- Others

By Body Type

- Compactor Trucks

- Transfer Trucks

- Roll-Off Trucks

- Hoist Trucks

By Capacity

- 10 to 20 tons

- Upto 10 tons

- Above 20 tons

By Propulsion

- ICE

- Electric

Drivers

Increasing Demand for Waste Management Solutions Drives Market Growth

The recycling trucks market is experiencing strong growth due to rising demand for better waste management systems. Cities worldwide are generating more waste than ever before, creating an urgent need for efficient collection and processing vehicles. This growing waste volume pushes municipalities to invest in modern recycling trucks.

Government rules are making recycling mandatory in many regions. New laws require businesses and households to separate waste properly, which means more specialized trucks are needed to collect different types of materials. These regulations create a steady demand for recycling vehicles.

Technology improvements are making recycling trucks smarter and more efficient. New trucks come with better sorting systems, fuel-saving engines, and automated features that reduce labor costs. These advances make recycling operations more profitable for waste management companies.

Environmental awareness is pushing both governments and private companies to invest in sustainable waste solutions. People want cleaner communities and are willing to support recycling programs. This public pressure creates more opportunities for recycling truck manufacturers and service providers.

Restraints

Limited Infrastructure for Waste Sorting Creates Market Challenges

The recycling trucks market faces significant barriers that slow its growth. Many regions lack proper waste sorting facilities, making it difficult to process collected materials effectively. Without adequate infrastructure, even the best recycling trucks cannot operate at full capacity.

High costs for buying and maintaining recycling trucks prevent many small waste management companies from upgrading their fleets. These specialized vehicles require expensive repairs and regular maintenance, which can strain budgets. Insurance and fuel costs add to the financial burden.

Finding skilled workers to operate advanced recycling trucks is becoming increasingly difficult. These vehicles need trained drivers who understand complex sorting systems and safety procedures. The shortage of qualified personnel limits how quickly companies can expand their recycling operations.

Market expansion is also slowed by inconsistent recycling standards across different regions. What works in one area may not meet requirements in another, forcing manufacturers to create multiple vehicle versions. This complexity increases production costs and delays market entry.

Growth Factors

Expansion of Recycling Programs Creates New Market Opportunities

The recycling trucks market has exciting growth potential as developing countries start building their waste management systems. These emerging markets need thousands of new recycling vehicles as they modernize their cities and implement environmental protection programs.

Electric and self-driving recycling trucks represent the future of the industry. Companies investing in these technologies will gain competitive advantages as cities push for cleaner, more efficient waste collection. Battery technology improvements make electric trucks more practical for daily operations.

The circular economy concept is driving demand for trucks that can recover valuable materials from waste. Modern recycling vehicles can separate metals, plastics, and other materials more effectively, turning waste into profitable resources. This creates new revenue streams for waste management companies.

Smart technology integration is transforming how recycling trucks operate. GPS tracking, route optimization, and automated sorting systems help companies reduce costs while improving service quality. Internet-connected trucks can report maintenance needs and track collection efficiency in real-time.

Emerging Trends

Focus on Zero-Emission Vehicles Shapes Market Trends

The recycling trucks market is shifting toward environmentally friendly vehicles as cities commit to reducing air pollution. Zero-emission trucks powered by electricity or hydrogen are becoming more popular, especially in urban areas where air quality is a major concern.

Partnerships between government agencies and private waste companies are changing how recycling services are delivered. These collaborations allow for better resource sharing and more efficient operations. Private companies bring expertise while municipalities provide regulatory support and funding.

Digital technology is revolutionizing waste collection through automated systems and data analytics. Modern recycling trucks use sensors and software to optimize routes, monitor vehicle performance, and track recycling rates. This digitalization improves efficiency and reduces operational costs.

Growing cities need better waste management solutions to handle increased population density. Urban expansion creates both challenges and opportunities for recycling truck manufacturers. More people means more waste, but also more potential customers for advanced waste management services.

Regional Analysis

North America Dominates the Recycling Trucks Market with a Market Share of 39.4%, Valued at USD 2.7 Billion

In 2024, North America dominated the Recycling Trucks market with a share of 39.4%, valued at USD 2.7 billion. The region’s dominance is attributed to its well-established recycling infrastructure, supportive government policies, and high demand for efficient waste management solutions. The growing trend towards sustainable practices and recycling technologies further boosts market growth in this region.

Europe Recycling Trucks Market Trends

Europe holds a significant position in the global Recycling Trucks market, driven by strong environmental regulations and a growing focus on waste reduction and recycling. The European Union’s initiatives to promote sustainability and stricter waste management standards provide a solid foundation for market growth. Countries like Germany, which leads in recycling rates, contribute heavily to the demand for advanced recycling trucks.

