Global Recreational and Outdoor Products Market Size, Share, Growth Analysis By Product Type (Camping & Hiking Equipment, Sports & Outdoor Gear, Fishing Gear, Outdoor Electronics, Others), By End Use (Individual, Professional), By Distribution Channel (Online, Hypermarket/Supermarkets, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159373

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

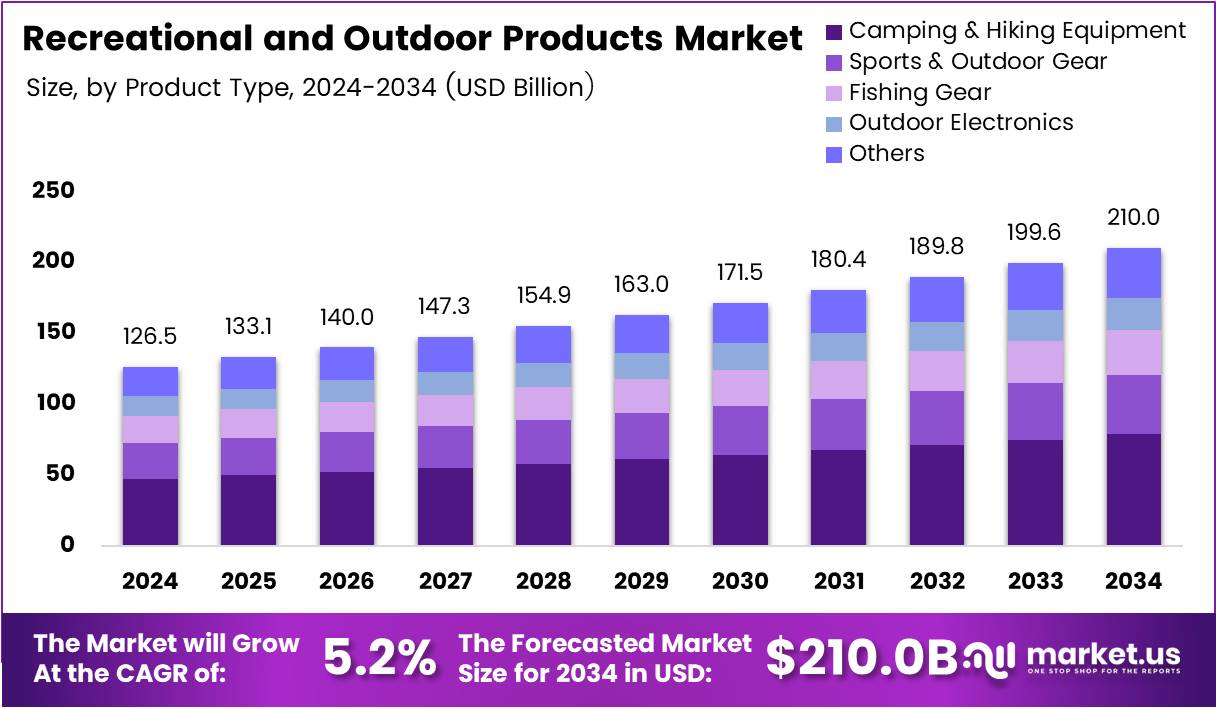

The Global Recreational and Outdoor Products Market size is expected to be worth around USD 210.0 Bn by 2034, from USD 126.5 Bn in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

The recreational and outdoor products market encompasses a wide range of goods designed for activities such as hiking, camping, fishing, and other outdoor sports. This market includes everything from tents and backpacks to fishing rods and bicycles. The growing demand for leisure and outdoor experiences has spurred significant market expansion.

The market’s growth can be attributed to several factors, including increased awareness of outdoor activities’ physical and mental health benefits. As consumers prioritize wellness, outdoor recreation has become an appealing choice. The expanding trend of eco-tourism and sustainable travel has also bolstered the demand for eco-friendly outdoor gear.

Government initiatives and regulations play an essential role in supporting market growth. For example, various programs have been established to promote outdoor recreation and improve public access to recreational spaces. These initiatives not only support environmental conservation but also stimulate demand for products that enhance outdoor experiences. Additionally, infrastructure development for national parks and recreational areas has created more opportunities for product demand.

