Global E-Waste Management System Market By Source Type (Household Appliances (Air Conditioners, Washing Machines, Refrigerators, Others), Consumer Electronics (Computers & IT Devices, Televisions, Phones, Others), Industrial Equipment, Other Source Types), By Material (Metal (Precious Metal, Non-precious Metal), Plastic, Glass), By Application (Disposals, Incineration, Landfill, Reuse, and Recycled), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 141403

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Source Type Analysis

- By Material Analysis

- By Application Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Impact of Macroeconomic / Geopolitical Factors

- Emerging Trends

- Regional Analysis

- Key E-Waste Management System Company Insights

- Key Opinion Leaders

- Recent Developments

- Report Scope

Report Overview

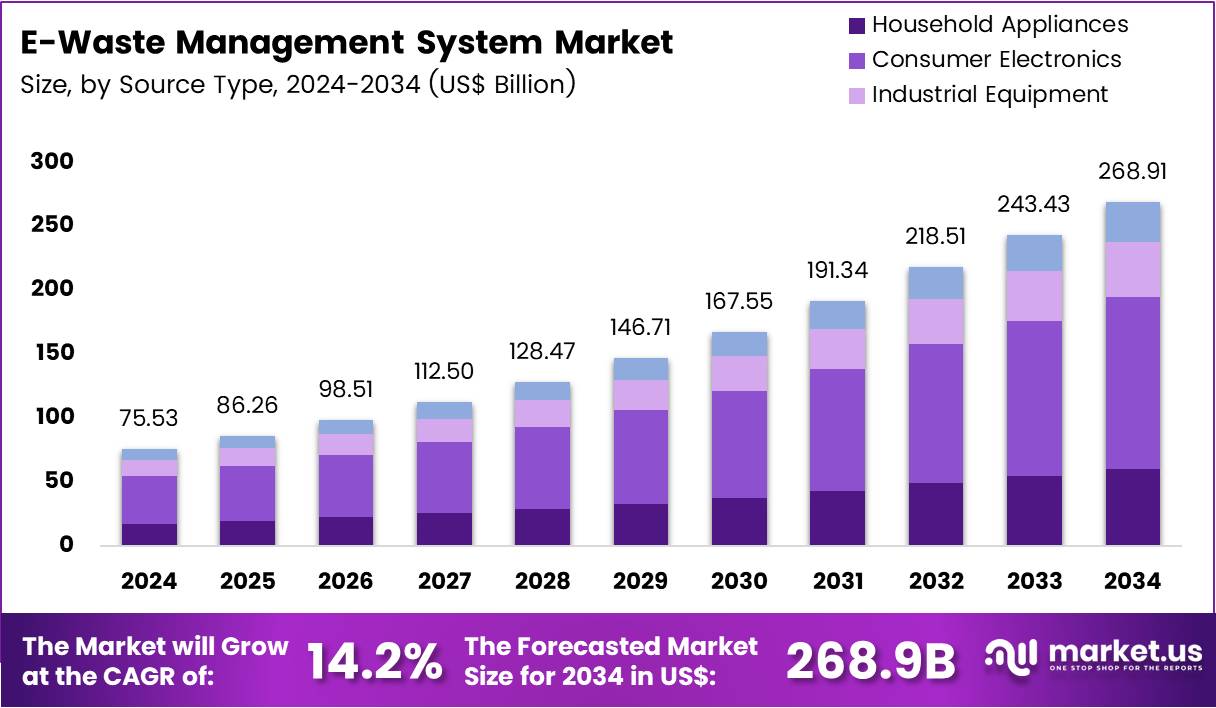

The Global E-Waste Management System Market size is expected to be worth around US$ 75.53 billion by 2034 from US$ 268.91 billion in 2024, growing at a CAGR of 14.2% during the forecast period 2025 to 2034. The global e-waste management system market is experiencing significant growth, driven by increasing electronic consumption, rapid technological advancements, and stringent regulatory mandates regarding e-waste disposal.