Asia Pacific Recycling Trucks Market Trends

The Asia Pacific region is anticipated to experience substantial growth in the Recycling Trucks market. With increasing urbanization and industrialization, the demand for waste management solutions is on the rise. Governments in countries like China and India are implementing policies to improve recycling rates, providing growth opportunities for the market. Additionally, the expanding middle class and the push for greener technologies are key growth drivers.

Middle East and Africa Recycling Trucks Market Trends

The Middle East and Africa market for Recycling Trucks is poised for growth, primarily driven by increasing waste generation due to rapid urbanization and industrial activities. The region’s focus on enhancing recycling infrastructure and addressing environmental challenges supports the market’s expansion. Despite relatively low recycling rates, initiatives aimed at improving waste management systems are expected to fuel demand for recycling trucks.

Latin America Recycling Trucks Market Trends

Latin America is expected to see steady growth in the Recycling Trucks market. While recycling infrastructure is still developing in many parts of the region, there is an increasing focus on sustainable waste management practices. Countries like Brazil are gradually adopting more efficient waste collection and recycling systems, creating a growing need for advanced recycling trucks to meet environmental and regulatory requirements.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Recycling Trucks Company Insights

In 2024, Amrep Inc. continues to be a significant player in the global Recycling Trucks Market, known for its innovative rear loader systems and versatile waste collection solutions. The company’s strong reputation for reliability and engineering excellence supports its ongoing growth in the sector.

Daimler Truck AG has cemented its position as a leading force in the recycling truck industry with a focus on advanced technology and sustainability. Their robust range of vehicles, particularly the Mercedes-Benz Econic, is highly regarded for its efficiency and environmental impact, aligning with growing green initiatives in waste management.

Dennis Eagle, a key player in the market, is recognized for its extensive range of waste collection vehicles tailored for municipal and industrial recycling operations. Their commitment to quality, safety, and customer satisfaction has helped them maintain a solid foothold in the global market.

Faun Umwelttechnik GmbH & Co. KG is a prominent manufacturer, offering a diverse portfolio of recycling trucks, including side and rear loaders. The company’s dedication to innovation in automation and sustainability continues to drive demand, especially in regions focused on improving recycling rates and reducing environmental footprints.

Top Key Players in the Market

- Amrep Inc.

- Daimler Truck AG

- Dennis Eagle

- Faun Umwelttechnik GmbH & Co. KG

- Heil – An Environmental Solutions Group Company

- Labrie Trucks

- McNeilus Truck and Manufacturing, Inc.

- Schwarze Industries

- Volvo Trucks

- WM Intellectual Property Holdings, L.L.C.

Recent Developments

- In July 2024, Eureka Recycling secured over $10M in financing to enhance its Materials Recovery Facility (MRF) to improve recycling processes and increase efficiency. This funding is part of their ongoing commitment to boosting the circular economy.

- In July 2025, Mack Trucks launched an electric refuse truck in the Bronx, marking a significant step towards reducing carbon emissions in urban waste management. The initiative is part of the company’s broader strategy to advance sustainable vehicle solutions.

- In December 2024, the EPA awarded over $735 million in grants to promote the adoption of clean heavy-duty vehicles. These funds aim to accelerate the transition to environmentally friendly fleets, helping reduce air pollution and enhance public health.

Report Scope

Report Features Description Market Value (2024) USD 6.9 Billion Forecast Revenue (2034) USD 11.8 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Truck (Rear Loaders, Side Loaders, Front Loaders, Automated Side Loaders, Grapple Trucks, Others), By Body Type (Compactor Trucks, Transfer Trucks, Roll-Off Trucks, Hoist Trucks), By Capacity (10 to 20 tons, Upto 10 tons, Above 20 tons), By Propulsion (ICE, Electric) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amrep Inc., Daimler Truck AG, Dennis Eagle, Faun Umwelttechnik GmbH & Co. KG, Heil – An Environmental Solutions Group Company, Labrie Trucks, McNeilus Truck and Manufacturing, Inc., Schwarze Industries, Volvo Trucks, WM Intellectual Property Holdings, L.L.C. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amrep Inc.

- Daimler Truck AG

- Dennis Eagle

- Faun Umwelttechnik GmbH & Co. KG

- Heil - An Environmental Solutions Group Company

- Labrie Trucks

- McNeilus Truck and Manufacturing, Inc.

- Schwarze Industries

- Volvo Trucks

- WM Intellectual Property Holdings, L.L.C.