Statistically, the U.S. outdoor recreation sector has demonstrated impressive growth. According to industry reports, in 2023, the U.S. outdoor recreation sector contributed $639.5 billion in value-added economic impact, marking a 9% increase from the previous year. The sector represented 2.3% of the U.S. GDP, supporting 5 million jobs with a total compensation of nearly $294 billion.

Participation in outdoor activities also continues to grow, with over 54% of Americans (about 164 million people) engaging in outdoor recreation activities in 2021. This trend has continued into 2023, with rising demand for gateway activities such as hiking, camping, and fishing. This participation, along with an increasing focus on outdoor wellness, positions the market for ongoing growth.

Key Takeaways

- The Global Recreational and Outdoor Products Market is expected to reach USD 210.0 Bn by 2034, growing at a CAGR of 5.2%.

- Camping & Hiking Equipment leads the market with a 37.4% share, driven by increasing interest in nature-based activities and adventure tourism.

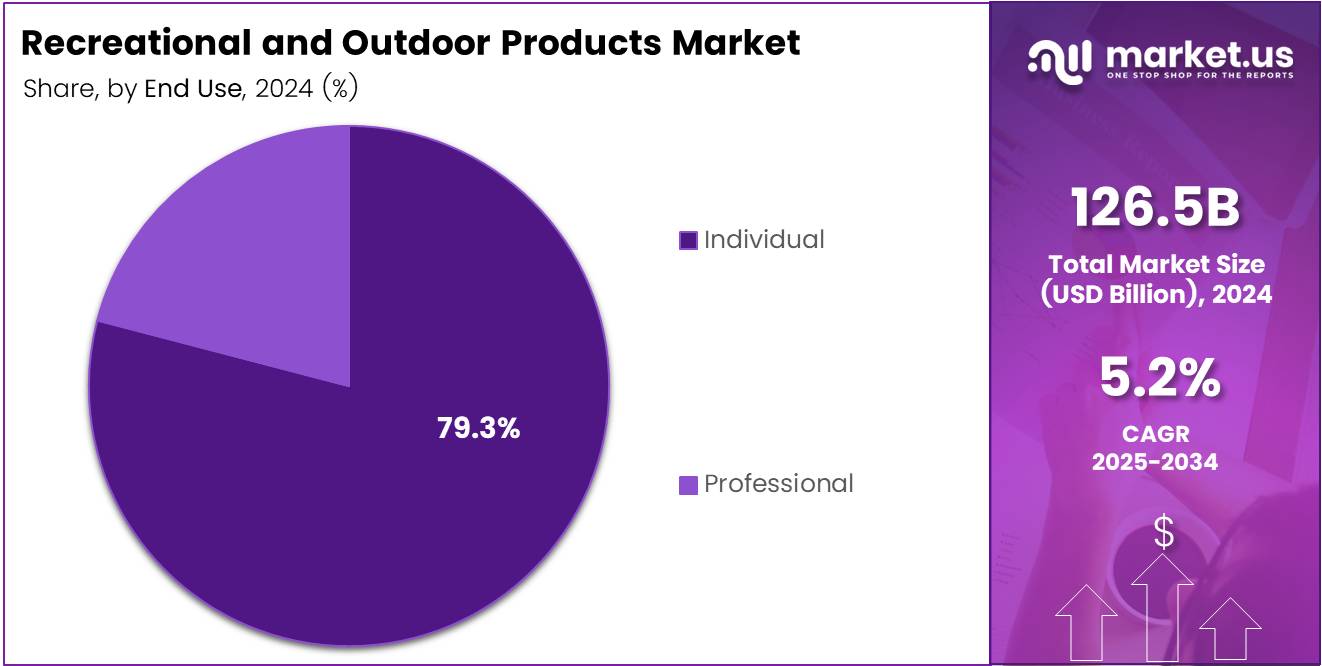

- Individual consumers dominate with 79.3% of the market share, reflecting a focus on personal wellness and adventure.