The proliferation of electronic devices across multiple sectors, including consumer electronics, IT & telecommunications, and healthcare, contributes to the volume of e-waste generated worldwide. Effective management of this e-waste is critical due to the hazardous materials often contained in discarded electronics, which can lead to severe environmental and health issues if not properly handled.

Global E-Waste Management System Market Size, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 37.75 46.66 57.92 66.14 75.53 14.2%

Governments and environmental agencies globally are implementing stricter regulations to ensure proper e-waste disposal and recycling, pushing companies to adopt sustainable practices. This regulatory landscape is fostering the growth of the e-waste management market as stakeholders seek compliant, efficient, and cost-effective waste management solutions. Additionally, the market is seeing a rise in the adoption of advanced technologies for e-waste recycling and recovery processes, aimed at maximizing resource extraction and minimizing environmental impact.

The global e-waste management system market addresses the increasing challenge of handling the vast amounts of electronic waste generated worldwide. This market comprises activities related to the collection, transportation, processing, and recycling of discarded electronic devices such as computers, smartphones, televisions, and refrigerators.

With rapid technological advancements and shortening product life cycles, the volume of e-waste has surged, prompting the need for effective management solutions to mitigate environmental and health impacts. E-waste contains hazardous substances like lead, mercury, and cadmium, which can pose serious health risks if not managed properly.

In October 2025, under the guidance of Prime Minister Shri Narendra Modi and the leadership of Union Minister of Coal & Mines Shri G. Kishan Reddy, the Ministry of Mines launched a Pan-India E-Waste Recycling Drive as part of Special Campaign 5.0, scheduled from 2 to 31 October 2025. The initiative aims to enhance Swachhata across government offices while promoting scientific e-waste disposal and maximizing resource recovery from discarded electronics.

Efficient e-waste management not only prevents harmful effects on the environment but also recovers valuable materials like gold, silver, copper, and rare earth metals. These recovery processes contribute to resource sustainability and offer economic opportunities by reintroducing materials back into the manufacturing cycle.

For instance, companies like Sims Recycling Solutions operate globally to provide secure and responsible electronic waste recycling, managing e-waste in a way that conserves resources and ensures environmental protection. In Europe, the WEEE Directive regulates the recycling and disposal of e-waste, encouraging member countries to achieve collection and recycling targets. These examples illustrate the proactive measures and opportunities within the global e-waste management system market to tackle one of the most pressing environmental challenges of today.

Key Takeaways

- The global e-waste management system market was valued at USD 75.53 billion in 2024 and is anticipated to register substantial growth of USD 268.91 billion by 2034, with 14.2% CAGR.

- By Source Type, the market is divided into Household Appliances, Consumer Electronics, Industrial Equipment, and Other Source Types, with Consumer Electronics taking the lead market share in 2024 with 49.9%.