- Hypermarket/Supermarkets hold 45.2% market share, benefiting from one-stop shopping convenience and competitive pricing.

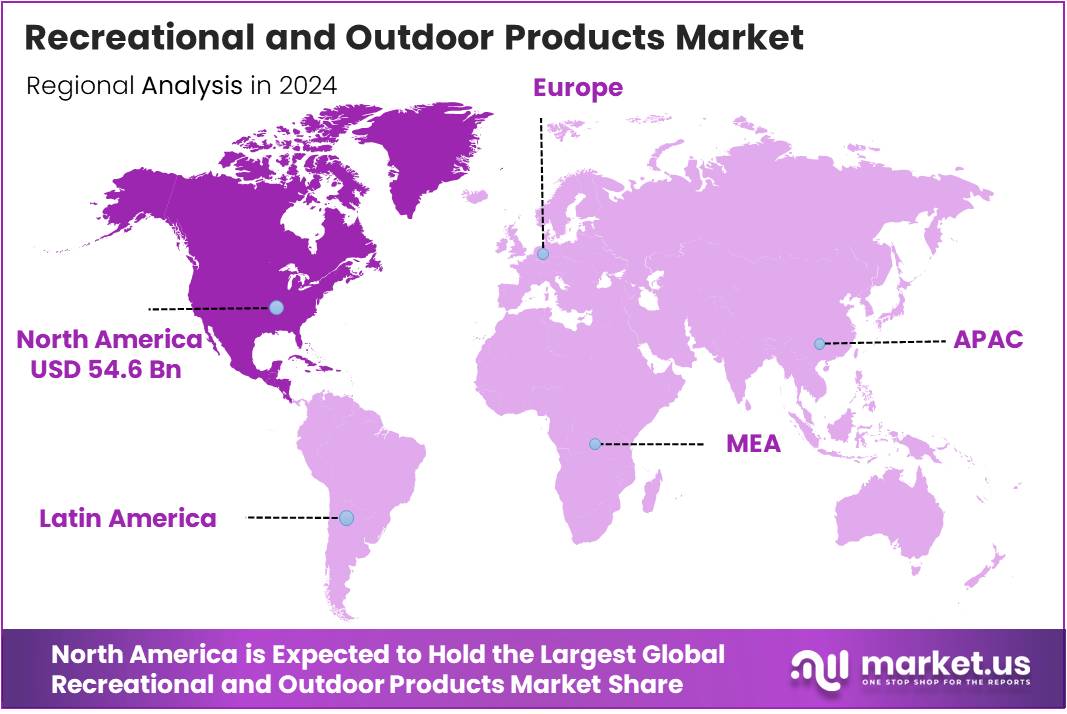

- North America accounts for 43.2% of the market share, valued at USD 54.6 billion, supported by high consumer spending and a strong retail infrastructure.

By Product Type Analysis

Camping & Hiking Equipment dominates with 37.4% due to its widespread popularity and essential nature for outdoor adventures.

Camping & Hiking Equipment emerges as the leading segment, capturing 37.4% market share through its fundamental role in outdoor recreation. This dominance stems from increasing consumer interest in nature-based activities and adventure tourism. The segment benefits from diverse product offerings including tents, backpacks, sleeping bags, and hiking boots that cater to various skill levels and budgets.

Sports & Outdoor Gear represents a significant portion of the market, driven by growing health consciousness and fitness trends. This segment encompasses equipment for various sports activities including cycling, running, climbing, and team sports. The increasing participation in recreational sports and the rise of outdoor fitness activities contribute substantially to this segment’s growth and market presence.

Fishing Gear maintains steady market demand through dedicated fishing enthusiasts and recreational anglers. This specialized segment includes rods, reels, tackle boxes, and fishing accessories. The segment’s stability comes from its loyal customer base and seasonal purchasing patterns, particularly during peak fishing seasons and holiday gift-giving periods.

Outdoor Electronics encompasses GPS devices, action cameras, portable chargers, and weather monitoring equipment. Meanwhile, the Others category includes miscellaneous outdoor products such as outdoor furniture, grills, and specialized accessories that don’t fit into primary categories but serve important niche markets.