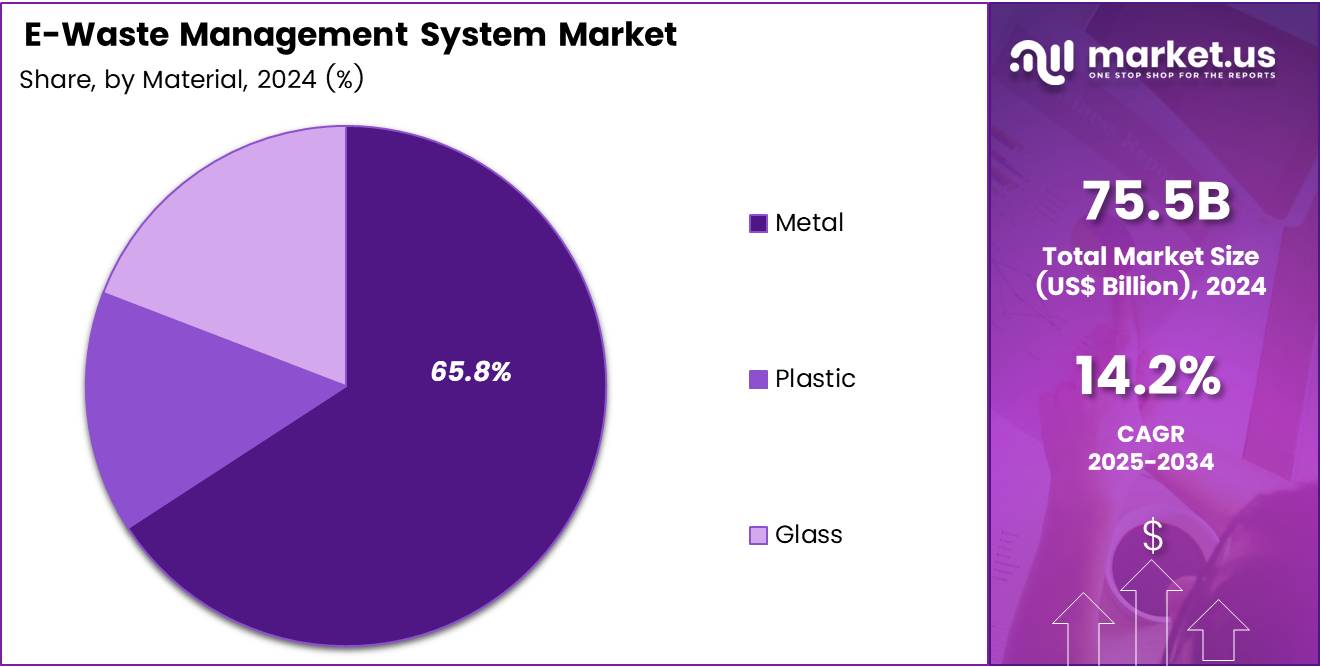

- By Material, the market is divided into Metal, Plastic, Glass, and, with Metal taking the lead market share in 2024 with 65.8%

- By Application, the market is divided into Disposals, and Recycled, with Disposals taking the lead market share in 2024 with 76.0%

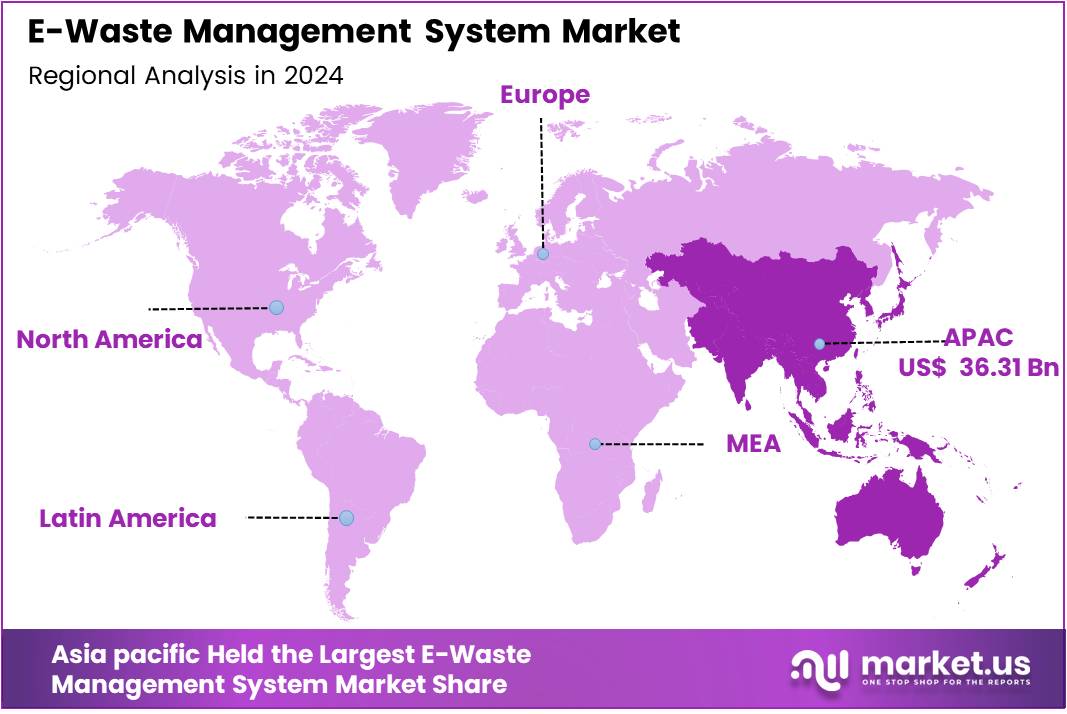

- Asia-Pacific held leading position in the global market with a share of over 48.1% of the total revenue.

By Source Type Analysis

The Consumer Electronics segment dominated the market with the highest revenue share of 49.9% in the Global E-Waste Management System market in the year 2024. The consumer electronics segment is a significant contributor to the global e-waste challenge, encompassing a diverse array of devices such as smartphones, computers, tablets, and televisions, each of which contributes to different segments like computers & IT Devices, televisions, phones, and others. This segment is particularly noteworthy due to the rapid pace of technological advancements and high consumer demand, which lead to short product lifecycles and, consequently, a high turnover of discarded electronics.

Each segment within consumer electronics presents unique recycling challenges due to the complex integration of small and valuable components. For instance, computers & IT devices, which include laptops, desktops, and servers, are rich in valuable metals like gold and palladium used in circuit boards and semiconductor devices.

The televisions segment, on the other hand, includes CRTs, LCDs, and plasma screens, each requiring different handling procedures, especially with older CRTs which contain hazardous leaded glass. Phones, including smartphones, are packed with precious metals and rare earth elements in their small components, making them economically valuable but technically challenging to recycle efficiently.

Global E-Waste Management System Market, By Source Type, 2020-2024 (US$ Million)

Source Type 2020 2021 2022 2023 2024 CAGR Household Appliances 8,356.6 10,366.4 12,915.5 14,801.5 16,963.0 14.6% Air Conditioners 2,251.2 2,795.8 3,487.2 4,000.8 4,590.2 14.7% Washing Machine 2,998.0 3,704.5 4,597.9 5,248.3 5,990.6 14.1% Refrigerators 1,848.4 2,297.1 2,867.2 3,291.8 3,779.3 14.8% Others 1,258.9 1,569.0 1,963.2 2,260.6 2,603.0 15.1% Consumer Electronics 19,054.0 23,486.3 29,074.3 33,109.1 37,703.7 13.9% Computers & IT Devices 11,077.6 13,626.3 16,834.0 19,130.0 21,739.2 13.6% Televisions 1,781.6 2,245.3 2,849.3 3,308.3 3,841.3 16.1% Phones 4,923.5 6,075.8 7,530.2 8,585.1 9,787.8 14.0% Others 1,271.3 1,538.9 1,860.8 2,085.6 2,335.5 11.5% Industrial Equipment 5,908.9 7,359.6 9,208.8 10,593.2 12,185.8 15.0% Other Source Types 4,428.4 5,445.7 6,718.4 7,637.3 8,680.5 13.6% TOTAL 37,747.8 46,658.1 57,916.9 66,141.1 75,533.1 14.2% By Material Analysis

The Metal segment acquired majority of revenue share of 65.8% in 2024. In the e-waste recycling industry, the metal segment is particularly critical due to the high value and demand for metals extracted from discarded electronics. This segment is further divided into sub-segments of precious metals and non-precious metals, each having distinct characteristics and recycling processes.

Precious Metals include gold, silver, and platinum, which are highly valued for their superior electrical conductivity, resistance to corrosion, and other unique properties that make them essential for high-performance electronics. These metals are typically found in small quantities in circuit boards, connectors, and other critical components of electronic devices.