By End Use Analysis

Individual consumers dominate with 79.3% share due to personal recreation and leisure activity preferences.

Individual consumers command the largest market share at 79.3%, reflecting the personal nature of recreational and outdoor activities. This dominance indicates that most outdoor products are purchased for personal use, family recreation, and individual hobbies. The segment thrives on consumer desire for personal wellness, adventure experiences, and leisure time activities that promote work-life balance.

Professional users, while representing a smaller segment, demonstrate consistent demand driven by outdoor industry professionals, tour guides, adventure sports instructors, and commercial outdoor service providers. This segment requires higher-quality, durable equipment designed for frequent use and harsh conditions. Professional purchases often involve bulk buying and specialized equipment that meets industry standards and safety requirements for commercial outdoor operations.

By Distribution Channel Analysis

Hypermarket/Supermarkets lead with 45.2% market share due to convenience and competitive pricing strategies.

Hypermarket/Supermarkets dominate with 45.2% market share through their strategic advantage of one-stop shopping convenience and competitive pricing. These large retail formats offer immediate product availability, hands-on product examination, and often feature seasonal outdoor product displays. Their success stems from combining recreational products with regular shopping trips, making outdoor gear more accessible to average consumers.

Online distribution channels have revolutionized the recreational products market by offering extensive product variety, detailed reviews, and convenient shopping experiences. This channel provides consumers with easy comparison shopping, competitive pricing, and direct-to-door delivery services. The digital platform particularly appeals to tech-savvy consumers seeking specialized products and bulk purchases for outdoor adventures.

Specialty Stores maintain significant market presence by offering expert advice, specialized product knowledge, and premium outdoor equipment. These retailers focus on serving serious outdoor enthusiasts who value professional guidance and high-quality gear. Their strength lies in providing personalized service, product demonstrations, and after-sales support that enhances customer loyalty and repeat purchases.

Other distribution channels include direct manufacturer sales, outdoor trade shows, and pop-up retail locations that serve specific market niches. These alternative channels often cater to specialized customer needs and provide unique shopping experiences that complement traditional retail formats in the recreational outdoor products market.

Key Market Segments

By Product Type

- Camping & Hiking Equipment

- Sports & Outdoor Gear

- Fishing Gear

- Outdoor Electronics

- Others

By End Use

- Individual

- Professional

By Distribution Channel

- Online

- Hypermarket/Supermarkets

- Specialty Stores

- Others

Drivers

Increasing Demand for Health and Fitness Drives Growth in Recreational and Outdoor Products Market

The growing focus on health and fitness is one of the key drivers for the recreational and outdoor products market. Consumers are becoming more health-conscious, seeking products that facilitate outdoor activities like hiking, biking, and running. As a result, outdoor sports equipment, fitness accessories, and wellness-related products are witnessing increased demand. This trend is anticipated to continue, as fitness and well-being remain top priorities for many.

The rising popularity of outdoor adventure activities further fuels the market. As people look for experiences that connect them with nature, activities such as camping, trekking, and water sports are becoming more common. This has led to a surge in demand for outdoor gear and equipment, driving the market’s growth. Outdoor adventure tourism is also gaining traction, especially among younger generations seeking thrill and adventure.

A growth in disposable income among middle-class consumers is also a contributing factor. With more people having the financial means to spend on recreational products, there is a noticeable shift toward premium and specialized outdoor equipment. This consumer shift is expected to increase demand for high-quality and durable products, further expanding the market.

Finally, the expansion of e-commerce platforms has made outdoor products more accessible. Online shopping allows consumers to conveniently purchase products, even in remote areas. This ease of access is driving sales and supporting the overall market growth.

Restraints

Unpredictable Weather and Urbanization Challenges in Recreational and Outdoor Products Market

Unpredictable weather conditions present a significant restraint to the recreational and outdoor products market. Frequent weather changes and extreme conditions can limit the ability of consumers to engage in outdoor activities, which in turn impacts demand for certain products. For instance, colder winters or unseasonable rain could result in slower sales of weather-dependent equipment such as tents and hiking gear.