Global E-Waste Management System Market, By Material, 2020-2024 (US$ Million)

Material 2020 2021 2022 2023 2024 CAGR Metal 24,981.2 30,835.9 38,225.2 43,593.2 49,715.2 14.0% Precious Metal 10,508.0 13,020.3 16,203.6 18,548.2 21,232.0 14.5% Non-precious Metal 14,473.2 17,815.6 22,021.5 25,045.0 28,483.2 13.7% Plastic 5,767.1 7,098.0 8,774.4 9,976.5 11,343.3 13.7% Glass 6,999.6 8,724.2 10,917.3 12,571.3 14,474.6 15.1% TOTAL 37,747.8 46,658.1 57,916.9 66,141.1 75,533.1 14.2% Due to their high value, recovering precious metals from e-waste is economically lucrative and significantly reduces the environmental impact associated with primary mining activities. Recycling processes for precious metals involve detailed and precise techniques such as chemical leaching, which dissolves the metals for subsequent recovery, or electrochemical processes that separate these metals from other materials.

Umicore Precious Metals Refining functions as one of the globe’s foremost precious metals recycling facilities. The company specializes in the recovery and sale of precious metals (including silver, gold, platinum, palladium, rhodium, iridium, and ruthenium), special metals (such as indium, selenium, and tellurium), secondary metals (like antimony, tin, and bismuth), and base metals (comprising lead, copper, and nickel).

By Application Analysis

The Disposal segment is estimated to account for 76.0% revenue share in the global E-Waste Management System market in the year 2024. The segment is further broken down into incineration, landfill, and reuse.

Incineration involves burning e-waste to reduce its bulk and potentially recover energy. Modern incinerators are equipped with advanced pollution control technologies to manage the release of toxic emissions, such as heavy metals and dioxins, which are common in e-waste. For example, countries like Sweden and Denmark use incineration extensively not just for waste reduction but also for energy generation, employing rigorous environmental safeguards.

Landfilling is often considered the least favourable option due to the risk of hazardous substances leaching into the soil and groundwater. E-waste contains harmful materials like lead, mercury, and flame retardants, which pose significant environmental risks. Despite these issues, landfilling remains prevalent, especially in regions lacking robust recycling infrastructure. Some landfills are specially designed with protective liners and leachate treatment systems to mitigate these risks, but the long-term environmental impacts can still be significant.

Global E-Waste Management System Market, By Application, 2020-2024 (US$ Million)

Application 2020 2021 2022 2023 2024 CAGR Disposal 28,846.4 35,604.2 44,132.7 50,326.3 57,389.1 14.0% Incineration 8,630.7 10,666.9 13,239.8 15,117.9 17,262.4 14.2% Landfill 13,309.5 16,402.6 20,301.0 23,114.6 26,318.2 13.9% Reuse 9,037.3 11,184.5 13,900.1 15,894.2 18,174.2 14.3% Recycled 8,901.4 11,053.9 13,784.2 15,814.8 18,144.0 14.7% TOTAL 37,747.8 46,658.1 57,916.9 66,141.1 75,533.1 14.2% Key Market Segments

By Source Type

- Household Appliances

- Air Conditioners

- Washing Machines

- Refrigerators

- Others

- Consumer Electronics

- Computers & IT Devices

- Televisions

- Phones

- Others

- Industrial Equipment

- Other Source Types

By Material

- Metal

- Precious Metal

- Non-precious Metal

- Plastic

- Glass

By Application

- Disposals

- Incineration

- Landfill

- Reuse

- Recycled

Drivers

Increasing Volume of E-Waste

The phenomenon of rapid technological advancements and the associated shorter lifecycles of electronic devices is a significant driver of the increasing volumes of e-waste globally. This trend is largely fueled by the fast pace of innovation in sectors such as smartphones, computers, and home appliances, where new models boasting enhanced features and capabilities are launched more frequently than ever before.