In urban areas, limited access to outdoor spaces is another barrier. Many cities face a shortage of parks or natural areas where residents can participate in outdoor activities. This lack of space can reduce the number of people participating in outdoor recreation, negatively affecting product demand in urban regions. Additionally, this trend may be more pronounced in highly populated areas where residential developments outpace the creation of outdoor recreational spaces.

Environmental concerns related to outdoor product manufacturing also pose challenges. As consumers become more environmentally conscious, they increasingly demand sustainable products. Manufacturers must comply with stricter regulations and find ways to reduce the environmental footprint of their products, such as using recyclable materials. While this is an opportunity for innovation, it can also raise production costs, making it a constraint for some companies in the market.

Growth Factors

Emerging Markets and Innovation Pave the Way for Growth in Recreational and Outdoor Products Market

The recreational and outdoor products market is seeing significant growth opportunities, especially in emerging markets. The expanding middle class in regions like Asia-Pacific, Latin America, and Africa is fueling demand for outdoor products. As disposable incomes rise, more people in these regions are seeking recreational experiences, providing new market segments for outdoor brands to target.

Innovations in sustainable outdoor products are also creating new avenues for growth. Consumers are becoming more eco-conscious, driving demand for products made with sustainable materials and environmentally friendly manufacturing processes. Brands that prioritize sustainability are likely to gain a competitive edge in the market.

Integration of smart technologies into outdoor gear presents another growth opportunity. The rise of smart outdoor products, such as GPS-enabled fitness trackers, smart tents, and solar-powered equipment, is appealing to tech-savvy consumers who want to combine outdoor experiences with digital functionality. These products are expected to gain popularity as outdoor recreation continues to evolve.

Lastly, the growth of eco-tourism and nature-based recreational activities offers substantial growth prospects. As more people opt for eco-friendly travel experiences, demand for products that support sustainable tourism, such as eco-friendly camping gear, is expected to rise. This trend is anticipated to benefit the market, especially in regions with rich natural resources.

Emerging Trends

Eco-friendly Trends and Social Influence Fuel Growth in Recreational and Outdoor Products Market

Several trending factors are shaping the recreational and outdoor products market. There is a noticeable surge in demand for eco-friendly and sustainable products. Consumers are increasingly prioritizing products that minimize environmental impact, such as biodegradable camping gear, reusable water bottles, and clothing made from sustainable fabrics. As sustainability becomes more important, outdoor brands are adapting to these preferences by offering eco-conscious options.

The rising popularity of glamping (glamorous camping) is another significant trend. Glamping combines outdoor experiences with luxury accommodations, attracting consumers who want the thrill of nature without compromising comfort. This trend has led to increased demand for high-end camping gear, stylish outdoor furniture, and other luxury products aimed at enhancing the camping experience.

The adoption of fitness and outdoor activity apps is also shaping the market. As more people use apps to track their outdoor adventures and physical activities, there is a growing demand for compatible outdoor products, such as fitness trackers, smart watches, and gear that integrates with these digital tools.

Finally, social media’s influence on outdoor lifestyle trends cannot be overlooked. Platforms like Instagram and TikTok are driving the popularity of outdoor adventures, with users showcasing their experiences and outdoor gear. This trend is influencing purchasing decisions, especially among younger consumers who are inspired by outdoor influencers and lifestyle trends they see online.

Regional Analysis

North America Dominates the Recreational and Outdoor Products Market with a Market Share of 43.2%, Valued at USD 54.6 Billion

North America continues to lead the recreational and outdoor products market, accounting for 43.2% of the market share, valued at USD 54.6 billion. This growth is driven by high consumer spending on outdoor recreational activities, a robust retail infrastructure, and increasing demand for adventure sports. The region’s well-established e-commerce platforms and increased focus on health and fitness further bolster market expansion.

Europe Recreational and Outdoor Products Market Trends

Europe follows closely, representing a significant share of the market with a growing interest in sustainable and eco-friendly outdoor products. The region’s increasing participation in outdoor activities and outdoor tourism supports growth. European countries are also investing in improving infrastructure to support recreational spaces, which is anticipated to fuel future growth.