Similarly, in the realm of consumer electronics like televisions and laptops, technological advancements such as higher resolution screens, more powerful processors, and lighter materials encourage consumers to replace their devices more often. The push towards smart home devices and IoT (Internet of Things) products also accelerates the turnover of electronic goods in homes and businesses. As these devices become integral to modern living and competitive business practices, the lifecycle of each device shrinks, thereby generating more e-waste.

As per United Nations Institute for Training and Research (UNITAR), within the small IT and telecommunication equipment category, which includes items such as laptops, mobile phones, GPS devices, and routers, the volume of e-waste amounts to 4.6 million tons. However, only 22% of this e-waste is documented to be collected and recycled.

Global and Regional E-Waste Recycling Statistics

Region E-Waste Recycling Rate Global Average 17.4% Americas 9.4% Europe 42.5% Asia 11.7% Africa 0.9% Oceania 8.8% Restraints

High Recycling Costs

The actual process of safely extracting valuable materials like gold, silver, and copper from complex electronics such as smartphones and computers involves chemical or mechanical treatments, which can be costly. For instance, to recover gold, processors often use chemical leaching techniques involving cyanide or other strong acids that require careful handling, neutralization, and disposal of toxic by-products, further adding to the cost. In addition to the economic costs, there’s a significant environmental cost if these substances are not handled correctly.

A study published in the Environmental Science and Technology journal indicates that the global north exports approximately 23% of its electronic waste each year, largely due to the elevated expenses associated with recycling in these regions. For instance, in the United States, the cost of building a state-of-the-art e-waste recycling facility can run into millions of dollars, a sum that covers not just sophisticated equipment but also compliance with environmental regulations.

This high entry barrier limits the number of players in the recycling market and can reduce the overall recycling rates, contributing to the global e-waste problem. This situation underscores the need for more cost-effective, scalable technologies in e-waste recycling to make it more accessible and widespread.

Growth Factors

Valuable Material Recovery

The extraction of precious metals and other valuable materials from e-waste not only provides a significant economic incentive for recycling industries but also offers a sustainable alternative to traditional mining practices. Electronic waste contains a high concentration of precious metals such as gold, silver, platinum, and palladium, as well as other valuable materials like copper and rare earth elements. These materials can be recovered and reused, which reduces the need to extract virgin resources from the earth, thereby minimizing environmental degradation and reducing energy consumption associated with mining processes.

For example, it is reported that one ton of mobile phones (about 6,000 handsets), without batteries, can yield as much as 130 kilograms of copper, 3.5 kilograms of silver, 340 grams of gold, and 140 grams of palladium. The economic value of these metals makes e-waste recycling very lucrative. Major companies and smaller startups alike are tapping into this potential.

Umicore, a global materials technology and recycling group, has sophisticated smelting operations in Belgium that recovers precious metals from e-waste efficiently. Similarly, BlueOak Resources in the United States has established an “urban mining” refinery in Arkansas dedicated to recovering precious metals from electronic waste.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic pressures and geopolitics are reshaping the global e-waste management system market across cost curves, flows, and technology choices. Elevated energy and labor costs are expected to tighten margins for collectors and recyclers, accelerating investment in automation, high-efficiency shredding, and advanced sorting to raise yields from printed circuit boards and lithium-ion batteries.

Interest-rate volatility is anticipated to slow greenfield facilities in emerging hubs while favoring asset-light partnerships. Commodity price swings for copper, aluminum, gold, and critical minerals directly influence refurbish-versus-recycle decisions, with high metals pricing projected to lift formal recovery rates but also risks incentivizing informal processing in under-regulated regions. Geopolitical frictions—sanctions, port disruptions, and shifting trade alignments—are prompting near-shoring of disassembly and refining, alongside tighter controls under the Basel Convention and national e-waste movement rules.