Asia Pacific Recreational and Outdoor Products Market Trends

Asia Pacific is expected to experience substantial growth in the coming years, driven by increasing disposable income, a young population, and rising awareness of the benefits of outdoor activities. The growing trend of adventure tourism and expanding retail markets in countries like China and India contribute to the region’s rapid development in the outdoor products space.

Middle East and Africa Recreational and Outdoor Products Market Trends

The Middle East and Africa market is gaining traction as outdoor leisure activities become more popular, especially in countries with developing tourism industries. Government investments in infrastructure and increased interest in sports and fitness are expected to drive the market forward. However, regional challenges such as unpredictable weather conditions may limit some growth potential.

Latin America Recreational and Outdoor Products Market Trends

Latin America shows potential in the recreational and outdoor products market, with increasing access to outdoor spaces and rising interest in physical activities. The growing middle class, alongside better retail availability, is driving market growth. However, economic fluctuations and regional instability could pose challenges to sustained market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Recreational and Outdoor Products Company Insights

In 2024, Clarus continues to play a pivotal role in the recreational and outdoor products market. Known for its diverse portfolio of outdoor brands, including Black Diamond and Sierra Designs, Clarus has strengthened its market presence through innovative product offerings and sustainability initiatives, addressing the growing demand for eco-conscious outdoor gear.

Columbia Sportswear remains one of the dominant players, with a significant market share driven by its comprehensive range of high-performance outdoor apparel and footwear. Its focus on technological innovations such as Omni-Heat and Omni-Tech ensures its products are well-suited for extreme outdoor conditions, catering to a wide range of adventure enthusiasts.

Deckers Outdoor has successfully expanded its presence in the outdoor footwear segment, with popular brands such as UGG and Hoka. With a strong emphasis on comfort and performance, Deckers continues to meet the evolving needs of consumers seeking durable and stylish outdoor footwear for various recreational activities.

Foot Locker, a well-known retailer, also significantly influences the recreational and outdoor products market. While its focus is primarily on athletic footwear, it has capitalized on the growing trend of outdoor recreational activities by offering a range of outdoor-focused brands, aligning with consumer preferences for both style and functionality in their outdoor gear.

These key players continue to shape the market through innovation, sustainability, and a strong focus on consumer needs, helping drive the recreational and outdoor products market forward.

Top Key Players in the Market

- Clarus

- Columbia Sportswear

- Deckers Outdoor

- Foot Locker

- Garmin

- Johnson Outdoors

- Marmot

- Patagonia

- REI

- The North Face

Recent Developments

- In Sep 2025, Yamaha Outdoor Access Initiative surpassed $8 million in funding, further enhancing its support for outdoor access programs and community-driven projects.

- In Jan 2025, Guidesly secured $9.5 million in Series A funding to fuel the growth of its AI and SaaS platform, designed to improve the outdoor recreation experience through data-driven insights.

- In May 2024, $6.3 million in VOREC grants were awarded to support 51 projects across Vermont, fostering growth and innovation in the state’s outdoor recreation sector.

- In Apr 2024, InvestUP announced the Michigan Outdoor Innovation Fund, a $3 million pre-seed fund dedicated to investing in emerging outdoor recreation startup companies.

Report Scope

Report Features Description Market Value (2024) USD 126.5 Bn Forecast Revenue (2034) USD 210.0 Bn CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Camping & Hiking Equipment, Sports & Outdoor Gear, Fishing Gear, Outdoor Electronics, Others), By End Use (Individual, Professional), By Distribution Channel (Online, Hypermarket/Supermarkets, Specialty Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Clarus, Columbia Sportswear, Deckers Outdoor, Foot Locker, Garmin, Johnson Outdoors, Marmot, Patagonia, REI, The North Face Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Recreational and Outdoor Products MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Recreational and Outdoor Products MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Clarus

- Columbia Sportswear

- Deckers Outdoor

- Foot Locker

- Garmin

- Johnson Outdoors

- Marmot

- Patagonia

- REI

- The North Face