Policy momentum around extended producer responsibility, WEEE-style frameworks, data-security mandates, and right-to-repair initiatives is expected to expand OEM take-back networks and certified refurb channels, improving feedstock quality but raising compliance costs. Meanwhile, supply-security priorities for EVs and renewables are increasing demand for secondary cobalt, nickel, and rare earths, strengthening the business case for hydrometallurgy and urban-mining routes. Net effect: a more regulated, regionalized, and technology-intensive industry with scale advantages for compliant operators.

Emerging Trends

Rise of Extended Producer Responsibility (EPR)

Extended Producer Responsibility (EPR) policies are regulatory strategies that transfer the responsibility for the disposal of end-of-life products from consumers and waste managers to the manufacturers.

By mandating that producers take on the costs and management of recycling their products once consumers are done with them, EPR policies aim to incentivize companies to design products that are easier to recycle, contain fewer hazardous materials, and have longer lifespans. This approach not only encourages sustainable product design but also facilitates better waste collection and recycling systems, ultimately reducing the environmental footprint of manufactured goods.

Reports indicate that Extended Producer Responsibility (EPR) policies have propelled the collection and recycling rates of targeted materials to over 75% in regions such as British Columbia, Belgium, Spain, South Korea, and the Netherlands. Additionally, Portugal and Quebec have achieved rates exceeding 60%. Conversely, U.S. state programs have demonstrated significantly lower performance across all materials.

Regional Analysis

Asia Pacific is leading the E-Waste Management System Market

Asia Pacific leads the e-waste management market with a 48.1% share. The Asia-Pacific (APAC) e-waste management system market is showing strong momentum driven by rapid electronics consumption, shorter device lifecycles and rising environmental awareness.

Growth in APAC is aided by rising urbanization and industrialization, major electronics manufacturing and disposal hubs in countries such as China, India, Japan and Southeast Asia, and stricter regulatory frameworks around take-back, recycling and circular economy practices. For example, China remains the largest contributor of e-waste in the region, reflecting its manufacturing base and domestic consumption, while India is emerging as a key growth market.

Technology trends such as hydrometallurgy for precious-metal recovery, advanced automated sorting systems and formalized collection networks are gaining traction in APAC, improving recovery yields and reducing informal disposal. Challenges persist: infrastructural gaps, informal sector dominance, transboundary e-waste flows and inconsistent regulation across countries slow progress and add risk.

In February 2024, China outlined plans to recycle half of its e-waste by 2025 amid a sharp rise in discarded small IT devices. As part of its broader push to advance circular-economy programs and strengthen sustainable development, the country also aims to increase the use of recycled materials in manufacturing, targeting a 20% share in production.

Europe is poised for fastest growth in the e-waste management market. Growth is being propelled by stringent regulatory frameworks such as the European Commission’s e-waste directives, strong consumer and industrial awareness around circular economy principles, and established infrastructure for collection and recycling across major EU economies. The combination of mature recycling systems and policy enforcement has positioned Europe as the dominant regional market, with major volumes of e-waste formally managed and recycled.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key E-Waste Management System Company Insights

Key players in the E-Waste Management System market includes Veolia Environment S.A., Sims Lifecycle Services, Green IT Recycling Center Pvt Ltd, Ecowise Waste Management Pvt. Ltd., Tetronics Environmental Technology Company, ERI, Enviroserve, TES, Stena Metall AB, Attero Recycling, Cosmos Recycling, Binbag Recycling Services Pvt Ltd., and Other Key Players.

Veolia Environnement S.A. is global environmental-services leader active across five continents, offering comprehensive waste-management solutions including electronics recycling, metals recovery and power-distribution equipment re-use, positioning itself as a strategic player in large-scale e-waste recovery ecosystems.

Sims Lifecycle Services is a worldwide IT-asset-disposition and e-waste-recycling specialist operating across Americas, EMEA and APAC, focused on secure data-destruction, component reuse and closed-loop materials recovery from end-of-life electronics. Green IT Recycling Center Pvt Ltd is an India-based firm specialising in end-of-life IT-asset recovery, data destruction, reverse logistics and WEEE recycling under EPR frameworks, positioned within the formal collection and processing infrastructure in Maharashtra.

Top Key Players in the Market

- Veolia Environment S.A.

- Sims Lifecycle Services

- Green IT Recycling Center Pvt Ltd

- Ecowise Waste Management Pvt. Ltd.

- Tetronics Environmental Technology Company

- ERI

- Enviroserve

- TES

- Stena Metall AB

- Attero Recycling

- Cosmos Recycling

- Binbag Recycling Services Pvt Ltd.

- Other Key Players

Key Opinion Leaders

Name / Title Statement Dr. Elise Moreau, Sustainability Director at Veolia Environment S.A “The global e-waste management ecosystem is rapidly transforming into a resource recovery network. In Asia-Pacific, we are prioritizing advanced metal extraction technologies and data-driven traceability systems to achieve near-zero landfill targets while meeting clients’ circular economy commitments and environmental compliance expectations.” David R. Bennett, Regional Head of Technology Circularity at Sims Lifecycle Services “In today’s digital economy, secure recycling and IT asset disposition are no longer optional—they are strategic imperatives. At Sims, we see growing demand from global tech firms seeking transparent, certified recycling for end-of-life data servers and devices, especially across the APAC and North American corridors.” Ananya Deshmukh, Operations Director at Green IT Recycling Center Pvt. Ltd. “India’s e-waste landscape is evolving with increased enforcement of Extended Producer Responsibility. Our focus is on building scalable, compliant collection centers and integrating automated dismantling lines to process high-volume IT waste, ensuring material recovery aligns with both environmental and industrial reuse goals.” Recent Developments

- In November 2025, Blue Planet E‑Waste Solutions (India) issued a press release stating it has strengthened its e-waste leadership in India by acquiring and integrating its subsidiary in Haryana and Karnataka, positioning itself with expanded footprint and capabilities in collection and recycling.

- In June 2025, Veolia Environnement S.A. announced that it is increasing its hazardous waste treatment capacity by 530,000 tonnes per year by 2030 as part of its GreenUp ambition, including acquisitions and new facilities in the US, Europe, Middle East and Asia.

- In February 2025, Sims Lifecycle Services (SLS) released that it has been listed as a Representative Vendor in the 2024 Gartner, Inc. “Market Guide for IT Asset Disposition (ITAD)” for the fifth consecutive time, signalling its ongoing leadership in secure e-waste recycling and IT-asset-disposition services.

- In December 2022, Veolia, in partnership with Dulverton Waste Management and the City of Launceston Council, embarked on a multimillion-dollar investment aimed at revamping recycling practices in Northern Tasmania.

Report Scope

Report Features Description Market Value (2024) USD 75.5 Billion Forecast Revenue (2034) USD 268.9 Billion CAGR (2025-2034) 14.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source Type (Household Appliances (Air Conditioners, Washing Machines, Refrigerators, Others), Consumer Electronics (Computers & IT Devices, Televisions, Phones, Others), Industrial Equipment, Other Source Types), By Material (Metal (Precious Metal, Non-precious Metal), Plastic, Glass), By Application (Disposals, Incineration, Landfill, Reuse, and Recycled) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Veolia Environment S.A., Sims Lifecycle Services, Green IT Recycling Center Pvt Ltd, Ecowise Waste Management Pvt. Ltd., Tetronics Environmental Technology Company, ERI, Enviroserve, TES, Stena Metall AB, Attero Recycling, Cosmos Recycling, Binbag Recycling Services Pvt Ltd., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  E-Waste Management Systems MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

E-Waste Management Systems MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Veolia Environment S.A.

- Sims Lifecycle Services

- Green IT Recycling Center Pvt Ltd

- Ecowise Waste Management Pvt. Ltd.

- Tetronics Environmental Technology Company

- ERI

- Enviroserve

- TES

- Stena Metall AB

- Attero Recycling

- Cosmos Recycling

- Binbag Recycling Services Pvt Ltd.

- Other Key Players